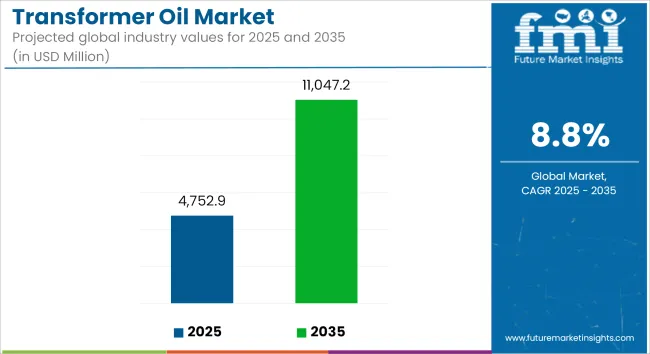

The global transformer oil market is estimated to reach USD 4,752.9 million in 2025 and is expected to grow to USD 11,047.2 million by 2035, reflecting a CAGR of 8.8% during the forecast period. Growth is being driven by increased electricity consumption, aging grid infrastructure, and rising investments in smart transmission and distribution networks.

Transformer oil is being applied as an insulating and cooling medium in transformers, reactors, and switchgear systems. Its function is critical to preventing electrical discharges and dissipating heat, thereby enhancing equipment longevity and grid reliability. Utilities and heavy industries are adopting premium-grade insulating fluids to maintain high-performance standards across primary and secondary power distribution systems.

The increasing pace of power grid modernization and the growing integration of renewable energy sources are supporting market expansion. Substations and transformers are being upgraded or newly installed in response to urbanization and rural electrification programs. Transformer oil demand is closely tied to the commissioning of new power infrastructure and refurbishment of aging transformer fleets.

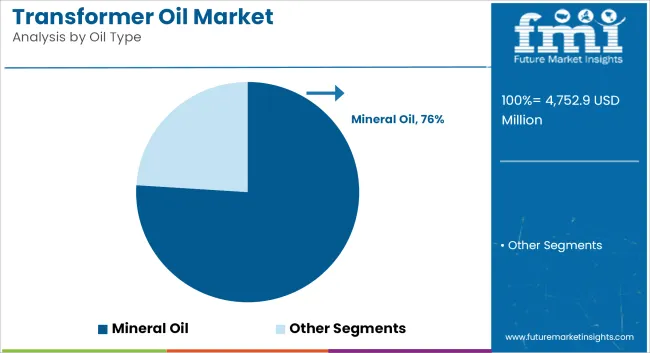

Mineral oil-based products are maintaining a dominant market share due to their availability, cost-efficiency, and stable dielectric properties. These oils are being used in conventional power distribution systems and remain widely preferred in both developed and developing regions. However, product innovation is shifting market dynamics toward synthetic and natural ester-based transformer oils.

Bio-based and synthetic variants are being adopted in applications requiring higher thermal stability, biodegradability, and fire resistance. These oils are gaining traction in sensitive environments, including densely populated areas and offshore wind farms, where environmental compliance and safety regulations are more stringent.

Grid digitization and smart grid deployments are contributing to higher transformer load cycles, prompting demand for oils with improved oxidation stability and extended service life. Equipment manufacturers are aligning product specifications with evolving standards for energy efficiency and reduced environmental risk.

Mineral oil is estimated to account for approximately 76% of the global transformer oil market share in 2025 and is projected to grow at a CAGR of 8.6% through 2035. Within mineral oils, naphthenic-based oils are more prevalent due to their superior low-temperature performance and oxidation stability compared to paraffinic grades.

Mineral oils continue to be the default insulating and cooling medium in power and distribution transformers, particularly in developing regions with expanding electrification programs. Despite increasing regulatory and environmental pressures, the segment maintains dominance owing to its ease of processing, compatibility with installed infrastructure, and mature supply chain. However, the transition to high-purity and ultra-low sulfur variants is underway to meet evolving performance and environmental standards.

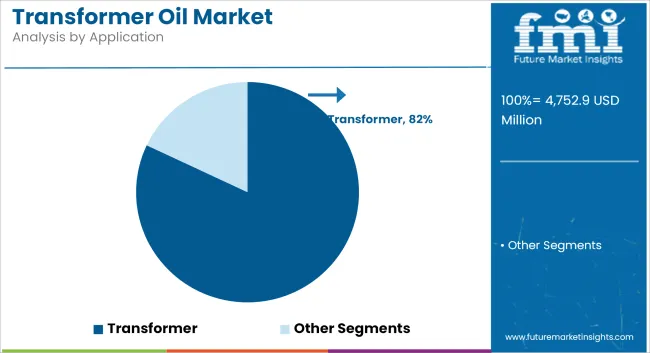

The transformer segment is projected to hold approximately 82% of the global transformer oil market share in 2025 and is expected to grow at a CAGR of 9.0% through 2035. Transformer oils play a vital role in insulation and thermal management of power transformers, distribution transformers, and dry-type transformer units.

With increasing investments in renewable energy integration, grid interconnection, and substation upgrades, the demand for high-performance transformer oils is rising across Asia-Pacific, the Middle East, and Africa. Additionally, utilities and private operators are adopting oils with improved oxidation resistance and longer service intervals to reduce maintenance costs. As nations focus on improving transmission reliability and expanding rural electrification, the transformer segment will remain the primary consumer of transformer oils globally.

Environmental and Regulatory Concerns:

The transformer oil market is getting harder to be survived by the super strict regulations on environmental matters, like the disposal of unused transformer oils and the environmental impact they have. A lot of countries across the globe have put on rules on waste management and emissions pertaining to hazardous substances that originate from transformer oil products.

Manufacturers have been pushed to implement sustainable solutions, as a result of these strict guidelines. These rules are of course operated from the perspective of increasing compliance costs when they really are just a way for the organizations to buy alternative insulating oils and do better environmental impact assessments.

These developments make it imperative for manufacturers to produce eco-friendly alternatives and tackle sustainability issues alongside the many liabilities that come with waste disposal, hence, bringing forth innovation in the transformer oil sector to comply with such dynamic regulatory expectations.

Fluctuating Raw Material Prices

Intermittent raw material prices affecting the costs of mineral-based transformer oils are especially the case with crude oil volatility. When the prices go up or down, manufacturers find it hard to keep their production costs stable and to manage their supply chains efficiently. Monetary instability is an issue as well since the profit margin has a correlation with the market stability.

One of the responses to this is the exploration of cost-effective alternatives whereby manufacturers are considering the use of bio-based transformer oils, which exhibit more predictable pricing. Not only is this a move towards environmental sustainability but it also means the diversification of input sources for the companies in the process to manage the raw material price instability in the transformer oil sector.

Growing Adoption of Bio-Based Transformer Oils

As environmental issues have been gaining more and more attention, the concept of bio-based and biodegradable transformer oils has been flourishing and largely replacing the traditional mineral oils. These oils are a great deal less toxic and generate significantly less carbon.

Thus, the strained regulatory requirements on the way to sustainable products and processes are an additional benefit for the manufacturers who are pursuing this path. Besides, it has become apparent that these oils have certain properties that they perform better at, like flame resistance and enhanced efficiency, than their counterparts.

Providing the bio-based oils is a high priority for almost all the governments and businesses who are focused on Environmental Friendly Solutions so the companies that invest in them are in the best position to ride the wave of demand for these greener and more sustainable transformer oil options.

Expansion of Renewable Energy Infrastructure

The world is attempting to transition to greener sources of energy like wind and solar. This trend pushes the need for an efficient transmission and storage system.

As more and more utilities and governments put their money into renewable energy infrastructure, they have simultaneously increased the requirement for high-performance transformer oils. Modernizing the grid that involves renewable energy integration and reliable energy storage and distribution are the main areas in which these oils find application.

As the ecosystem of green energy evolves, different manufacturers of the transformer oil have got plenty of potentials to support the renewed energy-based infrastructure with oils that are in line with. The shift not only adds to the market demand but it also results in innovations that are high-quality, energy-efficient, and designed for the needs of the renewable energy sector.

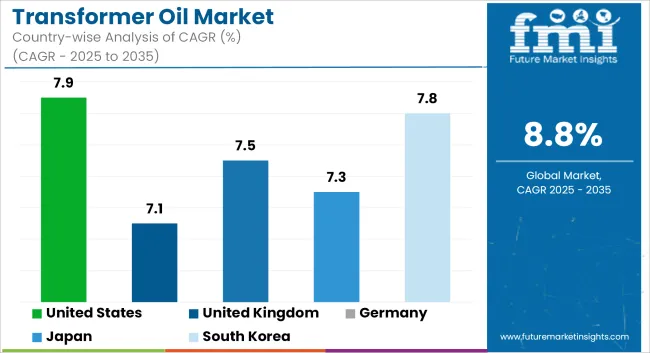

The rise of USA transformer oil market is dependent on the grid modernization, expansion of electricity-consuming products, and renewable energy projects. Smart grids are among the government-backed projects together with the retrofit of the old power infrastructure that will bring about energy-saving innovations.

High-Performance transformer oils reciprocally might be the most suitable lubrication for the growth of data centers and the industry. In addition, eco-friendly lifestyles are the primary drivers of the increase of the use of bio-based and biodegradable transformer oils.

Nevertheless, the supply chain interruptions and the constant fluctuation in crude oil prices are the obstacles to the expansion of the market. Another aspect is the added EV charging infrastructure, which brings the power transformers and oils sector a noticeable boost.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.9% |

The UK market for transformer oils is growing as a result of the integration of renewable energy, investment in smart grids, and industrial electrification. The government-specific carbon neutrality target and energy-efficient infrastructure program, are pushing the eco-friendly transformer oil demand up.

The increase in the offshore wind energy plants and high-voltage power transmission projects has created a requirement for transformer oils with dielectric strengths that are high. However, the market is affected by the increase in raw material prices and the post-Brexit trade uncertainty. The substitution of analog substations with digital ones and the upgrading of old power lines is the key factor that increases the need for innovative transformer oil solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.1% |

The transformer oil business in Germany is significantly influenced by the country concentration on renewable energy, the advancements in smart grid technology, and the renovation of power infrastructure. The Energiewende (energy transition) policy of the government has been responsible for driving progress in investments in wind, solar, and energy storage projects, thereby raising the bar for using advanced transformer oils.

The stringent EU regulations on carbon emissions have necessitated the migration of manufacturers towards bio-based and environmentally-friendly transformer oils. Further, the scaling of electrical vehicle technology and industrial automation fields will contribute to the development of the transformer oil market. However, the energy price increases and the import of crude oil are the major challenges the industry faces.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.5% |

The increase in household appliances and industrial machines together with the use of smart digital communication in transmission networks are the key drivers of the transformer oils sector in Japan. Also, safety measures are combined with the development of high-performance transformer installations.in the most hazardous areas including the high seismic areas. The continuous growth of renewable energy and also the put back of nuclear power since Fukushima has induced the necessity for special insulating transformer oils.

The presence of major transformer manufacturers like Toshiba and Hitachi and the adoption of high-temperature-resistant and durable transformer oils through thealmofinitive innovation imply that a long-term market for such goods exists. Nevertheless, the main challenges in this scenario are the high manufacturing costs and the fluctuation in the raw material prices.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.3% |

The transformer oil market of South Korea is on the rise owing to the rapid industrialization, the increase in the number of renewable energy projects, and the smart grid initiatives that are led by the government. The presence of the country in semiconductor manufacturing and heavy industries along with the increased electricity consumption, has created the demand for high-performance insulating oils.

The electric vehicles (EVs) being more frequently used and the plan of ultra-high-voltage transmission lines are the other factors that hold importance. The alliance of the South Korean administration with the mission to mellow carbon emissions has given birth to higher investments in bio-based and sustainable transformer oils. Thus, the sector does take a hit from the raw material dependency and the fluctuating crude oil prices.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.8% |

Producers in the transformer oil market are increasingly focusing on refining technologies to enhance oil performance, particularly in terms of thermal stability, dielectric strength, and oxidation resistance. In response to growing environmental concerns, there is a noticeable shift towards biodegradable and eco-friendly alternatives to traditional mineral oils, driven by sustainability regulations. Regional manufacturers are leveraging cost advantages, offering localized solutions to meet specific market demands.

Recent Developments

In terms of Oil Type: the industry is divided into Mineral Oil, (Paraffinic, Naphthenic), Silicone Oil, Bio-based Oil

In terms of End-use: the industry is divided into Transmission and Distribution, Power Generation, (Coal, Nuclear Plants, Wind Energy, Solar, Others), Railways & Metros

In terms of Application: the industry is divided into Transformer, Switchgear, Reactor

In terms of Transformer Capacities: the industry is divided into LV Transformers, (Up to 50 kva, 50 to 100 kva, 100 to 500 kva, Above 500 kva), MV Transformers, (Up to 1 Mva, 1 to 5 Mva, Above 5 Mva), HV Transformers, (Up to 10 Mva, 10 to 50 Mva, 50 to 100 Mva, 100 to 500 Mva, Above 500 Mva), Traction Transformer, (Up to 5 Mva, 5 to 10 Mva, 10 to 15 Mva)

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Transformer Oil Market is projected to reach USD 4,752.9 million by the end of 2025.

The market is anticipated to grow at a CAGR of 8.8% over the assessment period.

By 2035, the Transformer Oil Market is expected to reach USD 11,047.2 million.

With the increasing demand for electricity worldwide, power infrastructure is continuously expanding, including the development of new transmission and distribution networks.

Major companies operating in the Transformer Oil Market Hydro-Québec, Savita Oil Technologies, Apar Industries, Valvoline Inc., Hyrax Oil Sdn Bhd, Engen Petroleum Ltd.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biobased Transformer Oil Market

Oil Filled Transformer Market Growth – Trends & Forecast 2025 to 2035

Naphthenic Transformer Oil Market Size and Share Forecast Outlook 2025 to 2035

Paraffinic Transformer Oil Market Size and Share Forecast Outlook 2025 to 2035

Uninhibited Transformer Oil Market

Mineral Based Transformer Oil Market Size and Share Forecast Outlook 2025 to 2035

Silicone Based Transformer Oil Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Transformer Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Transformer Containment Bags Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Transformer Insulation Market Size and Share Forecast Outlook 2025 to 2035

Transformer Component Market Size and Share Forecast Outlook 2025 to 2035

Transformer Market Size and Share Forecast Outlook 2025 to 2035

Transformer Spare Parts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Transformer Tap Changers and Voltage Control Relay Market Growth – Trends & Forecast 2025 to 2035

Transformer Bobbin Market

Transformer Testing Equipment Market

Green Transformer Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA