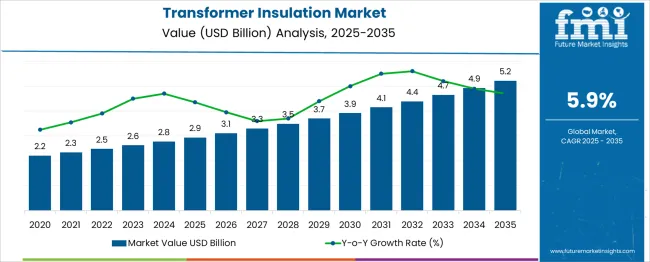

The global transformer insulation market is projected to expand from USD 2.9 billion in 2025 to approximately USD 5.2 billion by 2035, recording an absolute increase of USD 2.3 billion over the forecast period. This translates into a total growth of 79.5%, with the market forecast to expand at a CAGR of 5.9% between 2025 and 2035. The overall market size is expected to grow by nearly 1.8X during the same period, supported by increasing investments in electrical grid infrastructure, rising demand for renewable energy integration, and growing focus on power transmission efficiency and reliability.

Between 2025 and 2030, the transformer insulation market is projected to expand from USD 2.9 billion to USD 4.1 billion, resulting in a value increase of USD 1.2 billion, which represents 52.2% of the total forecast growth for the decade. This phase of growth will be shaped by accelerating power infrastructure development, increasing adoption of smart grid technologies, and growing penetration of renewable energy systems requiring advanced transformer solutions. Electrical equipment manufacturers are expanding their insulation product portfolios to address the growing demand for high-performance, environmentally renewable insulation materials.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2.9 billion |

| Forecast Value in (2035F) | USD 5.2 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

From 2030 to 2035, the market is forecast to grow from USD 4.1 billion to USD 5.2 billion, adding another USD 1.1 billion, which constitutes 47.8% of the overall ten-year expansion. This period is expected to be characterized by expansion of renewable energy infrastructure, integration of advanced insulation materials with enhanced thermal and electrical properties, and development of eco-friendly insulation solutions. The growing adoption of biodegradable insulation fluids and advanced solid insulation materials will drive demand for premium transformer insulation products with improved performance and environmental profiles.

Between 2020 and 2025, the transformer insulation market experienced steady expansion, driven by increasing global electricity demand and growing investments in power transmission infrastructure. The market developed as utilities and electrical equipment manufacturers recognized the need for reliable insulation systems to ensure transformer longevity and operational efficiency. Government initiatives promoting grid modernization and renewable energy integration began emphasizing the importance of advanced insulation materials in maintaining electrical system reliability and performance.

Market expansion is being supported by the increasing global demand for electrical energy and the corresponding need for efficient power transmission and distribution infrastructure. Modern power systems require advanced insulation materials that can withstand higher voltages, extreme temperatures, and environmental stresses while maintaining long-term reliability. The growing integration of renewable energy sources necessitates sophisticated transformer systems with superior insulation properties to handle variable power generation and grid stability challenges.

The rising emphasis on grid modernization and smart grid technologies is driving demand for high-performance insulation materials that can support advanced transformer designs. Utilities worldwide are investing in infrastructure upgrades to improve system reliability, reduce transmission losses, and accommodate distributed energy resources. The increasing focus on environmental consciousness

is also creating opportunities for biodegradable and eco-friendly insulation materials that meet stringent environmental regulations while delivering superior electrical performance.

The market is segmented by material, and region. By material type, the market is divided into liquid insulation materials, solid insulation materials, gaseous insulation, and others. Regionally, the market is divided into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

The liquid insulation materials segment is projected to account for 47.8% of the transformer insulation market in 2025, reaffirming its position as the category's dominant material type. Liquid insulation materials, primarily mineral oil and synthetic fluids, provide excellent dielectric properties, heat dissipation capabilities, and cost-effectiveness for large power transformers. These materials offer superior cooling performance and electrical insulation characteristics, making them essential for high-voltage transformer applications where thermal management is critical.

This segment forms the foundation of most transformer designs, as it represents the most established and proven insulation technology for large-scale electrical equipment. Ongoing development of biodegradable and fire-resistant liquid insulators continues to strengthen the segment's appeal among environmentally conscious utilities. With increasing power transmission requirements and transformer capacity expansion, liquid insulation materials align with both performance and economic optimization goals, ensuring dominance in the transformer insulation market.

The transformer insulation market is advancing steadily due to increasing global electricity demand and growing investments in power infrastructure development. However, the market faces challenges including raw material price volatility, environmental regulations on traditional insulation materials, and competition from alternative transformer technologies. Innovation in eco-friendly insulation materials and advanced manufacturing processes continue to influence product development and market expansion patterns.

The expanding deployment of renewable energy sources is creating significant demand for transformer insulation materials capable of supporting variable power generation and grid integration challenges. Wind and solar power installations require specialized transformers with advanced insulation systems to handle fluctuating electrical loads and maintain system stability. This trend is driving innovation in insulation material design and performance optimization.

Aging electrical infrastructure in developed countries and rapid urbanization in emerging markets are driving substantial investments in transformer insulation materials. Utilities worldwide are upgrading their transformer fleets to improve efficiency, reliability, and capacity. Modern insulation materials offer enhanced performance characteristics and longer service life, reducing maintenance costs and improving system reliability.

Increasing environmental awareness and stricter regulations on traditional insulation materials are driving demand for eco-friendly alternatives. Biodegradable insulation fluids and recyclable solid insulation materials are gaining popularity as utilities seek to reduce their environmental footprint. This trend is creating opportunities for innovative insulation material manufacturers to develop renewable solutions.

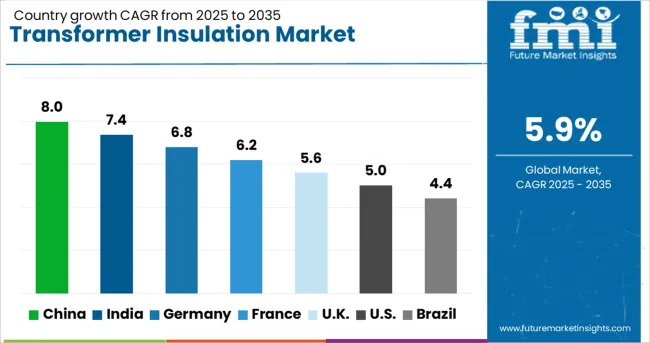

| Country | CAGR (2025-2035) |

|---|---|

| China | 8% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5% |

| Brazil | 4.4% |

The transformer insulation market is experiencing robust growth globally, with China leading at an 8 % CAGR through 2035, driven by massive infrastructure investments, renewable energy deployment, and industrial expansion. India follows at 7.4%, supported by electricity access programs, grid modernization, and manufacturing growth. Germany shows steady growth at 6.8%, emphasizing energy transition and infrastructure upgrades. France records 6.2%, focusing on nuclear power infrastructure maintenance and renewable energy integration. The UK shows 5.6% growth, prioritizing grid modernization and offshore wind development. The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

Revenue from transformer insulation materials in China is projected to exhibit strong growth with a CAGR of 8 % through 2035, driven by the country's massive investments in electrical infrastructure and renewable energy deployment. China's commitment to carbon neutrality and clean energy transition creates substantial demand for advanced transformer systems with high-performance insulation materials. The country's expanding urban population and industrial development require extensive power transmission and distribution infrastructure.

Revenue from transformer insulation materials in India is expanding at a CAGR of 7.4%, supported by ambitious electrification programs, industrial growth, and smart grid initiatives. The country's growing electricity demand and expanding transmission network create significant opportunities for insulation material suppliers. Government programs promoting renewable energy development and grid modernization are driving investments in advanced transformer technologies.

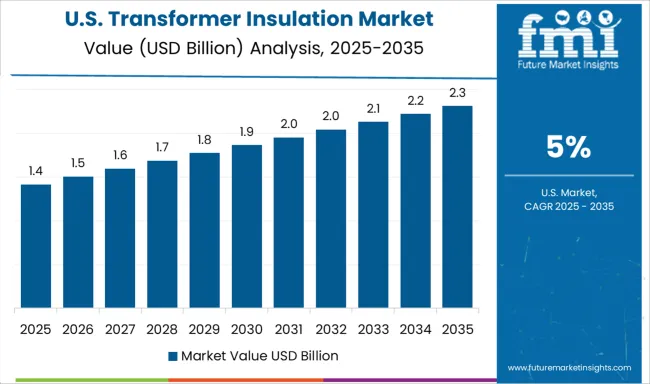

Demand for transformer insulation materials in the USA is projected to grow at a CAGR of 5 %, supported by ongoing grid modernization initiatives and aging infrastructure replacement programs. American utilities are investing in advanced transformer systems to improve reliability, efficiency, and renewable energy integration capabilities. The market is characterized by strong demand for high-performance insulation materials that meet stringent environmental and safety standards.

Revenue from transformer insulation materials in Germany is projected to grow at a CAGR of 6.8% through 2035, driven by the country's energy transition programs and renewable energy integration requirements. German utilities and manufacturers are investing in advanced transformer technologies to support wind and solar power integration while maintaining grid stability. The market emphasizes high-quality, environmentally renewable insulation materials.

Revenue from transformer insulation materials in the UK is projected to grow at a CAGR of 5.6% through 2035, supported by ambitious offshore wind development programs and grid modernization initiatives. British utilities are investing in advanced transformer systems to support renewable energy integration and improve system reliability. The market emphasizes innovative insulation materials capable of supporting harsh marine environments.

Revenue from transformer insulation materials in France is projected to grow at a CAGR of 6.2% through 2035, supported by the country's extensive nuclear power infrastructure and renewable energy development programs. French utilities require high-performance insulation materials for their transformer fleets serving nuclear plants and renewable energy integration systems. The market emphasizes reliability, safety, and long-term performance.

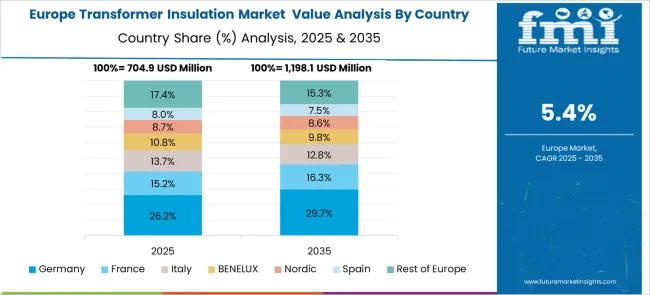

The European transformer insulation market demonstrates sophisticated development across major economies with Germany leading through its precision electrical engineering excellence and advanced energy transition capabilities, supported by companies emphasizing high-performance insulation materials, renewable energy integration systems, and comprehensive grid modernization solutions while maintaining strict quality standards and environmental compliance protocols. The UK shows strength in grid modernization initiatives and offshore wind development, with organizations specializing in specialized transformer insulation materials designed for marine applications and extreme environmental conditions that meet rigorous performance standards.

France contributes through its nuclear infrastructure maintenance and renewable energy development programs, delivering advanced insulation solutions that combine traditional electrical engineering expertise with modern requirements for critical power generation systems. Sweden and Nordic countries emphasize green manufacturing practices and environmental responsibility in electrical material production. Italy and Spain demonstrate growth in specialized industrial applications and renewable energy infrastructure development. The market benefits from stringent EU environmental regulations, established electrical manufacturing infrastructure, and growing demand for eco-friendly insulation materials that provide superior electrical performance and environmental consciousness.

The Japanese transformer insulation market demonstrates steady growth driven by precision manufacturing focus, advanced electrical technology development, and utility preference for high-quality insulation systems that ensure superior reliability and operational efficiency throughout power transmission infrastructure. Japanese organizations prioritize sophisticated material engineering and comprehensive quality assurance systems, creating demand for transformer insulation materials featuring advanced dielectric properties, thermal stability, and integrated environmental performance that align with Japanese manufacturing excellence standards.

The market emphasizes technological innovation in material science, thermal management, and electrical performance optimization that reflects Japanese attention to detail in electrical equipment design and power system reliability. Growing investment in smart grid initiatives and renewable energy integration supports adoption of next-generation insulation materials with enhanced performance characteristics, biodegradable properties, and long-term operational stability for critical electrical infrastructure. Japanese utilities focus on material reliability, consistent electrical performance, and long-term service life through advanced insulation technology implementation.

The South Korean transformer insulation market shows exceptional growth potential driven by expanding industrial development, increasing adoption of smart grid technologies, and growing demand for advanced electrical infrastructure requiring comprehensive insulation performance and reliability capabilities. The market benefits from South Korea's technological leadership in heavy industry and increasing focus on energy system modernization that drives investment in sophisticated electrical materials meeting international performance standards.

Korean utilities and industrial organizations increasingly adopt advanced liquid insulation materials, solid insulation systems, and integrated transformer solutions to improve power system efficiency and operational reliability while ensuring cost-effectiveness requirements. Growing influence of Korean heavy industry companies and electrical infrastructure initiatives supports demand for high-performance transformer insulation platforms that ensure comprehensive functionality while maintaining environmental consciousness and operational efficiency. The integration of renewable energy systems and smart manufacturing technologies creates opportunities for specialized insulation materials with enhanced thermal management and electrical performance capabilities.

The transformer insulation market is characterized by competition among established electrical material manufacturers, specialty chemical companies, and emerging renewable material developers. Companies are investing in advanced material science, green production processes, premium product development, and global distribution networks to deliver reliable, efficient, and environmentally responsible insulation solutions. Innovation, quality assurance, and technical support are central to strengthening product portfolios and market presence.

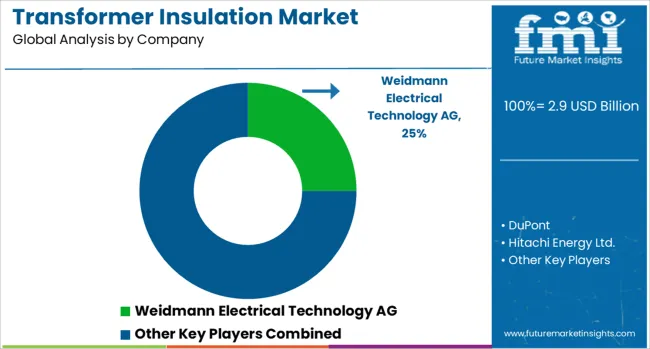

Weidmann Electrical Technology leads the market with significant global presence, offering comprehensive insulation material solutions with focus on electrical performance and reliability. DuPont provides advanced polymer-based insulation materials with emphasis on thermal stability and chemical resistance. Hitachi Energy Ltd. delivers integrated insulation systems with focus on transformer performance optimization. Elantas (Altana AG) specializes in electrical insulation materials with emphasis on industrial applications and technical innovation.

Cargill Incorporated provides bio-based insulation fluids with a focus on environmental consciousness and performance. Siemens Energy offers comprehensive transformer solutions including advanced insulation systems with emphasis on efficiency and reliability. Krempel GmbH specializes in solid insulation materials with focus on electrical and thermal performance. Apar Industries provides comprehensive electrical material solutions with emphasis on quality and cost-effectiveness. ZIEHL-ABEGG focuses on specialized insulation applications with emphasis on technical innovation and customer service.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2.9 billion |

| Material | Liquid insulation materials, Solid insulation materials, Gaseous insulation, Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Weidmann Electrical Technology , DuPont, Hitachi Energy Ltd., Elantas (Altana AG), Cargill Incorporated, Siemens Energy, Krempel GmbH, Apar Industries, and ZIEHL-ABEGG |

| Additional Attributes | Dollar sales by material type and voltage level, regional demand trends, competitive landscape, buyer preferences for liquid versus solid insulation materials, integration with environmental sustainability requirements, innovations in biodegradable materials, advanced cooling systems, and eco-friendly production practices |

The global transformer insulation market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the transformer insulation market is projected to reach USD 5.2 billion by 2035.

The transformer insulation market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in transformer insulation market are liquid insulation materials, solid insulation materials, gaseous insulation and others.

In terms of , segment to command 0.0% share in the transformer insulation market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA