The global castor oil market is expected to grow from USD 1.36 billion in 2025 to USD 1.83 billion by 2035, progressing at a compound annual growth rate (CAGR) of 3.2% over the forecast period. Market expansion is being driven by increasing demand for plant-derived ingredients in personal care, food, and pharmaceutical applications, coupled with greater reliance on bio-based raw materials for industrial uses.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.36 billion |

| Industry Value (2035F) | USD 1.83 billion |

| CAGR (2025 to 2035) | 3.2% |

In recent years, castor oil has gained significant traction across a wide spectrum of consumer and industrial products. Its natural viscosity, emollient properties, and ability to act as a carrier for active compounds have positioned it as a key input in skincare, cosmetics, and haircare formulations. The growing popularity of clean-label and naturally sourced personal care products continues to support castor oil's use in moisturizing lotions, lip balms, and shampoos. At the same time, consumer preference for chemical-free alternatives has contributed to rising demand in organic and vegan-certified beauty offerings.

In the food and nutraceuticals sector, castor oil derivatives are used in food-grade lubricants, flavoring carriers, and dietary supplements. As plant-based eating habits continue to gain popularity, castor oil's functional benefits as a natural additive are being increasingly recognized. Market participants are also responding to the shift toward food formulations free of synthetic emulsifiers and stabilizers, where castor oil-based esters offer a promising alternative.

Production-side developments have supported market availability and cost-effectiveness. Innovations in solvent-free extraction, cold pressing, and enzymatic processing have helped manufacturers improve oil recovery yields while maintaining product quality. These advancements are contributing to an improved environmental footprint for castor oil production, a factor of growing importance among corporate buyers aligning with environmentally responsible sourcing.

In industrial applications, castor oil is being integrated into the production of lubricants, resins, coatings, and plastics. Its hydroxyl functionality and renewable origin allow for chemical conversions into bio-polyols and sebacic acid, which are widely used in adhesives, flexible foams, and biodegradable polymers. Demand for these end-use segments is expected to remain stable, especially as regulations targeting fossil-derived chemicals become more prominent.

Regulatory support for green chemistry and the global shift toward resource efficiency are expected to create a favorable environment for market participants.

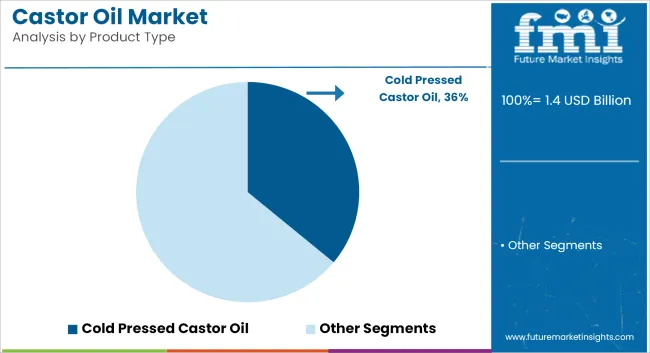

Cold pressed castor oil is projected to account for approximately 36% of the global castor oil market share in 2025 and is expected to grow at a CAGR of 3.3% through 2035. Extracted without the use of heat or chemicals, this type retains maximum nutrients and is widely used in hair oils, skincare products, massage formulations, and pharmaceutical-grade laxatives.

The segment continues to benefit from increasing demand for natural, organic, and clean-label personal care ingredients, particularly in North America and Europe. Producers are enhancing cold-press processing technologies to meet rising purity standards and secure certifications for export-grade castor oil across cosmetic and wellness markets.

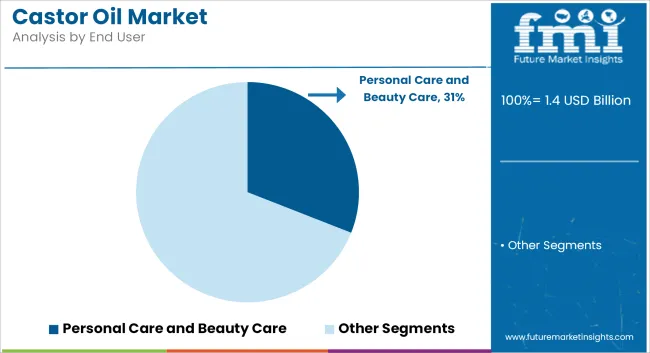

The personal care and beauty care segment is estimated to hold approximately 31% of the global castor oil market share in 2025 and is projected to grow at a CAGR of 3.4% through 2035. Castor oil is valued for its emollient, anti-inflammatory, and antimicrobial properties, making it a common base or active ingredient in products such as lip balms, moisturizers, and scalp treatments.

As consumer interest in botanical and multi-functional cosmetic ingredients increases, brands are incorporating castor oil into vegan, sulfate-free, and paraben-free product lines. Demand is particularly robust in Asia-Pacific and North America where grooming routines and DIY personal care trends continue to expand. With formulators exploring sustainable and biodegradable oils, castor oil remains a preferred plant-derived ingredient in the beauty and wellness industry.

In the Castor Oil industry, executives should focus on enhancing production processes to improve efficiency and reduce costs. This can be achieved particularly by adopting advanced extraction technologies. The integration of sustainable practices, such as using renewable energy in production and eco-friendly packaging, will be key differentiators as consumer preference shifts toward sustainable products. Companies must also stay ahead of regulatory pressures by ensuring compliance with evolving environmental and safety standards.

Strategic partnerships with agribusiness firms in key castor oil-producing regions like India, Brazil, and Africa will be crucial for securing a steady supply chain. Strengthening relationships with end-user industries, including cosmetics, pharmaceuticals, and biodiesel, will open new avenues for growth. Investing in emerging industry such as Southeast Asia and Africa, where demand for castor oil is increasing, will help position firms for long-term success in a competitive landscape.

The industry faces key risks, including fluctuations in raw material prices due to crop yields and climate conditions, which pose a high impact and medium probability. This requires careful inventory and price management.

Supply chain disruptions, with a medium probability, could affect production timelines, demanding effective risk mitigation strategies. To address these challenges, the company plans to invest in climate-resilient farming practices, collaborate with global partners, and diversify its sourcing strategies to reduce dependency on single industries.

Future Market Insights (FMI) conducted a comprehensive survey with industry stakeholders to identify emerging trends and challenges in the industry. According to the findings, 63% of stakeholders believe that innovation in product development will drive the future growth of the industry.

Among these, 48% emphasized the importance of integrating digital technologies to enhance product offerings and operational efficiency. Additionally, 45% of respondents pointed out that sustainable practices are becoming a critical factor in shaping consumer preferences, with a growing demand for eco-friendly solutions.

The survey also highlighted that 57% of stakeholders are prioritizing investments in research and development to remain competitive and cater to changing industry dynamics. Furthermore, 64% identified regulatory compliance as a significant challenge, with evolving environmental standards pushing companies to adapt their processes and products accordingly.

In terms of industry outlook, 72% of stakeholders are optimistic about future growth, particularly in emerging regions such as Asia-Pacific and Latin America. The majority (68%) are focusing their expansion strategies on these high-growth industry to tap into rising consumer demand.

However, 59% of respondents expressed concerns over supply chain disruptions, with geopolitical factors and transportation delays being the primary sources of uncertainty. As a result, 51% of stakeholders are looking to diversify their supply chains and reduce dependence on single regions. Overall, the survey highlights a strong drive towards digitalization, sustainability, and industry expansion, while underscoring the need for resilience in addressing operational challenges.

| Country | Policies and Regulations |

|---|---|

| United States | In the USA, the castor oil industry is influenced by the Food and Drug Administration (FDA), which oversees product safety, particularly for use in cosmetics and pharmaceuticals. The Environmental Protection Agency (EPA) regulates the environmental impact of castor oil production, especially regarding waste disposal and emissions. The industry must adhere to the Fair Packaging and Labeling Act, ensuring that castor oil products meet labeling and safety standards. Additionally, USDA Organic certification is often required for organic castor oil producers as per FDA EPA. |

| United Kingdom | The UK follows similar regulations to the EU, with the Food Standards Agency (FSA) overseeing the use of castor oil in food products. The Health and Safety Executive (HSE) enforces workplace safety regulations, especially in manufacturing processes. Organic certification, particularly from the Soil Association, is vital for products market ed as organic. The UK government also mandates that companies comply with environmental regulations related to production practices as per FSA. |

| France | In France, the regulatory landscape for castor oil is shaped by the European Union’s regulations, particularly concerning food safety and cosmetic products. The French Agency for Food, Environmental, and Occupational Health Safety (ANSES) is responsible for regulating castor oil used in consumer goods. Companies must also comply with the EU’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations to ensure product safety in cosmetics and pharmaceuticals as per ANSES. |

| Germany | Germany has strict environmental and safety regulations in place. The Federal Institute for Risk Assessment ( BfR ) governs the use of castor oil in food and pharmaceuticals. The German Federal Environment Agency enforces regulations related to the production process to minimize environmental harm. Castor oil producers need to meet EU organic certification standards, and any products used in cosmetics must adhere to the EU Cosmetics Regulation (EC 1223/2009) as per BfR Ge rman Federal Environment Agency. |

| Italy | Italy's castor oil industry is regulated by both EU-wide policies and national regulations. The Ministry of Health ensures the safe use of castor oil in cosmetics and pharmaceuticals, while the Ministry for the Environment oversees the environmental impact of production. Certification from organizations like the Italian Organic Association (ICEA) is important for organic castor oil producers as per Ministry of Health (www.salute.gov.it ), Ministry for the Environment. |

| South Korea | South Korea's Ministry of Food and Drug Safety (MFDS) is responsible for regulating castor oil used in cosmetics, pharmaceuticals, and food products. The country also follows stringent environmental standards, managed by the Ministry of Environment. Organic certification from the Korean Agency for Technology and Standards (KATS) is required for organic castor oil. In addition, South Korea’s Fair Trade Commission ensures that market ing and labeling are accurate and truthful as per MFDS (www.mfds.go.kr), Ministry of Env ironment. |

| Japan | In Japan, the Ministry of Health, Labour, and Welfare (MHLW) regulates the safety of castor oil for use in food, pharmaceuticals, and cosmetics. The Japan Agricultural Standards (JAS) certifies organic products, and companies must comply with the Food Sanitation Act for food-related applications. Environmental regulations on the production process are enforced by the Ministry of the Environment, which ensures minimal environmental impact as per MHLW, Ministry of Environment. |

| China | China’s industry is governed by several regulatory bodies, including the State Administration for Industry Regulation (SAMR) and the China Food and Drug Administration (CFDA). These agencies ensure that castor oil used in food, pharmaceuticals, and cosmetics meets safety standards. The China National Certification and Accreditation Administration (CNCA) oversees organic certification. Environmental regulations are becoming stricter, with the government pushing for more sustainable production practices as per SAMR (www.samr.gov.cn), CFDA. |

| Australia-New Zealand | In Australia and New Zealand, the castor oil industry is regulated by Food Standards Australia New Zealand (FSANZ) for food-grade products. The Therapeutic Goods Administration (TGA) oversees the safety of castor oil used in pharmaceuticals, while the Australian Pesticides and Veterinary Medicines Authority (APVMA) regulates any chemical use during production. Organic certification from Australian Certified Organic (ACO) is important for organic castor oil products. Both countries also have strict environmental regulations under the Environmental Protection Agencies as per FSANZ, TGA , APVMA |

Sales in the United States are anticipated to grow at a CAGR of 3.5% from 2025 to 2035. The USA, being one of the largest industries for castor oil, particularly in the personal care, pharmaceutical, and food sectors, shows strong growth potential. The increasing demand for organic and natural products in cosmetics and wellness products is a major factor driving this growth.

Additionally, with the growing trend of plant-based and natural alternatives in healthcare and beauty industries, the USA industry will continue to see robust demand for castor oil. Investments in research and development are likely to further fuel the sector’s expansion, ensuring its dominance in the global industry.

The industry in the United Kingdom is anticipated to grow at a CAGR of 3.0% from 2025 to 2035. The UK industry for castor oil is growing steadily, driven by the increasing preference for natural ingredients in the beauty and skincare industries. With the rise of organic and sustainable beauty products, castor oil has gained popularity as an essential ingredient.

The growing awareness of plant-based health alternatives in pharmaceuticals and personal care products supports steady demand. Furthermore, regulatory policies encouraging eco-friendly ingredients and formulations contribute to the potential of the UK industry to maintain steady growth in the forecast period.

Sales in France are anticipated to grow at a CAGR of 3.1% from 2025 to 2035. France, with its strong presence in the luxury and natural beauty segments, is a growing industry for castor oil. The demand for organic, eco-friendly, and cruelty-free products in skincare and haircare is increasing, especially in urban areas.

Castor oil is used extensively in the formulation of natural cosmetics, which continues to gain consumer attention. As the French industry shifts towards sustainable and health-conscious options, the growth of castor oil in the beauty, pharmaceutical, and food sectors will continue, reflecting the industry’s growing preference for clean and ethical products.

In Germany sales are anticipated to grow at a CAGR of 2.9% from 2025 to 2035. As one of the largest economies in Europe, Germany's industry for castor oil shows steady growth. The increasing demand for sustainable and organic products in the personal care and pharmaceutical industries supports this.

Germany has a strong regulatory framework that encourages the use of natural and eco-friendly ingredients, particularly in cosmetics and pharmaceuticals. Castor oil is increasingly used as a natural alternative in the healthcare sector for various treatments. Despite its steady growth, the industry faces competition from other natural oils and synthetic ingredients, which may impact its overall expansion.

The industry in Italy is anticipated to grow at a CAGR of 3.0% from 2025 to 2035. Italy’s industry for castor oil is supported by the rising demand for natural products in cosmetics, skincare, and personal care. The Italian beauty industry is embracing clean beauty, and castor oil is a key ingredient due to its moisturizing and rejuvenating properties.

The pharmaceutical sector is also expanding as consumers seek plant-based alternatives in over-the-counter medications. With Italy's long-standing focus on organic products and sustainability in its food and cosmetic sectors, the castor oil industry is well-positioned to grow steadily in the coming years.

Sales in South Korea are anticipated to grow at a CAGR of 4.0% from 2025 to 2035. South Korea’s rapidly expanding beauty and skincare industry plays a pivotal role in driving the growth of castor oil. The demand for natural ingredients in cosmetics is particularly high, as consumers seek effective, eco-friendly, and cruelty-free products.

The growing focus on haircare, skin rejuvenation, and wellness products in South Korea positions castor oil as a popular ingredient. Moreover, increasing awareness of natural health solutions, coupled with an active beauty influencer industry, will help accelerate the demand for castor oil in the region, ensuring strong industry growth.

The industry in Japan is anticipated to grow at a CAGR of 3.2% from 2025 to 2035. Japan's demand for castor oil is largely driven by its use in cosmetics, pharmaceuticals, and personal care products. The Japanese consumer industry values high-quality, natural ingredients, especially in skincare.

Castor oil’s effectiveness in hair and skin care products enhances its appeal. Additionally, Japan’s aging population is likely to increase the demand for pharmaceutical-grade castor oil used in medicinal and wellness products. As consumer preferences shift toward natural and organic ingredients, the Japanese industry will continue to grow, contributing significantly to the overall industry expansion.

In China sales are anticipated to grow at a CAGR of 4.5% from 2025 to 2035. China’s industry for castor oil is experiencing rapid growth, driven by rising consumer awareness of health, beauty, and wellness products. The increasing demand for organic and natural ingredients in cosmetics, combined with growing pharmaceutical needs, has spurred castor oil adoption.

The demand for personal care products in China is growing, particularly in the skincare and haircare categories, where castor oil is a key ingredient. Additionally, the expanding e-commerce industry and the growing middle class provide a promising outlook for castor oil’s future growth in China.

In Australia and New Zealand sector is anticipated to grow at a CAGR of 3.3% from 2025 to 2035. The demand for castor oil in Australia and New Zealand is largely driven by the increasing preference for natural, organic, and environmentally friendly products.

The beauty and personal care sectors in both countries are focused on clean, sustainable ingredients, with castor oil being a staple for haircare and skin treatments. Additionally, the growing consumer interest in plant-based alternatives in healthcare and the rising trend of wellness and self-care contribute to the growth of castor oil in these industries. The industry will continue to thrive with a strong demand for high-quality, ethically sourced products.

The castor oil market is advancing strategically in response to growing consumer demand for sustainable, plant-based products. Innovative castor oil-based products are being launched, particularly in the beauty and personal care sectors, to meet the rising preference for organic solutions. Concurrently, public-private initiatives are strengthening the castor oil value chain through investments in seed distribution, farmer training, and agro-processing, especially in arid regions.

The industry is segmented into cold pressed castor oil, hydrogenated castor Oil, jamaicanblack castor oil, dehydrated castor oil and others

Theindustry is divided into pharmaceuticals, personal care and beauty care, lubricants, paints and varnishes, food & beverages, animal feed and others

Theindustry is segmented into direct distribution, hypermarket/supermarket, convenience stores, traditional grocery stores, pharmacies & drug stores, discount stores, specialty stores and online retail

Theindustry is studied across North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa

The global castor oil industry is expected to reach USD 1.83 billion by 2035.

Rising demand for natural ingredients in cosmetics, personal care, and food products fueled the industry's growth in 2024.

New extraction technologies have improved production efficiency and reduced costs in the castor oil industry.

Emerging industries like Southeast Asia and Africa are key regions driving future industry growth.

Strategic partnerships with agribusiness firms and expanding ties with end-user industries are crucial for success.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Castor Oil Polyol Market Size and Share Forecast Outlook 2025 to 2035

Castor Oil-Based Biopolymer Market Size and Share Forecast Outlook 2025 to 2035

Castor Oil Derivatives Market Growth - Trends & Forecast 2025 to 2035

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA