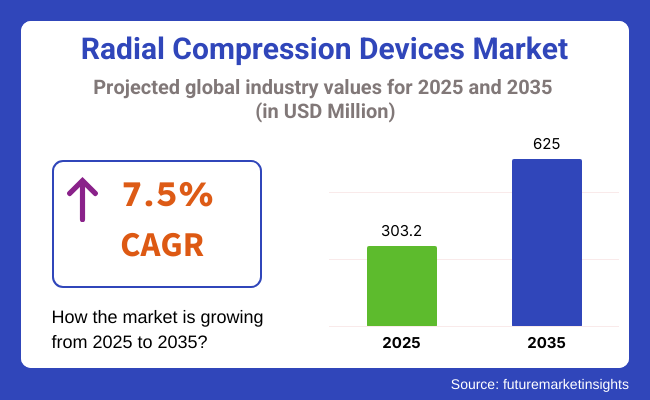

The global Radial Compression Devices Market was valued at USD 198.6 million in 2020 and is projected to reach USD 303.2 million by 2025. From 2025 to 2035, the market is forecast to expand at a robust CAGR of 7.5%, ultimately surpassing USD 625.0 million by 2035. This upward trajectory is primarily fueled by the growing clinical preference for radial artery access over femoral access in interventional cardiovascular procedures, including coronary angiography and percutaneous coronary interventions (PCI).

The transition to radial access is underpinned by lower complication rates, shorter recovery times, and cost-effective care delivery, making it a favorable approach for both patients and providers. As global procedural volumes rise, particularly among aging populations with cardiovascular comorbidities, the need for efficient hemostasis solutions has grown significantly.

The market is further supported by continuous innovations in device design, including adjustable pressure controls, transparent visualization bands, and antimicrobial-coated materials. Additionally, physician training initiatives and catheter lab partnerships by leading manufacturers are contributing to increased clinical adoption and sustained product utilization across key markets.

Major manufacturers operating in the radial compression devices space include Terumo Corporation, Merit Medical Systems, Abbott Laboratories, and Teleflex Incorporated. These companies continue to strengthen their market position through targeted product innovation, clinician education programs, and streamlined distribution models.

In 2024, DIZGENGENS Medical Science Co., Ltd. secured FDA 510(k) clearance, marking a significant step in expanding access to next-generation hemostasis technologies. New product introductions featuring antimicrobial coatings, dual-port mechanisms, and transparent pads are enhancing procedural safety, visualization, and clinician confidence. These advancements, combined with a growing emphasis on post-procedural outcomes and infection control, are expected to propel market competitiveness over the next decade.

North America is projected to maintain a leading position in the radial compression devices market in 2025, supported by high procedural volumes and favorable reimbursement structures that encourage the use of minimally invasive techniques. The USA healthcare system continues to witness a shift toward outpatient cardiovascular procedures, with CMS promoting ambulatory PCI protocols that rely heavily on radial access and associated hemostatic technologies.

Independent catheterization centers are also adopting radial-first strategies to enhance procedural safety and efficiency. In Europe, market growth is driven by the adoption of radial access guidelines issued by the European Society of Cardiology (ESC) and national initiatives to reduce vascular complications.

Countries such as Germany, France, and the Netherlands are investing in compact, disposable solutions tailored to public procurement strategies. Furthermore, EU-wide research collaborations aimed at minimizing radial artery occlusion are fostering innovation in compression system design and pressure regulation features

In 2025, the band/strap-based radial compression devices segment is expected to lead the global market, accounting for 80.0% of total revenue. This dominance is attributed to their superior ability to provide consistent, adjustable pressure over the radial artery following catheterization. The ergonomic design and transparent materials of these devices allow clinicians to monitor the access site without disrupting the compression, while the integration of antimicrobial elements reduces infection risks.

These devices also offer improved patient comfort, reduced incidence of occlusion, and are available in pre-sterilized kits for rapid deployment in high-throughput cardiovascular units. Hospitals and ambulatory centers have increasingly adopted strap-based solutions as the standard due to their simplicity, clinical reliability, and integration with cost-conscious purchasing frameworks across developed economies.

Disposable radial compression devices are projected to dominate the usage landscape in 2025, capturing 86.1% of global market revenue. This preference stems from heightened infection control measures and the demand for standardized, single-use solutions in high-volume procedural settings. Disposable devices mitigate the risk of cross-contamination and eliminate the need for reprocessing, aligning with hospital hygiene protocols and reducing turnaround times between procedures.

Regulatory authorities such as the FDA and EMA have endorsed disposable technologies in high-risk environments, driving their adoption across global healthcare systems. Manufacturers have responded with user-friendly innovations, such as built-in pressure valves, transparent interfaces, and simplified application mechanisms. The operational advantages of disposables-such as logistical ease, cost-effectiveness, and consistent performance-have positioned them as the gold standard for post-procedural radial artery management in both developed and emerging regions.

Challenges

Comprehensive Analysis of Challenges Impacting the Radial Compression Devices Market

The radial compression devices market faces challenges such as high costs of advanced compression systems, regulatory hurdles in obtaining approvals for innovative hemostasis technologies, and resistance to transitioning from femoral to radial access in some healthcare settings.

The need for improved compression device design to balance hemostasis and patient comfort, challenges in standardizing radial artery compression techniques, and disparities in reimbursement policies for radial procedures create barriers to market expansion.

Additionally, challenges in integrating AI-driven pressure monitoring into routine radial hemostasis, high costs associated with developing ultra-thin and lightweight compression devices, and concerns over long-term efficacy of bioresorbable radial bands impact market growth.

Opportunities

Emerging Opportunities and Innovations Driving Growth in the Radial Compression Devices Market

The increasing adoption of advanced hemostasis monitoring techniques, the expansion of transradial access in complex medical procedures, and rising investments in biodegradable radial closure devices are driving significant growth opportunities in the market. Innovations such as ultra-soft, adjustable radial bands and the integration of vascular closure methods with digital health solutions are further supporting market expansion.

Additionally, the rising use of hybrid radial and ulnar compression devices, alongside expanding research on non-invasive hemostasis tracking, is contributing to industry growth. Strengthening collaborations between pharmaceutical companies and medical technology firms to improve vascular access care is also expected to open new avenues for market development. Moreover, the growing demand for patient-focused radial compression solutions and user-friendly hemostasis devices is enhancing accessibility and boosting long-term market potential.

Emerging Trends

The rising adoption of eco-friendly, patient-friendly hemostasis solutions is expanding market opportunities in transradial access management and outpatient cardiac care. Moreover, governments and healthcare agencies are expanding support for radial access innovation, streamlining approval pathways for next-generation hemostasis solutions, and implementing policies to improve accessibility of advanced compression devices.

The rising demand for compression devices with dynamic pressure control and enhanced comfort features is driving innovation in adjustable, lightweight, and bioresorbable hemostasis devices, improving safety and treatment outcomes.

From 2020 through 2024, the market for radial compression devices experienced a great boost in growth, primarily driven by increased utilization of transradial access procedures in interventional cardiology. The trend was boosted by the benefits of transradial access, which include minimal risks of bleeding and enhanced patient comfort compared to traditional femoral access procedures.

While these advantages existed, market growth was hindered by factors such as the expense of devices and the need for specialized education, which restrained broader utilization at that time.

Looking forward to 2025 to 2035, the radial compression devices market will witness steady growth, fueled by continued technological advancements, the increasing incidence of cardiovascular diseases, and increased emphasis on minimally invasive treatments.

Improved device functionality is expected to advance treatment outcomes, enhancing patient care overall. Additionally, the creation of cost-effective and easy-to-use devices is expected to enhance accessibility, particularly in developing markets, leading to wider market growth.

Market Outlook

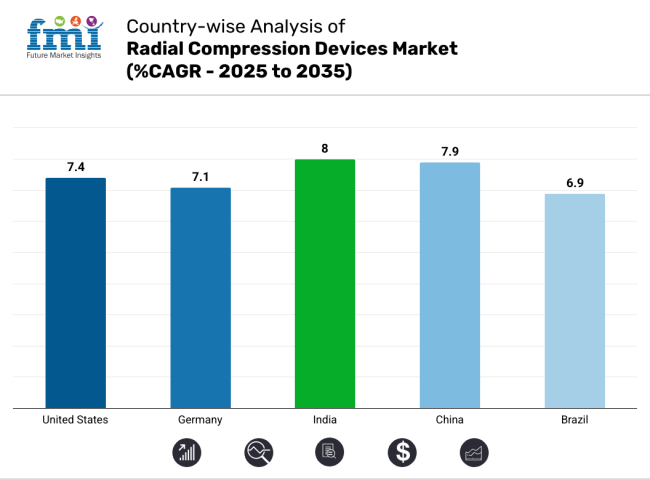

The United States is a major market for radial compression devices, with the rising volume of transradial catheterization procedures, growing incidence of cardiovascular diseases, and high adoption of minimally invasive procedures. Adoption of radial artery access over femoral artery access in interventional cardiology is driving market growth at a rapid pace. Also, improvements in radial compression technology and availability of major medical device companies are driving market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.4% |

Market Outlook

Germany is an important market for radial compression devices, enjoying its highly developed healthcare system, high rate of adoption of transradial catheterization, and high concentration of medical technology companies. The patient safety and efficiency in interventional procedures focus in the country is propelling demand for advanced radial hemostasis devices.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.1% |

Market Outlook

India's radial compression devices market is experiencing consistent growth due to the increasing incidence of cardiovascular diseases, the growing use of transradial catheterization procedures, and the burgeoning healthcare infrastructure. Although affordability is a major issue, the presence of affordable radial compression bands from local manufacturers is making it more accessible.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.0% |

Market Outlook

China's market for radial compression devices is expanding with increasing prevalence of cardiac disease, government spending on healthcare infrastructure, and the growing use of interventional cardiology procedures. The nation is also witnessing the growth of local manufacturing of affordable vascular closure devices, making transradial procedures more accessible.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.9% |

Market Outlook

The United Kingdom’s radial compression devices market is expanding due to increasing awareness of radial artery catheterization benefits, NHS investments in interventional cardiology, and advancements in vascular closure devices. The shift towards outpatient procedures and same-day discharge after angioplasty is further driving demand for radial compression devices.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 6.9% |

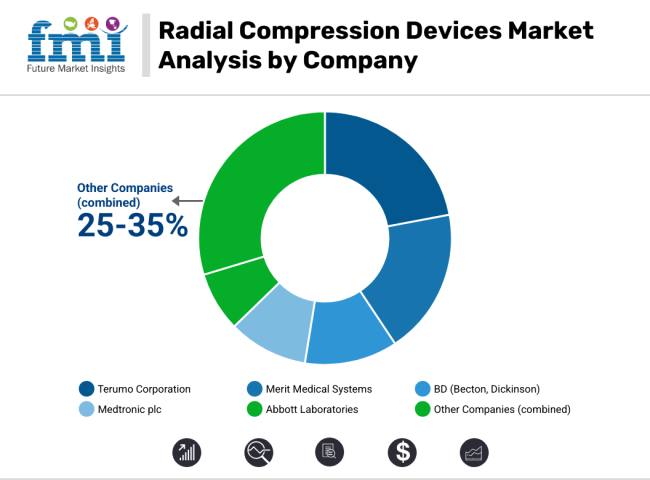

The radial compression devices market is highly competitive, driven by the increasing adoption of transradial access procedures, advancements in hemostasis technology, and the growing preference for minimally invasive cardiovascular interventions. Companies are investing in ergonomic designs, adjustable compression mechanisms, and patient-friendly hemostasis solutions to maintain a competitive edge.

The market is shaped by well-established medical device manufacturers, vascular access solution providers, and emerging hemostasis technology firms, each contributing to the evolving landscape of radial compression devices.

Terumo Corporation (22-26%)

A dominant player in the radial compression devices market, Terumo leads with high-performance hemostasis solutions for transradial interventions.

Merit Medical Systems (18-22%)

A leader in vascular access management, Merit Medical offers ergonomic radial compression bands that enhance patient comfort and procedural outcomes.

BD (Becton, Dickinson) (10-14%)

A key innovator in hemostasis technology, BD specializes in radial closure devices designed to reduce complications and improve workflow efficiency.

Medtronic plc (8-12%)

A strong competitor in cardiovascular devices, Medtronic provides user-friendly radial compression systems that ensure reliable and consistent hemostasis.

Abbott Laboratories (5-9%)

A major provider of vascular closure solutions, Abbott integrates advanced pressure-regulating features into its radial compression devices.

Other Key Players (25-35% Combined)

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

These companies focus on expanding the reach of radial compression solutions, offering competitive pricing and cutting-edge innovations to meet diverse interventional cardiology and vascular access needs.

Band/Strap Based, Knob Based and Plate Based

Disposable Device and Reusable Device

Surgical Intervention and Diagnostics

Hospitals, Independent Catheterization Lab, Ambulatory Surgical Centers and Specialized Clinics

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for Radial Compression Devices Market was USD 303.2 million in 2025.

The Radial Compression Devices Market is expected to reach USD 625.0 million in 2035.

Radial access in a PCI process provides greater patient satisfaction, higher benefits and savings due to shorter hospital stay and lower post-procedural complication are some factors that is likely to drive the growth of this market.

The top key players that drives the development of Radial Compression Devices Market are, Terumo Corporation, Merit Medical Systems, BD (Becton, Dickinson), Medtronic plc, and Abbott Laboratories

Band-based in product type of Radial Compression Devices market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 5: Global Market Value (US$ million) Forecast by Usage Type, 2017 to 2033

Table 6: Global Market Volume (Units) Forecast by Usage Type, 2017 to 2033

Table 7: Global Market Value (US$ million) Forecast by Application, 2017 to 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2017 to 2033

Table 9: Global Market Value (US$ million) Forecast by End User, 2017 to 2033

Table 10: Global Market Volume (Units) Forecast by End User, 2017 to 2033

Table 11: North America Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 13: North America Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 15: North America Market Value (US$ million) Forecast by Usage Type, 2017 to 2033

Table 16: North America Market Volume (Units) Forecast by Usage Type, 2017 to 2033

Table 17: North America Market Value (US$ million) Forecast by Application, 2017 to 2033

Table 18: North America Market Volume (Units) Forecast by Application, 2017 to 2033

Table 19: North America Market Value (US$ million) Forecast by End User, 2017 to 2033

Table 20: North America Market Volume (Units) Forecast by End User, 2017 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 23: Latin America Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 25: Latin America Market Value (US$ million) Forecast by Usage Type, 2017 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Usage Type, 2017 to 2033

Table 27: Latin America Market Value (US$ million) Forecast by Application, 2017 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Application, 2017 to 2033

Table 29: Latin America Market Value (US$ million) Forecast by End User, 2017 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End User, 2017 to 2033

Table 31: Western Europe Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2017 to 2033

Table 33: Western Europe Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 35: Western Europe Market Value (US$ million) Forecast by Usage Type, 2017 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Usage Type, 2017 to 2033

Table 37: Western Europe Market Value (US$ million) Forecast by Application, 2017 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Application, 2017 to 2033

Table 39: Western Europe Market Value (US$ million) Forecast by End User, 2017 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by End User, 2017 to 2033

Table 41: Eastern Europe Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2017 to 2033

Table 43: Eastern Europe Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 45: Eastern Europe Market Value (US$ million) Forecast by Usage Type, 2017 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Usage Type, 2017 to 2033

Table 47: Eastern Europe Market Value (US$ million) Forecast by Application, 2017 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Application, 2017 to 2033

Table 49: Eastern Europe Market Value (US$ million) Forecast by End User, 2017 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by End User, 2017 to 2033

Table 51: APEJ Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 52: APEJ Market Volume (Units) Forecast by Country, 2017 to 2033

Table 53: APEJ Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 54: APEJ Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 55: APEJ Market Value (US$ million) Forecast by Usage Type, 2017 to 2033

Table 56: APEJ Market Volume (Units) Forecast by Usage Type, 2017 to 2033

Table 57: APEJ Market Value (US$ million) Forecast by Application, 2017 to 2033

Table 58: APEJ Market Volume (Units) Forecast by Application, 2017 to 2033

Table 59: APEJ Market Value (US$ million) Forecast by End User, 2017 to 2033

Table 60: APEJ Market Volume (Units) Forecast by End User, 2017 to 2033

Table 61: Japan Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 62: Japan Market Volume (Units) Forecast by Country, 2017 to 2033

Table 63: Japan Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 64: Japan Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 65: Japan Market Value (US$ million) Forecast by Usage Type, 2017 to 2033

Table 66: Japan Market Volume (Units) Forecast by Usage Type, 2017 to 2033

Table 67: Japan Market Value (US$ million) Forecast by Application, 2017 to 2033

Table 68: Japan Market Volume (Units) Forecast by Application, 2017 to 2033

Table 69: Japan Market Value (US$ million) Forecast by End User, 2017 to 2033

Table 70: Japan Market Volume (Units) Forecast by End User, 2017 to 2033

Table 71: MEA Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 72: MEA Market Volume (Units) Forecast by Country, 2017 to 2033

Table 73: MEA Market Value (US$ million) Forecast by Product Type, 2017 to 2033

Table 74: MEA Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 75: MEA Market Value (US$ million) Forecast by Usage Type, 2017 to 2033

Table 76: MEA Market Volume (Units) Forecast by Usage Type, 2017 to 2033

Table 77: MEA Market Value (US$ million) Forecast by Application, 2017 to 2033

Table 78: MEA Market Volume (Units) Forecast by Application, 2017 to 2033

Table 79: MEA Market Value (US$ million) Forecast by End User, 2017 to 2033

Table 80: MEA Market Volume (Units) Forecast by End User, 2017 to 2033

Figure 1: Global Market Value (US$ million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Usage Type, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ million) by End User, 2023 to 2033

Figure 5: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ million) Analysis by Region, 2017 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2017 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ million) Analysis by Usage Type, 2017 to 2033

Figure 15: Global Market Volume (Units) Analysis by Usage Type, 2017 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Usage Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Usage Type, 2023 to 2033

Figure 18: Global Market Value (US$ million) Analysis by Application, 2017 to 2033

Figure 19: Global Market Volume (Units) Analysis by Application, 2017 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 22: Global Market Value (US$ million) Analysis by End User, 2017 to 2033

Figure 23: Global Market Volume (Units) Analysis by End User, 2017 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Usage Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Application, 2023 to 2033

Figure 29: Global Market Attractiveness by End User, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ million) by Usage Type, 2023 to 2033

Figure 33: North America Market Value (US$ million) by Application, 2023 to 2033

Figure 34: North America Market Value (US$ million) by End User, 2023 to 2033

Figure 35: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ million) Analysis by Usage Type, 2017 to 2033

Figure 45: North America Market Volume (Units) Analysis by Usage Type, 2017 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Usage Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Usage Type, 2023 to 2033

Figure 48: North America Market Value (US$ million) Analysis by Application, 2017 to 2033

Figure 49: North America Market Volume (Units) Analysis by Application, 2017 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: North America Market Value (US$ million) Analysis by End User, 2017 to 2033

Figure 53: North America Market Volume (Units) Analysis by End User, 2017 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Usage Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Application, 2023 to 2033

Figure 59: North America Market Attractiveness by End User, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ million) by Usage Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ million) by Application, 2023 to 2033

Figure 64: Latin America Market Value (US$ million) by End User, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ million) Analysis by Usage Type, 2017 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Usage Type, 2017 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Usage Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Usage Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ million) Analysis by Application, 2017 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Application, 2017 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 82: Latin America Market Value (US$ million) Analysis by End User, 2017 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by End User, 2017 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Usage Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ million) by Usage Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ million) by Application, 2023 to 2033

Figure 94: Western Europe Market Value (US$ million) by End User, 2023 to 2033

Figure 95: Western Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ million) Analysis by Usage Type, 2017 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Usage Type, 2017 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Usage Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Usage Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ million) Analysis by Application, 2017 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Application, 2017 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 112: Western Europe Market Value (US$ million) Analysis by End User, 2017 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by End User, 2017 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Usage Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ million) by Usage Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ million) by Application, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ million) by End User, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ million) Analysis by Usage Type, 2017 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Usage Type, 2017 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Usage Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Usage Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ million) Analysis by Application, 2017 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Application, 2017 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ million) Analysis by End User, 2017 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by End User, 2017 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Usage Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: Asia Pacific excluding Japan (APEJ) Market Value (US$ million) by Product Type, 2023 to 2033

Figure 152: APEJ Market Value (US$ million) by Usage Type, 2023 to 2033

Figure 153: APEJ Market Value (US$ million) by Application, 2023 to 2033

Figure 154: APEJ Market Value (US$ million) by End User, 2023 to 2033

Figure 155: APEJ Market Value (US$ million) by Country, 2023 to 2033

Figure 156: APEJ Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 157: APEJ Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 158: APEJ Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: APEJ Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: APEJ Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 161: APEJ Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 162: APEJ Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: APEJ Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: APEJ Market Value (US$ million) Analysis by Usage Type, 2017 to 2033

Figure 165: APEJ Market Volume (Units) Analysis by Usage Type, 2017 to 2033

Figure 166: APEJ Market Value Share (%) and BPS Analysis by Usage Type, 2023 to 2033

Figure 167: APEJ Market Y-o-Y Growth (%) Projections by Usage Type, 2023 to 2033

Figure 168: APEJ Market Value (US$ million) Analysis by Application, 2017 to 2033

Figure 169: APEJ Market Volume (Units) Analysis by Application, 2017 to 2033

Figure 170: APEJ Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 171: APEJ Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 172: APEJ Market Value (US$ million) Analysis by End User, 2017 to 2033

Figure 173: APEJ Market Volume (Units) Analysis by End User, 2017 to 2033

Figure 174: APEJ Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 175: APEJ Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 176: APEJ Market Attractiveness by Product Type, 2023 to 2033

Figure 177: APEJ Market Attractiveness by Usage Type, 2023 to 2033

Figure 178: APEJ Market Attractiveness by Application, 2023 to 2033

Figure 179: APEJ Market Attractiveness by End User, 2023 to 2033

Figure 180: APEJ Market Attractiveness by Country, 2023 to 2033

Figure 181: Japan Market Value (US$ million) by Product Type, 2023 to 2033

Figure 182: Japan Market Value (US$ million) by Usage Type, 2023 to 2033

Figure 183: Japan Market Value (US$ million) by Application, 2023 to 2033

Figure 184: Japan Market Value (US$ million) by End User, 2023 to 2033

Figure 185: Japan Market Value (US$ million) by Country, 2023 to 2033

Figure 186: Japan Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 187: Japan Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 188: Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Japan Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 191: Japan Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 192: Japan Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: Japan Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: Japan Market Value (US$ million) Analysis by Usage Type, 2017 to 2033

Figure 195: Japan Market Volume (Units) Analysis by Usage Type, 2017 to 2033

Figure 196: Japan Market Value Share (%) and BPS Analysis by Usage Type, 2023 to 2033

Figure 197: Japan Market Y-o-Y Growth (%) Projections by Usage Type, 2023 to 2033

Figure 198: Japan Market Value (US$ million) Analysis by Application, 2017 to 2033

Figure 199: Japan Market Volume (Units) Analysis by Application, 2017 to 2033

Figure 200: Japan Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 201: Japan Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 202: Japan Market Value (US$ million) Analysis by End User, 2017 to 2033

Figure 203: Japan Market Volume (Units) Analysis by End User, 2017 to 2033

Figure 204: Japan Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 205: Japan Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 206: Japan Market Attractiveness by Product Type, 2023 to 2033

Figure 207: Japan Market Attractiveness by Usage Type, 2023 to 2033

Figure 208: Japan Market Attractiveness by Application, 2023 to 2033

Figure 209: Japan Market Attractiveness by End User, 2023 to 2033

Figure 210: Japan Market Attractiveness by Country, 2023 to 2033

Figure 211: MEA Market Value (US$ million) by Product Type, 2023 to 2033

Figure 212: MEA Market Value (US$ million) by Usage Type, 2023 to 2033

Figure 213: MEA Market Value (US$ million) by Application, 2023 to 2033

Figure 214: MEA Market Value (US$ million) by End User, 2023 to 2033

Figure 215: MEA Market Value (US$ million) by Country, 2023 to 2033

Figure 216: MEA Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 217: MEA Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 218: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MEA Market Value (US$ million) Analysis by Product Type, 2017 to 2033

Figure 221: MEA Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 222: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: MEA Market Value (US$ million) Analysis by Usage Type, 2017 to 2033

Figure 225: MEA Market Volume (Units) Analysis by Usage Type, 2017 to 2033

Figure 226: MEA Market Value Share (%) and BPS Analysis by Usage Type, 2023 to 2033

Figure 227: MEA Market Y-o-Y Growth (%) Projections by Usage Type, 2023 to 2033

Figure 228: MEA Market Value (US$ million) Analysis by Application, 2017 to 2033

Figure 229: MEA Market Volume (Units) Analysis by Application, 2017 to 2033

Figure 230: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 231: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 232: MEA Market Value (US$ million) Analysis by End User, 2017 to 2033

Figure 233: MEA Market Volume (Units) Analysis by End User, 2017 to 2033

Figure 234: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 235: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 236: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 237: MEA Market Attractiveness by Usage Type, 2023 to 2033

Figure 238: MEA Market Attractiveness by Application, 2023 to 2033

Figure 239: MEA Market Attractiveness by End User, 2023 to 2033

Figure 240: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Radial Piston Motor Market Size, Share, and Forecast 2025 to 2035

Radial Drilling Machine Market Growth & Demand 2025 to 2035

Radial Piston Pumps Market

Transradial Closure Devices Market Size and Share Forecast Outlook 2025 to 2035

Compression Testers Market Size and Share Forecast Outlook 2025 to 2035

Compression Product Market Size and Share Forecast Outlook 2025 to 2035

Compression Garments Market Size and Share Forecast Outlook 2025 to 2035

Compression Testing Machines Market Size and Share Forecast Outlook 2025 to 2035

Compression Garments and Stockings Market Analysis - Size, Share, and Forecast 2025 to 2035

Compression Baggers Market Size and Share Forecast Outlook 2025 to 2035

Compression Gas Spring Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Compression Veterinary Bandages Market Trends – Growth & Forecast 2025 to 2035

Market Share Insights for Compression Baggers Providers

Industry Share Analysis for Compression Packing Providers

Compression Therapy Market Insights – Growth & Forecast 2024-2034

Compression Bags Market

Decompression Toys Market Growth - Trends & Forecast 2025 to 2035

Box Compression Tester Market Size and Share Forecast Outlook 2025 to 2035

Distal Compression Plates Market

Artery Compression Devices Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA