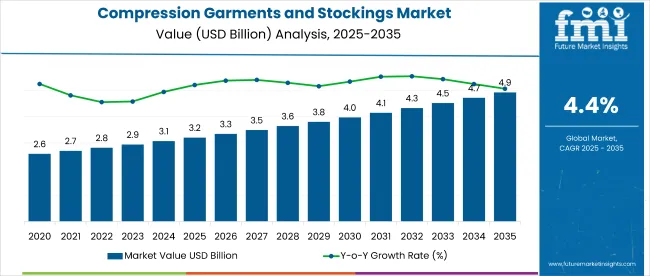

The global compression garments and stockings market is projected to expand from USD 3.2 billion in 2025 to approximately USD 5 billion by 2035, registering a CAGR of 4.4% during the forecast period. In 2024, a steady rise in demand was observed across post-surgical recovery, sports recovery, and chronic venous conditions. By 2025, market growth has been further driven by lifestyle-related conditions, aging demographics, and heightened focus on circulation support.

Compression therapy has gained clinical credibility as an effective solution for managing venous disorders, lymphatic issues, and muscle fatigue. Compression garments, which dominate the category, are increasingly prescribed in post-operative care and injury rehabilitation. Hospitals and physiotherapy centers are supporting adoption due to faster recovery timelines and better patient compliance. Rising awareness around preventive care has also contributed to demand in younger demographics engaged in active lifestyles.

In 2024 and early 2025, several innovations focused on comfort, fabric breathability, and targeted compression patterns were introduced. Brands have launched garments with antimicrobial finishes, seamless stitching, and zonal pressure grading to improve usability and appeal. Digital fittings and customization services are gaining traction through online retail and direct-to-consumer channels.

Compression stockings, though smaller in market share, are experiencing steady growth in outpatient and elderly populations. Healthcare professionals continue to recommend them for managing varicose veins, deep vein thrombosis (DVT), and swelling due to sedentary routines or long-haul travel.

Leading players such as 3M, Sigvaris, BSN Medical, and medi GmbH are focusing on expanding clinical partnerships and developing user-friendly designs for broader adoption. Product launches and regional expansion strategies suggest growing investment in ergonomic and therapeutic wearables.

With increasing diagnosis of vascular disorders, rising surgical procedures, and more awareness about physical recovery tools, the compression garments and stockings market is expected to maintain a strong growth trajectory over the next decade.

| Attributes | Key Insights |

|---|---|

| Estimated Size, 2025 | USD 3.2 billion |

| Projected Size, 2035 | USD 5 billion |

| Value-based CAGR (2025 to 2035) | 4.4% |

In North America, per capita spending on compression garments and stockings remains the highest globally. This is due to a combination of widespread insurance reimbursement, growing awareness of vascular health, and the strong presence of clinical recommendation for compression therapy. The aging population and post-surgical recovery protocols further drive sustained demand. As per the Population Reference Bureau, the number of people aged 65 and above is anticipated to reach 82 million by 2050, up from 58 million in 2022, which shows a 47% spike.

In Western Europe, well-established public healthcare systems actively promote compression therapy for chronic venous insufficiency and related disorders. Consistent government backing, coupled with early intervention practices, ensures strong market penetration. As a result, per capita spending in the region remains steady, particularly among senior citizens and patients with vascular conditions.

In Asia Pacific, growing urbanization and rising incidence of diabetes and obesity are creating new demand for compression products. As per WHO, nearly 77 million population aged above 18 years is diagnosed with diabetes type 2. Though per capita spending is lower than in the West, it is increasing steadily as middle-class populations invest in preventive and therapeutic healthcare solutions. Domestic manufacturing is helping reduce price barriers.

In Latin America and the Middle East & Africa (MEA), per capita spending is still emerging. Uptake is largely limited to urban centers where private hospitals and clinics have begun incorporating compression garments into treatment plans. However, rural penetration remains limited due to lack of awareness and supply chain gaps.

Global trade in compression garments and stockings underscores shifting manufacturing hubs and evolving demand patterns. Major producers in Asia and Europe leverage scale and precision to serve diverse markets. Exporters target both clinical and athletic segments, while importers focus on high‑volume healthcare systems. Trade volumes respond to regional healthcare spending and rising sports‑performance sales.

The above table presents the expected CAGR for the global compression garments and stockings market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 5.7%, followed by a slight decline in the growth rate of 5.1% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 5.7% (2024 to 2034) |

| H2 | 5.1% (2024 to 2034) |

| H1 | 4.4% (2025 to 2035) |

| H2 | 3.9% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 4.4% in the first half and decrease moderately to 3.9% in the second half. In the first half (H1) the market witnessed a decrease of 130.0 BPS while in the second half (H2), the market witnessed a decrease of 120.0 BPS.

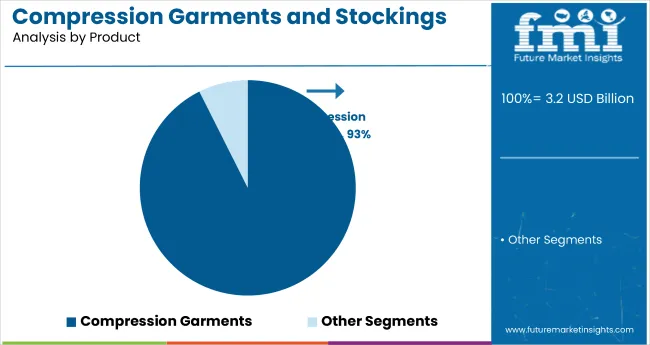

By product, compression garments are projected to hold a commanding 92.6% share of the market in 2024 and are expected to maintain dominance through 2035. These garments are widely used for post-surgical recovery, muscle stabilization, and lymphatic drainage support.

Their design flexibility allows them to serve both therapeutic and athletic purposes, making them applicable across a broad patient base. In 2025, hospitals and sports medicine clinics are continuing to adopt garments for post-op and injury rehabilitation protocols. Garments are also being used in cosmetic surgery recovery, particularly after procedures like liposuction.

Compression stockings, accounting for the remaining 7.4%, remain important for chronic venous insufficiency, elderly care, and long-distance travel. However, their medical appearance and usage limitations in high-mobility settings have led to slower uptake compared to garments. As customization options improve and fabric technology advances, compression garments are expected to see consistent preference due to their adaptability, coverage options, and integration into both healthcare and wellness routines.

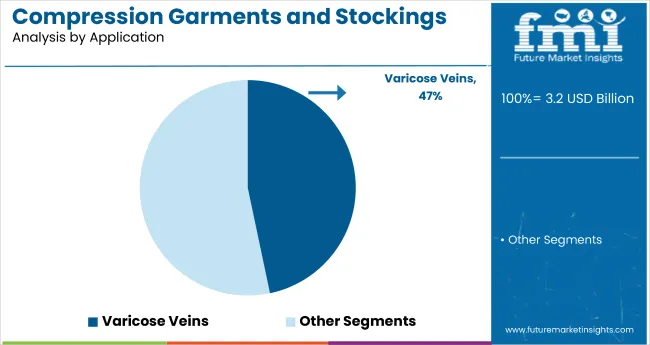

By application, varicose veins remain the top indication for compression therapy, with a 46.7% market share in 2024. These conditions are prevalent among aging populations and individuals with sedentary work patterns. In 2025, clinicians continue to recommend compression wear to reduce venous pressure, relieve leg discomfort, and prevent disease progression. Compression garments and stockings designed for this condition feature graduated pressure distribution and breathable materials suited for prolonged daily use.

Other applications-such as post-surgical recovery, lymphedema management, and athletic performance-collectively account for the remaining share, estimated at 53.3%. These segments are growing steadily as the benefits of compression therapy extend into wellness, recovery, and injury prevention.

In 2024 and 2025, fitness-focused brands began targeting gym-goers and runners with dual-purpose garments offering both support and muscle recovery advantages. However, varicose vein management remains the largest contributor due to its clinical relevance and repeat usage. As awareness and diagnosis improve globally, this segment is expected to hold its leading position through the forecast period.

Growing Adoption of Compression Garments in Post-Surgical Recovery Driving Market Demand

The main growth driver in this market is the rising adoption of compression garments in post-surgical recovery. Generally, compression garments have gained immense popularity because they decrease swelling, and blood clotting, and speed up recovery after vein surgeries, orthopedic treatments, and liposuction. Compression therapy enhances circulation and aids healing, reduces discomfort, and thus is an integral part of post-operative care.

The most significant benefits of compression garments lie in reducing post-operative complication rates. DVT and swelling excess are usually complications that delay recovery.

Recent innovations in compression garment technology also increase demand. Moisture-wicking materials, breathable fabrics, and non-irritating antibacterial properties have evolved to further enhance the comfort of the patient in the recovery phase. This is especially useful for longer recoveries or for those patients who need to wear their garments for quite some time.

With an increasing awareness of compression garments' contribution to the surgical outcome, the demand for such garments is likely to surge further, allowing them to become a routine component of post-operative recovery care for all elective as well as non-elective surgeries.

Rising Use of Compression Garments in Sports and Fitness Expanding Market Potential

The ever-increasing adoption of compression clothing in the sporting and fitness fields creates much scope for increasing market potential. Professional and amateur athletes increasingly resort to compression clothing for performance enhancement and faster recovery. Compression clothing improves blood flow, reduces muscle soreness, and even prevents injuries, thus, it becomes an integral part of most training and competition routines.

Compression wear remains very popular now, and further research has proven that it does indeed have a very positive impact on improving athletic performance and even quicker recovery of the muscles.

Compression garments apply targeted pressure to improve circulation, prevent the pooling of lactic acid, and provide support for maintaining the stabilization of muscles these enhance endurance and decrease recovery time. Because of such factors, compression garments are used across a wide range of athletic disciplines, from running and cycling to weightlifting.

Two of the leaders in compression wear, CEP, and 2XU, are inventing and manufacturing compression garments that are designed primarily to fit specific muscle groups for maximum mobility. They become highly functional yet highly fashionable sportswear that can be enjoyed by an increasingly large population of fitness enthusiasts seeking performance and fashion with their activewear.

This is one of the main drivers of demand for compression garments. The rise in fitness and more activity, especially in urbanized settings, goes hand-in-hand with increased demand. Though sporting and fitness activities are on the rise, the recovery equipment and kits to improve performance add up to a flourishing market.

Expansion of E-commerce Channels Driving Market Demand

Expansion in e-commerce channels is particularly contributing to the rising demand for compression garments, especially in regions where access to healthcare products is limited. Online shopping seems to be an emerging way by which companies are tapping into digital media to reach more customers who demand various compression garments to suit individual health requirements.

This helps expose a broader range of products, such as specialized items for specific medical conditions, like venous disorders or sports recovery, thus opening up access for customers all over the world.

This trend is more apparent in developed regions, where online shopping is quite common, and convenience is a core part of consumerism. Most companies have increased their digital presence, thereby providing expansive details of product descriptions, sizing guides, and client testimonials, all of which aim to empower the customers who will purchase them. Some others even offer customized solutions where customers are allowed to choose compression garments according to the health condition or athletic need they may be suffering from.

E-commerce has also opened up additional avenues of sales for compression garments due to the service of online consultations alongside the growth of telemedicine.

Healthcare providers can now instruct the patient on what products are available through the platform, thereby streamlining the transaction for the patient. Indeed, as increasingly more consumers start buying healthcare products and services through e-commerce especially post the COVID-19 pandemic, the channels for selling compression garments have simply become strictly online.

Generally, the advancement of e-commerce is fueling the availability and facilitation of products with compression garments among consumers; hence, it indirectly supports market growth.

Product Durability and Replacement Costs May Restrict Market Growth

The problem of durability of products and the associated replacement costs must be a significant issue facing the compression garments and stockings market. Compression garments are perceived as offering ongoing pressure that will assist with circulation as well as treatment of conditions such as venous insufficiency or support after surgery.

The elasticity and strength of compression in these garments decreased due to repeated use and washing in service. Therefore, they have to be replaced after a few months within three to six months based on the level of usage and quality.

Such garments wear out, hence a continuous expense for the consumer; more so for those who will require long-term compression therapy. Medically graded compression garments do not come cheaply; repeated replacement can further strain budgets reaching sizes beyond affordability for even patients with the lowest incomes.

This would lead to lower compliance among the end-users, who seek to extend their garments beyond the recommended life cycle; such a measure further compromises their therapeutic effectiveness. This further limits their long-term acceptance and utilization and is thus an impacting factor on the market growth.

The global compression garments and stockings industry recorded a CAGR of 4.4% during the historical period between 2020 and 2024. The growth of the compression garments and stockings industry was positive as it reached a value of USD 5 billion in 2035 from USD 3.2 billion in 2025.

The global compression garments and stockings market grew progressively from 2020 to 2024. It is mainly driven by the increasing awareness in the area of venous health, higher lifestyle-related conditions among patients with varicose veins and lymphedema, and greater demand for post-surgical applications.

More precisely, the increase in demand for compression stockings was witnessed in developed regions, due to increased healthcare awareness and better access to treatment options. Furthermore, sports compression wear added even more to that growth because of the rapidly increasing adoption of the garments themselves by professional athletes and those training seriously regularly.

Several trends are expected to shape the future of the compression garments market, and 2025 to 2035 is believed to be a time in which the market will hit its next phase of change in dynamics. Significant demand growth is expected to come from increasing healthcare awareness in emerging economies like India, Brazil, and Southeast Asia.

Further improvement in infrastructure, healthcare, and increasing focus on preventive care due to increased penetration of health insurance in these regions will increasingly boost the penetration of compression garments in these regions.

Advanced technology will also lead to more comfortable, durable, and innovative products that service both the medical and athletic needs of the wearer. Expansion of the market will be facilitated by growth in e-commerce, as consumers increasingly adopt online platforms for accessing goods, and web platforms provide easy access to a wide range of compression products.

Tier 1 companies will lead the compression garments and stockings market, accounting for almost 45.6% of the overall market share. The three major players are 3M, BSN Medical, and SIGVARIS, with strong portfolios of advanced compression solutions and robust technological capabilities.

They are innovative, quality-conscious, and uncompromising with respect to compliance with standard regulatory norms. Their heavy investment in research and development provides a platform where they can offer diverse products tailored for medical, post-surgical, and athletic applications that consolidates their leadership position in the market.

Firms like Medi GmbH & Co KG and Therafirm, at Tier 2, hold a market share of 29.6%. Such firms have niches within compression therapy: more specialized products for particular therapeutic applications like the management of lymphedema or sports recovery. Strategic investment in innovative technologies gives such firms much better positioning in terms of competition and enables them to quickly catch up with changing consumer wants.

Tier 3 consists of the smaller, niche players, including Leonisa, Inc., Nouvelle, Inc., and Medical Z. Their market share is below 15.9% of the total market. They target specific niche formulations or on treatment areas in compression garments and stockings. This maneuvering allows for greater diversification and innovation in the market because most of these firms respond to the particular needs of their customers with personalized-fit solutions for niche areas of the market.

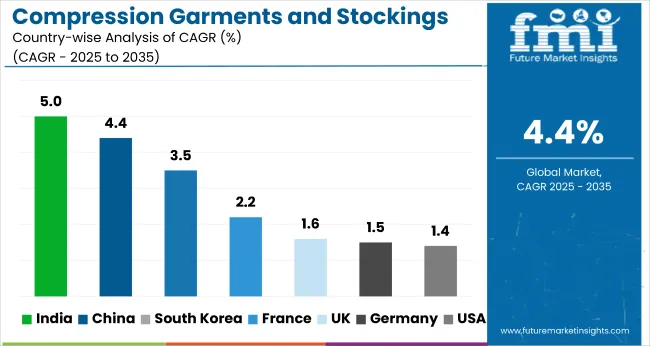

The section below covers the industry analysis for the compression garments and stockings market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided. The United States is anticipated to remain at the forefront in North America, with a CAGR of 1.4% through 2035. In Asia Pacific, China is projected to witness a CAGR of 4.4% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 1.4% |

| Germany | 1.5% |

| France | 2.2% |

| UK | 1.6% |

| China | 4.4% |

| India | 5.0% |

| South Korea | 3.5% |

Germany’s compression garments and stockings market is expected to exhibit a CAGR of 1.5% between 2025 and 2035. The Germany holds highest market share in the European market.

Germany exerts higher product pressures with strong regulatory standards and a focus on the quality of products. The country has a high standard of health care and enforces strict critical regulations on the use of medical devices. This means there would be a need for clinically validated compression products in some medical applications, like treatments for venous disorders and post-surgical recovery.

Companies in this industry, including BSN Medical and Medi GmbH & Co KG, cater to all the laws of the European Union, conduct research, and try to validate their effectiveness. This leaves the marketplace that is high on quality scientifically supported solutions so innovation drives the quality, and trust is maintained with consumers.

The USA market is anticipated to grow at a CAGR of 1.4% throughout the forecast period.

E-commerce is the most dominant factor, which has been influencing the USA compression garments market. Consumers are now accessing health-related products through online platforms, and therefore, to make it convenient and accessible, the brands are resorting to the channel of e-commerce. The pandemic has only hastened this trend. Many homebound people were already looking for healthcare solutions from their homes instead of visiting a physical place.

Companies like Sigvaris and Therafirm are also fully exploiting this trend through the optimization of web presence and direct sales offers to the consumer. The acceptance of telemedicine also leads to growing access to virtual consultations that help in recommending products such as compression garments and stockings.

India is expected to hold a dominating position in the South Asia market of compression garments and stockings and is anticipated to grow at a CAGR of 5.0% throughout the forecast period.

Growth in the Indian compression garment market is pretty fast, as there is rising awareness of venous health and compression therapy. Public health initiatives to educate people about chronic venous insufficiency and lymphedema have further helped the adoption of products that cater to these needs. Improved healthcare infrastructure and economies of scale facilitate the availability of compression solutions for consumers.

Aggressive forays are being made by local manufacturers and international brands into the Indian market, catering to the myriad needs with products that are not only medical but also lifestyle-based. The country has an increasing demand for compression garments at affordable prices and high quality.

The market for compression garments and stockings is highly competitive, encompassing a mix of both established players as well as new entrants in the space. Companies within this space are starting to focus more on their product lines with advanced technologies and materials catering to higher medical and athletic needs. Strategic partnerships, mergers, and acquisitions have become somewhat common occurrences as firms seek to expand their market presence and integrate cutting-edge solutions to address the growing demand for effective compression therapy.

Recent Industry Developments in the Compression Garments and Stockings Market

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.2 billion |

| Projected Market Size (2035) | USD 5 billion |

| CAGR (2025 to 2035) | 4.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value; million units for volume |

| Product Types Analyzed (Segment 1) | Compression Garments (Upper & Lower), Compression Stockings (Anti-embolism, Gradient) |

| Applications Analyzed (Segment 2) | Varicose Veins, Wound Care, Burns, Oncology, Others |

| Distribution Channels Analyzed (Segment 3) | Hospitals, Ambulatory Surgical Centers, Clinics, Online Sales, Other Healthcare Facilities |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players Influencing the Market | 3M, BSN Medical, Covidien Ltd., Medi GmbH & Co KG, SIGVARIS, Therafirm, 2XU Pty. Ltd., Santemol Group Medikal, Leonisa Inc., Nouvelle Inc., Medical Z |

| Additional Attributes | Increased demand for vascular support solutions, Expansion in post-surgical recovery and rehabilitation uses, Surge in online therapeutic wearables |

| Customization and Pricing | Customization and Pricing Available on Request |

In terms of product, the industry is divided into compression garments (upper compression garments and lower compression garments), compression stockings (anti-embolism compression stockings and gradient compression stockings)

In terms of application, the industry is divided into varicose veins, wound care, burns, oncology, and others

In terms of distribution channels, the industry is divided into hospitals, ambulatory surgical centers, clinics, online sales, and other healthcare facilities

Key countries of North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East and Africa (MEA) have been covered in the report.

The global compression garments and stockings industry is projected to witness a CAGR of 4.4% between 2025 and 2035.

The global compression garments and stockings industry stood at USD 3.08 billion in 2024.

The global compression garments and stockings industry is anticipated to reach USD 5 billion by 2035 end.

Japan is expected to show a CAGR of 1.8% in the assessment period.

The key players operating in the global compression garments and stockings industry include 3M, BSN Medical, Covidien Ltd., Medi GmBH & Co KG, SIGVARIS, Therafirm, 2XU Pty. Ltd., Santemol Group Medikal, Leonisa, Inc., Nouvelle, Inc. and Medical Z.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compression Testers Market Size and Share Forecast Outlook 2025 to 2035

Compression Product Market Size and Share Forecast Outlook 2025 to 2035

Compression Testing Machines Market Size and Share Forecast Outlook 2025 to 2035

Compression Baggers Market Size and Share Forecast Outlook 2025 to 2035

Compression Gas Spring Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Insights for Compression Baggers Providers

Industry Share Analysis for Compression Packing Providers

Compression Therapy Market Insights – Growth & Forecast 2024-2034

Compression Bags Market

Compression Veterinary Bandages Market Trends – Growth & Forecast 2025 to 2035

Compression Garments Market Size and Share Forecast Outlook 2025 to 2035

Decompression Toys Market Growth - Trends & Forecast 2025 to 2035

Box Compression Tester Market Size and Share Forecast Outlook 2025 to 2035

Radial Compression Devices Market Growth - Trends & Forecast 2025 to 2035

Distal Compression Plates Market

Artery Compression Devices Market

Colon Decompression Kits Market

Abdominal Compression Garments Market Size and Share Forecast Outlook 2025 to 2035

India Static Compression Therapy Market Report – Trends & Forecast 2016-2026

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA