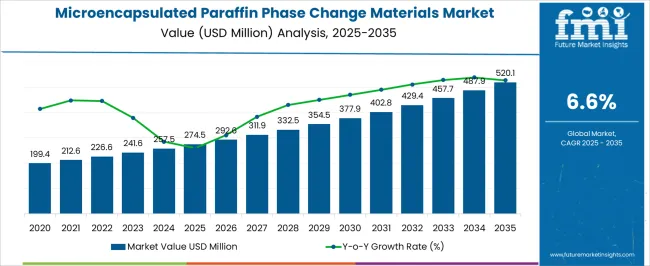

The Microencapsulated Paraffin Phase Change Materials Market is estimated to be valued at USD 274.5 million in 2025 and is projected to reach USD 520.1 million by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period. This trajectory reflects a clear transition through the typical adoption lifecycle, from early adoption to scaling and finally consolidation. During the early adoption phase (2020–2024), the market expands from USD 199.4 million to USD 257.5 million. Key breakpoints occur around USD 226–242 million, signaling the initial acceptance of microencapsulated PCMs in niche applications such as thermal energy storage in electronics, building materials, and cold chain packaging.

Early entrants focus on product innovation, pilot deployments, and small-scale partnerships to validate performance and cost-effectiveness. The scaling phase (2025–2030) sees the market grow from USD 274.5 million to USD 354.5 million. Breakpoints around USD 292–332 million highlight increased industrial adoption, larger-scale production, and broader integration into commercial applications. During this phase, manufacturers optimize cost structures, expand distribution networks, and leverage regulatory incentives for energy efficiency, driving accelerated adoption.

In the consolidation phase (2030–2035), the market climbs from USD 377.9 million to USD 520.1 million. Breakpoints near USD 429–488 million indicate market maturation, with leading players consolidating through mergers, strategic partnerships, and technology standardization. Innovation focuses on performance differentiation and sustainability rather than basic adoption, signaling a fully matured market poised for long-term stability.

Thermal engineers evaluate microencapsulated PCM specifications based on melting point precision, encapsulation durability, and thermal conductivity optimization when designing building envelope systems, cooling vest applications, and electronic thermal management solutions requiring precise temperature control without mechanical refrigeration. Material selection involves analyzing phase transition enthalpy, capsule size distribution, and chemical compatibility parameters while considering integration complexity, cost-performance ratios, and long-term stability factors necessary for successful thermal management deployment. Investment decisions balance material costs against energy savings potential, incorporating cooling load reduction, peak demand mitigation, and occupant comfort enhancement benefits that justify advanced thermal storage incorporation through measurable performance improvements.

Technology advancement prioritizes encapsulation durability enhancement, thermal property optimization, and application-specific customization that improve PCM performance while reducing implementation complexity and maintenance requirements throughout diverse thermal management applications. Innovation encompasses nanoencapsulation techniques, hybrid thermal storage systems, and smart material integration that optimize thermal regulation while enabling responsive temperature control and system automation. Advanced manufacturing includes continuous encapsulation processes, automated quality monitoring, and sustainable production methods that enhance efficiency while maintaining thermal property consistency and environmental responsibility.

| Metric | Value |

|---|---|

| Microencapsulated Paraffin Phase Change Materials Market Estimated Value in (2025 E) | USD 274.5 million |

| Microencapsulated Paraffin Phase Change Materials Market Forecast Value in (2035 F) | USD 520.1 million |

| Forecast CAGR (2025 to 2035) | 6.6% |

The Microencapsulated Paraffin Phase Change Materials market is experiencing notable growth, driven by increasing demand for energy-efficient and sustainable thermal management solutions. Current trends indicate a shift toward advanced building materials that contribute to reduced energy consumption and support green building certifications. According to insights from corporate press releases, energy industry news, and technical journals, microencapsulated paraffin is being adopted due to its stable thermal behavior, high latent heat capacity, and integration flexibility in construction materials.

The growing emphasis on reducing operational carbon emissions, combined with stricter energy efficiency regulations in both developed and emerging economies, is further influencing demand. Additionally, advancements in encapsulation technologies are improving durability and performance across various environmental conditions.

Companies have highlighted in their investor communications that the ability to tailor thermal storage properties for specific applications enhances the value proposition of these materials. As industries prioritize low-carbon technologies and smart infrastructure, microencapsulated paraffin is expected to play a central role in future energy-saving solutions.

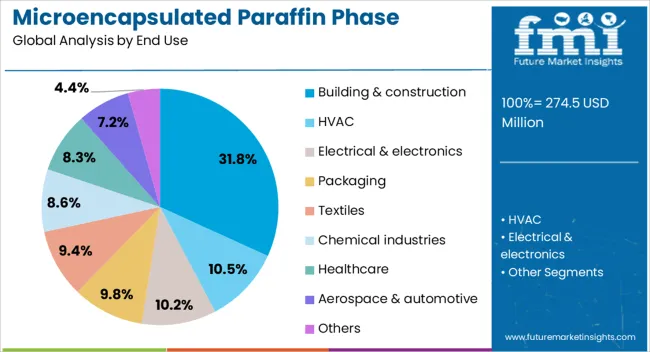

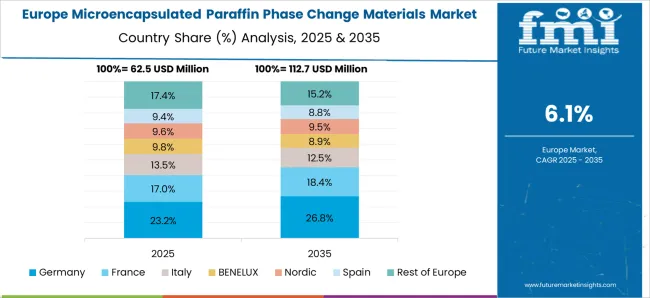

The microencapsulated paraffin phase change materials market is segmented by end use, and geographic regions. By end use of the microencapsulated paraffin phase change materials market is divided into Building & construction, HVAC, Electrical & electronics, Packaging, Textiles, Chemical industries, Healthcare, Aerospace & automotive, and Others. Regionally, the microencapsulated paraffin phase change materials industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The building and construction segment is projected to account for 31.8% of the Microencapsulated Paraffin Phase Change Materials market revenue share in 2025, making it the leading end-use category. This growth has been driven by rising demand for energy-efficient insulation materials in residential, commercial, and institutional buildings. According to updates in sustainable construction publications and smart building initiatives, microencapsulated paraffin has been increasingly used in wallboards, plasters, and concrete additives to regulate indoor temperatures and reduce HVAC load.

The segment’s expansion is being supported by strict energy codes and green building standards adopted across North America, Europe, and parts of Asia. It has been reported in infrastructure-focused news articles that developers are prioritizing thermal energy storage systems to meet performance-based building compliance targets.

Moreover, the integration of these phase change materials into traditional construction elements has enabled retrofitting and new installations without major design changes These advantages have positioned the segment as the most commercially viable application in the market for 2025.

The microencapsulated paraffin phase change materials (PCMs) market is expanding as energy-efficient thermal management solutions gain adoption across building, electronics, and industrial applications. These materials store and release thermal energy, improving energy savings, temperature regulation, and comfort. Growing interest in lightweight, adaptable thermal storage solutions for HVAC systems, smart textiles, and refrigeration drives demand. Manufacturers are focusing on high encapsulation efficiency, thermal reliability, and long lifecycle performance. Regional growth is led by North America and Europe, with increasing applications emerging in Asia-Pacific.

Microencapsulated paraffin PCMs are increasingly incorporated into building materials such as wall panels, concrete, and insulation systems to enhance thermal comfort and reduce energy consumption. These materials absorb excess heat during the day and release it at cooler times, stabilizing indoor temperatures. Architects and builders prefer PCMs for retrofitting and new constructions, particularly in regions with extreme temperature fluctuations. Adoption is driven by the need to optimize energy costs and meet building performance standards. Companies developing PCMs with higher phase change enthalpy, low leakage, and compatibility with construction materials gain a competitive advantage.

PCMs are vital in electronics and battery systems to manage heat and prevent overheating. Microencapsulated paraffin forms a protective barrier, controlling temperature rise in sensitive components and improving device longevity. The rise of portable electronics, data centers, and electric vehicles has increased demand for compact thermal regulation solutions. Manufacturers focus on producing microcapsules with uniform size, high thermal conductivity, and chemical stability to ensure reliable performance. Strategic partnerships with electronics and battery manufacturers help expand adoption, enabling integration into cooling systems, heat sinks, and energy storage devices.

Ensuring thermal reliability and long-term performance remains a challenge for microencapsulated paraffin PCMs. Leakage, phase separation, and degradation during repeated heating and cooling cycles can affect efficiency. Variability in encapsulation techniques and raw material quality may lead to inconsistent thermal properties. Producers must maintain strict quality control, validate phase change temperatures, and test durability across applications. Achieving large-scale production while preserving microcapsule integrity is critical for commercial success. Companies investing in research to enhance encapsulation methods and material stability gain credibility and market preference among construction, electronics, and industrial clients.

The market is highly competitive with established chemical manufacturers, material innovators, and niche PCM producers vying for adoption across sectors. Companies differentiate through encapsulation efficiency, thermal performance, and application-specific customization. Collaborations with building material manufacturers, electronics firms, and energy storage companies help in product validation and market penetration. Brands emphasizing long lifecycle performance, environmental safety, and multi-industry applicability strengthen their position. Forward-looking players also explore regional expansion in emerging markets, leveraging local partnerships to meet growing demand in Asia-Pacific and Latin America, enhancing global footprint and client engagement.

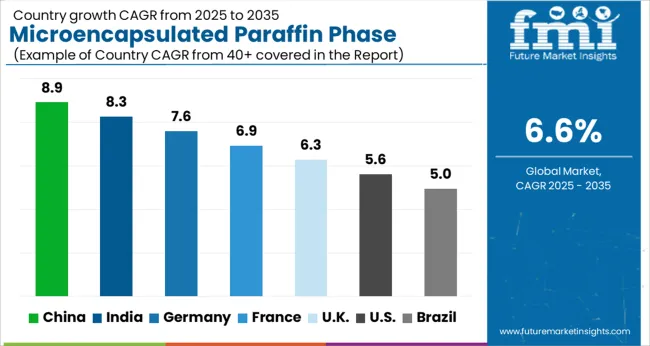

The global microencapsulated paraffin phase change materials market is projected to grow at a CAGR of 6.6%, driven by applications in energy storage, construction, and temperature regulation technologies. China leads the market with an 8.9% growth rate, supported by investments in energy-efficient building materials and industrial applications. India follows at 8.3%, fueled by growing demand for sustainable energy solutions and construction innovations. Germany shows steady growth at 7.6%, leveraging advanced manufacturing and renewable energy initiatives. The UK records a growth rate of 6.3%, reflecting increasing adoption in residential and commercial energy-efficient systems, while the USA grows at 5.6%, driven by steady demand in industrial and building sectors. This report includes insights on 40+ countries; the top countries are shown here for reference.

Market in China is growing at 8.9%, driven by the demand for energy-efficient building materials and thermal management solutions. Microencapsulated paraffin phase change materials (MPCM) are widely adopted in construction, electronics, and cold chain logistics to improve energy efficiency and thermal comfort. Government incentives for green building initiatives and renewable energy adoption further accelerate growth. Manufacturers are investing in advanced microencapsulation technologies to enhance material stability, thermal conductivity, and reliability. Additionally, research on scalable production and integration into building materials supports market expansion. China’s strong industrial base, combined with increasing urbanization and infrastructure development, positions the MPCM market for steady growth in both domestic and export markets.

The market in India is growing at 8.3%, supported by rising energy efficiency awareness and adoption of thermal energy storage solutions. MPCMs are increasingly used in green buildings, cold storage, and electronics cooling applications. Manufacturers are focusing on high-quality formulations and cost-effective production techniques to meet domestic and export demand. Government initiatives promoting sustainable construction and renewable energy adoption further drive market growth. Urbanization, infrastructure expansion, and industrial development create additional opportunities for integration of MPCMs in buildings and industrial applications. Technological advancements in microencapsulation and thermal performance enhance product appeal and market penetration.

The market in Germany is expanding at 7.6%, driven by strict energy efficiency regulations and strong adoption of green building standards. MPCMs are used in building insulation, electronics, and thermal management for industrial applications. Manufacturers focus on R&D to enhance thermal conductivity, reliability, and life cycle performance. Sustainability and environmental compliance are key factors shaping product development. Germany’s well-established supply chain and advanced infrastructure enable integration of MPCMs into various applications. Demand is also fueled by increasing adoption of renewable energy and energy storage solutions. Overall, Germany’s MPCM market maintains steady growth supported by technology, regulation, and industrial innovation.

The UK market is growing at 6.3%, influenced by rising awareness of energy efficiency in buildings and industrial processes. MPCMs are applied in thermal insulation, cold storage, and electronics cooling to reduce energy consumption and carbon footprint. Manufacturers emphasize high-performance and environmentally friendly formulations to meet regulatory standards. Government incentives for green building initiatives and energy-efficient technologies further support market adoption. Technological advancements in microencapsulation methods and thermal performance improve product reliability and usability. Evolving construction and industrial sectors, coupled with sustainability trends, drive steady demand for MPCMs in the UK

The USA biobased and synthetic polyamides market grows at 4.5%, driven by demand from automotive, electronics, and packaging industries. Compared to China, the USA emphasizes high-quality production and regulatory compliance over volume expansion. Manufacturers focus on eco-friendly polymers and advanced synthetic polyamides to meet environmental and performance standards. Industrial applications, particularly in lightweight automotive components and durable consumer goods, support steady growth. Investments in R&D enhance polymer efficiency, durability, and sustainability. Export opportunities are moderate, but domestic industrial demand ensures market stability. Technological improvements in polymerization and manufacturing processes reduce costs and improve product consistency. Although growth is slower than Asian markets, continuous innovation and adoption of sustainable practices support long-term expansion in the USA biobased and synthetic polyamides sector.

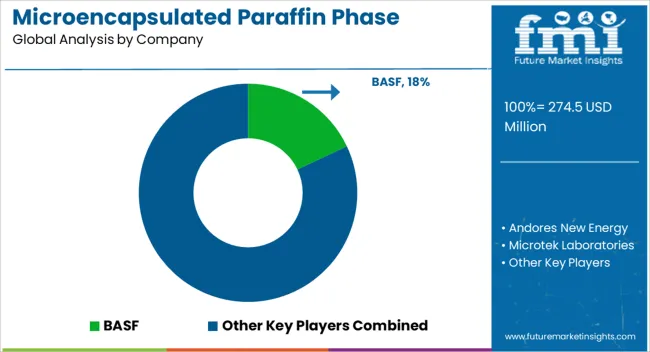

The Microencapsulated Paraffin Phase Change Materials (PCMs) Market is witnessing robust growth driven by rising demand for energy-efficient solutions in construction, textiles, packaging, and electronics. Leading companies such as BASF SE, Andores New Energy Co. Ltd., and Rubitherm Technologies GmbH are pioneering advanced paraffin-based PCM formulations that enhance thermal regulation and energy storage efficiency. Microtek Laboratories Inc. plays a crucial role in developing high-performance microencapsulation technologies that improve stability and prevent leakage during repeated thermal cycles.

Raha Paraffin Company contributes to the global supply of refined paraffin, which serves as a key raw material for PCM production, while Tempered Entropy focuses on smart temperature-control applications across consumer goods and industrial systems. The growing adoption of microencapsulated PCMs in building materials and HVAC systems reflects the global shift toward sustainable temperature management and reduced energy consumption.

With increasing emphasis on green construction and renewable integration, microencapsulated paraffin PCMs are gaining traction for their versatility and long lifecycle performance. Ongoing research and collaborations among chemical innovators and energy solution providers are accelerating product commercialization and expanding their application scope, positioning these materials as a cornerstone in the next generation of smart thermal management technologies.

| Item | Value |

|---|---|

| Quantitative Units | USD 274.5 Million |

| End Use | Building & construction, HVAC, Electrical & electronics, Packaging, Textiles, Chemical industries, Healthcare, Aerospace & automotive, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

BASF SE, Andores New Energy Co. Ltd., Microtek Laboratories Inc., Rubitherm Technologies GmbH, Raha Paraffin Company, Tempered Entropy |

| Additional Attributes | Dollar sales by type including microencapsulated powders, slurries, and granules, application across building & construction, textiles, and electronics cooling, and region covering North America, Europe, and Asia-Pacific. Growth is driven by demand for energy-efficient solutions, thermal management applications, and adoption in sustainable building materials. |

The global microencapsulated paraffin phase change materials market is estimated to be valued at USD 274.5 million in 2025.

The market size for the microencapsulated paraffin phase change materials market is projected to reach USD 520.1 million by 2035.

The microencapsulated paraffin phase change materials market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in microencapsulated paraffin phase change materials market are building & construction, hvac, electrical & electronics, packaging, textiles, chemical industries, healthcare, aerospace & automotive and others.

In terms of, segment to command 31.8% share in the microencapsulated paraffin phase change materials market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inorganic Ion Exchange Materials Market

Paraffin Wax Market Size and Share Forecast Outlook 2025 to 2035

Phase Shifting Transformer Market Size and Share Forecast Outlook 2025 to 2035

Change And Configuration Management Market Size and Share Forecast Outlook 2025 to 2035

Change Management Software Market Size and Share Forecast Outlook 2025 to 2035

Paraffinic Transformer Oil Market Size and Share Forecast Outlook 2025 to 2035

Paraffin Physical Therapy Market Size and Share Forecast Outlook 2025 to 2035

Paraffins Market Size and Share Forecast Outlook 2025 to 2035

Microencapsulated Omega-3 Powders Market Size and Share Forecast Outlook 2025 to 2035

Changeover Switch Market Size, Share, and Forecast 2025 to 2035

Microencapsulated Fish Oil Market

Change Control Management Software Market

Paraffin Inhibitors Market

Nanomaterials Market Insights - Size, Share & Industry Growth 2025 to 2035

Tire Materials Market Insights – Size, Trends & Forecast 2025–2035

Dual-Phase Cleanser Market Size and Share Forecast Outlook 2025 to 2035

Tire Changers - Market Growth - 2025 to 2035,

Interchangeable Biosimilars Market

Three-Phase Unbalanced Regulating Device Market Size and Share Forecast Outlook 2025 to 2035

Solid Phase Carrier Resin for Peptide Drug Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA