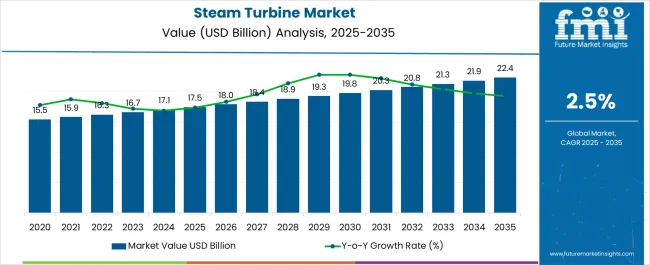

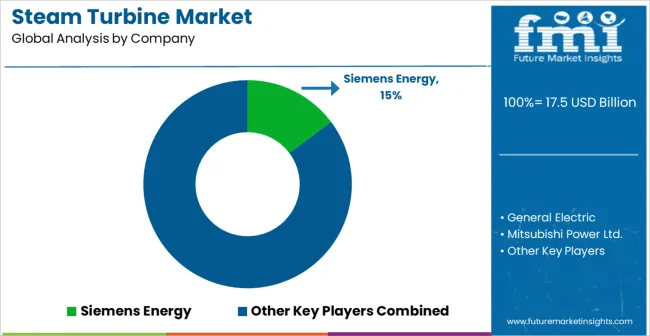

The Steam Turbine Market is estimated to be valued at USD 17.5 billion in 2025 and is projected to reach USD 22.4 billion by 2035, registering a compound annual growth rate (CAGR) of 2.5% over the forecast period.

| Metric | Value |

|---|---|

| Steam Turbine Market Estimated Value in (2025 E) | USD 17.5 billion |

| Steam Turbine Market Forecast Value in (2035 F) | USD 22.4 billion |

| Forecast CAGR (2025 to 2035) | 2.5% |

The Steam Turbine market is experiencing sustained growth, driven by the global demand for efficient power generation and modernization of existing thermal power infrastructure. Rising energy consumption, coupled with the need to reduce carbon emissions and improve efficiency, is encouraging adoption of advanced steam turbine technologies. Continuous innovations in turbine design, blade aerodynamics, and materials have enhanced performance and operational reliability, while reducing maintenance costs.

Integration with digital monitoring systems, predictive maintenance solutions, and automation is further improving operational efficiency and reducing downtime. The market is supported by increasing investments in thermal power stations, industrial plants, and combined heat and power systems, where steam turbines play a critical role. Government incentives for energy-efficient and high-capacity power generation units are also contributing to growth.

As the energy sector continues to prioritize cost-effective and reliable electricity production, steam turbines are expected to remain a cornerstone technology Continuous research into blade design, steam flow optimization, and system integration is expected to create opportunities for long-term market expansion.

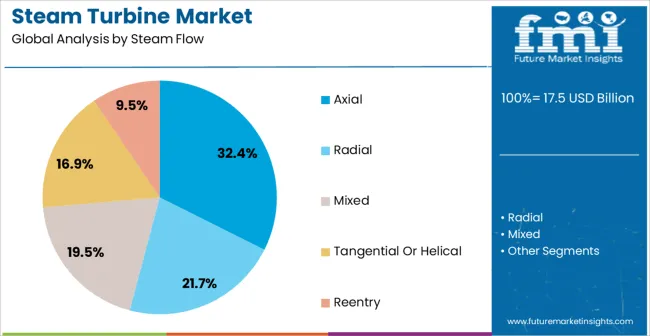

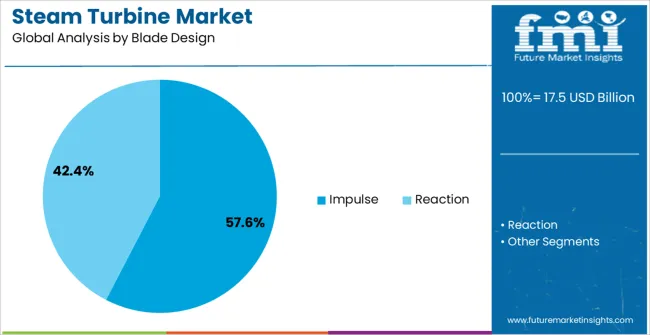

The steam turbine market is segmented by steam flow, blade design, application, and geographic regions. By steam flow, steam turbine market is divided into Axial, Radial, Mixed, Tangential Or Helical, and Reentry. In terms of blade design, steam turbine market is classified into Impulse and Reaction.

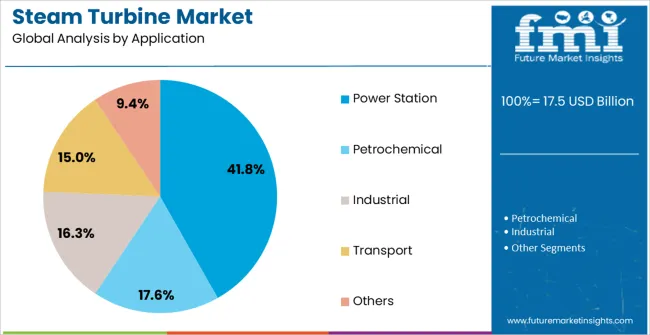

Based on application, steam turbine market is segmented into Power Station, Petrochemical, Industrial, Transport, and Others. Regionally, the steam turbine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The axial steam flow segment is projected to hold 32.4% of the market revenue in 2025, establishing it as the leading steam flow type. Its prominence is being driven by superior efficiency in handling large volumes of steam, which is critical for power generation applications. Axial flow turbines enable high-speed rotation with minimal energy loss, improving overall thermal efficiency and reducing operational costs.

Their design facilitates integration into both high-capacity power stations and industrial plants, offering scalability and reliability. Continuous advancements in computational fluid dynamics and aerodynamic blade profiling have enhanced performance, minimizing vibration and mechanical stress.

The ability to maintain high efficiency under varying load conditions strengthens adoption across modern energy systems With ongoing investments in power generation infrastructure and increasing emphasis on energy efficiency, the axial steam flow segment is expected to maintain its leadership, supported by its adaptability and proven performance in large-scale applications.

The impulse blade design segment is expected to account for 57.6% of the market revenue in 2025, making it the leading blade type. Growth in this segment is being driven by its capability to efficiently convert high-pressure steam into mechanical energy with minimal losses, which is essential for improving turbine efficiency. Impulse blades are designed to withstand high temperatures and pressures while maintaining structural integrity, supporting long operational lifetimes.

Their adoption is reinforced by applications in high-capacity power generation units and industrial plants where performance reliability is critical. Advancements in material science, blade geometry optimization, and manufacturing techniques have further enhanced durability and efficiency.

The ability to maintain stable performance under fluctuating load conditions provides operational flexibility and reduces maintenance requirements As energy producers increasingly prioritize efficiency, reliability, and long-term performance, the impulse blade design segment is expected to retain its market-leading position.

The power station application segment is projected to hold 41.8% of the market revenue in 2025, establishing it as the largest application area. Its growth is being driven by the expanding global electricity demand and the ongoing modernization of thermal and combined-cycle power plants. Steam turbines in power stations enable efficient conversion of thermal energy into electricity, optimizing energy output while reducing operational costs.

Advanced monitoring and control systems allow precise performance management, enhancing reliability and minimizing downtime. The ability to integrate axial steam flow and impulse blade designs into power station turbines improves overall plant efficiency and adaptability.

Government incentives for energy-efficient generation and carbon reduction initiatives are further supporting adoption Increasing emphasis on sustainable and high-performance energy infrastructure is driving investments in power generation facilities, which in turn reinforces the dominance of power stations as the primary application for steam turbines.

Steam turbine is a rotary heat engine which converts thermal energy contained in the steam to electrical and mechanical energy. A steam turbine consist turbine, boiler (steam generator), condenser, feed pump and variety of auxiliary devices. About 90% of electricity generated in world by steam turbine. These turbines are common feature of modern and also future thermal plants.

In fact, it is estimated that 88% of electricity generation in the United States uses steam turbines market. Also, nuclear integration will also depict considerable growth over the forecast period. For instance (in 2025), World Nuclear Association presented active construction of more than sixty power reactors across 12 countries that includes UAE, Russia, China, South Korea and Taiwan.

On the basis of design, the steam turbine market can be segmented into reaction and impulse. Owing to multiple applications in marine propulsion and power generation, impulse steam technology is estimated to be growing at significant CAGR. In 2025, Siemens Energy (Germany) developed their SST-500 GEO for geo-thermal plants.

Reaction steam technology is predicted to grow significantly owing to growing emphasis on efficient combined cycle and Waste to energy electricity generation. Recovering oil and gas industry will further enhance industry growth across the forecast period. In 2025, The U.S. based General Electric has been contracted to retrofit three steam turbine generators at the Yatagan coal-fired power plant in Turkey.

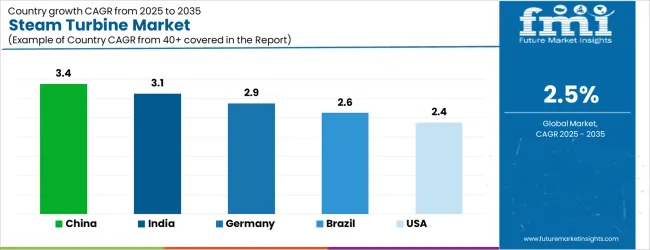

| Country | CAGR |

|---|---|

| China | 3.4% |

| India | 3.1% |

| Germany | 2.9% |

| Brazil | 2.6% |

| USA | 2.4% |

| UK | 2.1% |

| Japan | 1.9% |

The Steam Turbine Market is expected to register a CAGR of 2.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 3.4%, followed by India at 3.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates.

Japan posts the lowest CAGR at 1.9%, yet still underscores a broadly positive trajectory for the global Steam Turbine Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 2.9%.

The USA Steam Turbine Market is estimated to be valued at USD 6.1 billion in 2025 and is anticipated to reach a valuation of USD 6.1 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 898.5 million and USD 463.8 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.5 Billion |

| Steam Flow | Axial, Radial, Mixed, Tangential Or Helical, and Reentry |

| Blade Design | Impulse and Reaction |

| Application | Power Station, Petrochemical, Industrial, Transport, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens Energy, General Electric, Mitsubishi Power Ltd., Toshiba Corporation, Bharat Heavy Electricals Limited, Ansaldo Energia S.p.A, Doosan Škoda Power, Fuji Electric Co., Ltd., Kawasaki Heavy Industries, Ltd., MAN Energy Solutions, Elliot Group, and Trillium Flow Technologies |

The global steam turbine market is estimated to be valued at USD 17.5 billion in 2025.

The market size for the steam turbine market is projected to reach USD 22.4 billion by 2035.

The steam turbine market is expected to grow at a 2.5% CAGR between 2025 and 2035.

The key product types in steam turbine market are axial, radial, mixed, tangential or helical and reentry.

In terms of blade design, impulse segment to command 57.6% share in the steam turbine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Steam Turbine Service Market Size and Share Forecast Outlook 2025 to 2035

Steam Turbine For Power Generation Market

Industrial Steam Turbines Market

Steam Trap Valve Market Size and Share Forecast Outlook 2025 to 2035

Steam Sterilizer Bags Market Size and Share Forecast Outlook 2025 to 2035

Turbine Oils Market Size and Share Forecast Outlook 2025 to 2035

Steam Autoclaves Market Size and Share Forecast Outlook 2023 to 2033

Steam Methane Reforming Blue Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Steam Boiler Market Size and Share Forecast Outlook 2025 to 2035

Turbine Blade Material Market Size and Share Forecast Outlook 2025 to 2035

Steam Safety Valve Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Biogas To Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Trap Market Size, Growth, and Forecast 2025 to 2035

Steam Tables & Food Wells Market – Hot Food Service Solutions 2025 to 2035

Turbine Inlet Cooling System Market Growth - Trends & Forecast 2025 to 2035

Steam Chemical Indicator Market

Steam Operated Condensate Pump Market

Steam Humidifiers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA