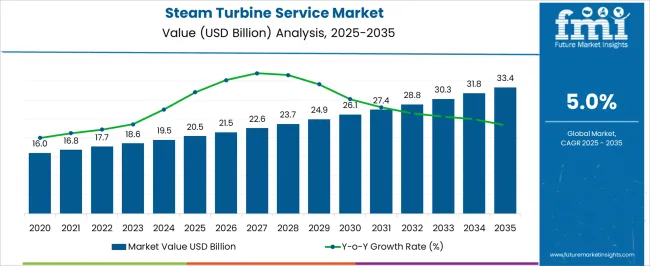

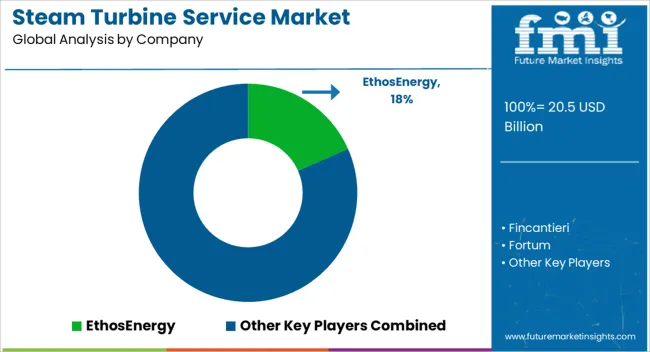

The steam turbine service market is estimated to be valued at USD 20.5 billion in 2025 and is projected to reach USD 33.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. The steam turbine service market is projected to generate an incremental gain of USD 5.6 billion over the first five years, which accounts for 29.4% of the total incremental growth over the 10-year forecast period. This early-phase growth is driven by the increasing demand for regular maintenance, repairs, and upgrades of steam turbines used in power plants and industrial applications.

As global energy demand rises and the need for efficient energy generation increases, service providers are capitalizing on the growing need for turbine optimization and compliance with stricter environmental regulations. Additionally, new technological advancements in turbine design and efficiency are driving higher demand for specialized services, further accelerating market growth. In the second half (2030–2035), the market will contribute USD 7.8 billion, representing 70.6% of the total growth, driven by the continued shift toward cleaner and more energy-efficient solutions. As older turbines are replaced and upgraded, coupled with the increasing demand for power in emerging markets, the need for high-quality turbine services will see accelerated growth. Annual increments are expected to rise from USD 1.1 billion in early years to USD 1.6 billion by 2035 as the focus on improving operational efficiency intensifies. Manufacturers providing services such as predictive maintenance, digital monitoring, and optimization technologies will dominate, capturing the largest share of this USD 13.4 billion opportunity.

| Metric | Value |

|---|---|

| Steam Turbine Service Market Estimated Value in (2025 E) | USD 20.5 billion |

| Steam Turbine Service Market Forecast Value in (2035 F) | USD 33.4 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

As energy producers aim to extend equipment life and meet regulatory efficiency standards, there has been a shift toward scheduled inspections, retrofitting, and predictive maintenance strategies. The growth of renewable integration has also led to fluctuating turbine load cycles, increasing the importance of regular servicing. Technological advancements in condition monitoring, digital twins, and remote diagnostics are enhancing service precision and reducing operational downtime.

The market outlook remains optimistic as industries focus on reducing carbon emissions and improving the reliability of existing power generation assets, thereby expanding the scope for turbine service providers across global markets.

The steam turbine service market is segmented by capacity, design, service, end use, service provider, and geographic regions. By capacity, the steam turbine service market is divided into ≤ 3 MW, > 3 MW - 100 MW, and > 100 MW. In terms of design, the steam turbine service market is classified into Reaction and Impulse. Based on service, the steam turbine service market is segmented into Maintenance, Repair, Overhaul, and Others.

By end use, the steam turbine service market is segmented into Industrial and Utility. By service provider, the steam turbine service market is segmented into OEM and non-OEM. Regionally, the steam turbine service industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

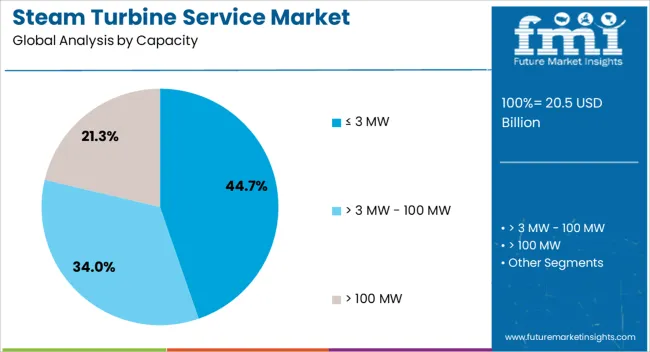

The capacity segment up to 3 MW is projected to contribute 44.70% of the total market revenue by 2025, establishing itself as the most prominent capacity category. This dominance is supported by the widespread use of small-scale steam turbines in distributed energy systems, cogeneration plants, and industrial facilities.

These turbines require frequent servicing to ensure optimal performance in variable load conditions. The increased deployment of biomass and waste heat recovery units has also added to the demand for service solutions in this capacity range.

With a focus on decentralized and modular energy generation, this segment continues to lead the market due to its recurring service requirements and operational flexibility.

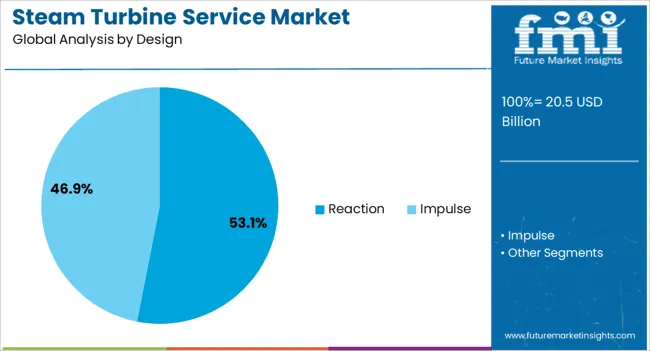

The reaction design segment is expected to hold 53.10% of total revenue by 2025 within the design category, positioning it as the dominant segment. This is attributed to the widespread use of reaction-type turbines in utility-scale applications where efficiency, heat rate performance, and load adaptability are critical.

Reaction turbines generally have more moving parts and complex operational dynamics, leading to a higher frequency of service interventions. Their application in baseload and intermediate load operations further intensifies the need for ongoing maintenance and component refurbishment.

As utilities aim to improve lifecycle efficiency and ensure regulatory compliance, the servicing of reaction turbines remains a key area of focus, supporting this segment’s continued leadership.

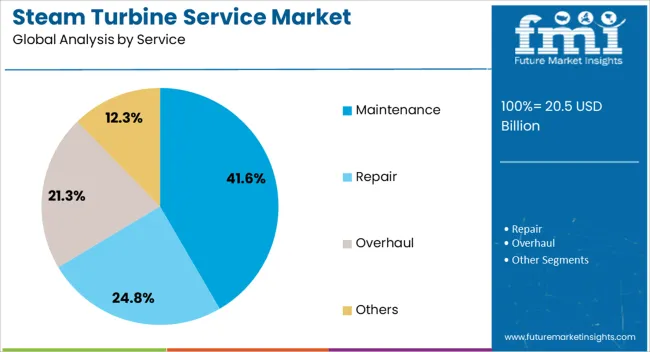

The maintenance segment is projected to account for 41.60% of the market by 2025 under the service category, making it the leading service type. This growth is driven by the need to minimize unexpected failures, optimize output efficiency, and extend asset life.

Routine maintenance activities such as part replacements, lubrication, alignment checks, and thermal inspections form the backbone of service contracts for both industrial and utility clients. With rising electricity demand and increasing pressure to reduce unplanned outages, operators are investing in preventive and condition-based maintenance programs.

As a result, the maintenance segment continues to dominate by providing the most essential and frequent form of service within the steam turbine ecosystem.

Emerging trends like predictive maintenance and performance monitoring are shaping the market's future. However, high service costs and the shortage of skilled workers remain barriers to widespread adoption. By 2025, overcoming these challenges with cost-effective solutions and better workforce training will be essential for sustaining market growth and improving service delivery.

The steam turbine service market is experiencing growth due to the increasing demand for efficient and reliable power generation. As global energy consumption rises, power plants are focusing on maintaining and optimizing their existing infrastructure, including steam turbines, to ensure operational efficiency and reduce downtime. The need for high-performing steam turbines in industries such as power generation, oil, and gas is driving the demand for regular maintenance and services. By 2025, the market will continue to expand as more plants invest in service contracts to enhance turbine performance and extend operational life.

Opportunities in the steam turbine service market are growing with the expansion of power generation and industrial applications. As the demand for electricity increases across the globe, power plants are adopting more steam turbines, leading to a greater need for specialized maintenance services. Additionally, steam turbines are essential in several industrial applications, including petrochemicals and chemicals. As these industries expand, the demand for regular servicing, repairs, and performance optimization will continue to grow. By 2025, the increasing investments in power infrastructure and industrial sectors will create significant opportunities for service providers.

Emerging trends in the steam turbine service market include the adoption of predictive maintenance and performance monitoring systems. With advancements in sensor technologies and data analytics, predictive maintenance allows for early detection of potential issues, reducing the risk of unexpected failures and minimizing downtime. By using real-time data, service providers can optimize turbine performance and schedule necessary interventions before costly breakdowns occur. By 2025, this trend toward predictive maintenance will dominate the market, helping organizations reduce costs while maintaining high-efficiency levels in their power generation operations.

Despite growth, challenges such as high service costs and a shortage of skilled workers persist in the steam turbine service market. The specialized knowledge required for servicing steam turbines, combined with the expensive tools and equipment involved, can result in high maintenance costs. Furthermore, the industry faces a shortage of skilled technicians capable of performing complex turbine repairs and maintenance, which can affect service quality and delivery times. By 2025, addressing these challenges through improved training programs and cost-effective service solutions will be crucial to ensure continued market expansion.

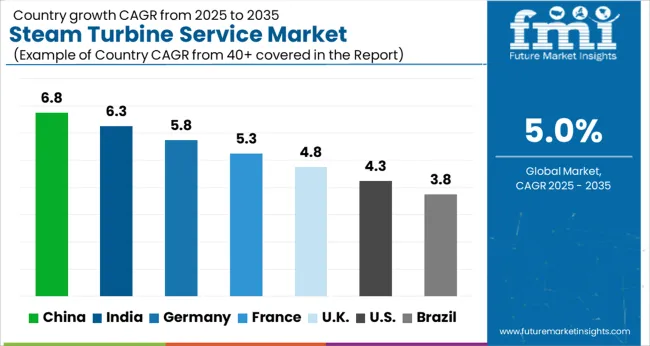

The global steam turbine service market is projected to grow at a 5% CAGR from 2025 to 2035. China leads with a growth rate of 6.8%, followed by India at 6.3%, and France at 5.3%. The United Kingdom records a growth rate of 4.8%, while the United States shows the slowest growth at 4.3%. These varying growth rates are driven by factors such as increasing demand for power generation, the need for maintenance services in industrial sectors, and the growing emphasis on efficiency and sustainability in energy production. Emerging markets like China and India are seeing higher growth due to increasing industrialization, power consumption, and government investments in energy infrastructure, while more mature markets like the USA and the UK see steady growth driven by technological advancements, regulatory support, and the ongoing need for turbine maintenance and upgrades in existing power plants. This report includes insights on 40+ countries; the top markets are shown here for reference.

The steam turbine service market in China is growing rapidly, with a projected CAGR of 6.8%. China’s increasing demand for power generation, coupled with the rapid industrialization and infrastructure development, is driving the need for efficient and reliable turbine services. The country’s expanding energy sector, including thermal power plants and renewable energy infrastructure, contributes significantly to the market growth. Additionally, China’s focus on reducing emissions and improving energy efficiency in power generation systems is pushing for more frequent maintenance and upgrades of steam turbines. The government’s support for clean energy technologies and investments in energy infrastructure further accelerates the adoption of steam turbine services.

The steam turbine service market in India is projected to grow at a CAGR of 6.3%. India’s increasing demand for electricity, driven by rapid industrialization and urbanization, is fueling the need for power generation services, including steam turbine maintenance and upgrades. The country’s expanding thermal power generation capacity, along with the growing interest in renewable energy sources, further contributes to market growth. Additionally, the government’s initiatives to improve energy efficiency and reduce emissions in existing power plants are driving the adoption of steam turbine services. As India’s industrial base continues to grow, the demand for turbine services in key sectors such as power generation, oil & gas, and chemicals also rises.

The steam turbine service market in France is projected to grow at a CAGR of 5.3%. France’s focus on enhancing the efficiency and sustainability of its power generation infrastructure, particularly in the nuclear and thermal power sectors, is driving steady demand for steam turbine services. The country’s regulatory environment, which prioritizes energy efficiency and environmental sustainability, further accelerates the adoption of maintenance and service solutions for steam turbines. Additionally, France’s ongoing investments in renewable energy technologies and infrastructure modernization contribute to the growing need for turbine services.

The steam turbine service market in the United Kingdom is projected to grow at a CAGR of 4.8%. The UK’s ongoing energy transition, driven by its goal to reduce carbon emissions and increase renewable energy generation, is contributing to the steady growth of the market. The country’s emphasis on improving energy efficiency in power plants, combined with investments in the modernization of aging infrastructure, is driving the need for steam turbine maintenance and upgrades. The UK’s strong regulatory framework, supporting clean energy and environmental protection, further accelerates the demand for turbine services.

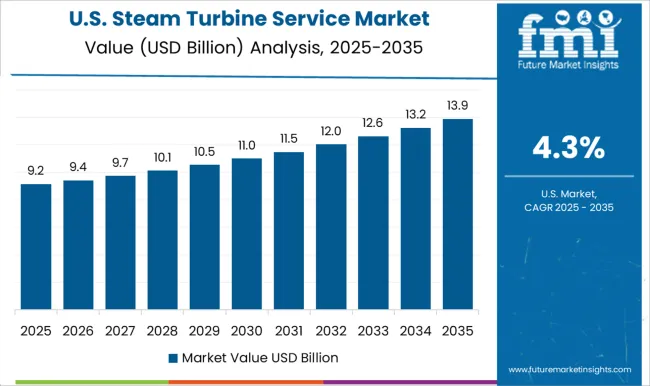

The steam turbine service market in the United States is expected to grow at a CAGR of 4.3%. The USA market remains steady, driven by the ongoing demand for power generation services, particularly in the aging thermal power plant infrastructure. The country’s increasing investments in grid modernization and renewable energy systems, alongside a focus on enhancing the efficiency of existing power plants, are key drivers of market growth. Additionally, government regulations supporting energy efficiency, emission reduction, and the shift towards cleaner energy solutions further accelerate the need for steam turbine services.

The steam turbine service market is dominated by GE Vernova, which leads with an extensive portfolio of maintenance, repair, and optimization solutions serving industries such as power generation, oil and gas, and heavy manufacturing. The company’s dominance is supported by advanced diagnostic capabilities, predictive monitoring systems, and a global service network that prioritizes turbine efficiency and lifecycle reliability. Siemens Energy, Mitsubishi Power, and Sulzer hold substantial shares by offering tailored service contracts, preventive maintenance programs, and turbine modernization packages that minimize downtime and enhance operational resilience across energy systems. Their strategies emphasize high-value upgrades, component efficiency improvements, and integration of digital service platforms.

Emerging participants such as EthosEnergy, Goltens, and Triveni Turbine are building market presence through specialized offerings that include refurbishments, retrofits, and performance optimization for niche applications in renewable energy, industrial processes, and regional power facilities. These companies focus on cost-effective solutions, adaptive service models, and advanced monitoring tools to differentiate themselves.

Growth in this market is being fueled by the rising need to extend turbine life cycles, reduce operational costs, and improve reliability in energy generation. Innovations in turbine optimization, lifecycle management, and predictive digital monitoring are expected to intensify competition and reinforce the importance of service-driven differentiation in the global steam turbine service landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD 20.5 Billion |

| Capacity | ≤ 3 MW, > 3 MW - 100 MW, and > 100 MW |

| Design | Reaction and Impulse |

| Service | Maintenance, Repair, Overhaul, and Others |

| End Use | Industrial and Utility |

| Service Provider | OEM and Non-OEM |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | EthosEnergy, Fincantieri, Fortum, GE Vernova, Goltens, Mechanical Dynamics & Analysis, Metalock Engineering, Mitsubishi Power, Power Services Group, S.T. Cotter Turbine Services, Siemens Energy, Söderqvist Engineering Sweden, Steam Turbine Services, Sulzer, Toshiba America Energy Systems, Trillium Flow Technologies, Triveni Turbine, and WEG |

| Additional Attributes | Dollar sales by service type and application, demand dynamics across power generation, industrial, and utilities sectors, regional trends in steam turbine service adoption, innovation in predictive maintenance and performance optimization technologies, impact of regulatory standards on efficiency and safety, and emerging use cases in renewable energy and decentralized power generation. |

The global steam turbine service market is estimated to be valued at USD 20.5 billion in 2025.

The market size for the steam turbine service market is projected to reach USD 33.4 billion by 2035.

The steam turbine service market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in steam turbine service market are ≤ 3 mw, > 3 mw - 100 mw and > 100 mw.

In terms of design, reaction segment to command 53.1% share in the steam turbine service market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Steam Trap Valve Market Size and Share Forecast Outlook 2025 to 2035

Steam Sterilizer Bags Market Size and Share Forecast Outlook 2025 to 2035

Steam Autoclaves Market Size and Share Forecast Outlook 2023 to 2033

Steam Methane Reforming Blue Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Steam Boiler Market Size and Share Forecast Outlook 2025 to 2035

Steam Safety Valve Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Biogas To Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Trap Market Size, Growth, and Forecast 2025 to 2035

Steam Tables & Food Wells Market – Hot Food Service Solutions 2025 to 2035

Steam Chemical Indicator Market

Steam Jet Ejector Market

Steam Flow Meter Market

Steam Operated Condensate Pump Market

Steam And Water Analysis System Market

Steam Humidifiers Market

Steam Trap Monitor Market

Steam Turbine Market Size and Share Forecast Outlook 2025 to 2035

Steam Turbine For Power Generation Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA