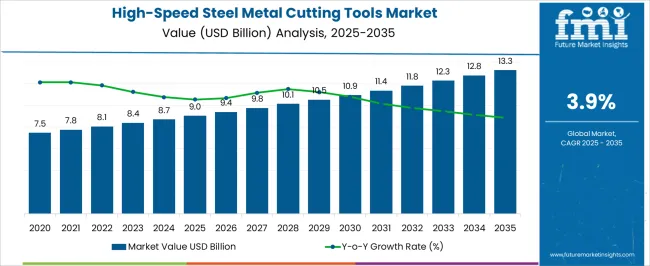

The High-Speed Steel Metal Cutting Tools Market is estimated to be valued at USD 9.0 billion in 2025 and is projected to reach USD 13.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period. The absolute dollar opportunity highlights a steady increase in market value over the decade, with initial growth from USD 9 billion in 2025 to approximately USD 9.4 billion in 2026 and USD 9.8 billion in 2027. Incremental gains continue as demand rises across industries such as automotive, aerospace, machinery manufacturing, and general engineering. Year-on-year increases, driven by rising adoption of precision cutting operations and efficiency-focused manufacturing processes, contribute to cumulative revenue growth. The early years emphasize expansion through replacement demand, capacity upgrades, and the adoption of higher-quality tooling solutions in established industrial regions, including North America and Europe.

From 2030 onward, the market continues to generate significant dollar opportunities, gradually reaching USD 13.3 billion by 2035. The progression reflects ongoing modernization of machine shops, increased machining complexity, and the growing preference for high-speed steel tools in multi-material operations. Emerging markets in Asia-Pacific contribute notable incremental gains, driven by expanding manufacturing infrastructure and rising industrial output. The absolute dollar opportunity further underscores the potential for tool manufacturers to capitalize on incremental demand by offering innovative designs, longer tool life, and optimized cutting performance. Overall, the market exhibits stable and predictable expansion, with consistent year-on-year revenue growth providing manufacturers and investors with clear indicators of long-term financial potential across global industrial applications.

| Metric | Value |

|---|---|

| High-Speed Steel Metal Cutting Tools Market Estimated Value in (2025 E) | USD 9.0 billion |

| High-Speed Steel Metal Cutting Tools Market Forecast Value in (2035 F) | USD 13.3 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

The high-speed steel metal cutting tools market is registering steady growth, supported by its essential role in manufacturing and metalworking industries worldwide. Demand is being driven by the material’s ability to deliver a balance of hardness, toughness, and heat resistance, enabling efficient machining of a wide range of metals. Expansion in sectors such as automotive, aerospace, construction, and general engineering is contributing to increased adoption of high-speed steel tools for drilling, milling, tapping, and threading operations.

Advances in coating technologies, such as titanium nitride and aluminum oxide layers, are further enhancing wear resistance and extending tool life. Manufacturers are focusing on optimizing cutting geometries and metallurgical compositions to meet the requirements of high-speed, high-precision operations.

The market is also benefiting from cost-effectiveness compared to carbide alternatives in specific applications, making it attractive for small and medium-scale manufacturers As global production levels rise and demand for precision-engineered components increases, high-speed steel cutting tools are expected to maintain a strong position due to their versatility, reliability, and adaptability across diverse industrial applications.

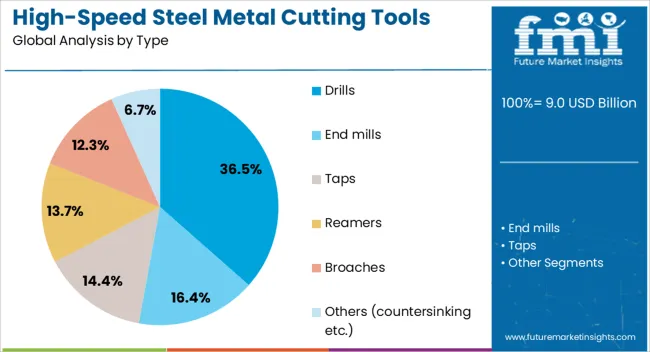

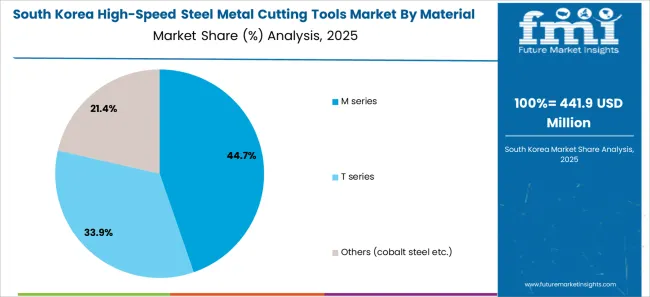

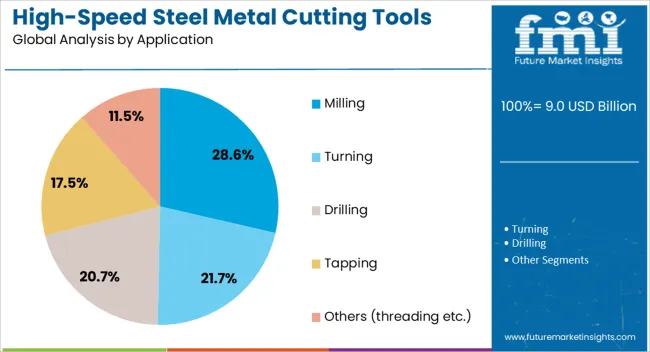

The high-speed steel metal cutting tools market is segmented by type, material grade, application, end use industry, distribution channel, and geographic regions. By type, the high-speed steel metal cutting tools market is divided into Drills, End mills, Taps, Reamers, Broaches, and Others (countersinking, etc.). In terms of material grade, the high-speed steel metal cutting tools market is classified into M series, T series, and Others (cobalt steel, etc.). Based on application, the high-speed steel metal cutting tools market is segmented into Milling, Turning, Drilling, Tapping, and Others (threading, etc.). By end use industry, high-speed steel metal cutting tools market is segmented into Automotive, Aerospace, Medical, Industrial manufacturing, Construction, and Others (electronics & electrical etc.).

By distribution channel, high-speed steel metal cutting tools market is segmented into Direct sales and Indirect sales. Regionally, the high-speed steel metal cutting tools industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The drills segment is projected to account for 36.5% of the high-speed steel metal cutting tools market revenue share in 2025, making it the leading product type. Its leadership is being driven by the versatility and efficiency of high-speed steel drills in machining operations across industries such as automotive, aerospace, heavy machinery, and general manufacturing. The ability to retain cutting performance at elevated temperatures while maintaining dimensional accuracy makes them suitable for both high-speed and heavy-duty drilling tasks.

High-speed steel drills offer superior resistance to chipping and wear, allowing for longer service life compared to lower-grade materials. The segment’s growth is also supported by advancements in drill point design and flute geometry, which improve chip evacuation and reduce machining time.

Coated variants are further enhancing productivity by reducing friction and increasing heat dissipation. The widespread availability of high-speed steel drills in various diameters and configurations ensures their adaptability to multiple applications, reinforcing their market dominance and sustaining demand over the forecast period.

The M series material grade segment is expected to hold 44.7% of the high-speed steel metal cutting tools market revenue share in 2025, making it the leading grade category. Its dominance is being supported by the combination of molybdenum and tungsten in the alloy composition, which delivers exceptional wear resistance, red hardness, and toughness. The M series grades maintain cutting efficiency even at higher operating temperatures, making them ideal for machining hard and abrasive materials.

This segment benefits from high demand in precision manufacturing sectors where consistent tool performance is critical for achieving tight tolerances. Technological improvements in metallurgical processing are enhancing grain structure uniformity, leading to improved durability and reduced tool failure rates.

The adaptability of M series high-speed steel to various surface coatings extends tool life and increases productivity, further reinforcing its preference among end users. As manufacturing industries prioritize efficiency and quality, the M series grade is expected to retain its leadership through its proven performance and broad applicability across multiple machining environments.

The milling application segment is anticipated to represent 28.6% of the high-speed steel metal cutting tools market revenue share in 2025, making it the largest application category. This leadership is being driven by the extensive use of high-speed steel milling cutters in producing complex shapes, slots, and profiles in a wide range of metals. Their toughness and shock resistance make them well-suited for interrupted cutting operations and heavy material removal.

Milling cutters made from high-speed steel maintain sharp cutting edges and dimensional stability even during prolonged use under high loads. The segment is benefiting from demand in automotive component manufacturing, die and mold production, and heavy machinery fabrication, where precision and durability are critical. Recent advancements in milling cutter design, including variable pitch geometry and enhanced rake angles, are improving machining efficiency and surface finish quality.

The cost-effectiveness of high-speed steel for medium-speed milling operations compared to carbide alternatives also supports adoption. With continued growth in precision engineering and component production, the milling segment is expected to maintain its strong market presence.

Growth in the high-speed steel metal cutting tools market is anticipated to remain steady, driven by rising demand for precision manufacturing. Industrial sectors, particularly automotive and aerospace, increasingly rely on these tools for cutting-edge production. As competitive pressure grows, companies will need to adapt their strategies to stay ahead. While raw material costs and alternative cutting tool options may challenge market expansion, demand for high-speed steel tools is projected to continue its upward trend, fueled by their ability to perform under intense operational conditions.

The high-speed steel metal cutting tools market is propelled by a growing demand from industries adopting automated manufacturing systems. Automation ensures that precision is maintained, reducing human error and boosting overall productivity. As these systems become more integrated into global production processes, the need for cutting tools capable of withstanding high temperatures and delivering superior cutting performance is more prominent. Manufacturing sectors, especially aerospace and automotive, are witnessing a shift towards automation, thereby increasing the demand for high-speed steel tools to meet the required production standards.

Expansion in emerging markets presents a strong growth avenue for high-speed steel metal cutting tools. Countries in Asia-Pacific and Latin America are seeing rapid industrialization, with a growing number of manufacturing facilities being established. This shift leads to an increased demand for durable and reliable cutting tools, like high-speed steel, to meet the challenges of mass production. As regional markets modernize their production capabilities, key players are pursuing strategic partnerships with local firms to secure market share and strengthen their presence in these rapidly developing regions.

Although high-speed steel tools remain widely used, alternatives such as carbide and ceramic cutting tools are gaining traction due to their cost-effectiveness. These materials are often favored in less demanding applications where durability and longevity are not as critical. As manufacturers focus on cost-cutting measures, the demand for these materials has grown. This presents challenges for high-speed steel tool manufacturers, as they must find ways to maintain their competitive edge in a market that is becoming more diverse in terms of material preferences and application ranges.

The high-speed steel tools market is being shaped by advancements in tool coatings and design improvements. New coating technologies, such as titanium nitride, are enhancing tool life and performance, allowing manufacturers to achieve higher output at lower costs. Cutting-edge tool geometries are also being developed to maximize material removal rates and precision. These ongoing innovations are essential for staying competitive, especially in industries like aerospace and automotive, where performance demands are consistently rising. Manufacturers must continue investing in R&D to develop tools that offer superior efficiency and reliability across a wide range of industrial applications.

| Country | CAGR |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| UK | 3.7% |

| USA | 3.3% |

| Brazil | 2.9% |

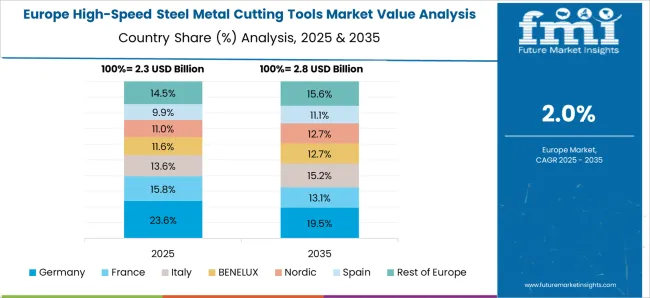

Global high-speed steel metal cutting tools demand is projected to rise at a 3.9% CAGR from 2025 to 2035. Of the profiled markets, China leads at 5.3%, followed by India at 4.9%, and France at 4.1%, while the United Kingdom records 3.7% and the United States posts 3.3%. These rates translate to a growth premium of +36% for China, +26% for India, and +5% for France versus the baseline, while the United Kingdom and the United States record more tempered expansion. Divergence is influenced by manufacturing dynamics, with China and India experiencing higher demand due to automotive, aerospace, and heavy machinery sectors, while the United States and the United Kingdom show maturity-linked growth. This report covers 40+ countries, highlighting the top markets here.

The high-speed steel metal cutting tools market in China is projected to expand at a CAGR of 5.3% from 2025 to 2035, making it the fastest-growing among leading economies. Demand is driven by the country’s robust automotive and heavy engineering industries, which rely extensively on cutting tools for machining and manufacturing operations. Aerospace production also creates opportunities, as precision machining is critical in turbine and structural component fabrication. Local manufacturers are investing in improved coating technologies to enhance tool life and efficiency. China’s expansive manufacturing ecosystem, coupled with increasing export-oriented demand, continues to accelerate adoption. These dynamics position China as the leading contributor to global growth in high-speed steel cutting tools.

The high-speed steel metal cutting tools market in India is expected to grow at a CAGR of 4.9% from 2025 to 2035, supported by rising adoption in automotive, construction, and defense manufacturing. Growth is accelerated by India’s expanding industrial base and infrastructure projects that require large-scale machining applications. Local tool manufacturers, along with international players, are strengthening distribution networks to cater to rising domestic consumption. The shift toward precision components in the electronics and medical device sectors also expands opportunities for high-speed steel cutting tools. Competitive labor and favorable government policies for industrial development further support market expansion in India.

The high-speed steel metal cutting tools market in France is projected to grow at a CAGR of 4.1% during 2025–2035, driven by industrial machinery, automotive, and aerospace sectors. France’s aerospace sector, particularly in turbine blade and engine part manufacturing, creates a strong base for tool demand. The automotive industry benefits from precision machining of lightweight materials, where high-speed steel tools remain critical for productivity. The country’s advanced engineering ecosystem ensures continuous adoption of innovative tool coatings and heat-resistant materials. Domestic firms and European suppliers collaborate to improve efficiency and sustainability in machining processes, further reinforcing growth momentum.

The high-speed steel metal cutting tools market in the United Kingdom is anticipated to rise at a CAGR of 3.7% from 2025 to 2035, showing moderate expansion. The automotive and aerospace industries remain primary contributors, with significant usage in machining and component manufacturing. Rising refurbishment activity in industrial equipment and energy infrastructure also sustains demand. The UK benefits from an established base of engineering service providers who integrate cutting tools in diverse applications. However, market expansion is moderated by reliance on imports for raw materials and strong competition from carbide-based alternatives. The adoption of high-performance coatings is helping improve durability and maintain competitiveness.

The high-speed steel metal cutting tools market in the United States is projected to grow at a CAGR of 3.3% between 2025 and 2035, indicating steady but slower expansion compared to Asian counterparts. Industrial usage is concentrated in aerospace, automotive, and construction applications, where high-speed steel continues to be valued for cost-effectiveness in machining operations. The USA manufacturing sector shows a preference for advanced coated tools that provide longer tool life and higher cutting efficiency. Growth in defense and energy sectors also contributes to tool adoption. Market maturity and the rising share of carbide alternatives temper expansion, but continued R&D in coatings and specialty tools supports resilience in demand.

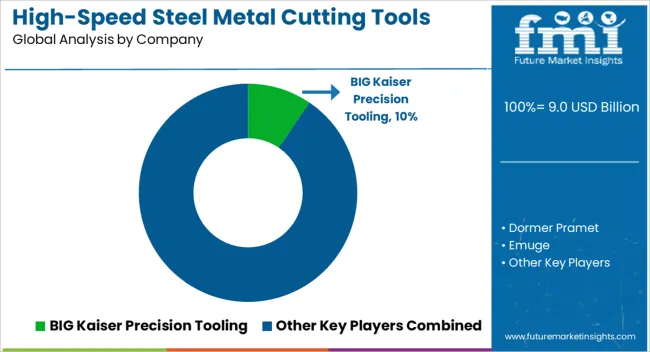

In the high-speed steel metal cutting tools market, leading suppliers are driving growth through material innovation, precision engineering, and expanded distribution networks. Global majors such as Sandvik Coromant, Seco Tools, Kennametal, and Sumitomo Electric Industries focus on advanced cutting geometries and coatings that enhance tool life and performance in demanding machining environments. TimkenSteel and Erasteel emphasize upstream integration, providing proprietary high-speed steel grades that offer durability and heat resistance tailored for automotive, aerospace, and general engineering applications. Premium tooling specialists such as BIG Kaiser Precision Tooling, Emuge, and Dormer Pramet strengthen their presence by offering customizable solutions designed for high-precision milling, drilling, and threading. These companies capitalize on partnerships with OEMs and contract manufacturers to maintain a steady flow of demand in key production hubs.

Mid-tier and regional players such as Niagara Cutter, Hannibal Carbide Tool, GWS Tool Group, RTS Cutting Tools, Toolmex Industrial Solutions, and Vargus are expanding market share through specialized tool lines, agile customer service, and competitive pricing. Their strategies often revolve around supplying tailored batches to small and medium-scale workshops, where flexibility and cost-efficiency are critical. The competitive intensity is shaped by low substitution risk and the continued reliance on high-speed steel for applications where carbide or ceramic tools remain uneconomical. To strengthen market positions, most companies are focusing on three strategies: optimizing tool design for extended wear resistance, expanding digital distribution channels, and forming technical service partnerships to assist end users with tool performance optimization.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.0 Billion |

| Type | Drills, End mills, Taps, Reamers, Broaches, and Others (countersinking etc.) |

| Material Grade | M series, T series, and Others (cobalt steel etc.) |

| Application | Milling, Turning, Drilling, Tapping, and Others (threading etc.) |

| End Use Industry | Automotive, Aerospace, Medical, Industrial manufacturing, Construction, and Others (electronics & electrical etc.) |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BIG Kaiser Precision Tooling, Dormer Pramet, Emuge, Erasteel, GWS Tool Group, Hannibal Carbide Tool, Kennametal, Niagara Cutter, RTS Cutting Tools, Sandvik Coromant, Seco Tools, Sumitomo Electric Industries, TimkenSteel, Toolmex Industrial Solutions, and Vargus |

| Additional Attributes | Dollar sales by tool type (drills, taps, milling cutters, reamers, saw blades), Dollar sales by end-use industry (automotive, aerospace, construction, general engineering), Shifts in demand between cobalt-based and molybdenum-based grades, Impact of coating technologies (TiN, TiAlN, AlCrN) on tool performance and longevity, Growth of precision machining in aerospace and medical sectors, Regional differences in adoption across Asia, Europe, and North America. |

The global high-speed steel metal cutting tools market is estimated to be valued at USD 9.0 billion in 2025.

The market size for the high-speed steel metal cutting tools market is projected to reach USD 13.3 billion by 2035.

The high-speed steel metal cutting tools market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in high-speed steel metal cutting tools market are drills, end mills, taps, reamers, broaches and others (countersinking etc.).

In terms of material grade, m series segment to command 44.7% share in the high-speed steel metal cutting tools market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Steel Drums & IBCs Market Size and Share Forecast Outlook 2025 to 2035

Steel Roll-on Tube Market Size and Share Forecast Outlook 2025 to 2035

Steel Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Steel Salvage Drums Market Size and Share Forecast Outlook 2025 to 2035

Steel Wire Reinforced Polyethylene Pipe Market Size and Share Forecast Outlook 2025 to 2035

Steel Wire Market Size and Share Forecast Outlook 2025 to 2035

Steel Strapping Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Industry Analysis in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Steel Studs Market Size and Share Forecast Outlook 2025 to 2035

Steel Rebar Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Market Trends - Growth, Demand & Forecast 2025 to 2035

Steel Sections Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Steel Market Size, Growth, and Forecast 2025 to 2035

Steel Containers Market Analysis by Product Type, Capacity Type, End Use, and Region through 2025 to 2035

Steel Pipe Market Growth - Trends & Forecast 2025 to 2035

Key Players & Market Share in the Steel Containers Industry

Competitive Overview of Steel Drum Market Share

Examining Market Share Trends in Steel Drums and IBCs Industry

Japan Steel Drum Market Analysis – Trends & Forecast 2023-2033

Korea Steel Drum Market Growth – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA