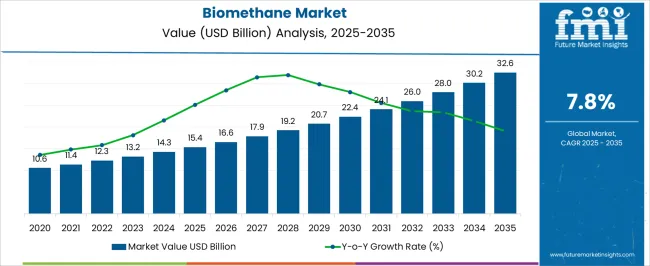

The Biomethane Market is estimated to be valued at USD 15.4 billion in 2025 and is projected to reach USD 32.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period.

The trajectory suggests a market transitioning from niche adoption to mainstream integration within the global energy mix. The growth reflects not only rising adoption of renewable gases but also an increasing shift in energy diversification strategies across developed and emerging economies. By 2030, the market is forecast to reach over USD 22 billion, demonstrating strong mid-period expansion before stabilizing into steady gains through 2035.

This progression highlights multiple concepts driving expansion. One is energy security, as biomethane offers a decentralized fuel source that reduces reliance on conventional natural gas imports. Another lies in circular economy models, since biomethane production often integrates agricultural residues, food waste, and organic byproducts, creating additional value streams.

Regulatory frameworks also influence adoption, with subsidies, feed-in tariffs, and renewable portfolio standards in Europe and Asia shaping demand. Competitive intensity is expected to rise as utilities, gas distributors, and infrastructure developers broaden their biomethane portfolios, seeking long-term resilience. The incremental growth of USD 17.2 billion between 2025 and 2035 underscores its potential role as a stable pillar within the global renewable energy system.

| Metric | Value |

|---|---|

| Biomethane Market Estimated Value in (2025 E) | USD 15.4 billion |

| Biomethane Market Forecast Value in (2035 F) | USD 32.6 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The biomethane market is undergoing significant expansion as governments and industries accelerate their transition to low-carbon energy alternatives. Increasing regulatory emphasis on reducing greenhouse gas emissions has positioned biomethane as a critical substitute for natural gas in power, transport, and industrial sectors. Supportive policies such as feed-in tariffs, green gas certificates, and blending mandates have created favorable economics for producers and investors alike.

The circular nature of biomethane production, utilizing organic waste streams for energy recovery, aligns with global sustainability goals and waste reduction frameworks. Advances in upgrading technologies and gas grid injection infrastructure have further enabled scalability and integration into national energy systems.

Industrial clusters and utilities are increasingly investing in localized biomethane plants to enhance energy self-sufficiency and meet renewable energy targets. Over the coming years, rising demand for clean molecules in hydrogen production, mobility, and distributed power generation is expected to reinforce biomethane’s role as a mainstream renewable fuel.

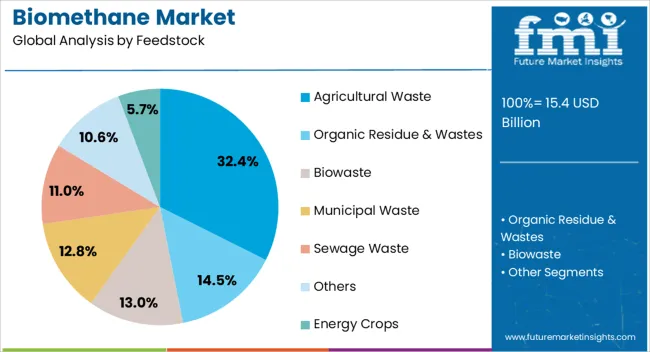

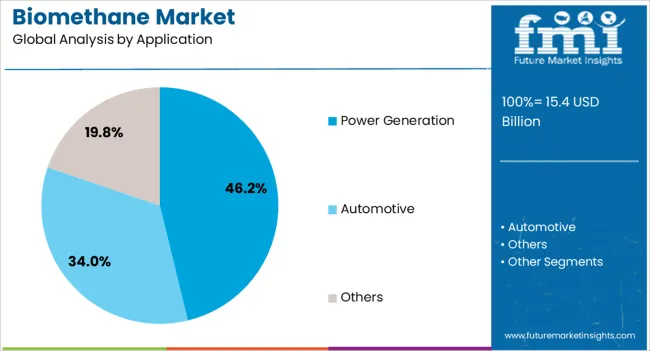

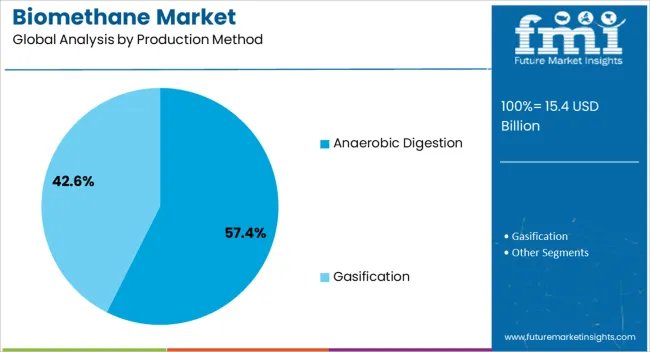

The biomethane market is segmented by feedstock, application, production method, and geographic regions. By feedstock, the biomethane market is divided into Agricultural Waste, organic residue and wastes, Biowaste, Municipal Waste, Sewage Waste, Others, and Energy Crops. In terms of application, the biomethane market is classified into Power Generation, Automotive, and Others. The production method of the biomethane market is segmented into Anaerobic Digestion and Gasification. Regionally, the biomethane industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Agricultural waste is projected to account for 32.4% of the total feedstock share in the biomethane market in 2025, making it the most utilized raw material. This leadership is being driven by the vast availability of crop residues, manure, and slurry from farming operations, which offer consistent organic content suitable for gas production. The decentralised nature of agricultural biomass sources has supported the establishment of small and medium-scale biomethane facilities in rural areas, reducing feedstock transportation costs.

Government incentives targeting farm-based energy generation have encouraged producers to valorize waste streams into renewable gas. Moreover, the high methane yield potential and year-round generation capacity from agricultural residues have contributed to their rising share.

Integration of nutrient recovery systems alongside biogas plants has enhanced the sustainability and economic viability of using agricultural waste. The adaptability of this feedstock to varied climatic and operational conditions has further reinforced its dominance in the overall market landscape.

The power generation segment is anticipated to contribute 46.2% of the total application revenue share in the biomethane market by 2025, emerging as the most dominant end-use. This growth has been supported by the increasing substitution of fossil fuels with renewable gases in electricity generation, especially in grid-constrained and off-grid locations. Biomethane’s compatibility with existing gas turbines and combined heat and power systems has enabled seamless adoption in both centralized and distributed energy models.

National energy strategies focused on dispatchable renewables and flexible baseload capacity have favored the integration of biomethane into power portfolios. Feed-in premiums and long-term power purchase agreements have further improved the financial attractiveness of biomethane-based power projects.

Additionally, the ability to generate power while recovering waste and reducing emissions aligns with the decarbonization objectives of utilities and industrial consumers. With rising electricity demand and the phaseout of coal and nuclear in many regions, biomethane’s contribution to renewable power capacity is expected to expand steadily.

Anaerobic digestion is expected to account for 57.4% of the total revenue share by production method in the biomethane market by 2025, reflecting its dominant role in current and future capacity additions. This process has become the preferred method due to its maturity, operational stability, and ability to process a broad range of organic feedstocks. Agricultural residues, food waste, and wastewater sludge are effectively converted into biomethane through anaerobic digestion, supporting both rural and urban circular economy models.

The widespread adoption of this method has been encouraged by low technological barriers, scalable plant designs, and well-established supply chains. Policymakers have supported anaerobic digestion projects through capital grants, carbon credits, and renewable energy subsidies, further driving adoption.

The co-benefits of nutrient-rich digestate and reduced landfill use have enhanced the environmental credentials of this technology. As decarbonization of waste management and energy sectors intensifies, anaerobic digestion is poised to remain the cornerstone of biomethane production worldwide.

The biomethane market is growing due to the increasing demand for alternative energy sources and the need to reduce reliance on fossil fuels. Biomethane, produced from organic waste through anaerobic digestion, is gaining traction as a cleaner and more efficient alternative to natural gas. As governments and industries worldwide focus on reducing carbon emissions and enhancing energy security, the demand for biomethane as a renewable energy source is increasing. The market is further supported by the growing adoption of waste-to-energy technologies and the increasing use of biomethane in transportation, power generation, and industrial applications.

The primary driver of growth in the biomethane market is the increasing demand for clean energy and efficient waste management solutions. Biomethane, derived from organic waste such as agricultural residue, food waste, and sewage, offers a dual benefit of reducing waste while providing a renewable energy source. The growing global focus on energy diversification, alongside the demand for cleaner fuels, is driving the adoption of biomethane. In addition, as governments implement stricter regulations for waste disposal and landfill reduction, the adoption of biomethane production facilities that convert waste into energy is expanding. The increasing demand for cleaner alternatives in energy generation is driving the growth of the biomethane market.

Despite the growth potential, the biomethane market faces challenges related to high production costs and infrastructure limitations. The production of biomethane requires specialized infrastructure for anaerobic digestion, purification, and injection into the gas grid, which involves significant upfront investment. Additionally, the costs associated with collecting and processing organic waste can be high, making it a less affordable option compared to conventional natural gas. Another challenge is the lack of widespread infrastructure to transport and distribute biomethane, particularly in regions where renewable gas networks are underdeveloped. These limitations restrict the scalability of biomethane production and its ability to compete with conventional energy sources in some markets.

The biomethane market presents significant opportunities driven by technological advancements and expanding use in the transportation sector. Improvements in anaerobic digestion technologies and purification processes are enhancing the efficiency and reducing the costs of biomethane production, making it more commercially viable. Furthermore, the growing adoption of biomethane as a fuel in the transportation sector, particularly in heavy-duty vehicles, buses, and trucks, presents a promising growth avenue. With increasing investment in infrastructure and the development of dedicated biomethane refueling stations, the market for biomethane in the transport sector is poised for further expansion. The rising demand for decentralized energy production solutions is opening new opportunities for biomethane in both rural and urban areas.

A key trend in the biomethane market is its increasing integration with renewable energy systems and industrial applications. Biomethane is being utilized in conjunction with other renewable energy sources, such as solar and wind power, to provide a stable and reliable energy supply, particularly during periods when intermittent renewable sources are unavailable. This integration is enhancing the overall energy efficiency of systems that combine multiple renewable technologies. Additionally, the use of biomethane in industrial processes, such as heating, cooling, and power generation, is expanding as industries look for cleaner alternatives to fossil fuels. This trend is contributing to the growing role of biomethane in both decentralized and large-scale energy solutions.

| Country | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

| USA | 6.6% |

| Brazil | 5.9% |

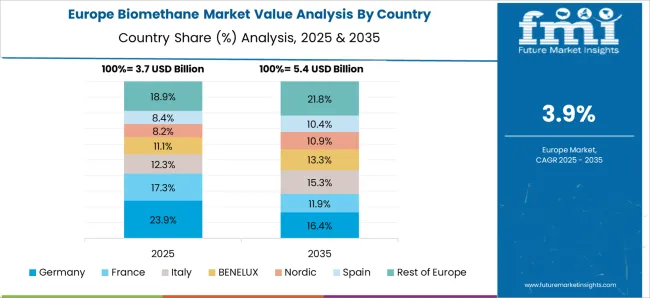

Global biomethane market demand is projected to rise at a 7.8% CAGR from 2025 to 2035.China leads at 10.5%, followed by India at 9.8%, and France at 8.2%, while the United Kingdom records 7.4% and the United States posts 6.6%. These rates translate to a growth premium of +35% for China, +25% for India, and +5% for France versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: increasing investments in renewable energy, government policies supporting cleaner fuel alternatives, and agricultural waste management in China and India, while more mature markets like the United States and the United Kingdom experience moderate growth due to established infrastructure and policy saturation. The analysis spans over 40+ countries, with the leading markets shown below.

The biomethane market in China is growing at a CAGR of 10.5%, driven by the country’s increasing investments in renewable energy and waste-to-energy projects. China’s significant agricultural production, combined with a growing focus on reducing emissions and managing agricultural waste, is fueling the demand for biomethane. The government’s strong support for cleaner fuels and renewable energy alternatives further accelerates the adoption of biomethane in sectors such as transportation and power generation. With the growing emphasis on environmental protection and achieving energy security, China is positioning itself as a leader in the biomethane market.

Sale of biomethane in India is projected to grow at a CAGR of 9.8%, supported by the country’s increasing focus on renewable energy, waste-to-energy initiatives, and the need for clean cooking and transportation fuels. India’s large agricultural base, particularly in crop residues and organic waste, provides abundant feedstock for biomethane production. The government’s policies promoting clean energy adoption, such as the National Bioenergy Programme and incentives for biogas plants, are accelerating the market. Biomethane is gaining traction in rural areas for clean cooking and is also being explored as an alternative fuel for the transportation sector.

The biomethane market in France is growing at a CAGR of 8.2%, driven by the country’s strong commitment to renewable energy and its focus on reducing carbon emissions. France is increasing its adoption of biomethane for power generation, heating, and transportation, with the government’s policies aimed at reducing fossil fuel dependency. Biomethane is being integrated into the country’s gas grid, providing a significant solution for energy diversification. The agricultural and waste management sectors also contribute to the supply of feedstock for biomethane production. France’s progressive environmental policies and renewable energy targets further promote the growth of the biomethane market.

The United Kingdom’s biomethane market is growing at a CAGR of 7.4%, supported by the country’s commitment to reducing emissions and diversifying energy sources. The UK has been at the forefront of integrating renewable energy into its national infrastructure, with biomethane playing an increasingly important role in transportation, heating, and power generation. Government schemes such as the Renewable Heat Incentive and Green Gas Support Scheme have further accelerated the adoption of biomethane. The growing focus on waste-to-energy projects and the rising demand for sustainable fuel alternatives in transport are contributing to the market’s expansion.

The USA biomethane market is growing at a CAGR of 6.6%, with demand driven by the increasing need for renewable energy alternatives in power generation, heating, and transportation. The USA government’s push for cleaner energy sources and growing awareness of environmental concerns are driving the adoption of biomethane. With an abundant supply of organic waste from agriculture, livestock, and municipal solid waste, the USA is well-positioned to produce significant volumes of biomethane. The market is also supported by advancements in technology that make biomethane production more efficient and cost-effective, especially for decentralized applications such as local energy grids and fleet fuels.

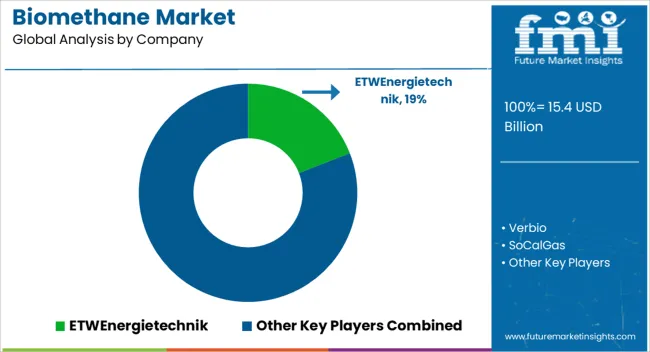

The biomethane market is driven by key players offering sustainable, renewable energy solutions derived from organic waste, playing a vital role in the global transition to cleaner energy sources. ETW Energietechnik is a significant player, specializing in the development of biomethane production systems, focusing on efficient waste-to-energy technologies and sustainable energy solutions for municipalities and industries.

Verbio is a global leader in the production of renewable energy, including biomethane, offering innovative solutions that convert agricultural waste into clean, renewable energy for the transport and industrial sectors. SoCalGas is a major player in the biomethane sector, investing in advanced technologies for the production and distribution of renewable natural gas (RNG), with a strong focus on decarbonizing the energy supply in Southern California.

Green Elephant focuses on offering cost-effective biomethane production solutions, converting organic waste into renewable natural gas and reducing greenhouse gas emissions for industrial and residential applications. Mailhem Ikos Environment is involved in producing biomethane from organic waste, focusing on sustainable energy generation and efficient waste management systems for municipalities, industries, and large-scale projects.

JV Energen specializes in the development of biomethane plants, using anaerobic digestion technology to produce renewable energy and contribute to waste reduction. Gazasia is a leader in the field of biomethane, developing renewable energy projects that focus on generating high-quality biomethane for injection into national gas grids and use in transportation.

| Item | Value |

|---|---|

| Quantitative Units | USD 15.4 Billion |

| Feedstock | Agricultural Waste, Organic Residue & Wastes, Biowaste, Municipal Waste, Sewage Waste, Others, and Energy Crops |

| Application | Power Generation, Automotive, and Others |

| Production Method | Anaerobic Digestion and Gasification |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ETW Energietechnik GmbH, VERBIO Vereinigte BioEnergie AG, SoCalGas, Green Elephant, Mailhem Ikos Environment, JV Energen, and Gazasia Ltd |

| Additional Attributes | Dollar sales by product type (biomethane for transportation, industrial use, residential, and grid injection) and end-use segments (energy production, transportation, industrial applications). Demand dynamics are driven by the increasing adoption of renewable energy sources, government incentives, and regulations promoting low-carbon energy solutions. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, with advancements in biomethane production technology, renewable energy policies, and rising consumer demand for cleaner energy contributing to market expansion. |

The global biomethane market is estimated to be valued at USD 15.4 billion in 2025.

The market size for the biomethane market is projected to reach USD 32.6 billion by 2035.

The biomethane market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in biomethane market are agricultural waste, organic residue & wastes, biowaste, municipal waste, sewage waste, others and energy crops.

In terms of application, power generation segment to command 46.2% share in the biomethane market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA