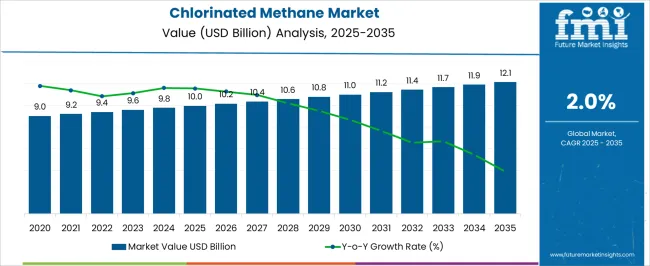

The chlorinated methane market is estimated to be valued at USD 10.0 billion in 2025 and is projected to reach USD 12.1 billion by 2035, registering a compound annual growth rate (CAGR) of 2.0% over the forecast period. The modest growth trajectory indicates that regulatory constraints play a substantial role in limiting rapid expansion, as chlorinated methane compounds are subject to stringent environmental and safety standards.

These regulations encompass emission limits, handling and storage guidelines, and restrictions on industrial discharge, all of which directly influence production volumes, manufacturing processes, and supply chain operations. Across key producing regions, adherence to chemical safety and environmental regulations necessitates investment in emission control systems, monitoring technologies, and compliance certification processes.

Companies are compelled to integrate sustainable practices, such as closed-loop processing and advanced scrubbing technologies, to mitigate regulatory risks, which in turn affects cost structures and operational efficiency. Regulatory scrutiny also impacts market entry for new players, with licensing requirements and compliance audits serving as barriers that preserve established market hierarchies. Over the forecast period, the cumulative effect of these regulations results in a controlled market growth pattern, with the value increasing gradually from USD 10.0 billion in 2025 to USD 12.1 billion in 2035. The regulatory landscape ensures that while the market expands, it does so within environmentally and operationally compliant boundaries, reinforcing the critical role of policy frameworks in shaping the trajectory of the chlorinated methane market.

The chlorinated methane market operates within manufacturing environments where chemical handling protocols and emission control systems create substantial operational coordination challenges across production and safety functions. Manufacturing facilities encounter complex process engineering requirements as chlorinated methane production involves high-temperature chlorination reactions, distillation purification, and vapor recovery systems that must operate within strict emission limits. Process engineers coordinate with environmental compliance teams to establish operating parameters that maintain product quality while meeting air quality standards, often discovering that emission control equipment affects both energy consumption and production capacity.

Production operations experience significant infrastructure requirements as chlorinated methane handling necessitates specialized storage systems, transfer equipment, and emergency response capabilities that exceed standard chemical manufacturing protocols. Plant operators work with safety engineering departments to establish procedures for leak detection, vapor containment, and emergency shutdown systems while coordinating with maintenance teams about equipment inspection schedules that address both process reliability and regulatory compliance requirements.

Cross-functional coordination between production teams and environmental affairs departments creates ongoing operational tensions as emission monitoring and reporting requirements can conflict with production optimization goals. Environmental specialists work with process engineers to establish continuous monitoring systems for stack emissions, fugitive releases, and wastewater discharge while managing documentation requirements that span multiple regulatory agencies and reporting timeframes.

| Metric | Value |

|---|---|

| Chlorinated Methane Market Estimated Value in (2025 E) | USD 10.0 billion |

| Chlorinated Methane Market Forecast Value in (2035 F) | USD 12.1 billion |

| Forecast CAGR (2025 to 2035) | 2.0% |

The chlorinated methane market is experiencing sustained growth due to its extensive use in pharmaceutical, agrochemical, and chemical processing applications. This growth is supported by the chemical’s versatility, particularly in its function as a solvent, intermediate, or extraction agent across multiple industrial verticals.

Increasing demand for methyl-based derivatives, stringent regulations promoting clean and efficient chemical reactions, and the rising need for fluorocarbon replacements in refrigeration systems are collectively shaping the market’s trajectory. Methylene chloride and other chlorinated methanes are being increasingly integrated into manufacturing ecosystems due to their high purity levels, favorable boiling points, and ability to dissolve a wide range of organic compounds.

The transition toward cleaner production technologies and compliance with global environmental directives have also influenced manufacturers to invest in process optimization and recovery systems for chlorinated solvents As demand for high-performance intermediates and precision synthesis expands, the market for chlorinated methanes is poised for steady long-term growth driven by its irreplaceable value in critical industrial pathways.

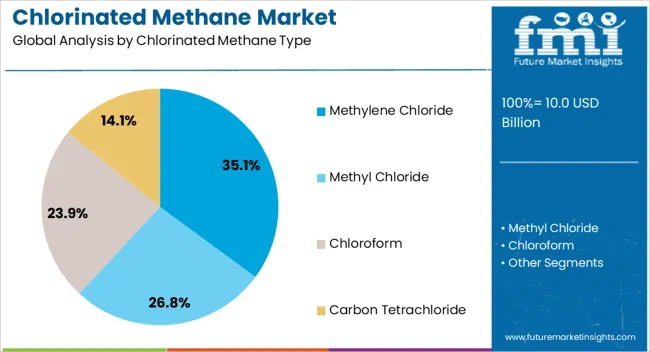

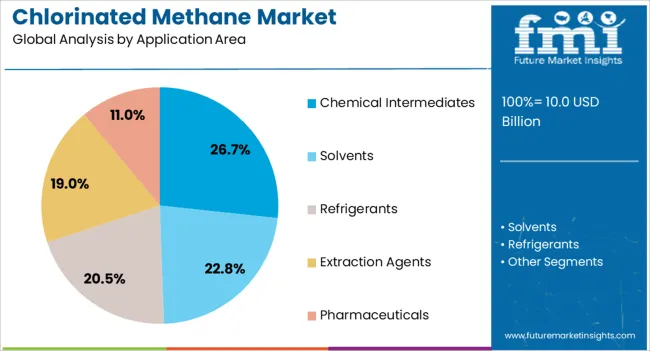

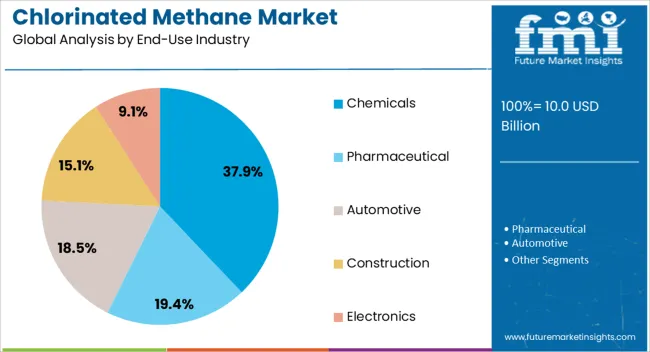

The chlorinated methane market is segmented by chlorinated methane type, application area, end-use industry, purity level, packaging type, and geographic region. By type of chlorinated methane, the market is divided into Methylene Chloride, Methyl Chloride, Chloroform, and Carbon Tetrachloride. In terms of the application area, the chlorinated methane market is classified into Chemical Intermediates, Solvents, Refrigerants, Extraction Agents, and Pharmaceuticals. Based on end-use industry, the chlorinated methane market is segmented into Chemicals, Pharmaceutical, Automotive, Construction, and Electronics.

By purity level, the chlorinated methane market is segmented into High Purity, Low Purity, and Medium Purity. By packaging type, the chlorinated methane market is segmented into Drums, Bottles, Bulk, and Cylinders. Regionally, the chlorinated methane industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Methylene chloride is expected to account for 35.1% of the chlorinated methane market’s total revenue share in 2025, making it the leading product type within the market. The segment’s dominance is attributed to the compound’s widespread use as a solvent in pharmaceutical formulations, paint stripping, and foam manufacturing. Its ability to deliver efficient degreasing and low surface residue has enhanced its demand in electronics and metal cleaning applications.

The high solvency power of methylene chloride, combined with its moderate volatility, enables superior performance in chemical processing environments. Additionally, regulatory acceptance in select industrial zones has supported its continued use under monitored handling protocols.

As demand for cost-effective solvents in precision formulation rises, methylene chloride has maintained its relevance due to its favorable cost-to-performance ratio. Its established supply infrastructure and proven compatibility with automated solvent recovery systems have further reinforced its adoption across both legacy and modern industrial settings.

The application of chlorinated methane in chemical intermediates is projected to contribute 26.7% to the market’s revenue share in 2025. This segment’s growth is being supported by its integral role in the synthesis of fluorocarbons, methylamines, and other specialty chemicals. Chlorinated methane compounds are widely used in intermediate steps that require high chemical stability and consistent reaction profiles.

Their reactivity with a broad range of compounds enables controlled transformations, which are essential for producing high-purity end-products in the agrochemical and pharmaceutical sectors. The segment has further benefited from increased global demand for feedstock materials used in advanced material synthesis and fine chemical manufacturing.

Improvements in downstream processing efficiency and growing investments in chemical R&D have also strengthened the case for chlorinated methanes as indispensable intermediates. With sustainability targets pushing industries toward closed-loop and high-efficiency chemical processes, the role of chlorinated methanes in scalable intermediate production continues to expand.

The chemicals end-use industry is forecast to represent 37.9% of the chlorinated methane market’s revenue share in 2025, establishing it as the dominant consumer segment. This leadership is driven by the compound’s essential role in chemical synthesis, polymer processing, and formulation of specialty materials. Chlorinated methanes have long been integrated into base chemical operations due to their high solubility, controlled volatility, and compatibility with reactive chemical frameworks.

The demand from large-scale chemical manufacturers is further reinforced by the need for solvents that ensure product stability and purity under regulated environments. As global production of pharmaceuticals, agrochemicals, and specialty polymers increases, the requirement for reliable intermediates and reaction solvents continues to rise.

Additionally, the transition of many manufacturers toward sustainable chemistry models has led to the optimization of chlorinated methane use within recycling and recovery loops. Strong capital investments in the chemicals sector and ongoing innovation in process technologies have created a favorable environment for the continued dominance of this segment.

The market has been expanding due to growing demand for specialty chemicals in industrial, pharmaceutical, and agricultural applications. Chlorinated methanes have been valued for their use as intermediates in the production of refrigerants, solvents, and pesticides. Market growth has been reinforced by advancements in chemical synthesis processes, environmental compliance technologies, and manufacturing efficiency. Rising industrialization, chemical processing activities, and regulatory frameworks for safe handling have further strengthened demand, positioning chlorinated methanes as critical chemical intermediates for diverse end-use applications worldwide.

The market has been significantly driven by its application in the production of refrigerants, solvents, and chemical intermediates. Chloromethane and dichloromethane have been widely used in the formulation of cooling agents and degreasing solvents for industrial and commercial purposes. The chemical’s compatibility with various polymerization, chlorination, and halogenation reactions has reinforced its adoption in chemical manufacturing. Growth in HVAC systems, refrigeration equipment, and industrial cleaning solutions has further increased demand. Manufacturers have focused on producing high-purity chlorinated methanes to ensure stability, efficiency, and safety during industrial processing. Regulatory compliance with environmental and occupational safety standards has strengthened the importance of reliable sourcing and controlled handling. As a result, the use of chlorinated methanes has become essential across industrial chemical processing, refrigeration, and solvent applications globally.

Technological innovations have strengthened the market by improving production efficiency, purity, and safety standards. Continuous chlorination processes, catalytic reactors, and solvent recovery systems have been developed to optimize yield and minimize hazardous byproducts. Automated monitoring, process control, and containment systems have reduced environmental impact and enhanced operational safety in chemical manufacturing plants. Advanced filtration, distillation, and purification technologies have been implemented to produce high-grade chlorinated methanes suitable for pharmaceutical and industrial applications. Research into alternative synthesis routes and greener chemical pathways has further enhanced sustainability while maintaining chemical performance. These technological advancements have allowed manufacturers to meet stringent quality and environmental regulations, making chlorinated methanes safer and more efficient for global industrial, pharmaceutical, and agricultural applications.

The market has been reinforced by applications in pharmaceutical and agrochemical industries. Chlorinated methanes have been used as intermediates in drug synthesis, pesticide formulation, and herbicide production. Their chemical stability and reactivity have enabled the development of active ingredients, solvents, and chemical carriers. Pharmaceutical companies have utilized chlorinated methanes for production of specialty compounds, while agrochemical manufacturers have leveraged them for crop protection chemicals and fumigants. Compliance with safety, purity, and environmental standards has driven adoption of high-quality chlorinated methanes in these sectors. Industrial focus on scalable production, regulatory adherence, and environmentally responsible handling has further strengthened market demand, positioning chlorinated methanes as essential intermediates for pharmaceutical and agrochemical manufacturing processes worldwide.

Despite strong growth, the market has faced challenges linked to environmental impact, toxicity, and stringent regulatory compliance. Chlorinated methanes have been identified as potential volatile organic compounds, requiring careful handling, storage, and disposal to prevent environmental contamination. Emissions, waste management, and occupational safety standards have influenced production costs and operational practices.

Regulatory frameworks governing chemical usage, transport, and exposure limits have required manufacturers to invest in safety, containment, and emission control systems. Alternatives and greener substitutes are being explored to reduce environmental impact. Continuous improvements in sustainable production, emission reduction, and safety compliance have remained essential for balancing market growth with environmental responsibility, ensuring chlorinated methanes remain viable and safe for industrial, pharmaceutical, and agrochemical applications globally.

| Countries | CAGR |

|---|---|

| China | 2.7% |

| India | 2.5% |

| Germany | 2.3% |

| France | 2.1% |

| UK | 1.9% |

| USA | 1.7% |

| Brazil | 1.5% |

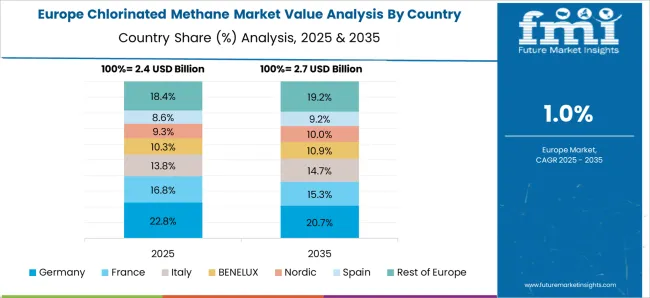

The market is anticipated to grow at a CAGR of 2.0% from 2025 to 2035, driven by steady demand in chemical intermediates, solvent applications, and refrigerant production. China leads with a 2.7% CAGR, producing at scale to support industrial chemical supply chains. India follows at 2.5%, expanding through increased chemical manufacturing and industrial adoption. Germany, at 2.3%, benefits from established chemical infrastructure and stringent regulatory compliance. The UK, growing at 1.9%, focuses on sustainable and controlled chemical usage, while the USA, at 1.7%, experiences steady demand in niche chemical applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is expected to grow at a CAGR of 2.7%, driven by industrial chemical applications, manufacturing of refrigerants, and solvent usage. Rising demand in pharmaceutical and agrochemical industries supports market expansion. Manufacturers are focusing on improving production efficiency and environmental compliance. Adoption of advanced chlorination processes and quality control measures ensures consistent supply for industrial users. Strategic collaborations between chemical producers and industrial consumers facilitate technology transfer and enhance market presence. Government regulations related to chemical safety and environmental standards influence production practices and market dynamics.

India is projected to grow at a CAGR of 2.5%, supported by expansion in chemical processing, pharmaceutical, and agrochemical industries. Manufacturers are adopting environmentally compliant production methods and investing in technology upgrades to meet industrial demand. Increased usage in intermediate chemical compounds for industrial applications creates market potential. The government’s chemical safety regulations and industrial standards guide production and distribution practices. Strategic partnerships with multinational chemical firms facilitate technology adoption and capacity expansion. Industrial growth in chemical manufacturing hubs strengthens demand for high-purity chlorinated methane products.

Germany’s market is anticipated to expand at a CAGR of 2.3%, influenced by stringent environmental regulations and high demand from industrial chemical sectors. Production focuses on high-purity intermediates for use in pharmaceutical, agrochemical, and specialty chemical applications. Manufacturers are leveraging automation and advanced process control to maintain efficiency and reduce emissions. The government’s strict chemical safety standards enforce operational compliance, while renewable energy integration in production reduces environmental impact. Strategic alliances with European industrial users support distribution efficiency and market reach.

The United Kingdom market is projected to grow at a CAGR of 1.9%, with demand driven by industrial chemicals, solvent applications, and specialty manufacturing. Manufacturers emphasize safety, regulatory compliance, and quality assurance to maintain market position. Expansion in chemical intermediates for industrial and pharmaceutical uses supports growth. Investment in process innovation and technology upgrades enhances production efficiency. Regulatory frameworks governing chemical safety and environmental standards influence market dynamics, while collaborations between local distributors and chemical producers improve market penetration.

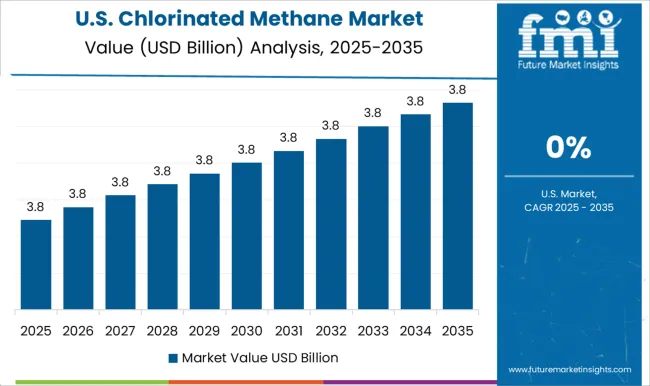

The United States market is expected to expand at a CAGR of 1.7%, driven by usage in industrial chemical manufacturing, solvents, and refrigerant applications. Manufacturers focus on quality control, regulatory compliance, and environmentally safe production practices. Rising adoption in pharmaceutical and specialty chemical industries creates additional opportunities. Strategic collaborations with domestic and international chemical suppliers facilitate technological improvements and enhance supply chain efficiency. Government policies on chemical safety and environmental protection impact production and market trends.

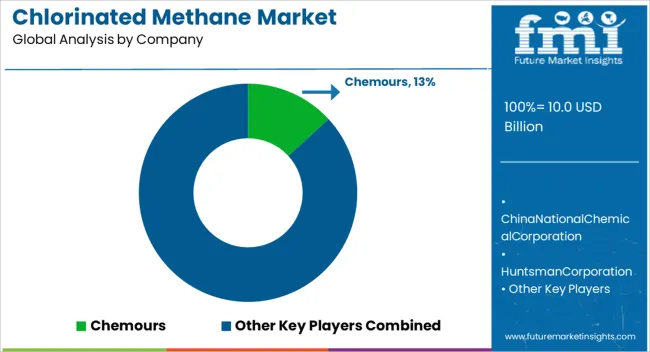

The chlorinated methane market is expanding steadily, driven by its diverse applications across pharmaceuticals, agrochemicals, refrigerants, and specialty chemical synthesis. The Chemours Company, China National Chemical Corporation Ltd. (ChemChina, part of Sinochem Holdings), and Huntsman Corporation are recognized as leading global providers, supplying high-purity chlorinated methane products that meet stringent industrial and regulatory standards. Their portfolios cater to critical applications demanding consistent quality, product stability, and compliance with international environmental and safety frameworks.

Albemarle Corporation, Wacker Chemie AG, and Occidental Petroleum Corporation (OxyChem) strengthen the market landscape through advanced process technologies, enhanced energy efficiency, and integrated supply chain networks. Their focus on operational reliability and optimized feedstock utilization enables stable production to meet increasing global demand. Lanxess AG, INEOS Group Ltd., and Eastman Chemical Company emphasize scalable production and sustainable chemical manufacturing, aligning with the industry’s broader transition toward low-emission and circular production models.

Koch Industries, Inc., BASF SE, and Mitsubishi Chemical Group Corporation contribute with diversified chemical portfolios supporting specialty and performance material applications across coatings, electronics, and polymer intermediates. Their vertically integrated operations ensure consistent quality and supply reliability across multiple downstream markets.

Tosoh Corporation, Shin-Etsu Chemical Co., Ltd., and Solvay S.A. (including Syensqo S.A.) provide high-grade chlorinated methane variants suitable for both industrial-scale and laboratory-grade applications, supported by robust quality control systems and advanced purification technologies. Collectively, these leading producers drive innovation and efficiency in the chlorinated methane market through technological advancement, sustainability integration, and global distribution excellence, ensuring consistent product availability and supporting the chemical industry’s capacity to meet evolving performance and environmental standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.0 Billion |

| Chlorinated Methane Type | Methylene Chloride, Methyl Chloride, Chloroform, and Carbon Tetrachloride |

| Application Area | Chemical Intermediates, Solvents, Refrigerants, Extraction Agents, and Pharmaceuticals |

| End-Use Industry | Chemicals, Pharmaceutical, Automotive, Construction, and Electronics |

| Purity Level | High Purity, Low Purity, and Medium Purity |

| Packaging Type | Drum, Bottle, Bulk, and Cylinder |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Chemours Company; China National Chemical Corporation Ltd. (ChemChina, part of Sinochem Holdings); Huntsman Corporation; Albemarle Corporation; Wacker Chemie AG; Occidental Petroleum Corporation (OxyChem); Lanxess AG; INEOS Group Ltd.; Eastman Chemical Company; Koch Industries, Inc.; BASF SE; Mitsubishi Chemical Group Corporation; Tosoh Corporation; Shin-Etsu Chemical Co., Ltd.; Solvay S.A. (including Syensqo S.A.). |

| Additional Attributes | Dollar sales by compound type and application, demand dynamics across chemical, pharmaceutical, and industrial sectors, regional trends in production and consumption, innovation in synthesis and purity enhancement, environmental impact of emissions and chemical handling, and emerging use cases in specialty chemicals and refrigerants. |

The global chlorinated methane market is estimated to be valued at USD 10.0 billion in 2025.

The market size for the chlorinated methane market is projected to reach USD 12.1 billion by 2035.

The chlorinated methane market is expected to grow at a 2.0% CAGR between 2025 and 2035.

The key product types in chlorinated methane market are methylene chloride, methyl chloride, chloroform and carbon tetrachloride.

In terms of application area, chemical intermediates segment to command 26.7% share in the chlorinated methane market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Methane Reduction Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Chlorinated Paraffin Market Size and Share Forecast Outlook 2025 to 2035

Methane Sulfonic Acid Market Growth - Trends & Forecast 2025 to 2035

Chlorinated Polyethylene Resins and Elastomers (CPE) Market Size, Growth, and Forecast for 2025 to 2035

Chlorinated Isocyanurates Market Growth - Trends & Forecast 2025 to 2035

Chlorinated Polyethylene Market Growth - Trends & Forecast 2024 to 2034

Biomethane Market Size and Share Forecast Outlook 2025 to 2035

Nitromethane Market Size and Share Forecast Outlook 2025 to 2035

Chloromethane Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Blue Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Liquid Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Steam Methane Reforming Biogas To Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Coal Bed Methane Market Size and Share Forecast Outlook 2025 to 2035

Diindolylmethane Market Trends - Form & Nature Analysis

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA