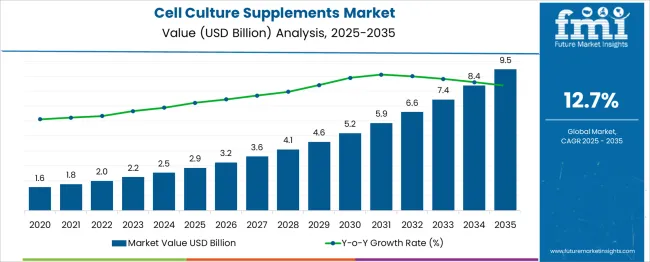

The global cell culture supplements market is predicted to grow from USD 2.9 billion in 2025 to approximately USD 9.5 billion by 2035, recording an absolute increase of USD 6.60 billion over the forecast period. This translates into a total growth of 231.6%, with the market forecast to expand at a compound annual growth rate (CAGR) of 12.7% between 2025 and 2035. The overall market size is expected to grow by nearly 3.32X during the same period, supported by the rising adoption of cell and gene therapies and increasing demand for specialized cell culture media in biopharmaceutical manufacturing.

Between 2025 and 2030, the cell culture supplements market is projected to expand from USD 2.9 billion to USD 5.53 billion, resulting in a value increase of USD 2.68 billion, which represents 40.6% of the total forecast growth for the decade. This phase of growth will be shaped by rising adoption of cell and gene therapy applications, increasing biopharmaceutical manufacturing activities requiring specialized cell culture media, and growing investment in biologics production capabilities. Companies are expanding their supplement portfolios to address the growing complexity of modern therapeutic manufacturing processes.

From 2030 to 2035, the market is forecast to grow from USD 5.53 billion to USD 9.5 billion, adding another USD 3.92 billion, which constitutes 59.4% of the overall ten-year expansion. This period is expected to be characterized by expansion of personalized medicine applications, integration of advanced cell culture technologies, and development of standardized supplement protocols across different therapeutic areas. The growing adoption of regenerative medicine and cell-based therapies will drive demand for more sophisticated culture supplements and specialized manufacturing capabilities.

Between 2020 and 2025, the cell culture supplements market experienced rapid expansion, driven by increasing adoption of biologics manufacturing and growing investment in cell and gene therapy development. The market developed as pharmaceutical companies recognized the need for high-quality culture media and supplements to support advanced therapeutic production. Research institutions and biotechnology companies began emphasizing specialized culture supplement requirements to maintain consistent cell growth and product quality.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2.9 billion |

| Forecast Value in (2035F) | USD 9.5 billion |

| Forecast CAGR (2025 to 2035) | 12.7% |

Market expansion is being supported by the rapid increase in cell and gene therapy development programs worldwide and the corresponding need for specialized culture supplements to support therapeutic manufacturing processes. Modern biopharmaceutical production relies on precise cell culture conditions and optimized supplement formulations to ensure proper cell growth, product quality, and manufacturing consistency. Even minor variations in culture supplement composition can significantly impact therapeutic efficacy and product safety.

The growing complexity of cell therapy applications and increasing regulatory requirements are driving demand for standardized culture supplements from certified suppliers with appropriate quality systems and technical expertise. Regulatory agencies are increasingly requiring comprehensive documentation of culture media composition and supplier qualification to maintain product approval and ensure therapeutic safety. Manufacturing specifications and quality standards are establishing standardized supplement protocols that require specialized formulations and validated supply chains.

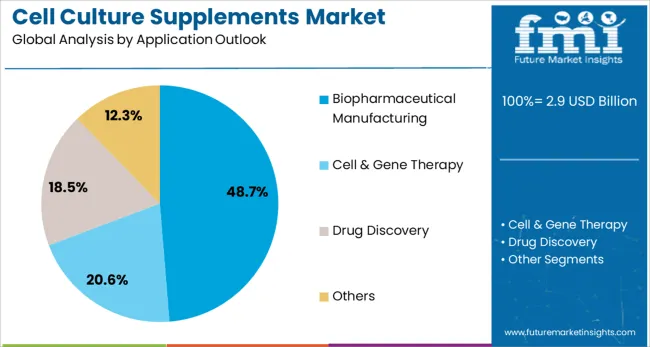

The market is segmented by product outlook, application outlook, end-use outlook, and region. By product outlook, the market is divided into protein-based and recombinant supplements, serum-based supplements, chemically defined supplements, and others. Based on application outlook, the market is categorized into biopharmaceutical manufacturing, cell and gene therapy, drug discovery, and others. In terms of end-use outlook, the market is segmented into pharmaceutical and biotechnology companies, cell culture media manufacturers, CDMOs/CMOs and CROs, and academic and research institutes. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Protein-based and recombinant supplements are projected to account for 42.5% of the cell culture supplements market in 2025. This leading share is supported by the widespread adoption of these supplements for advanced cell therapy applications and biopharmaceutical manufacturing processes that require defined protein compositions. Protein-based supplements provide consistent growth factors and regulatory proteins essential for cell proliferation and differentiation, making them the preferred choice for most therapeutic cell culture applications. The segment benefits from established manufacturing processes and comprehensive regulatory approval for clinical applications.

Biopharmaceutical manufacturing is expected to represent 48.7% of cell culture supplement demand in 2025. This dominant share reflects the extensive use of cell culture supplements in biologics production and the growing investment in therapeutic protein manufacturing capabilities. Modern biopharmaceutical production requires specialized culture media and supplements to maintain consistent cell line performance and product quality throughout manufacturing campaigns. The segment benefits from increasing regulatory requirements for culture media documentation and growing demand for biosimilar production capabilities.

Pharmaceutical and biotechnology companies are projected to contribute 41.6% of the market in 2025, representing organizations focused on developing and manufacturing cell-based therapeutics and biologics products. These companies require comprehensive supplement portfolios and specialized technical support to optimize cell culture processes for therapeutic applications. The segment is supported by growing investment in cell therapy development and increasing adoption of personalized medicine approaches that require customized culture conditions.

The cell culture supplements market is advancing rapidly due to increasing cell therapy adoption and growing recognition of culture media optimization importance. However, the market faces challenges including high supplement costs, need for continuous validation of new formulations, and varying regulatory requirements across different therapeutic applications. Standardization efforts and quality assurance programs continue to influence product development and market adoption patterns.

The growing development of chemically defined supplement formulations is enabling more consistent and reproducible cell culture conditions while reducing batch-to-batch variability in therapeutic manufacturing processes. Defined media formulations provide precise nutrient compositions and eliminate animal-derived components that may introduce contamination risks or regulatory concerns. These supplements are particularly valuable for cell therapy applications that require stringent quality control and regulatory compliance throughout the manufacturing process.

Modern supplement manufacturers are incorporating advanced monitoring systems and quality control technologies that improve supplement consistency and reduce manufacturing variability. Integration of real-time analytical methods and automated quality testing enables more precise supplement formulation and comprehensive batch documentation. Advanced manufacturing also supports development of customized supplement formulations for specific cell lines and therapeutic applications.

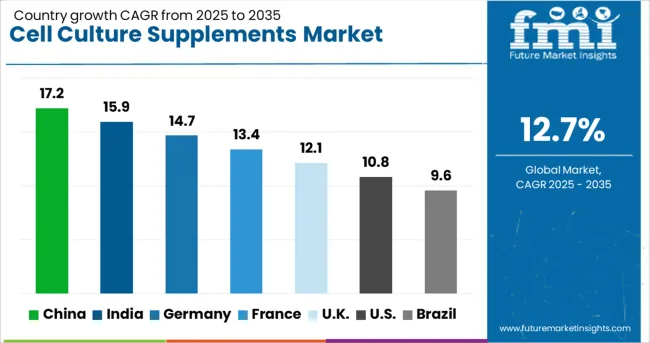

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 17.2% |

| India | 15.9% |

| Germany | 14.7% |

| France | 13.4% |

| UK | 12.1% |

| USA | 10.8% |

| Brazil | 9.6% |

The cell culture supplements market demonstrates strong growth patterns across key regions, with China leading at 17.2% CAGR through 2035, driven by expanding biopharmaceutical manufacturing and increasing cell therapy development programs. India follows at 15.9%, supported by growing biotechnology sector investment and regulatory framework development. Germany records 14.7% growth, emphasizing advanced cell culture technologies and precision manufacturing capabilities, while France shows 13.4% expansion through pharmaceutical research facility modernization programs. The UK demonstrates 12.1% growth through biotechnology innovation initiatives, the USA shows 10.8% driven by therapeutic development activities, and Brazil records 9.6% supported by pharmaceutical industry modernization efforts.

Revenue from cell culture supplements in China is projected to exhibit the highest growth rate with a CAGR of 17.2% through 2035, driven by rapid expansion of biopharmaceutical manufacturing facilities and increasing investments in cell therapy research infrastructure. The country's growing biologics production industry and domestic therapeutic development programs are creating significant demand for high-quality culture supplements and specialized manufacturing support systems. Major pharmaceutical companies and research institutes are establishing comprehensive cell culture facilities to support both traditional biologics manufacturing and advanced cell therapy applications.

Government biopharmaceutical industry development programs support establishment of world-class manufacturing facilities that meet international quality standards and regulatory requirements for global market access. Pharmaceutical industry modernization initiatives facilitate adoption of advanced cell culture technologies that support comprehensive therapeutic development capabilities across major biotechnology clusters.

Revenue from cell culture supplements in India is expanding at a CAGR of 15.9%, supported by increasing cell therapy development activities and growing biotechnology sector investment in advanced manufacturing capabilities. The country's expanding pharmaceutical industry and increasing focus on biologics production are driving demand for specialized culture media and supplement systems. Research institutions and biotechnology companies are gradually establishing comprehensive cell culture capabilities to serve growing therapeutic development requirements.

Biotechnology industry growth and pharmaceutical manufacturing expansion create opportunities for specialized supplement suppliers that can support diverse cell culture applications and regulatory compliance requirements. Professional training and technical development programs enhance manufacturing expertise among biotechnology companies, enabling comprehensive culture supplement utilization that meets international quality standards.

Demand for cell culture supplements in Germany is projected to grow at a CAGR of 14.7%, supported by the country's emphasis on biotechnology innovation and precision manufacturing capabilities. German pharmaceutical companies are implementing comprehensive cell culture systems that meet stringent quality standards and regulatory specifications for therapeutic applications. The market is characterized by focus on technological advancement, quality assurance programs, and compliance with comprehensive biotechnology manufacturing regulations.

Biotechnology industry investments prioritize advanced culture supplement technologies that demonstrate superior performance consistency while meeting German pharmaceutical quality standards. Professional certification programs ensure comprehensive technical expertise among manufacturing personnel, enabling specialized cell culture applications that support diverse therapeutic development programs.

Revenue from cell culture supplements in France is growing at a CAGR of 13.4%, driven by ongoing pharmaceutical research facility upgrades and increasing biotechnology sector investments in therapeutic development capabilities. The country's established pharmaceutical industry and growing focus on specialized biologics development are creating demand for advanced culture supplements and optimized manufacturing systems. Research institutions and pharmaceutical manufacturers are investing in modern cell culture infrastructure to support innovative therapeutic programs.

Pharmaceutical research industry modernization facilitates adoption of advanced culture supplement technologies that support comprehensive cell culture capabilities across major research and manufacturing centers. Technical development programs enhance cell culture expertise among facility operators, enabling specialized supplement utilization procedures that meet evolving pharmaceutical industry requirements.

Demand for cell culture supplements in the UK is expanding at a CAGR of 12.1%, driven by continued biotechnology research excellence and cell therapy development activities. The country's established pharmaceutical research infrastructure and growing investment in personalized medicine applications are creating demand for specialized culture supplements and advanced manufacturing support systems. Universities and biotechnology companies are establishing comprehensive cell culture capabilities to maintain competitive positioning in global therapeutic development markets.

Biotechnology research investments prioritize advanced culture supplement applications that support innovative therapeutic development while maintaining regulatory compliance and quality standards. Academic and industry collaboration programs facilitate knowledge transfer and technical expertise development that enhance cell culture capabilities across research networks.

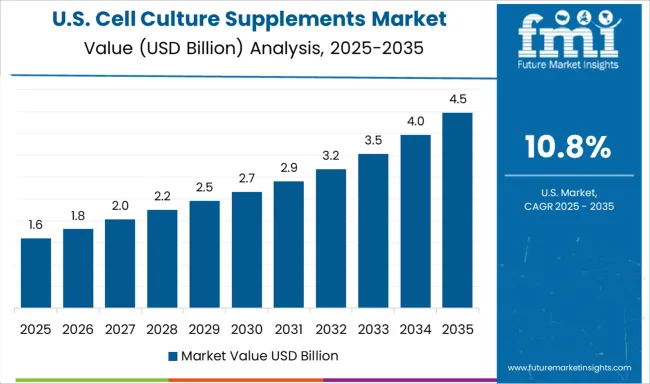

Demand for cell culture supplements in the USA is expanding at a CAGR of 10.8%, driven by increasing cell therapy development activities and growing emphasis on standardized manufacturing processes for biologics production. Large pharmaceutical companies and biotechnology organizations are establishing comprehensive culture supplement programs to serve diverse therapeutic development needs. The market benefits from regulatory agency requirements for culture media documentation and manufacturing quality assurance following therapeutic approval processes.

Pharmaceutical industry consolidation enables standardized culture supplement utilization across multiple manufacturing facilities, providing consistent product quality and comprehensive regulatory compliance throughout production networks. Professional training and certification programs develop specialized technical expertise among manufacturing personnel, enabling comprehensive cell culture capabilities that support evolving therapeutic requirements.

Revenue from cell culture supplements in Brazil is growing at a CAGR of 9.6%, driven by increasing pharmaceutical industry modernization and growing biotechnology sector investment in therapeutic development capabilities. The country's expanding healthcare infrastructure and increasing focus on domestic biologics production are creating opportunities for culture supplement suppliers and manufacturing support systems. Research institutions and pharmaceutical companies are gradually integrating advanced cell culture technologies to support therapeutic development programs.

Pharmaceutical industry modernization facilitates adoption of advanced culture supplement technologies that support comprehensive biologics manufacturing capabilities across major pharmaceutical regions. Professional service development programs enhance technical capabilities among research facilities, enabling specialized cell culture applications that meet evolving therapeutic industry requirements.

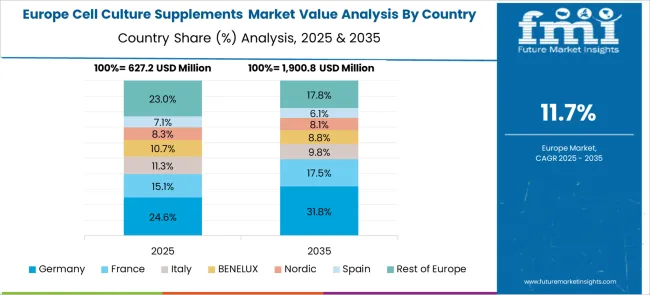

The cell culture supplements market in Europe is projected to grow steadily over the forecast period, with established pharmaceutical manufacturing centers driving consistent demand for specialized culture media. Germany is expected to maintain market leadership supported by its extensive biotechnology industry infrastructure and cell therapy research investments. The European market demonstrates strong emphasis on advanced cell culture technologies and comprehensive regulatory compliance requirements, particularly in biopharmaceutical manufacturing applications and therapeutic development programs. Germany's leadership position reflects its robust biotechnology sector and stringent quality standards for cell culture applications, while France's substantial market presence indicates significant investment in pharmaceutical research modernization and biologics manufacturing capabilities.

European cell culture supplement demand patterns show concentration in high-performance applications, with protein-based and recombinant supplements representing dominant product segments across major markets. The region's strict pharmaceutical regulatory frameworks and quality standards drive preference for certified culture supplement suppliers, supporting premium technology adoption and specialized technical relationships. Germany's pharmaceutical and biotechnology clusters, France's research facility modernization programs, and the United Kingdom's therapeutic development activities collectively establish Europe as a critical market for advanced cell culture supplement technologies. Regional supply chain integration and technical expertise development continue to strengthen European market position in global biopharmaceutical manufacturing and cell therapy applications.

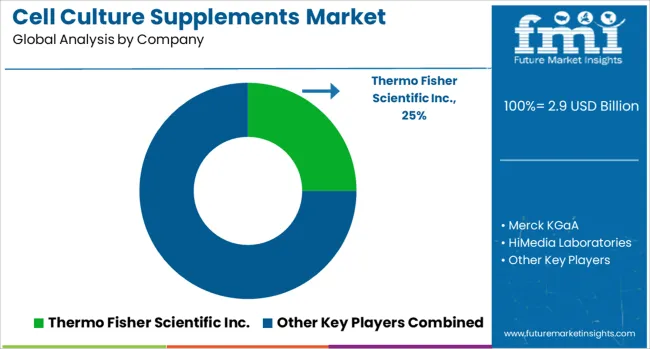

The cell culture supplements market is defined by competition among specialized biotechnology companies, pharmaceutical equipment manufacturers, and life sciences technology providers. Companies are investing in advanced supplement formulations, quality assurance systems, regulatory compliance capabilities, and comprehensive technical support to deliver precise, reliable, and cost-effective cell culture solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence in the rapidly evolving biopharmaceutical manufacturing landscape.

Major players in the market include Thermo Fisher Scientific Inc., recognized for comprehensive cell culture solutions and global manufacturing capabilities. Merck KGaA offers specialized supplement formulations with focus on pharmaceutical and biotechnology applications. HiMedia Laboratories provides diverse culture media solutions for research and manufacturing applications. Danaher emphasizes advanced biotechnology equipment and integrated culture systems, while Sartorius AG focuses on biopharmaceutical manufacturing solutions and process optimization. Additional market participants include Corning Inc., R&D Systems (Bio-Techne), STEMCELL Technologies, Repligen Corporation, and Proteintech Group Inc., each contributing specialized expertise in cell culture supplement development and manufacturing support technologies for therapeutic applications.

| Items | Values |

|---|---|

| Quantitative Units | USD 9.5 billion |

| Product Outlook | Protein-based & Recombinant Supplements, Serum-based Supplements, Chemically Defined Supplements, and Others |

| Application Outlook | Biopharmaceutical Manufacturing, Cell & Gene Therapy, Drug Discovery, and Others |

| End Use Outlook | Pharmaceutical & Biotechnology Companies, Cell Culture Media Manufacturers, CDMOs/CMOs & CROs, and Academic & Research Institutes |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Thermo Fisher Scientific Inc., Merck KGaA, HiMedia Laboratories, Danaher, Sartorius AG, Corning Inc., R&D Systems (Bio-Techne), STEMCELL Technologies, Repligen Corporation, Proteintech Group, Inc. |

| Additional Attributes | Dollar sales by product outlook, application outlook, and end-use outlook, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established players and emerging biotechnology companies, buyer preferences for defined versus serum-based formulations, integration with advanced cell culture monitoring and automation platforms, innovations in chemically defined supplement formulations and specialized growth factor combinations, and adoption of quality assurance systems with comprehensive batch documentation and regulatory compliance features. |

The global cell culture supplements market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the cell culture supplements market is projected to reach USD 9.5 billion by 2035.

The cell culture supplements market is expected to grow at a 12.7% CAGR between 2025 and 2035.

The key product types in cell culture supplements market are protein-based & recombinant supplements, serum-based supplements, chemically defined supplements and others.

In terms of application outlook, biopharmaceutical manufacturing segment to command 48.7% share in the cell culture supplements market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellulose Diacetate Film Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Fiber Market Forecast and Outlook 2025 to 2035

Cellulite Treatment Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Derivative Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Film Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cell Therapy Systems Market Size and Share Forecast Outlook 2025 to 2035

Cellular IoT Market Size and Share Forecast Outlook 2025 to 2035

Cell Isolation Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Ether and Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Cellular Push-to-talk Market Size and Share Forecast Outlook 2025 to 2035

Cellulosic Polymers Market Size and Share Forecast Outlook 2025 to 2035

Cellbag Bioreactor Chambers Market Size and Share Forecast Outlook 2025 to 2035

Cell Surface Markers Detection Market Size and Share Forecast Outlook 2025 to 2035

Cellular Modem Market Size and Share Forecast Outlook 2025 to 2035

Cellulite Reduction Treatments Market Size and Share Forecast Outlook 2025 to 2035

Cell Separation Market Size and Share Forecast Outlook 2025 to 2035

Cell Freezing Media Market Size and Share Forecast Outlook 2025 to 2035

Cellulase Market Size and Share Forecast Outlook 2025 to 2035

Cellular M2M Market Size and Share Forecast Outlook 2025 to 2035

Cellular Renewal Actives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA