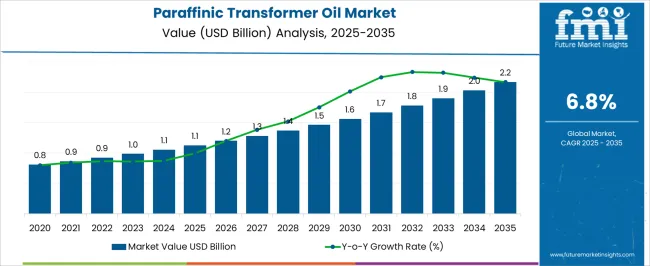

The paraffinic transformer oil market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 2.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

A growth contribution index analysis highlights how different drivers collectively support this expansion. Volume growth contributes significantly in the early years, as rising electrification in developing economies and expansion of transmission and distribution networks create strong demand for transformer installations. Utilities in Asia Pacific, Africa, and Latin America contribute a larger share of this index as grid modernization projects accelerate. Price-driven contribution strengthens in the mid to later phase of the forecast period, reflecting the impact of premium-grade paraffinic oils with higher oxidation stability, improved cooling efficiency, and extended transformer life.

Industrial users and utilities seeking reduced maintenance costs are expected to support this higher-value segment. Regulatory compliance and the shift toward cleaner and more efficient insulating fluids further enhance the index contribution from product differentiation. By 2035, the balance between volume-driven expansion in emerging regions and value-driven adoption in mature economies shapes the overall growth contribution index. This dual pathway confirms that both quantity and quality dimensions remain essential in sustaining long-term market progress for paraffinic transformer oil.

| Metric | Value |

|---|---|

| Paraffinic Transformer Oil Market Estimated Value in (2025 E) | USD 1.1 billion |

| Paraffinic Transformer Oil Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The market is supported by several industrial segments. Power generation and transmission utilities account for nearly 41%, as transformer oil is essential for insulation and cooling in grid infrastructure. Industrial equipment manufacturers contribute around 26%, supplying transformers and electrical machinery that rely on paraffinic oil. Automotive and transport electrification projects represent about 14%, applying transformer oils in charging stations and traction equipment. Renewable energy projects such as wind and solar hold close to 11%, where transformers form part of grid integration systems. Chemical refiners and specialty oil producers cover the remaining 8%, ensuring supply and product customization.

The market is advancing with demand from grid expansion and electrification. Global utility investment in transformer upgrades grew by 10% year-on-year, directly boosting consumption of paraffinic grades. Demand from renewable power integration rose by 13% in 2024, as paraffinic oils support long service life and oxidation stability. Manufacturers are developing low-viscosity blends to improve cooling efficiency, reducing transformer hotspot temperatures by 5–7°C. Bio-based and recyclable paraffinic oils are gaining attention, though adoption remains under 10% of total volumes. Digital monitoring of oil health and predictive replacement strategies are extending maintenance cycles, cutting downtime and operational costs across transmission networks.

The paraffinic transformer oil market is experiencing steady expansion, driven by the increasing deployment of electrical infrastructure and the need for high-performance insulating fluids. Industry sources and utility sector updates have emphasized paraffinic transformer oil’s superior oxidation stability, higher flash points, and better cooling performance compared to naphthenic counterparts, making it a preferred choice for long-life transformer applications.

Growth in electricity consumption, urban grid expansion, and rural electrification projects has accelerated the adoption of paraffinic oils in both new transformer installations and maintenance operations. Additionally, regulatory standards for energy efficiency and environmental safety are influencing oil formulations, leading to the development of low-sulfur and biodegradable variants.

Investments in renewable power generation and smart grid technologies have further fueled demand for reliable insulating oils capable of supporting high-load conditions. Looking ahead, the market is expected to benefit from modernization programs in aging power infrastructure, continued electrification in emerging economies, and the growing preference for oils offering extended service life and reduced maintenance needs.

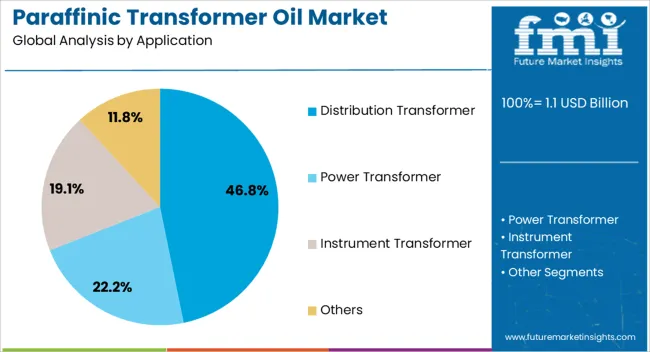

The paraffinic transformer oil market is segmented by application, and geographic regions. By application, paraffinic transformer oil market is divided into distribution transformer, power transformer, instrument transformer, and others. Regionally, the paraffinic transformer oil industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The distribution transformer segment is projected to account for 46.8% of the paraffinic transformer oil market revenue in 2025, maintaining its leading share due to the extensive use of these transformers in electricity distribution networks. This segment’s dominance is supported by the critical role distribution transformers play in delivering electricity from substations to end users, necessitating reliable insulating and cooling fluids. Paraffinic transformer oil has been favored in this application for its ability to provide long-term oxidation stability, resist sludge formation, and maintain dielectric strength under varying load conditions. Utility operators and industrial facilities have increasingly opted for paraffinic-based oils in distribution transformers to extend service intervals and reduce lifecycle maintenance costs. Furthermore, ongoing grid expansion in developing regions and the replacement of aging transformers in mature markets have contributed to sustained demand. With increasing emphasis on energy efficiency, safety, and equipment longevity, the distribution transformer segment is expected to continue driving significant consumption of paraffinic transformer oil globally.

The paraffinic transformer oil market is expanding as power utilities, industrial facilities, and renewable energy projects intensify investments in electrical infrastructure. Demand is driven by growing electricity consumption, modernization of aging grids, and the installation of high-capacity transmission lines. Paraffinic oils are valued for superior oxidation resistance, thermal stability, and low volatility, making them ideal for transformers operating under high loads or extreme conditions. Environmental considerations are prompting the adoption of low-sulfur and eco-compliant formulations.

Rapid industrialization, urbanization, and the push for reliable electricity access are driving demand for transformers and their insulating fluids. Utilities in Asia Pacific are upgrading networks with high-voltage transformers that depend on paraffinic oils for thermal and dielectric performance. Developed regions are replacing older mineral oils with higher-purity paraffinic alternatives to reduce maintenance and extend operational life. Industries including manufacturing, mining, and chemicals rely on stable transformer operation to prevent downtime. I believe that the increasing electrification of urban centers and expansion of grid infrastructure worldwide will remain a strong driver for paraffinic transformer oil consumption over the next decade.

The transition to renewable energy and smart grids is creating new avenues for paraffinic transformer oil adoption. Wind farms, solar parks, and hybrid renewable projects require transformers capable of handling fluctuating loads efficiently. Paraffinic oils provide thermal stability, dielectric strength, and long service life, making them suitable for these applications. In addition, governments are incentivizing utilities to replace aging transformers with environmentally safer and energy-efficient alternatives. From my perspective, suppliers offering high-performance oils that comply with environmental regulations and support renewable integration will gain significant competitive advantage in the coming decade.

Transformer manufacturers and utilities are increasingly adopting low-sulfur, high-purity paraffinic oils to improve operational efficiency and meet environmental compliance standards. Advanced refining processes produce oils with higher oxidation resistance and enhanced dielectric properties. These oils allow transformers to operate under heavy loads, high temperatures, and demanding environmental conditions with longer maintenance intervals. Customized formulations are being designed for specific applications such as offshore wind farms and desert solar installations. I believe that the combination of stricter regulatory requirements, rising transformer replacement programs, and innovation in oil chemistry will sustain strong demand for high-quality paraffinic transformer oils.

The paraffinic transformer oil market faces challenges from fluctuating crude oil prices, which directly influence production costs and profitability. Regulatory restrictions on mineral oil formulations increase compliance expenditure, particularly for small and medium-scale manufacturers. Transitioning to eco-friendly or high-purity alternatives requires investments in refining technology, quality control, and logistics. In my view, companies that focus on cost optimization, supply chain resilience, and technological upgrades for sustainable oils will be better positioned to capture long-term growth despite these challenges.

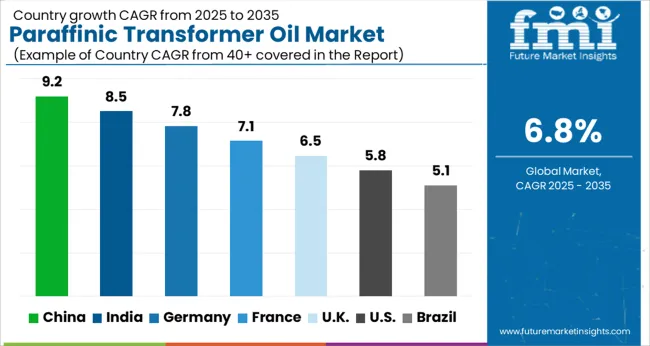

| Country | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| France | 7.1% |

| UK | 6.5% |

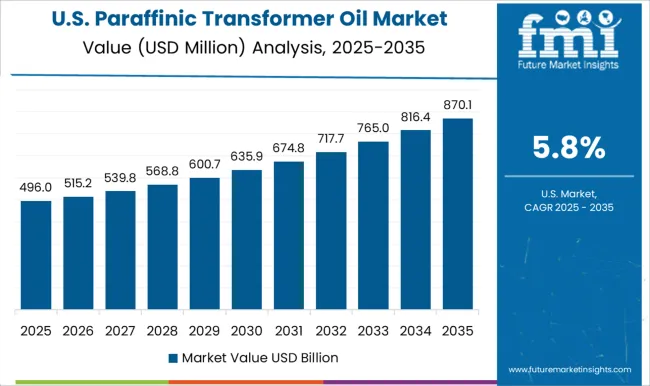

| USA | 5.8% |

| Brazil | 5.1% |

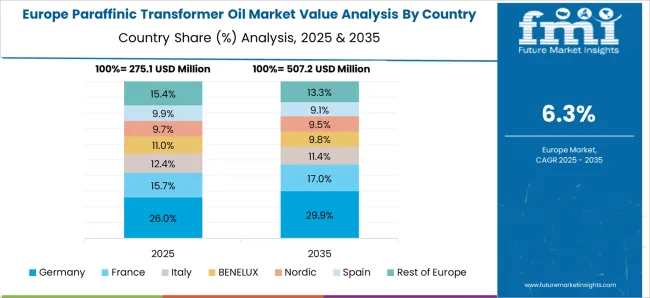

The paraffinic transformer oil market is expanding worldwide at a CAGR of 6.8% from 2025 to 2035, shaped by grid modernization, renewable integration, and rising electricity demand. China records the highest growth at 9.2%, +35% above the global benchmark, supported by BRICS-led investment in transmission networks, expansion of renewable capacity, and large-scale industrial electrification. India follows at 8.5%, +25% above the global average, reflecting increased rural electrification programs and stronger demand from expanding distribution infrastructure. Germany posts 7.8%, +15% over global growth, influenced by OECD-backed emphasis on efficient power systems and the shift toward advanced insulating materials. The United Kingdom stands at 6.5%, slightly below the global CAGR, with activity centered on selective grid upgrades and modernization of aging transformers. The United States records 5.8%, −15% under the global rate, shaped by slower replacement cycles but balanced by ongoing renewable energy projects and demand for stable grid performance.

China is registering the highest growth in the paraffinic transformer oil market with a CAGR of 9.2%. The expansion of electricity transmission networks and investments in renewable integration are driving transformer installations across provinces. Local refineries are increasing production of high-grade paraffinic oil to meet rising domestic demand and to reduce dependency on imports. Rapid industrialization and smart grid deployment are creating a consistent requirement for transformer oil with higher oxidation stability and extended service life. Strategic partnerships between utility providers and oil producers are helping to secure long-term supply reliability. With exports of electrical equipment also rising, China is cementing its role as both a consumer and supplier of paraffinic transformer oil.

India is advancing at a CAGR of 8.5% in the paraffinic transformer oil market, supported by growing electricity demand and grid modernization projects. Expansion of rural electrification and higher power generation capacity are driving transformer deployment across the country. Domestic refiners are focusing on paraffinic grades with better heat dissipation and dielectric strength to serve utilities and industrial users. Rising investments in metro rail, data centers, and large-scale manufacturing facilities are adding to transformer installations. Imports are also supplementing domestic production, with suppliers from the Middle East and Southeast Asia providing additional volumes. Long-term demand prospects remain strong as India scales its transmission infrastructure.

Germany is witnessing a CAGR of 7.8% in the paraffinic transformer oil market, supported by the country’s focus on energy transition and renewable power integration. Rising transformer installations in wind and solar projects are contributing to steady demand for high-performance paraffinic oils. German refineries are developing low-viscosity oils with improved cooling efficiency to extend transformer lifespan. Compliance with strict European standards is accelerating the shift toward oils with high oxidation stability. Industrial users are also boosting demand through modernized manufacturing and automation facilities that require stable power distribution. Germany’s position as an exporter of advanced electrical equipment strengthens the consumption of transformer oils within its industrial sector.

The United Kingdom is recording a CAGR of 6.5% in the paraffinic transformer oil market, shaped by investments in power infrastructure upgrades and offshore wind projects. Utilities are replacing older transformer fleets with advanced models requiring paraffinic oils for longer service intervals. Imports remain a significant component of supply, with Europe and Asia providing refined oils. Demand is also supported by rising industrial electrification and digital infrastructure projects, including data centers. Oil suppliers are focusing on securing long-term agreements with utility operators to maintain supply security and pricing stability. Research activities are expanding in the development of enhanced transformer oils with improved thermal stability.

The United States is progressing at a CAGR of 5.8% in the paraffinic transformer oil market, supported by replacement of aging transmission infrastructure and renewable integration. Utilities are investing in modern transformer fleets to improve grid resilience and energy efficiency. Domestic refiners are supplying paraffinic oils tailored for high-load transformers, particularly in urban transmission systems. Industrial demand is also growing as manufacturing and processing plants expand. Strategic collaborations between oil producers and transformer OEMs are boosting product innovation, ensuring compatibility with new-generation transformers. With steady electricity consumption and infrastructure modernization, the USA market is expected to maintain consistent demand for paraffinic transformer oils.

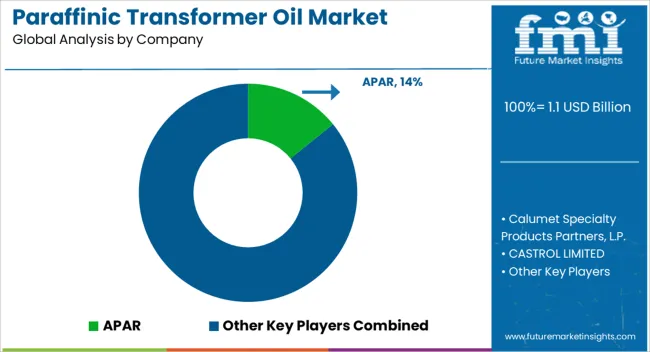

The paraffinic transformer oil market is influenced by established refiners and specialty chemical firms delivering insulating oils that ensure stability, thermal efficiency, and dependable transformer performance. APAR Industries is often positioned as the front-runner, supported by its diversified product grades and presence across utility, transmission, and distribution sectors. Exxon Mobil Corporation secures global traction with consistent supply reliability and premium formulations engineered for extended service intervals. Castrol Limited has built recognition with advanced insulating oils designed for modern high-capacity transformers, while Ergon Inc. and Calumet Specialty Products Partners strengthen their portfolios with refined base oils that meet strict dielectric and oxidation requirements. Additional players maintain competitiveness through tailored approaches and focused product lines.

RENKERT OIL and Gandhar Oil Refinery (India) Limited serve both local and export markets with transformer oils engineered for cost-effectiveness and operational safety. China Petroleum & Chemical Corporation leverages large-scale refining capabilities to deliver high volumes across Asia. Companies such as Adinath Chemicals and ACME Insulation Co. Ltd. emphasize regional supply with standard-grade offerings suited to varied climatic conditions. NYNAS AB continues to expand with insulating oils known for stability in heavy-duty applications. Petrotek and Nepal Lube Oil Limited further enrich the market through country-focused production and service support. Across the sector, competition is reinforced by product consistency, long-term equipment compatibility, and technical collaboration with electrical OEMs.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 billion |

| Application | Distribution Transformer, Power Transformer, Instrument Transformer, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | APAR, Calumet Specialty Products Partners, L.P., CASTROL LIMITED, RENKERT OIL, Ergon, Inc., Exxon Mobil Corporation, Gandhar Oil Refinery (India) Limited, China Petroleum & Chemical Corporation, Adinath Chemicals, ACME INSULATION CO.LTD, Petrotek, NYNAS AB, and Nepal Lube Oil Limited |

| Additional Attributes | Dollar sales by oil grade and transformer type, demand dynamics across power generation, transmission, and distribution, regional trends across North America, Europe, and Asia-Pacific, innovation in high oxidation stability, low viscosity, and extended service life formulations, environmental impact of oil recycling and reduced carbon footprint, and emerging use in smart grids, renewable energy integration, and high-voltage applications. |

The global paraffinic transformer oil market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the paraffinic transformer oil market is projected to reach USD 2.2 billion by 2035.

The paraffinic transformer oil market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in paraffinic transformer oil market are distribution transformer, power transformer, instrument transformer and others.

In terms of application, the distribution transformer segment is set to command 46.8% share in the paraffinic transformer oil market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transformer Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Transformer Containment Bags Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Transformer Insulation Market Size and Share Forecast Outlook 2025 to 2035

Transformer Component Market Size and Share Forecast Outlook 2025 to 2035

Transformer Market Size and Share Forecast Outlook 2025 to 2035

Transformer Spare Parts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Transformer Tap Changers and Voltage Control Relay Market Growth – Trends & Forecast 2025 to 2035

Transformer Bobbin Market

Transformer Testing Equipment Market

Transformer Oil Market Growth - Trends & Forecast 2025 to 2035

Green Transformer Market Growth – Trends & Forecast 2025 to 2035

Power Transformer Market Growth – Trends & Forecast 2024 to 2034

Train Transformer Market

Signal Transformer Market

Dry Type Transformer Market Size and Share Forecast Outlook 2025 to 2035

Traction Transformer Market

Biobased Transformer Oil Market

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Converter Transformer Market

Cast Resin Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA