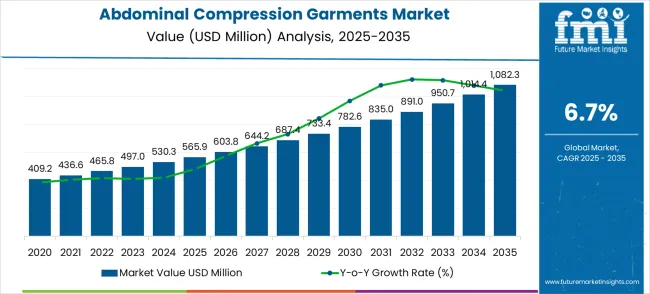

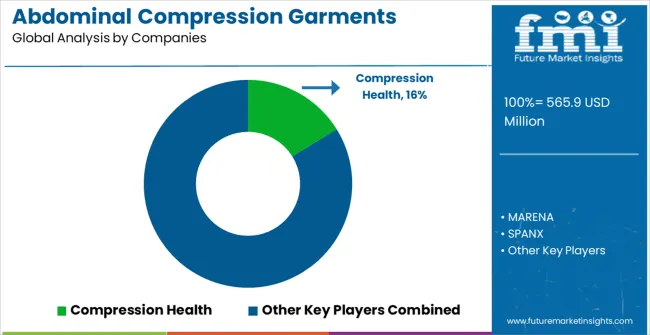

The global abdominal compression garments market is projected to expand from USD 565.9 million in 2025 to approximately USD 1,082.3 million by 2035, recording an absolute increase of USD 516.4 million over the forecast period. This translates into a total growth of 91.2%, with the market forecast to expand at a CAGR of 6.7% between 2025 and 2035. The overall market size is expected to grow by nearly 1.9X during the same period, supported by increasing demand for athletic performance wear, growing health and wellness awareness, and rising adoption of compression therapy solutions across the global sports, medical, and fashion industries.

Between 2025 and 2030, the market is projected to expand from USD 565.9 million to USD 782.6 million, resulting in a value increase of USD 216.7 million, which represents 42.0% of the total forecast growth for the decade. This phase of development will be shaped by increasing fitness and wellness trends, rising demand for therapeutic compression solutions, and growing utilization in athletic performance and medical recovery applications. Compression garment manufacturers and sportswear specialists are expanding their capabilities in abdominal compression garments to address the growing demand for comfortable and effective compression solutions in the sports, healthcare, and fashion markets.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 565.9 million |

| Forecast Value in (2035F) | USD 1,082.3 million |

| Forecast CAGR (2025 to 2035) | 6.7% |

From 2030 to 2035, the market is forecast to grow from USD 782.6 million to USD 1,082.3 million, adding another USD 299.7 million, which constitutes 58.0% of the ten-year expansion. This period is expected to be characterized by the expansion of smart textile technologies, the integration of advanced fabric innovations for premium compression garment products, and the development of specialized garment designs for emerging applications. The growing focus on personalized wellness and athletic performance optimization will drive demand for advanced abdominal compression garments with enhanced comfort characteristics and improved therapeutic benefits.

Between 2020 and 2024, the abdominal compression garments market experienced robust growth, driven by increasing fitness participation and growing recognition of compression therapy's benefits across athletic performance and medical recovery applications. The market developed as consumers recognized the potential for compression garments to enhance performance while meeting wellness and recovery requirements. Technological advancement in textile engineering and fabric development began focusing the critical importance of maintaining compression effectiveness while improving comfort and style appeal.

Market expansion is being supported by the increasing global demand for athletic performance wear and the corresponding shift toward health and wellness solutions that can provide superior comfort and therapeutic benefits while meeting consumer preferences for stylish and functional apparel. Modern fitness enthusiasts and healthcare professionals are increasingly focused on incorporating abdominal compression garments to enhance performance and recovery while satisfying demands for comfortable and effective compression therapy. Abdominal compression garments' proven ability to deliver superior muscle support, improved circulation, and enhanced comfort makes them essential products for athletic performance, medical recovery, and everyday wellness applications.

The growing focus on fitness culture and preventive healthcare is driving demand for high-quality abdominal compression garment products that can support distinctive performance capabilities and premium lifestyle positioning across sports, medical, and fashion categories. Consumer preference for products that combine functionality with style appeal is creating opportunities for innovative compression garment implementations in both traditional athletic and emerging wellness applications. The rising influence of social media and fitness trends is also contributing to increased adoption of premium abdominal compression garment products that can provide authentic performance and aesthetic benefits.

The market is segmented by material type, application, and region. By material type, the market is divided into cotton, chemical fiber, functional fabric, and others. Based on application, the market is categorized into sports compression, health, medical, and fashion apparel. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The cotton segment is projected to account for 35.3% of the abdominal compression garments market in 2025, reaffirming its position as the leading material type category. Garment manufacturers and consumers increasingly utilize cotton-based compression garments for their superior comfort characteristics, natural breathability, and skin-friendly properties across diverse compression applications. Cotton material technology's established textile processing and reliable comfort directly address the consumer requirements for comfortable compression wear and efficient moisture management in daily compression garment usage.

This material segment forms the foundation of modern compression garment applications, as it represents the material with the greatest comfort appeal and established consumer acceptance across multiple compression garment categories. Manufacturer investments in cotton blend optimization and comfort enhancement continue to strengthen adoption among users of compression garments. With consumers prioritizing comfort and natural materials, cotton compression garments align with both comfort objectives and wellness requirements, making them the central component of comprehensive compression wear strategies.

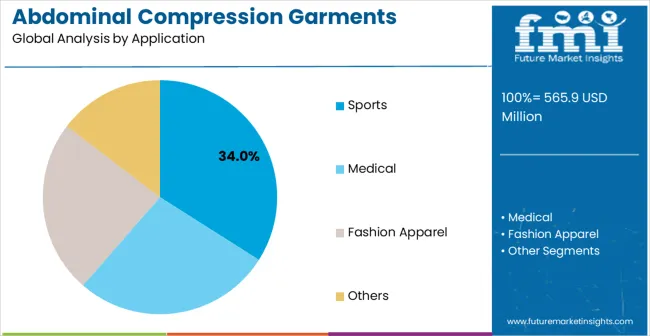

Sports compression applications are projected to accounts for 34.0% the abdominal compression garments demand in 2025, underscoring their critical role as the primary application for performance enhancement in athletic training and sports competition activities. Athletes and fitness enthusiasts prefer compression garments for their exceptional muscle support capabilities, performance enhancement properties, and ability to maintain consistent compression while supporting athletic performance requirements during physical activities. Positioned as essential equipment for high-performance athletic applications, compression garments offer both performance optimization and recovery enhancement advantages.

The segment is supported by continuous growth in fitness participation and the growing availability of specialized compression technologies that enable enhanced athletic performance and recovery optimization at the individual level. The athletes are investing in advanced compression solutions to support competitive advantage and training effectiveness. As sports participation continues to expand and athletes seek superior performance enhancement solutions, sports compression applications will continue to dominate the application landscape while supporting athletic advancement and performance optimization strategies.

The market is advancing rapidly due to increasing fitness participation and growing demand for wellness solutions that emphasize superior comfort and therapeutic benefits across sports, healthcare, and lifestyle applications. The market faces challenges, including sizing complexity for optimal compression effectiveness, higher costs compared to regular apparel alternatives, and consumer education requirements regarding compression benefits. Innovation in smart textile technologies and personalized compression solutions continues to influence market development and expansion patterns.

The growing adoption of abdominal compression garments in health and wellness lifestyle applications is enabling garment manufacturers to develop products that provide distinctive wellness benefits while commanding premium positioning and enhanced lifestyle appeal. Advanced applications offer superior comfort and support while allowing more sophisticated wellness development across various consumer categories and lifestyle segments. Manufacturers are increasingly recognizing the competitive advantages of wellness positioning for premium garment development and health-conscious market penetration.

Modern abdominal compression garment suppliers are incorporating smart textile technologies, advanced fabric innovations, and personalized fit systems to enhance compression effectiveness, improve comfort characteristics, and meet consumer demands for intelligent and adaptive compression solutions. These programs improve garment performance while enabling new applications, including biometric monitoring integration and personalized compression therapy. Advanced technology integration also allows suppliers to support premium market positioning and innovation leadership beyond traditional commodity compression garments.

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| Brazil | 7.0% |

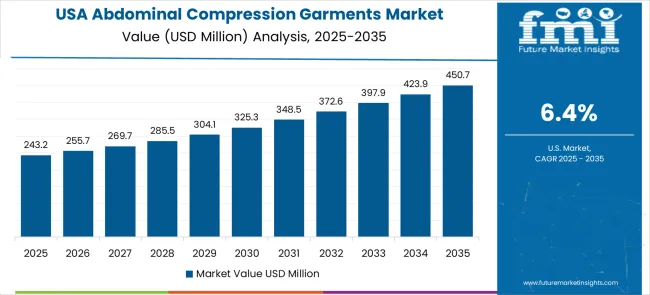

| U.S. | 6.4% |

| U.K. | 5.7% |

| Japan | 5.0% |

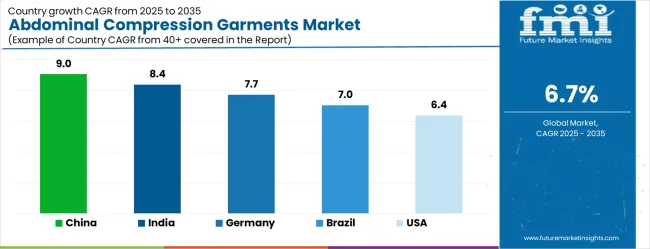

The market is experiencing exceptional growth globally, with China leading at a 9.0% CAGR through 2035, driven by the rapidly expanding fitness industry, massive investments in sports participation, and increasing adoption of wellness lifestyle trends. India follows at 8.4%, supported by growing health awareness, rising sports participation, and expanding middle-class fitness adoption. Germany shows growth at 7.7%, focusing advanced textile technology and premium sportswear manufacturing. Brazil records 7.0%, focusing on emerging fitness applications and wellness lifestyle development. The U.S. demonstrates 6.4% growth, prioritizing athletic performance innovation and wellness market advancement. The U.K. exhibits 5.7% growth, supported by fitness culture development and advanced sportswear capabilities. Japan shows 5.0% growth, focusing precision textile manufacturing excellence and high-quality compression garment production.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is projected to grow at a CAGR of 9.0% between 2025 and 2035, supported by rising demand from the medical, cosmetic, and wellness sectors. Abdominal compression garments are increasingly adopted after surgical procedures such as liposuction, hernia repairs, and bariatric surgeries to aid recovery. Growing fitness awareness and body contouring trends are also creating demand among younger consumers. Domestic manufacturers are investing in new fabric technologies to improve comfort, durability, and breathability of garments. E-commerce channels play a vital role in distribution, widening access to both urban and semi-urban regions. International brands are expanding presence through partnerships with local retailers, while Chinese companies are strengthening exports to Asia Pacific. The competitive landscape is defined by innovation and affordability, positioning China as a high-growth hub for abdominal compression garments.

India is expected to expand at a CAGR of 8.4% from 2025 to 2035, driven by growing medical procedures, rising fitness awareness, and lifestyle-related conditions. Abdominal compression garments are widely used in post-operative recovery, especially in bariatric and cosmetic surgeries, which are increasing in major cities. Domestic players are focusing on producing cost-effective garments that meet medical-grade standards while being affordable for broader patient segments. Growing awareness in the fitness sector also drives demand for compression garments as supportive tools during exercise and body shaping. Distribution through both retail pharmacies and digital health platforms has strengthened market accessibility. International players are entering India through joint ventures and online partnerships, while local firms are investing in textile innovation for improved elasticity and skin-friendly materials. India is positioned for steady adoption across both healthcare and wellness applications.

Germany is forecasted to grow at a CAGR of 7.7% between 2025 and 2035, supported by advancements in medical technology and a strong healthcare infrastructure. Abdominal compression garments are widely prescribed for post-surgical recovery, especially in abdominal and hernia procedures. German manufacturers are known for precision engineering, producing garments with advanced fabric compositions that improve support while maintaining high comfort. Demand is strengthened by the increasing use of garments in sports medicine and rehabilitation clinics. Innovation in antimicrobial fabrics and adjustable compression levels is shaping the product landscape. International brands view Germany as a strategic hub for European expansion, while local firms focus on exports across the region. The strong presence of healthcare providers, combined with insurance support in certain cases, contributes to consistent market adoption.

Brazil is set to grow at a CAGR of 7.0% from 2025 to 2035, driven by demand from both medical recovery and cosmetic surgery sectors. Abdominal compression garments are widely used after liposuction and other body contouring surgeries, which are highly popular in Brazil. The fitness culture also contributes to higher adoption as consumers use compression garments for shaping and exercise support. Local manufacturers are expanding production capacity to meet domestic demand, while international brands are entering through distribution partnerships. Cost efficiency is a major factor in purchasing decisions, encouraging firms to deliver affordable yet effective products. Brazil’s healthcare system is also increasingly prescribing compression garments for post-operative recovery, boosting credibility and demand. Growing awareness campaigns around safe surgical recovery are further fueling adoption.

The United States is projected to expand at a CAGR of 6.4% between 2025 and 2035, supported by high volumes of surgical procedures, including bariatric, cosmetic, and reconstructive surgeries. Abdominal compression garments are increasingly recommended for improved recovery outcomes and patient comfort. Growing interest in wellness and body contouring further boosts demand. U.S. manufacturers are focusing on advanced textile technologies, including moisture-wicking and breathable fabrics, to enhance user experience. Online retail channels, along with hospital distribution networks, play a significant role in accessibility. International brands see the U.S. as a lucrative market due to the high spending on medical and wellness products. Innovation in design and fit personalization is shaping competitive strategies. Insurance coverage for certain medical garments also encourages adoption.

The United Kingdom is anticipated to grow at a CAGR of 5.7% from 2025 to 2035, with adoption driven by post-surgical care and cosmetic recovery needs. Abdominal compression garments are commonly used in NHS and private healthcare practices for patient recovery, particularly in abdominal and weight-loss related surgeries. Demand is also fueled by cosmetic surgery, which has been increasing in the private healthcare sector. Local manufacturers are investing in ecofriendly textile technologies to create garments that combine durability, comfort, and medical-grade support. The retail and online healthcare supply chains are expanding, making products more accessible across regions. International brands are targeting the U.K. market through direct-to-consumer platforms. Demand is steady due to strong healthcare awareness and availability of specialized products.

Japan is forecasted to expand at a CAGR of 5.0% between 2025 and 2035, driven by technological innovation and growing demand in healthcare and wellness. Abdominal compression garments are increasingly prescribed for post-operative recovery in abdominal surgeries, and they are also adopted for lifestyle-driven fitness applications. Japanese manufacturers are focusing on precision engineering and high-performance textiles that provide superior comfort and breathability. The demand for advanced, skin-friendly fabrics is particularly strong due to consumer preference for quality and long-lasting products. Distribution networks through hospitals and e-commerce platforms are expanding accessibility. International players are entering Japan through partnerships with local distributors. Continuous investment in R&D ensures that Japan remains competitive in producing advanced compression solutions.

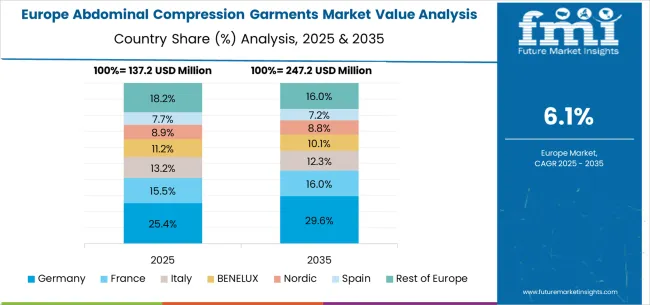

The abdominal compression garments market in Europe is projected to grow from USD 147.4 million in 2025 to USD 265.3 million by 2035, registering a CAGR of 6.1% over the forecast period. Germany is expected to maintain its leadership position with a 31.2% market share in 2025, remaining stable at 31.0% by 2035, supported by its advanced textile technology sector, precision sportswear manufacturing industry, and comprehensive innovation capabilities serving European and international markets.

The United Kingdom follows with a 19.8% share in 2025, projected to reach 20.1% by 2035, driven by fitness culture development programs, advanced sportswear capabilities, and growing focus on compression garment solutions for premium applications. France holds a 17.6% share in 2025, expected to maintain 17.4% by 2035, supported by fashion and sportswear industry demand and advanced textile applications, but facing challenges from market competition and economic considerations. Italy commands a 14.7% share in 2025, projected to reach 14.9% by 2035, while Spain accounts for 9.3% in 2025, expected to reach 9.5% by 2035. The Netherlands maintains a 4.8% share in 2025, growing to 4.9% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to hold 16.4% in 2025, declining slightly to 16.1% by 2035, attributed to mixed growth patterns with strong expansion in some fitness markets balanced by moderate growth in smaller countries implementing sportswear development programs.

The market is characterized by competition among established sportswear companies, specialized compression garment manufacturers, and integrated textile solution suppliers. Companies are investing in advanced fabric technologies, comfort optimization systems, application-specific product development, and comprehensive consumer support capabilities to deliver consistent, high-performance, and comfortable compression garment products. Innovation in compression effectiveness enhancement, comfort advancement, and customized fitness solutions is central to strengthening market position and customer satisfaction.

Health leads the market with a strong focus on wellness and therapeutic compression solutions, offering sophisticated compression garment products that emphasize health benefits and comfort excellence. MARENA provides specialized medical and post-surgical compression capabilities with a focus on therapeutic applications and healthcare networks. SPANX delivers innovative shapewear and compression technology with a focus on fashion appeal and lifestyle positioning. SKINS specializes in athletic compression with focus on sports performance and recovery optimization. ContourMD focuses on medical compression solutions with advanced therapeutic technologies. Atateks emphasizes compression textile expertise, focusing on athletic performance and comfort engineering.

Abdominal compression garments are specialized textile products that provide graduated pressure to the core area, supporting athletic performance, medical recovery, and wellness applications through improved circulation, muscle support, and body contouring. With the market projected to grow from USD 565.9 million in 2025 to USD 1,082.3 million by 2035 at a 6.7% CAGR, these products serve the expanding fitness culture, medical rehabilitation needs, and fashion-conscious consumer segments seeking functional apparel.

The dominance of cotton materials (35.3% market share) and sports compression applications reflects consumer preference for comfort and performance-oriented products. The market expansion faces challenges, including sizing complexity for optimal compression effectiveness, higher production costs compared to regular apparel, consumer education needs regarding compression benefits, and ensuring products promote a healthy body image rather than unrealistic expectations. Maximizing growth potential requires coordinated efforts across textile manufacturers and fashion designers, healthcare professionals and sports medicine experts, retail partners and fitness industry stakeholders, consumer education and wellness advocates, and green production and supply chain partners.

Advanced Fabric Technology Development: Invest in next-generation compression textiles, including moisture-wicking materials, four-way stretch fabrics, and breathable compression technologies that maintain therapeutic pressure while providing optimal comfort. Develop smart fabrics with integrated sensors for monitoring physiological parameters during athletic activities or recovery periods.

Ergonomic Design Innovation: Create compression garments with scientifically-designed pressure gradients that optimize blood circulation and muscle support while ensuring a comfortable fit across diverse body types. Develop adaptive sizing systems and customizable compression zones that address individual anatomical differences and specific therapeutic needs.

Ecofriendly Material Integration: Incorporate eco-friendly materials, including recycled fibers, organic cotton blends, and biodegradable synthetic alternatives that reduce environmental impact while maintaining compression effectiveness. Develop circular economy approaches, including garment recycling programs and green production methods, to promote a more sustainable approach to fashion.

Comfort and Style Integration: Design compression garments that seamlessly blend therapeutic functionality with contemporary fashion aesthetics, enabling users to wear products confidently in various social and professional settings. Create versatile designs suitable for athletic activities, medical recovery, and everyday wear applications.

Quality and Durability Enhancement: Implement advanced manufacturing techniques that ensure consistent compression levels, extended garment life, and maintained therapeutic benefits through multiple wash cycles. Develop testing protocols that verify compression effectiveness and fabric durability under real-world usage conditions.

Clinical Research and Validation: Conduct comprehensive clinical studies demonstrating the therapeutic benefits of abdominal compression garments for various medical conditions, including post-surgical recovery, chronic pain management, and circulatory disorders. Develop evidence-based guidelines for appropriate compression levels and wearing durations.

Professional Education Programs: Establish training programs for healthcare providers covering proper compression garment selection, fitting techniques, and patient monitoring protocols. Create certification programs for healthcare professionals specializing in compression therapy applications and patient care.

Patient Safety and Monitoring: Develop comprehensive safety protocols, including contraindication screening, proper sizing assessment, and ongoing patient monitoring, to ensure compression garments provide benefits without causing adverse effects. Create patient education materials explaining adequate use, care, and safety considerations.

Therapeutic Application Development: Identify and validate new therapeutic applications for abdominal compression garments, including pregnancy support, postpartum recovery, and athletic injury prevention. Develop specific protocols for different patient populations and medical conditions requiring compression therapy.

Integration with Treatment Plans: Establish guidelines for incorporating compression garments into comprehensive treatment programs, including physical therapy, post-surgical care, and chronic condition management. Create protocols that optimize therapeutic outcomes while ensuring patient comfort and compliance.

Consumer Education and Guidance: Provide comprehensive education about compression garment benefits, proper sizing, and appropriate applications through knowledgeable sales staff, educational materials, and fitting services. Develop tools and resources that help consumers select products suitable for their specific needs and body types.

Professional Fitting Services: Establish specialized fitting services that ensure proper compression garment selection and sizing, particularly important for medical applications where incorrect sizing can reduce effectiveness or cause discomfort. Train staff in anatomy, compression principles, and customer service for sensitive health-related purchases.

Multi-Channel Distribution: Develop comprehensive distribution strategies, including specialty medical retailers, sports equipment stores, online platforms, and healthcare facility partnerships that provide convenient access while maintaining product quality and professional guidance.

Customer Support and Follow-up: Implement customer service programs that provide ongoing support, including sizing adjustments, product care guidance, and replacement recommendations. Develop loyalty programs and educational resources that support long-term customer satisfaction and proper product usage.

Market Segmentation and Targeting: Create targeted marketing approaches for different customer segments, including athletes, medical patients, and general wellness consumers, while ensuring messaging promotes healthy attitudes toward body image and realistic expectations about product benefits.

Realistic Benefit Communication: Develop educational campaigns that accurately communicate compression garment benefits while avoiding unrealistic claims about weight loss, dramatic body transformation, or medical cure potential. Focus on evidence-based benefits, including improved circulation, muscle support, and recovery enhancement.

Body Positivity and Healthy Image Promotion: Advocate for marketing and product development that promotes healthy body image, self-acceptance, and wellness rather than unrealistic appearance standards. Ensure compression garments are positioned as health and performance tools rather than solutions for body dissatisfaction.

Proper Usage Education: Create comprehensive educational resources explaining proper compression garment usage, including appropriate wearing duration, activity guidelines, and safety considerations. Develop materials that help consumers understand when to seek professional medical advice regarding compression therapy.

Mental Health Considerations: Address the psychological aspects of compression garment usage, including potential dependency issues, body dysmorphia concerns, and the importance of maintaining healthy relationships with body image and clothing. Provide resources for consumers who may develop unhealthy usage patterns.

Community Building and Support: Foster supportive communities around healthy compression garment usage, including user forums, educational workshops, and peer support networks that emphasize wellness, athletic performance, and medical recovery rather than appearance-focused outcomes.

Ethical Manufacturing Practices: Implement fair labor practices throughout the supply chain, including safe working conditions, fair wages, and worker rights protection in compression garment manufacturing facilities. Develop supplier codes of conduct that ensure ethical treatment of workers across all production stages.

Environmental Impact Reduction: Develop ecofriendly production methods, including reduced water usage, minimized chemical processing, and renewable energy utilization in textile manufacturing. Implement circular economy principles, including garment recycling, material recovery, and waste reduction programs.

Supply Chain Transparency: Establish comprehensive traceability systems that provide visibility into raw material sourcing, manufacturing processes, and labor practices. Develop reporting mechanisms that allow consumers and stakeholders to make informed decisions about product sustainability and ethical considerations.

Innovation in Sustainable Materials: Invest in research and development of ecofriendly textile alternatives, including bio-based fibers, recycled materials, and low-impact dyeing processes that maintain compression effectiveness while reducing environmental footprint.

Global Market Development: Support responsible market expansion in emerging economies like China (9.0% CAGR) and India (8.4% CAGR) through local partnership development, technology transfer programs, and community-based manufacturing initiatives that create economic opportunities while maintaining environmental and social standards.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 565.9 million |

| Material Type | Cotton, Chemical Fiber, Functional Fabric, Others |

| Application | Sports Compression, Health, Medical, Fashion Apparel |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Health, MARENA, SPANX, SKINS, ContourMD, Atateks, Under Armour, CW-X, Delta Garments, Bangjie Holding Group, Goldenlady, Pompea, Memteks, Tefron, Wolford, Bonny, and Guangdong Singwear Garments |

| Additional Attributes | Dollar sales by material type and application, regional demand trends, competitive landscape, technological advancements in compression technology, comfort optimization development initiatives, performance enhancement programs, and wellness integration strategies |

North America

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global automotive synchronizer ring market is estimated to be valued at USD 694.7 million in 2025.

The market size for the automotive synchronizer ring market is projected to reach USD 989.4 million by 2035.

The automotive synchronizer ring market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in automotive synchronizer ring market are copper alloy gear ring, powder metallurgy gear ring, steel gear ring and other.

In terms of application, manual transmission (mt) segment to command 48.0% share in the automotive synchronizer ring market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Abdominal Aortic Aneurysm Treatment Market Analysis – Size, Share & Forecast 2025 to 2035

Abdominal Closure Systems Market Analysis – Trends & Forecast 2024-2034

Transabdominal Retrieval Kits Market

Intra-Abdominal Infection Treatment Market Size and Share Forecast Outlook 2025 to 2035

Intra-Abdominal Pressure Measurement Devices Market Analysis - Size, Trends & Forecast 2025 to 2035

Compression Testers Market Size and Share Forecast Outlook 2025 to 2035

Compression Product Market Size and Share Forecast Outlook 2025 to 2035

Compression Testing Machines Market Size and Share Forecast Outlook 2025 to 2035

Compression Baggers Market Size and Share Forecast Outlook 2025 to 2035

Compression Gas Spring Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Compression Veterinary Bandages Market Trends – Growth & Forecast 2025 to 2035

Market Share Insights for Compression Baggers Providers

Industry Share Analysis for Compression Packing Providers

Compression Therapy Market Insights – Growth & Forecast 2024-2034

Compression Bags Market

Compression Garments Market Size and Share Forecast Outlook 2025 to 2035

Compression Garments and Stockings Market Analysis - Size, Share, and Forecast 2025 to 2035

Decompression Toys Market Growth - Trends & Forecast 2025 to 2035

Box Compression Tester Market Size and Share Forecast Outlook 2025 to 2035

Radial Compression Devices Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA