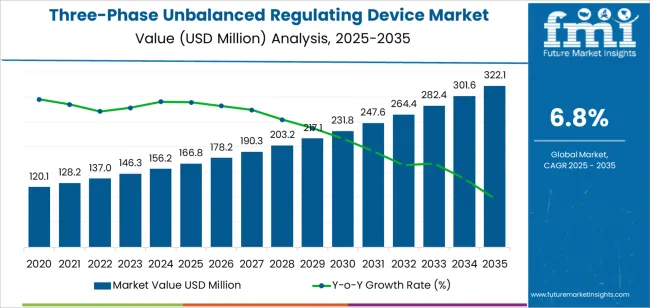

The global three-phase unbalanced regulating device market is expected to reach USD 322.1 million by 2035, reflecting an absolute increase of USD 155.3 million over the forecast period. Valued at USD 166.8 million in 2025, the market is set to grow at a CAGR of 6.8%. This growth is driven by increasing demand for stable and efficient electrical systems across industrial, commercial, and residential sectors. As the need for efficient power distribution systems grows, particularly in regions with fluctuating power quality, three-phase unbalanced regulating devices are becoming essential to ensure the balance and stability of power grids.

The three-phase unbalanced regulating devices are designed to stabilize the voltage and current in three-phase electrical systems that experience unbalanced load conditions. These devices are critical in preventing issues like voltage fluctuations, equipment damage, and system inefficiencies caused by unbalanced power supply. The market expansion is fueled by the growing adoption of renewable energy sources, which often lead to fluctuations in power quality. These devices are increasingly used in sectors such as manufacturing, utilities, and transportation, where maintaining power quality and operational efficiency is essential. With the rise in automation and industrial processes, there is a heightened demand for stable, uninterrupted power supply, further driving the adoption of unbalanced regulating devices.

The three-phase unbalanced regulating device market is projected to grow significantly from 2025 to 2035. Between 2025 and 2030, the market is expected to expand from USD 166.8 million to approximately USD 214.5 million, representing a value increase of about USD 47.7 million. This growth accounts for roughly 30.7% of the total forecasted growth for the decade. The demand for more stable and efficient power distribution systems will drive this phase, alongside advancements in regulating technologies that improve grid reliability and performance. The increasing need for efficient power management across industrial, commercial, and residential sectors will also contribute to this expansion.

From 2030 to 2035, the market is forecast to grow from USD 214.5 million to USD 322.1 million, adding USD 107.6 million. This phase constitutes about 69.3% of the overall market growth for the period. The market will be further propelled by increased investments in renewable energy integration, as more countries shift toward clean energy sources, which often lead to fluctuating power quality. Additionally, the continued expansion of smarter power distribution networks and the integration of IoT solutions for real-time grid monitoring and management will play a key role in this growth. As these technologies mature, the demand for three-phase unbalanced regulating devices will intensify, ensuring efficient and stable power distribution systems in an increasingly connected world.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 166.8 million |

| Market Forecast Value (2035) | USD 322.1 million |

| Forecast CAGR (2025 to 2035) | 6.8% |

The three-phase unbalanced regulating device market is growing due to the increasing demand for efficient power regulation systems across industries such as manufacturing, energy, and utilities. These devices are essential for managing unbalanced electrical loads in three-phase systems, which helps to prevent equipment damage, improve energy efficiency, and ensure stable power supply. As industrial and commercial sectors expand, the need for reliable power regulation becomes critical for maintaining operational efficiency and minimizing power-related disruptions.

The rising adoption of renewable energy sources and distributed generation systems is contributing to the growth of the market. These energy systems often lead to unbalanced power conditions, which can impact the stability of the grid. Three-phase unbalanced regulating devices help address these challenges by stabilizing voltage levels and balancing loads, ensuring smoother integration of renewable energy into existing infrastructure.

Technological advancements in power electronics and increasing awareness of energy efficiency are also driving market growth. Despite these positive trends, challenges such as the high cost of advanced regulating devices and the need for specialized installation and maintenance may limit widespread adoption, especially in regions with less developed electrical infrastructure.

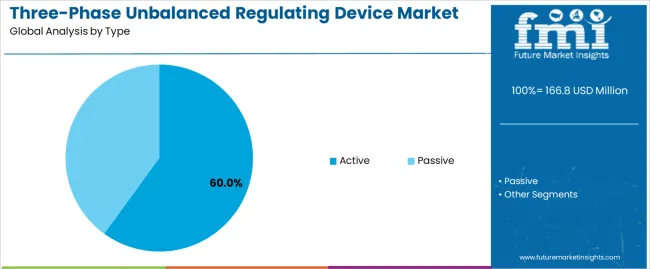

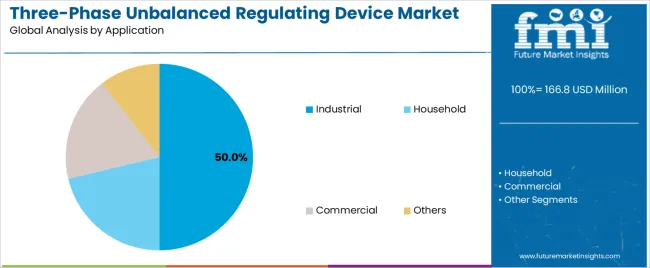

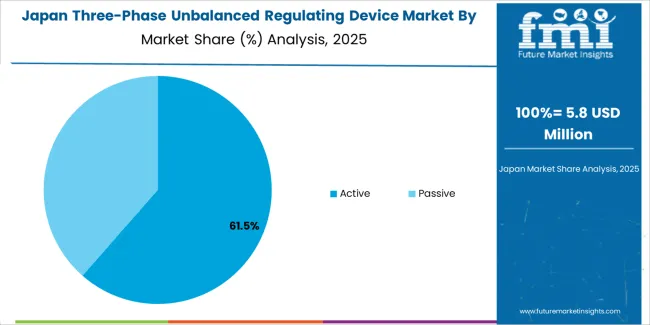

The market is segmented by type, application, and region. By type, the market is divided into Active and Passive, with Active devices leading the market. Based on application, the market is categorized into Industrial, Household, Commercial, and Others, with Industrial applications holding the largest share. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The active type segment holds the largest share of the three-phase unbalanced regulating device market, accounting for around 60%. Active regulating devices are designed to adjust the voltage imbalance in real-time, providing immediate corrections to any irregularities in a three-phase power system. These devices are essential for industries that require high-quality, uninterrupted power supply, such as manufacturing, energy production, and heavy machinery operations. Active devices actively monitor and correct the power supply, ensuring minimal disruption to sensitive equipment and processes.

The growing adoption of automation in industries has increased the demand for precise and reliable power management solutions, making active devices more desirable. As industries face greater pressures to reduce downtime, improve productivity, and protect sensitive equipment from electrical faults, active regulating devices provide a crucial solution. As power quality concerns grow globally, particularly with the rise in energy consumption and technological advancements, the demand for active regulating devices is expected to continue rising. As industries in emerging economies adopt advanced manufacturing practices, the active segment's growth is anticipated to expand beyond traditional markets.

The industrial application segment holds a significant share in the three-phase unbalanced regulating device market, accounting for about 50%. Industrial applications are a key driver of market growth as businesses in sectors like manufacturing, chemical processing, and energy depend heavily on stable and efficient power systems. In industries where large machinery, complex production lines, and automation systems are used, voltage imbalances can cause significant equipment damage, lead to downtime, and decrease overall efficiency. Three-phase unbalanced regulating devices help prevent such issues by stabilizing power and ensuring a constant, reliable energy supply.

The increasing demand for automation and energy-efficient solutions in industries worldwide is driving the need for better power regulation. As industries become more complex, with higher energy demands and more sensitive electrical systems, the need for reliable power regulation becomes more crucial. As industrial operations in emerging markets grow and modernize, the market for regulating devices is expected to see significant growth. The focus on minimizing operational downtime and maintaining system integrity makes these devices indispensable in industrial settings, ensuring that the industrial application segment remains a dominant force in the market’s future development.

The market is expanding due to the increasing demand for efficient and reliable power quality solutions in industrial, commercial, and utility sectors. These devices offer features like unbalance detection, real-time correction, and improved operational efficiency. Key drivers include the rise of single-phase loads and infrastructure upgrades, while restraints stem from the high cost of implementation and integration challenges with legacy systems.

One trend is the increasing deployment of automated monitoring and control modules that detect unbalance in real‑time and automatically adjust phase‑connections or switch compensation elements. Another is the shift toward compact modular systems suitable for retrofits in industrial and commercial facilities, rather than only at large substations. The growing integration of smart grid and IIoT‑enabled sensors allows unbalance devices to connect into broader power‑quality management platforms. Also, the rise of distributed energy resources (DERs) and single‑phase loads in three‑phase networks is driving demand for devices that can manage dynamic unbalance conditions. Manufacturers are focusing on multi‑function compensation units that handle unbalance, reactive‑power correction and harmonic mitigation in a single package.

Growth is driven by increasing awareness of power‑quality issues: many industrial and utility customers recognise the cost of unbalance in losses, downtime and equipment wear. The proliferation of single‑phase loads, variable frequency drives and asymmetric load profiles in modern plants accentuates unbalance, creating demand for dedicated devices. Regulatory and performance‑standards for industrial equipment, motors and utilities are pushing installations to maintain balanced systems and mitigate negative sequence currents. Also, infrastructure upgrades in developing regions and modernization of ageing networks create opportunities for unbalance regulation devices. As more mission‑critical and sensitive equipment is installed (data‑centres, automated manufacturing), the tolerance for unbalanced supply decreases, fuelling adoption.

The market faces several challenges. One is the higher cost and complexity of unbalance regulation devices compared with basic voltage‑stabilising or standard regulator equipment, which may deter smaller facilities. Another restraint is integration complexity: retrofitting balancing devices into existing three‑phase systems often involves instrumentation, control logic and coordination with other compensation equipment, which increases project complexity and timelines. The lack of awareness or prioritisation of phase unbalance in some regions means potential customers may not recognise the value‑proposition. Technological compatibility issues (with legacy systems, varied industrial standards) and the availability of cheaper albeit less effective alternatives (such as manual phase‑balancing practices) can limit uptake.

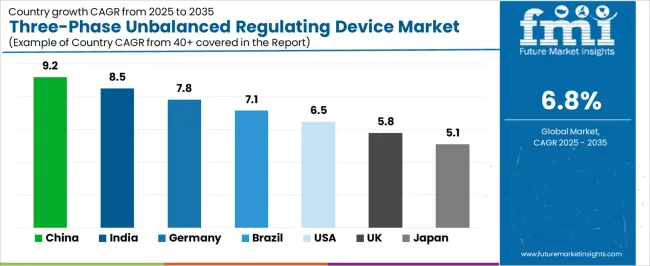

| Country | CAGR (%) |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| Brazil | 7.1% |

| USA | 6.5% |

| UK | 5.8% |

| Japan | 5.1% |

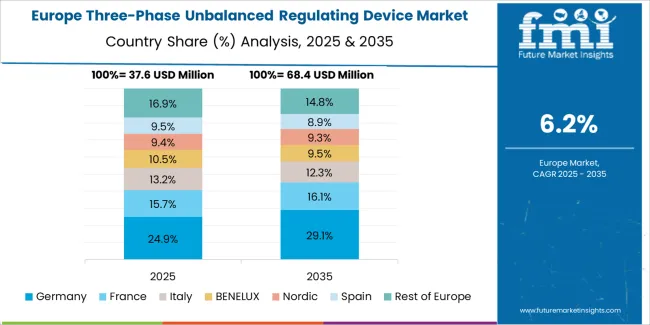

The three-phase unbalanced regulating device market is experiencing strong growth globally, with China leading at a 9.2% CAGR, driven by its rapid industrialization and demand for efficient power regulation systems. India follows with an 8.5% CAGR, fueled by the country’s expanding energy sector and adoption of advanced power solutions. Germany grows at a 7.8% CAGR, driven by industrial demand and renewable energy integration. Brazil's market grows at a 7.1% CAGR, influenced by infrastructure development and energy regulation needs. The USA shows a 6.5% CAGR, with growth driven by smart grid implementation and renewable energy adoption. The UK and Japan show moderate growth at 5.8% and 5.1% respectively, due to increasing renewable energy adoption, smart grid technologies, and industrial modernization.

China is leading the three-phase unbalanced regulating device market with a 9.2% CAGR, driven by its rapid industrialization and demand for reliable power regulation systems across various sectors. The growth of China’s manufacturing sector, along with its increasing reliance on electrical grids for industrial, commercial, and residential power needs, has significantly boosted the adoption of unbalanced regulating devices. These devices are crucial for maintaining power stability in industries with fluctuating demands, ensuring the efficient operation of machines and equipment. China’s focus on modernizing its power infrastructure and increasing electricity accessibility, particularly in rural areas, is also contributing to the market's expansion.

The country's push towards smart grid technology and renewable energy integration, such as solar and wind power, has increased the need for advanced voltage regulation solutions. The integration of renewable energy into the grid requires precise regulation to balance fluctuating power supplies, making unbalanced regulating devices essential. China’s government initiatives to improve energy efficiency and promote clean energy are also accelerating the market's growth. As China continues to invest in advanced technologies and energy-efficient solutions, the demand for these devices will continue to rise, solidifying China’s leading position in the market.

India is experiencing strong growth in the three-phase unbalanced regulating device market, with an 8.5% CAGR, driven by the country’s growing industrial sector, increasing energy demands, and focus on infrastructure development. As India’s economy expands, industries such as manufacturing, heavy industries, and IT require reliable power distribution solutions to maintain operational efficiency. The increasing adoption of electrical equipment and machinery that relies on stable voltage regulation further contributes to the demand for unbalanced regulating devices. Additionally, India’s ongoing efforts to modernize its power infrastructure and electrify rural areas have created opportunities for the widespread adoption of power regulation technologies.

India’s push for renewable energy integration, particularly solar and wind power, is accelerating the need for advanced power regulation devices. As renewable energy sources are intermittent and fluctuate in power generation, the need for systems that can manage these fluctuations within the national grid is growing. The government's initiatives, such as "Make in India" and investments in infrastructure, further support the adoption of these devices across various sectors. As industrial growth continues and the integration of green technologies advances, India’s market for three-phase unbalanced regulating devices is expected to maintain strong growth.

Germany is witnessing steady growth in the three-phase unbalanced regulating device market, with a 7.8% CAGR, driven by its strong industrial base and commitment to energy efficiency. The country’s manufacturing, automotive, and engineering sectors, which rely heavily on stable and efficient power distribution, are major drivers of demand for power regulation devices. As Germany’s industries continue to modernize and embrace automation, the need for reliable voltage regulation systems, such as unbalanced regulating devices, becomes more critical. These devices ensure that fluctuations in power supply do not impact sensitive machinery or production lines, which are essential for precision manufacturing.

Germany’s transition to renewable energy sources, particularly solar and wind power, is further increasing the need for unbalanced regulating devices. As renewable energy becomes a larger part of the country’s energy mix, these devices help stabilize the grid and prevent power supply disruptions. Germany’s well-established focus on sustainability and smart grid technologies provides a favorable environment for the growth of these systems. As the country continues to invest in smart infrastructure and energy efficiency, the demand for advanced power regulation solutions will continue to increase, supporting steady market growth.

Brazil is experiencing moderate growth in the three-phase unbalanced regulating device market, with a 7.1% CAGR, driven by the country’s expanding industrial base, infrastructure development, and increasing energy demand. Brazil’s mining, manufacturing, and agriculture sectors are major consumers of power regulation devices, as fluctuating power supplies can lead to inefficiencies and equipment damage in these industries. Unbalanced regulating devices are essential for maintaining voltage stability, ensuring that the power supply is constant and reliable. The growth of these sectors, along with Brazil’s large consumer base, creates opportunities for the widespread adoption of power regulation technologies.

Brazil’s commitment to expanding renewable energy projects, such as hydropower, solar, and wind power, is increasing the need for unbalanced regulating devices. As these renewable energy sources are intermittent, the integration of unbalanced regulating devices helps stabilize power flow and integrate renewable energy into the national grid. The Brazilian government’s focus on improving energy infrastructure, modernizing the power sector, and increasing electricity access in rural areas further contributes to the demand for advanced power regulation devices. As Brazil modernizes its energy sector and adopts more efficient power solutions, the demand for these devices will continue to rise steadily.

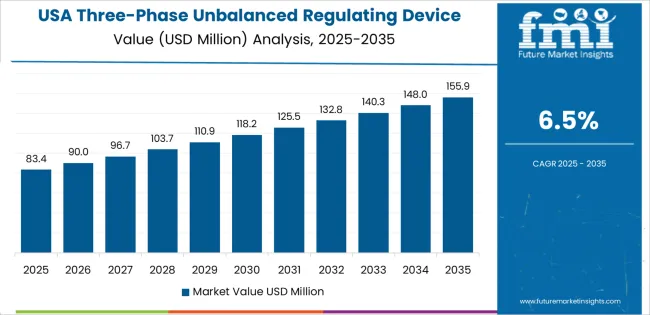

The USA is experiencing steady growth in the three-phase unbalanced regulating device market, with a 6.5% CAGR, driven by increasing demand for power stability across industrial and commercial sectors. As industries in the USA continue to embrace automation and energy efficiency, the need for reliable voltage regulation devices becomes more crucial. The manufacturing, healthcare, and IT sectors, which rely on sensitive equipment that requires consistent power supply, are key drivers for the market. Additionally, the USA’s ongoing efforts to modernize its power grid and invest in smart technologies are boosting the adoption of unbalanced regulating devices.

The integration of renewable energy into the national grid, including wind and solar power, is also driving the demand for these regulating devices. Since renewable energy sources can be unpredictable, unbalanced regulating devices help maintain stability and balance power supply across the grid. The USA’s commitment to reducing carbon emissions and increasing the share of green energy in its power mix further contributes to the adoption of advanced power regulation solutions. With continuous infrastructure investment and a focus on green technologies, the demand for three-phase unbalanced regulating devices in the USA is expected to continue growing.

The UK is experiencing moderate growth in the three-phase unbalanced regulating device market, with a 5.8% CAGR, driven by increasing demand for power regulation systems across industries like manufacturing, transportation, and construction. As the UK focuses on energy efficiency and sustainability, the need for stable and reliable power distribution solutions has grown, particularly in sectors where power fluctuations can cause operational inefficiencies or equipment damage. The integration of renewable energy sources, such as wind and solar power, into the national grid has further amplified the need for unbalanced regulating devices that can stabilize power supply.

The UK government’s commitment to smart grid technologies and modernizing infrastructure is contributing to the adoption of advanced power regulation devices. As the country focuses on transitioning to a low-carbon economy, these devices are essential for balancing the power grid, especially as intermittent renewable energy sources increase. The growing trend of industrial automation and the rise of energy-efficient technologies also support the demand for unbalanced regulating devices. As the UK continues to focus on sustainable development and energy resilience, the demand for these devices is expected to rise steadily.

Japan is seeing steady growth in the three-phase unbalanced regulating device market, with a 5.1% CAGR, driven by its strong industrial base, technological advancements, and commitment to energy efficiency. Japan’s manufacturing, automotive, and electronics sectors are significant drivers of market demand, as these industries require stable and reliable power for precise equipment and operations. The adoption of automation and smart technologies in Japan’s industries further fuels the need for unbalanced regulating devices, which help maintain consistent voltage and prevent power fluctuations.

Japan’s focus on sustainability and the integration of renewable energy, such as solar and wind power, is driving the demand for unbalanced regulating devices. Japan’s power grid must manage fluctuations caused by renewable sources, and these devices play a critical role in stabilizing the grid. The country’s commitment to digital transformation and smart grid technologies is also contributing to the market growth, as businesses seek efficient and resilient power regulation solutions. With Japan’s emphasis on energy efficiency and high-quality industrial production, the demand for three-phase unbalanced regulating devices is expected to grow steadily, supporting market expansion.

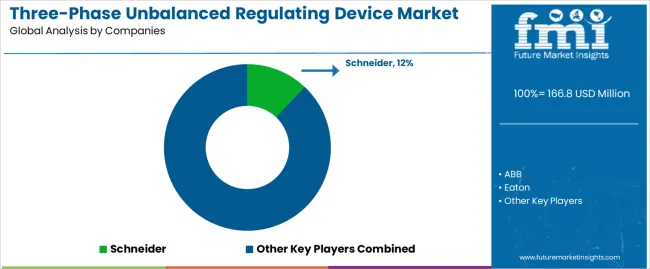

The three-phase unbalanced regulating device market is characterized by a mix of global leaders and regional players, each offering a range of solutions for optimizing power distribution and ensuring system stability. Schneider leads the market with a 12% share, leveraging its strong brand presence and expertise in automation, energy management, and power regulation. Schneider’s focus on innovation and high-performance products makes it a dominant force in both industrial and commercial applications.

Other major competitors in the market include ABB, Eaton, and Siemens, which are recognized for their comprehensive offerings in power regulation and grid optimization. ABB and Eaton provide advanced technologies aimed at enhancing energy efficiency and system reliability, while Siemens integrates automation and smart solutions to offer a more connected approach to regulating unbalanced power loads. These companies are heavily invested in smart grid solutions, ensuring that their devices meet the evolving needs of modern power systems.

Regional players like General Electric, Toshiba, and TeAn Electric Power are also integral to the market, offering cost-effective yet reliable products that cater to both local and international markets. Companies such as Chint, Delixi Electric, and Yunuotech focus on delivering affordable and efficient regulating devices, while Actionpower, IN-POWER Electric, and Wasion Electric are expanding their presence with innovative solutions aimed at improving energy management and balancing loads in diverse applications. The competition is driven by technological advancements, affordability, and the increasing demand for energy-efficient solutions in industrial and commercial power systems.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Active, Passive |

| Application | Industrial, Household, Commercial, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, Japan, South Korea, India, Australia & New Zealand, ASEAN, Rest of Asia Pacific, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, Rest of Europe, United States, Canada, Mexico, Brazil, Chile, Rest of Latin America, Kingdom of Saudi Arabia, Other GCC Countries, Turkey, South Africa, Other African Union, Rest of Middle East & Africa |

| Key Companies Profiled | Schneider, ABB, Eaton, Siemens, General Electric, Toshiba, TeAn Electric Power, Yunuotech, CHINT, Delixi Electric, Actionpower, IN POWER Electric, Wasion Electric, Yingtuo Runda Electric, Zhiming Group, Kangrun Electric, HSBC Power Automation, Ruitong Electric Technology |

| Additional Attributes | Dollar sales by type and application categories, market growth trends, market adoption by classification and application segments, regional adoption trends, competitive landscape, technological advancements in regulating devices, integration with industrial and commercial power systems. |

The global three-phase unbalanced regulating device market is estimated to be valued at USD 166.8 million in 2025.

The market size for the three-phase unbalanced regulating device market is projected to reach USD 322.1 million by 2035.

The three-phase unbalanced regulating device market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in three-phase unbalanced regulating device market are active and passive.

In terms of application, industrial segment to command 50.0% share in the three-phase unbalanced regulating device market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Device-Embedded Biometric Authentication Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Market Size and Share Forecast Outlook 2025 to 2035

IoT Device Management Platform Market Size and Share Forecast Outlook 2025 to 2035

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

FBAR Devices Market

X-Ray Device Market Size and Share Forecast Outlook 2025 to 2035

Power Device Analyzer Market Growth – Trends & Forecast 2025 to 2035

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Biopsy Device Market Forecast and Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Mobile Device Management Market Analysis by Deployment Type, Solution, Business Size, Vertical, and Region Through 2035

Venous Device Market

Serial Device Servers Market

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Trays Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Technology Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA