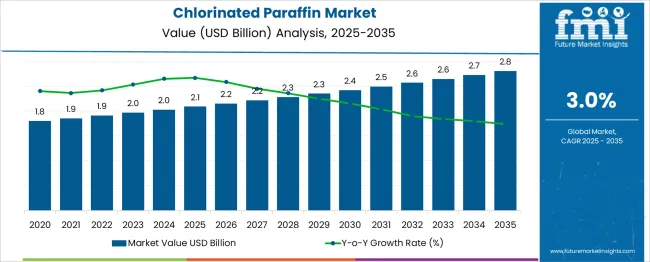

The Chlorinated Paraffin Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 3.0% over the forecast period. During the initial phase from 2020 to 2025, the market expands from USD 1.8 billion to USD 2.1 billion, supported by consistent demand across industries such as plastics, metalworking fluids, paints, and coatings. Chlorinated paraffins serve as essential additives for plasticizers, flame retardants, and lubricants, making them valuable in automotive, construction, and electrical sectors. This phase is marked by gradual adoption, driven by manufacturers seeking cost-effective solutions that improve product durability and fire resistance while adhering to regulatory standards.

From 2026 to 2030, the market grows from USD 2.2 billion to USD 2.4 billion. This period benefits from increased industrial activity, particularly in emerging economies, where infrastructure development and consumer goods manufacturing require reliable additives. Innovations focusing on low-chlorine formulations address environmental concerns, facilitating regulatory compliance and supporting market growth. Between 2031 and 2035, the market further rises from USD 2.5 billion to USD 2.8 billion. This phase reflects heightened regulatory scrutiny over environmental and health impacts, encouraging the adoption of safer chlorinated paraffin grades and improved production technologies. These advancements enhance product quality, consistency, and performance, maintaining relevance amid evolving market demands. The chlorinated paraffin market is poised for steady expansion through 2035, driven by diversified applications, regulatory adaptation, and ongoing industrial development worldwide.

| Metric | Value |

|---|---|

| Chlorinated Paraffin Market Estimated Value in (2025 E) | USD 2.1 billion |

| Chlorinated Paraffin Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

The chlorinated paraffin market is witnessing steady growth due to its broad industrial applicability, low cost, and strong flame-retardant and plasticizing properties. Key demand is being driven by its incorporation in metalworking fluids, PVC products, sealants, and paints, particularly across fast-industrializing regions.

Regulatory scrutiny concerning environmental and health impacts has prompted increased R&D into less hazardous formulations, especially in regions like North America and Europe. However, the material’s performance efficiency in high-pressure lubrication and flame resistance continues to support strong uptake in heavy-duty manufacturing, construction, and marine sectors.

Additionally, rapid expansion in automotive, electrical, and coatings applications across Asia-Pacific is expected to reinforce long-term market growth.

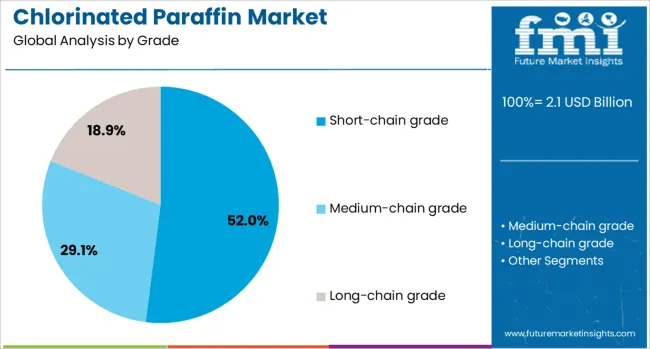

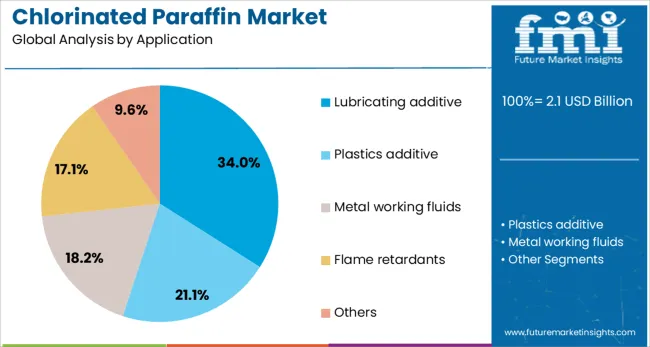

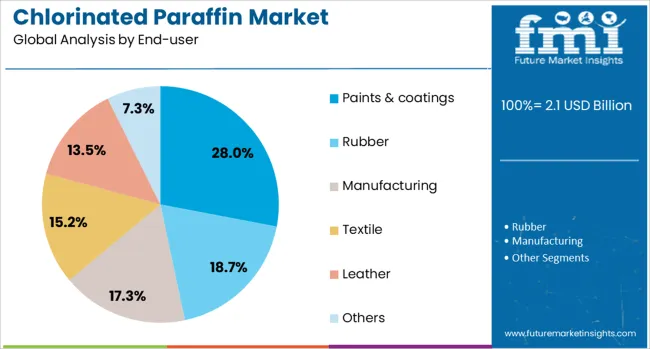

The chlorinated paraffin market is segmented by grade, application, end-user, and geographic regions. The chlorinated paraffin market is divided into Short-chain grade, Medium-chain grade, and Long-chain grade. In terms of application, the chlorinated paraffin market is classified into Lubricating additives, Plastics additives, metalworking fluids, Flame retardants, and others. The end-users of the chlorinated paraffin market are segmented into Paints & coatings, Rubber, Manufacturing, Textile, Leather, and others. Regionally, the chlorinated paraffin industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Short-chain chlorinated paraffin is projected to account for 52.00% of the total market share by 2025, making it the dominant grade segment. Its prevalence is driven by superior thermal stability, excellent flame-retardant characteristics, and low volatility, which are essential for high-performance applications.

Despite regulatory restrictions in some regions, this grade continues to be favored in developing markets where regulatory pressures are lower and industrial applications are expanding.

Its compatibility with PVC compounds, rubber, and metalworking fluids ensures widespread utility across sectors, while improved formulations aim to reduce environmental persistence and toxicity concerns.

Lubricating additives are expected to represent 34.00% of the market share by 2025, leading among applications for chlorinated paraffins. Their ability to reduce friction and wear under extreme conditions makes them ideal for use in metal cutting, drilling, and forming fluids.

Chlorinated paraffins enhance the load-bearing capacity and anti-weld properties of oils, especially in high-speed or high-load industrial machinery.

The segment’s growth is also attributed to increased demand from automotive, aerospace, and general engineering industries, where high-pressure lubrication is essential for equipment longevity and energy efficiency.

The paints & coatings sector is forecast to hold 28.00% of the chlorinated paraffin market share by 2025, making it the leading end-use industry. This is due to the compound’s effective role as a plasticizer and flame retardant in paint formulations, which improves flexibility, adhesion, and resistance to heat and chemicals.

As infrastructure development and urbanization rise globally, especially in the Asia-Pacific region, the demand for high-performance coatings has surged.

Chlorinated paraffins enable manufacturers to meet industry standards for durability and fire safety while maintaining cost competitiveness.

Chlorinated paraffin remains essential in industrial lubricants, plasticizers, and flame retardants, driven by performance advantages and cost benefits. Market dynamics are influenced by regulatory pressures and the growing demand for safer, high-performance formulations across key application sectors.

The demand for chlorinated paraffin has been driven by its versatility across multiple sectors such as metalworking, plastics, and rubber. Its primary function as an extreme-pressure additive in metal cutting fluids ensures higher durability and reduced wear in heavy-duty machining processes. In PVC manufacturing, it acts as a secondary plasticizer, delivering cost efficiency and enhanced material flexibility. The adoption is further influenced by its ability to provide flame retardancy, making it suitable for wire and cable coatings. Its performance attributes, including thermal stability and compatibility with various resins, contribute to its sustained industrial preference despite rising competition from alternative additives in selected geographies. Continuous diversification of applications keeps the market highly relevant.

Regulatory scrutiny surrounding chlorinated paraffin has intensified due to concerns over potential bioaccumulation and toxicity in aquatic environments. Short-chain variants have faced severe restrictions in regions like Europe and North America, pushing manufacturers toward medium- and long-chain grades. Compliance with standards such as REACH and restrictions under Stockholm Convention frameworks has increased production costs for key suppliers. These regulatory pressures have created a demand for safer formulations and substitution strategies in certain high-risk markets. Producers are investing in testing protocols and certifications to maintain supply contracts, ensuring adherence to environmental and occupational safety norms while preserving competitive pricing models.

Market players have focused on scaling production of mid-chain chlorinated paraffin, which is perceived as safer while meeting industrial requirements. Partnerships with downstream PVC and lubricant manufacturers have helped secure long-term supply contracts. Investment in modernized blending facilities has strengthened consistency in quality and performance. Cost leadership strategies remain critical in price-sensitive regions, particularly across Asia-Pacific where high-volume demand exists. Strategic moves such as vertical integration into additive production and enhanced distribution networks have improved supply security. Global manufacturers are also expanding footprint through mergers and acquisitions, targeting regions with less stringent restrictions to maintain overall volume growth.

The market is witnessing a gradual shift toward custom-tailored formulations offering reduced environmental impact while maintaining efficiency in critical applications. Demand for flame-retardant grades in wire insulation and polymer-based coatings remains strong due to fire safety requirements. Industries such as automotive and construction rely on these properties for enhanced performance under heat exposure. Metalworking applications are adopting formulations with balanced chlorine content to optimize lubrication and minimize corrosion risks. Growing awareness of safer chemical profiles is fostering innovation in additive chemistry, creating opportunities for specialty chlorinated paraffin blends. These advancements are positioning suppliers to retain relevance in evolving regulatory and performance-driven markets.

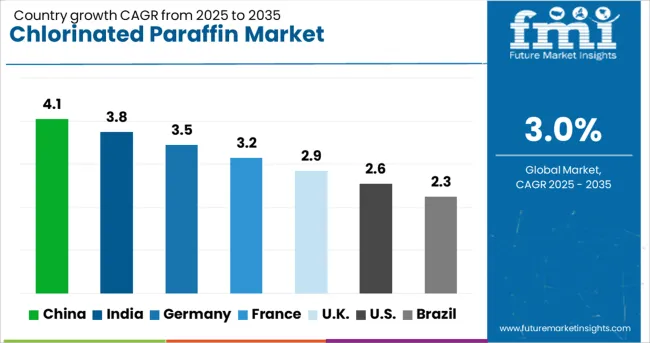

| Country | CAGR |

|---|---|

| China | 4.1% |

| India | 3.8% |

| Germany | 3.5% |

| France | 3.2% |

| UK | 2.9% |

| USA | 2.6% |

| Brazil | 2.3% |

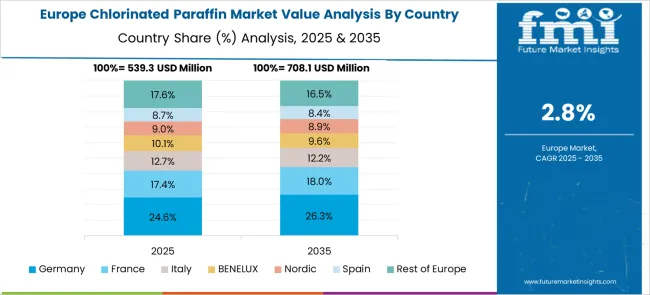

The chlorinated paraffin market is projected to expand globally at a CAGR of 3.0% from 2025 to 2035, supported by consistent demand across lubricants, PVC plasticizers, and flame-retardant applications. China leads with a CAGR of 4.1%, driven by extensive manufacturing of metalworking fluids and high PVC consumption for cable and construction applications. India follows at 3.8%, benefiting from industrial growth and increased demand for cost-effective additives in automotive and construction sectors. France stands at 3.2%, influenced by demand for customized plasticizer blends in specialty polymers. The United Kingdom grows at 2.9%, focusing on compliance-driven applications, while the United States posts 2.6% due to tighter environmental regulations and gradual substitution trends. The assessment draws on performance data from multiple regions, with these countries representing strategic benchmarks for suppliers optimizing capacity, compliance readiness, and distribution frameworks in a competitive specialty chemicals landscape.

China is forecasted to achieve a CAGR of 4.1% for 2025–2035, higher than the approximately 3.6% observed between 2020–2024. The acceleration is attributed to continuous demand from PVC-based products and high dependency on chlorinated paraffin for flame retardancy in cable insulation. Rising infrastructure investments and large-scale manufacturing capacity keep the consumption outlook positive. Industrial lubricants remain another key application segment where chlorinated paraffin is widely adopted for metalworking operations. The transition toward mid-chain grades has gained momentum as producers focus on reducing toxicity risks while meeting compliance standards, reinforcing growth prospects over the long term.

India is projected to record a CAGR of 3.8% for 2025–2035, an increase from the near 3.3% achieved during 2020–2024. This improvement is underpinned by demand for lubricating additives in automotive and heavy engineering industries. Expanding polymer processing capacity and cost-sensitive markets continue to favor chlorinated paraffin as an affordable plasticizer alternative. Domestic suppliers are improving blending and distribution networks, making the supply chain more reliable for end users. Regulatory frameworks remain less restrictive compared to Europe or the USA, giving India a competitive advantage for sustained manufacturing and export-oriented growth across Asia-Pacific markets.

France is expected to post a CAGR of 3.2% for 2025–2035, marginally higher than the 2.9% registered during 2020–2024. The market shift is influenced by increased use of specialty plasticizer formulations in high-performance PVC products. Regulatory alignment within the European Union has driven manufacturers to adopt safer mid-chain formulations, reducing restrictions while maintaining performance standards. Flame retardant applications in wire insulation and flooring systems remain strong, driven by construction and infrastructure upgrades. Enhanced compliance and quality assurance frameworks have prompted innovation, enabling suppliers to retain market share despite rising substitution interest from alternative additives in niche segments.

The United Kingdom is projected to achieve a CAGR of 2.9% for 2025–2035, higher than the estimated 2.4% during 2020–2024. This rise reflects the growing emphasis on compliance-focused formulations and enhanced demand in niche industrial applications. The domestic market is characterized by limited large-scale production, resulting in higher reliance on imports from Asian suppliers for price competitiveness. Despite substitution pressures from bio-based and alternative additives, chlorinated paraffin remains relevant in certain segments such as lubricants and coatings. The gradual transition toward safer chemical variants ensures regulatory adherence while sustaining industrial performance requirements across downstream markets.

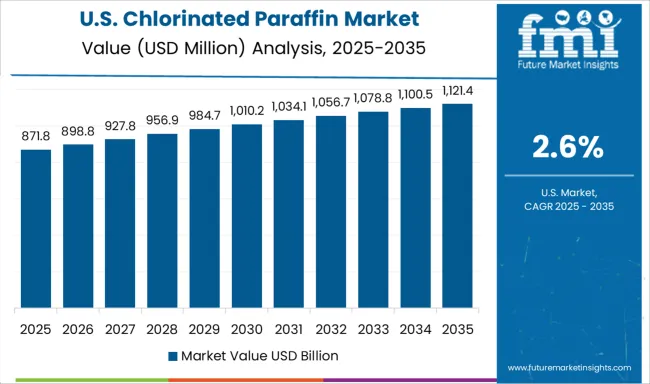

The United States is anticipated to grow at a CAGR of 2.6% for 2025–2035, slightly above the 2.1% recorded during 2020–2024. The increase is driven by continued use in select industrial lubricants and specialty PVC applications despite stringent environmental restrictions. Regulatory barriers have accelerated the adoption of alternatives in high-risk applications, but chlorinated paraffin retains a niche role in heavy-duty metalworking and coatings. Import volumes from Asia remain significant, supporting local consumption at competitive costs. Manufacturers are emphasizing product innovation and cleaner grades to navigate compliance challenges while preserving key industrial contracts in automotive and engineering sectors.

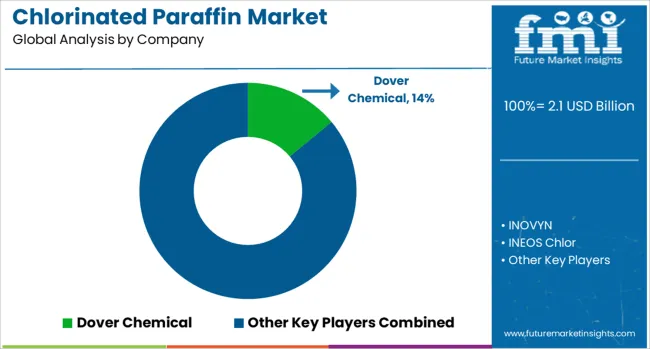

The chlorinated paraffin market is characterized by a mix of global chemical giants and regional producers delivering additives for metalworking fluids, PVC plasticizers, and flame-retardant applications. Leading players include Dover Chemical, INOVYN, and INEOS Chlor, recognized for their strong product portfolios and compliance-focused solutions catering to international markets. United Group and Aditya Birla Chemicals maintain significant market penetration in Asia-Pacific through cost-efficient manufacturing and extensive distribution networks. Ajinomoto Fine-Techno and JSC Kaustik focus on specialty-grade formulations targeted toward performance-sensitive industries such as automotive and electronics. European players like LEUNA-Tenside GmbH, Altair Chimica SpA, and Caffaro Industrie emphasize REACH-compliant solutions and advanced manufacturing capabilities to maintain regulatory adherence across the EU region.

North American suppliers, including Handy Chemical Corporation Ltd, sustain market share through strategic alliances and niche formulations for heavy-duty applications. Additionally, companies such as Quimica del Cinca, S.A and Makwell Group cater to emerging markets with competitive pricing and customized product offerings. Competitive differentiation is primarily influenced by the ability to provide safer mid-chain and long-chain formulations while ensuring consistent performance in critical applications like metal processing and PVC compounding. Leading companies are investing in production upgrades, research-driven compliance solutions, and long-term partnerships with downstream manufacturers to secure sustainable market positioning. Strategic priorities include expanding capacity for specialty chlorinated paraffin grades, reinforcing regional supply chains, and developing environmentally safer alternatives to maintain growth momentum under evolving regulatory frameworks.

Market strategies include focusing on mid-chain and long-chain formulations to meet compliance requirements, expanding regional production facilities to reduce import dependency, and forming partnerships with downstream manufacturers for consistent supply. Investments in R&D for safer chemical alternatives and improved performance grades are becoming critical as regulations tighten globally. Cost optimization through process efficiency and diversification into niche applications such as specialty coatings and cable insulation will strengthen competitive positioning during this period.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Grade | Short-chain grade, Medium-chain grade, and Long-chain grade |

| Application | Lubricating additive, Plastics additive, Metal working fluids, Flame retardants, and Others |

| End-user | Paints & coatings, Rubber, Manufacturing, Textile, Leather, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Dover Chemical, INOVYN, INEOS Chlor, United Group, Aditya Birla Chemicals, Ajinomoto Fine-Techno, JSC Kaustik, LEUNA-Tenside GmbH, Altair Chimica SpA, Caffaro Industrie, Handy Chemical Corporation Ltd, Quimica del Cinca, S.A, and Makwell Group |

| Additional Attributes | Dollar sales, share by application and region, pricing trends, regulatory impact, competitive landscape, demand outlook, raw material cost patterns, capacity expansions, and end-user adoption trends for strategic planning. |

The global chlorinated paraffin market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the chlorinated paraffin market is projected to reach USD 2.8 billion by 2035.

The chlorinated paraffin market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in chlorinated paraffin market are short-chain grade, medium-chain grade and long-chain grade.

In terms of application, lubricating additive segment to command 34.0% share in the chlorinated paraffin market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paraffin Wax Market Size and Share Forecast Outlook 2025 to 2035

Paraffinic Transformer Oil Market Size and Share Forecast Outlook 2025 to 2035

Paraffin Physical Therapy Market Size and Share Forecast Outlook 2025 to 2035

Chlorinated Methane Market Size and Share Forecast Outlook 2025 to 2035

Paraffins Market Size and Share Forecast Outlook 2025 to 2035

Chlorinated Polyethylene Resins and Elastomers (CPE) Market Size, Growth, and Forecast for 2025 to 2035

Chlorinated Isocyanurates Market Growth - Trends & Forecast 2025 to 2035

Chlorinated Polyethylene Market Growth - Trends & Forecast 2024 to 2034

Paraffin Inhibitors Market

Food Grade Paraffin Market

Microencapsulated Paraffin Phase Change Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA