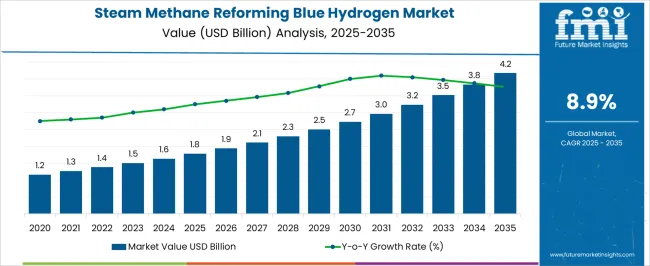

The steam methane reforming blue hydrogen market is projected to reach USD 1.8 billion in 2025 and anticipated to climb to USD 3.8 billion by 2035, expanding at a CAGR of 8.9%. A breakpoint analysis of growth momentum reveals distinct shifts across the decade that highlight the evolving role of blue hydrogen in global energy systems. Between 2025 and 2028, growth remains steady, moving from USD 1.8 billion to USD 2.1 billion, reflecting incremental adoption as countries integrate carbon capture with conventional SMR units. Pilot projects, early-scale investments, and supportive policy frameworks in Europe and North America mark this stage.

By 2029, the market accelerates past USD 2.5 billion, with large-scale projects in industrial clusters and refineries beginning to dominate the landscape. This represents the midpoint breakpoint, where the transition from demonstration to full commercialization drives a sharp uptick in growth momentum. Between 2030 and 2033, rapid industrial uptake pushes the market past USD 3.2 billion, reinforced by government funding for decarbonization of steel, chemicals, and power sectors. In the later years, growth moderates slightly, with expansion fueled more by replacement and retrofitting of existing SMR plants than entirely new builds.

The overall breakpoint analysis shows how the market shifts from a steady, pilot-driven phase to a commercial acceleration phase, before stabilizing into a mature growth pattern by 2035, with carbon capture deployment as the key enabler.

| Metric | Value |

|---|---|

| Steam Methane Reforming Blue Hydrogen Market Estimated Value in (2025 E) | USD 1.8 billion |

| Steam Methane Reforming Blue Hydrogen Market Forecast Value in (2035 F) | USD 4.2 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

The steam methane reforming (SMR) blue hydrogen market is shaped by five interconnected parent markets, each contributing significantly to its expansion. The industrial energy and heavy manufacturing market holds the largest share at 38%, as steel, cement, and chemical producers are adopting blue hydrogen to decarbonize energy-intensive operations while retaining cost efficiency.

The refining and petrochemical sector contributes 27%, where SMR with carbon capture is deployed to reduce emissions from hydrogen traditionally used in hydrocracking, desulfurization, and chemical feedstocks. The power generation market accounts for 15%, with utilities incorporating blue hydrogen into turbines and fuel blending strategies to achieve emission reduction targets. The carbon capture, utilization, and storage (CCUS) infrastructure market holds a 12% share, enabling the integration of SMR with CO₂ sequestration facilities that support large-scale deployment. Finally, the transportation and mobility market represents 8%, as blue hydrogen is gradually introduced into fuel cell applications for long-haul trucks, buses, and shipping.

Industrial energy, refining, and power sectors account for 80% of overall demand, underscoring that hard-to-abate industries remain the primary drivers of adoption, while CCUS infrastructure and transport applications provide supporting growth and long-term opportunities for global blue hydrogen integration.

The steam methane reforming blue hydrogen market is expanding steadily, supported by increasing investments in low carbon hydrogen production technologies and the global shift toward decarbonization across heavy industries. Rising regulatory support for carbon capture and storage combined with infrastructure readiness for steam methane reforming are creating favorable conditions for market adoption.

Blue hydrogen, produced using natural gas with carbon emissions captured, offers an immediate pathway for transitioning from grey hydrogen to cleaner energy sources without significant disruptions to existing systems. Industrial users are leveraging this technology to align with net-zero targets while maintaining a high-volume hydrogen supply.

The outlook remains strong as energy companies, governments, and industrial operators collaborate to scale blue hydrogen capacity through integrated project pipelines and long-term decarbonization strategies.

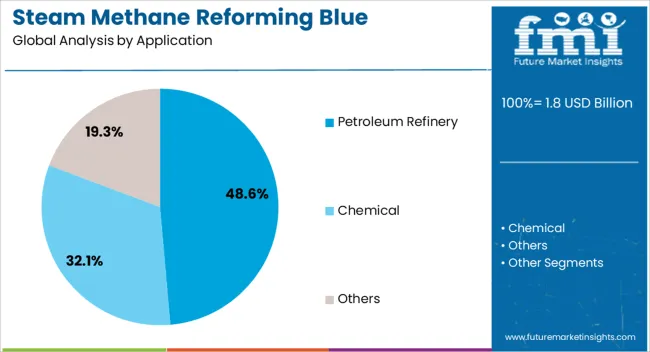

The steam methane reforming blue hydrogen market is segmented by application, and geographic regions. By application, steam methane reforming blue hydrogen market is divided into Petroleum Refinery, Chemical, and Others. Regionally, the steam methane reforming blue hydrogen industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The petroleum refinery segment is projected to account for 48.60% of total market revenue by 2025, making it the dominant application area within the steam methane reforming blue hydrogen market. This leading share is driven by the significant hydrogen demand in refining operations, especially for desulfurization processes that require large scale continuous hydrogen supply.

Blue hydrogen provides a viable low emission alternative for meeting this need without overhauling refinery infrastructure. Refineries are under increasing pressure to reduce their carbon footprint, and integrating carbon capture systems with existing steam methane reforming units offers a cost-effective compliance path.

Additionally, the regulatory emphasis on cleaner fuels and emission control is accelerating the transition from grey to blue hydrogen in refinery applications. The combination of operational compatibility, regulatory incentives, and environmental benefits has positioned the petroleum refinery segment as the key driver of market growth.

The SMR blue hydrogen market is shaped by industrial adoption, refinery integration, CCUS infrastructure, and policy frameworks. Together, these dynamics reinforce its role as a scalable, transitional pathway to a low-carbon energy future.

The steam methane reforming (SMR) blue hydrogen market is gaining momentum as energy-intensive industries accelerate decarbonization strategies. Steel, cement, and chemical producers are prioritizing SMR with carbon capture to lower emissions while maintaining reliable energy supply. Large-scale facilities are being commissioned in industrial clusters, enabling cost-sharing of capture and storage infrastructure. Blue hydrogen is also becoming a transitional fuel for manufacturers seeking near-term solutions ahead of green hydrogen scalability. Demand is concentrated in regions with supportive policies and carbon pricing frameworks, which incentivize companies to invest in SMR retrofits. This industrial adoption sets a strong foundation for market growth and positions SMR-based blue hydrogen as a central solution for heavy-duty applications.

Refineries and petrochemical plants are emerging as major adopters of SMR-based blue hydrogen due to its compatibility with existing operations. Hydrogen plays a critical role in hydrocracking, desulfurization, and ammonia production, making the integration of carbon capture a natural extension for emission reduction. Companies are investing in retrofitting legacy SMR units with capture systems to align with tightening environmental regulations. This trend is reinforced by the need for reliable, high-purity hydrogen supply at scale, which SMR can deliver more economically than many alternatives. Partnerships between refiners, petrochemical giants, and carbon capture developers are strengthening the adoption landscape, ensuring that blue hydrogen becomes embedded in global refining strategies.

The expansion of carbon capture, utilization, and storage (CCUS) infrastructure is a defining factor for SMR blue hydrogen adoption. Without adequate capture and storage facilities, the viability of SMR with carbon management remains limited. Governments and private investors are accelerating funding for large-scale sequestration projects and CO₂ transport networks, ensuring captured emissions can be stored or repurposed effectively. Industrial clusters are prioritizing shared CCUS hubs, which reduce individual project costs while expanding regional adoption. These developments make SMR-based hydrogen more feasible, creating economies of scale. The growth of CCUS infrastructure ensures that SMR will remain competitive as the demand for low-carbon hydrogen increases globally.

Government policies and regulations are shaping the pace of SMR blue hydrogen adoption. Carbon pricing mechanisms, tax incentives, and direct subsidies are incentivizing the retrofitting of SMR plants with carbon capture systems. Regulatory compliance in regions like Europe, North America, and parts of Asia is creating mandatory thresholds for emission reductions, pushing industries to consider blue hydrogen. National hydrogen strategies and funding programs are also prioritizing SMR-based pathways to accelerate low-carbon supply at scale. This combination of incentives and compliance pressures ensures that blue hydrogen plays a key transitional role while green hydrogen capacity builds. Policy-driven momentum is central to its long-term market relevance.

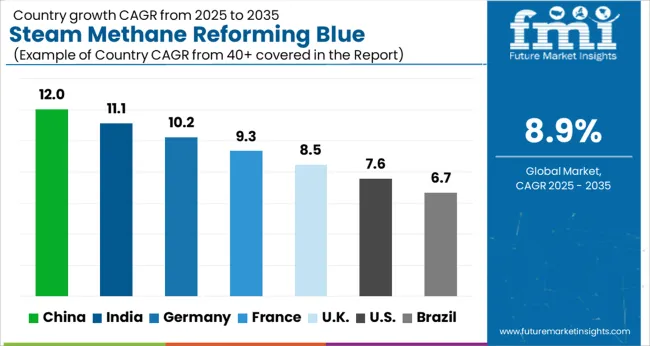

| Country | CAGR |

|---|---|

| China | 12.0% |

| India | 11.1% |

| Germany | 10.2% |

| France | 9.3% |

| UK | 8.5% |

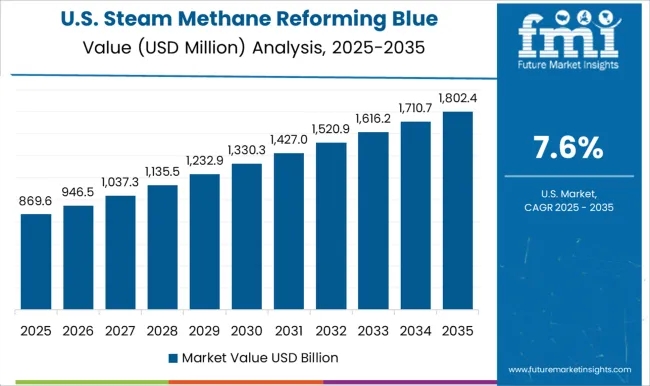

| USAA | 7.6% |

| Brazil | 6.7% |

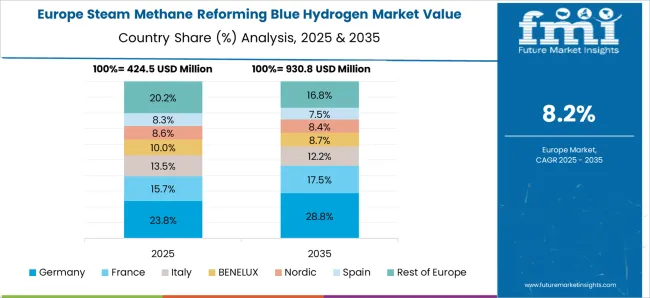

The global steam methane reforming (SMR) blue hydrogen market is projected to grow at a CAGR of 8.9% from 2025 to 2035. China leads at 12.0%, followed by India at 11.1% and Germany at 10.2%, while France records 9.3%, the UK posts 8.5%, and the USA trails at 7.6%. Growth in China and India is reinforced by industrial decarbonization goals, large refining operations, and early investments in carbon capture infrastructure. Germany and France focus on emission reduction compliance, integrating SMR blue hydrogen into chemicals, steel, and power sectors. The UK and USA show moderate but steady growth, driven by pilot projects, hydrogen hubs, and replacement of legacy hydrogen systems with low-carbon alternatives. Collectively, Asia is setting the pace with aggressive industrial deployment, while Europe and North America emphasize regulatory compliance, integration with CCUS networks, and cross-sector adoption. The analysis covers over 40 countries, with the leading markets shown below.

The steam methane reforming blue hydrogen market in China is projected to grow at 12.0% CAGR from 2025 to 2035. Expansion is being pulled by steel, ammonia, and refinery clusters where carbon capture and storage hubs are already planned. Provincial programs are encouraging shared CO₂ pipelines, which lowers unit capture costs and accelerates final investment decisions. Early retrofits of existing SMR trains are being prioritized to cut Scope 1 emissions while preserving large on-site hydrogen supply. Domestic EPC firms are forming consortia with capture licensors and storage developers, which should compress timelines. China’s scale and cluster approach position the country to lead adoption, with offtake tied to low carbon fuels standards and contracts for difference.

The SMR blue hydrogen market in India is expected to expand at 11.1% CAGR between 2025 and 2035. Refineries and fertilizer plants are being targeted first because hydrogen demand already exists and carbon capture can be added to running units. Industrial corridors with natural gas access and sedimentary basins for storage are being mapped for hub development. Public sector undertakings are testing offtake models linked to low carbon ammonia and refinery desulfurization. My assessment is that pragmatic sequencing will dominate, with brownfield retrofits followed by select greenfield units once CO₂ offtake is proven. Tariff incentives, viability gap funding, and blended finance are likely to move projects from intent to execution.

Germany is anticipated to grow at 10.2% CAGR from 2025 to 2035. Demand is being shaped by chemicals and steel pilots that require firm low carbon hydrogen ahead of full green supply. CO₂ transport regulations and cross border storage access are being clarified, which improves bankability for capture projects. Blue supply is being considered as a bridge to stabilize early pipeline volumes into industrial parks. Procurement teams are specifying verified capture rates and lifecycle intensity thresholds, which should reward high capture designs. Germany will use blue supply tactically to de risk hydrogen backbone buildout while green capacity scales.

The UK market is projected to rise at 8.5% CAGR from 2025 to 2035. Cluster projects around the North Sea are pairing SMR with transport and storage networks that already have geological data and permitting momentum. Blue hydrogen is being written into industrial decarbonization plans for refineries, power plants, and CHP sites. Revenue support via contracts for difference and allocation rounds is creating clearer price signals. My view is that phased commissioning tied to storage readiness will keep execution disciplined and reduce risk to offtakers.

The USA market is expected to grow at 7.6% CAGR from 2025 to 2035. Gulf Coast and Midwest hubs offer pipeline CO₂ networks, saline formations, and dense refinery capacity, which suit SMR retrofits. Tax credits for capture are improving project returns and spurring partnerships between emitters and storage operators. Offtakers in chemicals and fuels are seeking low carbon intensity hydrogen for compliance and export opportunities. It is argued that blue volumes will anchor hub utilization while green projects advance, giving buyers a dependable near term supply.

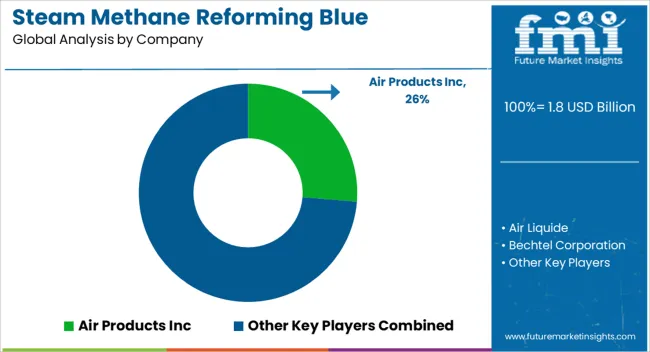

The steam methane reforming (SMR) blue hydrogen market has been shaped by a mix of energy giants and industrial gas producers that are scaling projects to capitalize on the rising demand for low-carbon hydrogen. Companies such as Air Liquide, Linde, Shell, and BP are leading participants, deploying SMR units integrated with carbon capture and storage (CCS) systems to reduce emissions from hydrogen production. These firms hold advantages through their established infrastructure, technical expertise, and access to capital for large-scale facilities.

New entrants and regional players are gradually building capacity through joint ventures with energy and utility companies to gain footholds in the market. Oil and gas firms are aggressively transitioning existing SMR units into blue hydrogen production hubs to safeguard long-term revenues. Competition is centered on production cost optimization, capture efficiency, and reliability of carbon storage solutions. Strategic partnerships, long-term supply contracts, and co-location with industrial clusters are common approaches to secure market share. The landscape remains moderately consolidated, but competitive intensity is rising as more players race to commission large-scale blue hydrogen plants before regulatory frameworks and carbon pricing mechanisms fully mature.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Application | Petroleum Refinery, Chemical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Products Inc, Air Liquide, Bechtel Corporation, Exxon Mobil Corporation, Eni SpA, John Wood Group PLC, Johnson Matthey, MaireTecnimont Spa, SK E&S CO.LTD., Shell plc, thyssenkrupp Industrial Solutions AG, Technip Energies N.V, TOPSOE, and Woodside Energy |

| Additional Attributes | Dollar sales by production capacity, share by end-use sector (refining, steel, power, transport), regional adoption trends, CCUS integration costs, policy incentives, and competitive positioning. |

The global steam methane reforming blue hydrogen market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the steam methane reforming blue hydrogen market is projected to reach USD 4.2 billion by 2035.

The steam methane reforming blue hydrogen market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in steam methane reforming blue hydrogen market are petroleum refinery, chemical and others.

In terms of , segment to command 0.0% share in the steam methane reforming blue hydrogen market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Steam Trap Valve Market Size and Share Forecast Outlook 2025 to 2035

Steam Turbine Market Size and Share Forecast Outlook 2025 to 2035

Steam Sterilizer Bags Market Size and Share Forecast Outlook 2025 to 2035

Steam Autoclaves Market Size and Share Forecast Outlook 2023 to 2033

Steam Boiler Market Size and Share Forecast Outlook 2025 to 2035

Steam Turbine Service Market Size and Share Forecast Outlook 2025 to 2035

Steam Safety Valve Market Size and Share Forecast Outlook 2025 to 2035

Steam Trap Market Size, Growth, and Forecast 2025 to 2035

Steam Tables & Food Wells Market – Hot Food Service Solutions 2025 to 2035

Steam Chemical Indicator Market

Steam Jet Ejector Market

Steam Flow Meter Market

Steam Operated Condensate Pump Market

Steam And Water Analysis System Market

Steam Humidifiers Market

Steam Turbine For Power Generation Market

Steam Trap Monitor Market

Steam Methane Reforming Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Biogas To Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA