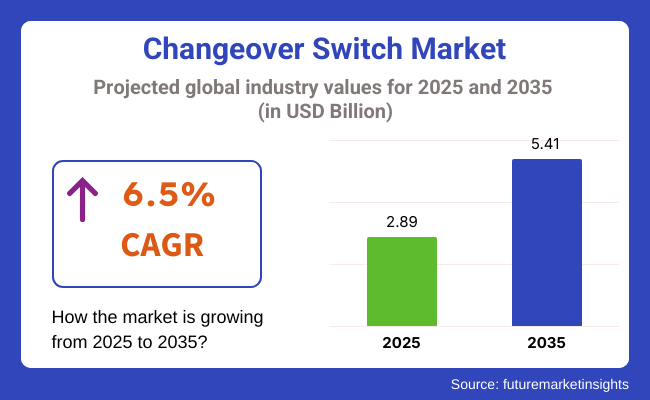

The global changeover switch market is expected to rise steadily from USD 2.89 billion in 2025 to USD 5.41 billion by 2035, registering a CAGR of 6.5% over the forecast period. This growth is driven by the increasing need for uninterrupted power across commercial, residential, and industrial sectors.

Changeover switches-critical for seamless source transitions between grid and generator-are becoming indispensable in power-sensitive applications such as data centers, manufacturing units, HVAC systems, and healthcare infrastructure. Countries like the USA, Germany, and China are witnessing accelerated deployment, especially in smart city and grid modernization initiatives.

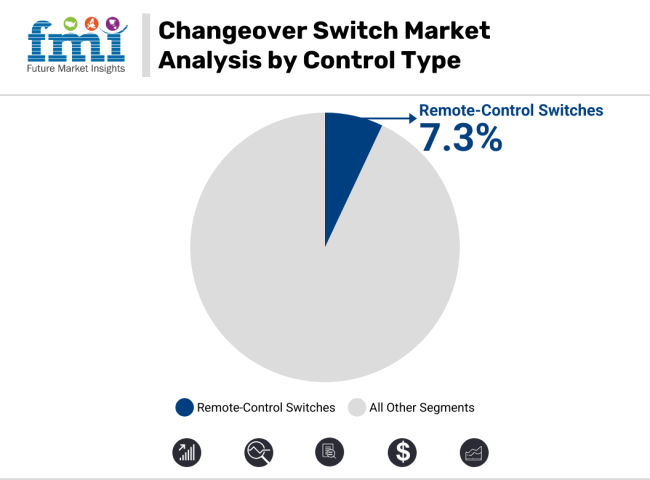

Automatic changeover switches currently lead the market due to their reliability and wide usage across residential buildings and industrial facilities. Manual and remote-control switches continue to serve cost-sensitive and infrastructure-constrained areas, especially in South Asia and Latin America.

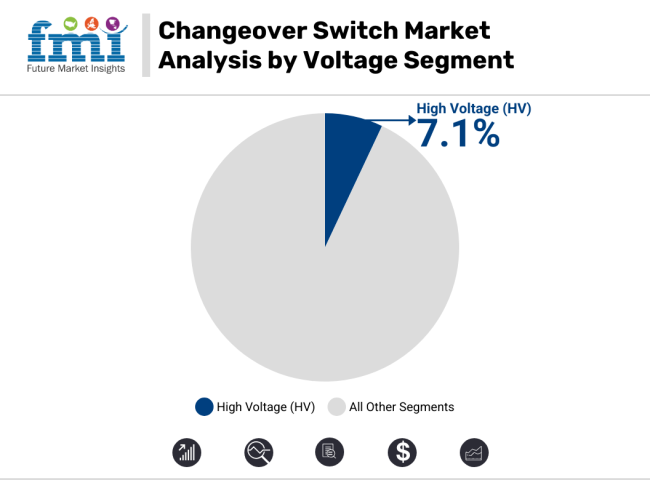

Demand for medium and high voltage switches is rising sharply due to increased investments in renewable energy and smart grid upgrades, with applications spreading across distributed energy storage, microgrids, and large-scale backup systems.

Moreover, evolving user expectations and regulatory pressures are prompting a shift toward more intelligent and energy-efficient switching solutions. In Western Europe and North America, smart changeover switches equipped with real-time diagnostics, IoT-based remote monitoring, and programmable logic control (PLC) are gaining momentum.

These advanced systems enable predictive maintenance and help optimize energy usage, reducing operational downtime in mission-critical environments. Simultaneously, in high-growth regions like India and Southeast Asia, government incentives for rural electrification and industrial corridor development are spurring first-time installations of cost-effective manual and automatic switches.

As building codes and electrical safety standards become more stringent globally, manufacturers are prioritizing compact designs, wide ampere range coverage, and compliance-ready models to cater to both premium and budget-conscious buyers.

Low voltage changeover switches remain dominant in residential and commercial applications, where demand is driven by frequent power outages and growing dependence on backup systems. However, medium and high voltage switches are seeing faster growth, particularly in industrial automation, substations, and renewable energy grids.

High voltage switches are being rapidly adopted in solar farms, EV charging stations, and grid-scale storage installations, especially across China, Germany, and the USA Their robustness and capacity to manage heavy loads make them a vital part of large infrastructure modernization efforts globally.

Automatic changeover switches continue to dominate the global landscape, offering seamless switching between power sources during grid failures-critical for sectors like manufacturing, telecom, and healthcare. Their ease of use, compatibility with automation systems, and role in minimizing human error make them essential in high-demand facilities.

Manual switches, though declining in share, remain relevant in remote and low-budget applications. Meanwhile, remote-controlled switches are rising in popularity as part of smart building systems, enabling power management via wireless or PLC-based systems-especially in office buildings, retail chains, and smart cities.

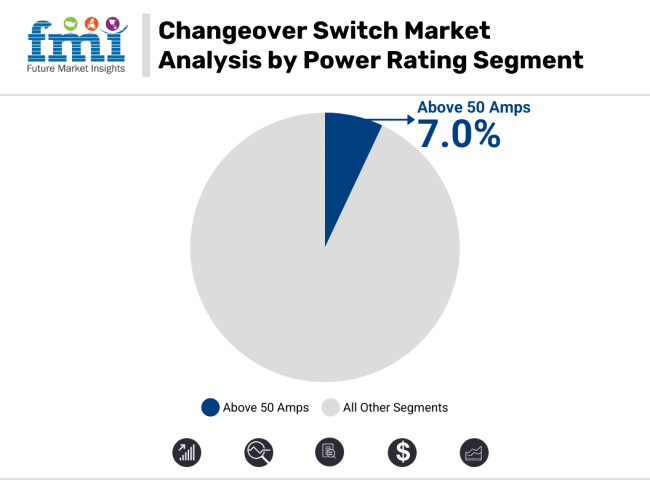

Switches rated above 50 amps are increasingly used in high-load scenarios such as industrial plants, large commercial buildings, and centralized backup systems. Their ability to handle substantial current without overheating or degradation makes them critical for long-duration power shifts.

Conversely, lower-rated segments like 10-20 amps and 20-30 amps are widely adopted in homes, small businesses, and modular systems. Product innovation in thermal protection and space-efficient high-amp designs is supporting demand for above-50-amp variants across the globe.

Power distribution remains the leading application area for changeover switches, driven by its universal need across residential, commercial, and industrial buildings. However, industrial automation is emerging as the fastest-growing segment due to its dependence on continuous, automated power flows.

Factories, logistics centers, and production lines are adopting smart switches to maintain uninterrupted operations, minimize equipment wear, and comply with ISO and IEC safety standards. HVAC systems and lighting control are also key growth areas, particularly in high-performance buildings and energy-managed campuses.

The industry is poised for steady growth, driven by increasing demand for reliable and energy-efficient power management solutions across industries such as utilities, manufacturing, and renewable energy. As businesses adopt more automated and smart grid technologies, those offering innovative, compact, and cost-effective switches will see significant benefits. However, companies that fail to adapt to digital transformation and energy sustainability trends may face challenges in maintaining industry relevance.

Invest in Smart and Digital Solutions

Executives should prioritize investment in smart technologies, focusing on integration with IoT, cloud computing, and automation systems. This will meet the increasing demand for energy-efficient, remotely monitored, and self-regulating power distribution solutions across industries, particularly in utilities and manufacturing.

Align with Renewable Energy and Sustainability Trends

Focus on aligning product development with the rise of renewable energy sources and smart grid technologies. By offering adaptable switches that can seamlessly integrate with solar, wind, and energy storage systems, companies can position themselves as key players in the clean energy transition, capturing market share in expanding renewable energy sectors.

Strengthen Channel Partnerships and R&D Investment

To ensure long-term success, companies should forge strategic partnerships with utility providers, smart grid developers, and renewable energy firms. Concurrently, increasing investment in R&D to innovate compact, reliable, and cost-effective switchgear solutions will strengthen the industry position, boost brand loyalty, and open opportunities for mergers or acquisitions in the growing industry.

Impact: High - Failure to innovate may result in market share erosion and reduced competitiveness. Impact: High - Disruptions could cause delays, increased costs, and reduced profitability. Impact: Medium - Changes in regulations could increase operational costs and cause delays in product approvals.

| Risk | Probability & Impact |

|---|---|

| Technological Obsolescence |

|

| Supply Chain Disruptions |

|

| Regulatory Compliance and Standards Changes |

|

| Priority | Immediate Action |

|---|---|

| Smart Switch Integration | Initiate R&D for integrating IoT and automation capabilities to meet the growing demand for smart grid solutions. |

| Renewable Energy Integration | Develop and test changeover switches tailored for renewable energy sources (solar, wind) and energy storage systems. |

| Supply Chain Optimization | Run feasibility studies on alternative suppliers for key components to mitigate risks from potential supply chain disruptions. |

To stay ahead of the competition in the industry, the client must prioritize investment in digital and smart technologies while aligning product development with the renewable energy transition. This intelligence highlights the growing demand for automated, energy-efficient solutions, especially within industries adopting smart grids and renewable power systems.

The client should focus on enhancing R&D for IoT-enabled changeover switches, integrate them with energy storage systems, and strengthen partnerships within the renewable energy sector. By doing so, they will differentiate themselves from competitors, secure a stronger industry position, and meet the evolving needs of both established and emerging sectors, ensuring long-term growth and profitability.

Surveyed Q4 2024, n=450 stakeholder participants evenly distributed across manufacturers, distributors, and end-users in the US, Western Europe, Japan, and South Korea

Regional Variance:

High Variance:

Convergent and Divergent Perspectives on ROI:

71% of USA stakeholders believe smart this industry is a "worthwhile investment," while 47% in Japan still use manual switches due to higher upfront costs.

Consensus:

Steel: Selected by 68% globally for its durability and reliability, particularly in high-voltage applications.

Regional Variance:

Shared Challenges:

87% of stakeholders identified rising material costs (steel up 20%, aluminium up 15%) as a significant concern affecting product pricing and profitability.

Regional Differences:

Manufacturers:

Distributors:

End-Users (Utility Providers/Manufacturers):

Alignment:

70% of global manufacturers plan to invest in automation and smart technology R&D, focusing on predictive maintenance and real-time energy management.

Divergence:

High Consensus:

Reliability, integration with smart grids, and energy efficiency are key priorities across regions.

Key Variances:

Strategic Insight:

Tailored solutions based on regional demands (e.g., smart switches in the US, cost-effective designs in Asia, sustainability in Europe) will be essential to break into and lead in these industries.

| Countries | Regulatory Impact and Policies |

|---|---|

| United States | Energy efficiency regulations like EPACT and EISA push for energy-efficient switchgear. Smart grid policies promote IoT-enabled switches. Mandatory UL certifications and compliance with NEC standards are required. |

| European Union | Eco Design and Energy Efficiency Directives promote sustainable switchgear. RoHS and WEEE regulations focus on eco-friendly materials and recycling. CE Marking is required for safety and environmental compliance. |

| Japan | Smart grid policies and the Energy Conservation Law push for advanced energy solutions. PSE and JIS certifications are mandatory for safety and quality standards. |

|

South Korea |

Renewable energy policies and the Green New Deal promote digital changeover switches. Energy-efficient products are required by the Energy Use Rationalization Act. KCs certification is needed for safety and quality. |

| China | Policies under the 13th Five-Year Plan focus on smart grids and renewable energy. Energy efficiency regulations drive demand for automated switches. CCC and CQC certifications are required for safety and quality. |

| India | The National Smart Grid Mission and BEE regulations push for energy-efficient. ISI certification is required for electrical products. |

| Australia | The National Energy Productivity Plan and ARENA support renewable energy integration. C-tick and RCM certifications ensure product safety and compliance. |

From 2025 to 2035, the industry in the USA is anticipated to expand at a CAGR of 5.1% due, to the growing adoption of renewable energy, the modernization of electrical grids, and the push for more effective power switching systems.

With the government making advances in clean energy and infrastructure modernization, the demand for these switches in daily life is increasing. Regulatory standards like the NEC, and UL certification to cover the requirements for safety as well as the performance of the systems act as another driving factor for the demand of such systems in residential as well as industrial sectors.

In the UK, the sector is expected to expand at a CAGR of 4.8% between 2025 and 2035, significantly boosted by the transition to renewable energy and the modernization of power distribution networks. The ongoing transition of the country towards net-zero emissions has increased the demand for energy-efficient and automated systems including changeover switches.

Current legislation, like the Eco Design Directive and other energy efficiency directives, are creating motivation for the procurement of products that meet higher performance and environmental standards. During power failure or system malfunction, these switches provide a way to act and transfer power to the inverter or battery supply or vice versa.

France is projected to see a CAGR of 5.3% in the switch gear industry from 2025 to 2035, driven by EU-wide initiatives for grid modernization. It is experiencing growth in the industry and is driven by its commitment to renewable energy. With increasing investments in solar and wind power, demand for switches capable of handling these energy sources is rising.

Regulatory frameworks such as the EU’s Eco Design Directive and RoHS are pushing manufacturers to deliver efficient and eco-friendly products. The country’s grid modernization initiatives and energy efficiency targets will further contribute to the robust industry growth during this period.

The German industry is expected to grow at a 5.3% CAGR from 2025 to 2035 driven by the country's energy transition to renewables and energy grid modernization. In Germany, the transition to different renewable energy sources is gaining traction, leading to greater demand for reliable electrical systems for a seamless transition from the grid.

These systems are critical to maintaining reliable electricity supply during variations of renewable energy sources such as wind and solar. The government’s Energiewende initiative for decarbonization encourages such systems. The EU’s focus on reducing carbon footprints drives stricter regulations and increased demand for energy-efficient solutions. Apart from that, with stringent regulations in place such as Eco Design directive, CE marking, etc. only safe and energy-efficient solutions are welcomed in the country which propels growth in this segment.

In Italy, the industry is forecast to expand at a five-year CAGR of 5.3% from 2025 to 2035, matching that of the country’s fast-tracked progression to further adopt renewable energy alongside upgraded grid infrastructure. With Italy's increasing renewable energy production, especially in solar and wind, the role of switching systems is becoming more critical.

These systems enhance grid stability as Italy integrates variable renewables, with sustainability driven by EU regulations like the Eco Design Directive and RoHS, fueling demand for advanced electrical solutions. These are part and parcel of modernizing the Italian grid and enabling the country’s clean energy transition.

South Korea is expected to grow with a CAGR of 5.4% during the forecast period, mainly due to government-driven interests in smart grid development and renewable energy integration, South Korea’s industry is projected to see rapid growth.

With a reduced carbon footprint, governments and regulators are pushing for energy-efficient technologies through the Green New Deal, enhancing demand for advanced transfer transitions that allow the seamless switch between power supply sources. Such systems are needed because of the government’s sustainability goals and carbon reduction commitments and because of stringent regulatory standards. The increasing penetration of RE sources will further back up the progress of this sector.

Japan’s industry, on the other hand, is expected to grow at a steady pace, with a CAGR of 5.1% anticipated from 2025 to 2035, as the country updates its grid infrastructure and continues to integrate renewable energy. The government’s efficiency and carbon reduction initiatives are encouraging the uptake of advanced systems that guarantee seamless transitions across grids. Japan is cautious about the costs of such transitions, but despite these concerns, the PSE certification and strict safety standards ensure the use of high-quality and reliable systems in grid modernization.

China’s industry is expected to grow at a CAGR of 6.4% from 2025 to 2035, driven by rapid industrial growth and infrastructure development. China’s industry is experiencing significant growth driven by its ambitious renewable energy goals and grid modernization efforts. The government’s focus on clean energy and smart grid infrastructure is creating strong demand for energy-efficient and automated switches.

With policies promoting smart grid development and carbon emission reduction, China is set to remain a dominant industry. Stringent regulations like CCC certification ensure that products meet safety and energy efficiency standards, supporting continuous growth in this industry.

The industry underwent significant transformation in 2024 as manufacturers prioritized sustainability initiatives. Several leading companies introduced new eco-friendly switchgear solutions that replaced SF6 gas with more environmentally responsible alternatives, responding to tightening global regulations on greenhouse gases.

Digital transformation accelerated across the industry with enhanced integration of IoT capabilities in the products. These smart solutions enabled remote monitoring, predictive maintenance, and improved grid stability, particularly important for critical infrastructure applications including data centres and healthcare facilities.

Industry expansion in developing regions, particularly Southeast Asia and parts of Africa, created new competitive dynamics as regional manufacturers gained traction by offering solutions specifically engineered for local electrical grid requirements and price points. This regional diversification prompted established global players to adapt their strategies.

The industry is segmented into low voltage (LV), medium voltage (MV), and high voltage (HV).

It is segmented into manual changeover switches, automatic changeover switches, and remote control changeover switches.

It is segmented into up to 10 amps, 10-20 amps, 20-30 amps, 30-50 amps, and above 50 amps.

It is fragmented into power distribution, motor control, lighting control, heating, ventilation, air conditioning (HVAC), and industrial automation.

The industry is fragmented among North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

Changeover switches are electrical devices that allow a seamless transition between two power sources. They ensure continuous power supply by switching from a primary to a backup source when needed.

Industries like manufacturing, healthcare, data centres, and residential applications benefit the most, as they require uninterrupted power for operations and safety.

The voltage rating should match the electrical requirements of the application. Low voltage switches are ideal for residential use, while higher ratings are needed for industrial or commercial applications.

Consider the level of automation required, frequency of use, and the environment. Automatic transfer switches (ATS) are preferred for critical systems, while manual switches may suffice for less demanding applications.

Technological advancements, such as smart monitoring and automation, enhance the efficiency of these switches by improving reliability, reducing downtime, and offering remote control capabilities.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 & 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 & 2033

Table 3: Global Market Value (US$ Million) Forecast by Voltage, 2018 & 2033

Table 4: Global Market Volume (Units) Forecast by Voltage, 2018 & 2033

Table 5: Global Market Value (US$ Million) Forecast by Control Type, 2018 & 2033

Table 6: Global Market Volume (Units) Forecast by Control Type, 2018 & 2033

Table 7: Global Market Value (US$ Million) Forecast by Power Rating, 2018 & 2033

Table 8: Global Market Volume (Units) Forecast by Power Rating, 2018 & 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 10: Global Market Volume (Units) Forecast by Application, 2018 & 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 & 2033

Table 13: North America Market Value (US$ Million) Forecast by Voltage, 2018 & 2033

Table 14: North America Market Volume (Units) Forecast by Voltage, 2018 & 2033

Table 15: North America Market Value (US$ Million) Forecast by Control Type, 2018 & 2033

Table 16: North America Market Volume (Units) Forecast by Control Type, 2018 & 2033

Table 17: North America Market Value (US$ Million) Forecast by Power Rating, 2018 & 2033

Table 18: North America Market Volume (Units) Forecast by Power Rating, 2018 & 2033

Table 19: North America Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 20: North America Market Volume (Units) Forecast by Application, 2018 & 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 & 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Voltage, 2018 & 2033

Table 24: Latin America Market Volume (Units) Forecast by Voltage, 2018 & 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Control Type, 2018 & 2033

Table 26: Latin America Market Volume (Units) Forecast by Control Type, 2018 & 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Power Rating, 2018 & 2033

Table 28: Latin America Market Volume (Units) Forecast by Power Rating, 2018 & 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 30: Latin America Market Volume (Units) Forecast by Application, 2018 & 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 & 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Voltage, 2018 & 2033

Table 34: Western Europe Market Volume (Units) Forecast by Voltage, 2018 & 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Control Type, 2018 & 2033

Table 36: Western Europe Market Volume (Units) Forecast by Control Type, 2018 & 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Power Rating, 2018 & 2033

Table 38: Western Europe Market Volume (Units) Forecast by Power Rating, 2018 & 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 40: Western Europe Market Volume (Units) Forecast by Application, 2018 & 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 & 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Voltage, 2018 & 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Voltage, 2018 & 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Control Type, 2018 & 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Control Type, 2018 & 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Power Rating, 2018 & 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Power Rating, 2018 & 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Application, 2018 & 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 52: East Asia Market Volume (Units) Forecast by Country, 2018 & 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Voltage, 2018 & 2033

Table 54: East Asia Market Volume (Units) Forecast by Voltage, 2018 & 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Control Type, 2018 & 2033

Table 56: East Asia Market Volume (Units) Forecast by Control Type, 2018 & 2033

Table 57: East Asia Market Value (US$ Million) Forecast by Power Rating, 2018 & 2033

Table 58: East Asia Market Volume (Units) Forecast by Power Rating, 2018 & 2033

Table 59: East Asia Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 60: East Asia Market Volume (Units) Forecast by Application, 2018 & 2033

Table 61: South Asia Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 62: South Asia Market Volume (Units) Forecast by Country, 2018 & 2033

Table 63: South Asia Market Value (US$ Million) Forecast by Voltage, 2018 & 2033

Table 64: South Asia Market Volume (Units) Forecast by Voltage, 2018 & 2033

Table 65: South Asia Market Value (US$ Million) Forecast by Control Type, 2018 & 2033

Table 66: South Asia Market Volume (Units) Forecast by Control Type, 2018 & 2033

Table 67: South Asia Market Value (US$ Million) Forecast by Power Rating, 2018 & 2033

Table 68: South Asia Market Volume (Units) Forecast by Power Rating, 2018 & 2033

Table 69: South Asia Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 70: South Asia Market Volume (Units) Forecast by Application, 2018 & 2033

Table 71: MEA Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 72: MEA Market Volume (Units) Forecast by Country, 2018 & 2033

Table 73: MEA Market Value (US$ Million) Forecast by Voltage, 2018 & 2033

Table 74: MEA Market Volume (Units) Forecast by Voltage, 2018 & 2033

Table 75: MEA Market Value (US$ Million) Forecast by Control Type, 2018 & 2033

Table 76: MEA Market Volume (Units) Forecast by Control Type, 2018 & 2033

Table 77: MEA Market Value (US$ Million) Forecast by Power Rating, 2018 & 2033

Table 78: MEA Market Volume (Units) Forecast by Power Rating, 2018 & 2033

Table 79: MEA Market Value (US$ Million) Forecast by Application, 2018 & 2033

Table 80: MEA Market Volume (Units) Forecast by Application, 2018 & 2033

Figure 1: Global Market Value (US$ Million) by Voltage, 2023 & 2033

Figure 2: Global Market Value (US$ Million) by Control Type, 2023 & 2033

Figure 3: Global Market Value (US$ Million) by Power Rating, 2023 & 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 & 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 & 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 & 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 & 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 & 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Voltage, 2018 & 2033

Figure 11: Global Market Volume (Units) Analysis by Voltage, 2018 & 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Voltage, 2023 & 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Control Type, 2018 & 2033

Figure 15: Global Market Volume (Units) Analysis by Control Type, 2018 & 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Control Type, 2023 & 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Control Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Power Rating, 2018 & 2033

Figure 19: Global Market Volume (Units) Analysis by Power Rating, 2018 & 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Power Rating, 2023 & 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 23: Global Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Voltage, 2023 to 2033

Figure 27: Global Market Attractiveness by Control Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Power Rating, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Voltage, 2023 & 2033

Figure 32: North America Market Value (US$ Million) by Control Type, 2023 & 2033

Figure 33: North America Market Value (US$ Million) by Power Rating, 2023 & 2033

Figure 34: North America Market Value (US$ Million) by Application, 2023 & 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 & 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Voltage, 2018 & 2033

Figure 41: North America Market Volume (Units) Analysis by Voltage, 2018 & 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Voltage, 2023 & 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Control Type, 2018 & 2033

Figure 45: North America Market Volume (Units) Analysis by Control Type, 2018 & 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Control Type, 2023 & 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Control Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Power Rating, 2018 & 2033

Figure 49: North America Market Volume (Units) Analysis by Power Rating, 2018 & 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Power Rating, 2023 & 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 53: North America Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Voltage, 2023 to 2033

Figure 57: North America Market Attractiveness by Control Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Power Rating, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Voltage, 2023 & 2033

Figure 62: Latin America Market Value (US$ Million) by Control Type, 2023 & 2033

Figure 63: Latin America Market Value (US$ Million) by Power Rating, 2023 & 2033

Figure 64: Latin America Market Value (US$ Million) by Application, 2023 & 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 & 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Voltage, 2018 & 2033

Figure 71: Latin America Market Volume (Units) Analysis by Voltage, 2018 & 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Voltage, 2023 & 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Control Type, 2018 & 2033

Figure 75: Latin America Market Volume (Units) Analysis by Control Type, 2018 & 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Control Type, 2023 & 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Control Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Power Rating, 2018 & 2033

Figure 79: Latin America Market Volume (Units) Analysis by Power Rating, 2018 & 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Power Rating, 2023 & 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 83: Latin America Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Voltage, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Control Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Power Rating, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Voltage, 2023 & 2033

Figure 92: Western Europe Market Value (US$ Million) by Control Type, 2023 & 2033

Figure 93: Western Europe Market Value (US$ Million) by Power Rating, 2023 & 2033

Figure 94: Western Europe Market Value (US$ Million) by Application, 2023 & 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 & 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Voltage, 2018 & 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Voltage, 2018 & 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Voltage, 2023 & 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Control Type, 2018 & 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Control Type, 2018 & 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Control Type, 2023 & 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Control Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Power Rating, 2018 & 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Power Rating, 2018 & 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Power Rating, 2023 & 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Voltage, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Control Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Power Rating, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Voltage, 2023 & 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Control Type, 2023 & 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Power Rating, 2023 & 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Application, 2023 & 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 & 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Voltage, 2018 & 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Voltage, 2018 & 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Voltage, 2023 & 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Control Type, 2018 & 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Control Type, 2018 & 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Control Type, 2023 & 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Control Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Power Rating, 2018 & 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Power Rating, 2018 & 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Power Rating, 2023 & 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Voltage, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Control Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Power Rating, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Voltage, 2023 & 2033

Figure 152: East Asia Market Value (US$ Million) by Control Type, 2023 & 2033

Figure 153: East Asia Market Value (US$ Million) by Power Rating, 2023 & 2033

Figure 154: East Asia Market Value (US$ Million) by Application, 2023 & 2033

Figure 155: East Asia Market Value (US$ Million) by Country, 2023 & 2033

Figure 156: East Asia Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 157: East Asia Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 158: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 159: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: East Asia Market Value (US$ Million) Analysis by Voltage, 2018 & 2033

Figure 161: East Asia Market Volume (Units) Analysis by Voltage, 2018 & 2033

Figure 162: East Asia Market Value Share (%) and BPS Analysis by Voltage, 2023 & 2033

Figure 163: East Asia Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 164: East Asia Market Value (US$ Million) Analysis by Control Type, 2018 & 2033

Figure 165: East Asia Market Volume (Units) Analysis by Control Type, 2018 & 2033

Figure 166: East Asia Market Value Share (%) and BPS Analysis by Control Type, 2023 & 2033

Figure 167: East Asia Market Y-o-Y Growth (%) Projections by Control Type, 2023 to 2033

Figure 168: East Asia Market Value (US$ Million) Analysis by Power Rating, 2018 & 2033

Figure 169: East Asia Market Volume (Units) Analysis by Power Rating, 2018 & 2033

Figure 170: East Asia Market Value Share (%) and BPS Analysis by Power Rating, 2023 & 2033

Figure 171: East Asia Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 172: East Asia Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 173: East Asia Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 174: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 175: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 176: East Asia Market Attractiveness by Voltage, 2023 to 2033

Figure 177: East Asia Market Attractiveness by Control Type, 2023 to 2033

Figure 178: East Asia Market Attractiveness by Power Rating, 2023 to 2033

Figure 179: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 180: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: South Asia Market Value (US$ Million) by Voltage, 2023 & 2033

Figure 182: South Asia Market Value (US$ Million) by Control Type, 2023 & 2033

Figure 183: South Asia Market Value (US$ Million) by Power Rating, 2023 & 2033

Figure 184: South Asia Market Value (US$ Million) by Application, 2023 & 2033

Figure 185: South Asia Market Value (US$ Million) by Country, 2023 & 2033

Figure 186: South Asia Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 187: South Asia Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 188: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 189: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: South Asia Market Value (US$ Million) Analysis by Voltage, 2018 & 2033

Figure 191: South Asia Market Volume (Units) Analysis by Voltage, 2018 & 2033

Figure 192: South Asia Market Value Share (%) and BPS Analysis by Voltage, 2023 & 2033

Figure 193: South Asia Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 194: South Asia Market Value (US$ Million) Analysis by Control Type, 2018 & 2033

Figure 195: South Asia Market Volume (Units) Analysis by Control Type, 2018 & 2033

Figure 196: South Asia Market Value Share (%) and BPS Analysis by Control Type, 2023 & 2033

Figure 197: South Asia Market Y-o-Y Growth (%) Projections by Control Type, 2023 to 2033

Figure 198: South Asia Market Value (US$ Million) Analysis by Power Rating, 2018 & 2033

Figure 199: South Asia Market Volume (Units) Analysis by Power Rating, 2018 & 2033

Figure 200: South Asia Market Value Share (%) and BPS Analysis by Power Rating, 2023 & 2033

Figure 201: South Asia Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 202: South Asia Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 203: South Asia Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 204: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 205: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 206: South Asia Market Attractiveness by Voltage, 2023 to 2033

Figure 207: South Asia Market Attractiveness by Control Type, 2023 to 2033

Figure 208: South Asia Market Attractiveness by Power Rating, 2023 to 2033

Figure 209: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 210: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: MEA Market Value (US$ Million) by Voltage, 2023 & 2033

Figure 212: MEA Market Value (US$ Million) by Control Type, 2023 & 2033

Figure 213: MEA Market Value (US$ Million) by Power Rating, 2023 & 2033

Figure 214: MEA Market Value (US$ Million) by Application, 2023 & 2033

Figure 215: MEA Market Value (US$ Million) by Country, 2023 & 2033

Figure 216: MEA Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 217: MEA Market Volume (Units) Analysis by Country, 2018 & 2033

Figure 218: MEA Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 219: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MEA Market Value (US$ Million) Analysis by Voltage, 2018 & 2033

Figure 221: MEA Market Volume (Units) Analysis by Voltage, 2018 & 2033

Figure 222: MEA Market Value Share (%) and BPS Analysis by Voltage, 2023 & 2033

Figure 223: MEA Market Y-o-Y Growth (%) Projections by Voltage, 2023 to 2033

Figure 224: MEA Market Value (US$ Million) Analysis by Control Type, 2018 & 2033

Figure 225: MEA Market Volume (Units) Analysis by Control Type, 2018 & 2033

Figure 226: MEA Market Value Share (%) and BPS Analysis by Control Type, 2023 & 2033

Figure 227: MEA Market Y-o-Y Growth (%) Projections by Control Type, 2023 to 2033

Figure 228: MEA Market Value (US$ Million) Analysis by Power Rating, 2018 & 2033

Figure 229: MEA Market Volume (Units) Analysis by Power Rating, 2018 & 2033

Figure 230: MEA Market Value Share (%) and BPS Analysis by Power Rating, 2023 & 2033

Figure 231: MEA Market Y-o-Y Growth (%) Projections by Power Rating, 2023 to 2033

Figure 232: MEA Market Value (US$ Million) Analysis by Application, 2018 & 2033

Figure 233: MEA Market Volume (Units) Analysis by Application, 2018 & 2033

Figure 234: MEA Market Value Share (%) and BPS Analysis by Application, 2023 & 2033

Figure 235: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 236: MEA Market Attractiveness by Voltage, 2023 to 2033

Figure 237: MEA Market Attractiveness by Control Type, 2023 to 2033

Figure 238: MEA Market Attractiveness by Power Rating, 2023 to 2033

Figure 239: MEA Market Attractiveness by Application, 2023 to 2033

Figure 240: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Switchgear for Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Switchrack Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Switching Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Switching Commercial Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Switched Reluctance Motors Market Growth - Trends & Forecast 2025 to 2035

Switchgear Market Growth - Trends & Forecast 2025 to 2035

AC Switchgear Market Size and Share Forecast Outlook 2025 to 2035

RF Switches Market Size and Share Forecast Outlook 2025 to 2035

DC Switchgear Market - Size, Share, and Forecast 2025 to 2035

Keyboard, Video (monitor), Mouse (KVM) Switch Market Size, Growth, and Forecast for 2025 to 2035

Time Switch Market Analysis Size and Share Forecast Outlook 2025 to 2035

Level Switches Market Growth - Trends & Forecast 2025 to 2035

Rocker Switch Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Bypass Switch Market Size, Growth, and Forecast 2025 to 2035

Safety Switches Market Trends – Growth & Forecast 2025 to 2035

Vacuum Switches Market

Antenna Switch Module Market Size and Share Forecast Outlook 2025 to 2035

Optical Switches Market Analysis by Type, Application & Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA