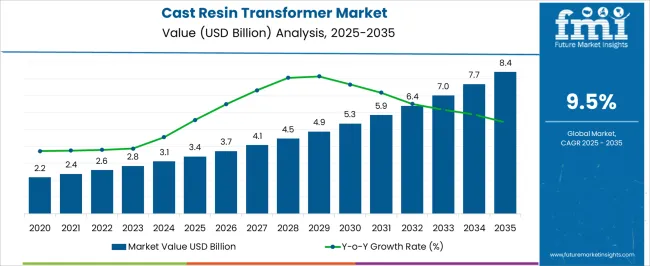

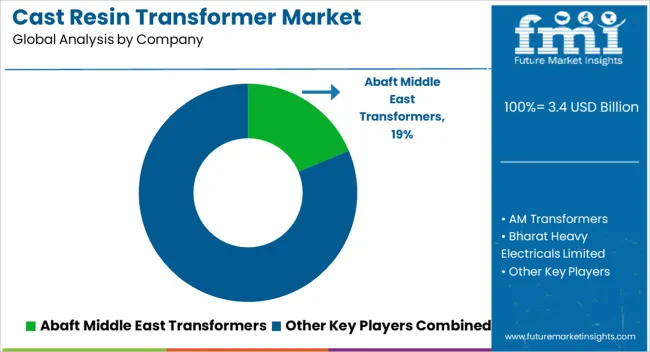

The cast resin transformer market is projected to reach USD 3.4 billion in 2025 and expand to USD 8.4 billion by 2035, growing at a CAGR of 9.5%. Market expansion is driven by increasing demand for reliable, compact, and maintenance-free transformers across industrial, commercial, and utility sectors. Utilities and large-scale industrial facilities are adopting cast resin transformers for enhanced safety, reduced fire hazards, and improved performance in harsh environments.

Investments in renewable energy infrastructure, including solar and wind power, are accelerating deployment of medium-voltage cast resin transformers for grid integration. Manufacturers are optimizing designs for higher thermal endurance, compact footprints, and eco-friendly materials. Lifecycle management and low total cost of ownership are prioritized by end users, emphasizing durability and reduced maintenance intervals. Emerging markets in Asia-Pacific and the Middle East are witnessing rapid adoption due to grid expansion, industrialization, and increased demand for energy-efficient electrical equipment. Strategic partnerships between transformer manufacturers and engineering, procurement, and construction (EPC) firms are facilitating project-based deployments. Technological upgrades in insulation systems, epoxy resin formulations, and fault-tolerant designs further enhance reliability and operational lifespan.

| Metric | Value |

|---|---|

| Cast Resin Transformer Market Estimated Value in (2025 E) | USD 3.4 billion |

| Cast Resin Transformer Market Forecast Value in (2035 F) | USD 8.4 billion |

| Forecast CAGR (2025 to 2035) | 9.5% |

The cast resin transformer market is shaped by five interconnected parent markets that collectively influence its growth trajectory and adoption across industries. The utility and power distribution market holds the largest share at 35%, driven by the need for reliable, maintenance-free transformers in urban grids, renewable energy integration, and substation upgrades. Industrial manufacturing contributes 25%, as facilities in steel, cement, chemical, and automotive sectors deploy cast resin transformers for enhanced safety, thermal stability, and compact installation in high-voltage environments. The commercial buildings segment accounts for 15%, where office complexes, hospitals, and data centers increasingly adopt low-noise, eco-friendly transformers to ensure uninterrupted power supply and compliance with safety regulations.

The renewable energy market represents 15%, fueled by solar and wind power projects requiring medium-voltage cast resin transformers for grid connection, durability, and fault tolerance. Finally, the aftermarket and maintenance services market contributes 10%, as refurbishment, predictive maintenance, and lifecycle management solutions enhance transformer longevity and operational efficiency.

Utilities, industrial, and renewable sectors account for over 75% of overall dollar sales and market share, highlighting that high-voltage deployment, safety, and operational reliability remain the primary growth drivers. The sector’s trajectory is expected to strengthen further with increased renewable integration, expanding industrial infrastructure, and cross-border project collaborations that position cast resin transformers as a core component in modern electrical networks.

The cast resin transformer market is expanding steadily due to growing adoption of safe, low maintenance, and environmentally friendly transformer solutions. Rising demand from commercial and industrial infrastructure projects, coupled with stringent safety regulations, has boosted market penetration.

Cast resin technology offers superior fire resistance, moisture protection, and durability, making it suitable for challenging environments. Increasing integration of renewable energy sources and the need for efficient distribution systems are further driving adoption.

Advancements in manufacturing techniques, insulation materials, and thermal performance are enhancing operational reliability and lifespan. The future outlook is positive as industries and utilities seek compact, efficient, and sustainable transformer solutions to meet modern power distribution requirements.

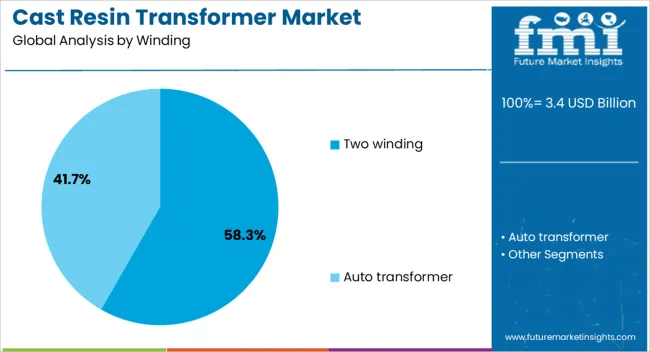

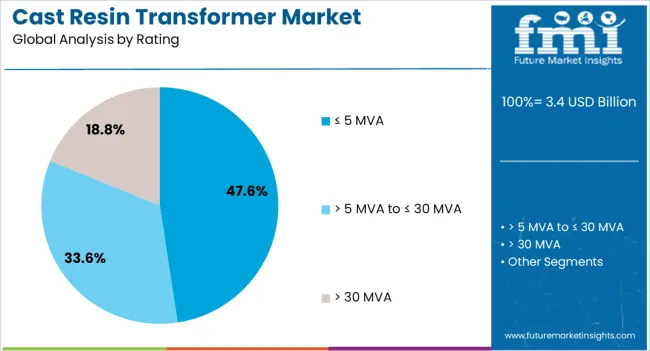

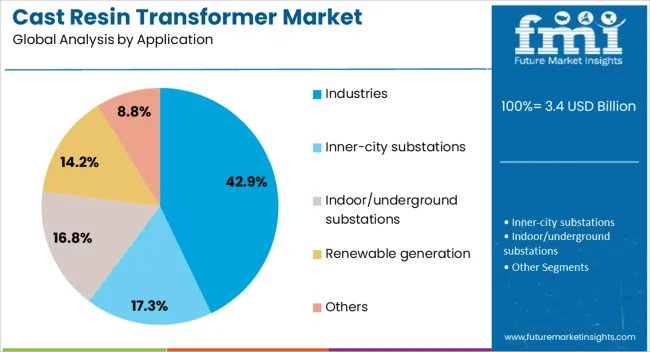

The cast resin transformer market is segmented by winding, rating, application, and geographic regions. By winding, cast resin transformer market is divided into Two winding and Auto transformer. In terms of rating, cast resin transformer market is classified into ≤ 5 MVA, > 5 MVA to ≤ 30 MVA, and > 30 MVA. Based on application, cast resin transformer market is segmented into Industries, Inner-city substations, Indoor/underground substations, Renewable generation, and Others.

Regionally, the cast resin transformer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The two winding category is anticipated to account for 58.30% of total market revenue by 2025, making it the leading segment within the winding classification. Its dominance is attributed to its reliability, versatility, and suitability for a wide range of voltage transformation needs.

Two winding transformers are preferred in distribution and industrial applications due to their straightforward design, cost effectiveness, and ease of maintenance.

The ability to provide electrical isolation between primary and secondary circuits enhances operational safety and system stability, further supporting its strong market presence.

The ≤ 5 MVA rating segment is expected to hold 47.60% of total market revenue by 2025, positioning it as the most prominent in the rating category. This growth is driven by the high demand for compact power solutions in commercial complexes, small to medium scale industries, and renewable energy projects.

The segment’s cost efficiency, ease of installation, and suitability for low to medium load requirements make it the preferred choice for multiple operational settings.

Its adaptability to urban infrastructure and localized distribution networks has reinforced its leadership in the rating segment.

The industries application segment is projected to represent 42.90% of total market revenue by 2025, making it the leading application area. This dominance is fueled by the increasing need for reliable and efficient power supply in manufacturing, processing, and heavy industrial operations.

Cast resin transformers in industrial environments provide enhanced resistance to environmental stressors such as dust, humidity, and chemical exposure.

Their operational safety, minimal maintenance requirements, and long service life have made them integral to industrial power infrastructure, further solidifying this segment’s market leadership.

Cast resin transformers are expanding rapidly across utilities, industrial, commercial, and renewable sectors. Growth is driven by safety, low maintenance, and operational reliability.

The cast resin transformer market is increasingly driven by utilities and power distribution networks seeking safe, low-maintenance, and reliable solutions. Expanding electricity demand, aging infrastructure replacement, and the integration of renewable energy sources are prompting investment in medium- and high-voltage cast resin transformers. Utilities are adopting epoxy-resin insulated designs to enhance operational safety, reduce fire hazards, and limit environmental risks associated with oil-filled transformers. Grid modernization projects, smart substation upgrades, and compliance with IEC and ANSI standards are accelerating adoption. Transformers are preferred for their compact size, low noise, and high thermal stability, making them suitable for dense urban areas and industrial hubs. Predictive maintenance and remote monitoring integration are increasingly shaping procurement decisions and capital planning for utilities globally.

Industrial adoption of cast resin transformers is fueled by demand for reliable power in high-load manufacturing environments. Industries such as steel, cement, chemicals, and automotive rely on compact, high-efficiency transformers for machinery, process equipment, and critical operations. Cast resin transformers are favored for their fire-resistant properties, reduced maintenance needs, and immunity to oil leakage risks in enclosed or confined spaces. The industrial market emphasizes compliance with occupational safety standards and operational continuity, especially in hazardous or temperature-sensitive zones. Lifecycle cost analysis and energy efficiency considerations are influencing purchase decisions, while manufacturers are offering custom voltage ratings, compact footprints, and enhanced insulation systems to meet complex industrial requirements. Retrofit and expansion projects in older plants further boost demand.

Commercial establishments including hospitals, data centers, office complexes, and airports are increasingly deploying cast resin transformers for reliable and quiet power supply. Low-noise performance, compact design, and minimal maintenance requirements are driving adoption in sensitive environments. Growing awareness of fire safety, operational reliability, and adherence to local electrical codes is encouraging facility managers to invest in epoxy-insulated transformers. Retrofit projects in existing buildings, new construction, and expansion of high-rise structures are boosting demand. Energy efficiency regulations, grid reliability concerns, and limited space for conventional transformers in urban facilities further support market growth. Suppliers are providing turnkey solutions, installation support, and performance monitoring services to enhance adoption in the commercial infrastructure segment.

The renewable energy sector is contributing significantly to cast resin transformer adoption, especially for solar farms and wind power projects requiring compact, high-voltage solutions. Medium-voltage transformers are deployed for grid interconnection, fault tolerance, and thermal stability in harsh environments. Aftermarket services such as predictive maintenance, refurbishment, and lifecycle management are driving secondary market growth. Replacement cycles, retrofitting of oil-filled transformers, and regulatory compliance audits create opportunities for service providers. Manufacturers are emphasizing modular designs, remote monitoring compatibility, and adherence to IEC and ANSI standards. This combination of renewable project deployment and after-sales service ensures continued dollar sales growth and broader market penetration.

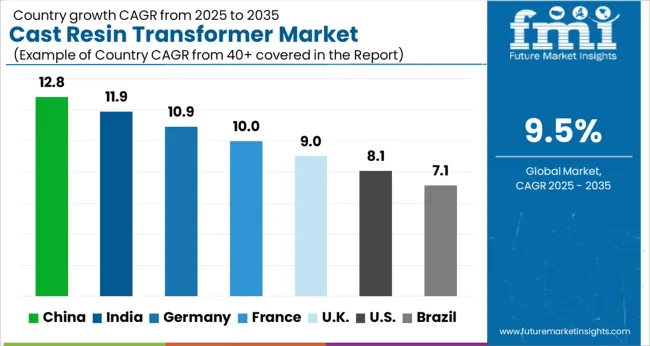

| Country | CAGR |

|---|---|

| China | 12.8% |

| India | 11.9% |

| Germany | 10.9% |

| France | 10.0% |

| UK | 9.0% |

| USA | 8.1% |

| Brazil | 7.1% |

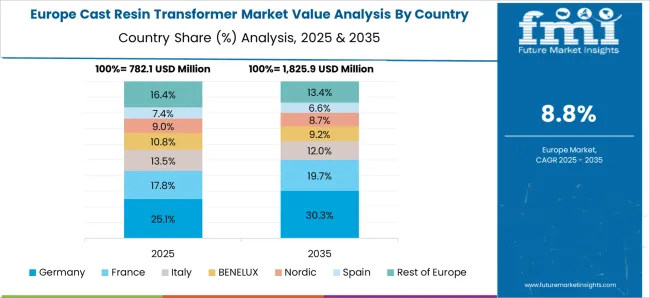

The global cast resin transformer market is projected to grow at a CAGR of 9.5% between 2025 and 2035. China and India, as leading BRICS economies, dominate production capacity and installation demand, driven by grid modernization, power distribution upgrades, and industrial electrification projects. Germany, the United Kingdom, and the United States, representing major OECD markets, focus on high-performance, compact, and safe transformer solutions for industrial, commercial, and critical infrastructure applications. Market expansion is supported by increasing investment in renewable energy integration, smart substations, and replacement of aging oil-filled transformers. Asia-Pacific leads in large-scale deployment and export potential, while Europe and North America emphasize safety, compliance, low-maintenance designs, and lifecycle efficiency. Strategic partnerships, local manufacturing, and after-sales service further accelerate adoption across key regions. The analysis spans over 40+ countries, highlighting leading markets and regional growth dynamics.

The cast resin transformer market in China is projected to grow at a CAGR of 12.8% from 2025 to 2035, fueled by the country’s rapid industrialization, grid expansion, and investments in renewable energy projects. Distribution and transmission networks are being upgraded with safer, low-maintenance cast resin transformers to meet increasing electricity demand from commercial, industrial, and residential sectors. Domestic manufacturers are scaling production capacities while integrating advanced insulation materials and compact designs to improve performance and safety. Government policies supporting smart grids, substation modernization, and green energy adoption further enhance demand. Export opportunities to neighboring Asian markets are also being leveraged, strengthening China’s position as a key global supplier.

India’s cast resin transformer market is expected to grow at a CAGR of 11.9%, supported by expanding power distribution networks, industrial electrification, and renewable energy integration. Investments in substations and rural electrification projects are boosting transformer installations, while industries prioritize safety, compactness, and low-maintenance designs. Domestic manufacturers are partnering with international technology providers to produce high-quality cast resin units, meeting stringent performance and insulation standards. Government initiatives, including support for solar and wind energy projects, further stimulate adoption. Increased urbanization, industrial parks, and smart city projects also drive demand for medium- and high-voltage transformers. Export opportunities to South Asian markets provide additional growth potential.

The cast resin transformer market in Germany is projected to grow at a CAGR of 10.9%, driven by industrial modernization, strict safety regulations, and renewable energy integration. Germany’s energy transition (Energiewende) emphasizes grid stability, low environmental impact, and high-performance transformer deployment. Industrial sectors, including automotive, manufacturing, and chemicals, demand reliable, compact, and low-maintenance transformers. Domestic manufacturers focus on premium insulation materials, noise reduction, and fire safety compliance to meet regulatory standards. Smart grid adoption, substation retrofitting, and integration of solar and wind energy projects further accelerate market growth. Partnerships with European technology providers and a focus on export-quality production enhance Germany’s competitive positioning.

The UK cast resin transformer market is expected to grow at a CAGR of 9.0%, supported by grid modernization, urban infrastructure upgrades, and renewable energy integration. Power utilities prioritize compact, low-maintenance transformers to reduce operational costs while ensuring high reliability. Industrial sectors, including manufacturing, logistics, and commercial construction, require energy-efficient and safe transformer solutions. Domestic manufacturers collaborate with European technology partners to meet performance, insulation, and fire safety standards. Government incentives for renewable energy, substation retrofits, and smart grid expansion further stimulate demand. Export opportunities to nearby European markets are also leveraged to strengthen the UK’s market presence.

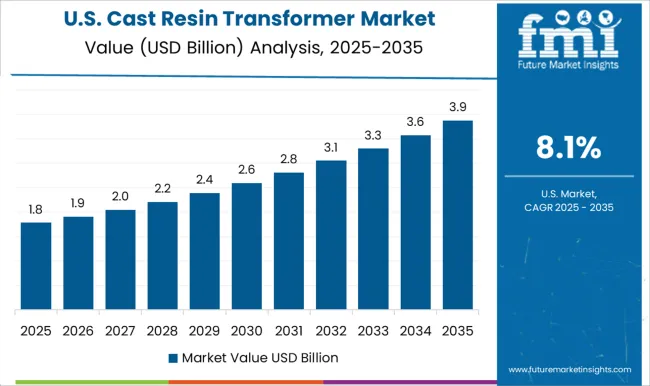

The USA cast resin transformer market is projected to grow at a CAGR of 8.1%, driven by aging grid infrastructure, industrial expansion, and renewable energy projects. Utilities and industrial players prioritize low-maintenance, compact, and high-safety transformers for medium- and high-voltage applications. Domestic manufacturers focus on quality, performance, and compliance with national safety standards. Smart grid deployments, substation modernization, and integration of solar and wind farms accelerate adoption. Public and private investment in energy infrastructure and industrial parks supports market growth, while export opportunities to Latin American markets provide additional expansion potential.

Competition in the cast resin transformer market is defined by electrical efficiency, insulation performance, and grid reliability. ABB Ltd. leads globally with a broad portfolio of medium- and high-voltage cast resin transformers, leveraging advanced insulation systems, compact designs, and global service networks. Siemens Energy follows closely, focusing on grid modernization, renewable integration, and high-performance transformer solutions tailored for industrial and utility clients. Schneider Electric differentiates through modular designs, digital monitoring capabilities, and strong after-sales support, catering to smart grid and substation upgrades. Hitachi Energy and GE Vernova emphasize reliability, low-maintenance solutions, and energy-efficient transformer technologies for large-scale power distribution and industrial applications.

Bharat Heavy Electricals Limited and Kirloskar Electric Company maintain a strong regional presence in India, delivering cost-effective, high-quality cast resin transformers for domestic power utilities and industrial clients. WEG and Fuji Electric Co., Ltd. focus on high-efficiency, low-noise transformer designs for commercial and industrial sectors, backed by robust R&D and technical consultation. CG Power & Industrial Solutions and AM Transformers target emerging markets with customized solutions addressing local voltage standards, safety regulations, and environmental compliance. Eaton and Toshiba Energy Systems and Solutions Corporation leverage technological expertise and global supply chains to serve multi-regional utility and industrial clients.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.4 Billion |

| Winding | Two winding and Auto transformer |

| Rating | ≤ 5 MVA, > 5 MVA to ≤ 30 MVA, and > 30 MVA |

| Application | Industries, Inner-city substations, Indoor/underground substations, Renewable generation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Abaft Middle East Transformers, AM Transformers, Bharat Heavy Electricals Limited, Bowers Electrical Ltd, CG Power & Industrial Solutions, Eaton, Emirates Transformer and Switchgear Ltd., Fuji Electric Co. Ltd., GE Vernova, Hitachi Energy, Kirloskar Electric Company, LS ELECTRIC Co., Ltd., Raychem RPG Private Limited, Schneider Electric, SGB SMIT, Siemens Energy, TMC Transformers, Toshiba Energy Systems and Solutions Corporation, URJA Techniques, and WEG |

| Additional Attributes | Dollar sales, share, regional demand patterns, voltage class adoption, industrial vs utility consumption, growth in renewable integration, product efficiency trends, service and maintenance requirements, regulatory compliance, competitive positioning, export-import dynamics, and raw material cost trends. |

The global cast resin transformer market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the cast resin transformer market is projected to reach USD 8.4 billion by 2035.

The cast resin transformer market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in cast resin transformer market are two winding and auto transformer.

In terms of rating, ≤ 5 mva segment to command 47.6% share in the cast resin transformer market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA