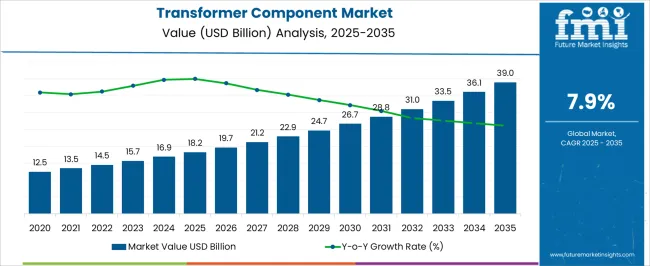

The transformer component market achieves a value of USD 18.2 billion in 2025 and is estimated to climb to USD 39.0 billion by 2035, at a CAGR of 7.9%. In the initial phase from 2021 to 2025, the market progresses from USD 12.5 billion to USD 18.2 billion, with annual increments passing through USD 13.5 billion, 14.5 billion, 15.7 billion, and 16.9 billion. Growth during this period is supported by increasing demand for power distribution and transmission infrastructure, along with a focus on improving grid efficiency and reliability.

Both volume expansion and price appreciation contribute to gains, as manufacturers adopt advanced materials and designs to enhance transformer performance and longevity. Between 2026 and 2030, the market strengthens from USD 18.2 billion to USD 26.7 billion, advancing through USD 19.7 billion, 21.2 billion, 22.9 billion, and 24.7 billion, driven by widespread upgrades in industrial and utility transformers, as well as stricter regulatory standards for safety and energy efficiency. From 2031 to 2035, the market further extends its reach, rising from USD 26.7 billion to USD 39.0 billion, with intermediate values of USD 28.8 billion, 31.0 billion, 33.5 billion, and 36.1 billion.

| Metric | Value |

|---|---|

| Transformer Component Market Estimated Value in (2025 E) | USD 18.2 billion |

| Transformer Component Market Forecast Value in (2035 F) | USD 39.0 billion |

| Forecast CAGR (2025 to 2035) | 7.9% |

The transformer component market is shaped by several parent markets that together determine demand across power, utility, and industrial settings. The power transmission and distribution market serves as the primary driver, with transformer components contributing about 20–25 percent as cores, windings, bushings, tap changers, conservators, radiators, and protection devices are specified to keep networks reliable and safe.

The electrical equipment market adds roughly 15–18%, since transformers and their sub-assemblies are embedded across substations and plant power rooms where dependable voltage regulation and insulation integrity are required. Renewable energy infrastructure contributes around 10–12%, as solar, wind, and hydro projects rely on step-up and step-down units that manage variable generation profiles and grid interconnection, lifting demand for bushings, OLTCs, oil management hardware, and digital monitors. Industrial machinery and equipment accounts for about 8–10 percent, with large motors, furnaces, and process lines depending on transformers fitted with high-temperature insulation systems, cooling assemblies, and condition sensors to handle continuous duty. Utilities and smart grid programs represent approximately 7–9%, where component demand is linked to fleet refurbishment, remote monitoring, and fault detection, including dissolved gas analysis sensors, bushing CTs, surge arresters, and relays that help improve asset health and outage response.

The market is experiencing steady growth, supported by increasing demand for reliable and efficient power transmission infrastructure across both developed and emerging economies. Rapid urbanization and industrialization have driven the need for advanced electrical networks, with utilities and manufacturers prioritizing components that enhance operational efficiency and longevity. Growing investments in renewable energy integration and grid modernization projects are also creating significant opportunities for component manufacturers.

The transition toward smart grids and energy-efficient systems has further elevated the importance of high-quality transformer components that can support varying load demands while minimizing losses. Additionally, advancements in material science and manufacturing processes are enabling the production of components with superior thermal stability, improved durability, and enhanced performance under fluctuating environmental conditions.

Regulatory initiatives focusing on energy efficiency and the reduction of carbon emissions are fostering innovation in component design. The market outlook remains positive, with sustained growth expected as global energy needs expand and the shift toward sustainable power generation accelerates.

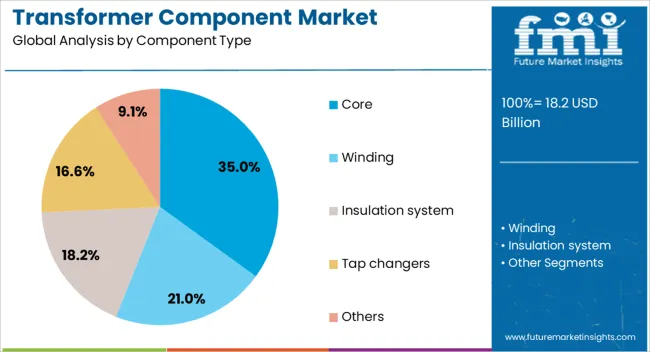

The transformer component market is segmented by component type, and geographic regions. By component type, transformer component market is divided into Core, Winding, Insulation system, Tap changers, and Others. Regionally, the transformer component industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The core segment is projected to account for 35% of the Transformer Component market revenue share in 2025, making it the leading component type. This dominance has been driven by the core's essential role in determining the efficiency and performance of transformers through effective magnetic flux management. The use of high-grade electrical steel and advanced manufacturing techniques has improved energy transfer efficiency while reducing core losses.

Demand for high-performance cores has been reinforced by the expansion of power distribution networks and the growing adoption of renewable energy sources, which require efficient transformers to manage variable loads. Furthermore, the push for energy conservation and compliance with global efficiency standards has encouraged utilities to upgrade to transformers with optimized core designs.

The long service life and reliability of advanced core materials have made them a preferred choice in both new installations and replacement projects. As the global energy landscape shifts toward cleaner and smarter grids, the core segment is expected to maintain its leadership in the market.

The transformer component market is growing as electricity demand, grid modernization, and renewable energy integration drive investment in efficient power infrastructure. Core, winding, and insulating components are central to maintaining transformer performance and safety. High production costs, raw material volatility, and complex compliance requirements remain key challenges for manufacturers. Opportunities are rising in smart grid projects, renewable integration, and electric mobility infrastructure. With digital monitoring, advanced materials, and regional electrification fueling adoption, transformer components are becoming critical enablers of reliable, modern, and adaptive power distribution networks worldwide.

Increasing urban development, industrialization, and electrification of rural areas are fueling investments in power distribution and transmission. Transformers remain critical in maintaining voltage stability and efficiency, with components such as cores, windings, insulators, and bushings playing vital roles in performance. The push for grid modernization and renewable energy integration is further boosting demand for advanced transformer components capable of handling fluctuating loads. Rapid growth in electric mobility and the need for charging infrastructure also support the market, as distribution networks are upgraded to handle increased capacity. Manufacturers are focusing on producing components that improve operational life, minimize energy losses, and ensure safety under demanding conditions. These factors make transformer components indispensable in the expansion and modernization of power infrastructure across global regions.

Core and winding materials such as copper and electrical steel are subject to price fluctuations, directly impacting manufacturing expenses. Specialized insulating materials and advanced coatings further elevate costs. Smaller manufacturers often struggle to compete due to their limited ability to absorb sudden increases in raw material prices. In addition, the production of high-quality transformer components requires precision engineering and strict compliance with performance standards, adding to manufacturing complexity. Maintenance of installed components also presents challenges, as failures can lead to costly outages and operational disruptions. Supply chain disruptions and longer lead times for critical parts affect project schedules, particularly in large-scale grid expansion efforts. These barriers limit affordability and put pressure on manufacturers to balance quality, performance, and cost efficiency.

Smart grid development requires transformers equipped with advanced monitoring and control systems, creating demand for sensors, tap changers, and digital-ready components. Renewable energy projects such as wind and solar farms rely on specialized transformer components capable of handling intermittent power flows and maintaining grid stability. Increasing electrification of transportation, including charging networks for electric vehicles, also fuels demand for distribution transformer components. Manufacturers are investing in research to enhance thermal performance, reduce energy losses, and extend the life of critical parts. Partnerships between utilities, technology firms, and component suppliers are accelerating innovation in intelligent solutions that align with grid modernization efforts. These advancements present significant opportunities for companies that can provide reliable, efficient, and adaptive components for next-generation power systems.

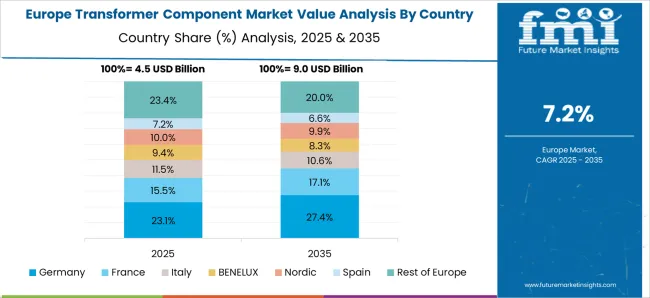

Manufacturers are incorporating digital monitoring systems that provide real-time data on component performance, enabling predictive maintenance and reducing downtime. New insulating materials and advanced cooling methods are being developed to improve efficiency and reliability under heavy load conditions. Regionally, the Asia Pacific is witnessing strong growth due to rapid electrification and industrial expansion, while North America and Europe focus on upgrading aging grid infrastructure. Collaborations between utilities and manufacturers are driving the adoption of smart components designed for evolving energy landscapes. The integration of digital technologies, combined with rising regional investments in grid resilience, highlights how innovation and localized demand are shaping the competitive dynamics of the transformer component market.

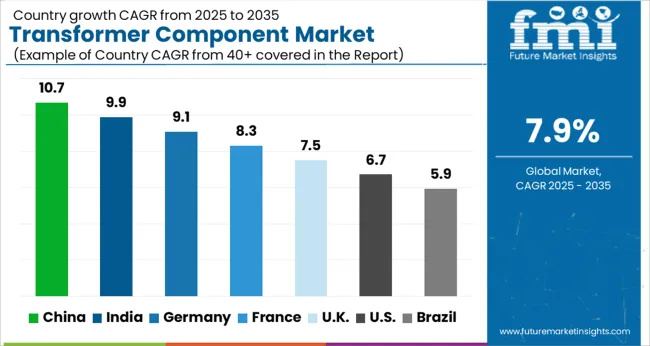

| Country | CAGR |

|---|---|

| China | 10.7% |

| India | 9.9% |

| Germany | 9.1% |

| France | 8.3% |

| UK | 7.5% |

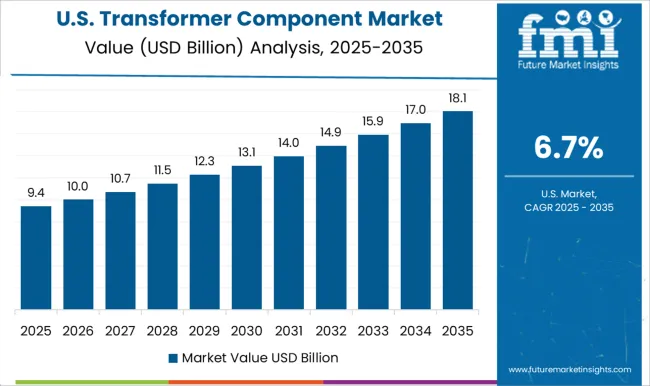

| USA | 6.7% |

| Brazil | 5.9% |

Global Two Winding Cast Resin Transformer market demand is projected to rise at a 9.4% CAGR from 2025 to 2035. China leads at 12.7%, followed by India at 11.8%, and France at 9.9%, while the United Kingdom records 8.9% and the United States posts 8.0%. These rates translate to a growth premium of +35% for China, +25% for India, and +5% for France versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: rising industrial demand, government initiatives for grid development, and the adoption of cleaner, energy-efficient solutions in China and India, while more mature markets like the United States and the United Kingdom experience moderate growth due to established infrastructure. The analysis spans over 40+ countries, with the leading markets shown below

The transformer component market in China is projected to grow at a CAGR of 10.7% from 2025 to 2035, driven by large-scale grid expansion, ultra-high-voltage (UHV) projects, and industrial electrification. Demand is concentrated on CRGO and amorphous cores, precision windings, epoxy-cast bushings, radiators, and on-load tap changers (OLTCs). Utilities are increasingly adopting digital monitoring systems, including online DGA, bushing health, and OLTC position feedback. Industrial and urban substation projects demand compact, high-performance components with enhanced thermal and dielectric tolerances. Local manufacturers benefit from proximity to steel and resin supply chains, reducing lead times for production. Global players are expanding engineering and assembly operations in China to cater to fast-track projects.

The transformer component market in India is expected to expand at a CAGR of 9.9% between 2025 and 2035, fueled by distribution upgrades, interstate transmission projects, rail electrification, and metro expansions. Components such as CRGO cores, low-loss windings, OLTCs, polymeric and composite bushings are increasingly in demand. Utilities are emphasizing pre-installed monitoring systems for thermal, partial discharge, and bushing health. Steel and resin availability improvements are easing production constraints, supporting faster delivery of cores and epoxy-cast components. Replacement cycles for medium-power transformers are accelerating due to rural feeder upgrades and urban electrification projects. Industrial campuses, hospitals, and campuses require modular transformers with factory-fitted monitoring and high thermal tolerance. EPCs increasingly prefer pre-engineered, ready-to-install components to shorten commissioning time.

The transformer component market in France is projected to grow at a CAGR of 8.3% from 2025 to 2035, supported by grid reinforcement, life-extension projects for generation assets, and urban electrification. High-grade CRGO cores with low loss, vacuum-pressure-impregnated (VPI) windings, epoxy and RIP bushings, and durable OLTCs dominate demand.Utilities are tightening specifications for dielectric strength, partial discharge, and online diagnostics. Local and pan-European suppliers collaborate closely with test labs to expedite type testing and quality assurance. Replacement of aging distribution fleets in urban centers drives demand for compact, high-fault-level designs. Rail and interconnector projects further support orders for advanced radiators, cooling systems, and OLTC assemblies.

The UK market is anticipated to grow at a CAGR of 7.5% from 2025 to 2035, driven by DNO and TO asset-replacement programs, reinforcement for interconnections, and dense urban substation development. Components such as low-loss CRGO cores, polymeric bushings with high creepage resistance, OLTCs with superior arcing chambers, and corrosion-resistant radiators are in demand. Compact, pre-assembled units with integrated DGA, thermal, and bushing monitoring are increasingly specified. Data centers and logistics hubs require medium-to-large power transformers with forced-cooling systems. Distributor partnerships with European factories ensure faster delivery and standardized spare parts.

The USA market is projected to expand at a CAGR of 6.7% from 2025 to 2035, driven by replacement of aging infrastructure, data centers, airport and stadium projects, and grid-hardening in storm-prone areas. Demand is highest for high-grade CRGO and amorphous cores, copper windings with reinforced insulation, RIP/epoxy bushings, and long-life OLTCs. Online DGA, fiber-optic winding sensors, thermal monitoring, and bushing health analytics are increasingly specified. Regional assembly plants and international suppliers with USA testing facilities reduce lead times and support commissioning. Industrial campuses and logistics parks favor medium-power transformers with enhanced radiators and forced-oil/forced-air cooling. Pre-assembled kits and standardized accessories streamline EPC schedules.

The transformer component market is highly competitive, driven by demand from power transmission, distribution, and industrial infrastructure projects. Competition centers on product quality, reliability, energy efficiency, and cost-effectiveness of components such as cores, windings, bushings, tap changers, insulators, and cooling systems. Companies differentiate through advanced materials, precision manufacturing, and enhanced thermal performance to meet evolving utility and industrial standards.

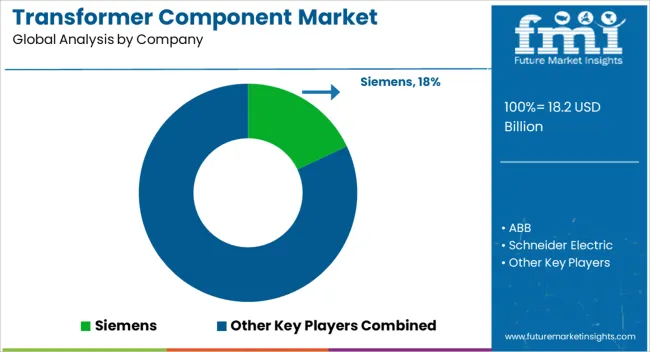

Key players such as ABB, Siemens Energy, General Electric, Schneider Electric, Eaton, Mitsubishi Electric, Toshiba Energy Systems, Hitachi Energy, Crompton Greaves, and Bharat Heavy Electricals Limited (BHEL) dominate the market with extensive portfolios of high-performance transformer components. These companies leverage global distribution networks, strategic partnerships with utilities and OEMs, and continuous R&D investments to strengthen market presence. Regional and emerging manufacturers compete by offering cost-effective, application-specific, and customizable solutions for power and distribution transformers. The market is moderately fragmented, with leading players focusing on technological improvements, long-term reliability, and service support to maintain market share and meet the growing demand for efficient transformer components across diverse sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.2 Billion |

| Component Type | Core, Winding, Insulation system, Tap changers, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens, ABB, Schneider Electric, Mitsubishi Electric, Toshiba, Hitachi Energy, General Electric (GE), and Eaton / Others |

| Additional Attributes | Dollar sales by component type (cores, windings, bushings, insulation), voltage class (low, medium, high), and application (utility, industrial, commercial). Demand dynamics are driven by modernization of electrical grids, renewable integration, and reliability requirements. Regional trends highlight strong growth in North America, Europe, and Asia-Pacific, supported by investments in power infrastructure and smart grid initiatives. |

The global transformer component market is estimated to be valued at USD 18.2 billion in 2025.

The market size for the transformer component market is projected to reach USD 39.0 billion by 2035.

The transformer component market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in transformer component market are core, winding, insulation system, tap changers, others, _cooling & accessories, _conservator & tanks and _protection relays.

In terms of , segment to command 0.0% share in the transformer component market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transformer Valve Market Size and Share Forecast Outlook 2025 to 2035

Transformer Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Transformer Containment Bags Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Transformer Insulation Market Size and Share Forecast Outlook 2025 to 2035

Transformer Market Size and Share Forecast Outlook 2025 to 2035

Transformer Spare Parts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Transformer Oil Market Growth - Trends & Forecast 2025 to 2035

Transformer Tap Changers and Voltage Control Relay Market Growth – Trends & Forecast 2025 to 2035

Transformer Bobbin Market

Transformer Testing Equipment Market

Green Transformer Market Growth – Trends & Forecast 2025 to 2035

Power Transformer Market Growth – Trends & Forecast 2024 to 2034

Train Transformer Market

Signal Transformer Market

Dry Type Transformer Market Size and Share Forecast Outlook 2025 to 2035

Traction Transformer Market

Biobased Transformer Oil Market

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Converter Transformer Market

Cast Resin Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA