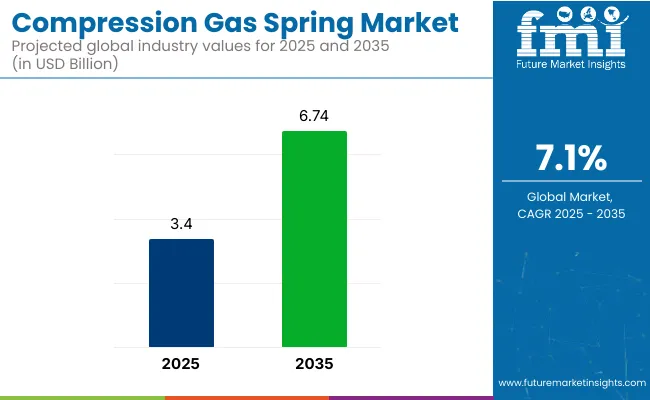

The global compression gas spring market is anticipated to grow from USD 3.4 billion in 2025 to USD 6.74 billion by 2035, registering a CAGR of 7.1%. This growth is fueled by expanding applications in automotive, aerospace, medical devices, industrial machinery, and furniture sectors.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 3.4 Billion |

| Market Size (2035) | USD 6.74 Billion |

| CAGR (2025 to 2035) | 7.1% |

The shift toward compact mechanical systems, adjustable motion control, and enhanced ergonomics is accelerating the use of gas springs in manufacturing and consumer products. Innovations in precision damping, self-adjusting force control, and maintenance-free designs are further enhancing adoption, especially in sectors demanding high-cycle performance, safety, and controlled linear motion.

Recent innovations in compression gas spring technology have focused on enhanced force control, reduced friction, and precision-engineered damping. Advanced sealing systems now ensure longer service life and improved resistance to harsh environments.

Compact, lightweight designs are being developed for high-performance applications in automotive, aerospace, and medical sectors. Integration of smart sensors enables real-time pressure monitoring and load adjustment, enhancing system reliability and efficiency.

Additionally, new surface treatments and corrosion-resistant materials have significantly boosted durability. These advancements are driving broader adoption across industries where controlled motion, weight balancing, and high-cycle performance are critical to operational safety and functionality.

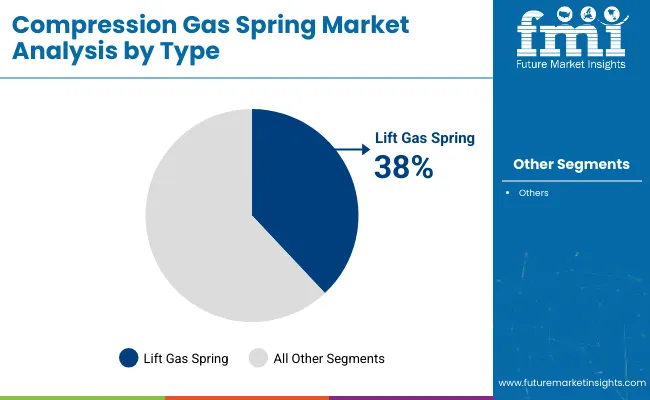

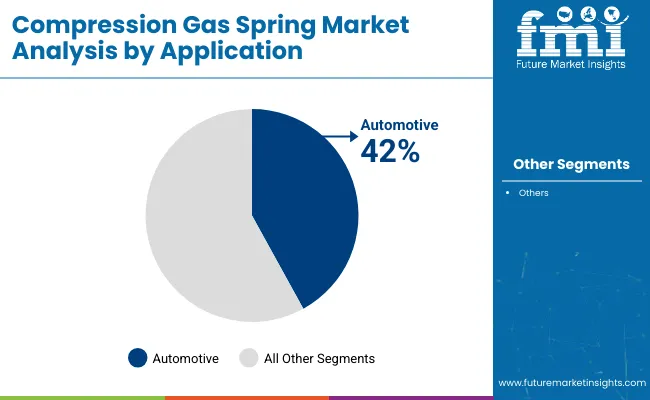

Japan is projected to be the fastest-growing market in the global compression gas spring industry, with a CAGR of 7.4% between 2025 and 2035. Lift gas springs will dominate the type segment, accounting for 38% of the market share in 2025. The automotive sector will lead all applications, capturing 42% of the total market share. The USA and Germany will also experience notable expansion, with projected CAGRs of 6.8% and 6.9% respectively.

The compression gas spring market is segmented into type, application, and region. By type, the market is divided into lift gas spring, lockable gas spring, swivel chair gas spring, gas traction spring, gas spring damper, and others (adjustable force gas spring, stainless steel gas spring, tension gas spring, and hydraulic-gas hybrid spring).

In terms of application, the market is categorized into automotive, aerospace, marine, medical, furniture, and industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East, and Africa.

Lift gas springs have been anticipated to dominate the segment, capturing a 38% market share in 2025 due to their wide usage in automotive, industrial, and furniture applications. These springs are being extensively used for providing controlled lifting and lowering mechanisms in vehicles and ergonomic furniture.

The automotive sector has been identified as the most lucrative application, holding a 42% market share in 2025. This dominance has been driven by the growing integration of gas springs in tailgates, hoods, seats, and trunk systems across both ICE and electric vehicles.

The global compression gas spring market is experiencing steady growth, fueled by rising demand for precision motion systems, ergonomic industrial designs, and advancements in smart gas spring technologies.

Recent Trends in the Compression Gas Spring Market

Challenges in the Compression Gas Spring Market

The compression gas spring demand in the USA is projected to expand at a CAGR of 6.8% from 2025 to 2035. Growth is being driven by high adoption in the automotive, aerospace, and industrial automation sectors. The country is witnessing a rising demand for ergonomic office furniture and medical equipment incorporating gas springs to enhance operational safety and ease of use.

The U.K. compression gas spring market is anticipated to grow at a CAGR of 6.5% from 2025 to 2035. Demand is being influenced by a mature aerospace sector, rising electric vehicle adoption, and increasing automation in healthcare and furniture manufacturing. Emphasis is also being placed on eco-friendly and recyclable gas spring materials.

Sales of compression gas springs in Germany are expected to register a CAGR of 6.9% from 2025 to 2035. As a European hub for automotive and industrial engineering, Germany is leveraging advanced motion control technology in automated production, EV assembly, and ergonomic workplace tools.

France’s compression gas spring market is forecasted to grow at a CAGR of 6.6% over the forecast period. Market expansion is being fueled by demand in electric vehicles, medical devices, and industrial robotics. France’s push for automation and eco-sustainable technologies is strengthening local adoption.

Japan’s compression gas spring market is set to achieve a CAGR of 7.4%, the highest among developed nations. The country's leadership in robotics, automotive innovation, and aging population is fueling strong uptake in medical beds, assistive devices, and precision industrial tools.

The competitive landscape of the compression gas spring market is moderately fragmented, with a mix of global tier-one suppliers and numerous mid-tier regional players. Intense competition is being fostered through innovation, tailored solutions, strategic partnerships, and geographic expansion initiatives.

Leading firms are competing based on advanced customization, smart functionality, and cost-efficient manufacturing. Innovation is being driven via IoT-enabled and corrosion-resistant gas springs, while strategic partnerships and acquisitions are being leveraged to enter new regional markets. Pricing strategies and in-house production capacities are being optimized to balance performance and cost competitiveness.

Recent Compression Gas Spring Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 3.4 billion |

| Projected Market Size (2035) | USD 6.74 billion |

| CAGR (2025 to 2035) | 7.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameters | Revenue in USD billions/Volume in million units |

| By Type | Lift Gas Spring, Lockable Gas Spring, Swivel Chair Gas Spring, Gas Traction Spring , Gas Spring Damper, and Others ( Adjustable Force Gas Spring , Stainless Steel Gas Spring , Tension Gas Spring , and Elastomeric Gas Spring ) |

| By Application | Automotive, Aerospace, Marine, Medical, Furniture, and Industrial |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East , and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Weforma Dämpfungstechnik GmbH, Dictator Technik GmbH, Camloc Motion Control, ACE Controls Inc., Lesjöfors AB, AVM Industries, Barnes Group Inc., Associated Spring Raymond, Zhongde Gas Spring Manufacturing Co. Ltd, Metrol Spring s Ltd, and other major players. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

In terms of Type, the industry is divided into Lift Gas Spring, Lockable Gas Spring, Swivel chair Gas Spring., Gas traction springs, Gas spring Damper, Others

In terms of application, the industry is divided into Automotive, Aerospace, Marine, Medical, Furniture, Industrial

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The market is valued at USD 3.4 billion in 2025.

The market is forecasted to reach USD 6.74 billion by 2035, reflecting a CAGR of 7.1%.

Lift gas springs will lead the market by type with a 38% market share in 2025.

The automotive sector will dominate the market with a 42% share in 2025.

Japan is projected to grow at the fastest rate, with a 7.4% CAGR from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nitrogen Gas Springs Market

China Nitrogen Gas Spring Market Report - Trends, Growth & Forecast 2025 to 2035

Leading Providers & Market Share in China Nitrogen Gas Springs

Gas Insulated Switchgear (GIS) Bushing Market Size and Share Forecast Outlook 2025 to 2035

Gas Discharge Tube (GDT) Arresters Market Size and Share Forecast Outlook 2025 to 2035

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Desiccant Dehydration Unit Market Size and Share Forecast Outlook 2025 to 2035

Gas Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Gasket and Seal Market Size and Share Forecast Outlook 2025 to 2035

Gas Separation Membrane Market Size and Share Forecast Outlook 2025 to 2035

Gas Jet Compressor Market Size and Share Forecast Outlook 2025 to 2035

Compression Testers Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Water-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Spring Applied Clutches Market Size and Share Forecast Outlook 2025 to 2035

Compression Product Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Real Estate Generator Market Size and Share Forecast Outlook 2025 to 2035

Gastric-soluble Hollow Capsules Market Size and Share Forecast Outlook 2025 to 2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Gasoline Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Smart Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA