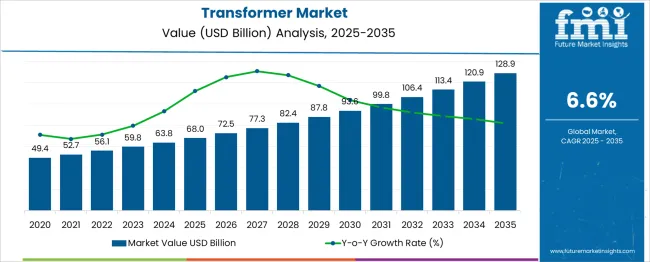

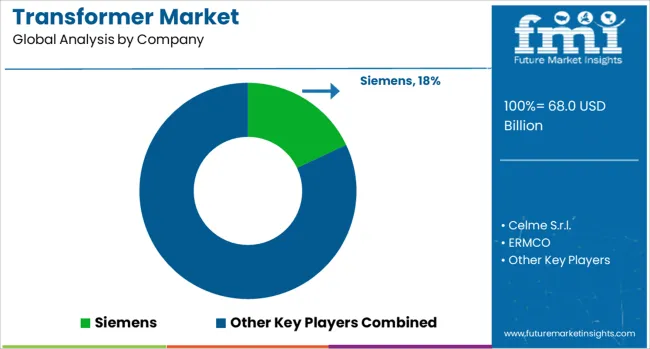

The Transformer Market is estimated to be valued at USD 68.0 billion in 2025 and is projected to reach USD 128.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period. Breakpoint analysis identifies demand acceleration thresholds and maturity plateaus across the decade.

The first observable breakpoint occurs between 2027 and 2028, where the market size crosses USD 82.4 billion to USD 87.8 billion. This marks a shift from incremental upgrades to grid-scale retrofits in key regions driven by regional interconnection projects and smart substation initiatives. Growth between 2025 and 2027 averages 6.7%, whereas the CAGR from 2027 to 2030 rises slightly to 7.1%, indicating the onset of an equipment refresh cycle. A second critical breakpoint appears post-2030, as the market exceeds the USD 100 billion threshold. This phase captures volume adoption of digital transformers and deployment in large-scale renewable integration zones, particularly in coastal and semi-urban corridors. The CAGR from 2030 to 2035 holds at 6.4%, reflecting growth moderation from base saturation, but total value gains remain strong. The decade-long multiplying factor stands at 1.89×, illustrating consistent value buildup. These breakpoints confirm a pattern of mid-decade acceleration followed by stabilization as grid modernization becomes standardized across utility procurement programs.

| Metric | Value |

|---|---|

| Transformer Market Estimated Value in (2025 E) | USD 68.0 billion |

| Transformer Market Forecast Value in (2035 F) | USD 128.9 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

Distribution transformers account for approximately 60% of the combined power and distribution transformer market, reflecting widespread deployment in grid infrastructure. Power transformers make up the remaining 40%, serving high-voltage transmission and generation tie-ins. Within system types, three-phase transformers hold about 70% of the market, while single-phase units comprise around 30%. Among insulation-cut types in the distribution segment, oil-immersed transformers hold roughly 60–62%, and dry-type units make up about 38–40%, favored in safer indoor environments.

By application in the distribution domain, utilities consume nearly 50%, industries account for approximately 45%, and residential/commercial users make up the rest. In mounting types, pad mounted transformers represent close to 60%, pole mounted lines at 30%, and underground vault setups offer around 10% of deployment share. Growth is being driven by ongoing utility electrification initiatives, grid modernization programs, and renewable energy integration across emerging and mature markets. Smart grid adoption is spurring deployment of transformers embedded with IoT sensors and condition monitoring tools to enable predictive maintenance. Material advancements are introducing amorphous core and low-loss steel to reduce energy waste and meet efficiency standards. Lead times are extending due to complex manufacturing cycles and constrained supply chains, often exceeding two years for custom high-voltage designs. Regional diversification of sourcing and investments in localized manufacturing are gaining traction to reduce dependency risks. Compact modular transformers optimized for urban and underground networks are also emerging alongside solid-state transformer prototypes for future-proof power distribution infrastructure.

The transformer market is witnessing steady growth driven by the global push toward grid modernization, electrification of industry, and the integration of renewable energy sources. Expanding urban infrastructure and rising electricity demand across developing economies have accelerated investments in power transmission and distribution networks.

Favorable government regulations and funding for smart grid development have encouraged upgrades to existing transformers for greater efficiency and reliability. Technological advancements, such as digital monitoring systems and insulation materials, are enhancing transformer performance while reducing lifecycle costs.

As power utilities prioritize grid stability, efficiency, and emission reduction, the market for high-performance, application-specific transformers continues to expand across sectors including power generation, manufacturing, railways, and data centers.

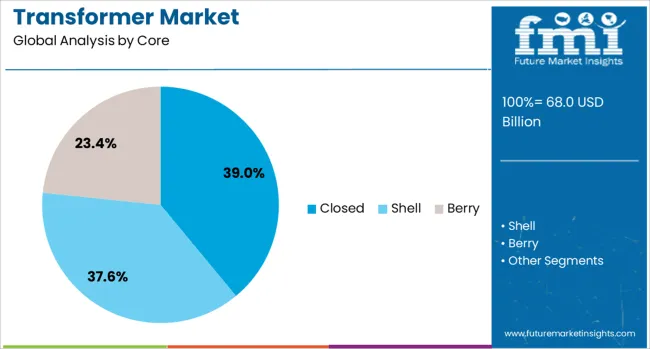

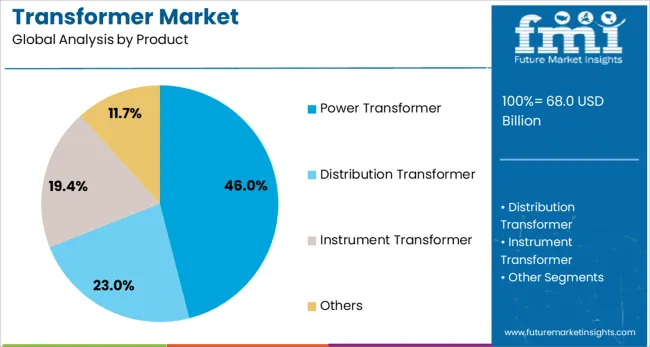

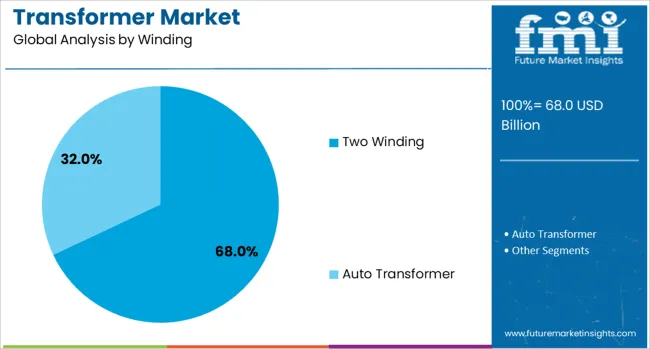

The transformer market is segmented by core, product, winding, cooling, insulation, application, and geographic regions. The core of the transformer market is divided into Closed, Shell, and Berry. In terms of the product, the transformer market is classified into Power Transformer, Distribution Transformer, Instrument Transformer, and Others. Based on winding, the transformer market is segmented into two-winding and Auto transformers. The transformer market is segmented by cooling type into Oil Immersed and Dry Type. The transformer market is segmented into Oil, Gas, Solid, Air, and Others. The transformer market is segmented into Utility, Residential, and Commercial & Industrial. Regionally, the transformer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Closed core transformers are expected to contribute 39.0% of the total transformer market revenue by 2025, making them the leading core type. Their popularity stems from superior magnetic flux containment and higher efficiency in both step-up and step-down applications.

These transformers are particularly suitable for medium to high-voltage transmission systems where energy loss minimization is critical. The closed design reduces leakage flux and noise while providing better mechanical strength, which is essential for environments with space constraints or operational stress.

As smart grid initiatives continue to scale globally, the demand for compact and efficient core designs like closed core transformers is expected to grow steadily.

Power transformers are forecast to hold a 46.0% share of the transformer market by 2025, dominating the product segment. Their widespread deployment in large-scale power transmission and grid infrastructure projects underlines their critical role in voltage regulation and long-distance energy delivery.

As national grids expand to accommodate growing renewable energy input and industrial consumption, high-capacity power transformers are increasingly favored.

Innovations in oil-immersed cooling, on-load tap changers, and real-time diagnostic systems are further enhancing reliability and lifespan, making power transformers a strategic investment for utility operators and grid integrators.

The two winding transformer segment is projected to lead with a 68.0% market share in 2025. These transformers are commonly used in applications requiring electrical isolation between primary and secondary circuits.

Their robust design, cost-effectiveness, and suitability for standard voltage transformation tasks have ensured their dominance in distribution networks, substations, and industrial machinery. As industries prioritize safety and load balancing, the adoption of two winding transformers continues to rise across medium-voltage and high-voltage systems.

Their compatibility with both conventional and smart transformers further reinforces their value in grid reliability and efficiency improvement strategies.

Global demand for electrical transformers has surged due to rising infrastructure modernization, renewable integration, and grid resilience needs. Both distribution and power transformers are being upgraded to support smart grid deployments, renewable interconnections, microgrids, and increased load density. Innovation in high-efficiency cores, compact dry-type units, and modular designs is being adopted to reduce losses, space usage, and installation time. Electrification of mobility, data centers, and industrial automation continues to broaden transformer deployment. Utilities, commercial real estate, and industrial sectors are accelerating order volumes to support digital grid flexibility.

Expansion of renewable energy assets—such as wind farms and solar parks—has intensified demand for transformers with low loss, rapid responsiveness, and high reliability. Distribution transformers are being retrofitted to manage two-way power flows and accommodate interconnection of rooftop PV, EV charging farms, and battery storage systems. Substation upgrades are enabling smart grid control, requiring transformers with integrated sensors and remote diagnostics. Aging power networks in developed economies are undergoing transformer replacements to ensure compliance with efficiency regulations. Microgrid deployments in resilient campuses and industrial estates are also catalyzing demand for compact, high-performance units that support islanding and low-voltage integration.

Recent innovations in transformer design feature amorphous steel cores, vacuum-impregnated windings, and synthetic ester fluids to reduce no-load and load losses. Dry-type transformers with cast resin insulation have expanded usage in indoor and confined spaces due to fire safety advantages. Modular transformer units with plug-and-play connectors are gaining ground in data centers and modular buildings to simplify installation and scalability. Sensors integrated into transformers are enabling condition-based maintenance and remote load monitoring. These developments have improved energy efficiency by up to 10% relative to older units and have shortened deployment timelines. Collaboration across OEMs, suppliers, and utilities has facilitated faster qualification and broad adoption, especially in retrofit and automation-driven environments.

Transformer procurement is affected by raw material cost volatility—especially copper, silicon steel, and insulation materials—leading to fluctuating pricing for utilities and contractors. Tight supply chains have resulted from concentrated manufacturing locations and COVID-era disruptions, impacting project delivery schedules. Compliance with evolving standards—for example IEC, IEEE, and NEMA regulations—mandates extensive testing for loss, noise, short-circuit withstand, and thermal performance. Certification cycles, particularly for grid-interconnected products, extend lead times. High inventory requirements and specialized transport logistics for large transformers increase project complexity. Smaller utilities and EPC firms often face hurdles in qualifying local vendors or meeting testing protocols for high-performance units in developing markets.

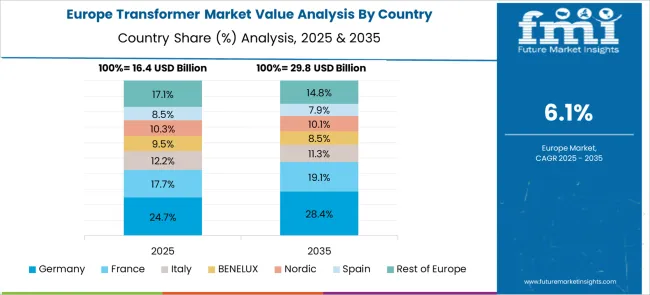

Transformer demand exhibits distinct regional patterns: Asia-Pacific leads installed capacity volumes, fueled by rapid electrification and urban infrastructure build out. North America and Europe prioritize replacement of legacy units to meet efficiency mandates and support distributed energy resources. Middle East and Latin America deployments are linked to grid expansion and industrial park electrification. Segment-wise, distribution transformers dominate volume share, while grid-scale power transformers support transmission interconnections for renewables. Demand is rising for pad-mounted, underground, and mobile transformers in urban and utility environments. Growth in modular construction, EV charging hubs, and renewable-rich campuses is expanding opportunities for compact and fast-deployable transformer solutions across global markets.

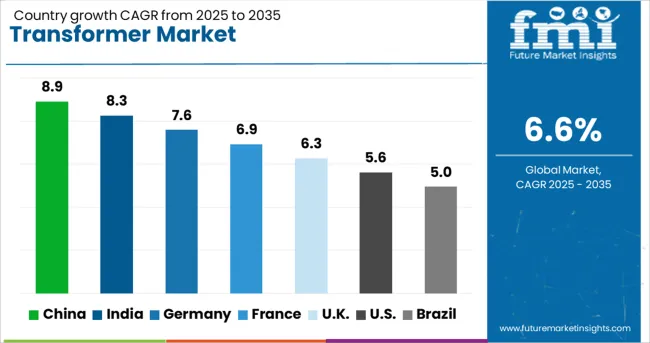

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

The global transformer market is projected to grow at a CAGR of 6.6% from 2025 to 2035. China leads with 8.9%, outpacing the global average by 35%, followed by India at 8.3% and Germany at 7.6%, indicating deviations of 26% and 15% respectively. The United Kingdom's CAGR of 6.3% sits slightly below the global benchmark, while the United States trails at 5.6%. China and India are expanding capacity to support grid modernization and utility-scale renewable integration. Germany’s demand is led by industrial retrofits and cross-border grid stabilization under EU mandates. The UK and US show more measured growth driven by replacement cycles and partial upgrades. Among ASEAN members, growth remains uneven, while OECD nations prioritize digital monitoring and high-efficiency transformers.

China's transformer market is projected to grow at a CAGR of 8.9%, which is 35% higher than the global average. Expansion of ultra-high-voltage (UHV) lines and decentralized renewable generation has accelerated procurement of both power and distribution transformers. National policy targets for clean energy and electric mobility have contributed to double-digit order volume increases. Leading domestic producers have been expanding output for gas-insulated and dry-type units to serve urban and coastal grid expansions.

The transformer market in the United Kingdom is set to grow at a CAGR of 6.3%, 5% below the global rate. Growth is supported by the gradual shift from oil-immersed to dry-type and cast resin transformers across residential and commercial networks. Electric vehicle charging infrastructure rollouts have increased localized transformer installations, particularly near transport corridors. However, rising equipment costs and skilled labor shortages have delayed several planned substation upgrades.

India’s transformer market is expected to grow at a CAGR of 8.3%, 26% above the global trend. Load balancing challenges in rural networks and state-sponsored electrification programs are driving transformer deployment in both high- and low-voltage segments. Growing industrial parks and metro rail expansion are generating consistent demand for compact substation solutions. Joint ventures with Japanese and European firms have facilitated localized manufacturing of smart transformer modules.

Germany is projected to expand its transformer market at a CAGR of 7.6%, exceeding the global rate by 15%. Grid digitalization under the Energiewende strategy and increasing electrification of heat and transport have generated consistent demand for automation-compatible transformer models. Utility-scale replacements are underway for aging infrastructure, particularly in East German states. Efficiency upgrades and real-time condition monitoring are being prioritized across public sector tenders.

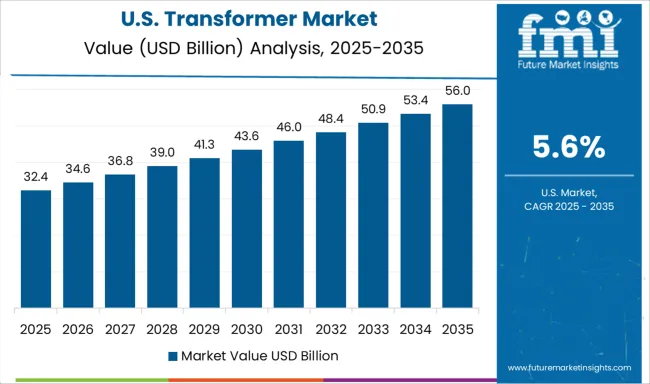

The United States is forecast to register a CAGR of 5.6%, 15% below the global average. Upgrades in aging grid infrastructure and federal incentives under the IIJA have triggered transformer purchases among municipal utilities and co-ops. However, long lead times for large power transformers and reliance on imported core steel have limited scale. Demand remains steady in data centers, renewables, and electric mobility sectors, yet pricing volatility affects budget planning.

Siemens remains a global leader in the transformer market, offering a full range of distribution and power transformers with digital monitoring capabilities designed for utilities, industrial plants, and renewable integration. Celme S.r.l. specializes in oil-immersed and dry-type transformers for mid-voltage applications, with custom-built units tailored for infrastructure and substation upgrades.

ERMCO supplies distribution transformers across North America, focusing on compact, high-efficiency models for electric cooperatives and municipal utilities. Elsewedy Electric manufactures a broad portfolio of transformers suited for grid expansion and industrial electrification in the Middle East and Africa. Eaton Corporation delivers medium-voltage transformers integrated with switchgear and power management systems, often deployed in commercial and institutional buildings.

General Electric supports large-scale power grid infrastructure with transmission transformers, emphasizing modular designs for simplified installation. Hitec Products, Inc. focuses on critical power systems, offering transformers paired with rotary UPS for data centers and defense applications. Hitachi Energy Ltd. and ABB provide advanced high-voltage transformers for transmission networks, including digitally enabled and eco-efficient models.

Hammond Power Solutions offers dry-type transformers for OEMs and commercial facilities. HYOSUNG HEAVY INDUSTRIES, Mitsubishi Electric Corporation, Toshiba Energy Systems & Solutions Corporation, ORMAZABAL, Voltamp, and Power Transformers, Inc. supply regional and global markets with both standard and application-specific transformer units designed for reliability, grid stability, and compact installations.

Manufacturers invested in regional production to address critical delivery delays, with lead times for large units often exceeding 24 months.

Demand for dry-type and digital transformers rose due to safety and monitoring advantages in renewable and industrial applications. High-voltage transformer orders surged in response to transmission infrastructure upgrades. Workforce and core material constraints remained challenges across North America, Europe, and parts of Asia.

| Item | Value |

|---|---|

| Quantitative Units | USD 68.0 Billion |

| Core | Closed, Shell, and Berry |

| Product | Power Transformer, Distribution Transformer, Instrument Transformer, and Others |

| Winding | Two Winding and Auto Transformer |

| Cooling | Oil Immersed and Dry Type |

| Insulation | Oil, Gas, Solid, Air, and Others |

| Application | Utility, Residential, and Commercial & Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens, Celme S.r.l., ERMCO, Elsewedy Electric, Eaton Corporation, General Electric, Hitec Products, Inc., Hitachi Energy Ltd., Hammond Power Solutions, HYOSUNG HEAVY INDUSTRIES, Mitsubishi Electric Corporation, ORMAZABAL, Power Transformers, Inc., ABB, Toshiba Energy Systems & Solutions Corporation, and Voltamp |

| Additional Attributes | Dollar sales by transformer type (power, distribution, instrument), end-use (utilities, industries, renewables), demand dynamics in grid modernization and T&D infrastructure, regional dominance in Asia‑Pacific, innovation in solid‑state and amorphous core designs, environmental impact of oil leakage and material recycling, and emerging use cases in offshore wind integration and electric vehicle charging networks. |

The global transformer market is estimated to be valued at USD 68.0 billion in 2025.

The market size for the transformer market is projected to reach USD 128.9 billion by 2035.

The transformer market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in transformer market are closed, shell and berry.

In terms of product, power transformer segment to command 46.0% share in the transformer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transformer Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

Transformer Valve Market Size and Share Forecast Outlook 2025 to 2035

Transformer Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Transformer Containment Bags Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Transformer Insulation Market Size and Share Forecast Outlook 2025 to 2035

Transformer Component Market Size and Share Forecast Outlook 2025 to 2035

Transformer Spare Parts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Transformer Oil Market Growth - Trends & Forecast 2025 to 2035

Transformer Tap Changers and Voltage Control Relay Market Growth – Trends & Forecast 2025 to 2035

Transformer Bobbin Market

Transformer Testing Equipment Market

Green Transformer Market Growth – Trends & Forecast 2025 to 2035

Power Transformer Market Growth – Trends & Forecast 2024 to 2034

Train Transformer Market

Signal Transformer Market

Dry Type Transformer Market Size and Share Forecast Outlook 2025 to 2035

Biobased Transformer Oil Market

Traction Transformer Market

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Converter Transformer Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA