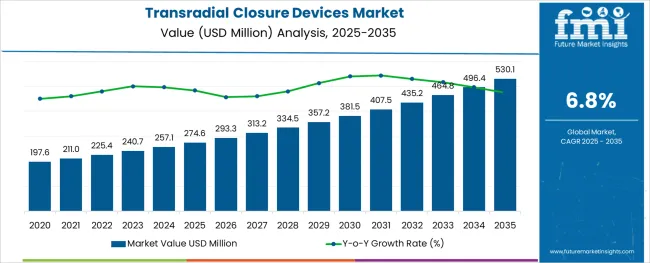

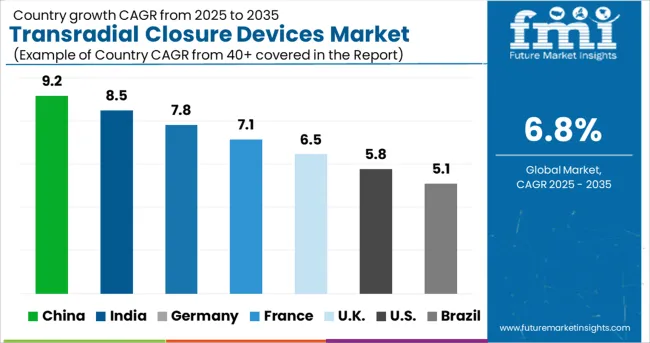

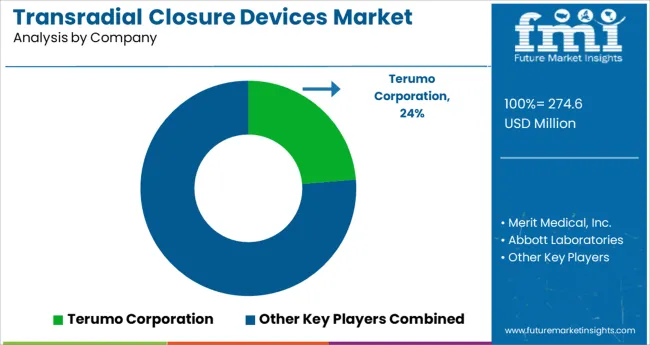

The Transradial Closure Devices Market is estimated to be valued at USD 274.6 million in 2025 and is projected to reach USD 530.1 million by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

The transradial closure devices market is undergoing steady expansion, driven by the rising adoption of radial access in cardiovascular and interventional procedures due to its lower complication rate and faster patient recovery. Healthcare providers are increasingly shifting toward patient-centric approaches, where early ambulation and reduced hospital stays are prioritized.

This trend has elevated the demand for closure devices that ensure effective hemostasis while minimizing discomfort and complication risks. Technological innovation in compression mechanisms, material design, and anatomical conformity has led to next-generation products with enhanced safety and usability.

Furthermore, infection control protocols and heightened focus on procedural efficiency have propelled the demand for sterile, disposable closure solutions. As minimally invasive surgical volumes rise globally and transradial access becomes the preferred route in catheterization labs, future opportunities are anticipated in customizable, pressure-adjustable devices with real-time feedback systems. Growth is also being supported by favorable reimbursement frameworks and expanding use in ambulatory and outpatient surgical centers.

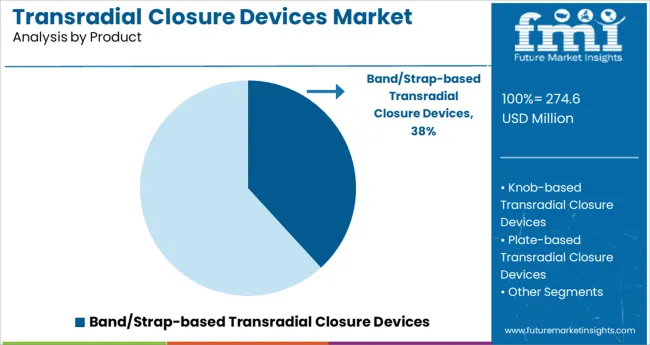

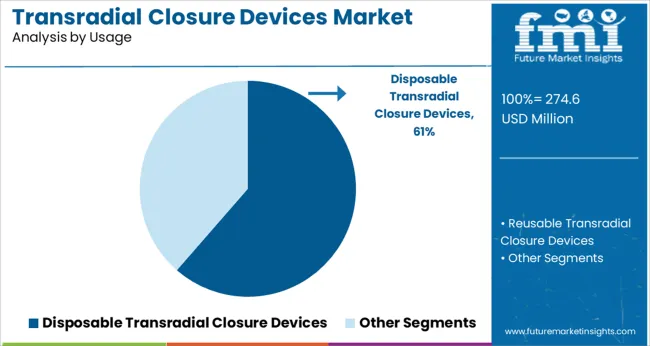

The market is segmented by Product, Usage, Application, and End User and region. By Product, the market is divided into Band/Strap-based Transradial Closure Devices, Knob-based Transradial Closure Devices, and Plate-based Transradial Closure Devices. In terms of Usage, the market is classified into Disposable Transradial Closure Devices and Reusable Transradial Closure Devices.

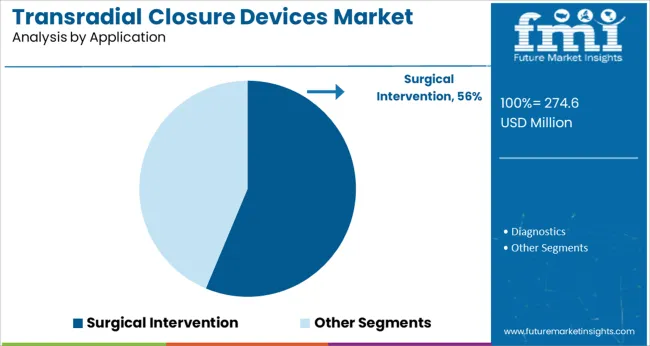

Based on Application, the market is segmented into Surgical Intervention and Diagnostics. By End User, the market is divided into Hospitals, Independent Catheterization Centers, Ambulatory Surgical Centers, and Specialized Clinics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The band or strap based transradial closure devices segment is projected to hold 38.2% of the total product category revenue in 2025, making it the leading product type. This segment's dominance is supported by its ability to offer consistent, adjustable compression over the access site, ensuring effective hemostasis while enhancing patient comfort.

The re-engineering of bands to include transparent windows, micro-adjustable knobs, and non-latex materials has improved usability for clinicians and minimized pressure-related complications. Their widespread availability and compatibility with various wrist anatomies have contributed to adoption across high-volume catheterization labs.

Hospitals and surgical centers have favored these devices due to their simplicity, minimal training requirements, and ability to support standardized post-procedure protocols. As patient safety and procedure turnaround time become increasingly important, the reliability and adaptability of band or strap based products are expected to sustain their leadership in the market.

Disposable transradial closure devices are forecast to contribute 61.4% of revenue in the usage category by 2025, making it the dominant format. This leadership is driven by the heightened focus on infection prevention, workflow efficiency, and regulatory compliance in surgical and interventional care settings.

The single-use nature of disposable devices eliminates cross-contamination risks and supports hospital infection control mandates. In addition, disposable formats are preferred due to their convenience, faster deployment, and reduced need for reprocessing, thereby optimizing procedural throughput.

These factors are particularly critical in high-volume centers where procedural turnover and patient safety are key operational priorities. Manufacturers are also innovating with eco-conscious materials to balance disposability with environmental concerns. As healthcare systems continue emphasizing sterilization and efficiency, disposable devices are expected to remain the primary choice for transradial closure across diverse clinical environments.

The surgical intervention segment is expected to account for 56.3% of total market revenue by 2025, securing its position as the leading application area. This dominance is being reinforced by the increasing adoption of transradial access in surgical procedures, particularly in cardiology and vascular surgery, where it offers reduced bleeding risks and shorter recovery times compared to femoral access.

The rising number of complex catheter-based surgeries and therapeutic interventions has heightened the need for reliable closure solutions post-procedure. Clinical emphasis on reducing complications such as hematoma, pseudoaneurysm, and infection has made transradial closure devices a standard component in surgical protocols.

As healthcare providers aim to optimize patient discharge times and reduce hospital resource utilization, closure devices tailored for surgical intervention have gained traction. Continued procedural innovation and surgeon preference for minimally invasive approaches are anticipated to uphold the segment’s leading share in the coming years.

| Particulars | Details |

|---|---|

| H1, 2024 | 6.62% |

| H1, 2025 Projected | 6.80% |

| H1, 2025 Outlook | 6.70% |

| BPS Change - H1, 2025 (O) - H1, 2025 (P) | (-) 10 ↓ |

| BPS Change - H1, 2025 (O) - H1, 2024 | (+) 08 ↑ |

The variation between the BPS values observed within this market in H1, 2025 - outlook over H1, 2025 projected reflects a decline of 10 BPS units. However, a positive BPS growth in H1-2025 over H1-2024 by 08 Basis Point Share (BPS) is demonstrated by the market.

The market observes a reduction in BPS due to the limitations associated with transradial closure devices in access site crossover, thus diminishing positive procedure outcomes.

Moreover, with advanced product launches, there is an increasing need for trained professionals for device usage, which presents an additional burden upon medical facilities with staffing based costs.

However, with the advent of bioresorbable technologies within the transradial closure devices market space, the market is set to present a positive growth outlook during the forecasted years. With improved safety of newly launched vascular closure devices, the market for transradial closure devices will also witness a boost.

The market is subject to changes as per device regulations, licensing, disease epidemiology, and product adoption rates, in accordance to the macro and industry dynamics.

For radial artery closure, transradial closure devices have developed as a viable alternative for conventional mechanical compression. Improved patient satisfaction with minimum irritation and early patient discharge are all advantages of these devices. The market is expected to see increased product demand as a result of its favourable applications.

The transradial closure devices market expanded at a CAGR of 4.8% from 2020 to 2024, and accumulated revenue worth USD 257.1 Million in 2024. Over the coming years, rising risk of heart stroke combined with a burgeoning population suffering from multiple vascular illnesses will drive market expansion.

Hospitals, independent catheterization centers, and healthcare clinics will continue to increase their demand, according to Future Market Insights (FMI).

As a result of this, the global transradial closure devices market is expected to expand at a 6.8% CAGR from 2025 to 2035, and reach an estimated net worth of USD 530.1 Million through 2035.

Transradial closure systems use the radial artery rather than the femoral artery, which has the advantage of producing a reduced artery calibre while reducing the risk of severe access site haemorrhage. As a result, healthcare professionals and patients alike favour transradial closure units.

Rising Incidence of Cardiovascular Diseases Surging Sales of Transradial Closure Devices

Demand for efficient therapy for cardiovascular disorders is driving sales of transradial closure devices. According to the World Health Organization (WHO), cardiovascular illnesses claim the lives of roughly 17.9 million people each year, accounting for 31% of all fatalities globally.

The need for transradial closure devices is steadily increasing as healthcare segments become more advanced by being equipped with cutting-edge surgical and diagnostic instruments.

Transradial closure systems, which represent a breakthrough in modern interventional cardiology, are gaining acceptance around the world due to their ability to provide a more convenient location for safe calibration with less risk and discomfort.

Clinical Research Encouraging Adoption of Transradial Closure Technologies in Healthcare Facilities

Transradial access has been shown in clinical investigations to help reduce vascular and bleeding problems. In addition, the use of transradial closure devices reduces the likelihood of site injury.

Transradial closure equipment is getting popular in the healthcare business because they give superior comfort and reduce the risk of harm as compared to traditional methods.

Hospitals, diagnostic centers, and other healthcare facilities have started to adopt current technology and instruments as a result of digital improvements, which is driving the demand curve for transradial closure devices higher.

Transradial closure devices are frequently used during coronary angiography, angioplasty, and other medical operations because they are more efficient in terms of safety, comfort, and accuracy. Transradial access is more effective in clinical investigations all around the world.

With the tendency unlikely to abate over the coming years, FMI anticipates a significant increase in demand for transradial closure devices.

Lack of Skilled Healthcare Workers May Impede Transradial Closure Device Usage

Transradial closure devices require unique knowledge, care, and safeguards when used. Despite the superficial position and simplicity of compression, radial access difficulties can occur, resulting in bleeding and damage at the access site.

As a result, it is critical to have sufficient understanding to handle the complete operation, which may function as a barrier to its general adoption.

North America Leads Transradial Closure Devices Market Due to Increasing Cases of Cardiac Illnesses

North America dominates the global transradial closure devices market and is projected to do so over the forecast period. The North America transradial closure devices market is being driven by an increase in the incidence of various cardiovascular illnesses such as coronary heart disease, cardiac arrest, hypertension, and others caused by food habits, lifestyle, and other factors.

As more people become conscious of cardiac health, the market for transradial closure devices in North America is seeing an increase in demand due to increased diagnostics utilization. At present, North America is expected to account for 38.3% of the global market share.

Europe is the second-largest market for transradial closure devices, and it is expected to remain so over the forecast period.

The Europe transradial closure devices market is being boosted by advancements in major end-use industries such as independent catheterization centers, hospitals, specialty clinics, and others. Currently, Europe is likely to hold 33.5% of the global market share.

Cardiovascular disease accounts for more than half of all fatalities in Europe, according to the World Health Organization, and 80 percent of premature heart disease and stroke are preventable. The demand for transradial closure devices is expanding tremendously as more people obtain knowledge about improving cardiovascular health.

South Asia has emerged as a viable market for transradial closure devices, with steady growth projected in the coming years. The healthcare industry in South Asia is steadily increasing, according to the World Health Organization.

As a result, the market for transradial closure devices in South Asia is expected to expand. The increasing use of transradial closure devices in surgical and diagnostic procedures is expected to propel the South Asia transradial closure devices market forward over the forecast period.

In 2025, South Asia, East Asia, and Oceania together are predicted to account for 20.6% of the global market share. While Latin America and MEA are likely to account for 4.6% and 3% of the global market share respectively in 2025.

Growing Fear of Cardiovascular Disease & Advanced Healthcare Infrastructure Driving Demand for Transradial Closure Devices

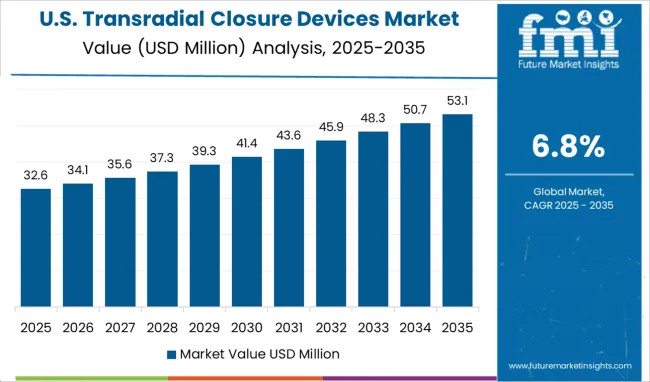

The United States is likely to dominate the North America transradial closure devices market. The high prevalence of the heart disease necessitates the use of transradial closure devices, which drives the market's growth in the country.

According to a research published by the Centers for Disease Control and Prevention, "In the United States, heart disease is the top cause of death for men, women, and people of most racial and ethnic groups.

In the United States, one person dies from cardiovascular disease every 36 seconds. Heart disease claims the lives of around 659,000 people in the United States each year, accounting for one out of every four deaths".

Furthermore, the market in the country is aided by modern infrastructure and rising healthcare spending among the populace.

Presence of Improved Healthcare Systems Boosts Demand for Transradial Closure Devices

India is set to be a growing market for the healthcare industry. In terms of revenue and employment, healthcare has become one of India's most important industries.

The Indian healthcare system is expanding rapidly as a result of improved coverage, services, and increased spending by both public and private entities. In addition, the country's well-developed manufacturing activities and healthcare system are expanding the transradial closure devices market forward.

Bands or Straps to Be Leading Transradial Closure Devices Due to their Advanced Features

Transradial closure devices with a band or strap have a success rate in helping radial artery haemostasis following transradial surgery.

This type of transradial closure device has several advantages, including the capacity to selectively compress the radial artery to enable blood flow while maintaining patency, the availability of preferred band lengths for exact fit and best patient comfort, and so on.

In terms of product type, band- or strap-based transradial closure devices currently lead the transradial closure devices market and are projected to continue to do so in the coming years due to increased demand for their unique features.

Efficient & Effective Quality Make Disposable Devices Prominent Selling Product

Disposable devices are the most preferred since they are cost-effective and require no maintenance. Disposable devices are in high demand among a wide range of end users, from hospitals to ambulatory surgical clinics.

Disposable devices are popular because they are efficient for one-time diagnosis and surgical intervention. Disposable devices will be the most prevalent throughout the predicted period, according to FMI.

Rising Heart Illnesses & Growing Awareness of Diagnostics to Fuel Demand for Transradial Closure Devices

Increasing occurrences of cardiovascular illnesses and rising patient awareness are driving the use of transradial closure devices in the diagnostic segment. The diagnostic segment is anticipated to maintain its advantage in the coming years, according to FMI.

Because transradial closure devices are less expensive than transfemoral closure devices, diagnosis centers prefer them for mild to severe cases. Furthermore, the lower hazards associated with the diagnostic method have made it the leading choice in this segment.

High Consumption of Transradial Closure Devices by Independent Catheterization Centers Due to their Specialized Features

Catheterization facilities are specialized hospital rooms where minimally invasive tests and treatments are performed to detect and treat cardiovascular problems.

As the prevalence of cardiovascular disorders rises, the number of independent catheterization centers is increasing to serve the growing patient pool. This segment currently dominates the worldwide transradial closure devices market and is expected to do so over the forecast period.

Patients who require invasive interventional procedures as an alternative to surgery should seek out independent catheterization centers. Furthermore, a large section of the population with cardiovascular illness prefers independent cardiac catheterization laboratories because they are solely focused on the diagnosis and treatment of this disease.

Because the market is so competitive, major competitors are focusing their efforts on introducing cutting-edge technology and equipment.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value, Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; Middle East & Africa (MEA) |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, China, Japan, South Korea, India, Indonesia, Malaysia, Singapore, Australia, New Zealand, Turkey, South Africa, and GCC Countries |

| Key Market Segments Covered | Product, Usage, Application, End User, Region |

| Key Companies Profiled | Merit Medical, Inc.; Abbott Laboratories; Fisher & Paykel Healthcare Corporation Ltd.; Vascular Solution Inc.; Advanced Vascular Dynamics; Comed B.V.; Beijing Demax Medical Technology Co., Ltd. |

| Pricing | Available upon Request |

The global transradial closure devices market is estimated to be valued at USD 274.6 million in 2025.

It is projected to reach USD 530.1 million by 2035.

The market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types are band/strap-based transradial closure devices, knob-based transradial closure devices and plate-based transradial closure devices.

disposable transradial closure devices segment is expected to dominate with a 61.4% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enclosure Support Arm Systems Market Size and Share Forecast Outlook 2025 to 2035

Bag Closure Clips Market Size and Share Forecast Outlook 2025 to 2035

Bag Closures Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Bag Closure Clip Providers

Case Closures and Sealers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tube Closures Market Size and Share Forecast Outlook 2025 to 2035

Cap and Closure Market Trends - Growth & Demand 2025-2035

T-Top Closures Market - Growth & Demand 2025 to 2035

Crown Closures Market Growth & Packaging Innovations 2025 to 2035

Metal Closures Market Report – Key Trends & Forecast 2024-2034

Spout Closures Market

Heart Closure Devices Market Size and Share Forecast Outlook 2025 to 2035

Ribbed Closures Market

Snap-on Closures Market Analysis by Diameter, Material Type, End Use, and Region Forecast Through 2035

Cranial Closure And Fixation Devices Market Size and Share Forecast Outlook 2025 to 2035

Clic Loc Closure Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Closure Boxes Market Trends - Growth & Demand 2025 to 2035

Market Share Breakdown of Caps and Closure Market

Competitive Overview of Clic-Loc Closure Market Share

Buttress Closures Market Growth - Size & Demand Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA