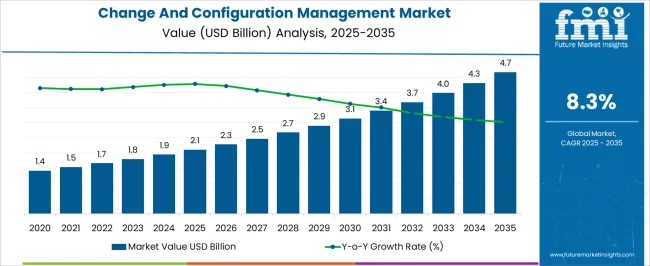

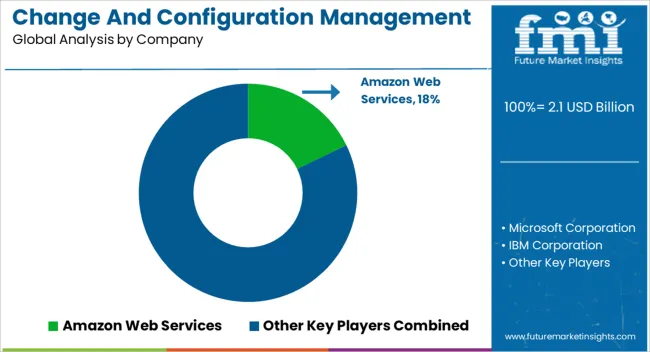

The Change And Configuration Management Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 8.3% over the forecast period.

| Metric | Value |

|---|---|

| Change And Configuration Management Market Estimated Value in (2025 E) | USD 2.1 billion |

| Change And Configuration Management Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 8.3% |

The Change And Configuration Management market is expanding steadily, supported by the increasing need for enterprises to handle complex IT infrastructure, ensure service continuity, and maintain compliance with regulatory frameworks. Organizations are facing growing challenges in managing rapid digital transformations, cloud migrations, and frequent software updates, which makes robust change and configuration management solutions essential. These platforms allow enterprises to track configuration items, automate change approvals, and reduce risks associated with system downtime or security vulnerabilities.

The rising adoption of cloud-native technologies, DevOps practices, and hybrid IT environments is further fueling demand for integrated solutions that provide visibility and control across distributed systems. Increasing regulatory scrutiny around IT governance and data security has also reinforced the need for effective change and configuration management practices.

Businesses are investing in automation, AI-driven analytics, and real-time monitoring to enhance operational efficiency and reduce costs As IT environments grow in complexity, the market is expected to maintain strong momentum, with innovation in automation, compliance management, and predictive risk assessment shaping future growth opportunities.

The change and configuration management market is segmented by component, end-user, vertical, and geographic regions. By component, change and configuration management market is divided into Software and Services. In terms of end-user, change and configuration management market is classified into Large Scale Enterprises and SMEs. Based on vertical, change and configuration management market is segmented into IT And Telecommunications, BFSI, Healthcare, Retail, Energy And Utilities, Transportation, Manufacturing, and Others. Regionally, the change and configuration management industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

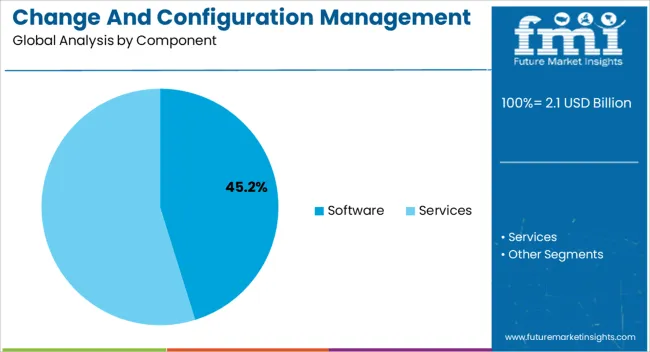

The software component segment is projected to hold 45.2% of the Change And Configuration Management market revenue in 2025, reinforcing its position as the leading component type. The growing preference for software-based solutions stems from their ability to automate change requests, streamline workflows, and provide real-time visibility into configuration items. Enterprises are increasingly leveraging advanced platforms with AI-driven features, predictive analytics, and automated reporting to minimize risks associated with downtime and non-compliance.

Software solutions also provide integration with IT service management, cloud infrastructure, and security systems, which enhances efficiency and reduces manual intervention. Their scalability allows enterprises of varying sizes to adopt tailored functionalities that suit their operational needs. Cost-effectiveness, combined with faster implementation timelines, further supports their adoption.

As organizations continue to expand digital operations and manage complex infrastructure environments, the demand for flexible, automated, and intelligent software platforms is expected to remain strong This dominance highlights the central role of software in shaping the efficiency, resilience, and adaptability of enterprise IT management practices.

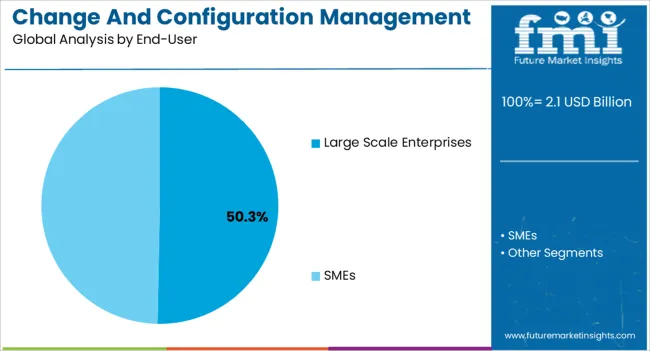

The large scale enterprises segment is anticipated to account for 50.3% of the Change And Configuration Management market revenue in 2025, establishing itself as the leading end-user group. Growth in this segment is being fueled by the increasing complexity of IT infrastructure in multinational corporations, where managing distributed systems and diverse applications requires comprehensive solutions. Large organizations face heightened risks related to system downtime, data breaches, and compliance violations, making robust change and configuration management essential.

Investments in automation, real-time monitoring, and advanced analytics are helping enterprises reduce operational risks while improving service delivery. The ability to manage configuration changes seamlessly across hybrid cloud, multi-vendor, and geographically dispersed environments strengthens adoption in this segment.

Regulatory compliance and governance requirements, particularly in highly regulated industries, further drive demand for enterprise-grade solutions As digital transformation initiatives accelerate, large enterprises are expected to continue prioritizing change and configuration management to enhance business continuity, operational efficiency, and security posture, ensuring this segment retains its dominant market share

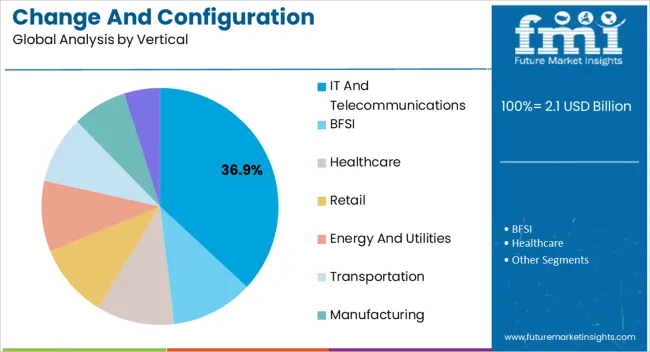

The IT and telecommunications vertical is projected to hold 36.9% of the Change And Configuration Management market revenue in 2025, making it the leading vertical. This dominance is attributed to the industry’s reliance on highly complex, interconnected systems that require continuous monitoring, frequent updates, and strict compliance management. The growing demand for high availability, uninterrupted services, and secure infrastructure is pushing IT and telecom companies to adopt advanced change and configuration management practices.

The segment’s growth is further supported by the ongoing expansion of 5G networks, cloud services, and digital platforms, all of which demand agile and scalable IT operations. Automated tools that provide real-time insights, predictive analytics, and proactive risk management are being widely deployed to minimize disruptions and improve performance.

The need to comply with stringent data security and service quality regulations reinforces the adoption of these solutions As IT and telecommunications providers continue to evolve into digital service enablers, the vertical’s dependence on efficient change and configuration management platforms is expected to remain strong, driving sustained leadership in the market.

Change and configuration management is gradually gaining importance across enterprises due to its several benefits such as reduction in cost as it avoids unnecessary duplication due to knowledge of all the elements required for configuration, provides greater agility and faster problem resolution, thus giving better quality of service.

In addition to this, change and configuration management have the ability to define and enforce formal policies and procedures that govern asset identification, status monitoring, and auditing and offers enhanced efficiencies, stability and control by improving visibility and tracking.

Hence by configuring an efficient change and configuration management system, an enterprise can achieve greater levels of security and minimize the risk factor involved in any project.

Configuration management system comes into picture if there is any change related to the development of the product, for example if a new feature is added into the scope during the development phase of the product. Change management system is relevant when there is a change related to the timeline or the cost of the project.

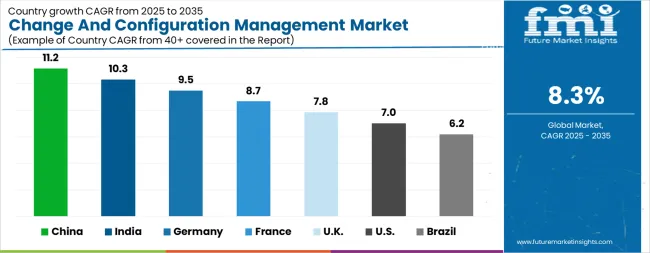

| Country | CAGR |

|---|---|

| China | 11.2% |

| India | 10.3% |

| Germany | 9.5% |

| France | 8.7% |

| UK | 7.8% |

| USA | 7.0% |

| Brazil | 6.2% |

The Change And Configuration Management Market is expected to register a CAGR of 8.3% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 11.2%, followed by India at 10.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.2%, yet still underscores a broadly positive trajectory for the global Change And Configuration Management Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 9.5%. The USA Change And Configuration Management Market is estimated to be valued at USD 770.4 million in 2025 and is anticipated to reach a valuation of USD 1.5 billion by 2035. Sales are projected to rise at a CAGR of 7.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 107.6 million and USD 71.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Component | Software and Services |

| End-User | Large Scale Enterprises and SMEs |

| Vertical | IT And Telecommunications, BFSI, Healthcare, Retail, Energy And Utilities, Transportation, Manufacturing, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amazon Web Services, Microsoft Corporation, IBM Corporation, BMC Software Inc., CA Technologies (Broadcom Inc.), Ansible (Red Hat, Inc.), Hewlett-Packard Enterprise Company, Puppet, Chef Software, Inc., Servicenow Inc., and Codenvy, Inc. |

The global change and configuration management market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the change and configuration management market is projected to reach USD 4.7 billion by 2035.

The change and configuration management market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in change and configuration management market are software and services.

In terms of end-user, large scale enterprises segment to command 50.3% share in the change and configuration management market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Changeover Switch Market Size, Share, and Forecast 2025 to 2035

Change Management Software Market Size and Share Forecast Outlook 2025 to 2035

Change Control Management Software Market

Tire Changers - Market Growth - 2025 to 2035,

Interchangeable Biosimilars Market

Ion Exchange Resins Market Size & Forecast 2025 to 2035

Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

VHF Data Exchange System (VDES) Market Forecast and Outlook 2025 to 2035

Currency Exchange Bureau Software Market – FinTech Evolution

Music Speed Changer Market Size and Share Forecast Outlook 2025 to 2035

Plate Heat Exchanger Market Growth - Trends & Forecast 2025 to 2035

Brewery Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Heat Moisture Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Ion Exchange Materials Market

Transformer Tap Changers and Voltage Control Relay Market Growth – Trends & Forecast 2025 to 2035

Air Cooled Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Automotive Heat Exchanger Market

Brazed Plate Heat Exchangers Market Size and Share Forecast Outlook 2025 to 2035

Shell & Tube Heat Exchangers Market

High Pressure Heat Exchanger Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA