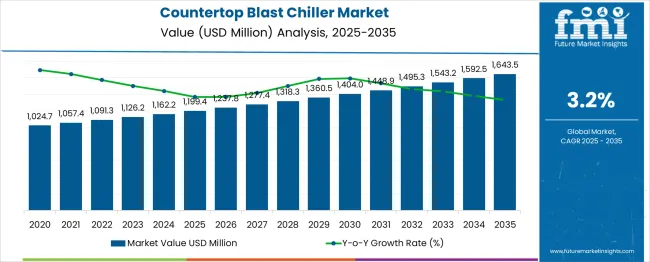

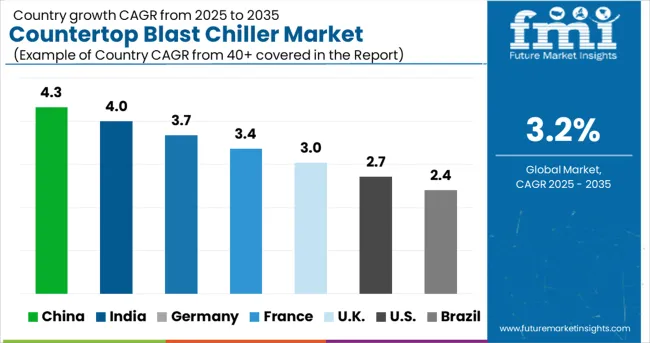

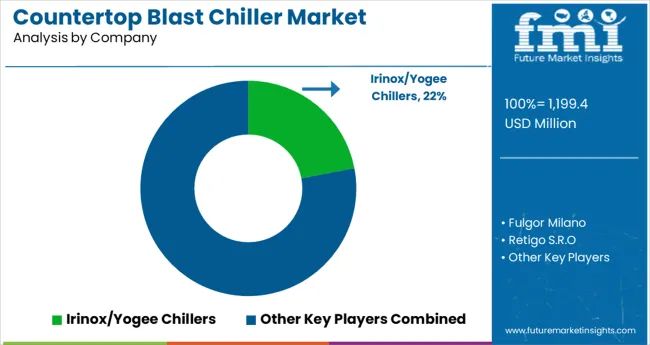

The Countertop Blast Chiller Market is estimated to be valued at USD 1199.4 million in 2025 and is projected to reach USD 1643.5 million by 2035, registering a compound annual growth rate (CAGR) of 3.2% over the forecast period.

The countertop blast chiller market is progressing steadily as commercial kitchens, bakeries, and foodservice operators increasingly adopt compact and efficient chilling solutions to ensure food safety and quality.

Growth is being propelled by stringent food safety regulations, rising awareness of HACCP compliance, and the demand for space-saving equipment in high-density kitchen environments. Manufacturers are focusing on energy-efficient designs and user-friendly interfaces to meet operator needs while minimizing operational costs.

The future outlook remains positive, supported by continued investments in the hospitality sector, evolving culinary trends that demand precise temperature control, and innovations in cooling technology aimed at reducing environmental impact. Opportunities are also emerging from the growing adoption of modular kitchens and the expanding quick-service restaurant segment, paving the way for wider market penetration and sustained growth.

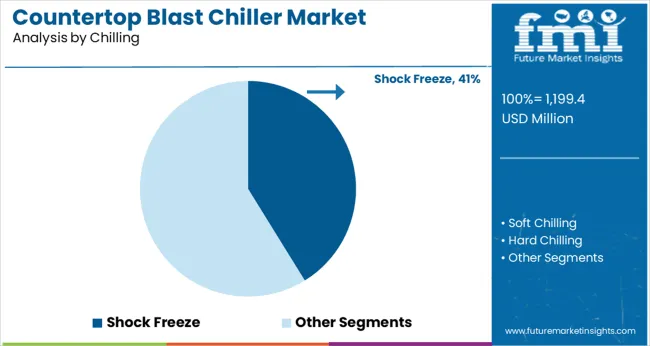

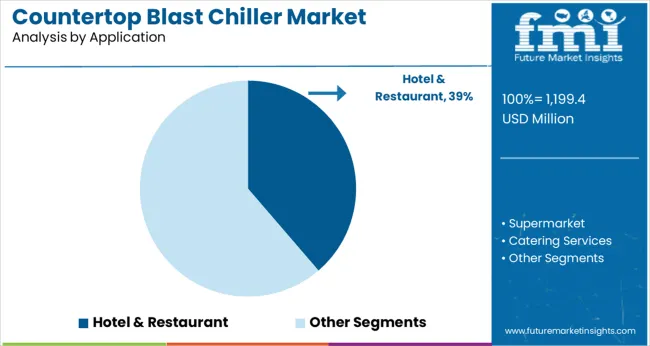

The market is segmented by Chilling, Application, and Product Type and region. By Chilling, the market is divided into Shock Freeze, Soft Chilling, and Hard Chilling. In terms of Application, the market is classified into Hotel & Restaurant, Supermarket, Catering Services, Bakery & Confectionary, and Others.

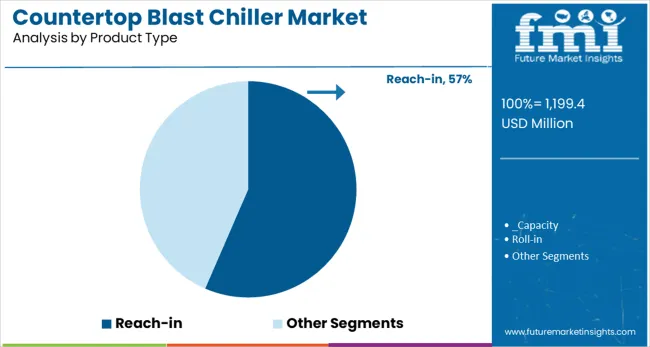

Based on Product Type, the market is segmented into Reach-in and Roll-in. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by chilling method, the shock freeze segment is projected to account for 41.2% of the total market revenue in 2025, establishing itself as the leading chilling subsegment. This position has been driven by the necessity to rapidly lower food temperatures to inhibit bacterial growth and preserve nutritional value.

Foodservice operators have increasingly adopted shock freeze technology to meet stringent food safety standards while minimizing food wastage. Advancements in refrigeration components and control systems have further improved the efficiency and reliability of shock freeze units, encouraging widespread use in professional kitchens.

The segment’s dominance has been strengthened by its ability to extend product shelf life without compromising texture and taste, making it indispensable in operations where quality and compliance are critical.

In terms of application, the hotel and restaurant segment is expected to capture 38.7% of the market revenue in 2025, emerging as the largest segment by application. This leadership has been supported by the hospitality industry’s ongoing emphasis on food safety, operational efficiency, and premium guest experiences.

Hotels and restaurants have increasingly integrated countertop blast chillers into their workflows to comply with hygiene standards while optimizing kitchen throughput. Compact designs, ease of use, and enhanced cooling performance have enabled seamless adoption even in space-constrained kitchens.

The growing prevalence of buffet services, high-volume banquets, and gourmet menu offerings has further reinforced the need for reliable chilling solutions in this segment. The ability to maintain consistency and quality across diverse menu items has ensured continued preference for countertop blast chillers in hotel and restaurant settings.

Segmenting by product type shows that the reach-in segment is forecast to hold 56.5% of the market revenue in 2025, positioning it as the dominant product type. This prominence has been achieved through its ergonomic design, which allows easy accessibility and efficient use of space in busy kitchen environments.

The reach-in configuration has gained popularity due to its balance of storage capacity and compact footprint, making it ideal for high-turnover foodservice operations. Continuous enhancements in insulation materials, airflow management, and digital controls have improved performance while minimizing energy consumption, further increasing its appeal.

The durability and flexibility of reach-in units have also contributed to their leadership, as they cater effectively to the operational demands of diverse culinary establishments that prioritize speed, reliability, and hygiene.

The expert analysts at FMI have identified that the key players in the countertop blast chiller market are adopting new technologies for these shock freezers. With the evolution of the lifestyle and business of the populace, there is a need for faster food services, fueling the sale of compact blast chillers.

To keep in tandem with consumer demand, the market is driven by Artificial Intelligence (AI) and Internet of Things (IoT)-based blast chillers, which are creating a huge impact on fast processing. For instance, a key manufacturer Rendell launched its new BC series reach-in blast chiller, a model that holds 18 standard pans, nine sheet pans, or a combination of both.

| Report Attribute | Details |

|---|---|

| Countertop Blast Chiller Market Value (2025) | USD 1,126.20 million |

| Countertop Blast Chiller Market Anticipated Value (2035) | USD 1,543.20 miillion |

| Countertop Blast Chiller Projected Growth Rate (2025 to 2035) | 3.2% |

As per the analysis of FMI, the countertop blast chiller market has been witnessing an unprecedented surge in the past few years. There is an approximate rise of USD 1199.4 million surge in the total market value from 2025 to 2025.

The upsurge in the sale of countertop blast chillers can be attributed to the increasing demand for advanced machinery. Rising awareness regarding food safety and government initiatives to reduce food wastage are propelling the demand for this product further. Industry 4.0, Big Data, and the introduction of IoT has led to the rise of smart food industries to manufacture technology-based equipment.

The usage of countertop blast chillers is helping aid restaurants to achieve the highest level of food safety, improvement of traceability, cut down wastage, and reduce cost, self-diagnosis, and remote maintenance, due to which they are largely incorporating these freezers to avail the benefits. This aspect is driving the market demand and is expected to lead the market towards further expansion during the projection period.

It is anticipated that the roll-in blast chillers are dominating the product type segment and are likely to advance at a moderate pace, registering a CAGR of 7.5% through the forecast period. The roll-in freezers are further classified into below 100KG, 100-200KG, and above 200 KG. The main factors attributing to the growth of this segment can be identified as follows:

FMI has analyzed that OEMs are focusing on developing countertop blast chillers for the bakery and confectionary sector. This segment accounted for an approximate share of 10% during the base year. The rising application in the bakery and confectionary sector is due to the following aspects:

Countertop blast chiller manufacturers are launching their new products, especially for bakery & confectionary applications, to improve their market share. OEMs, including Irinox and Hobart Dayton Mexicana, are unveiling their latest innovations to stay competitive in the market.

| Country/Region | United States |

|---|---|

| Statistics | The countertop blast chiller market in the USA is projected to record a moderate-paced CAGR of 6% through 2035. The current market valuation stands at USD 1199.4 million in 2025. |

| Growth Propellants | Aspects fueling the growth of the market in the USA are:

|

| Country/Region | Europe |

|---|---|

| Statistics | The European countertop blast chiller market is anticipated to register a CAGR of 7%, and the market valuation is estimated to surpass USD 1643.5 million by 2035. |

| Growth Propellants |

|

| Country/Region | Japan |

|---|---|

| Statistics | The countertop blast chiller market In Japan is poised to register a CAGR of 6% during the forecast period. |

| Growth Propellants | The factors attributing to the propulsion of the market in Japan can be identified as follows:

|

| Country/Region | Korea |

|---|---|

| Statistics | Korea is expected to advance at an average-paced CAGR of 6.5% during the period 2025 to 2035. |

| Growth Propellants | The aspects responsible for the expansion of the countertop blast chiller market in Korea are as follows:

|

Attempts of Start-up Firms in Stirring Up the Market Dynamics

The new entrants in the countertop blast chiller market are leveraging advancements in technology to launch new products and gain a competitive advantage. These firms are continually investing in research and development activities to keep themselves in tandem with the changing consumer preferences and end-use industry demands. Efforts are being made to strengthen their foothold in the forum and aid the further progression of the countertop blast chiller market.

Top Start-ups to Watch For

KREW - This India-based firm is manufacturing fully automatic ice machines and has been focusing on developing products that are particular about the quality of ice; and are unveiling their new products to improve market statistics in the potential industry.

Labh Projects Pvt. Ltd - This emerging company is professionally competent in manufacturing customized process chillers. You can share your industrial requirements, dimensions, applications, etc., with the team comprising engineers and technicians. Their team dedicatedly works on the customer requirement to deliver the product you require.

Industry Biggies Cede a Silver Lining to the Market-o-nomics

Countertop blast chillers have garnered significant popularity over the past few years, owing to fluctuating consumer preferences.

Countertop blast chiller manufacturers are launching the mini blast chiller series to improve their market position. Manufacturers are investing heavily in their Research and Development (R&D) to invent new blast freezers with multiple features and easy-handling facilities. OEMs are designing large quantity blast chillers & freezers to attract established hotel business companies to increase their flash freezers sale.

3 Top Players Identified in the Forum

IRINOX

IRINOX manufactures and sells shock freezers, blast chillers, holding cabinets, and proofing systems. The company has installed more than 40,000 machines and distributed its products in more than 80 countries. The company focuses on investments in R&D to develop innovative products with improved technology.

Williams Refrigeration

Williams Refrigeration manufactures and supplies refrigeration solutions across the world. Its offerings include reach-in/modular blast chillers and freezers, merchandisers, back bars, counters, cabinets, and specialist bakery equipment. It operates as a subsidiary of the AFE Group and has manufacturing facilities in China and Australia. Williams Refrigeration focuses on R&D, the manufacture of new products, and the redesigning of its existing products.

Traulsen & Co

Traulsen engages in the design, manufacture, and servicing of refrigeration equipment that include quick and blast chillers, dual-temperature models, prep tables, and hot-food holding cabinets. It also offers convertible freezers, sliding-glass-door refrigerators, fast freezers, and wine coolers. It operates as a subsidiary of Hobart Corporation.

The company is continuously developing new products and incorporating innovative technologies to meet the demands of customers. It focuses on the development of new electronic systems that include temperature controls and monitors.

Recent Developments

The global countertop blast chiller market is estimated to be valued at USD 1,199.4 million in 2025.

It is projected to reach USD 1,643.5 million by 2035.

The market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types are shock freeze, soft chilling and hard chilling.

hotel & restaurant segment is expected to dominate with a 38.7% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Countertop Convection Oven Market Size and Share Forecast Outlook 2025 to 2035

Countertop Pressure Fryer Market Size and Share Forecast Outlook 2025 to 2035

Countertop Griddle Market Size and Share Forecast Outlook 2025 to 2035

United States Countertop Market Trends - Growth, Demand & Forecast 2025 to 2035

Countertop Market Size & Demand 2025 to 2035

Countertop Pizza Warmers & Merchandisers Market - Fresh & Ready Pizzas 2025 to 2035

Countertop Ice Dispensers Market - Space-Efficient Solutions & Industry Growth 2025 to 2035

Countertop Warmers & Display Cases Market – Food Presentation & Preservation 2025 to 2035

Countertop Spray Market Trends – Growth & Forecast 2023-2033

Countertop Paper Napkin Dispenser Market

Electric Countertop Griddles Market

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Blast Freezing for Frozen Food and Feed Market Size and Share Forecast Outlook 2025 to 2035

Blasthole Drills Market Size and Share Forecast Outlook 2025 to 2035

Blast Chillers Market Size and Share Forecast Outlook 2025 to 2035

Sandblasting Media Market Size and Share Forecast Outlook 2025 to 2035

Glioblastoma Treatment Drugs Market Size and Share Forecast Outlook 2025 to 2035

Sand Blasting Machines Market Size and Share Forecast Outlook 2025 to 2035

Global Fibroblast-Derived Protein Market Size and Share Forecast Outlook 2025 to 2035

Shot Blasting Machine Market - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA