The commercial steam boiler market is estimated to be valued at USD 5.0 billion in 2025 and is projected to reach USD 10.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period. The market follows a clear trajectory across its lifecycle, reflecting technological adoption, market expansion, and eventual consolidation. During the early adoption phase from 2020 to 2024, the market was primarily driven by niche industrial applications, regulatory compliance, and the adoption of energy-efficient technologies. Market value grew steadily from USD 3.6 billion to USD 4.7 billion, as early adopters invested in modern steam boiler solutions to improve operational efficiency and reduce emissions. The scaling phase between 2025 and 2030 is characterized by rapid market expansion. By 2025, the market reaches USD 5.0 billion, entering a period of accelerated adoption fueled by increased industrialization, government incentives for energy-efficient equipment, and growing awareness of operational cost savings. During this phase, annual growth strengthens, with market value reaching approximately USD 7.1 billion by 2030.

Competitors expand production, enhance distribution networks, and introduce technologically advanced boilers to capture a larger market share. From 2030 to 2035, the market transitions into consolidation. By 2035, the market is projected to reach USD 10.0 billion, with growth stabilizing as leading players dominate through brand loyalty, large-scale contracts, and strategic partnerships. Innovation becomes incremental, focused on efficiency improvements and emissions reduction. Market consolidation reduces fragmentation, establishing a mature, competitive landscape where scale and technological reliability define success.

Manufacturing process innovations emphasize modular construction methods and prefabricated assembly techniques that reduce installation time and cost while maintaining quality standards and safety compliance requirements. Automated welding processes ensure consistent pressure vessel construction while advanced materials enable weight reduction and improved thermal efficiency. Quality control systems verify pressure testing, safety device calibration, and performance characteristics that ensure reliable operation and regulatory compliance throughout boiler operational lifecycles.

Environmental considerations drive development of ultra-low emission boiler technologies and alternative fuel capabilities that address air quality regulations and corporate sustainability objectives. Biomass boiler systems utilize renewable fuel sources while carbon capture technologies explore emission reduction possibilities for fossil fuel applications. Energy recovery systems capture waste heat for facility heating or domestic hot water applications that improve overall system efficiency while reducing environmental impact.

Innovation development focuses on hydrogen fuel compatibility and fuel cell integration that enable zero-emission steam generation while maintaining operational reliability and cost-effectiveness necessary for commercial applications. Artificial intelligence applications optimize combustion parameters and maintenance scheduling based on operational data analysis and predictive modeling. Advanced materials research explores corrosion-resistant alloys and improved insulation systems that extend equipment life while improving thermal efficiency and reducing maintenance requirements.

| Metric | Value |

|---|---|

| Commercial Steam Boiler Market Estimated Value in (2025 E) | USD 5.0 billion |

| Commercial Steam Boiler Market Forecast Value in (2035 F) | USD 10.0 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

Rising emphasis on energy efficiency, regulatory mandates targeting emission reductions, and the need for reliable heating in extreme climatic conditions are shaping market demand.

Technological advancements in boiler designs and the integration of smart control systems are further enhancing operational performance and lifecycle efficiency. Additionally, retrofitting activities in aging infrastructure and ongoing urban development projects are accelerating the replacement of conventional systems with advanced steam boiler units.

As businesses prioritize sustainable and cost-effective heating solutions, the market is expected to continue its upward trajectory, supported by demand across educational institutions, healthcare facilities, food processing units, and commercial establishments.

The commercial steam boiler market is segmented by fuel, capacity, technology, application, and geographic regions. By fuel, the commercial steam boiler market is divided into Natural gas, Oil, Coal, Electric, and Others. In terms of capacity, the commercial steam boiler market is classified into ≤ 0.3 - 2.5 MMBTU/hr, > 2.5 - 10 MMBTU/hr, > 10 - 50 MMBTU/hr, > 50 - 100 MMBTU/hr, and > 100 - 250 MMBTU/hr. Based on technology, the commercial steam boiler market is segmented into Condensing and Non-condensing.

By application, the commercial steam boiler market is segmented into Offices, Healthcare facilities, Educational institutions, Lodgings, Retail stores, and Others. Regionally, the commercial steam boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The natural gas segment is anticipated to lead the fuel category with a 47.60% revenue share in 2025. This dominance is primarily due to its cleaner combustion profile, cost-effectiveness, and widespread availability in commercial zones.

Regulatory pressures to curb greenhouse gas emissions have accelerated the transition from oil and coal to natural gas-based systems. Furthermore, natural gas boilers offer lower maintenance requirements and higher efficiency, which has strengthened their adoption in commercial buildings and institutional facilities.

As environmental standards tighten and infrastructure for natural gas continues to expand, this segment is expected to maintain its leadership position in the fuel category.

The 0.3 to 2.5 MMBTU per hour capacity range is projected to capture 34.20% of the market in 2025 under the capacity category. This segment’s prominence is attributed to its alignment with the heating requirements of medium-scale commercial applications such as hotels, educational campuses, and mid-sized manufacturing units.

These units strike a balance between energy output and operational efficiency, making them ideal for facilities that demand consistent but moderate steam generation. Their compact design, ease of installation, and compatibility with modern burner systems further support their growing preference.

As commercial users seek scalable solutions that optimize fuel usage without oversizing, this capacity range is expected to remain the preferred option.

The condensing technology segment is expected to command 56.30% of total revenue by 2025 within the technology category. Its leadership is driven by the ability to achieve superior thermal efficiency by capturing and utilizing latent heat from exhaust gases.

This technology offers considerable fuel savings and emissions reduction, aligning well with global energy efficiency standards. Its adoption has been supported by government incentives and building codes promoting high-performance heating systems.

Additionally, condensing boilers are favored for their long-term cost benefits and lower environmental impact, which are increasingly important for commercial facilities aiming to meet ESG goals. The widespread acceptance of this technology highlights a clear shift toward sustainability and operational excellence in the commercial steam boiler market.

Steam boilers are essential for heating, sterilization, and power generation applications, making them critical for operational efficiency. Energy efficiency, emission reduction, and automation are key drivers as industries adopt eco-friendly and cost-effective solutions.

North America and Europe lead the market due to stringent energy efficiency regulations and replacement demand for aging infrastructure, while Asia-Pacific shows rapid expansion fueled by industrial growth. Technological advancements, such as modular boilers, low-NOx burners, and IoT-enabled monitoring, enhance reliability and operational performance. Market players focus on after-sales service, preventive maintenance, and turnkey solutions to strengthen customer relationships. Increasing government initiatives for energy conservation and industrial modernization further support the adoption of high-performance steam boilers.

Commercial steam boilers face challenges in meeting increasingly stringent energy efficiency and emission regulations. Variability in fuel type, load demand, and operational practices can reduce efficiency, resulting in higher energy costs and environmental impact. Retrofitting older systems with modern controls, low-NOx burners, and economizers requires significant investment and technical expertise. Proper boiler maintenance, water treatment, and monitoring are crucial to avoid scaling, corrosion, and unplanned downtime. Manufacturers must ensure products comply with energy labels, emissions standards, and local environmental regulations. Additionally, integrating automation and IoT monitoring adds complexity but is necessary for predictive maintenance and operational optimization. Companies investing in research, digital solutions, and efficiency-focused designs can gain a competitive edge. Without addressing efficiency challenges, end-users may face higher operational costs, regulatory penalties, and reduced equipment lifespan, limiting broader market adoption.

Innovation in commercial steam boiler design and operation is shaping the market. Modern boilers feature modular construction, compact footprints, enhanced heat exchangers, and automated controls, improving efficiency and scalability. Low-NOx burners and advanced combustion technologies reduce emissions and comply with environmental regulations. Integration with IoT and cloud-based monitoring systems allows real-time performance tracking, predictive maintenance, and energy management optimization. Smart boilers can automatically adjust fuel and water input based on load demand, maximizing efficiency and reducing operational costs.

Additionally, developments in alternative fuels, such as biomass and hydrogen-compatible boilers, cater to sustainability trends. Companies leveraging cutting-edge technology can offer premium solutions with reduced downtime and lower energy consumption. As industries increasingly prioritize energy-efficient and environmentally friendly operations, technology-driven differentiation becomes a key factor for market leadership.

The commercial steam boiler market is heavily influenced by regional regulations governing energy efficiency, emissions, and safety. Boiler installations must comply with standards set by local authorities, such as pressure vessel certifications, boiler safety regulations, and emission limits. Failure to meet these standards can lead to fines, shutdowns, or operational restrictions. Environmental concerns, particularly regarding CO₂, NOx, and particulate emissions, drive adoption of cleaner, more efficient boilers. Governments offer incentives for energy-efficient boiler replacement, but navigating diverse regional compliance frameworks can be challenging for manufacturers and end-users. Certifications, inspections, and documentation requirements increase operational complexity and cost. Companies proactively designing boilers to meet or exceed regulatory standards gain faster market access, credibility, and reduced legal risk. Until global harmonization occurs, stakeholders must manage a dynamic regulatory landscape to ensure safe, compliant, and sustainable operations.

The commercial steam boiler market is competitive, with global manufacturers, regional suppliers, and new entrants vying for market share. Brand reputation, technology, service quality, and pricing are critical differentiators. Supply chain issues, such as fluctuations in steel and alloy prices, manufacturing lead times, and transportation logistics, impact project timelines and profitability. Dependence on skilled technicians for installation and maintenance can create bottlenecks, especially in emerging markets. Companies investing in local manufacturing, inventory management, and training programs enhance reliability and customer trust. Product differentiation also focuses on energy efficiency, modularity, and environmental compliance. Competitive pressures incentivize continuous innovation and service improvements. Until raw material stability and skilled labor availability improve globally, supply chain constraints and rivalry will continue to significantly influence commercial steam boiler adoption in industrial and institutional applications.

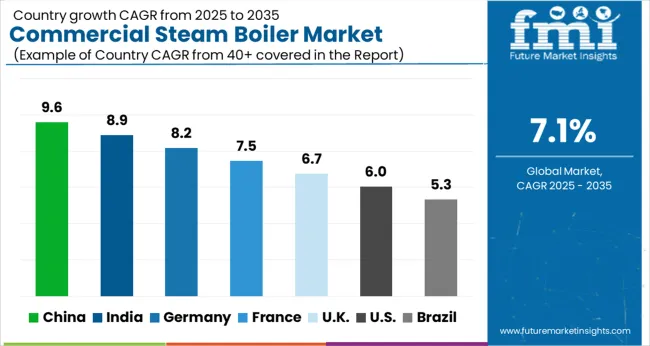

| Country | CAGR |

|---|---|

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| France | 7.5% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The global Commercial Steam Boiler Market is projected to grow at a CAGR of 7.1% through 2035, supported by increasing demand across industrial, commercial, and institutional heating applications. Among BRICS nations, China has been recorded with 9.6% growth, driven by large-scale production and deployment in industrial and commercial heating systems, while India has been observed at 8.9%, supported by rising utilization in commercial and institutional boiler installations. In the OECD region, Germany has been measured at 8.2%, where production and adoption for industrial, commercial, and institutional sectors have been steadily maintained. The United Kingdom has been noted at 6.7%, reflecting consistent use in commercial and industrial heating applications, while the USA has been recorded at 6.0%, with production and utilization across industrial, commercial, and institutional sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The commercial steam boiler market in China is growing at a CAGR of 9.6%, driven by industrialization, expanding manufacturing sectors, and urban infrastructure development. Steam boilers are widely used in chemical, food processing, textile, and energy industries for heating and power generation. Increasing demand for energy-efficient and eco-friendly solutions fuels the adoption of modern, high-efficiency boilers. Government policies promoting industrial growth and energy conservation, along with investments in smart infrastructure, support market expansion. Technological innovations such as automated control systems, low-emission boilers, and modular designs enhance operational efficiency and reduce environmental impact. The shift towards sustainable industrial practices ensures steady adoption of commercial steam boilers across factories, power plants, and commercial complexes in China.

India’s commercial steam boiler market is expanding at a CAGR of 8.9%, supported by rapid industrialization, growing manufacturing facilities, and urban development. Steam boilers are essential for power generation, heating, and process operations in industries such as chemicals, food & beverage, textiles, and pharmaceuticals. Increasing focus on energy efficiency, emission reduction, and renewable integration drives market adoption. Government initiatives promoting industrial infrastructure, energy audits, and energy-efficient technologies accelerate growth. Technological advancements, including automation, modular designs, and improved heat recovery systems, enhance operational efficiency. The rising demand for sustainable industrial processes and modernization of facilities ensures strong adoption of commercial steam boilers across India.

Germany’s commercial steam boiler market is growing at a CAGR of 8.2%, driven by industrial process heating, energy efficiency regulations, and environmental standards. Steam boilers are crucial for manufacturing, food processing, chemicals, and energy production. The adoption of high-efficiency, low-emission, and automated boilers aligns with the country’s sustainability goals. Regulatory frameworks encourage energy audits and environmental compliance, fostering market expansion. Technological innovations, including heat recovery systems, digital controls, and fuel-efficient designs, enhance performance and reduce operating costs. Industrial modernization, renewable integration, and demand for cleaner production processes ensure steady growth of commercial steam boilers across Germany’s industrial sector.

The commercial steam boiler market in the United Kingdom is expanding at a CAGR of 6.7%, supported by industrial applications, commercial facilities, and energy efficiency initiatives. Steam boilers are used in manufacturing, food processing, healthcare, and hospitality sectors for heating and power. Increasing adoption of high-efficiency and low-emission boilers meets regulatory requirements and reduces operational costs. Government policies emphasizing industrial energy audits, sustainability, and emission reduction enhance market growth. Technological advancements such as automation, modular designs, and smart controls improve operational efficiency. The UK market continues to benefit from modernization of industrial facilities and commercial complexes, ensuring steady demand for commercial steam boilers.

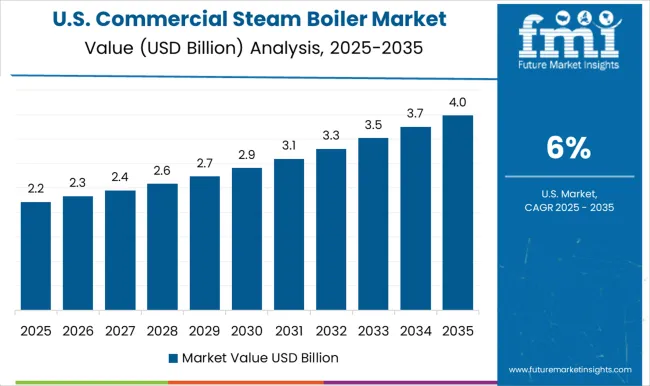

The USA commercial steam boiler market is growing at a CAGR of 6.0%, driven by demand from industrial, commercial, and institutional sectors. Steam boilers are widely used in food processing, chemicals, pharmaceuticals, and manufacturing facilities for heating and power. Increasing focus on energy efficiency, emission reduction, and environmental compliance drives adoption of modern, automated, and high-efficiency boilers. Government incentives for industrial modernization and energy-efficient technologies further support market growth. Technological innovations such as smart controls, modular systems, and waste heat recovery enhance operational performance. The USA market benefits from the emphasis on sustainable industrial processes, renewable energy integration, and industrial upgrades, ensuring consistent growth in commercial steam boiler adoption.

The commercial steam boiler market is led by established boiler manufacturers and thermal system specialists offering high-efficiency steam generation solutions for industrial, institutional, and commercial applications. Babcock & Wilcox Enterprises, Inc. dominates the market with a wide portfolio of industrial and commercial steam boilers engineered for power generation, district heating, and process industries. The company’s focus on reliability, modular design, and advanced combustion control strengthens its leadership in heavy-duty applications.

Bosch Industriekessel (Bosch Group) provides compact and scalable steam boiler systems designed for high efficiency, safety, and easy integration into existing energy infrastructures. Cleaver-Brooks, Inc. is a major player in the North American market, known for its packaged and custom-engineered steam boilers that deliver precise steam control and fuel efficiency. Clayton Industries specializes in once-through steam generators offering rapid start-up and low-emission performance suited to food processing, pharmaceutical, and chemical industries.

Fulton Companies produces vertical and horizontal steam boilers recognized for compact design and consistent thermal output, catering to laundry, healthcare, and hospitality sectors. Hoval GmbH focuses on environmentally efficient heating and steam systems for commercial buildings and manufacturing facilities. LAARS Heating Systems provides smaller-scale commercial boilers emphasizing reliability and simple operation. Parker Boiler Co. supplies durable low-NOx steam boilers optimized for quick response and longevity in light commercial and institutional applications. Viessmann Group combines advanced digital controls and modular design for flexible installation in large-scale facilities. York-Shipley (John Wood Group) offers robust firetube and watertube boilers engineered for long service life and ease of maintenance.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.0 Billion |

| Fuel | Natural gas, Oil, Coal, Electric, and Others |

| Capacity | ≤ 0.3 - 2.5 MMBTU/hr, > 2.5 - 10 MMBTU/hr, > 10 - 50 MMBTU/hr, > 50 - 100 MMBTU/hr, and > 100 - 250 MMBTU/hr |

| Technology | Condensing and Non-condensing |

| Application | Offices, Healthcare facilities, Educational institutions, Lodgings, Retail stores, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Babcock & Wilcox Enterprises, Inc.; Bosch Industriekessel (Bosch Group); Cleaver-Brooks, Inc.; Clayton Industries; Fulton Companies; Hoval GmbH; LAARS Heating Systems; Parker Boiler Co.; Viessmann Group; York-Shipley (John Wood Group) |

| Additional Attributes | Dollar sales vary by boiler type, including fire-tube boilers, water-tube boilers, electric boilers, and hybrid boilers; by fuel type, spanning natural gas, oil, coal, biomass, and electricity; by capacity, such as low (<5 tons/hr), medium (5–20 tons/hr), and high (>20 tons/hr); by application, including industrial manufacturing, power generation, chemical processing, food & beverage, and commercial buildings; by region, led by Asia-Pacific, North America, and Europe. Growth is driven by industrial expansion, rising demand for energy-efficient and low-emission boilers, adoption of automation and IoT for monitoring, infrastructure development, and stringent environmental and safety regulations. |

The global commercial steam boiler market is estimated to be valued at USD 5.0 billion in 2025.

The market size for the commercial steam boiler market is projected to reach USD 10.0 billion by 2035.

The commercial steam boiler market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in commercial steam boiler market are natural gas, oil, coal, electric and others.

In terms of capacity, ≤ 0.3 - 2.5 mmbtu/hr segment to command 34.2% share in the commercial steam boiler market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA