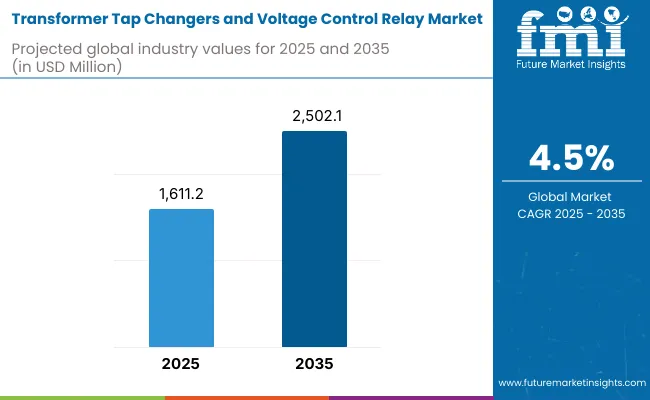

The transformer tap changers and voltage control relay market is expected to reach USD 1,611.2 Million by 2025, and then USD 2,502.1 Million by 2035. This happens due to a growth rate of 4.5% each year on average. More need for power, new energy sources, money put into the grid, and smart grid tech boost this rise.

From 2025 to 2035, the transformer tap changers and voltage control relay market is expected to experience significant growth. This stems from the need for improved power grids, more efficient energy management, and innovative electrical tools. Tap changers and relays in transformers maintain the steady power supply for homes, workplaces, and factories. They help the power flow right in grids, which is key for most uses.

North America should have a big part of the market for transformer tap changers and voltage control relays. This is due to upgrades to power grids and the need for good power distribution. The USA and Canada lead in putting money into smart grids, green-powered energy, and changing old setups.

The use of better voltage control relays and tap changers is growing. This is because of the need for reliable grids and good energy management. Adding more resources like wind and sunlight to power grids needs better equipment for voltage control. This boosts demand for these tools even more.

Europe is big for the growth of tap changers and voltage control relay market. Countries like Germany, France, UK, and Italy are leading. The area is spending a lot on green energy, saving energy, and making smart grids, which need good voltage control.

The EU's big goals for cleaner energy and cutting gas emissions help the need for smart voltage tech. Europe’s aim on digital and smart grids also boosts tap changers and voltage relays.

The Asia-pacific region will see fast growth in the transformer tap changers and voltage control relay market. This is due to high rates of industry, city growth, and more needs for electricity. Countries like China, India, Japan, and South Korea are working hard to grow and update their power systems to meet the rising energy needs of their people.

In particular, the use of green energy in places like China and India, which have big plans for renewable energy, is pushing the need for better voltage control tools. Also, large amounts of money spent on power systems and grid updates in APAC countries will keep driving the demand for tap changers and voltage control relays.

Challenges

High Initial Costs and System Complexity

The high cost of advanced equipment devices such as smart grids and smart systems is one of the main restraints for the transformer tap changers and voltage control relay market. Furthermore, the difficulty of deployment and integration into existing power grids can also present challenges, particularly in developing markets with less established infrastructure.

The lengthy payback period of large-scale grid modernization is one of the obstacles to the acceptance of advanced tap changers and even voltage control relays to operate and maintain these systems, which requires increasingly specialized professionals with advanced skills.

Opportunities

Smart Grid Integration and Renewable Energy Integration

While there are challenges, the market presents immense growth potential. An important opportunity for the transformer tap changers and voltage control relay market is the global transition toward smart grids and renewable energy sources. Smart grids that require dynamic regulation and control are expected to be widely adopted, particularly in developed economies.

In addition to this, there is a push to increase the use of renewable energy sources, such as solar and wind. As we transition towards renewable energy, the variability of these power sources creates a demand for more flexible voltage control devices. The demand for advanced tap changers and voltage control relays will persist as nations focus on improving energy efficiency, enhancing grid resiliency, and promoting sustainability.

From 2020 to 2024, the growth of the transformer tap changers and voltage control relay market is driven by the rising need to stabilize power and ensure efficient electricity transmission, as well as the increase in population, urbanization, industrialization, and the global initiative for the use of renewable energy sources.

These transformer tap changers enabled voltage level adjustments to help ensure the reliability and efficiency of the power distribution systems utilized by the fully integrated system. Voltage regulation is a concern for many types of industrial processes and for the operation of the electrical grid, and so the number of voltage control relays is increasing in electrical networks.

From 2025 to 2035, the market for transformer tap changers and voltage control relays is expected to continue growing, driven by advancements in smart grid technologies and automation. Utilities and industries are trying to focus on the improvement of the reliability of the grid and the efficiency of operations, which will lead to the increasing application of digital and automated voltage control solutions.

The smart transformers, with advanced tap changer mechanisms and voltage control relays, will be increasingly deployed, empowering real-time voltage regulation and monitoring, optimizing energy distribution, and minimizing energy losses. Furthermore, the increasing installation of renewable energy technologies, along with the trend towards decentralized power generation, will create a higher demand for innovative transformer tap changers and voltage control relays that can efficiently handle variable power outputs.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Increased focus on compliance with environmental and safety standards for power distribution systems. |

| Technological Advancements | Improved designs for tap changers and relays to increase durability, reduce maintenance, and improve voltage regulation. |

| Industry Applications | Primarily used in power distribution networks, transformers, and electrical grids. |

| Adoption of Smart Equipment | Limited integration of smart features such as remote control and monitoring in voltage control devices. |

| Sustainability & Cost Efficiency | Growing focus on reducing energy losses and improving the efficiency of electrical grids. |

| Data Analytics & Predictive Modeling | Basic monitoring of voltage levels and tap changer performance. |

| Production & Supply Chain Dynamics | Standardized manufacturing processes for tap changers and relays, with some flexibility for custom solutions. |

| Market Growth Drivers | Demand for improved power transmission, efficient energy distribution, and integration of renewable energy sources. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Implementation of stricter regulations governing grid efficiency, renewable energy integration, and smart grid technologies. |

| Technological Advancements | Development of smart transformers with integrated digital tap changers and voltage control relays that enable real-time monitoring and predictive control. |

| Industry Applications | Expansion into renewable energy sectors, especially in solar and wind farms, to regulate variable energy outputs and integrate decentralized power sources. |

| Adoption of Smart Equipment | Widespread adoption of smart tap changers and voltage control relays with IoT integration, enabling real-time data collection, performance analytics, and remote control. |

| Sustainability & Cost Efficiency | Stronger emphasis on sustainable energy distribution, grid optimization, and reduction of operational costs through advanced voltage control technologies. |

| Data Analytics & Predictive Modeling | Advanced predictive analytics and AI-driven models for optimizing voltage control, forecasting maintenance needs, and minimizing downtime. |

| Production & Supply Chain Dynamics | Shift towards more flexible, modular production methods to accommodate the increasing demand for customized, smart voltage control solutions. |

| Market Growth Drivers | Growth driven by the need for grid modernization, the integration of smart grid technologies, and the transition towards decentralized, renewable-based power systems. |

In the United States, the transformer tap changers and voltage control relays market is experiencing extensive growth. This is a result of growing demand for improved power networks, increased investment in green power, and much greater interest in smart grid technology. Agencies like the Federal Energy Regulatory Commission (FERC) and the U.S. Department of Energy (DOE) make rules about the safe and efficient electrical grid.

Among the major trends are increasing deployment of on-load tap changers (OLTCs) in substations, growing demand for voltage control relays capable of catering to stable grids, and spending on predictive technologies for smarter performance. The transition to electric vehicles and renewable power is also driving demand for more sophisticated voltage solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

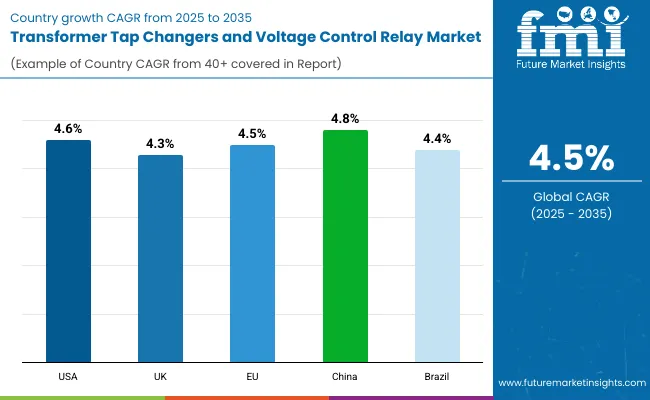

| USA | 4.6% |

The UK transformer tap changers and voltage control relay market is expected to grow in the coming years. This increase is attributed to increased investment in renewable energy sources, such as offshore wind and solar power. There is a greater need to modernize the power grid and find better methods to store energy. The Office of Gas and Electricity Markets (Ofgem) makes sure that power networks and safety rules are followed.

Some trends in the market are the increase in tap changers in transformers for a stable grid, more voltage control systems in energy storage, and better digital relays for a smarter grid. The government’s goal of less carbon and a cleaner energy grid will likely boost the need for advanced voltage solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.3% |

The EU transformer tap changers and voltage control relay market is seeing growth. Renewable energy, modern grids, and smart grid technologies boost this market. ENTSO-E and ACER govern the grid and power systems. Main trends show a push for energy efficiency. On-load tap changers (OLTCs) help control voltage in green energy setups.

This leads to a greater need for voltage control relays in smart grids. Digital and automated tap changers are now common. They improve energy distribution and make grids more resilient.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.5% |

The market for transformer tap changers and voltage control relay in China is growing fast. This is due to increased industrial demands, the development of newer power grids, and a greater investment in green energy. Groups such as the State Grid Corporation of China (SGCC) and the National Energy Administration (NEA) guide the development and utilization of energy systems.

Trends to watch include the increased use of on-load tap changers (OLTCs) in substation systems, the higher need for voltage control relays in small energy setups (DERs), and a push for smart grid technology. Additionally, China's "Made in China 2025" plan is promoting advancements in power technology and upgrading the country's power grids.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 4.8% |

The market for transformer tap changers and voltage control relays in Brazil is growing. This is due to the larger electric grid, increased use of renewable energy, and steps to make the energy system more stable and efficient. Bodies like the National Electric Energy Agency (ANEEL) make sure power is safe and up to standard.

The market is seeing more need for tap changers in renewable energy. Voltage control relays are also needed to manage grid changes. There is a move towards using smart tech and automation in energy. Additionally, the Brazilian government's energy reforms are driving the adoption of smart grid technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 4.4% |

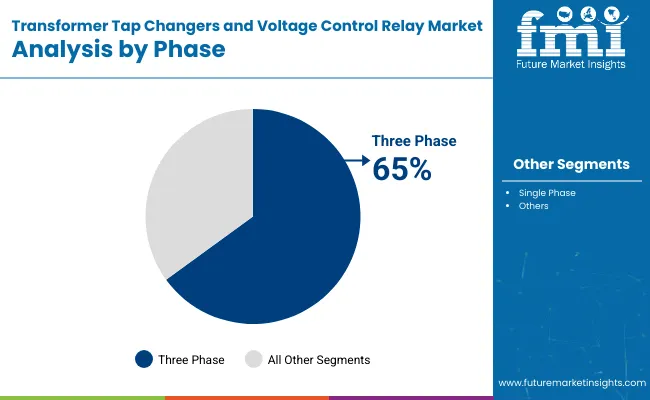

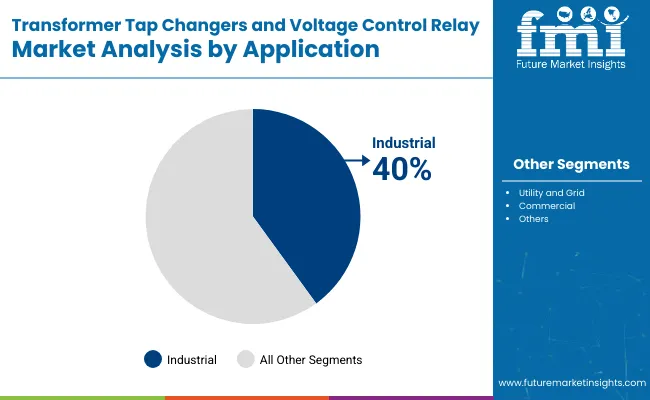

The transformer tap changer and voltage control relay market is growing well because more people require a reliable power supply and steady voltage in factories and power plants. Three-Phase Transformers lead the pack, with the Industrial sector taking center stage due to its big need for strong power tools.

Market Share by Phase (2025)

| Phase | Market Share (2025) |

|---|---|

| Three Phase | 65.0% |

The three-phase transformer is the most popular product type in the transformer market since it is suited for in-depth essential loads and delivers a greater amount of efficiency when compared to its single-phase counter-part and is at last used at industrial and various burglar levels. They are crucial in the transmission and distribution of electrical power in grids and large-scale places.

Three-phase transformers are generally more reliable and efficient, which leads to their demand by industrial manufacturing and utility grids for better power supply systems. With global industries and power grids increasing across different regions, the need for three-phase transformers with tap changers and voltage control relays would be ever-increasing to achieve the required control over voltage levels.

Market Share by Application (2025)

| Application | Market Share (2025) |

|---|---|

| Industrial | 40.0% |

Three-phase transformers are top sellers in the market. They work with bigger power and are more efficient, perfect for factories and utilities. They are key for moving and spreading power in grids and big places. People want three-phase transformers for better and steady power systems in factories and utility grids. As factories and grids grow worldwide, the need for transformers with tap changers and voltage control relays will rise. This is to manage and keep voltage stable.

The growth of transformer tap changers and the voltage control relay market can be attributed to the increasing demand for efficient power management systems, especially in the power generation and distribution industries. Some of the major factors driving market growth include the exponential demand for continuous power supply, grid modernization, and increased energy efficiency.

The tap taps of the transformer can also be used with the help of relays during voltage control to regulate the voltage and protect the system from these fluctuations. Market players are adopting innovations such as load tap changers, on-load and off-load tap changers, and digital voltage control relays in this market to enhance system performance and reliability.

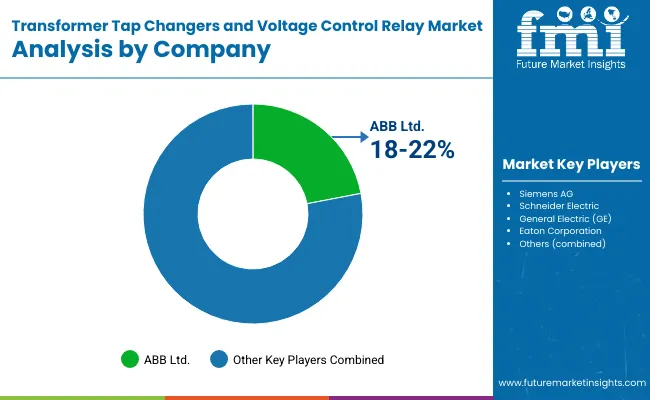

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ABB Ltd. | 18-22% |

| Siemens AG | 14-18% |

| Schneider Electric | 12-16% |

| General Electric (GE) | 10-14% |

| Eaton Corporation | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| ABB Ltd. | In 2024, new tap changers made for good grid use came out. |

| Siemens AG | In 2025, new digital relays to fix voltage in modern grids were launched. |

| Schneider Electric | In 2024, they made more tap changers to work with smart grids to save energy. |

| General Electric (GE) | In 2025, new tap changers with better insulation and safety from high-voltage hits were shown. |

| Eaton Corporation | In 2024, new relays with smart upkeep options for a more reliable grid were launched. |

Key Company Insights

ABB Ltd. (18-22%)

ABB leads in the development of devices for changing transformer taps and voltage control. They offer a wide range of products for these purposes that are used worldwide.

Siemens AG (14-18%)

Siemens is known for digital voltage control tools. They use smart grid tech to make power networks better and more reliable.

Schneider Electric (12-16%)

Schneider Electric makes eco-friendly and energy-saving devices. They provide smart tap changers and voltage control systems that monitor power grids in real-time.

General Electric (GE) (10-14%)

GE's products include both manual and digital tap changers. These enhancements improve the safety of transformers and strengthen the power grid.

Eaton Corporation (6-10%)

Eaton focuses on high-performance voltage control tools and tap changers. They offer solutions for both industrial use and power grids, with a goal of making systems more reliable through advanced analytics.

Other Key Players (30-40% Combined)

Several manufacturers and suppliers of power control and protection systems also play a significant role in the transformer tap changers and voltage control relay market. These include:

The overall market size for the transformer tap changers and voltage control relay market was USD 1,611.2 Million in 2025.

The transformer tap changers and voltage control relay market is expected to reach USD 2,502.1 Million in 2035.

Increasing demand for reliable and efficient power transmission and distribution systems, growth in renewable energy integration, advancements in smart grid technologies, and the need for improved voltage regulation and system stability will drive market growth.

The USA, China, India, Germany, and Japan are key contributors.

The utility power distribution segment is expected to lead due to the increasing demand for voltage regulation in power grids and the growing focus on enhancing grid reliability.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transformer Valve Market Size and Share Forecast Outlook 2025 to 2035

Transformer Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Transformer Containment Bags Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Transformer Insulation Market Size and Share Forecast Outlook 2025 to 2035

Transformer Component Market Size and Share Forecast Outlook 2025 to 2035

Transformer Market Size and Share Forecast Outlook 2025 to 2035

Transformer Spare Parts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Transformer Oil Market Growth - Trends & Forecast 2025 to 2035

Transformer Bobbin Market

Transformer Testing Equipment Market

Green Transformer Market Growth – Trends & Forecast 2025 to 2035

Power Transformer Market Growth – Trends & Forecast 2024 to 2034

Train Transformer Market

Signal Transformer Market

Dry Type Transformer Market Size and Share Forecast Outlook 2025 to 2035

Traction Transformer Market

Biobased Transformer Oil Market

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Converter Transformer Market

Cast Resin Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA