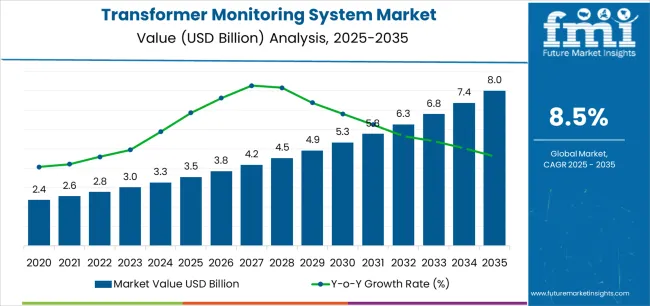

The Transformer Monitoring System Market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 8.0 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period.

The Transformer Monitoring System market is experiencing significant growth, driven by increasing demand for energy-efficient power distribution and grid reliability solutions. Rising investments in power infrastructure, smart grids, and industrial electrification are contributing to the adoption of advanced monitoring systems. These systems enable real-time tracking of transformer health, load management, and predictive maintenance, which minimizes unplanned downtime and extends equipment life.

The integration of IoT-enabled sensors, data analytics, and cloud-based monitoring is enhancing operational efficiency and decision-making for utility companies and industrial operators. Regulatory requirements for safety, grid stability, and energy efficiency are further accelerating market growth.

The increasing need for continuous condition monitoring of transformers to prevent failures, optimize performance, and reduce operational costs is shaping the adoption of monitoring solutions across various sectors As utilities and industrial operators pursue modernization and digitalization strategies, the Transformer Monitoring System market is expected to witness sustained growth, with technological innovation and system integration capabilities driving demand.

| Metric | Value |

|---|---|

| Transformer Monitoring System Market Estimated Value in (2025 E) | USD 3.5 billion |

| Transformer Monitoring System Market Forecast Value in (2035 F) | USD 8.0 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

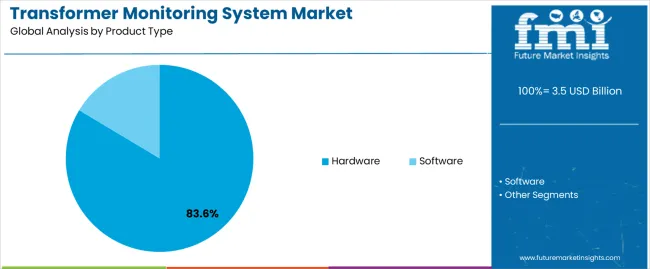

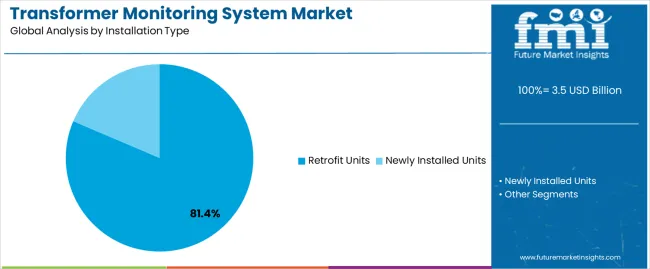

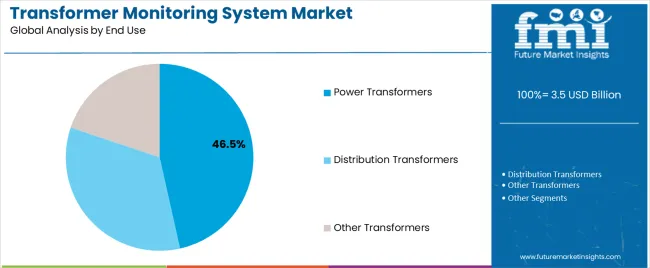

The market is segmented by Product Type, Installation Type, End Use, and Application and region. By Product Type, the market is divided into Hardware and Software. In terms of Installation Type, the market is classified into Retrofit Units and Newly Installed Units. Based on End Use, the market is segmented into Power Transformers, Distribution Transformers, and Other Transformers. By Application, the market is divided into Dissolved Gas Analysis (DGA), Partial Discharge (PD), Bushing Monitoring, Cooling Control, and Voltage Regulation. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware product type segment is projected to hold 83.6% of the market revenue in 2025, establishing it as the leading product category. Growth in this segment is being driven by the demand for robust and reliable physical monitoring components, including sensors, data loggers, and communication devices, which enable accurate measurement of voltage, current, temperature, and other operational parameters. Hardware solutions provide the foundation for transformer monitoring systems and are essential for real-time performance tracking and fault detection.

Integration with software platforms enhances predictive maintenance, data analytics, and operational optimization. The ability to deploy hardware solutions in both new installations and retrofit units allows for flexible application across utility and industrial transformers.

Proven reliability, long operational life, and compatibility with advanced monitoring platforms reinforce adoption As transformer operators increasingly prioritize continuous monitoring and performance optimization to reduce downtime and operational risks, hardware components are expected to maintain their dominant position in the market, supported by advances in sensor technology and connectivity standards.

The retrofit units installation type segment is anticipated to account for 81.4% of the market revenue in 2025, making it the leading installation type. Growth is being driven by the increasing need to modernize existing transformer assets without complete replacement. Retrofit monitoring units enable the integration of real-time monitoring capabilities into legacy transformers, providing operational insights, predictive maintenance, and fault detection while minimizing capital expenditure.

The ability to enhance existing infrastructure with minimal disruption is particularly appealing to utilities and industrial operators. Adoption is also supported by regulatory mandates and efficiency standards that require condition-based monitoring to ensure reliability and safety.

Retrofit units are scalable and adaptable, allowing integration with cloud platforms and analytics tools for enhanced decision-making As the focus on extending transformer lifespans, optimizing performance, and reducing unplanned outages intensifies, retrofit installations are expected to continue driving market growth, solidifying their position as the preferred installation approach.

The power transformers end-use segment is expected to hold 46.5% of the market revenue in 2025, establishing it as the leading end-use category. This segment is being driven by the critical need for real-time monitoring of high-capacity transformers, which are essential for power transmission and distribution networks. Monitoring systems enable early detection of faults, load imbalances, and thermal anomalies, ensuring uninterrupted electricity supply and reducing maintenance costs.

Growing investments in smart grids, renewable energy integration, and industrial electrification are increasing the deployment of monitoring systems in power transformers. The ability to optimize transformer performance, extend operational life, and comply with regulatory standards reinforces adoption.

Utilities are increasingly implementing predictive maintenance programs and digital monitoring solutions to enhance reliability and safety As energy demand continues to rise and grid stability becomes a priority, the power transformers segment is expected to remain the largest end-use category, supported by advancements in sensor technologies, IoT integration, and real-time analytics capabilities.

Global commercial, urban, and industrial sector growth, associated with escalating electricity consumption, supports market expansion. The installation of more capacity for power production is a significant determining factor in the evolving infrastructure construction for distribution and transmission.

The factors, including the requirement for electricity and remarkable capital investments, amplify the demand for electrical transmission infrastructure. Investments in smart grids account for a decent market percentage. The mushrooming adoption of smart grids strengthens the industry to prevent power outages globally. Adopting contemporary communication technologies in smart grids is a major factor in expanding the market.

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 2,425.50 million |

| Historical Market Value for 2025 | USD 3,005.60 million |

| CAGR from 2020 to 2025 | 4.38% |

The categorized market analysis of transformer monitoring system is comprised in the ensuing portion. Based on all-inclusive explorations, the hardware segment commands the product type category. Followed by, the retrofit units sector dominating the installation type category.

| Leading Segment | Hardware |

|---|---|

| Market Share (2025) | 83.60% |

Hardware is preferred by transformer monitoring system manufacturers because it gives them control over the monitoring process and a sense of security. For transformer monitoring system vendors, hardware's capacity to provide accurate, real-time data is essential, given the escalating concentration on grid efficiency and dependability. Hardware components frequently integrate with the current infrastructure effortlessly, causing the least amount of interruption and promising compatibility.

| Leading Segment | Retrofit Units |

|---|---|

| Market Share (2025) | 81.40% |

Initiatives to enhance a transformer's capacity to handle the ever-evolving energy loads reinforce sales of transformer monitoring systems. The flourishing installation of smart grids and environment-friendly transformers in metropolitan areas is a crucial factor that pushes sales upward. The high energy consumption in the residential and commercial sectors ushers the growth in the retrofit segment.

The transformer monitoring system industry is examined in the consequent tables, which focus on the dominant regions in North America, Europe, and Asia Pacific. A comprehensive evaluation demonstrates that Asia Pacific has enormous transformer monitoring system market opportunities.

Market Dynamics of Transformer Condition Monitoring in Asia Pacific

| Countries | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.10% |

| India | 10.00% |

| China | 9.40% |

| Australia | 9.20% |

| South Korea | 8.90% |

The Japanese transformer asset management market has widened due to the increased investments in asset management and grid resilience. In light of this trend, the demand for these systems is intensified in Japan by the surging adoption of smart grid technologies.

Japan leads the way in the implementation of transformer monitoring systems through the merger of renewable energy sources and an emphasis on modernizing infrastructure.

Transformer monitoring system adoption is facilitated by government actions like the "Smart Cities Mission" and "Made in India," which spur investments in cutting-edge grid infrastructure. Large-scale renewable energy project implementation opens growth paths for Indian transformer monitoring system suppliers.

Rapid industrialization and urbanization prompt the electricity sector growth, which favors transformer monitoring system vendors in China. Government regulations catapult the demand in China to diminish emissions and strengthen energy efficiency.

The demand in Australia is developed by utilities' adoption of digital transformation efforts. The transformer monitoring system adoption in Australia is due to regulatory requirements for cybersecurity and grid stability.

The concentration on condition-based monitoring and predictive maintenance quickens the adoption of transformer monitoring systems by South Korean utilities. The transformer monitoring system producers in South Korea benefit from the integration of renewable energy sources and electric vehicle charging infrastructure.

Overview of Electrical Transformer Monitoring System Market in North America

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 8.90% |

| Canada | 7.30% |

The demand for transformer monitoring systems to regulate the intricacy of decentralized power generation is surging in the United States market due to the broadening integration of renewable energy sources. These are gaining prominence in the United States because of the developing investments in smart grid infrastructure and the digitalization of power networks, which advance asset management and operational efficiency.

Due to its sizeable geography, Canada faces barriers in the distribution of power, leading to the adoption of transformer monitoring systems to control environmental conditions, load variations, and voltage oscillations. Canadian electricity providers are investing in transformer monitoring system adoption to optimize asset performance and ease the integration of renewable energy sources as their efforts to reduce carbon emissions.

Analysis of Power Transformer Monitoring Industry in Europe

| Countries | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 9.60% |

| Spain | 9.20% |

| France | 8.50% |

| Germany | 7.90% |

| Italy | 5.60% |

The transformer monitoring system providers are using advanced technologies to reduce the risk of equipment failure and downtime owing to the aging power infrastructure in the United Kingdom. There is wide adoption of transformer monitoring systems in the United Kingdom as grid modernization gains significance to improve grid resilience and reliability.

The demand for transformer monitoring systems to facilitate remote monitoring and predictive maintenance is boosted by the energy sector's move to digitalization in Spain. To advance grid resilience and lower the effects of outages, Spain is investing in these systems due to the surged frequency of extreme weather occurrences.

These are progressively important in France as transportation and heating systems get electrified to manage the booming load and strengthen energy distribution. The adoption is bolstered to ensure adherence and minimize risks during operations because of France's strict laws regarding grid safety.

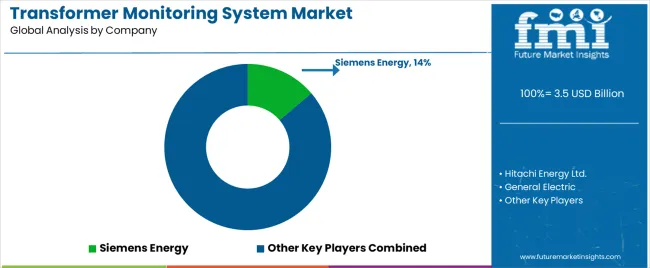

Key transformer monitoring system manufacturers such as Siemens Energy, General Electric, Mitsubishi Electric Corporation, Hitachi Energy Ltd., and Maschinenfabrik Reinhausen GmbH command, boosting invention. The transformer monitoring system vendors lead the technological advancements, influencing the innovation of TMS solutions.

Producers of transformer monitoring systems like Qualitrol Company LLC, Groupe Cahors S.A., and Eaton cater to the competitive outlook, providing distinctive expertise and transformer monitoring system solutions.

The competitive scenario is intensified by MTE Meter Test Equipment AG, CETT Co., Ltd, and other prestigious transformer monitoring system suppliers, each adding their unique contributions to the dynamic environment of TMS solutions. Through continual innovation and partnerships, the manufacturers spur the transformer health monitoring market growth.

As the transformer monitoring system producers continue to traverse improvements in technology, the market is poised for expansion, assuring magnified efficiency and attainment of power infrastructure.

Noticeable Evolutions

| Company | Details |

|---|---|

| Siemens | Siemens made the acquisition of Senseye to widen its portfolio for innovative predictive maintenance and asset intelligence. Up to 50% less unscheduled machine downtime and up to 30% more productivity from maintenance personnel are possible with the predictive maintenance solution of Senseye. |

| Schneider Electric | EcoStruxure Power Transformer Monitoring solution was introduced by Schneider Electric in the United Kingdom and Ireland to prolong the oil transformers lifespan and diminish downtime. |

| GANZ Transformers | A collaboration agreement in the research and manufacturing of intelligent transformers was sealed in April 2025 by GANZ Transformers and Maschinenfabrik Reinhausen, who teamed up as solution providers. |

| Hitachi Energy | On its mission to "advance a sustainable energy future for all," Hitachi Energy declared the launch of "EconiQ transformers" in October 2024. |

| Nepal Electricity Authority (NEA) | To monitor its substations and large transformers, the Nepal Electricity Authority (NEA) launched in July 2020 that it intented to employ smart transformer monitoring systems. This enabled the authority to obtain substation data regarding voltage, loading, off-pick loading, and pick loading. |

The global transformer monitoring system market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the transformer monitoring system market is projected to reach USD 8.0 billion by 2035.

The transformer monitoring system market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in transformer monitoring system market are hardware, _direct winding transformer monitors, _intelligent transformer monitors and software.

In terms of installation type, retrofit units segment to command 81.4% share in the transformer monitoring system market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transformer Containment Bags Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Transformer Insulation Market Size and Share Forecast Outlook 2025 to 2035

Transformer Component Market Size and Share Forecast Outlook 2025 to 2035

Transformer Market Size and Share Forecast Outlook 2025 to 2035

Transformer Spare Parts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Transformer Oil Market Growth - Trends & Forecast 2025 to 2035

Transformer Tap Changers and Voltage Control Relay Market Growth – Trends & Forecast 2025 to 2035

Transformer Bobbin Market

Transformer Testing Equipment Market

Green Transformer Market Growth – Trends & Forecast 2025 to 2035

Power Transformer Market Growth – Trends & Forecast 2024 to 2034

Train Transformer Market

Signal Transformer Market

Dry Type Transformer Market Size and Share Forecast Outlook 2025 to 2035

Traction Transformer Market

Biobased Transformer Oil Market

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Converter Transformer Market

Cast Resin Transformer Market Size and Share Forecast Outlook 2025 to 2035

Naphthenic Transformer Oil Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA