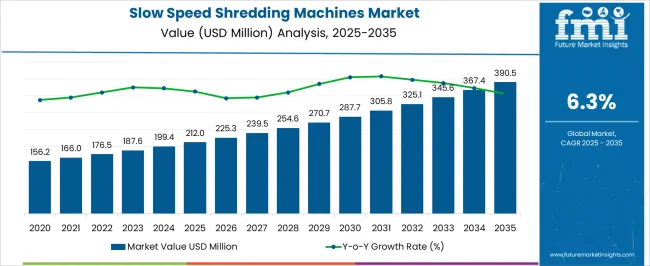

The Slow Speed Shredding Machines Market is estimated to be valued at USD 212.0 million in 2025 and is projected to reach USD 390.5 million by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period. The slow speed shredding machines market is projected to generate an absolute gain of USD 178.5 million and a growth multiplier of 1.84x over the decade. This growth, driven by a CAGR of 6.3%, is fueled by increasing demand for shredding machines in industries like waste management, recycling, and construction.

During the first five years (2025–2030), the market is expected to grow from USD 212 million to USD 287.7 million, adding USD 75.7 million, which accounts for 42.4% of the total incremental growth. The increasing focus on waste disposal solutions, stricter environmental regulations, and advancements in shredding technology drives the early-phase growth. The second phase (2030–2035) is expected to contribute USD 102.8 million, representing 57.6% of the total growth, driven by the ongoing adoption of shredding solutions across multiple sectors, particularly in recycling and industrial waste management. Annual increments will rise from USD 0.8 million in the early years to USD 2.7 million by 2035, signaling accelerated growth due to technological advancements in shredding efficiency and performance. Manufacturers focusing on providing cost-effective, high-efficiency, and environmentally friendly shredding machines are expected to capture the largest share of the USD 178.5 million opportunity.

| Metric | Value |

|---|---|

| Slow Speed Shredding Machines Market Estimated Value in (2025 E) | USD 212.0 million |

| Slow Speed Shredding Machines Market Forecast Value in (2035 F) | USD 390.5 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

The slow speed shredding machines market is expanding steadily, driven by the rising global focus on sustainable waste management and the increasing complexity of material recovery processes. These machines are being adopted across municipal, industrial, and commercial sectors due to their ability to handle heterogeneous waste streams with high torque and low speed, minimizing dust and noise emissions.

The emphasis on reducing landfill burden and maximizing resource recovery has led to significant investments in material recovery facilities, where slow speed shredders are playing a vital role. Technological innovations such as automated controls, energy optimization, and customizable cutter systems are enhancing machine efficiency and adaptability across applications.

Government mandates regarding recycling rates, extended producer responsibility, and circular economy objectives are further pushing the adoption of robust shredding systems In the forecast period, growth is expected to be propelled by the integration of digital monitoring, predictive maintenance features, and demand from both emerging and developed markets seeking to modernize their waste processing infrastructure.

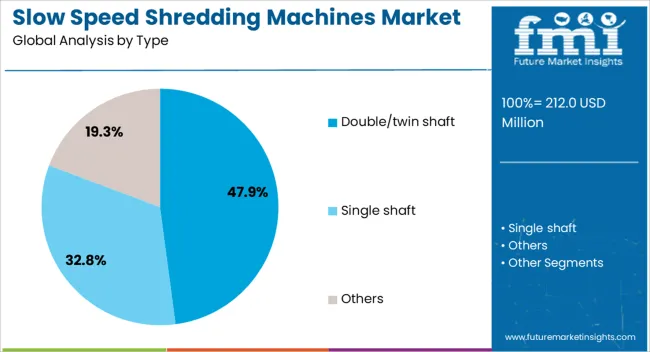

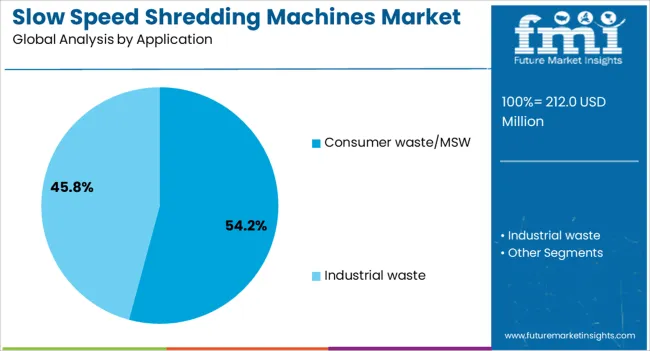

The slow speed shredding machines market is segmented by type, application, and geographic regions. By type, the slow speed shredding machines market is divided into Double/twin shaft, Single shaft, and Others. In terms of application, the slow speed shredding machines market is classified into Consumer waste/MSW and Industrial waste. Regionally, the slow speed shredding machines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The double twin shaft segment is projected to contribute 47.9% of the revenue share in the slow speed shredding machines market in 2025. This leading position is being driven by the segment’s superior performance in processing bulky, mixed, and high-moisture content waste materials. Double twin shaft shredders have been widely adopted due to their high torque output, intermeshing rotors, and the ability to operate at reduced speed while delivering consistent output particle size.

These systems provide extended wear life and minimal maintenance, which has proven advantageous in demanding environments such as scrap yards and municipal solid waste facilities. Their design enables continuous operation under variable loads, improving throughput in high-volume applications.

The modular configuration of these machines supports flexible integration into both stationary and mobile platforms, which has expanded their use across multiple industries. Additionally, compatibility with automated feed systems and real-time monitoring technologies has contributed to improved operational efficiency and cost savings, reinforcing the segment’s dominance in the market.

The consumer waste MSW application segment is expected to hold 54.2% of the overall revenue share in the slow speed shredding machines market in 2025. This segment’s growth has been largely influenced by increasing urbanization, population growth, and the resultant surge in household waste volumes. Municipal solid waste management programs have increasingly prioritized mechanical pre-treatment to improve sorting and recycling outcomes, where slow speed shredders serve as critical primary size reducers.

These machines are preferred in MSW applications due to their ability to process organic matter, plastics, textiles, and packaging waste without frequent jamming or tool wear. The integration of slow speed shredders in waste-to-energy and composting facilities has been growing due to their energy-efficient operation and compatibility with downstream separation technologies.

Enhanced machine durability, reduced maintenance intervals, and the ability to comply with evolving environmental norms have further reinforced their demand. As governments and municipalities continue to modernize waste treatment infrastructure, the adoption of slow-speed shredders in consumer waste processing is expected to accelerate.

The slow-speed shredding machines market is propelled by increasing demand for waste management solutions and material recycling. Opportunities lie in emerging markets where recycling efforts are expanding. Automation trends are reshaping the industry, offering greater efficiency and reduced human intervention. However, high initial costs and operational expenses remain significant barriers. By 2025, addressing these challenges while capitalizing on growth opportunities in emerging regions will be essential for maintaining a competitive edge in the market.

The growth of the slow-speed shredding machines market is primarily driven by the increasing demand for efficient waste management and material recycling. With businesses focusing on sustainable disposal practices, shredding machines are essential for reducing waste volume and preparing materials for recycling. By 2025, the continued push for cleaner and more efficient waste processing across industries such as construction, recycling, and municipal waste management will further fuel the demand for slow-speed shredding machines, especially in developed regions like North America and Europe.

The growing emphasis on recycling in emerging economies provides significant opportunities for the slow-speed shredding machines market. Countries in Asia-Pacific and Latin America are increasingly implementing waste recycling initiatives, leading to higher demand for efficient shredding equipment. Additionally, as more industries focus on reducing their environmental impact, companies are seeking cost-effective solutions for waste reduction. By 2025, the market is poised to benefit from these opportunities, as both governmental regulations and corporate social responsibility initiatives push for improved waste processing technologies.

The market is witnessing a shift towards more automated slow-speed shredding machines with enhanced efficiency and minimal human intervention. Automation improves the processing speed and consistency of materials, while advanced features such as load sensing and smart controls further optimize machine performance. By 2025, these trends are expected to grow stronger as companies increasingly demand cost-effective, energy-efficient, and reliable shredding machines that reduce operational downtime and improve overall productivity.

The slow-speed shredding machines market faces challenges related to high initial capital costs and operational expenses. The price of acquiring advanced shredding machines may deter smaller companies or those with limited budgets from investing in these systems. Additionally, the maintenance and energy costs associated with the operation of these machines can become a significant financial burden. By 2025, manufacturers must find ways to reduce these costs while maintaining the machines' durability and performance, making the market more accessible for a wider range of industries.

| Countries | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

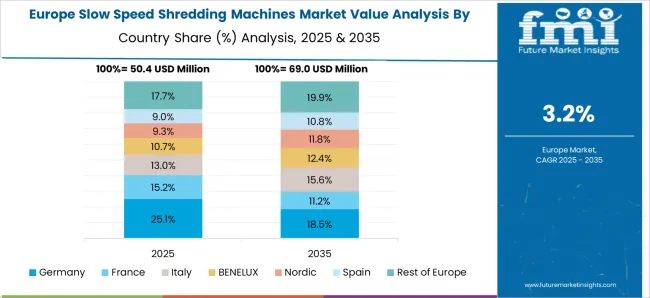

The global slow-speed shredding machines market is projected to grow at a 6.3% CAGR from 2025 to 2035. China leads with a growth rate of 8.5%, followed by India at 7.9%, and France at 6.6%. The United Kingdom records a growth rate of 6%, while the United States shows the slowest growth at 5.4%. These varying growth rates are driven by increasing demand for waste management solutions, recycling processes, and the need for efficient shredding in industries such as construction, waste management, and manufacturing. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, urbanization, and government policies promoting waste reduction and recycling, while more mature markets like the USA and the UK see steady growth driven by advancements in shredding technologies, environmental regulations, and increased demand for sustainable waste processing solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The slow-speed shredding machines market in China is growing rapidly, with a projected CAGR of 8.5%. China’s strong focus on industrialization, coupled with government support for recycling and waste management solutions, continues to drive the demand for slow-speed shredding machines. The country's growing construction, manufacturing, and waste processing industries further fuel market growth. Additionally, the growing emphasis on environmental sustainability and regulatory requirements for waste management is contributing to the adoption of efficient shredding solutions. As urbanization accelerates, the demand for waste reduction, recycling, and efficient processing solutions continues to support market expansion.

The slow-speed shredding machines market in India is projected to grow at a CAGR of 7.9%. India’s rapid industrialization and increasing investments in recycling and waste management technologies continue to drive market demand. The country’s growing urbanization, industrial output, and construction activities contribute to the rising need for shredding machines. Additionally, India’s strong focus on environmental sustainability and government initiatives promoting waste reduction and recycling further accelerate the adoption of slow-speed shredding machines. The demand for efficient waste processing solutions in sectors such as manufacturing, construction, and municipal waste management continues to support market growth.

The slow-speed shredding machines market in France is projected to grow at a CAGR of 6.6%. France’s growing demand for efficient waste management and recycling solutions is driving the adoption of shredding technologies. The country’s emphasis on sustainability, reducing carbon emissions, and adhering to European Union regulations on waste management continues to accelerate the demand for advanced shredding machines. France’s increasing industrial and manufacturing activities, along with the rising demand for municipal waste processing solutions, further fuel the market growth. As the need for eco-friendly and efficient waste management systems increases, France remains a key market for slow-speed shredding machines.

The slow-speed shredding machines market in the United Kingdom is projected to grow at a CAGR of 6%. The UK’s growing focus on waste management, sustainability, and reducing carbon emissions continues to drive steady demand for shredding machines. The country’s increasing investments in recycling infrastructure, combined with regulations promoting eco-friendly manufacturing and waste disposal solutions, are key drivers of market growth. Additionally, the rise in urbanization, infrastructure development, and demand for efficient waste processing solutions in industries such as construction, manufacturing, and municipal services further accelerates the demand for slow-speed shredding machines.

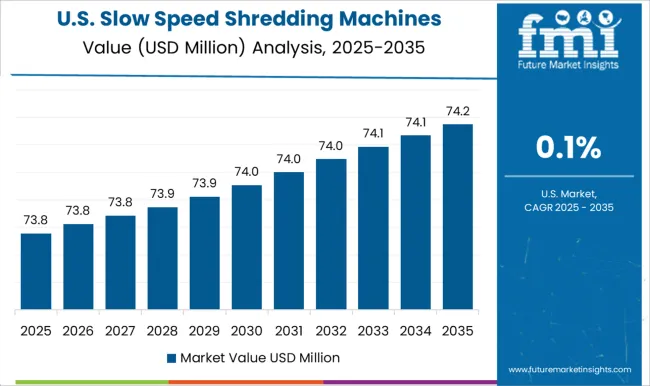

The slow-speed shredding machines market in the United States is expected to grow at a CAGR of 5.4%. The USA market remains steady, driven by the growing demand for efficient waste management solutions, particularly in industrial, municipal, and commercial applications. The country’s increasing focus on sustainability, green technologies, and waste reduction continues to contribute to the adoption of shredding machines. Additionally, the rise in recycling activities, government regulations on waste processing, and increasing investments in waste-to-energy systems further accelerate market growth. The USA market also benefits from advancements in shredding technology, improving efficiency and performance in waste processing applications.

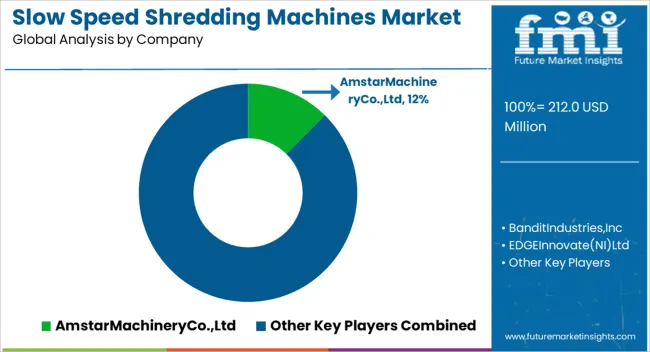

The slow-speed shredding machines market is dominated by SSI Shredding Systems, Inc., which leads with its high-performance shredders used for processing a wide range of materials, including metals, plastics, and municipal waste. SSI’s dominance is supported by its advanced technology, customizability, and ability to deliver highly reliable and efficient slow-speed shredding solutions for industrial applications. Key players such as Granutech-Saturn Systems, Komptech Group, and Vermeer Corporation maintain significant market shares by offering durable shredders that provide consistent performance and are known for their ability to handle tough materials with reduced energy consumption. These companies focus on enhancing the durability and efficiency of their machines, improving safety features, and providing robust support services to meet the needs of industrial recycling.

Emerging players like Amstar Machinery Co., Ltd., Bandit Industries, Inc., and GENOX Recycling Tech Co., Ltd. are expanding their market presence by offering specialized slow-speed shredders for niche applications such as biomass, e-waste, and demolition waste processing. Their strategies include offering customizable shredding solutions, improving processing speeds, and enhancing machine longevity. Market growth is driven by the increasing demand for recycling solutions, the need for waste reduction, and the growing emphasis on environmentally responsible disposal of materials. Innovations in blade design, automation, and the integration of digital monitoring systems are expected to continue shaping competitive dynamics and fuel further growth in the global slow-speed shredding machines market.

| Item | Value |

|---|---|

| Quantitative Units | USD 212.0 Million |

| Type | Double/twin shaft, Single shaft, and Others |

| Application | Consumer waste/MSW and Industrial waste |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AmstarMachineryCo.,Ltd, BanditIndustries,Inc, EDGEInnovate(NI)Ltd, FORNNAXTechnologyPvtLtd, GENOXRecyclingTechCo.,Ltd, Granutech-SaturnSystems, HAMMBREAKER, KomptechGroup, LINDNER-RECYCLINGTECHGMBH, SSIShreddingSystems,Inc, TerexCorporation, UNTHAshreddingtechnology, VermeerCorporation, ZERMAMachinery&RecyclingTechnology, and WilliamsPatentCrusherandPulverizerCo.,Inc |

| Additional Attributes | Dollar sales by shredder type and application, demand dynamics across municipal waste, industrial recycling, and construction sectors, regional trends in slow-speed shredding machine adoption, innovation in energy-efficient and low-maintenance technologies, impact of regulatory standards on waste processing, and emerging use cases in sustainable waste management and material recovery. |

The global slow speed shredding machines market is estimated to be valued at USD 212.0 million in 2025.

The market size for the slow speed shredding machines market is projected to reach USD 390.5 million by 2035.

The slow speed shredding machines market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in slow speed shredding machines market are double/twin shaft, single shaft and others.

In terms of application, consumer waste/msw segment to command 54.2% share in the slow speed shredding machines market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Slow Cooker and Sous Vide Market Analysis – Trends, Growth & Forecast 2025 to 2035

Controlled & Slow Release Fertilizers Market 2025-2035

Speed Gate Market Growth – Trends & Forecast 2025 to 2035

Low Speed Vehicle (LSV) Market Trends – Growth & Forecast 2024-2034

High Speed Rolling Bearings Market Size and Share Forecast Outlook 2025 to 2035

High-Speed Steel Metal Cutting Tools Market Size and Share Forecast Outlook 2025 to 2035

High Speed Blowers Market Size and Share Forecast Outlook 2025 to 2035

Road Speed Limiter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

High-Speed Interconnects Market by Type by Application & Region Forecast till 2035

High Speed Steel (HSS) Tools Market Growth - Trends & Forecast 2025 to 2035

High-speed Engine Market Growth – Trends & Forecast 2024-2034

Wind Speed Alarm Market

High Speed Data Converters Market

Radar Speed Displays Market Forecast Outlook 2025 to 2035

Music Speed Changer Market Size and Share Forecast Outlook 2025 to 2035

Vehicle Speed Monitoring System Market Growth - Trends & Forecast 2025 to 2035

Digital Speedometer Market Growth – Trends & Forecast 2024-2034

Rotation Speed Indicators Market Size and Share Forecast Outlook 2025 to 2035

Variable Speed Generators Market Analysis & Forecast by Technology, End Use and Region through 2035

Automotive Speedometer Cable Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA