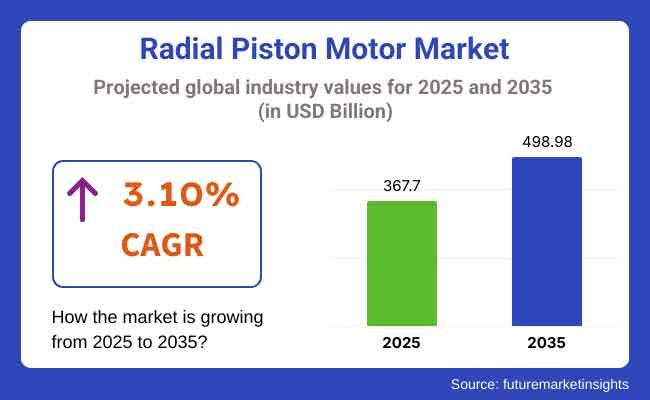

The global radial piston motor market is projected to grow from USD 367.7 million in 2025 to USD 498.98 million by 2035, expanding at a CAGR of 3.1%. This moderate yet steady growth is driven by increasing automation across industries like mining, construction, and manufacturing.

The United States, Germany, and China remain dominant in terms of production and adoption, with India emerging as one of the fastest-growing markets. Among motor types, medium-speed radial piston motors (500-2,000 rpm) hold the largest share due to their versatility and suitability across industries requiring controlled power delivery.

Key demand drivers include the increasing deployment of energy-efficient hydraulic systems, the growing popularity of IoT-enabled motors, and the surge in smart factory solutions under Industry 4.0. These motors are especially favored in applications requiring high torque and durability, such as power transmission, heavy machinery, and renewable energy systems. However, high raw material costs, regulatory complexities, and supply chain disruptions-particularly in semiconductors-pose adoption challenge

From 2025 onwards, regional variations will strongly shape the market. While North America focuses on smart IoT and predictive maintenance technologies, Europe emphasizes decarbonization and energy efficiency. In contrast, Asia-Pacific, especially China and India, is prioritizing affordability and high-volume manufacturing.

The rising trend of modular motor designs, hybrid material casings, and compact, wireless-enabled formats is expected to create new opportunities. Companies investing in AI-based diagnostics, sensor integration, and sustainable compliance will hold a competitive edge as government regulations (OSHA, CE, CCC, BIS) grow more stringent. The market’s evolution is poised to balance cost-sensitive innovation with high-performance, digitally integrated motor technologies.

Medium-speed radial piston motors (500 to 2,000 rpm) dominate the market owing to their optimal balance between torque and speed, making them highly suitable for diverse applications in construction, mining, and manufacturing. These motors are favored in heavy-duty scenarios requiring precise control and endurance.

In contrast, low-speed motors (up to 500 rpm) serve niche uses such as marine propulsion and hydraulic presses, where high torque at minimal speed is essential. High-speed motors (above 2,000 rpm) are gaining traction in aerospace and robotics for precision control, but face competition from newer drive technologies. As Industry 4.0 advances and smart motor integration spreads across sectors, medium-speed motors will continue to lead due to their broad compatibility and adaptability across both legacy and advanced industrial systems.

| Product Type | CAGR (2025 to 2035) |

|---|---|

| Medium-Speed Motors | 3.5% |

Among automation types, MH and Small SMA motors currently command high market shares due to their widespread use in mobile equipment and general industrial applications. These motors are reliable and adaptable, meeting essential performance benchmarks.

However, XF and XJ automation systems are poised to register the fastest growth, especially in sectors like aerospace, robotics, and semiconductors, where compactness, smart monitoring, and high-performance features are critical. As industries prioritize predictive maintenance, IoT integration, and real-time diagnostics, XF/XJ-class motors-designed with advanced sensor arrays and modular control units-are gaining market preference, particularly in Europe, South Korea, and the USA.

| Automation Type | CAGR (2025 to 2035) |

|---|---|

| XF Automation | 3.9% |

Mobile machinery applications remain the largest end-use segment, driven by strong demand in construction, mining, and agriculture, especially in emerging economies. Industrial machinery follows closely in developed regions with advanced manufacturing ecosystems.

However, the power generation and transmission segment is expected to grow the fastest, owing to rising investments in renewables and hydropower. These sectors require reliable, high-torque hydraulic motors to support turbines and fluid systems. Additionally, demand from aerospace & defense and transportation is climbing, particularly for high-speed motors with advanced motion control capabilities. Environmental compliance and digital transformation across sectors further accelerate the adoption of radial piston motors.

| End-Use Industry | CAGR (2025 to 2035) |

|---|---|

| Power Generation & Transmission | 4.1% |

Introduction

The global radial piston motor industry has multiple dynamic factors that shape its evolution and transformation in 2023. A comprehensive FMI survey of 450 industry participants in Q4 2024 provides invaluable insights into industry trends.

Adherence to Safety Rules

The safety score was assessed, showing significant interest in occupational safety standards. According to 85% of surveyed stakeholders, safety compliance is a key priority.

Reliability and Efficiency

78% emphasized high-durability and energy-efficient motors, particularly for industrial and construction applications.

Regional Variances

Technological Integration

Divergent ROI Perspectives

73% of USA stakeholders view automation as an investment, in comparison to 35% of Japanese stakeholders who remain skeptical of it due to initial costs.

Global Consensus

62% of stakeholders prefer polycarbonate motor enclosures for their durability and resistance to the weather and environmental conditions.

Regional Variations

Increasing Costs

86% of users cited rising semiconductor and material prices as a major challenge.

Price Sensitivity by Region

Manufacturing Challenges

Issues Related to Distributors and End Users

Consensus on Innovation

72% of makers plan to invest in IoT-enabled motors for predictive analytics.

Regional Priorities

Different Regulatory Impacts

Global Commonalities

Safety, durability, and cost control are common problems.

Key Regional Variations

Strategic Implications

To successfully penetrate these heterogeneous markets, firms need to tailor their strategy geographically-IoT in the USA, sustainability in Europe, and affordability inAsia.

| Countries | Regulations & Certifications Impacting the Market |

|---|---|

| United States (USA) |

|

| United Kingdom (UK) |

|

| France |

|

| Germany |

|

| Italy |

|

| South Korea |

|

| Japan |

|

| China |

|

| India |

|

The USA radial piston motor industry will grow at a 3.5% CAGR in 2025 to 2035, which is slightly higher than the global average of 3.1%. The growth is fueled by increasing investments in industrial automation, oil and gas, construction, and aerospace industries. The use of IoT-enabled hydraulic motors is gaining traction, as 72% of USA industrial stakeholders value smart factory solutions.

Regulatory pressures from the government in the form of OSHA safety regulations and EPA environmental regulations are forcing manufacturers to produce effective, long-lasting motors. The USA is also a world leader in terms of R&D spending, and companies are embedding AI-based predictive maintenance for industrial motors to optimize operational efficiency. Supply chain disruption and semiconductor shortage are challenges.

The UK radial piston motor industry is forecast to advance at a 3.0% CAGR, in step with worldwide trends. The post-Brexit regulatory landscape has brought new compliance rules, such as UKCA marking. Construction, mining, and renewable energy industries are major drivers of demand. 88% of UK stakeholders focus on energy-efficient motors in accordance with rigorous sustainability policies.

The Industrial Strategy Challenge Fund is driving automation and intelligent hydraulic solutions. Yet, economic volatility and the high cost of production in the UK made it a moderately profitable industry relative to Germany and the USA.

The French industry is expected to expand at a 2.9% CAGR due to strong government support for green energy and automation. The Energy Transition Law is also a prominent driver for the use of low-energy-consuming industrial motors. Moreover, ATEX certification is required for motors applied in dangerous conditions like oil refineries and chemical plants.

The agriculture and marine industries also significantly contribute to demand. Nevertheless, high regulatory fees and strict labour laws can hinder industry growth. France is behind Germany in adopting industrial automation but is still a dominant industry owing to its emphasis on green manufacturing.

Germany will experience a robust 3.7% CAGR owing to its dominance in industrial automation, robotics, and precision engineering. The Industry 4.0 initiative has prompted 53% of German manufacturers to incorporate AI-based motor diagnostics and automation. BAFA subsidies for energy-efficient machinery further prompt enterprises to adopt next-gen hydraulic motors.

The DIN standards and CE marking render compliance high, but they also guarantee quality industry entrants. Industries like automotive manufacturing, mining, and industrial equipment largely depend upon high-torque motors, keeping Germany a world-class industry for these motors.

Italy's industry will have a growth of 2.8% CAGR, being marginally lesser than the overall average. Its strong focus on heavy equipment, construction, and the textile industry continues to hold the demand stable. But there is slower growth due to excessive dependency on conventional mechanical systems instead of new automation.

Safety regulations by INAIL are influencing the design standards of motors, and the Eco-Design Directive is encouraging energy-efficient industrial machinery. Furthermore, Italy's emphasis on exporting hydraulic systems in the EU and worldwide guarantees consistent industry growth. However, the regulatory issues and changing economic conditions affect industrial investment.

South Korea is forecasted to register a 3.4% CAGR, spearheaded by smart manufacturing, automation, and miniaturized industrial solutions. 67% of South Korean manufacturers prioritize space-efficient motor design due to urban space limitations. Publicly supported efforts such as Smart Factory Korea are propelling IoT-enabled hydraulic motors adoption.

Further, KC certification and KOSHA safety requirements guarantee product excellence. Shipbuilding, automotive, and semiconductor are key industries that drive demand. But supply chain difficulties and rivalry from Chinese makers subject domestic producers to pricing pressures, necessitating strategic technology differentiation.

Japan’s industry will develop at a 2.6% CAGR, which is below the global average. Despite being a technology leader, Japan’s manufacturing sector continues to favour conventional mechanical systems over digital automation due to cost concerns. Just 25% of Japanese industrial players have implemented smart alarms and IoT-integrated hydraulic motors.

Yet, JIS standards and METI regulations guarantee that motors have high safety and durability standards. Industries such as automotive, robotics, and heavy industry maintain demand, but low digital penetration and old industrial infrastructure constrain rapid industry growth. The trend toward hybrid material constructions for motors is a new trend.

China is expected to have the highest CAGR among large markets, at 4.2%. The nation's fast-paced industrialization, infrastructure development, and government-supported automation drive fuel demand. MIIT policies require energy-saving motors, and CCC certification is a requirement for industry access.

China is the leading producer in the mining, construction, and heavy machinery sectors. The government's Made in China 2025 also promotes local manufacturing, adding to the competition among local and foreign producers. However, pricing competition and intellectual property concerns remain key challenges for foreign market entrants.

The industry in India will be growing at a 4.0% CAGR and will be one of the fastest-growing markets. Government-sponsored infrastructure initiatives, the Make in India movement, and manufacturing sector growth stimulate demand. BIS certification and CPCB environment standards govern industrial motors.

Major consumers are the textile, automobile and heavy machinery industries with growing investments in automation and energy-efficient technologies. Challenges include high import reliance on major motor components and raw material price volatilities. The use of smart hydraulic motors is increasing, especially in automotive and industrial automation.

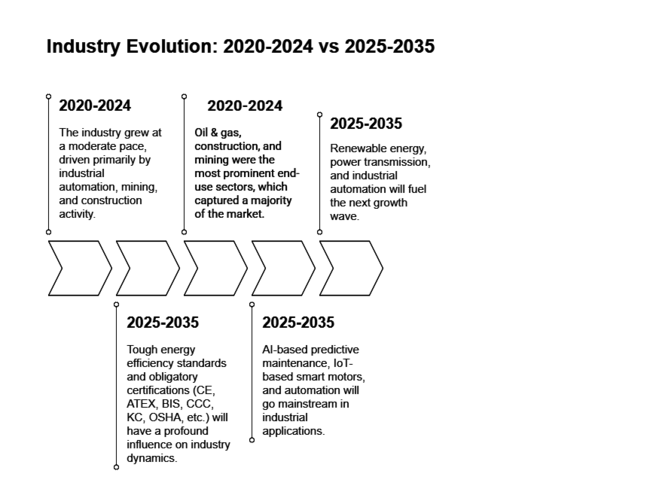

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The industry grew at a moderate pace, driven primarily by industrial automation, mining, and construction activity. | Industry growth is projected to pick up pace with greater uptake of energy-efficient motors, IoT-enabled automation, and smart hydraulic systems. |

| The COVID-19 pandemic disrupted supply chains and raw material prices, which impacted production. | Efforts to strengthen supply chains and localize component production are expected to improve industry stability. |

| Growing demand for medium-speed radial piston motors in heavy-duty use maintained industry pace. | Demand for high-speed motors will increase, especially in aerospace, defense, and precision automation. |

| Oil & gas, construction, and mining were the most prominent end-use sectors, which captured a majority of the market. | Renewable energy, power transmission, and industrial automation will fuel the next growth wave. |

| Regulatory compliance and efficiency requirements were increasing, but enforcement remained lenient. | Tough energy efficiency standards and obligatory certifications (CE, ATEX, BIS, CCC, KC, OSHA, etc.) will have a profound influence on industry dynamics. |

| Many industries favored conventional mechanical hydraulic systems, which constrained the uptake of smart motors. | AI-based predictive maintenance, IoT-based smart motors, and automation will go mainstream in industrial applications. |

| The Asia-Pacific region (China, India, and South Korea) experienced the highest growth, driven by industrial growth. | China and India will continue to be high-growth areas, while North America and Europe will concentrate on high-tech and green solutions. |

Key companies in the radial piston motor industry contend based on pricing strategies, technological innovations, strategic collaborations, and regional expansion. While many companies focus on cost-cutting and modular product designs to serve a broad range of industries, high-end players prioritize energy-efficient motors with IoT connectivity and predictive maintenance capabilities.

Companies are expanding their global presence through acquisitions, mergers, and joint ventures, with a strong focus on Asia-Pacific and Europe. OEM collaboration with mobile and industrial equipment producers drives industry penetration. Moreover, companies are investing in research & development (R&D) for hybrid as well as electric alternatives, complying with sustainability regulations & Industry 4.0 innovation that will ensure long-term growth.

The industry is segmented into low speed (up to 500 rpm), medium speed (500 to 2,000 rpm) and high speed (over 2,000 rpm)

It is fragmented into MH, XJ, XF, Small SMA and SMA

It is segmented among mobile machinery, industrial machinery, power generation and transmission, oil and gas industry, aerospace and defence, transportation, agriculture and forestry, manufacturing, construction and mining

It segmented into North America, Europe, Asia Pacific, Latin America and The Middle East & Africa

Similarly, radial piston motors find extensive use in construction, mining, industrial automation, power transmission, aerospace, and agriculture.

Advancements in IoT, predictive maintenance, energy-efficient technologies, and advanced materials are enhancing performance and reliability.

Asia-Pacific, especially China and India, is developing rapidly due to infrastructure expansion and automation in the industry.

Disruptions in supply chains, fluctuations in raw material prices, and stringent environmental regulations are the chief challenges.

High-efficiency hydraulic motors benefit from the realizations of governments and industries regarding emissions demand, sustainability, and cost-effective reduction.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Motor Type, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Motor Type, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by Application, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Motor Type, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Motor Type, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 20: Latin America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Motor Type, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by Motor Type, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 28: Western Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Motor Type, 2019 to 2034

Table 30: Western Europe Market Volume (Units) Forecast by Motor Type, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 36: Eastern Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Motor Type, 2019 to 2034

Table 38: Eastern Europe Market Volume (Units) Forecast by Motor Type, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 40: Eastern Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Type, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Motor Type, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Motor Type, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Application, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 52: East Asia Market Volume (Units) Forecast by Type, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Motor Type, 2019 to 2034

Table 54: East Asia Market Volume (Units) Forecast by Motor Type, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 56: East Asia Market Volume (Units) Forecast by Application, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Units) Forecast by Type, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Motor Type, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Units) Forecast by Motor Type, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Units) Forecast by Application, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Motor Type, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 10: Global Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Motor Type, 2019 to 2034

Figure 14: Global Market Volume (Units) Analysis by Motor Type, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Motor Type, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Motor Type, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 18: Global Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 21: Global Market Attractiveness by Type, 2024 to 2034

Figure 22: Global Market Attractiveness by Motor Type, 2024 to 2034

Figure 23: Global Market Attractiveness by Application, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Motor Type, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 34: North America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Motor Type, 2019 to 2034

Figure 38: North America Market Volume (Units) Analysis by Motor Type, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Motor Type, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Motor Type, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 42: North America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 45: North America Market Attractiveness by Type, 2024 to 2034

Figure 46: North America Market Attractiveness by Motor Type, 2024 to 2034

Figure 47: North America Market Attractiveness by Application, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Motor Type, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 58: Latin America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Motor Type, 2019 to 2034

Figure 62: Latin America Market Volume (Units) Analysis by Motor Type, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Motor Type, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Motor Type, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 66: Latin America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Motor Type, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Motor Type, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 82: Western Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Motor Type, 2019 to 2034

Figure 86: Western Europe Market Volume (Units) Analysis by Motor Type, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Motor Type, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Motor Type, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 90: Western Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Motor Type, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Motor Type, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Motor Type, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Units) Analysis by Motor Type, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Motor Type, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Motor Type, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Motor Type, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Motor Type, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Motor Type, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Motor Type, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Motor Type, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Motor Type, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Motor Type, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Motor Type, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 154: East Asia Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Motor Type, 2019 to 2034

Figure 158: East Asia Market Volume (Units) Analysis by Motor Type, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Motor Type, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Motor Type, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 162: East Asia Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Motor Type, 2024 to 2034

Figure 167: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Motor Type, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Motor Type, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Motor Type, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Motor Type, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Motor Type, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Motor Type, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Radial Compression Devices Market Growth - Trends & Forecast 2025 to 2035

Radial Drilling Machine Market Growth & Demand 2025 to 2035

Radial Piston Pumps Market

Transradial Closure Devices Market Size and Share Forecast Outlook 2025 to 2035

Piston Grouting Pump Market Size and Share Forecast Outlook 2025 to 2035

Piston Fillers Market Size and Share Forecast Outlook 2025 to 2035

Piston Seals Market Size, Growth, and Forecast 2025 to 2035

Axial Piston Pumps Market

Axial Piston Motor Market- Analysis and Forecast by Product Type, End-User and Region 2025 to 2035

Automotive Piston System Market Growth - Trends & Forecast 2025 to 2035

Lightweight Aluminium Pistons Market Growth - Trends & Forecast 2025 to 2035

Motor Bearing Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Fuel Hoses Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Drive Chain Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Wheels Market Size and Share Forecast Outlook 2025 to 2035

Motorized Ring Main Unit Market Size and Share Forecast Outlook 2025 to 2035

Motorhome Market Size and Share Forecast Outlook 2025 to 2035

Motor Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Airbag Jacket Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Helmet Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA