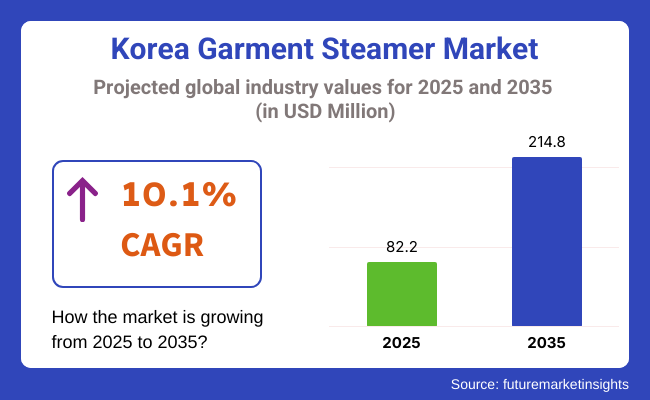

The Korea garment steamer market is poised to register a valuation of USD 82.2 million in 2025. The industry is slated to grow at 10.1% CAGR from 2025 to 2035, witnessing USD 214.8 million by 2035. The industry is witnessing steady growth based on a mix of lifestyle changes, greater emphasis on personal grooming, and changing consumer tastes.

With more Koreans embracing fast-paced, urban lifestyles, demand for convenient, time-saving home appliances has grown by leaps and bounds. Clothing steamers, which are easy to use and quick to eliminate wrinkles, suit the busy schedule of working professionals and young adults who need effective daily life tools. Steamer ironing is quicker to set up than conventional irons and is soft on sensitive fabrics, which makes the product more attractive in a fashion-oriented society like Korea where clothing care is prioritized.

Increasing popularity of compact and multi-functional appliances is contributing to industry growth. Most Korean homes are in apartments with limited space, so compact steamers are more desirable than larger ironing systems.

Manufacturers are reacting by providing lightweight, portable, and fashionable steamer models that complement contemporary interiors. In addition, as Korean consumers become more health- and hygiene-conscious, the sanitizing capacity of garment steamers, which decreases allergens and bacteria on the clothing, has become a selling feature, particularly in the post-pandemic scenario.

Cultural factors also enhance industry growth. Korea's dominance in international fashion and entertainment, such as K-pop and K-drama, drives a high level of personal grooming. Steamers are not only employed in the home but also in retail, fashion houses, and even behind the scenes at events.

Coupled with rising disposable income and heightened awareness of high-end home care products, these trends are encouraging more consumers to spend money on better-quality garment steamers. Overall, these drivers are anticipated to keep propelling demand and innovation in the Korean garment steamer industry over the next few years.

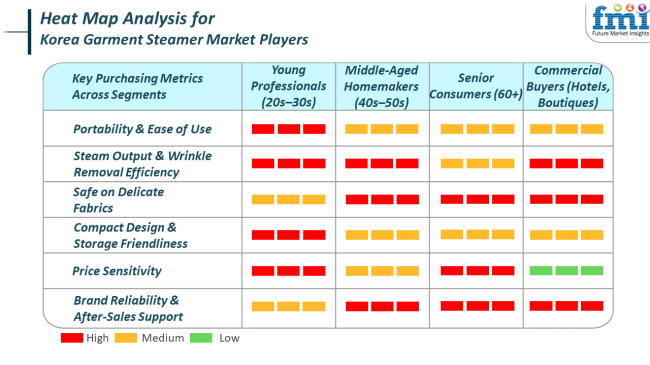

The Korea garment steamer market is driven by varied trends and buying habits in residential, commercial, and fashion/retail categories. Residential buyers, such as young professionals and homemakers, value convenience, compactness, and ease of use because of space limitations and hectic lifestyles.

Major considerations in this category are portability, quick heat-up time, safety for fabrics, and sleek design. Pandemic-driven consciousness about hygiene has also raised the demand for steamers with sanitizing features. Quietness and energy efficiency are key factors, particularly for shared or small living areas. With personal care and laundry needs becoming increasingly essential in daily lifestyles, residential customers are looking for multifunction appliances that combine performance with style.

Commercial and fashion/retail segments, however, focus more on performance, durability, and efficiency. Hotels, dry cleaners, and laundries prioritize heavy-duty steamers with continuous operation, high output, and simple maintenance, with operating cost and after-sales service being key decision drivers.

Fashion stores and studios, on the other hand, look for lightweight, fast-heating steamers that can handle different fabrics safely and still look professional. Quiet operation, portability, and appearance are also important in retail settings, where customer experience and brand image are considerations. Since every segment has special requirements, producers are now customizing products to fulfill these special needs, promoting product diversification and innovation in Korea's expanding garment steamer market.

Between 2020 and 2024, the Korea garment steamer market experienced dramatic changes due to changing lifestyles, increased hygiene awareness, and consumer interest. The COVID-19 pandemic had a major impact in driving demands for home appliances that facilitate cleanliness and garment care, leading garment steamers to be highly sought after by homes seeking to sanitize garments and minimize allergens.

Throughout this time, social distancing and remote work resulted in an increase in home-based lifestyles, which encouraged greater investment in functional, time-saving appliances. The industry also witnessed a trend towards smaller, easy-to-use, and visually appealing steamers, which mirrored the requirements of younger, urban consumers with smaller living spaces. E-commerce also became more prominent as a major sales channel, with consumers increasingly turning to online reviews and influencer marketing to inform their purchases.

Looking forward to 2025 to 2035, the industry is likely to develop with increasing focus on smartness, sustainability, and premiumization. Buyers will probably call for steamers that are compatible with smart home systems, provide app-based control, and offer performance analytics or maintenance notifications.

Environmentally friendly design will also be in focus, with energy-efficient models and sustainable materials emerging as key differentiators. As Korea remains the epicenter of fashion and pop culture, demand for high-performing steamers that safeguard exquisite, high-quality fabrics will grow-especially in retail, fashion, and entertainment industries. Advances in technology, including quicker heat-up times, compatibility with multiple fabrics, and better steam control, will be key drivers of competition among brands.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| COVID-19 escalated awareness among the public about fabric and personal hygiene. Consumers increasingly found value in garment steamers not only for unwrinkling clothes, but also to sterilize clothes and eliminate allergens, making steamers multi-functional hygiene devices. | As smart home penetration increases, consumers will demand garment steamers with connectivity capabilities like app-based control, steaming settings programmability, and automatic shut-off notifications. Support for wider home ecosystems (such as Google Home or Samsung SmartThings) will become an increasingly common selling feature. |

| Due to the high density of population in cities and the commonality of small apartments, there was a strong inclination toward small, foldable, and light steamer models. Form was important, with customers opting for products that were both portable and good-looking. | Environmental issues are likely to influence buying decisions, with buyers seeking energy-efficient steamers that utilize recyclable materials and cause little harm to the environment. Companies with transparent eco- labeling and recyclable packaging will gain a competitive advantage. |

| With limited retail availability and the tech-savvy inclinations of younger consumers, ecommerce was the prevalent channel. Social media influencers, YouTubers, and product reviews typically drove product discovery, particularly among 20- and 30-year-olds. | As consumers become increasingly quality-oriented and look for products that address individual needs, demand will grow for high-end steamers with mode-specific fabrics, strong pressure steam, extended usage times, and slim designs that fit luxury home styles. |

Although the Korea garment steamer market is growing steadily, it comes with its own set of risks. One of the major issues is industry saturation, particularly in the residential sector. This saturation hit entry-level and mid-range product segments specifically hard, where there is little differentiation and intense price competition. Furthermore, consumer tastes are also changing quickly; companies not innovating or keeping up with changing lifestyle patterns are in danger of losing their industry position.

Another major risk is import dependence and supply chain disruption. Most garment steamers sold in Korea are either made in or imported from such countries as China. Any geopolitical tensions, trade barriers, or worldwide logistics problems may hamper product availability or drive up the cost. Additionally, the business is subject to volatile raw material prices, mostly metals and plastics, which have the potential to impact profit margins if not closely monitored. All these risks are compounded by the limited domestic base of manufacturing of small appliances in Korea, hence exposing the industry to challenges.

Handheld steamers have been a popular option in Korea due to their convenience and portability. Most Koreans reside in small apartments or high-rise apartments, for which space needs to be saved. Handheld steamers are convenient to store, light in weight, and can be used for instant touch-ups.

With the fast-paced lifestyle in cities, individuals purchase products that are simple to operate and will freshen up an article of clothing easily without requiring an ironing board. They are also multi-functional, perfect to steam not just clothes but curtains and upholstery too.

Though handheld models are the most popular, upright steamers also command a considerable industry share in Korea, particularly in homes with greater space or in retail outlets such as clothing stores. Upright steamers tend to be employed for more extensive steaming operations and can accommodate greater quantities of clothes or thicker fabrics.

They are preferred by those who steam clothes on a regular and professional basis, as they offer a more even steam output and typically have larger water tanks for extended use. Even though they are larger, they remain a favorite among those who have the space and requirement for more heavy-duty steaming capabilities.

Plastic and stainless steel are the most common materials used in garment steamer manufacturing in Korea, with plastic used extensively for the outer body and stainless steel frequently applied to inner parts such as the steam nozzle, boiler, or heating components. Plastic's extensive application is mainly because of its light weight, cost-effectiveness, and ease of design.

Korean consumers prefer sleek, modern, and space-saving designs, which plastic allows through easy molding and color customization. Moreover, plastic keeps the overall unit lightweight and portable-a definite advantage in the mass-market segment's handheld steamer category. Its price sensitivity also fits well with the affordability concerns of most daily consumers, so it is perfect for mass production.

Conversely, stainless steel is preferred for internal heating components and steam-generating parts because it is strong, corrosion-resistant, and can withstand high temperatures without degrading. It provides a longer appliance lifespan and improves performance consistency, particularly in providing continuous and strong steam. Stainless steel is also attractive to quality-oriented buyers who relate it to high-quality, safe, and sanitary manufacture-factors of concern in a market where product reliability and safety are of most importance.

The Korean garment steamers industry has a blend of multinational consumer electronics firms and specialist appliance players offering niche products, all of which have been tailor-made to respond to the diverse needs of consumers in Korea.

Global leaders such as LG Electronics and Everyday Gourmet control the industry with their high-performance, cost-effective steamers, while specialist manufacturers such as AICOK and Pure Enrichment offer economical, smaller-scale options that address the unique needs of contemporary city dwellings. The marketplace is further influenced by trends in eco-friendliness, technology, and online shopping as a primary sales channel.

Key Company Share Analysis

| Company Name | Estimated Industry Share (%) |

|---|---|

| LG Electronics | 12-15% |

| Hamilton Beach Brands Holding Company | 8-10% |

| Spectrum Brands | 6-8% |

| AICOK | 5-7% |

| Groupe SEB | 7-9% |

| Conair Corporation | 4-6% |

| Pure Enrichment Company | 3-5% |

| BLACK+DECKER Inc. | 4-6% |

| Reliable Corporation | 2-4% |

| Electrolux AB | 5-7% |

| Company Name | Key Offerings & Activities |

|---|---|

| LG Electronics | The leading home appliance company, LG Electronics provides innovative garment steamers with smart temperature control and anti- calc functions. Its history of high-tech, dependable products resonates in the Korean industry , where there is increasing demand from consumers for innovative home products. |

| Hamilton Beach Brands Holding Company | Recognized for making affordable and functional garment steamers, Hamilton Beach is well entrenched in the Korean industry via retail alliances. The company's products emphasize easy-to-use steamers that suit average household needs. |

| Spectrum Brands | A leading brand in the garment steamer industry with names such as Conair, Spectrum has a series of steamers that are renowned for their portability and user-friendliness. Its products are promoted as convenient and effective solutions for busy Korean households. |

| AICOK | AICOK targets affordable but highly e fficient garment steamers. It has been increasingly popular in Korea because it targets easy-to-use, compact models perfect for small homes, which are prevalent in Korea. |

| Groupe SEB | Groupe SEB is a dominant player in the small appliance industry, with its garment steamers being reputed for durability and high performance. Their products tend to highlight eco-friendly aspects, which appeal to eco-friendly Korean consumers. |

| Conair Corporation | Conair garment steamers are popularly known to be easy to use and budget-friendly. Conair has effectively accessed Korea's emerging e-commerce industry with its strong online retail presence. |

| Pure Enrichment Company | Pure Enrichment specializes in well-designed, visually appealing garment steamers. Its products are created with user experience in mind, featuring quiet operation and rapid steam generation, which appeals to Korean consumers who prefer comfort and efficiency. |

| BLACK+DECKER Inc. | BLACK+DECKER garment steamers are famous for their durability and high-pressure steaming capacity. The brand's extensive presence in Korean retail stores makes it a household name in home care. |

| Reliable Corporation | A specialist in selling high-end steamers, Reliable focuses on professional-grade models for garment care professionals and home consumers. Its products address Korea's high demand for durable and long-lasting home appliances. |

| Electrolux AB | Electrolux garment steamers are highly regarded for their slim profiles and effective performance. Their focus on sustainability and environmental manufacturing processes has been drawing interest in the Korean industry , where consumers are increasingly becoming environment-conscious. |

The Korean garment steamer market is defined by a combination of global and domestic brands providing innovative and functional solutions to the increasingly technology-oriented and environmentally aware consumer base.

Well-established international brands such as LG Electronics and BLACK+DECKER lead the market because of their extensive distribution networks, brand recognition, and emphasis on high-performance products. Yet, new entrants like AICOK and Pure Enrichment are catching up by providing affordable yet efficient steamers that resonate with young, urban customers in Korea's small living spaces.

In terms of product type, the industry is classified into handheld/portable and upright/non-portable.

With respect to end use, the market is divided into household/residential and commercial.

Based on power, the industry is classified into 750 Watt, 750-1000 Watt, 1000-1500 Watt, 1500-2500 Watt, and 2500 Watt & above.

In terms of water tank capacity, the industry is divided into below 500 ml, 500-1 Litre, 1-2 Litre, 2-3 Litre, 3-4 Litre, and 4 Litre & above.

Based on material, the market is classified into plastic, metal, aluminium, stainless steel, cast iron, and ceramic.

In terms of sales channel, the industry is categorized into direct and indirect.

Regionally, the industry is divided into South Gyeongsang, North Jeolla, South Jeolla, Jeju, and the rest of Korea.

The industry is expected to reach USD 82.2 million in 2025.

The industry is projected to witness USD 214.8 million by 2035.

The industry is slated to grow at 10.1% CAGR during the study period.

Handheld products are majorly bought.

Leading companies include LG Electronics, Hamilton Beach Brands Holding Company, Spectrum Brands, AICOK, Groupe SEB, Conair Corporation, Pure Enrichment Company, BLACK+DECKER Inc., Reliable Corporation, and Electrolux AB.

Table 1: Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Korea Industry Analysis and Outlook Volume (Unit) Forecast by Region, 2019 to 2034

Table 3: Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Korea Industry Analysis and Outlook Volume (Unit) Forecast by Product Type, 2019 to 2034

Table 5: Korea Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 6: Korea Industry Analysis and Outlook Volume (Unit) Forecast by End Use, 2019 to 2034

Table 7: Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Power, 2019 to 2034

Table 8: Korea Industry Analysis and Outlook Volume (Unit) Forecast by Power, 2019 to 2034

Table 9: Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Water Tank Capacity, 2019 to 2034

Table 10: Korea Industry Analysis and Outlook Volume (Unit) Forecast by Water Tank Capacity, 2019 to 2034

Table 11: Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 12: Korea Industry Analysis and Outlook Volume (Unit) Forecast by Material, 2019 to 2034

Table 13: Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 14: Korea Industry Analysis and Outlook Volume (Unit) Forecast by Sales Channel, 2019 to 2034

Table 15: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 16: South Gyeongsang Industry Analysis and Outlook Volume (Unit) Forecast by Product Type, 2019 to 2034

Table 17: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 18: South Gyeongsang Industry Analysis and Outlook Volume (Unit) Forecast by End Use, 2019 to 2034

Table 19: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Power, 2019 to 2034

Table 20: South Gyeongsang Industry Analysis and Outlook Volume (Unit) Forecast by Power, 2019 to 2034

Table 21: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Water Tank Capacity, 2019 to 2034

Table 22: South Gyeongsang Industry Analysis and Outlook Volume (Unit) Forecast by Water Tank Capacity, 2019 to 2034

Table 23: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 24: South Gyeongsang Industry Analysis and Outlook Volume (Unit) Forecast by Material, 2019 to 2034

Table 25: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 26: South Gyeongsang Industry Analysis and Outlook Volume (Unit) Forecast by Sales Channel, 2019 to 2034

Table 27: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: North Jeolla Industry Analysis and Outlook Volume (Unit) Forecast by Product Type, 2019 to 2034

Table 29: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 30: North Jeolla Industry Analysis and Outlook Volume (Unit) Forecast by End Use, 2019 to 2034

Table 31: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Power, 2019 to 2034

Table 32: North Jeolla Industry Analysis and Outlook Volume (Unit) Forecast by Power, 2019 to 2034

Table 33: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Water Tank Capacity, 2019 to 2034

Table 34: North Jeolla Industry Analysis and Outlook Volume (Unit) Forecast by Water Tank Capacity, 2019 to 2034

Table 35: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 36: North Jeolla Industry Analysis and Outlook Volume (Unit) Forecast by Material, 2019 to 2034

Table 37: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 38: North Jeolla Industry Analysis and Outlook Volume (Unit) Forecast by Sales Channel, 2019 to 2034

Table 39: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 40: South Jeolla Industry Analysis and Outlook Volume (Unit) Forecast by Product Type, 2019 to 2034

Table 41: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 42: South Jeolla Industry Analysis and Outlook Volume (Unit) Forecast by End Use, 2019 to 2034

Table 43: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Power, 2019 to 2034

Table 44: South Jeolla Industry Analysis and Outlook Volume (Unit) Forecast by Power, 2019 to 2034

Table 45: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Water Tank Capacity, 2019 to 2034

Table 46: South Jeolla Industry Analysis and Outlook Volume (Unit) Forecast by Water Tank Capacity, 2019 to 2034

Table 47: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 48: South Jeolla Industry Analysis and Outlook Volume (Unit) Forecast by Material, 2019 to 2034

Table 49: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 50: South Jeolla Industry Analysis and Outlook Volume (Unit) Forecast by Sales Channel, 2019 to 2034

Table 51: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 52: Jeju Industry Analysis and Outlook Volume (Unit) Forecast by Product Type, 2019 to 2034

Table 53: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 54: Jeju Industry Analysis and Outlook Volume (Unit) Forecast by End Use, 2019 to 2034

Table 55: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Power, 2019 to 2034

Table 56: Jeju Industry Analysis and Outlook Volume (Unit) Forecast by Power, 2019 to 2034

Table 57: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Water Tank Capacity, 2019 to 2034

Table 58: Jeju Industry Analysis and Outlook Volume (Unit) Forecast by Water Tank Capacity, 2019 to 2034

Table 59: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 60: Jeju Industry Analysis and Outlook Volume (Unit) Forecast by Material, 2019 to 2034

Table 61: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 62: Jeju Industry Analysis and Outlook Volume (Unit) Forecast by Sales Channel, 2019 to 2034

Table 63: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 64: Rest of Korea Industry Analysis and Outlook Volume (Unit) Forecast by Product Type, 2019 to 2034

Table 65: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 66: Rest of Korea Industry Analysis and Outlook Volume (Unit) Forecast by End Use, 2019 to 2034

Table 67: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Power, 2019 to 2034

Table 68: Rest of Korea Industry Analysis and Outlook Volume (Unit) Forecast by Power, 2019 to 2034

Table 69: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Water Tank Capacity, 2019 to 2034

Table 70: Rest of Korea Industry Analysis and Outlook Volume (Unit) Forecast by Water Tank Capacity, 2019 to 2034

Table 71: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Material, 2019 to 2034

Table 72: Rest of Korea Industry Analysis and Outlook Volume (Unit) Forecast by Material, 2019 to 2034

Table 73: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 74: Rest of Korea Industry Analysis and Outlook Volume (Unit) Forecast by Sales Channel, 2019 to 2034

Figure 1: Korea Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Korea Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 3: Korea Industry Analysis and Outlook Value (US$ Million) by Power, 2024 to 2034

Figure 4: Korea Industry Analysis and Outlook Value (US$ Million) by Water Tank Capacity, 2024 to 2034

Figure 5: Korea Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 6: Korea Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 7: Korea Industry Analysis and Outlook Value (US$ Million) by Region, 2024 to 2034

Figure 8: Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 9: Korea Industry Analysis and Outlook Volume (Unit) Analysis by Region, 2019 to 2034

Figure 10: Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 11: Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 12: Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 13: Korea Industry Analysis and Outlook Volume (Unit) Analysis by Product Type, 2019 to 2034

Figure 14: Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 15: Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 16: Korea Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 17: Korea Industry Analysis and Outlook Volume (Unit) Analysis by End Use, 2019 to 2034

Figure 18: Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 19: Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 20: Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Power, 2019 to 2034

Figure 21: Korea Industry Analysis and Outlook Volume (Unit) Analysis by Power, 2019 to 2034

Figure 22: Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Power, 2024 to 2034

Figure 23: Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Power, 2024 to 2034

Figure 24: Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Water Tank Capacity, 2019 to 2034

Figure 25: Korea Industry Analysis and Outlook Volume (Unit) Analysis by Water Tank Capacity, 2019 to 2034

Figure 26: Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Water Tank Capacity, 2024 to 2034

Figure 27: Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Water Tank Capacity, 2024 to 2034

Figure 28: Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 29: Korea Industry Analysis and Outlook Volume (Unit) Analysis by Material, 2019 to 2034

Figure 30: Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 31: Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 32: Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 33: Korea Industry Analysis and Outlook Volume (Unit) Analysis by Sales Channel, 2019 to 2034

Figure 34: Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 35: Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 36: Korea Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 37: Korea Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 38: Korea Industry Analysis and Outlook Attractiveness by Power, 2024 to 2034

Figure 39: Korea Industry Analysis and Outlook Attractiveness by Water Tank Capacity, 2024 to 2034

Figure 40: Korea Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 41: Korea Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 42: Korea Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 43: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 44: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 45: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Power, 2024 to 2034

Figure 46: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Water Tank Capacity, 2024 to 2034

Figure 47: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 48: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 49: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 50: South Gyeongsang Industry Analysis and Outlook Volume (Unit) Analysis by Product Type, 2019 to 2034

Figure 51: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 52: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 53: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 54: South Gyeongsang Industry Analysis and Outlook Volume (Unit) Analysis by End Use, 2019 to 2034

Figure 55: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 56: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 57: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Power, 2019 to 2034

Figure 58: South Gyeongsang Industry Analysis and Outlook Volume (Unit) Analysis by Power, 2019 to 2034

Figure 59: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Power, 2024 to 2034

Figure 60: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Power, 2024 to 2034

Figure 61: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Water Tank Capacity, 2019 to 2034

Figure 62: South Gyeongsang Industry Analysis and Outlook Volume (Unit) Analysis by Water Tank Capacity, 2019 to 2034

Figure 63: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Water Tank Capacity, 2024 to 2034

Figure 64: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Water Tank Capacity, 2024 to 2034

Figure 65: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 66: South Gyeongsang Industry Analysis and Outlook Volume (Unit) Analysis by Material, 2019 to 2034

Figure 67: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 68: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 69: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 70: South Gyeongsang Industry Analysis and Outlook Volume (Unit) Analysis by Sales Channel, 2019 to 2034

Figure 71: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 72: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 73: South Gyeongsang Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 74: South Gyeongsang Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 75: South Gyeongsang Industry Analysis and Outlook Attractiveness by Power, 2024 to 2034

Figure 76: South Gyeongsang Industry Analysis and Outlook Attractiveness by Water Tank Capacity, 2024 to 2034

Figure 77: South Gyeongsang Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 78: South Gyeongsang Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 79: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 80: North Jeolla Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 81: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Power, 2024 to 2034

Figure 82: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Water Tank Capacity, 2024 to 2034

Figure 83: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 84: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 85: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 86: North Jeolla Industry Analysis and Outlook Volume (Unit) Analysis by Product Type, 2019 to 2034

Figure 87: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 88: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 89: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 90: North Jeolla Industry Analysis and Outlook Volume (Unit) Analysis by End Use, 2019 to 2034

Figure 91: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 92: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 93: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Power, 2019 to 2034

Figure 94: North Jeolla Industry Analysis and Outlook Volume (Unit) Analysis by Power, 2019 to 2034

Figure 95: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Power, 2024 to 2034

Figure 96: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Power, 2024 to 2034

Figure 97: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Water Tank Capacity, 2019 to 2034

Figure 98: North Jeolla Industry Analysis and Outlook Volume (Unit) Analysis by Water Tank Capacity, 2019 to 2034

Figure 99: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Water Tank Capacity, 2024 to 2034

Figure 100: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Water Tank Capacity, 2024 to 2034

Figure 101: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 102: North Jeolla Industry Analysis and Outlook Volume (Unit) Analysis by Material, 2019 to 2034

Figure 103: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 104: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 105: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 106: North Jeolla Industry Analysis and Outlook Volume (Unit) Analysis by Sales Channel, 2019 to 2034

Figure 107: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 108: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 109: North Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 110: North Jeolla Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 111: North Jeolla Industry Analysis and Outlook Attractiveness by Power, 2024 to 2034

Figure 112: North Jeolla Industry Analysis and Outlook Attractiveness by Water Tank Capacity, 2024 to 2034

Figure 113: North Jeolla Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 114: North Jeolla Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 115: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 116: South Jeolla Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 117: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Power, 2024 to 2034

Figure 118: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Water Tank Capacity, 2024 to 2034

Figure 119: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 120: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 121: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 122: South Jeolla Industry Analysis and Outlook Volume (Unit) Analysis by Product Type, 2019 to 2034

Figure 123: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 124: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 125: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 126: South Jeolla Industry Analysis and Outlook Volume (Unit) Analysis by End Use, 2019 to 2034

Figure 127: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 128: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 129: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Power, 2019 to 2034

Figure 130: South Jeolla Industry Analysis and Outlook Volume (Unit) Analysis by Power, 2019 to 2034

Figure 131: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Power, 2024 to 2034

Figure 132: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Power, 2024 to 2034

Figure 133: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Water Tank Capacity, 2019 to 2034

Figure 134: South Jeolla Industry Analysis and Outlook Volume (Unit) Analysis by Water Tank Capacity, 2019 to 2034

Figure 135: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Water Tank Capacity, 2024 to 2034

Figure 136: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Water Tank Capacity, 2024 to 2034

Figure 137: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 138: South Jeolla Industry Analysis and Outlook Volume (Unit) Analysis by Material, 2019 to 2034

Figure 139: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 140: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 141: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 142: South Jeolla Industry Analysis and Outlook Volume (Unit) Analysis by Sales Channel, 2019 to 2034

Figure 143: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 144: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 145: South Jeolla Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 146: South Jeolla Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 147: South Jeolla Industry Analysis and Outlook Attractiveness by Power, 2024 to 2034

Figure 148: South Jeolla Industry Analysis and Outlook Attractiveness by Water Tank Capacity, 2024 to 2034

Figure 149: South Jeolla Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 150: South Jeolla Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 151: Jeju Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 152: Jeju Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 153: Jeju Industry Analysis and Outlook Value (US$ Million) by Power, 2024 to 2034

Figure 154: Jeju Industry Analysis and Outlook Value (US$ Million) by Water Tank Capacity, 2024 to 2034

Figure 155: Jeju Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 156: Jeju Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 157: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 158: Jeju Industry Analysis and Outlook Volume (Unit) Analysis by Product Type, 2019 to 2034

Figure 159: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 160: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 161: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 162: Jeju Industry Analysis and Outlook Volume (Unit) Analysis by End Use, 2019 to 2034

Figure 163: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 164: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 165: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Power, 2019 to 2034

Figure 166: Jeju Industry Analysis and Outlook Volume (Unit) Analysis by Power, 2019 to 2034

Figure 167: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Power, 2024 to 2034

Figure 168: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Power, 2024 to 2034

Figure 169: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Water Tank Capacity, 2019 to 2034

Figure 170: Jeju Industry Analysis and Outlook Volume (Unit) Analysis by Water Tank Capacity, 2019 to 2034

Figure 171: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Water Tank Capacity, 2024 to 2034

Figure 172: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Water Tank Capacity, 2024 to 2034

Figure 173: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 174: Jeju Industry Analysis and Outlook Volume (Unit) Analysis by Material, 2019 to 2034

Figure 175: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 176: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 177: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 178: Jeju Industry Analysis and Outlook Volume (Unit) Analysis by Sales Channel, 2019 to 2034

Figure 179: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 180: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 181: Jeju Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 182: Jeju Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 183: Jeju Industry Analysis and Outlook Attractiveness by Power, 2024 to 2034

Figure 184: Jeju Industry Analysis and Outlook Attractiveness by Water Tank Capacity, 2024 to 2034

Figure 185: Jeju Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 186: Jeju Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Figure 187: Rest of Korea Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 188: Rest of Korea Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 189: Rest of Korea Industry Analysis and Outlook Value (US$ Million) by Power, 2024 to 2034

Figure 190: Rest of Korea Industry Analysis and Outlook Value (US$ Million) by Water Tank Capacity, 2024 to 2034

Figure 191: Rest of Korea Industry Analysis and Outlook Value (US$ Million) by Material, 2024 to 2034

Figure 192: Rest of Korea Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 193: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 194: Rest of Korea Industry Analysis and Outlook Volume (Unit) Analysis by Product Type, 2019 to 2034

Figure 195: Rest of Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 196: Rest of Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 197: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 198: Rest of Korea Industry Analysis and Outlook Volume (Unit) Analysis by End Use, 2019 to 2034

Figure 199: Rest of Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 200: Rest of Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 201: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Power, 2019 to 2034

Figure 202: Rest of Korea Industry Analysis and Outlook Volume (Unit) Analysis by Power, 2019 to 2034

Figure 203: Rest of Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Power, 2024 to 2034

Figure 204: Rest of Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Power, 2024 to 2034

Figure 205: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Water Tank Capacity, 2019 to 2034

Figure 206: Rest of Korea Industry Analysis and Outlook Volume (Unit) Analysis by Water Tank Capacity, 2019 to 2034

Figure 207: Rest of Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Water Tank Capacity, 2024 to 2034

Figure 208: Rest of Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Water Tank Capacity, 2024 to 2034

Figure 209: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 210: Rest of Korea Industry Analysis and Outlook Volume (Unit) Analysis by Material, 2019 to 2034

Figure 211: Rest of Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 212: Rest of Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 213: Rest of Korea Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 214: Rest of Korea Industry Analysis and Outlook Volume (Unit) Analysis by Sales Channel, 2019 to 2034

Figure 215: Rest of Korea Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 216: Rest of Korea Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 217: Rest of Korea Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 218: Rest of Korea Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 219: Rest of Korea Industry Analysis and Outlook Attractiveness by Power, 2024 to 2034

Figure 220: Rest of Korea Industry Analysis and Outlook Attractiveness by Water Tank Capacity, 2024 to 2034

Figure 221: Rest of Korea Industry Analysis and Outlook Attractiveness by Material, 2024 to 2034

Figure 222: Rest of Korea Industry Analysis and Outlook Attractiveness by Sales Channel, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Korea Automotive Performance Tuning and Engine Remapping Service Industry Size and Share Forecast Outlook 2025 to 2035

Korea Smart Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Korea Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Korea Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Korea Isomalt Industry – Market Trends & Industry Growth 2025 to 2035

Korea Probiotic Supplement Industry – Industry Insights & Demand 2025 to 2035

Korea Calcium Supplement Market is segmented by form,end-use, application and province through 2025 to 2035.

The Korea Non-Dairy Creamer Market in Korea is segmented by form, nature, flavor, type, base, end-use, packaging, distribution channel, and province through 2025 to 2035.

Korea Women’s Intimate Care Market Analysis - Size, Share & Trends 2025 to 2035

Korea Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Korea Visitor Management System Market Growth – Trends & Forecast 2025 to 2035

Korea fiber optic gyroscope market Growth – Trends & Forecast 2025 to 2035

Korea Event Management Software Market Insights – Demand & Growth Forecast 2025 to 2035

Korea Submarine Cable Market Insights – Demand & Forecast 2025 to 2035

Last-mile Delivery Software Market in Korea – Trends & Forecast through 2035

Korea HVDC Transmission System Market Trends & Forecast 2025 to 2035

Korea Base Station Antenna Market Growth – Trends & Forecast 2025 to 2035

Smart Space Market Analysis in Korea-Demand & Growth 2025 to 2035

Korea Banking-as-a-Service (BaaS) Platform Market Growth – Trends & Forecast 2025 to 2035

Korea I2C Bus Market Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA