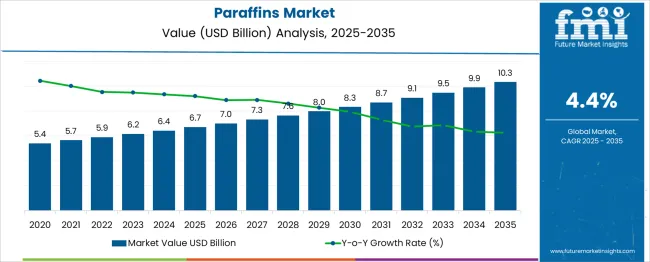

The Paraffins Market is estimated to be valued at USD 6.7 billion in 2025 and is projected to reach USD 10.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

| Metric | Value |

|---|---|

| Paraffins Market Estimated Value in (2025 E) | USD 6.7 billion |

| Paraffins Market Forecast Value in (2035 F) | USD 10.3 billion |

| Forecast CAGR (2025 to 2035) | 4.4% |

The increasing popularity of candles in home décor is expected to play an important role in driving the market for paraffins market during the forecast period. Also, the growing need for scented candles is likely to spur the demand for paraffins, thus, supporting the market expansion during the assessment period.

There has been a significant demand for scented candles among hotels, restaurants, spas, and beauty parlors to devise a therapeutic environment. This is projected to be another potential component, developing the market expansion in the forecast period.

In addition, beneficial initiatives taken by players in the market are projected to play an important role in enlarging the market size in the forthcoming period. In April 2020, Yankee Candle Company rolled out a Sunday Brunch Candle collection. The candle was launched in seven various fragrances such as; vanilla, honey lavender, and others. Such initiatives are expected to increase the demand for Paraffins and propel the industry growth in the forecast period.

Moreover, rapid technological innovations have resulted in the advent of Electric, LED, and battery-powered candles. Such innovations are expected to increase demand for paraffins, thus, augmenting the market size in the coming time. In addition, other varieties, like fancy candles, remote control candles, and others, are predicted to support the market expansion in the forecast period.

Increasing demand for personal care products, especially in emerging economies such as; India, South Korea, and others, is expected to play a crucial role in developing the paraffins market in the forecast period. Increasing disposable income and ease of availability through various distribution channels are expected to enhance demand for cosmetics, thereby, casting a positive impact on the market growth in the forecast period. Also, rapid urbanization and the increasing number of working women are other important factors contributing to the surged demand for paraffins in the forecast period.

Ongoing technical development in the beauty sector is expected to offer various opportunities for expansion in the forthcoming period. Players such as BASF SE and Dow are some of the most active players developing the industry during the forecast period.

Europe has been identified as the most lucrative region for beauty care products, which will augment the market size in the coming time. The domination of Europe can be attributed to the growing demand for personal care products such as; haircare, skincare, and other makeup products. Also, the presence of France, which is a globally renowned hub for fashion, is predicted to be another salient cause in increasing the demand for cosmetics, thereby, propelling the paraffins market size in the assessment period.

In addition, renowned players in the industry are taking various initiatives to expand their reach, which will benefit the market in the assessment period. For instance, in April 2024, Ashland Chemicals announced the acquisition of Schulke & Mayr GmbH, a personal care player. Such initiatives are expected to impact the paraffins demand, and eventually, benefit the industry in the forecast period.

Concerns about the environment are expected to hamper the market growth during the forecast period. Toxic gases and fumes produced by paraffins wax have a negative impact on human health and on the environment, which is anticipated to hinder the market growth in the forecast period. In order to tackle such issues, eco-friendly products, free of paraffins are launched. This can limit the market growth in the forecast period.

Moreover, fluctuating costs of crude oil and the availability of eco-friendly products are other causes that can hinder market growth in the coming time. However, with various end-user sectors, generating significant demand for paraffins can counter the hampering factors, and assist in the market growth in the forthcoming period.

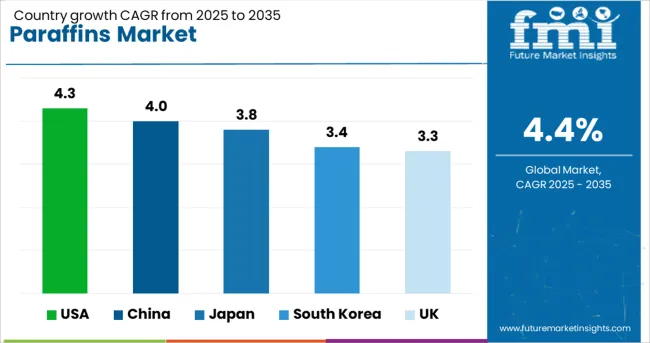

According to Future Market Insights, North America is anticipated to lead the global market. Among all, the USA is projected to lead the market in the assessment period. The region is expected to garner USD 3.2 Billion while recording a CAGR of 4.3% in the assessment period.

Presence of established players in the region such as; Avon, Maybelline, Johnson & Johnson, and Procter & Gamble, among others. Players in the region are making significant investments in R&D, which is expected to benefit the market in the forecast period. For instance, in May 2025, Bobbi Brown and Jones Road launched What the Foundation. Such initiatives are expected to augment the market size in the forecast period.

Also, increasing demand from various end-use industries like candles, rubber, packaging, and board sizing, among others are expected to grow demand for paraffins, thus, driving the market in the forecast period in the region. There has been a significant rise in demand for packaging in food processing, e-commerce, consumer goods, and pharmaceuticals, among others. After the USA, Canada is expected to be the most remunerative industry in the forecast period.

As per the analysis, Asia Pacific is projected to be the most lucrative market during the forecast period. In the region, China is expected to lead the regional market. China is estimated at USD 6.7 Million while exhibiting a CAGR of 4% from 2025 to 2035. Other lucrative regions identified are Japan and South Korea. Japan is anticipated at USD 600 Million while South Korea is estimated at USD 300 Million in the forecast period.

The growth of the region can be attributed to the growing demand for products such as candles, packaging, and cosmetics. Also, the presence of South Korea is expected to propel the regional market significantly. South Korea is a globally renowned market for beauty trends and aesthetically appealing packaging. For instance, Face Shop, the South Korean brand, garnered global attention owing to its fine products. The launch of such brands is likely to benefit both global and regional markets.

The packaging industry of India is projected to play a significant role in developing the regional market. The Indian market has made a mark with exceptional exports and imports, which is likely to have made a significant contribution to the regional market. As per the Packaging Industry Association of India, the industry is expanding at a rapid rate of 22-25% annually. Such a swift growth in the packaging industry is likely to enhance demand for paraffins, thereby, expanding the regional market in the forecast period.

| Countries | Estimated CAGR |

|---|---|

| USA | 4.3% |

| UK | 3.3% |

| China | 4% |

| Japan | 3.8% |

| South Korea | 3.4% |

As per the analysis at FMI, the global paraffins wax segment is expected to lead the market while expanding at a CAGR of 4.1% during the forecast period from 2025 to 2035.

Expansion of the market can be attributed to the increasing demand for paraffins wax in packaging to give the gloss, moisture, grease barriers, and freshness seals. Furthermore, other benefits offered such as; water and water vapor resistance, and gas and odor barrier, among others, are likely to be other factors driving the segmental growth in the forecast period.

As per the analysis, the paper board and packaging segment is expected to record a CAGR of 4% during the forecast period from 2025 to 2035. The development of the segment can be attributed to the rapid growth of the packaging industry.

The demand for paper packaging based on paraffins has increased significantly in e-commerce uses, which is predicted to be another salient factor driving the segmental growth in the assessment period.

Key players in the global paraffins market include Exxon Mobil Corporation, Sasol, LANXESS, China Petroleum & Chemical Corporation, and ENEOS Corporation.

Recent Developments in the Market are as follows:

The global paraffins market is estimated to be valued at USD 6.7 billion in 2025.

The market size for the paraffins market is projected to reach USD 10.3 billion by 2035.

The paraffins market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in paraffins market are paraffin wax, liquid paraffin, kerosene and petroleum jelly.

In terms of application, cosmetics and personal care segment to command 36.7% share in the paraffins market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA