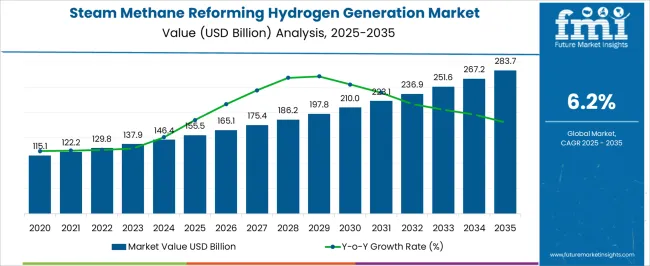

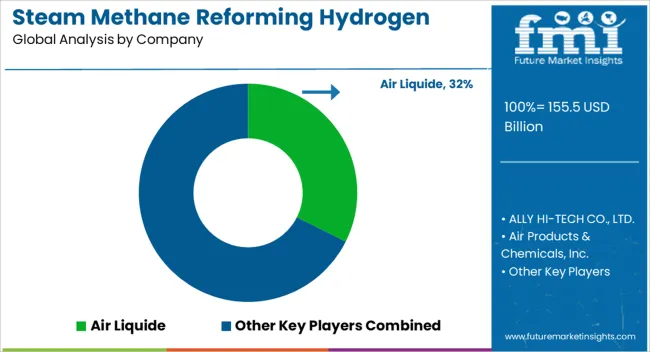

The steam methane reforming hydrogen generation market is forecast to expand from USD 155.5 billion in 2025 to USD 283.7 billion in 2035, registering a CAGR of 6.2%. However, regional performance is not evenly distributed, as Asia Pacific, Europe, and North America display varying growth drivers, structural challenges, and levels of policy support that shape imbalances in development.

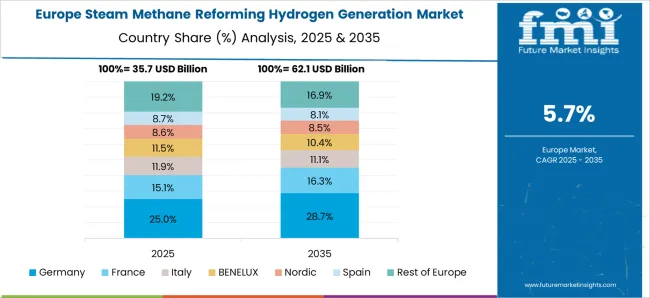

Asia Pacific is expected to dominate expansion, supported by large-scale industrial hydrogen demand, refining activities, and growing adoption of hydrogen for energy transition strategies in China, Japan, and South Korea. Investment flows are concentrated in production hubs, with regional governments offering subsidies and pilot projects that encourage higher capacity additions compared to other regions. Europe, while technologically advanced and policy-driven, faces cost-related challenges and stricter carbon regulations. This creates slower uptake of conventional steam methane reforming, with more emphasis shifting toward carbon capture integration, which tempers overall market volume growth despite strong environmental policy backing. North America holds a balanced position, driven by abundant natural gas reserves and increasing decarbonization initiatives.

The United States leads in scaling up reforming units integrated with carbon capture, yet policy fragmentation across states influences uniform adoption. The resulting imbalance shows Asia Pacific driving overall capacity growth, Europe constrained by regulatory strictness, and North America stabilizing with a mix of supply advantages and gradual policy alignment.

| Metric | Value |

|---|---|

| Steam Methane Reforming Hydrogen Generation Market Estimated Value in (2025 E) | USD 155.5 billion |

| Steam Methane Reforming Hydrogen Generation Market Forecast Value in (2035 F) | USD 283.7 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The steam methane reforming hydrogen generation market represents a dominant segment within the global hydrogen production landscape, owing to its large-scale efficiency and cost advantages. Within the broader hydrogen generation industry, it accounts for nearly 47.5%, underscoring its position as the most widely adopted process. In the overall industrial gas production market, its share is estimated at 6.8%, driven by its role in ammonia, methanol, and refining applications. Across the clean energy and fuel transition sector, it contributes about 4.1%, reflecting its continued importance despite decarbonization efforts. Within the chemical processing equipment market, it holds nearly 3.6%, highlighting its integration with large-scale industrial operations. Its footprint in the global energy infrastructure solutions sector stands at 2.9%, demonstrating its strategic relevance for ongoing hydrogen supply chains.

Recent developments in this market emphasize decarbonization strategies, efficiency improvements, and integration with carbon capture solutions. Growing focus has been placed on low-carbon hydrogen, where steam methane reforming is being coupled with carbon capture and storage (CCS) technologies to lower emissions. Equipment manufacturers are innovating with advanced reformer designs to increase energy efficiency and extend catalyst lifecycles. Partnerships between hydrogen producers and energy companies are expanding to establish blue hydrogen hubs. Digital monitoring systems are being adopted to optimize reformer performance and predict maintenance needs. Pilot projects are being initiated in Europe, North America, and Asia to demonstrate large-scale CCS-enabled reforming plants. Investment is directed toward hybrid models where reforming is paired with renewable electricity, creating pathways toward greener hydrogen production while leveraging existing infrastructure.

The current market is shaped by the rising adoption of hydrogen as a cleaner fuel and as a critical feedstock in chemical processes. This technology’s high efficiency, cost-effectiveness, and established operational infrastructure have contributed to its widespread utilization.

Growing investments in low-carbon hydrogen initiatives, coupled with advancements in carbon capture integration, are expanding the market’s long-term potential. Demand is further reinforced by the role of hydrogen in decarbonizing energy-intensive industries and meeting sustainability targets.

With policy support in several regions and strategic industrial partnerships, the market is positioned for continuous growth. The capability of steam methane reforming to scale efficiently and adapt to evolving environmental regulations ensures its relevance in both current and future energy landscapes.

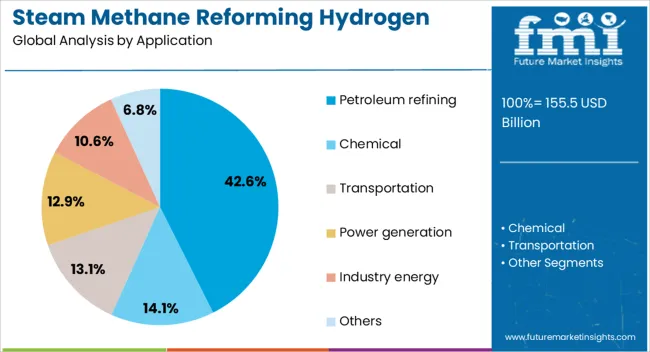

The steam methane reforming hydrogen generation market is segmented by application and geographic regions. By application, the steam methane reforming hydrogen generation market is divided into petroleum refining, chemical, transportation, power generation, industry energy, and others. Regionally, the steam methane reforming hydrogen generation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The petroleum refining application is projected to hold 42.6% of the steam methane reforming hydrogen generation market revenue in 2025, making it the leading segment. This dominance is being attributed to the significant volume of hydrogen required for refining processes such as hydrocracking and desulfurization. The reliability and scalability of steam methane reforming make it the preferred method to meet these large and consistent hydrogen demands.

The segment’s growth has been reinforced by the global emphasis on producing cleaner fuels and reducing sulfur content in petroleum products to comply with stringent environmental regulations. The ability to integrate hydrogen generation facilities within or near refineries has enhanced operational efficiency and reduced supply chain complexities.

Continuous technological improvements in process optimization and carbon capture readiness are further strengthening its position. As refiners continue to adapt to evolving fuel standards and energy transition strategies, the petroleum refining segment is expected to sustain its leading share through consistent demand and established infrastructure.

The market has remained the most dominant hydrogen production pathway, largely due to its established technology, cost-effectiveness, and scalability. This process relies on natural gas as a feedstock, producing hydrogen through catalytic reforming with high efficiency. It is widely used in industries such as refining, chemicals, fertilizers, and power generation. While the growing focus on cleaner hydrogen alternatives has raised concerns over carbon emissions, investments in carbon capture and storage technologies are being integrated to reduce environmental impact.

Steam methane reforming has been the backbone of industrial hydrogen supply for decades, primarily because of its ability to produce hydrogen at large scale and relatively low cost. The method is particularly dominant in ammonia and methanol production, oil refining, and chemical processing industries, where hydrogen demand remains substantial. Its operational maturity ensures that industries rely on it for consistent output, while infrastructure investments support large scale deployment. Although alternative methods such as electrolysis are gaining traction, they have not yet matched the cost competitiveness of steam methane reforming at scale. Thus, SMR continues to underpin global hydrogen production and is expected to remain critical as industries maintain their reliance on high volume hydrogen supplies.

The integration of carbon capture and storage with steam methane reforming has been an influential factor shaping its market prospects. With increasing regulatory pressure to minimize emissions, the ability of SMR facilities to capture carbon dioxide has improved their environmental acceptability. Carbon capture technologies have allowed SMR to be repositioned as a lower carbon hydrogen production method, often referred to as blue hydrogen. This integration not only extends the lifespan of existing SMR infrastructure but also positions it as a transitional pathway bridging conventional hydrogen production with greener alternatives. The emphasis on decarbonization ensures that CCS coupled SMR solutions attract investment, particularly in regions aiming to meet emission reduction targets.

Regional variations in natural gas availability and industrial demand strongly influence the growth of steam methane reforming hydrogen generation. Countries with abundant natural gas reserves and established refining or chemical industries continue to favor SMR as a secure and cost efficient option. North America, the Middle East, and parts of Asia Pacific have shown strong reliance on this method due to favorable feedstock economics. The role of SMR in supporting regional energy security is vital, as it enables countries to leverage local natural gas resources while meeting growing hydrogen demand. This regional alignment ensures that despite global debates on clean hydrogen, SMR retains relevance in many industrial economies.

The market faces challenges from the accelerating push toward renewable based hydrogen. Critics point to the high emissions associated with conventional SMR, particularly where carbon capture is absent. However, industry stakeholders are addressing these challenges through innovations in reforming efficiency, carbon capture integration, and hybrid approaches combining SMR with renewable energy sources. As global hydrogen strategies evolve, SMR is expected to maintain a central role in short to medium term supply, while longer term transitions toward green hydrogen gain momentum. This dual role demonstrates how SMR is simultaneously challenged and sustained, as industries balance cost, scalability, and climate targets in shaping hydrogen futures.

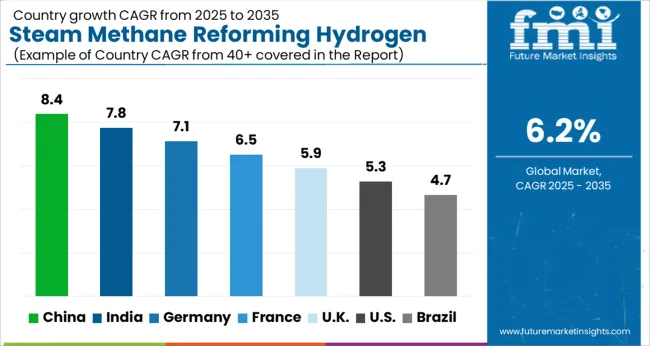

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

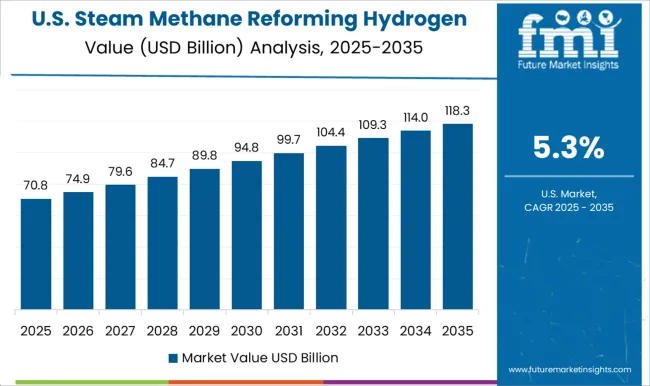

| USA | 5.3% |

| Brazil | 4.7% |

The market is advancing steadily as industries prioritize hydrogen for cleaner energy and chemical applications. India grows at 7.8%, supported by infrastructure expansion and investment in hydrogen-based projects. Germany records 7.1%, with emphasis on industrial decarbonization and energy transition policies. China leads the market at 8.4%, driven by large-scale adoption of hydrogen in refining and chemical production. The United Kingdom progresses at 5.9%, with increasing focus on energy diversification. The United States follows at 5.3%, where hydrogen adoption is supported by both industrial demand and policy-driven initiatives. These growth patterns highlight the pivotal role of steam methane reforming in shaping hydrogen supply for global markets. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is expected to achieve a CAGR of 8.4%, supported by heavy industrial demand and large scale refinery operations. Growth has been driven by consistent natural gas supply and expansion of hydrogen hubs in regions such as Hebei and Shandong. It is considered that SMR remains the dominant pathway for hydrogen production in China due to cost competitiveness and well established infrastructure. Integration of carbon capture and storage technologies has also begun to reduce the emission footprint of SMR plants, reinforcing their long term role. Leading state owned enterprises such as Sinopec are investing in large SMR units connected to industrial clusters. This trajectory suggests that SMR will remain the primary hydrogen production method in China over the next decade.

The Indian market is projected to record a CAGR of 7.8%, reflecting increasing industrial usage and refining sector expansion. Adoption has been influenced by energy security strategies and investment in domestic gas infrastructure. It is viewed that public and private refiners continue to rely on SMR for cost effective hydrogen supply, particularly for desulfurization of fuels. Pilot projects have been initiated to pair SMR with carbon capture systems, aiming to address emissions while preserving cost advantages. Indian Oil and Reliance Industries have been investing in expanding hydrogen generation units within their refining complexes. The trajectory indicates that SMR hydrogen production will retain a strong presence in India, especially as natural gas availability improves and demand for cleaner fuels accelerates.

Germany is anticipated to expand at a CAGR of 7.1% in the SMR hydrogen market, driven by industrial reliance and gradual integration of decarbonization technologies. Although Germany has set long term targets for green hydrogen, SMR remains the most widely used method due to cost efficiency and infrastructure readiness. It is assessed that SMR with carbon capture will be critical in the short to medium term, especially for chemical industries and steel production. German engineering firms are investing in upgrading SMR units with improved efficiency and emission control systems. Imports of natural gas, despite transition pressures, continue to support SMR plant operations. The market outlook indicates that SMR will retain relevance in Germany as an interim solution until renewable based hydrogen scales significantly.

A CAGR of 5.9% has been predicted for the United Kingdom SMR hydrogen market, reflecting moderate but steady expansion. U K refining and chemical industries have continued to use SMR for hydrogen, while policy emphasis has been placed on carbon capture integration. It is considered that projects such as HyNet North West are crucial, as they combine SMR hydrogen with large scale carbon capture and storage infrastructure. Oil majors such as BP and Shell are active in advancing these hybrid approaches, ensuring that SMR remains commercially viable during the transition toward renewable hydrogen. The outlook suggests that U K SMR capacity will play a bridging role, enabling industry to decarbonize while preparing for wider adoption of green hydrogen solutions.

The market in the United States is projected to expand at a CAGR of 5.3%, highlighting steady industrial and energy sector reliance. It is judged that SMR remains the backbone of hydrogen supply, serving refineries, ammonia production, and petrochemical plants. U S natural gas abundance has kept SMR production cost competitive, while federal incentives have encouraged integration of carbon capture solutions to lower emissions. Companies such as Air Products and Linde are expanding SMR facilities linked to carbon storage sites. The combination of industrial scale demand and low feedstock prices has ensured resilience of SMR in the U S. It is expected that this pathway will remain prominent, even as green hydrogen investments accelerate over the longer term.

The market is shaped by major industrial gas companies and technology providers driving large scale and distributed hydrogen production. Air Liquide, Linde plc, and Air Products & Chemicals, Inc. dominate with global networks of reforming plants, supplying hydrogen for refining, chemicals, and mobility applications. Taiyyon Nippon Sanso Corporation and Messer extend their presence in Asia and Europe, focusing on industrial and clean energy demand. Technology specialists like Topsoe, CALORIC, and Mahler AGS GmbH contribute advanced SMR designs, emphasizing process efficiency, integration with carbon capture systems, and modular units for decentralized applications. HyGear and ALLY HI-TECH CO., LTD. serve niche markets with compact reformers suitable for on-site hydrogen generation, aligning with localized supply models.

NUVERA FUEL CELLS, LLC and Plug Power Inc. integrate hydrogen production into fuel cell ecosystems, targeting mobility and backup power solutions. The market is being reshaped by the rising emphasis on low carbon hydrogen, with players investing in hybrid SMR-CCS technologies and partnerships to align with decarbonization goals. This competitive landscape highlights a balance between large scale producers and technology innovators, each driving the transition toward cleaner hydrogen supply.

| Item | Value |

|---|---|

| Quantitative Units | USD 155.5 billion |

| Application | Petroleum refining, Chemical, Transportation, Power generation, Industry energy, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Air Liquide, ALLY HI-TECH CO., LTD., Air Products & Chemicals, Inc., CALORIC, HyGear, Linde plc, Mahler AGS GmbH, Messer, NUVERA FUEL CELLS, LLC, Plug Power Inc., TAIYYON NIPPON SANSO CORPORATION, and Topsoe |

| Additional Attributes | Dollar sales by reformer type and application, demand dynamics across industrial, chemical, and energy sectors, regional trends in hydrogen adoption, innovation in catalyst efficiency, carbon capture integration, and process optimization, environmental impact of CO2 emissions and mitigation strategies, and emerging use cases in fuel cells, refining, and large-scale hydrogen infrastructure development. |

The global steam methane reforming hydrogen generation market is estimated to be valued at USD 155.5 billion in 2025.

The market size for the steam methane reforming hydrogen generation market is projected to reach USD 283.7 billion by 2035.

The steam methane reforming hydrogen generation market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in steam methane reforming hydrogen generation market are petroleum refining, chemical, transportation, power generation, industry energy and others.

In terms of application, the petroleum refining segment is set to command 42.6% share in the steam methane reforming hydrogen generation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Steam Trap Valve Market Size and Share Forecast Outlook 2025 to 2035

Steam Turbine Market Size and Share Forecast Outlook 2025 to 2035

Steam Sterilizer Bags Market Size and Share Forecast Outlook 2025 to 2035

Steam Autoclaves Market Size and Share Forecast Outlook 2023 to 2033

Steam Boiler Market Size and Share Forecast Outlook 2025 to 2035

Steam Turbine Service Market Size and Share Forecast Outlook 2025 to 2035

Steam Safety Valve Market Size and Share Forecast Outlook 2025 to 2035

Steam Trap Market Size, Growth, and Forecast 2025 to 2035

Steam Tables & Food Wells Market – Hot Food Service Solutions 2025 to 2035

Steam Chemical Indicator Market

Steam Jet Ejector Market

Steam Flow Meter Market

Steam Operated Condensate Pump Market

Steam And Water Analysis System Market

Steam Humidifiers Market

Steam Trap Monitor Market

Steam Turbine For Power Generation Market

Steam Methane Reforming Blue Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Biogas To Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA