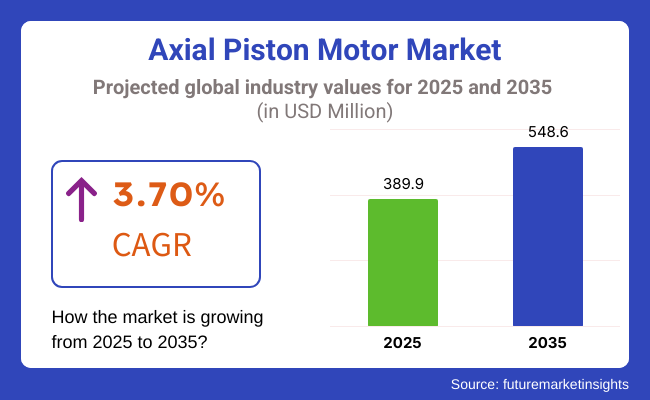

The axial piston motor market is witnessing steady growth, owing to increasing advancements in industrial technologies and the rising application in various end-use industries. The market is predicted to grow with a 3.70% CAGR during 2025 to 2035.

Based on technology, the axial piston motor market is expected to demonstrate steady growth between 2025 and 2035, owing to technological developments and high demand from industrial sectors. The market is estimated to reach USD 389.9 million in 2025 and is expected to grow to USD 548.6 million by 2035.

The growing adoption of axial piston motors can be attributed to key industries like construction, mining, agriculture, and industrial automation. Having a very high efficiency, these motors are also durable, and thanks to that, a great choice to use in hydraulic systems. In addition, innovative technologies for energy-efficient designs are driving the market growth. The growing trend of automation, smart hydraulics, and electrification in industrial applications is anticipated to propel the market growth.

The axial piston motor market is anticipated to have growth in the next decade, owing to continuous innovation along with rising investment in advanced machinery.

| Key Drivers Key Restraints | Key Restraints |

|---|---|

| That has led to increased demand for small and lightweight hydraulic solutions. | Rising costs due to increasingly high precision manufacturing needs. |

| Combining IoT and predictive maintenance in hydraulic systems. | Older systems can no longer keep up with new technologies. |

| The growing use of axial piston motors in the defense and aerospace sectors. | Parts availability and supply chain disruptions. |

| In the development of new renewable energy projects using hydro systems. | Difficulties obtaining high energy efficiency under extreme conditions. |

| Developing trends toward energy saving utilizes variable displacement motors. | Lack of awareness and technical skills in the developing world |

| Decreasing noise-reduction engine technology. | Tighter environmental regulations on hydraulic fluid disposal. |

| Utilization of high-pressure axial piston motors in deep-sea exploration. | Rising competition from new e- and electro-hydrostatic systems. |

Impact Assessment of Key Dynamics

| Key Drivers | Impact Level |

|---|---|

| Rising demand for compact and lightweight hydraulic solutions | High |

| Integration of IoT and predictive maintenance in hydraulic systems | High |

| Increasing use of axial piston motors in defense and aerospace sectors | Medium |

| Expansion of renewable energy projects using hydraulic systems | Medium |

| Growing preference for variable displacement motors for energy savings | High |

| Development of noise-reduction technologies in piston motors | Medium |

| Adoption of high-pressure axial piston motors in deep-sea exploration | Low |

| Key Restraints | Impact Level |

|---|---|

| High-precision manufacturing requirements increase costs | High |

| Complexity in retrofitting older systems with new technologies | Medium |

| Supply chain disruptions affecting component availability | High |

| Challenges in achieving high energy efficiency in extreme conditions | Medium |

| Limited awareness and technical expertise in developing regions | Low |

| Stricter environmental regulations on hydraulic fluid disposal | High |

| Increased competition from emerging electric and electro-hydrostatic systems | Medium |

Growing demand in construction, aerospace, and industrial automation will spur High-speed axial piston motors. Advancements in cooling efficiency, lightweight materials and durability will be spurred by their ability to deliver high power and rapid operation.

Pitch on Medium-speed axial piston motors will be used extensively in agriculture, material handling, and hydraulic systems. Their high speed and high torque will be key components of automated farming machinery, Autonomous forklifts, and conveyor systems. Energy efficiency innovations and smart integration will make them even more attractive.

Marine, mining, and oil and gas applications will drive Low-speed axial piston motors to grow in popularity. This accommodates them for heavy-duty tasks due to their superior torque. This will be achieved through corrosion-resistant materials, variable displacement technology, and advanced lubrication systems.

Axial piston motors will still be used for mining excavators, haul trucks, and drilling rigs. Growing automation and remote-controlled devices will increase the demand for high-performance, durable motors and superior capability motors for higher load handling.

Axial piston motors will be used in electric and hybrid cars. Their use in powertrains, steering and transmissions will increase, with manufacturers focusing on compact design, predictive maintenance and smart sensor integration.

Axial piston motors will be integrated into propulsion systems, winches, and offshore equipment in the marine industry. The transition to more energy-efficient solutions will spur the development of hybrid propulsion, corrosion-resistant parts, and advanced cooling technologies.

The oil and gas industry will not cease utilizing axial piston motors in drilling rigs, pipelines, and offshore implementations. Technologies such as high-pressure capabilities, sealing technologies, and explosion-proof designs will advance as the need for extreme environmental efficiency and safety increases.

By 2025, the estimated value of the USA axial piston motor market will be around USD 390 million and is expected to grow steadily during the forecast period. The growth of construction, mining, and industrial automation industries will drive demand. Electric and hybrid vehicles sensitize the population toward producing energy-efficient and high-performance motors. Investments in offshore drilling and renewable energy projects will also fuel market growth.

The integration of IoT and predictive maintenance in hydraulic systems is set to enhance automated solutions in the future, with manufacturers pivoting towards motor solutions that are smarter and more efficient, driving long-term growth in the industry.

The Canadian axial piston motor market is anticipated to expand due to an estimated valuation of USD 85 million by 2025. Key growth drivers will come from the country’s mining, oil and gas, and construction industries. Due to the implementation of automation across industrial machinery and material handling processes, the demand for medium and high-speed axial piston motors will rise. This will inspire the emergence of hydraulic power solutions that are temperature- and usage-tolerant.

This innovation will be driven further by investments in green energy projects and government infrastructure development, encouraging manufacturers to adopt more energy-efficient and environmentally friendly hydraulic motor technologies.

The Marine, Defense, and Construction industries will be responsible for this growth, and the power train segment should achieve a value of USD 70 million in the UK axial piston motor market by 2025. The government’s commitment to reducing carbon emissions will boost the transition to electric and hybrid vehicles, increasing demand for compact and high-efficiency hydraulic motors. Offshore wind farms and advancements in marine propulsion systems will also support this market.

The increasing penetration of AI and automation in industrial applications will lead to the evolution of smart and connected hydraulic motor systems, pushing manufacturers to innovate for efficiency and performance enhancements across various sectors.

With its strong automotive, industrial automation, and machinery sectors, is projected to maintain an axial piston motor market of USD 90 million in 2025. High-performance and digitally connected hydraulic motors will be in demand, thanks to the country's leadership position in precision engineering and the adoption of Industry 4.0. Technology management opportunities in the transportation industry will be available in EV powertrains and smart transmission/charging systems.

As manufacturers aim to achieve sustainability goals and comply with stringent regional regulations, they will continue to prioritize the development of energy-efficient hydraulic solutions with low-emission characteristics to ensure continued growth in industrial and construction applications.

The USD 65 million South Korean axial piston motor market is driven by progress in the country’s shipbuilding, automotive, and industrial robotics projects. Growing offshore industries and smart factory initiatives will drive demand for high-torque, high-durability hydraulic motors in the country.

Hydrogen and electric vehicles have seen particularly rapid production growth and will drive innovation in lightweight and high-performance motor technologies. As the nation aspires to absolute automation in industrial processes, smart hydraulic motors equipped with IoT-based norms are anticipated to hit the key verge of trends, paving the way for sustainable market growth.

Japan's Axial Piston Motor Market will be valued at USD 80 million by 2025 due to strong automotive, robotics, and industrial automation in the country. The country’s emphasis on miniaturization and precision engineering will promote the evolution of small, high-power-density motors. Increasing investments in smart manufacturing and adopting IoT-based industrial solutions will propel the market toward implementing AI-powered predictive maintenance systems.

With the adoption of EV and hybrid vehicles working at a greater rate, demand for lightweight, energy-efficient axial piston motors will continue to grow, helping to sustain Japan’s long and proud legacy of innovation in developing advanced industrial technologies.

China's axial piston motor market is expected to reach USD 120 million by 2025, making it the fastest-growing region. The rapid infrastructure development, the growing construction sector, and manufacturing driven by automation in the country will increase the demand for durable and high-efficiency motors. And, of course, as transportation shifts towards electrification components, the push towards innovation of EV-compatible hydraulic motor technologies will further gain and accelerate.

China's growing investments in renewable energy and its rising industrial robotics sector will involve the adoption of next-gen sensor-integrated hydraulic motors, generating a competitive localized market landscape for domestic and foreign industries.

By 2025, India’s axial piston motor market is estimated to be worth USD 90 million due to rapid industrialization, urbanization, and infrastructure projects. Its booming construction, mining and agriculture sectors will play a major role in fuelling market growth. Medium- and high-speed axial piston motors are in demand due to automated material handling systems and industrial equipment mechanization.

However, domestic manufacturing under the Make in India and Atma Nirbhar Bharat initiatives will give rise to indigenisation and testing of the devices. With increasing investments in electric cars and renewable energy, the need for low-cost, energy-efficient hydraulic systems with fluid solution engineering will be in high demand.

| Past (2020 to 2024) | Future Projections (2025 to 2035) |

|---|---|

| Market growth is driven by demand in construction, mining, and industrial automation. | Expansion fuelled by smart hydraulic systems, IoT integration, and predictive maintenance. |

| Electric and hybrid vehicle adoption started increasing hydraulic motor usage. | EV and hydrogen-powered vehicles to create a surge in demand for compact, energy-efficient axial piston motors. |

| Moderate R&D investments focused on improving motor efficiency and durability. | High R&D investments are expected in AI-driven automation and smart hydraulic technologies. |

| Regulations on emission control and energy efficiency encouraged the development of better motors. | Stricter environmental policies will drive innovation in low-emission and high-performance hydraulic motors. |

| The adoption of Industry 4.0 started influencing hydraulic motor manufacturing. | Full-scale digitalization of hydraulic systems with real-time monitoring and AI-based diagnostics. |

| Established players dominated with minimal startup disruption. | Emerging startups will challenge key players with innovative, tech-driven solutions. |

| Focus on material advancements for better durability. | Shift toward lightweight, corrosion-resistant, and high-strength materials for efficiency gains. |

| Growth is primarily in North America and Europe, with moderate expansion in Asia. | Rapid growth in Asia-Pacific driven by urbanization, industrial automation, and EV market expansion. |

2024, High activity in the axial piston motor industry with scale-ups and global majors worldwide. For instance, prominent players such as Bosch Rexroth AG, Danfoss A/S, and Eaton Corporation plc are focusing on creating next-generation, energy-efficient motors for different industrial applications so that they can add more to their portfolio. Bosch Rexroth AG launched its new range of compact axial piston motors for high-pressure operation for maximum performance of heavy machines.

On some others, new companies were as interested in digital divinations as they were in hydraulic ones. IoT-powered sensors and predictive maintenance capabilities did this in real-time, rendering these innovations possible. The push factor needed was an increased number of partnerships between established firms and startups to adapt and bring innovations in smart hydraulics to industries like construction, agriculture, and manufacturing.

In 2024, the fight occurred on a tattered canvas of legacy engineering and pieced-together new tech. For businesses, investing in R&D was a necessary step to keep up with the dizzying pace of change that technology was driving in the world around us, and as a result, it has propelled motors that not only provide best-of-breed performance but also align to the trends of the day-automation and sustainability. This kind of environment was needed to promote endless innovation and development of the axial piston motor market.

It is segmented into High Speed, Medium Speed and Low Speed

It is further fragmented into Mining, Automotive, Marine and Oil and Gas

It is segmented into North America, Latin America, Europe, South Asia, East Asia, Oceania and Middle East and Africa (MEA)

Rising demand due to industrial automation, construction and mining growth, and an energy-efficient hydraulic system change leads to the rising demand.

The increasing presence of hybrid and electric vehicles will drive manufacturers to design and manufacture lightweight, high-efficiency hydraulic motors for better performance.

Asia-Pacific is projected to be the fastest-growing region owing to quick industrialisation, increased urbanisation, and the adoption of smart hydraulic systems.

Smart digitalisation technology collects huge amounts of data in its hardware and processes it in intelligent ways.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Application, 2019 to 2034

Table 7: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 22: Western Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 24: Western Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Eastern Europe Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: Eastern Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Application, 2019 to 2034

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 38: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 40: East Asia Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 42: East Asia Market Volume (Units) Forecast by Application, 2019 to 2034

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2019 to 2034

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 48: Middle East and Africa Market Volume (Units) Forecast by Application, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 13: Global Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 16: Global Market Attractiveness by Product Type, 2024 to 2034

Figure 17: Global Market Attractiveness by Application, 2024 to 2034

Figure 18: Global Market Attractiveness by Region, 2024 to 2034

Figure 19: North America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 20: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 21: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 23: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 31: North America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 34: North America Market Attractiveness by Product Type, 2024 to 2034

Figure 35: North America Market Attractiveness by Application, 2024 to 2034

Figure 36: North America Market Attractiveness by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 38: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 39: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 49: Latin America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 52: Latin America Market Attractiveness by Product Type, 2024 to 2034

Figure 53: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 54: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 56: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 57: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 63: Western Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 67: Western Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 70: Western Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 71: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 72: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 85: Eastern Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2024 to 2034

Figure 89: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 90: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2024 to 2034

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 110: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 111: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 117: East Asia Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 121: East Asia Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 124: East Asia Market Attractiveness by Product Type, 2024 to 2034

Figure 125: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 126: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2024 to 2034

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2024 to 2034

Figure 143: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 144: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Axial Spondyloarthritis Management Market Analysis by Types, End-User, Drug Class, and Region through 2035

Axial Piston Pumps Market

Biaxially Oriented Polyamide Films Market Size and Share Forecast Outlook 2025 to 2035

Coaxial Splitters Market Size and Share Forecast Outlook 2025 to 2035

Coaxial Attenuators Market Size and Share Forecast Outlook 2025 to 2035

Coaxial Coupler Market Size and Share Forecast Outlook 2025 to 2035

Biaxially Oriented Polypropylene Market Size and Share Forecast Outlook 2025 to 2035

Biaxially Oriented Polyamide BOPA Films Market Size and Share Forecast Outlook 2025 to 2035

Coaxial Cable Market Growth & Demand 2025 to 2035

Uniaxial Tester Market Size and Share Forecast Outlook 2025 to 2035

Multi Coaxial Connectors Market - Growth & Forecast 2025 to 2035

Hybrid Fiber Coaxial Market - Broadband & 5G Growth 2025 to 2035

Micro-Miniature Co-axial Adapter Market Size and Share Forecast Outlook 2025 to 2035

Piston Grouting Pump Market Size and Share Forecast Outlook 2025 to 2035

Piston Fillers Market Size and Share Forecast Outlook 2025 to 2035

Piston Seals Market Size, Growth, and Forecast 2025 to 2035

Engine Piston Ring Set Market Size and Share Forecast Outlook 2025 to 2035

Radial Piston Pumps Market

Radial Piston Motor Market Size, Share, and Forecast 2025 to 2035

Automotive Piston System Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA