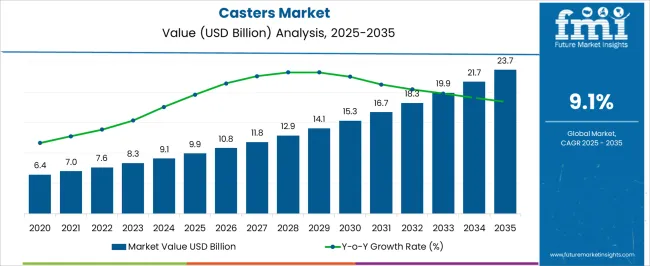

The casters market is projected to reach 9.9 USD billion in 2025 and is anticipated to expand to 23.7 USD billion by 2035, representing a CAGR of 9.1%. Market growth is being fueled by rising demand for mobility solutions across industrial, commercial, and healthcare sectors. Industrial facilities increasingly rely on casters for material handling, assembly lines, and transport of heavy machinery, while healthcare and office segments adopt ergonomic and mobile furniture solutions incorporating advanced caster designs. E-commerce, warehousing, and logistics expansion are creating incremental demand for durable, load-bearing, and smooth-rolling casters.

Manufacturers are exploring lightweight alloys, polyurethane wheels, and modular mounting systems to enhance performance and reduce maintenance. Regional infrastructure development and automation in warehouses and factories are further accelerating adoption, while cost-efficiency and operational reliability remain central decision criteria for buyers.

Emerging markets show strong momentum as local manufacturing and urban commercial development drive growth. Additionally, partnerships with OEMs and furniture suppliers are enabling scalable production and distribution. The market is also shaped by regulatory compliance for industrial safety, noise reduction, and floor protection standards, ensuring broader applicability across sectors.

| Metric | Value |

|---|---|

| Casters Market Estimated Value in (2025 E) | USD 9.9 billion |

| Casters Market Forecast Value in (2035 F) | USD 23.7 billion |

| Forecast CAGR (2025 to 2035) | 9.1% |

The casters market is shaped by five interconnected parent markets, each contributing differently to overall demand and growth. The industrial manufacturing market holds the largest share at 35%, driven by the need for mobility solutions in factories, assembly lines, and material handling operations, where casters facilitate efficient movement of heavy machinery and equipment. The logistics and warehousing market contributes 25%, as casters are critical for transport trolleys, racks, pallets, and mobile storage systems, enabling smooth handling of goods and improving operational productivity.

The healthcare and medical equipment market accounts for 15%, with casters used in hospital beds, surgical tables, medical carts, and diagnostic equipment to ensure mobility, safety, and ergonomic handling. The commercial and office furniture market holds a 12% share, driven by rolling chairs, modular furniture, and mobile workstations that enhance flexibility and workspace efficiency. The retail and hospitality market represents 8%, supporting movable displays, service carts, and luggage trolleys for convenience and operational speed.

The casters market is witnessing steady growth, supported by expanding industrial manufacturing, warehousing, and logistics activities, along with increasing integration of mobility solutions in commercial and institutional settings. Demand has been underpinned by the rising need for efficient material handling systems, coupled with advancements in caster design for enhanced durability, maneuverability, and load-bearing performance.

Manufacturers are focusing on product innovations that optimize rolling resistance, noise reduction, and floor protection while aligning with ergonomic and safety standards. Global trade expansion and e-commerce sector growth are contributing to higher consumption in distribution centers, while infrastructure development in emerging economies is boosting demand across various sectors.

Raw material price volatility and competitive cost pressures are influencing sourcing strategies, leading to greater emphasis on localized production and supply chain resilience. Over the forecast period, the market is expected to benefit from automation integration, customized solutions for specialized applications, and a strong shift toward high-performance materials to meet evolving industrial and commercial demands.

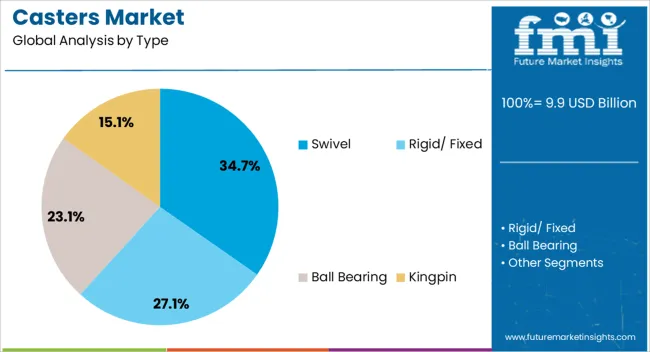

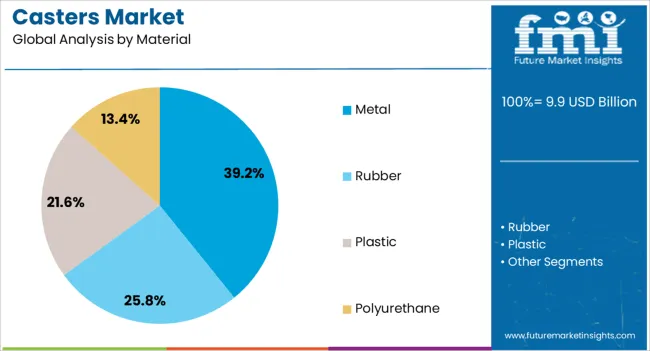

The casters market is segmented by type, material, load capacity, mounting, application, end use, distribution channel, and geographic regions. By type, casters market is divided into Swivel, Rigid/ Fixed, Ball Bearing, and Kingpin. In terms of material, casters market is classified into Metal, Rubber, Plastic, and Polyurethane.

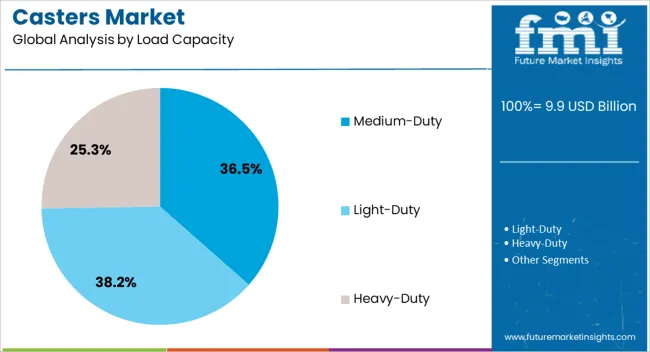

Based on load capacity, casters market is segmented into Medium-Duty, Light-Duty, and Heavy-Duty. By mounting, casters market is segmented into Plate and Stem. By application, casters market is segmented into Industrial, Commercial, Healthcare, and Residential. By end use, casters market is segmented into Automotive, Aerospace, Food Industry, Medical, Textile Industry, and Other End-Users. By distribution channel, casters market is segmented into Direct and Indirect. Regionally, the casters industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The swivel type segment, holding 34.7% of the type category, has been leading the market due to its superior maneuverability and adaptability in diverse applications. Its design allows for 360-degree rotation, enabling ease of movement in confined spaces, which is highly valued in manufacturing, warehousing, and healthcare environments.

This functional advantage has driven consistent adoption across sectors requiring frequent directional changes. The segment’s growth has been reinforced by advancements in bearing technologies, improving load handling and reducing operational effort.

Additionally, swivel casters are increasingly being produced with enhanced materials and protective coatings to withstand harsh working conditions, ensuring longer service life and reduced maintenance costs The sustained demand from both heavy-duty and light-duty applications, coupled with customization options for different floor types and mobility requirements, continues to solidify the segment’s market leadership and ensure its relevance in evolving industrial and commercial environments.

The metal segment, accounting for 39.2% of the material category, maintains its lead position due to its durability, strength, and suitability for heavy-load applications. Its resistance to wear, impact, and high temperatures makes it an essential choice for industrial operations, manufacturing plants, and logistics facilities.

The segment benefits from the ability to handle higher weight capacities while offering long-term reliability, which reduces replacement frequency and operational downtime. Advancements in alloy compositions and protective finishes have improved corrosion resistance, expanding usage in both indoor and outdoor settings.

The metal segment’s share is further supported by its compatibility with precision manufacturing techniques, enabling the production of specialized caster designs for demanding operational environments Continued infrastructure development and growth in sectors such as automotive, aerospace, and material handling are expected to reinforce demand, ensuring the segment’s prominence in the market over the forecast period.

The medium-duty segment, representing 36.5% of the load capacity category, leads the market by addressing the widest range of industrial, commercial, and institutional applications. Its balance between mobility and weight-bearing capacity makes it versatile for equipment, carts, and machinery requiring moderate load support without compromising maneuverability.

The segment’s popularity is sustained by its suitability for environments where frequent movement is required but extreme weight handling is unnecessary. Enhanced wheel designs and advanced bearing systems have improved operational smoothness, while the use of reinforced materials has increased durability under continuous use.

Demand is further supported by the expansion of retail distribution networks, healthcare facilities, and manufacturing units that prioritize cost-effective yet durable caster solutions As industries continue to seek equipment that offers operational efficiency and adaptability, the medium-duty category is expected to maintain its market dominance and play a critical role in the broader casters market growth trajectory.

The casters market is primarily driven by industrial, healthcare, and commercial adoption, with a growing focus on specialized and designer solutions. Manufacturers providing durable, ergonomic, and application-specific casters are capturing higher market share.

The demand for casters is driven by the increasing use of material handling equipment across warehouses, manufacturing units, and logistics hubs. Industries are investing in mobile storage solutions, trolleys, and carts to improve efficiency in transporting goods. Manufacturers of casters are observed to benefit from large-scale production of industrial machinery and automated systems. Lightweight and heavy-duty casters are gaining traction for their ease of installation and ability to carry significant loads. Growth in e-commerce and retail distribution centers has accelerated the requirement for smooth mobility and ergonomic designs. Market growth is expected to continue as operational efficiency becomes a higher priority among industrial players.

Casters are being adopted extensively in healthcare facilities for hospital beds, diagnostic equipment, medical carts, and patient transport trolleys. The increasing focus on patient mobility, safety, and hygiene standards has influenced the adoption of high-quality caster solutions. Medical-grade casters are gaining preference due to corrosion resistance, noise reduction, and smooth maneuverability in sensitive environments. Hospitals and clinics are actively replacing old equipment with casters designed to handle frequent movement while minimizing floor damage. This segment has shown consistent demand and is expected to remain a key driver. Manufacturers focusing on specialized caster solutions for healthcare are likely to witness higher revenue and market penetration.

Industrial and commercial sectors have witnessed significant caster integration in production floors, office environments, and retail setups. The use of casters in heavy machinery, conveyor systems, and modular furniture has increased operational flexibility. Customizable caster solutions are being favored to meet specific weight, surface, and mobility requirements. The focus on optimizing workflow and reducing manual labor has led to higher acceptance of multi-directional and locking casters. Growth in warehouses, assembly lines, and office furniture sectors has created continuous demand. Manufacturers offering durable, low-maintenance, and ergonomic caster options are positioned advantageously in the competitive landscape.

Specialty casters designed for specific surfaces, decorative purposes, or customized applications have been increasingly preferred by businesses and institutions. Aesthetic appeal, corrosion resistance, and noise reduction features are influencing procurement decisions in hospitality, laboratories, and corporate offices. The availability of casters made from polyurethane, stainless steel, and other advanced materials is attracting attention in premium applications. Market participants are encouraged to offer versatile products catering to diverse environments and requirements. Growth opportunities are visible in customized and designer solutions as businesses emphasize durability, convenience, and operational efficiency. Manufacturers investing in innovation to enhance caster performance are gaining higher adoption rates.

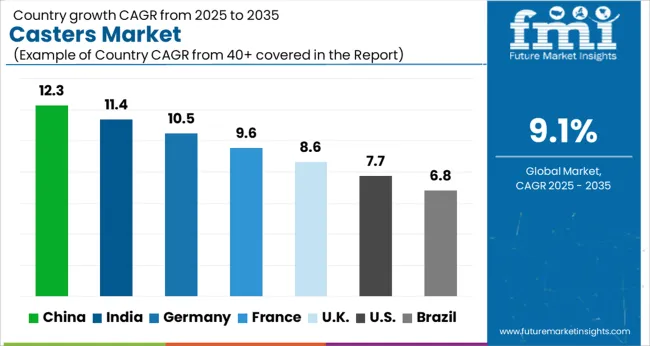

| Country | CAGR |

|---|---|

| China | 12.3% |

| India | 11.4% |

| Germany | 10.5% |

| France | 9.6% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

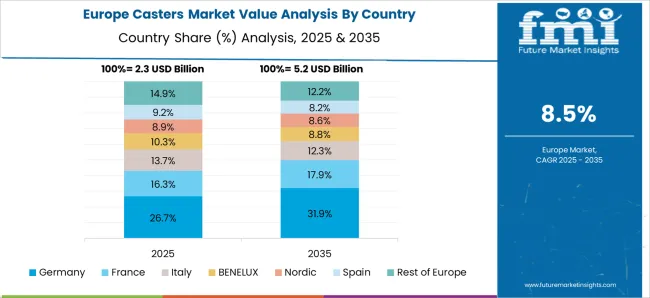

The global casters market is projected to grow at a CAGR of 9.1% from 2025 to 2035. China leads at 12.3%, followed by India at 11.4%, Germany at 10.5%, the UK at 8.6%, and the USA at 7.7%. Market expansion is being driven by rising demand in industrial, healthcare, and commercial sectors, where mobility, operational efficiency, and ergonomic handling are prioritized. Demand is increasing for heavy-duty, medical-grade, and specialty casters that support diverse applications, from trolleys and carts to machinery and hospital equipment. Manufacturers offering durable, low-maintenance, and customizable solutions are gaining higher adoption. Asia dominates due to industrial growth, while Europe and North America emphasize quality, safety, and specialized applications. The analysis includes over 40+ countries, with the leading markets detailed below.

The casters market in China is projected to grow at a CAGR of 12.3% from 2025 to 2035, driven by rapid industrial expansion, manufacturing growth, and modernization of logistics operations. Demand is increasing across warehouses, factories, hospitals, and commercial facilities where trolleys, mobile carts, and machinery require smooth mobility and long-lasting performance. Manufacturers are focusing on heavy-duty, medical-grade, and industrial casters that offer corrosion resistance, noise reduction, and ergonomic designs. E-commerce fulfillment centers and distribution networks are further driving adoption of versatile caster solutions. Domestic players are investing in advanced materials and innovative designs, while collaborations with global suppliers enhance access to specialized components.

The casters market in India is expected to grow at a CAGR of 11.4% from 2025 to 2035, supported by industrial infrastructure growth, logistics hubs, and expanding healthcare facilities. Demand is rising for trolleys, carts, and hospital beds equipped with high-performance casters offering smooth maneuverability and long service life. Manufacturers are focusing on ergonomic, heavy-duty, and durable solutions for industrial, commercial, and medical applications. Growth in e-commerce and cold-chain logistics is accelerating adoption. Domestic players are collaborating with international suppliers to integrate noise reduction features, corrosion resistance, and specialized materials. Leasing and rental options are helping SMEs access premium solutions cost-effectively.

The casters market in Germany is projected to grow at a CAGR of 10.5% from 2025 to 2035, driven by advanced manufacturing, automotive plants, and logistics sector expansion. Industrial-grade and medical-grade casters with high load-bearing capacity, precision mobility, and noise reduction features are increasingly preferred. Hospitals, laboratories, warehouses, and manufacturing floors are major end-users. Manufacturers are emphasizing high-quality materials such as polyurethane, stainless steel, and heavy-duty polymers to improve durability. Growth in modular furniture, conveyor systems, and material handling solutions is further supporting adoption. German companies are focusing on customization, quality compliance, and long-term performance, while global partnerships provide access to advanced components.

The casters market in the UK is expected to grow at a CAGR of 8.6% from 2025 to 2035, supported by rising adoption in healthcare, warehouses, and commercial environments. Specialty and heavy-duty casters are increasingly deployed in hospital beds, medical trolleys, and industrial carts. Manufacturers are focusing on corrosion-resistant, smooth-operating, and low-maintenance solutions. Expansion in e-commerce distribution centers and office infrastructure is boosting demand for ergonomic and durable caster products. Domestic players are prioritizing customization, compliance with safety standards, and long-lasting performance. Partnerships with global suppliers are enabling access to advanced materials and innovative designs to enhance operational efficiency.

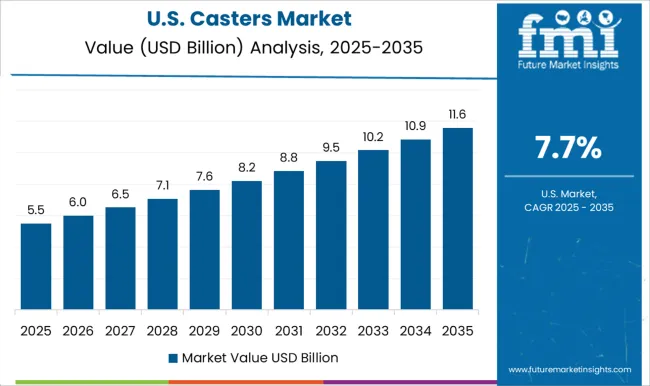

The casters market in the USA is projected to grow at a CAGR of 7.7% from 2025 to 2035, driven by industrial manufacturing, healthcare expansion, and logistics sector growth. High-performance casters for mobile equipment, carts, and trolleys are increasingly preferred due to durability, multi-directional mobility, and floor protection. Heavy-duty and ergonomic designs are gaining adoption to improve workflow efficiency and reduce operational costs. E-commerce fulfillment centers and cold-chain logistics are further accelerating demand for precision and versatile casters. Manufacturers are focusing on polyurethane, stainless steel, and advanced polymer materials to enhance lifespan and performance. Customization, safety compliance, and low-maintenance features remain critical procurement factors.

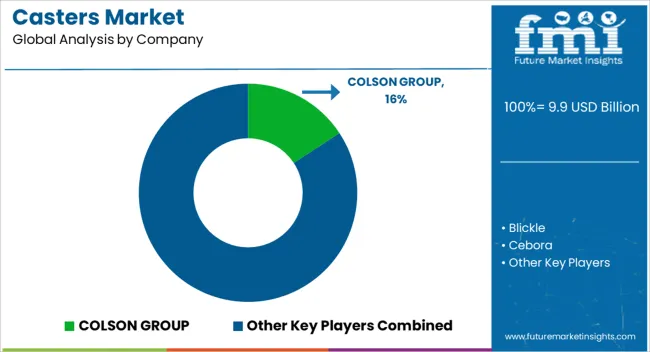

Competition in the casters market is influenced by load capacity, mobility efficiency, material durability, and operational versatility. COLSON GROUP leads with a broad portfolio of industrial and medical casters, emphasizing ergonomic design, high-load performance, and corrosion-resistant materials. Blickle differentiates through precision-engineered solutions, including heavy-duty and specialty casters for industrial floors, hospitals, and logistics hubs. Cebora and Er Wagner compete with robust, modular caster designs suited for warehouse, manufacturing, and automated material handling applications. Flywheel Metalwork and Hamilton focus on lightweight and medium-duty casters with smooth maneuverability and noise reduction for commercial and institutional environments.

Hexpol, Payson Casters, and Regal Castors are recognized for customized caster solutions, including polyurethane and stainless steel variants for healthcare, retail, and industrial applications. RWM Casters and Takigen cater to niche sectors requiring specialty load capacities and environment-specific features, while Tellure and TENTE provide modular, multi-directional, and ergonomic designs for hospitals, laboratories, and production floors. TrioPines and ZONWE emphasize innovation in material composition, load-bearing performance, and surface adaptability, targeting diverse markets from commercial furniture to automated logistics.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.9 Billion |

| Type | Swivel, Rigid/ Fixed, Ball Bearing, and Kingpin |

| Material | Metal, Rubber, Plastic, and Polyurethane |

| Load Capacity | Medium-Duty, Light-Duty, and Heavy-Duty |

| Mounting | Plate and Stem |

| Application | Industrial, Commercial, Healthcare, and Residential |

| End Use | Automotive, Aerospace, Food Industry, Medical, Textile Industry, and Other End-Users |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | COLSON GROUP, Blickle, Cebora, Er Wagner, Flywheel Metalwork, Hamilton, Hexpol, Payson Casters, Regal Castors, RWM Casters, Takigen, Tellure, TENTE, TrioPines, and ZONWE |

| Additional Attributes | Dollar sales, market share, CAGR trends, key applications, industrial and healthcare demand, competitive landscape, material preferences, price benchmarks, growth drivers, distribution channels, and regulatory standards. |

The global casters market is estimated to be valued at USD 9.9 billion in 2025.

The market size for the casters market is projected to reach USD 23.7 billion by 2035.

The casters market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in casters market are swivel, rigid/ fixed, ball bearing and kingpin.

In terms of material, metal segment to command 39.2% share in the casters market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA