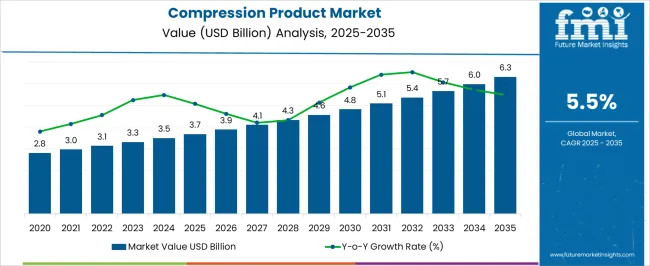

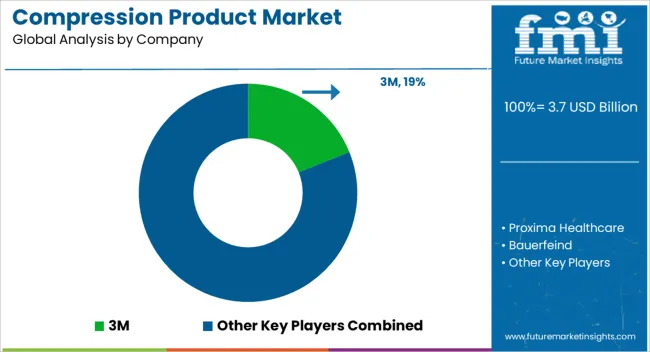

The Compression Product Market is estimated to be valued at USD 3.7 billion in 2025 and is projected to reach USD 6.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Compression Product Market Estimated Value in (2025 E) | USD 3.7 billion |

| Compression Product Market Forecast Value in (2035 F) | USD 6.3 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The compression product market is experiencing sustained growth. Rising prevalence of circulatory disorders, increasing awareness of preventive healthcare, and growing adoption of non-invasive therapeutic solutions are driving market expansion. Current dynamics are shaped by integration of advanced materials, ergonomic designs, and enhanced comfort features in compression products.

Regulatory standards and quality certifications have reinforced product reliability, while expanding healthcare infrastructure and insurance coverage have improved accessibility. The future outlook is characterized by growing demand in both clinical and homecare settings, rising adoption among aging populations, and increased use of compression therapy in postoperative and chronic condition management.

Growth rationale is grounded in the proven efficacy of compression products in improving patient outcomes, ongoing product innovation, and strategic distribution through pharmacies and healthcare networks These factors collectively support market stability, increased penetration in emerging regions, and continued revenue growth across the forecast period.

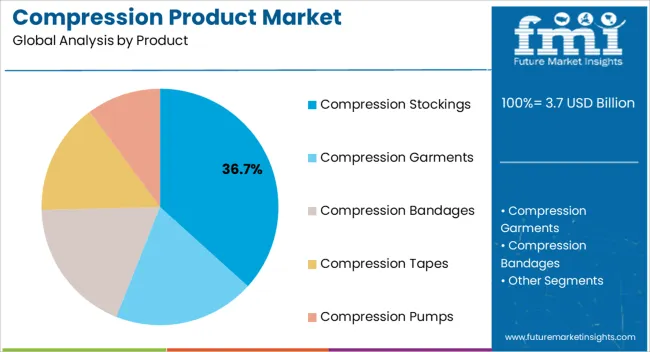

The compression stockings segment, representing 36.70% of the product category, has emerged as the leading product due to its effectiveness in promoting venous return and reducing the risk of blood clots. Adoption has been reinforced by clinical recommendations, user comfort, and material innovations that enhance durability and wearability.

Manufacturing standards and regulatory compliance have strengthened market confidence. Demand has been supported by both therapeutic and preventive applications, while rising awareness among healthcare providers and patients has contributed to steady growth.

Continued innovation in design, including graduated compression and customizable sizing, is expected to sustain market share and reinforce the segment’s leadership within the compression product category.

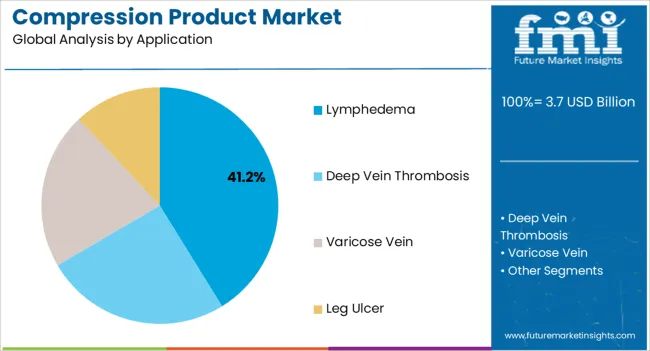

The lymphedema application segment, accounting for 41.20% of the application category, has maintained prominence due to the high clinical necessity of managing fluid retention and swelling in patients. Adoption has been driven by treatment guidelines, physician recommendations, and patient adherence programs.

Availability of supportive care products and education on disease management has increased segment acceptance. Product efficacy and comfort have strengthened patient compliance, while insurance coverage and reimbursement policies have facilitated broader access.

Ongoing development of specialized compression therapies and integrated care solutions is expected to maintain the segment’s market share and support incremental growth across diverse healthcare settings.

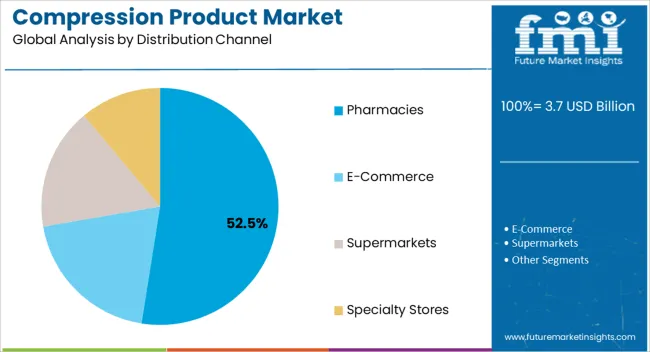

The pharmacies segment, holding 52.50% of the distribution channel category, has emerged as the leading channel owing to its accessibility, reliability, and central role in patient procurement. Adoption has been facilitated by established supply chains, regulatory oversight, and professional guidance on product selection and usage.

Pharmacies provide timely availability for both chronic and acute therapy needs, while partnerships with manufacturers enhance inventory management and product awareness. Operational efficiencies, combined with patient trust and convenience, have reinforced market leadership.

Expansion of pharmacy networks and integration with healthcare providers in emerging markets are expected to sustain segment share and support continued penetration over the forecast period.

| Attributes | Details |

|---|---|

| Compression Product Market Size (2020) | USD 2,847.1 million |

| Compression Product Market Size (2025) | USD 3,477.9 million |

| Compression Product Market CAGR (2020 to 2025) | 4.8% |

The compression product market size is anticipated to be worth USD 6,492 million by 2035. Historically, the global compression product market recorded a CAGR of 4.8% from 2020 to 2025.

The aging population of the world, which is particularly susceptible to age-related muscular issues and the prevalence of illnesses like lymphedema, bolsters industry expansion. The global trend toward fitness in modern civilization and people's general concern for their physical and mental health also drive the market's potential worldwide. The increased public awareness is helping the compressed product industry develop a solid and stable foundation.

Lymphatic and venous disorders are becoming increasingly prevalent. Variables affecting these conditions' development include varicose veins, pregnancy, past deep vein thrombosis, and immobility. Conditions including chronic venous insufficiency, breast cancer, and procedures can also result in lymphatic issues. As a result, the prevalence of chronic illnesses is predicted to rise, and people are becoming more aware of advanced treatments like compression garments and other items.

The demand for compression products is also being driven in part by increased obesity rates. Obesity has several side effects, one of which is circulation-related foot edema. According to WHO reports, childhood obesity is common in this age range as well. This benefits the industry by increasing the quantity of products produced and distributed.

It is challenging to treat conditions like lymphedema and venous leg ulcers. The expansion of product use as an effective treatment option and product innovation have been identified as two primary compression therapy industry trends. Clinical studies have shown that this treatment can speed up the healing of venous leg ulcers (VLUs) and lower their incidence of recurrence. Additionally, lymphedema is successfully treated. A growing number of distinctive products are being presented to the market due to significant research initiatives in product development by major market competitors.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 6.0% |

| China | 5.2% |

| Canada | 5.0% |

| India | 6.2% |

| Germany | 5.0% |

The demand for compression products market in the United States is estimated to rise at a 6.0% CAGR through 2035. The growing emphasis on post-surgical rehabilitation is an important aspect driving the market's expansion. The advantages of compression garments in post-surgical recovery are consistent with the focus placed by the American healthcare system on effective and efficient rehabilitation procedures.

Medical and consumer demand is being driven by the recommendation of compression goods by healthcare professionals and surgeons as essential elements of rehabilitation programs. Compression apparel is positioned as a critical component of the continuum of treatment because of its strategic connection with healthcare practices. For the country's manufacturers of compressed garments, this offers profitable opportunities. This factor is anticipated to generate significant incremental opportunities in the United States and rising online compression product sales.

The sales of compression products market in China are projected to surge at a 5.2% CAGR through 2035. China's e-commerce supremacy and extensive adoption of digital platforms are critical to market development. Alibaba and JD.com, for example, offer a wide online marketplace for compression equipment. Companies that engage Chinese customers through sophisticated digital marketing techniques, social commerce, and live-streaming thrive in the country's digital economy, driving sales and market reach.

The compression product market size in Canada is anticipated to develop at a 5.0% CAGR through 2035. The aging population of Canada, as well as a parallel trend of active aging, are significant factors of market development. Compression gear that improves joint health lowers muscle fatigue, and assists in recovery is in high demand as the demographic landscape swings towards older customers who prioritize health and fitness. Companies that properly match their marketing tactics with the active aging narrative capture a rising market niche, contributing to sustained demand.

The demand for compression product market in India is estimated to rise at a 6.2% CAGR through 2035. The growing desires of India's emerging middle class for health and fitness are key elements driving market development. As disposable income rises, so does the proclivity to invest in health and wellness items such as compression gear. Companies profiting from this trend intentionally coordinate their marketing efforts to promote compression apparel as a vital component of a contemporary, healthy lifestyle, appealing to the aspirational customer attitude.

The sales of compression product market in Germany are projected to surge at a 5.0% CAGR through 2035. Partnerships with orthopedic specialists and rehabilitation institutes are a distinct aspect impacting market progress in Germany. Companies that work with healthcare professionals actively market compression gear as an important part of orthopedic care and post-surgery recovery.

This strategic connection boosts product credibility and builds confidence among customers looking for medically backed solutions, resulting in long-term market growth. DKOU 2025, the largest medical congress for orthopedics and trauma surgery, was hosted in Germany in October 2025, where more than 12,000 global healthcare professionals participated. Several partnerships are anticipated to arise with this meeting in the near future.

| Segment | Compression Garments (Product Type) |

|---|---|

| Value Share (2025) | 36.2% |

Compression garments are growing increasingly popular among athletes and fitness enthusiasts as a way to improve performance. These clothes are intended to provide total muscular support during physical activity, decrease muscle vibration, and promote blood circulation. Compression garments are becoming increasingly popular as essential activewear because of the growing global interest in sports and fitness.

The rise in popularity of compression garments, particularly in the athleisure industry, can be attributed to the combination of design and practicality. Manufacturers have created fashionable and fashionable compression garment styles in response to consumer desires. Demand is being fueled by the allure of compression clothing trends such as performance gear and style statements, especially for individuals looking for sportswear that can be worn from the gym to regular settings.

| Segment | Pharmacies (Distribution Channel) |

|---|---|

| Value Share (2025) | 35.9% |

Pharmacies frequently collaborate strategically with hospitals, clinics, and other healthcare organizations. These collaborations can include cooperative healthcare services, pooled educational programs, and coordinated marketing campaigns. By presenting pharmacies as auxiliary parts of the larger healthcare system, these partnerships boost their reputation and draw in customers looking for compression garments and other healthcare solutions. The growth in demand within pharmacies is partly attributed to this strategic positioning.

Companies that sell compression products are actively attempting to enhance their positions through the introduction of new products and the approval of both existing and up-and-coming market participants. The product launch and approvals speed up the manufacturer's plan to take advantage of the market share and gain a sizable market share. This market is poised to have a significant influence. It is anticipated to boost sales of compression goods as the key players concentrate on organic expansion by bolstering their product portfolios.

Recent Developments

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; and Middle East & Africa (MEA). |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Argentina, Rest of Latin America, United Kingdom, Germany, Italy, Russia, Spain, France, BENELUX, Rest of Europe, Japan, China, South Korea, India, Thailand, Indonesia, Malaysia, Australia, New Zealand, Turkey, GCC, South Africa, North Africa and Rest of MEA. |

| Key Market Segments Covered | Product, application, distribution channel, and region |

| Key Companies Profiled | Proxima Healthcare; 3M; Bauerfeind; Macom Enterprises; Leonisa; LIPOELASTIC; Cosmac Healthcare; Lohmann and Rauscher; Wear Ease; Peninsula BioMedical; LympheDIVAs; Juzo; Medico International; The Marena Group; Smith & Nephew plc; Spectrum Healthcare; Bio Compression Systems Inc; Gottfried Medical Inc.; Cardinal Health |

| Pricing | Available upon Request |

The global compression product market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the compression product market is projected to reach USD 6.3 billion by 2035.

The compression product market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in compression product market are compression stockings, compression garments, compression bandages, compression tapes and compression pumps.

In terms of application, lymphedema segment to command 41.2% share in the compression product market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compression Testers Market Size and Share Forecast Outlook 2025 to 2035

Compression Garments Market Size and Share Forecast Outlook 2025 to 2035

Compression Testing Machines Market Size and Share Forecast Outlook 2025 to 2035

Compression Garments and Stockings Market Analysis - Size, Share, and Forecast 2025 to 2035

Compression Baggers Market Size and Share Forecast Outlook 2025 to 2035

Compression Gas Spring Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Compression Veterinary Bandages Market Trends – Growth & Forecast 2025 to 2035

Market Share Insights for Compression Baggers Providers

Industry Share Analysis for Compression Packing Providers

Compression Therapy Market Insights – Growth & Forecast 2024-2034

Compression Bags Market

Decompression Toys Market Growth - Trends & Forecast 2025 to 2035

Box Compression Tester Market Size and Share Forecast Outlook 2025 to 2035

Radial Compression Devices Market Growth - Trends & Forecast 2025 to 2035

Distal Compression Plates Market

Artery Compression Devices Market

Colon Decompression Kits Market

Abdominal Compression Garments Market Size and Share Forecast Outlook 2025 to 2035

India Static Compression Therapy Market Report – Trends & Forecast 2016-2026

Product Life-Cycle Management (PLM) IT Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA