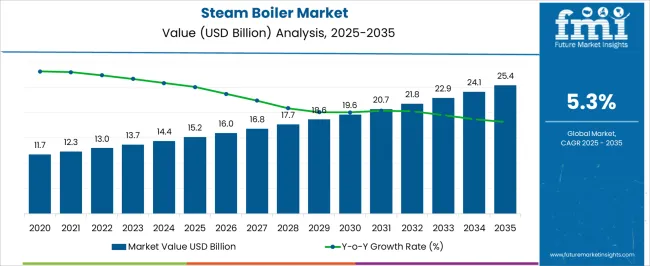

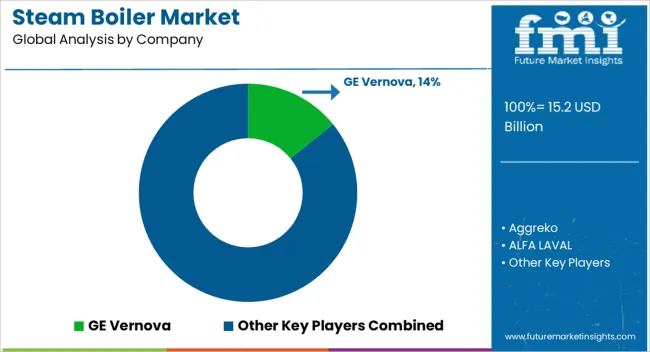

The steam boiler market, valued at USD 15.2 billion in 2025 and projected to reach USD 25.4 billion by 2035 at a CAGR of 5.3%, demonstrates a balanced progression supported by a structured cost and value chain framework. The cost structure of this market is shaped primarily by raw materials such as steel, alloys, pressure vessels, and combustion equipment, which account for a significant share of production expenditure. Fabrication, welding, and quality testing further add to capital intensity, making manufacturing costs a critical determinant of pricing strategies.

Energy and operational efficiency improvements play a key role in value creation, as boiler designs increasingly incorporate advanced combustion systems and automated controls. Supply chain dynamics rely on component suppliers, system integrators, and technology providers who collectively influence lead times and overall cost competitiveness. Distribution is managed through both direct sales channels and industrial solution providers, which add service value including installation, maintenance, and after-sales support.

From a value-chain perspective, equipment manufacturers capture the largest share, while service providers enhance recurring revenue streams through retrofitting and energy optimization solutions. Regulatory compliance costs also affect margins, as emission standards demand continuous R&D investments.

| Metric | Value |

|---|---|

| Steam Boiler Market Estimated Value in (2025 E) | USD 15.2 billion |

| Steam Boiler Market Forecast Value in (2035 F) | USD 25.4 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The steam boiler market is positioned as a vital segment of industrial and energy systems, offering essential thermal energy across multiple applications. It contributes about 4.6% to the industrial equipment industry and holds a 3.9% share in the power generation segment, as boilers remain indispensable for electricity production. Within heating equipment, its share is approximately 7.2%, underlining its importance in industrial and district heating solutions.

The process manufacturing industry accounts for 5.1% of the demand due to steam integration in chemical, food, and textile production. In oil and gas equipment, a 2.8% share reflects its supporting role in refining and upstream processes. Recent industry trends have been shaped by the growing adoption of high-efficiency and low-emission boilers that comply with stricter environmental norms. Groundbreaking developments include the integration of IoT-enabled monitoring systems for predictive maintenance and energy optimization. Manufacturers are advancing supercritical and ultra-supercritical boiler technologies to improve operational efficiency and reduce fuel costs.

Strategic collaborations between boiler OEMs and clean fuel technology providers have been initiated to support hydrogen-ready and biofuel-compatible designs. Asia Pacific has been a major growth driver with increasing industrial investments, while Europe has focused on replacement demand led by regulatory compliance and decarbonization initiatives.

The steam boiler market is witnessing steady expansion, supported by rising demand across industrial manufacturing, power generation, and commercial heating applications. The current landscape is shaped by the integration of energy-efficient designs, regulatory requirements for emissions reduction, and the increasing adoption of automation in boiler operations. Market growth is underpinned by capacity upgrades in high-demand sectors and retrofitting of existing systems to improve thermal efficiency and operational safety.

Natural gas adoption has been strengthened by its cleaner combustion profile and cost stability compared to other fossil fuels. Larger capacity boilers are gaining traction in heavy industries due to their ability to handle high steam loads efficiently, while advanced condensing technologies are being implemented to maximize energy recovery.

Over the forecast horizon, growth prospects will be driven by industrial expansion in emerging economies, stricter environmental regulations prompting technology shifts, and ongoing investments in sustainable fuel integration. Strategic innovations in controls, monitoring systems, and materials are expected to enhance performance, reduce lifecycle costs, and maintain competitive positioning.

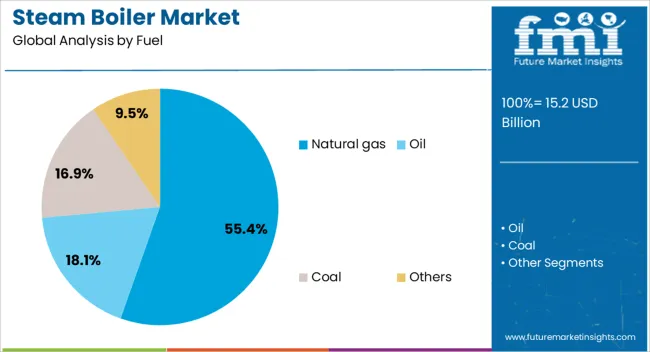

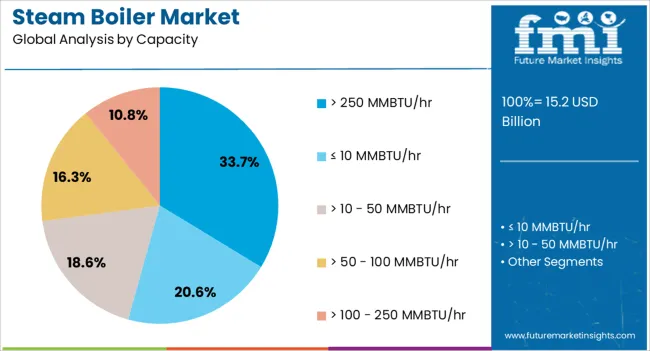

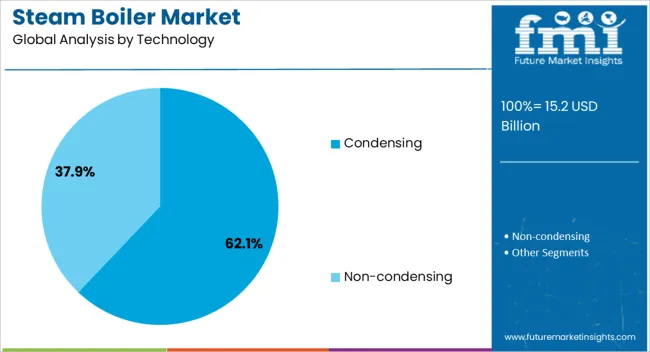

The steam boiler market is segmented by fuel, capacity, technology, application, and geographic regions. By fuel, steam boiler market is divided into Natural gas, Oil, Coal, and Others. In terms of capacity, steam boiler market is classified into > 250 MMBTU/hr, ≤ 10 MMBTU/hr, > 10 - 50 MMBTU/hr, > 50 - 100 MMBTU/hr, and > 100 - 250 MMBTU/hr. Based on technology, steam boiler market is segmented into Condensing and Non-condensing. By application, steam boiler market is segmented into Commercial and Industrial. Regionally, the steam boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The natural gas segment, holding 55.40% of the fuel category, remains the dominant choice due to its favorable cost-to-efficiency ratio and reduced emissions profile compared to coal or oil-based alternatives. Its market strength has been reinforced by extensive pipeline infrastructure, ensuring consistent supply to industrial and commercial end-users.

Regulatory pressures to curb greenhouse gas emissions have accelerated the replacement of older, high-emission boilers with natural gas-fired systems, supporting long-term adoption. Operational advantages such as faster start-up times, stable combustion characteristics, and lower maintenance requirements have further cemented its preference.

In regions with strong energy transition policies, natural gas boilers are being paired with hybrid systems or renewable energy inputs to enhance sustainability. This combination of environmental compliance, cost-efficiency, and performance reliability positions the segment to sustain its lead as industries modernize their steam generation infrastructure.

The >250 MMBTU/hr capacity segment, accounting for 33.70% of the capacity category, has been leading the market due to its suitability for high-demand industrial processes and large-scale power generation. These boilers are capable of delivering consistent steam volumes under heavy operational loads, making them essential for sectors such as chemicals, steel, and refining.

The segment’s dominance has been supported by investments in high-capacity manufacturing facilities and the modernization of utility-scale plants. Advances in design have improved fuel efficiency, reduced heat losses, and optimized load response, enabling better cost control for operators.

Stringent emission norms have also driven the integration of advanced combustion systems and waste heat recovery solutions in this category. As industrial output expands in developing economies, demand for large-capacity steam boilers is expected to remain strong, particularly in applications where process continuity and reliability are critical.

The condensing technology segment, representing 62.10% of the technology category, leads the market due to its ability to achieve higher thermal efficiency by recovering latent heat from exhaust gases. This efficiency advantage has aligned well with global sustainability goals and regulatory frameworks aimed at reducing energy waste. The segment has gained traction across both industrial and commercial applications, where operational cost savings and reduced fuel consumption are prioritized.

Technological improvements in corrosion-resistant materials and advanced controls have addressed earlier limitations in handling varying return water temperatures, enabling broader adoption. Condensing boilers also contribute to lower carbon footprints, making them a preferred choice in regions with stringent environmental regulations.

Market adoption is further supported by the rising cost of fuel, which incentivizes end-users to invest in technologies that maximize energy utilization. With continuous advancements in design and integration capabilities, the condensing segment is expected to strengthen its dominance in both retrofit and new installation projects.

The market plays a vital role in industrial processes, power generation, and heating applications across diverse sectors. Boilers are essential for energy conversion, producing steam that is widely used in manufacturing, chemical processing, food and beverage production, and electricity generation. The market is influenced by regulatory frameworks, fuel availability, and technological innovations focused on efficiency and emissions reduction. The increasing shift toward cleaner fuels and advanced designs has been shaping the competitive environment. Global demand patterns also reflect regional industrialization levels, infrastructure development, and energy policies that influence adoption rates and modernization strategies.

The rising activity in industries such as chemicals, textiles, food processing, and energy has been creating consistent demand for steam boilers. These boilers are essential in processes requiring high temperature and pressurized steam. Developing economies are witnessing notable growth due to increased industrialization and investments in production capacity. In established economies, demand is more focused on upgrading existing boiler systems to improve efficiency and reduce operating costs. Steam boilers are being integrated into diverse industrial operations where energy reliability and thermal efficiency are critical. This industrial momentum has maintained boilers as indispensable components of global production systems.

The steam boiler market has been significantly shaped by environmental regulations and energy efficiency requirements. Governments and regulatory agencies are enforcing stricter emission norms, particularly concerning greenhouse gases and particulate matter. Manufacturers are being driven to design boilers that consume less fuel while delivering optimal steam output. Cleaner fuels such as natural gas, biomass, and hydrogen are being integrated into boiler systems, gradually reducing reliance on coal. Energy recovery technologies and advanced control systems are also being introduced to ensure compliance. These regulatory influences have accelerated innovation, making efficiency and environmental performance crucial competitive factors.

Rapid innovations in boiler technology are transforming system design and operation. Advanced monitoring systems, automation, and predictive maintenance are being widely deployed to reduce downtime and extend boiler life cycles. Modular boiler systems are gaining traction due to their flexibility, ease of installation, and scalability for industrial and commercial users. Waste heat recovery and hybrid systems integrating renewable energy sources are also being developed. These innovations not only enhance operational efficiency but also reduce lifecycle costs, making modernization an attractive option for industries. The adoption of digital solutions is further enabling precise control over fuel consumption and emissions.

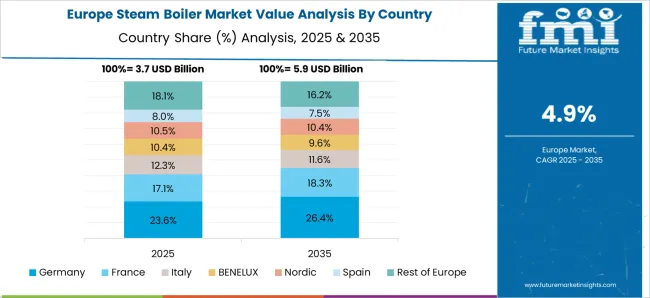

Regional policy frameworks and infrastructure investments are playing a decisive role in shaping the steam boiler market. Asia Pacific is leading in demand due to rapid industrial growth and power sector expansion, particularly in China and India. Europe is advancing with a focus on low-emission technologies, supported by strict regulatory frameworks. North America remains significant due to industrial upgrading and technological integration. Meanwhile, Middle Eastern and African nations are increasing investment in energy and industrial infrastructure, which in turn drives the adoption of steam boilers. These regional developments highlight the importance of local policies in influencing global demand trends.

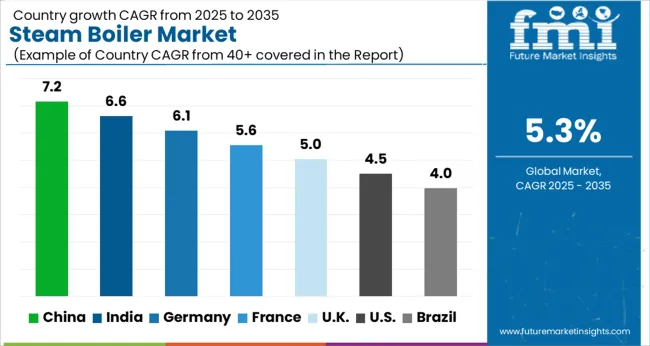

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

China is projected to lead the market with a forecast CAGR of 7.2%, supported by extensive industrial expansion, energy production, and manufacturing sector requirements. India follows with 6.6%, where growing demand from textile, chemical, and power generation industries has created a favorable outlook. Germany recorded 6.1%, influenced by advanced engineering standards and adoption of efficient boiler technologies in industrial applications. The United Kingdom posted 5.0%, where modernization of heating systems and compliance with environmental standards shaped growth. The United States registered 4.5%, driven by replacement of aging infrastructure and focus on higher efficiency solutions. Collectively, these markets demonstrate how energy efficiency, industrial modernization, and technology upgrades are shaping the future demand for steam boilers across regions. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to register a CAGR of 7.2% in the market, supported by strong demand from power generation and heavy industries. Expanding manufacturing capacity and investments in energy infrastructure are driving significant adoption. Industrial processes requiring high efficiency and reliability in steam generation continue to create market opportunities. Cleaner and more advanced boiler technologies are gaining preference as environmental regulations tighten. Government initiatives promoting energy efficiency and low-emission equipment are further shaping the competitive landscape. As industrial activity remains robust, the market outlook for steam boilers in China is expected to stay strong.

India is anticipated to grow at a CAGR of 6.6% in the market, supported by rapid industrialization and growing energy needs. Sectors such as chemicals, food processing, and textiles are expanding their reliance on steam generation systems. Demand for efficient boilers with low maintenance requirements is strengthening across industries. Rising government focus on energy-efficient equipment is promoting modernization of industrial boilers. Increasing investments in thermal power and manufacturing plants are expected to sustain long-term demand. The market in India is positioned for consistent growth with evolving industrial requirements.

Germany is forecasted to expand at a CAGR of 6.1% in the market, driven by advanced industrial processes and a shift toward cleaner energy solutions. The country’s strong engineering and manufacturing base supports adoption of high-performance boiler systems. Increasing emphasis on low-emission and sustainable solutions is shaping the competitive environment. The replacement of outdated systems with modern, energy-efficient boilers is expected to gain pace. Strong demand from the chemical and food sectors contributes to steady consumption. With ongoing technological innovation, Germany is expected to maintain a strong position in the European steam boiler market.

The United Kingdom is expected to grow at a CAGR of 5.0% in the market, supported by moderate demand from power, healthcare, and food industries. Regulatory focus on carbon reduction is pushing adoption of efficient steam boilers. Hybrid systems combining traditional and renewable energy inputs are attracting interest. Replacement demand for outdated equipment is creating growth opportunities for modern, compact, and energy-saving boilers. Although industrial growth is slower compared to emerging economies, the emphasis on sustainability and compliance is influencing purchasing decisions. The UK is likely to remain an important European market for specialized boiler applications.

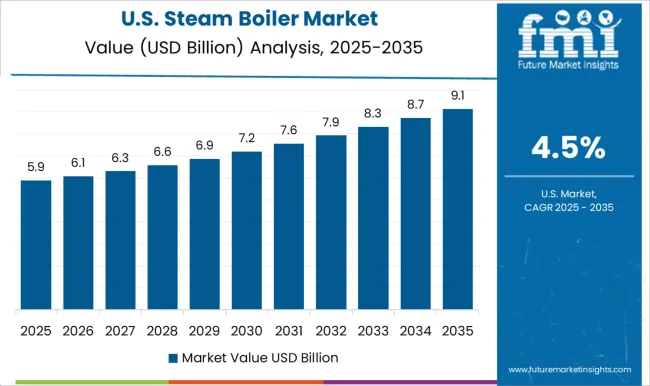

The United States is projected to witness a CAGR of 4.5% in the market, driven by applications in power generation, pharmaceuticals, and oil refining. Modernization of industrial facilities is boosting the need for high-capacity and efficient boilers. Increasing awareness about emissions reduction is encouraging the adoption of eco-friendly designs. Technological advancements, including smart monitoring and automation, are transforming operational efficiency. While competition remains high among domestic and international suppliers, investment in research and product innovation continues to enhance competitiveness. The US market is expected to maintain stable growth with a focus on performance and compliance.

The market is shaped by a broad mix of multinational corporations and regional manufacturers offering systems for industrial, commercial, and power generation use. GE Vernova is a prominent provider with advanced boiler technologies integrated into its energy solutions portfolio, while Aggreko contributes through temporary and rental steam boiler systems supporting industries with flexible demand. ALFA LAVAL is known for incorporating heat transfer expertise into boiler efficiency solutions. Established companies such as Babcock & Wilcox and Babcock Wanson have longstanding reputations for reliable large-scale steam generation, with Bosch Industriekessel and Clayton Industries offering versatile designs for multiple industrial applications.

Cleaver-Brooks, Cochran, and FERROLI deliver packaged and customized steam boiler systems catering to manufacturing and processing industries. Forbes Marshall and Fulton have strengthened positions in process industries, particularly in textiles, pharmaceuticals, and food sectors. Hoval and Hurst Boiler & Welding are recognized for robust energy solutions, while John Cockerill provides advanced boiler technologies aligned with power and heavy industry. Miura America specializes in modular and high-efficiency boilers, addressing compact and on-demand steam generation needs. Smaller manufacturers such as P.M. Lattner Manufacturing, PARKER BOILER, and Precision Boilers address niche demand segments. Global players like Thermax, VIESSMANN, and Weil-McLain expand the market by offering a mix of energy-efficient and environmentally conscious solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.2 Billion |

| Fuel | Natural gas, Oil, Coal, and Others |

| Capacity | > 250 MMBTU/hr, ≤ 10 MMBTU/hr, > 10 - 50 MMBTU/hr, > 50 - 100 MMBTU/hr, and > 100 - 250 MMBTU/hr |

| Technology | Condensing and Non-condensing |

| Application | Commercial and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | GE Vernova, Aggreko, ALFA LAVAL, Babcock & Wilcox, Babcock Wanson, Bosch Industriekessel, Clayton Industries, Cleaver-Brooks, Cochran, FERROLI, Forbes Marshall, Fulton, Hoval, Hurst Boiler & Welding, John Cockerill, Miura America, P.M. Lattner Manufacturing, PARKER BOILER, Precision Boilers, Thermax, VIESSMANN, and Weil-McLain |

| Additional Attributes | Dollar sales by boiler type and capacity, demand dynamics across industrial, commercial, and power generation sectors, regional trends in thermal energy adoption, innovation in efficiency, automation, and fuel flexibility, environmental impact of emissions and resource consumption, and emerging use cases in renewable integration and decentralized power systems. |

The global steam boiler market is estimated to be valued at USD 15.2 billion in 2025.

The market size for the steam boiler market is projected to reach USD 25.4 billion by 2035.

The steam boiler market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in steam boiler market are natural gas, oil, coal and others.

In terms of capacity, > 250 MMbtu/hr segment to command 33.7% share in the steam boiler market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Steam Boiler Market Size and Share Forecast Outlook 2025 to 2035

Steam Trap Valve Market Size and Share Forecast Outlook 2025 to 2035

Steam Turbine Market Size and Share Forecast Outlook 2025 to 2035

Steam Sterilizer Bags Market Size and Share Forecast Outlook 2025 to 2035

Steam Autoclaves Market Size and Share Forecast Outlook 2023 to 2033

Steam Methane Reforming Blue Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Steam Turbine Service Market Size and Share Forecast Outlook 2025 to 2035

Steam Safety Valve Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Biogas To Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Trap Market Size, Growth, and Forecast 2025 to 2035

Steam Tables & Food Wells Market – Hot Food Service Solutions 2025 to 2035

Steam Chemical Indicator Market

Steam Humidifiers Market

Steam Jet Ejector Market

Steam Flow Meter Market

Steam Operated Condensate Pump Market

Steam And Water Analysis System Market

Steam Trap Monitor Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA