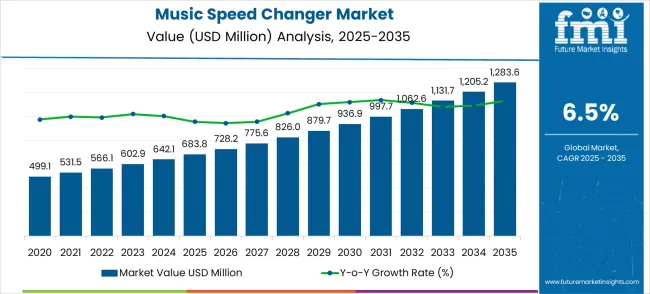

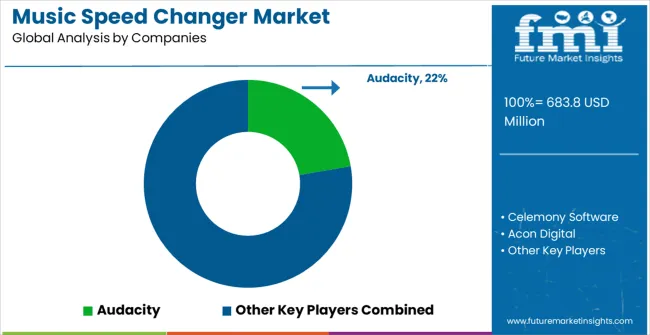

The global music speed changer market is projected to grow from USD 683.8 million in 2025 to approximately USD 1,283.6 million by 2035, recording an absolute increase of USD 599.8 million over the forecast period. This translates into a total growth of 87.7%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.5% between 2025 and 2035. The overall market size is expected to grow by nearly 1.88X during the same period, supported by the rising adoption of digital audio processing technologies and increasing demand for professional and personal music editing solutions.

Between 2025 and 2030, the Music Speed Changer market is projected to expand from USD 683.8 million to USD 936.9 million, resulting in a value increase of USD 253.1 million, which represents 42.2% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of digital audio workstations across creative industries, increasing demand for tempo manipulation tools in music production, and growing adoption of cloud-based audio processing solutions. Service providers are expanding their software capabilities to address the growing complexity of modern audio editing requirements.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 683.8 million |

| Forecast Value (2035) | USD 1,283.6 million |

| Forecast CAGR (2025–2035) | 6.5% |

The music speed changer market, contributing approximately 6.2%, plays a significant role within the audio equipment market, driven by demand for tools that assist in adjusting playback speed for practice, editing, and content creation. In the music production software market, it holds a share of 8.5%, as these features are often integrated into digital platforms used by producers and musicians. Within the digital audio workstation (DAW) market, the share is around 7.1%, with speed adjustment being a key function in editing and mixing audio. The musical instrument accessories market contributes 4.9%, as musicians often use speed changers for practice or performance adjustments. Lastly, the streaming services market, which accounts for 3.7%, leverages these tools to enhance user experiences, particularly for educational or personalized music experiences. These parent markets contribute a combined 30.4%, highlighting the broader relevance of music speed changers in supporting creators, performers, and listeners in various music-related activities. Their growing importance reflects the need for flexible audio manipulation in both professional and consumer-oriented applications.

Market expansion is being supported by the rapid increase in digital content creation and the corresponding need for specialized audio processing tools that enable precise tempo control without pitch distortion. Modern content creators rely on accurate speed manipulation technologies to enhance audio content quality including podcast production, music composition, and educational material development. Even minor tempo adjustments require sophisticated algorithms to maintain optimal audio quality and listener experience.

The growing complexity of audio production technologies and increasing demand for professional-grade editing capabilities are driving demand for advanced speed changing solutions from certified software providers with appropriate algorithms and expertise. Content creation platforms are increasingly requiring high-quality audio processing capabilities to maintain competitive advantages and ensure content quality standards. Industry requirements and professional production specifications are establishing standardized tempo manipulation procedures that require specialized software tools and trained operators.

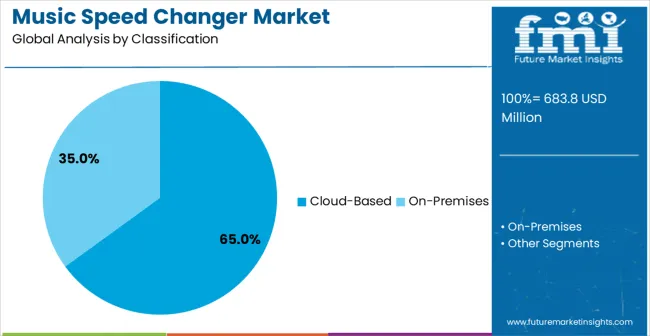

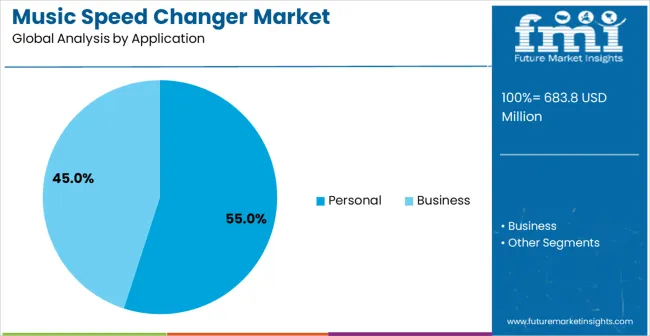

The market is segmented by deployment type, application, and region. By deployment type, the market is divided into cloud-based and on-premises solutions. Based on application, the market is categorized into personal and business applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

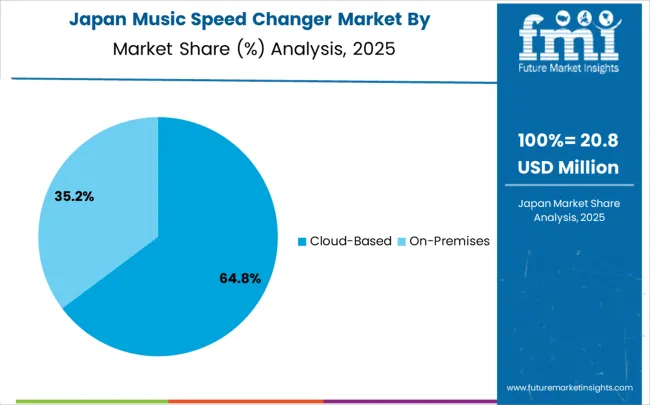

Cloud-based deployment is projected to account for 65% of the music speed changer market in 2025. This leading share is supported by the widespread adoption of cloud computing solutions for audio processing applications, which offer enhanced accessibility and collaborative capabilities across multiple devices and platforms. Cloud-based platforms provide scalable processing power and cross-device synchronization, making them the preferred choice for most professional and personal users who require consistent access to their audio editing projects. The segment benefits from established cloud infrastructure and comprehensive feature availability from multiple software providers who have invested heavily in server-side processing capabilities.

The dominance of cloud-based solutions stems from their ability to handle resource-intensive audio processing tasks without requiring high-end local hardware configurations. Users can access sophisticated tempo manipulation algorithms and real-time processing capabilities through standard web browsers or lightweight applications, eliminating the need for expensive software installations and hardware upgrades. Cloud platforms also enable seamless collaboration between multiple users, allowing music producers, content creators, and audio engineers to share projects and work simultaneously on tempo adjustment tasks. Additionally, automatic software updates, backup capabilities, and cross-platform compatibility further strengthen the appeal of cloud-based music speed changer solutions among diverse user communities.

Personal applications are expected to represent 55% of music speed changer software demand in 2025. This dominant share reflects the high penetration of individual content creators and music enthusiasts who require tempo manipulation tools for personal projects, including music practice, podcast creation, and entertainment content development. Modern personal users increasingly utilize multiple speed changing features for various audio editing activities, ranging from slowing down complex musical passages for learning purposes to adjusting tempo for fitness routines and dance choreography. The segment benefits from growing consumer awareness of audio editing capabilities and increasing accessibility of professional-grade tools that were previously available only to industry professionals.

The personal application segment's growth is driven by the democratization of content creation and the rising popularity of user-generated audio content across social media platforms and streaming services. Individual musicians, music students, and hobbyists represent a substantial portion of this market, using tempo manipulation tools to practice instruments, create covers, and develop original compositions. The availability of intuitive user interfaces and affordable pricing models has made professional-quality speed changing software accessible to non-technical users. Furthermore, the integration of educational features, preset configurations, and guided tutorials has lowered the barrier to entry, enabling casual users to achieve professional-quality results without extensive technical knowledge or audio engineering expertise.

The music speed changer market is witnessing growing demand driven by its increasing use in the music industry, education, and audio production. Demand has surged with the rise of digital music platforms, online learning, and music creation tools. Opportunities are emerging in music analysis, audio editing, and personalized learning environments. However, challenges related to software integration, limited compatibility with certain formats, and competition from free or lower-cost solutions continue to affect market growth and adoption in diverse sectors.

The demand for music speed changers has grown significantly, driven by their increasing use in music production, audio editing, and practice tools for musicians. In opinion, audio professionals and hobbyists alike are increasingly turning to speed changers to manipulate tempo, pitch, and rhythm, offering enhanced control over music tracks. These tools are seen as essential in music remixing, learning, and transcription processes. As digital music platforms continue to evolve, the need for such tools in enhancing audio content, adapting to user preferences, and improving accessibility is becoming more apparent. Overall, the rise in music production and audio content creation is fueling the demand for speed changers in various applications.

Opportunities in the music speed changer market are emerging across education and music analysis sectors. In opinion, music teachers and students are increasingly adopting these tools for music practice, transcription, and learning at customized tempos. Educational institutions are using speed changers to help students learn complex musical pieces at their own pace, improving musical comprehension and skill development. Furthermore, music analysts and composers are leveraging speed changers for detailed music analysis, adjusting speeds to study composition and structure in-depth. As the demand for personalized music learning experiences and efficient music analysis grows, the market is expected to see further opportunities in these areas.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| Brazil | 6.8% |

| United States | 6.2% |

| United Kingdom | 5.5% |

| Japan | 4.9% |

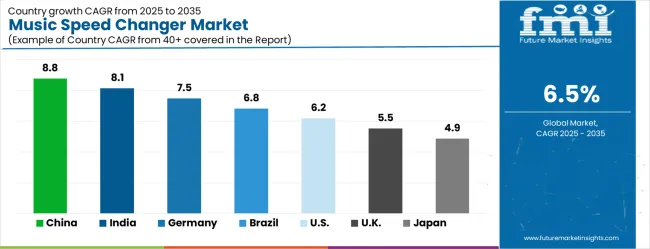

The music speed changer market is growing rapidly, with China leading at an 8.8% CAGR through 2035, driven by strong digital content creation adoption, expanding creative industries, and increasing professional audio production capabilities. India follows at 8.1%, supported by rising music technology adoption and growing independent content creator communities. Germany grows steadily at 7.5%, integrating advanced audio processing into its established music production infrastructure. Brazil records 6.8%, emphasizing accessibility and creative application development. The United States shows solid growth at 6.2%, focusing on professional market expansion and educational integration. The United Kingdom demonstrates steady progress at 5.5%, maintaining established creative industry applications. Japan records 4.9% growth, concentrating on technological innovation and quality enhancement. The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

The music speed changer market in China is expanding at a CAGR of 8.8%, driven by the increasing demand for music production tools in both professional and amateur settings. The country’s rapidly growing entertainment and media industries, particularly in digital music, are significant drivers of growth. As China continues to embrace digital content creation and online music platforms, the adoption of music speed changers, which help creators manipulate audio to fit different production needs, is increasing. The rise in the number of music producers, artists, and content creators further supports the demand for these tools.

The music speed changer market in India is projected to grow at a CAGR of 8.1%, driven by the expanding music industry and the increasing popularity of digital music creation and audio editing tools. The rise in local content production and the growing number of independent music artists and producers are driving the adoption of music speed changers for altering audio speed and pitch. India’s growing music streaming market and the increasing consumption of digital content also contribute to the demand for tools that help enhance the audio experience.

The music speed changer market in Germany is growing at a CAGR of 7.5%, driven by the demand for high-efficiency music production tools in professional settings. Germany’s strong music production industry and its focus on innovation in audio editing technologies continue to push demand for speed changers. As the country embraces digital tools for creative audio processes, the adoption of music speed changers for professional use continues to rise. The presence of a large base of professional artists, DJs, and producers further drives the market.

The music speed changer market in Brazil is projected to grow at a CAGR of 6.8%, supported by the expansion of the entertainment and media industries. Brazil’s growing interest in digital music production and editing tools continues to fuel the demand for music speed changers. As more Brazilian artists and producers embrace digital technologies for audio manipulation, the need for speed changers to adjust audio tempos and pitch increases. Furthermore, Brazil’s emerging digital content creation culture is contributing to the rising use of audio editing tools among content creators.

The music speed changer market in the United States is growing at a CAGR of 6.2%, fueled by increasing demand in the music production, media, and entertainment sectors. As the USA continues to lead in music technology innovations, the adoption of music speed changers among professionals and enthusiasts for live performances, audio editing, and music creation continues to rise. Furthermore, the growing number of music production schools and courses helps foster interest in tools that assist with audio manipulation.

The music speed changer market in the United Kingdom is growing at a CAGR of 5.5%, with steady demand from the music production and professional audio editing sectors. The UK’s strong presence in the entertainment and music industry supports the increasing use of audio tools that allow producers to fine-tune audio for different creative needs. As digital music creation continues to expand, the demand for speed changers in both professional and amateur settings rises.

The music speed changer market in Japan is expanding at a CAGR of 4.9%, with increasing demand from the music production, entertainment, and content creation sectors. Japan’s robust music industry and technological advancements in audio editing tools support the growth of speed changers, which are essential for adjusting tempos and pitch in music creation. As digital music and content creation gain popularity in Japan, there is a rising demand for audio editing tools to cater to the growing number of music creators.

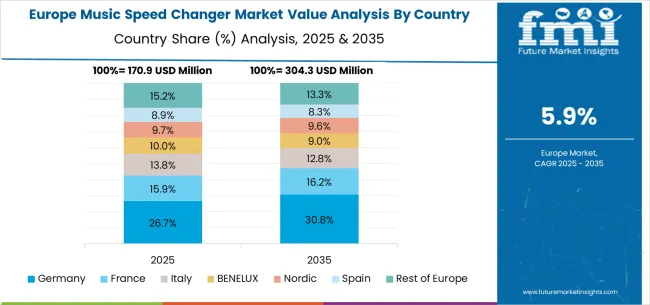

The European music speed changer market is forecast to grow from USD 183.7 million in 2025 to USD 341.6 million by 2035, achieving a CAGR of 6.5%. Germany will remain the region’s largest market, with its share easing from 24.0% in 2025 to 23.5% by 2035, supported by advanced audio technology innovation and strong professional adoption. The United Kingdom follows with 19.0% in 2025, edging down to 18.8% as growth stabilizes in creative industry applications and education. France accounts for 15.0% in 2025, slipping to 14.6% by 2035 amid moderate demand, while Italy holds steady around 12.0% as uptake continues in media and training. Spain expands its share from 9.0% to 9.4% with growing content creation demand. BENELUX eases from 7.0% to 6.8%, reflecting smaller-scale adoption. The remainder of Europe declines from 14.0% to 13.5%, highlighting mixed growth across Nordic creative hubs and slower-moving Eastern European markets.

The music speed changer market is defined by competition among specialized software developers, audio processing companies, and digital audio workstation providers. Companies are investing in advanced algorithm development, cloud-based processing capabilities, cross-platform compatibility, and user interface optimization to deliver precise, reliable, and user-friendly tempo manipulation solutions. Strategic partnerships, technological innovation, and feature enhancement are central to strengthening software portfolios and market presence.

Celemony Software, Germany-based, provides advanced audio processing solutions with professional-grade tempo adjustment algorithms. Acon Digital specializes in high-quality audio restoration and processing tools with precise speed control capabilities. iZotope Inc. delivers technologically advanced audio processing software with integrated tempo manipulation features.

| Item | Value |

|---|---|

| Quantitative Units | USD 683.8 million |

| Deployment Type | Cloud-Based, On-Premises |

| Application | Personal, Business |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan,and 40+ countries |

| Key Companies Profiled | Audacity, Celemony Software, Acon Digital, iZotope Inc., Sony Creative Software, Magix Software, Steinberg Media Technologies, Ableton AG, Native Instruments, MOTU |

| Additional Attributes | Dollar sales by deployment type and application segment, regional demand trends across major markets, competitive landscape with established software providers and emerging technology companies, user preferences for cloud-based versus on-premises solutions, integration with digital audio workstation platforms and mobile applications, innovations in real-time processing capabilities and artificial intelligence integration, and adoption of cross-platform compatibility solutions with enhanced user interfaces and collaborative features for improved content creation workflows. |

The global music speed changer market is estimated to be valued at USD 683.8 million in 2025.

The market size for the music speed changer market is projected to reach USD 1,283.6 million by 2035.

The music speed changer market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in music speed changer market are cloud-based and on-premises.

In terms of application, personal segment to command 55.0% share in the music speed changer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Music and Streaming Service Market Size and Share Forecast Outlook 2025 to 2035

Musical Instrument Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analyzing Musical Instrument Market Share & Industry Leaders

Music Tourism Market Growth – Forecast 2024-2034

Kids Musical Instrument Market Size and Share Forecast Outlook 2025 to 2035

Smart Musical Instrument Market

Electronic Musical Instruments Market Size and Share Forecast Outlook 2025 to 2035

Electronic Dance Music (EDM) Market Analysis - Trends, Growth & Forecast 2025 to 2035

Speed Gate Market Growth – Trends & Forecast 2025 to 2035

Low Speed Vehicle (LSV) Market Trends – Growth & Forecast 2024-2034

High Speed Rolling Bearings Market Size and Share Forecast Outlook 2025 to 2035

High-Speed Steel Metal Cutting Tools Market Size and Share Forecast Outlook 2025 to 2035

Slow Speed Shredding Machines Market Size and Share Forecast Outlook 2025 to 2035

High Speed Blowers Market Size and Share Forecast Outlook 2025 to 2035

Road Speed Limiter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

High-Speed Interconnects Market by Type by Application & Region Forecast till 2035

High Speed Steel (HSS) Tools Market Growth - Trends & Forecast 2025 to 2035

High-speed Engine Market Growth – Trends & Forecast 2024-2034

Wind Speed Alarm Market

High Speed Data Converters Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA