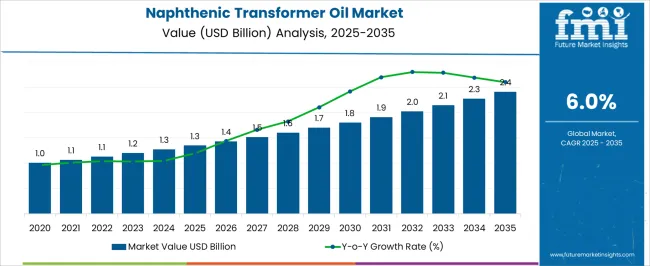

The naphthenic transformer oil market is projected to grow at a CAGR of 6.0% from 2025 to 2035, with the market anticipated at USD 1.3 billion in 2025 and forecasted to reach USD 2.4 billion by 2035. Early growth in the curve from 2025 to around 2029 is defined by moderate adoption, as demand gradually advances from 1.0 billion to 1.4 billion through incremental replacement of mineral-based transformer fluids in aging grid assets. This phase highlights the importance of stable pricing, performance in cold climates, and dielectric strength that makes naphthenic grades competitive against paraffinic counterparts.

Late growth from 2030 to 2035 reflects a stronger inflection, rising from 1.5 billion to 2.4 billion, as utilities accelerate large-scale replacement programs and global transmission expansion requires reliable insulating oils. Grid modernization in North America and Europe combines with electrification initiatives in the Asia-Pacific region, creating wider adoption. Manufacturers are anticipated to leverage refining capacity improvements and regional blending strategies to secure higher margins, while competition grows around bio-based hybrid blends. The early years indicate cautious scaling and specification-driven demand, while the latter years show stronger momentum as policy support and global grid expansion generate higher dollar sales and sustained share gains.

| Metric | Value |

|---|---|

| Naphthenic Transformer Oil Market Estimated Value in (2025 E) | USD 1.3 billion |

| Naphthenic Transformer Oil Market Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The naphthenic transformer oil market is strongly shaped by five interconnected parent markets, each exerting a unique influence on adoption and growth. The power transmission and distribution sector accounts for the largest share at 42%, supported by extensive use of naphthenic oils in transformers for grid expansion and modernization projects. The industrial and heavy manufacturing segment contributes 23%, as high-load equipment requires reliable insulating and cooling solutions to maintain operational efficiency.

Renewable energy integration holds 15%, with wind and solar projects relying on high-performance transformer oils to ensure stable energy transfer under fluctuating loads. The railway and transportation electrification sector represents 12%, driven by growing reliance on electric locomotives, metros, and charging infrastructure that demands high-grade insulating oils. The commercial and residential infrastructure segment holds an 8% share, where distribution transformers in urban and semi-urban areas use naphthenic oils for safety, efficiency, and extended equipment life.

Transmission, industrial, and renewable sectors command 80% of demand, highlighting that grid expansion, heavy-duty applications, and renewable integration are the central growth levers.

The market is exhibiting robust growth driven by its critical role in electrical power infrastructure, particularly in power transformers. The market’s trajectory is influenced by the increasing demand for reliable and efficient transformer oils that provide superior dielectric strength, thermal conductivity, and oxidation stability.

The ongoing expansion of power generation and distribution networks globally is fueling the consumption of naphthenic transformer oil, especially in regions investing heavily in grid modernization and renewable integration. Furthermore, rising industrialization and urbanization are creating a sustained need for efficient power transformers that rely on high-performance insulating oils.

Technological advancements aimed at improving oil life and environmental compliance are expected to provide additional momentum. The future outlook remains positive as the electrical utilities sector prioritizes durability and safety in transformer operations, ensuring continued demand for naphthenic-based insulating oils.

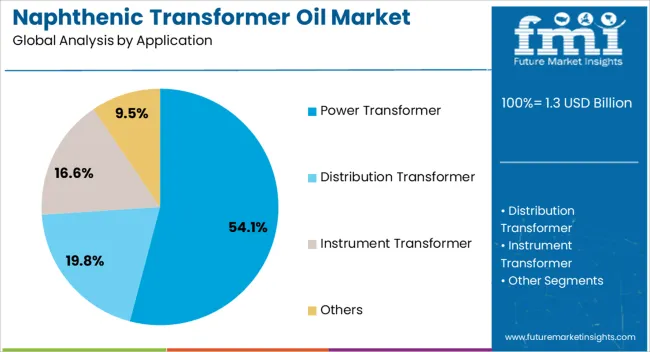

The naphthenic transformer oil market is segmented by application and geographic regions. By application, naphthenic transformer oil market is divided into Power Transformer, Distribution Transformer, Instrument Transformer, and Others. Regionally, the naphthenic transformer oil industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Power Transformer application segment is projected to hold 54.1% of the Naphthenic Transformer Oil market revenue share in 2025, establishing it as the leading segment. This prominence is attributed to the essential function of naphthenic transformer oil in providing electrical insulation and heat dissipation within power transformers.

The segment’s growth is supported by the extensive use of power transformers in high voltage transmission and distribution networks, which require oils with excellent dielectric and thermal properties. The compatibility of naphthenic oil with transformer materials and its cost-effectiveness compared to alternative oils have further encouraged widespread adoption.

Need for oils that maintain stability under thermal and electrical stress has driven preference towards naphthenic transformer oils in critical power infrastructure. The increasing deployment of renewable energy systems and expansion of electrical grids globally are anticipated to sustain the demand in this segment, reinforcing its market leadership position.

Transmission expansion, industrial applications, renewable integration, and regulatory compliance drive naphthenic transformer oil demand. Growth is expected to accelerate as adoption shifts from replacement cycles to strategic infrastructure deployment.

Naphthenic transformer oil adoption is being shaped by the rapid replacement and expansion of transmission infrastructure worldwide. Utilities are prioritizing reliable insulating fluids that maintain dielectric strength under heavy load cycles and fluctuating voltage levels. The fluid’s low pour point performance makes it suitable for regions with harsh winters, ensuring the uninterrupted operation of transformers across diverse climates. Replacement of aging paraffinic grades with naphthenic oils is also intensifying as grid operators seek improved cooling efficiency and stable performance. Transmission growth, grid modernization programs, and cross-border interconnections will continue to create a strong foundation for demand, positioning naphthenic oils as a necessary material in the global transmission landscape.

The industrial segment represents a key growth avenue where heavy machinery, steel plants, petrochemical facilities, and mining operations require uninterrupted power support. Naphthenic transformer oil is favored for its thermal conductivity and oxidation stability, reducing downtime risks and extending transformer lifespan under intensive industrial loads. Industrialization across the Asia-Pacific has encouraged manufacturers to secure long-term supply contracts, while Western markets focus on the replacement of outdated transformer units. Industrial demand is strongly influenced by production reliability, where outages can have high financial consequences. Industrial adoption is not just supplementary but a consistent driver that secures baseline demand and ensures steady dollar sales growth in the long term.

Renewable integration has been anticipated as a major driver of demand for naphthenic transformer oil. Wind and solar installations depend heavily on transformers for reliable grid synchronization and efficient voltage step-up operations. As renewable corridors expand, grid operators are increasingly selecting oils with superior oxidation resistance and cold temperature performance, which enhances system reliability. Electrification of transport, including charging stations for electric rail and EV infrastructure, also drives significant demand for high-quality transformer oils. Renewable penetration, coupled with electrification programs, acts as a structural catalyst that shifts adoption from niche demand to essential application, ensuring future growth momentum.

Regulatory compliance plays a decisive role in shaping competition within the naphthenic transformer oil market. Standards governing fire safety, biodegradability, and electrical insulation push manufacturers to refine oil formulations. Producers differentiate through advanced refining processes that reduce sulfur, improve oxidation stability, and enhance cooling efficiency.

Regional safety certifications are often necessary for tender qualification, making compliance a core commercial factor. Manufacturers that combine technical specifications with extended service life and reliable field performance tend to secure greater market share. Regulation not only filters market participation but also creates opportunities for premium-grade oils, where differentiated product quality leads to stronger margins and greater global presence.

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

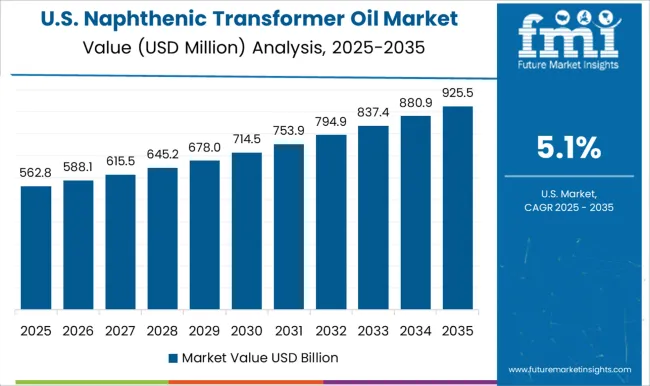

| USA | 5.1% |

| Brazil | 4.5% |

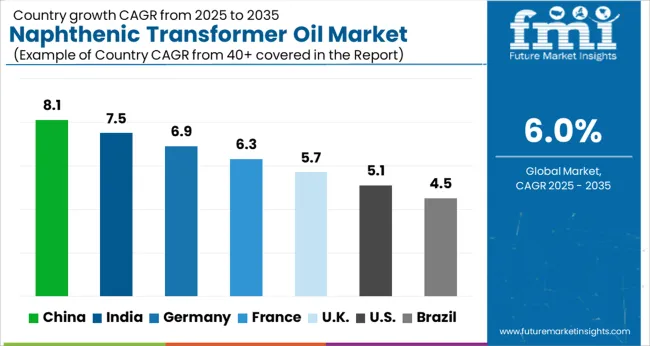

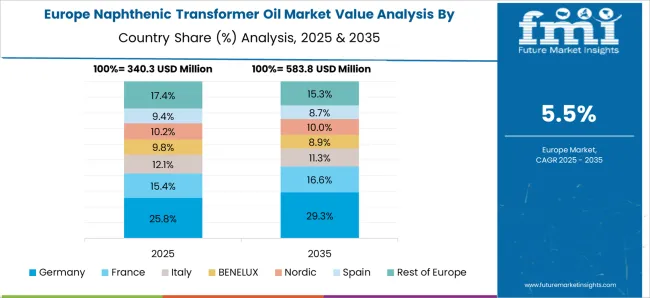

The global naphthenic transformer oil market is projected to grow at a CAGR of 6.0% from 2025 to 2035. China leads at 8.1%, followed by India at 7.5%, Germany at 6.9%, France at 6.3%, the UK at 5.7%, and the USA at 5.1% Growth is being shaped by rising transformer replacements, long-term electrification programs, and expansion of renewable integration across power grids. China and India continue to accelerate adoption through massive infrastructure investments, large-scale grid modernization, and regional manufacturing capabilities, which strengthens their dominance. Germany and France emphasize high-performance oils with enhanced cooling and oxidation stability to support renewable corridors and industrial networks. The UK shows consistent adoption through offshore wind projects and transmission upgrades, while the USA focuses on gradual replacement cycles and selective grid expansions. Asia-Pacific demonstrates the strongest growth trajectory, while Europe highlights quality-driven adoption, and North America pursues steady but measured replacement demand. The analysis spans over 40+ countries, with the leading markets highlighted above.

The naphthenic transformer oil market in China is projected to expand at a CAGR of 8.1% from 2025 to 2035. Growth is propelled by large-scale grid modernization programs, regional electrification projects, and increasing renewable energy deployment. Transmission upgrades in high-voltage corridors and replacement cycles in aging distribution transformers sustain strong consumption. Domestic refiners are expanding capacity to meet quality standards required for long-duration performance and efficiency. Demand for cold-weather formulations is also observed in northern provinces. China is well-positioned to remain the largest consumer of naphthenic oils given its scale of industrial expansion, government-backed projects, and steady integration of renewable infrastructure.

India’s naphthenic transformer oil market is anticipated to grow at a CAGR of 7.5% between 2025 and 2035, supported by transmission line expansions and regional electrification schemes. Government-driven investments in renewable energy corridors are intensifying the need for reliable transformer oils with superior oxidation stability and cooling capacity. Industrial applications, particularly in steel, cement, and mining, amplify consumption due to continuous heavy-load operations. The adoption of digital substations and long-term utility upgrades adds further momentum. Domestic refiners are working with international suppliers to secure high-grade feedstock and match quality benchmarks. India represents a significant opportunity where rural electrification and rapid renewable integration continue to widen the market footprint.

The naphthenic transformer oil market in France is expected to grow at a CAGR of 6.3% from 2025 to 2035, supported by expansion of offshore wind projects and consistent modernization of distribution networks. The country places strong emphasis on efficiency standards and reliable insulating fluids for renewable integration. Replacement of aging transformers in metropolitan areas and industrial corridors drives notable adoption. French refiners and distributors are focusing on hybrid blends with superior cooling and oxidation stability to address environmental requirements and improve service life. The French market, though smaller than Asia-Pacific, thrives on quality-driven adoption, advanced testing standards, and infrastructure upgrades that sustain long-term demand.

The UK naphthenic transformer oil market is projected to expand at a CAGR of 5.7% between 2025 and 2035, led by offshore wind farms, interconnection projects, and replacement of older transformer fleets. Utilities prioritize oils with excellent low-temperature properties, supporting performance in colder regions. Market adoption is influenced by regulatory standards promoting efficiency and reliability in energy infrastructure. Domestic distribution focuses on partnering with global refiners to ensure supply security. The UK market benefits from renewable adoption and grid modernization but grows at a steadier pace compared to Asia, driven more by replacements and policy-led initiatives than new large-scale grid additions.

The USA naphthenic transformer oil market is forecast to grow at a CAGR of 5.1% from 2025 to 2035, shaped by selective grid modernization, transmission upgrades, and industrial expansions. Replacement of legacy transformers in aging power networks is the dominant driver of demand. Regional variations exist, with stronger adoption in colder climates due to the oil’s superior low-temperature properties. The USA market also emphasizes environmental regulations, driving refiners to enhance product specifications for oxidation resistance and long service life. Growth remains steady rather than aggressive, as utilities balance investment between transformer oil upgrades and digital grid solutions.

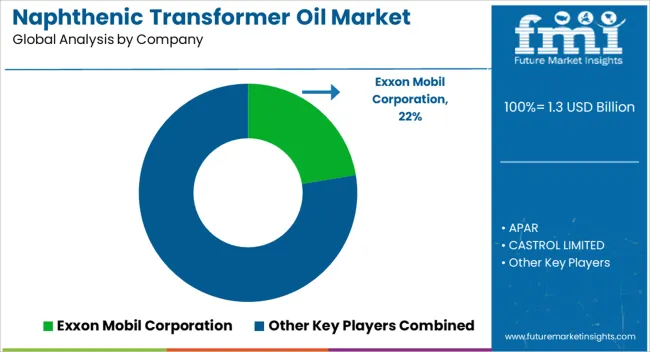

The naphthenic transformer oil market is shaped by a competitive environment involving several leading global and regional players. Key companies in this market include Nynas AB, Calumet Specialty Products, PetroChina, Apar Industries, Ergon Inc., San Joaquin Refining, Hydrodec Group, Gandhar Oil Refinery, Shell, Chevron, ExxonMobil, PetroCanada Lubricants, Sinopec, Lubline, Cargill, Savita Oil Technologies, Lubrizol, Hyrax Oil, Eastern Petroleum, and Raj Petro Specialties. These companies are focusing on product innovation, strategic partnerships, and regional expansion to strengthen their market positions. The market growth is driven by rising demand for energy-efficient transformers, the integration of renewable energy sources, and increased investment in grid infrastructure. However, challenges such as competition from synthetic ester-based oils, crude oil price volatility, and stricter environmental disposal regulations pose constraints for manufacturers. Opportunities lie in smart grid development, renewable power transmission, and growing infrastructure projects in developing countries, which are expected to further boost the adoption of high-quality naphthenic transformer oils, positioning the market for steady expansion over the coming years.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Application | Power Transformer, Distribution Transformer, Instrument Transformer, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Exxon Mobil Corporation, APAR, CASTROL LIMITED, HCS Group, Ergon Inc, Hydrodec Group plc, China Petroleum & Chemical Corporation, Calumet Specialty Products Partners L.P, Phillips 66 Company, Sunoco Lubricants, Mineral Oil Corporation, Gandhar Oil Refinery (India) Limited, and NYNAS AB and Chevron Corporation |

| Additional Attributes | Dollar sales, share, regional demand patterns, competitive benchmarking, refinery capacity trends, raw material availability, utility adoption, regulatory standards, product differentiation factors, long-term replacement cycles, and export opportunities. |

The global naphthenic transformer oil market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the naphthenic transformer oil market is projected to reach USD 2.4 billion by 2035.

The naphthenic transformer oil market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in naphthenic transformer oil market are power transformer, distribution transformer, instrument transformer and others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Naphthenic Acid Market

Transformer Valve Market Size and Share Forecast Outlook 2025 to 2035

Transformer Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Transformer Containment Bags Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Transformer Insulation Market Size and Share Forecast Outlook 2025 to 2035

Transformer Component Market Size and Share Forecast Outlook 2025 to 2035

Transformer Market Size and Share Forecast Outlook 2025 to 2035

Transformer Spare Parts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Transformer Tap Changers and Voltage Control Relay Market Growth – Trends & Forecast 2025 to 2035

Transformer Bobbin Market

Transformer Testing Equipment Market

Transformer Oil Market Growth - Trends & Forecast 2025 to 2035

Green Transformer Market Growth – Trends & Forecast 2025 to 2035

Power Transformer Market Growth – Trends & Forecast 2024 to 2034

Train Transformer Market

Signal Transformer Market

Dry Type Transformer Market Size and Share Forecast Outlook 2025 to 2035

Traction Transformer Market

Biobased Transformer Oil Market

Specialty Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA