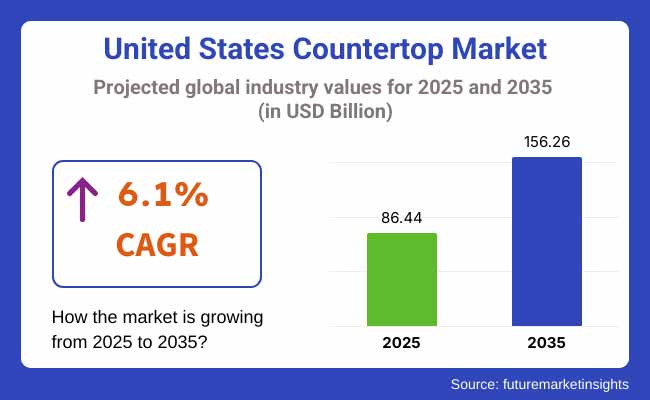

The United States countertop market is estimated at USD 86.4 billion in 2025 and is forecast to expand to USD 156.2 billion by 2035, registering a CAGR of 6.1%. Market expansion is driven by rising demand for aesthetic and functional kitchen and bathroom surfaces in residential remodeling, and continued growth in multi-family and hospitality construction.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 86.4 Billion |

| Market Size in 2035 | USD 156.2 Billion |

| CAGR (2025 to 2035) | 6.1% |

The United States countertop market is expanding in response to rising home renovations, commercial property upgrades, and evolving consumer expectations for durable and low-maintenance materials. The demand for quartz and engineered stone surfaces has increased, supported by consistent investment in multi-family housing, hospitality, and office refurbishment projects.

Quartz countertops have gained widespread acceptance due to their non-porous structure and ease of maintenance. Manufacturers such as Caesarstone and Cambria have scaled domestic production to reduce lead times and mitigate overseas sourcing risks. With improved inventory management and shorter delivery cycles, retailers are better positioned to serve both custom and standard product requests across residential and commercial applications.

In commercial sectors such as restaurants and hotels, the focus has shifted toward durable, hygienic surfaces. As a result, demand has grown for surfaces that offer resistance to staining, moisture, and microbial growth. Surfaces with built-in antimicrobial properties and thermal durability are increasingly used in food preparation zones and high-traffic commercial restrooms.

There has also been a notable shift toward recycled and low-impact surfaces. Countertop producers such as IceStone and PaperStone have introduced materials using post-consumer glass and compressed paper composites to cater to sustainable building requirements. These materials are being specified in LEED-certified projects, particularly in urban centers with green building mandates.

Technological innovation has allowed for the development of self-healing and scratch-resistant surfaces in select engineered stone categories. Research groups and manufacturers are testing polymer-infused surfaces that improve the longevity of countertop applications in kitchens and utility spaces.

Real estate trends further support countertop market growth. Many homeowners are choosing to renovate existing homes instead of purchasing new ones. This has led to increased investment in kitchen and bathroom upgrades, with countertops serving as focal points. High-income households are allocating greater budgets toward customized stone surfaces, boosting demand in the premium segment.

Engineered quartz is projected to account for 28.6% of the market share in 2025 and is expected to grow at a CAGR of 6.4% through 2035. Composed of quartz crystals bound with resin, these countertops are resistant to moisture, stains, and scratches, making them suitable for kitchens, vanity tops, and utility rooms. The segment is preferred in mid- to high-end residential and commercial applications due to uniformity in pattern and color availability.

Engineered quartz is increasingly adopted in kitchen remodeling due to its low maintenance and variety of design options. It is used in both traditional and contemporary interiors. Key players in this segment are expanding distribution partnerships with home improvement retailers and fabrication shops to support demand. Growth is particularly strong in urban and suburban housing markets across California, Texas, and Florida, where consumer spending on kitchen renovations remains high.

Renovation in residential settings is projected to hold 36.2% of the market share in 2025 and is expected to grow at a CAGR of 6.5% through 2035. Demand is driven by aging housing stock, increased home equity loans, and rising preference for customized kitchen and bathroom spaces. Countertops are among the most common replacements during kitchen and bath upgrades, as homeowners seek improved aesthetics, durability, and property value.

The popularity of DIY renovations and designer-led remodeling programs on digital platforms has further influenced purchasing behavior. Consumers in the USA are opting for resilient materials that meet both utility and design requirements. States such as New York, Illinois, and Washington are experiencing notable activity in residential remodeling, supported by urban renewal efforts. Demand is also seen in older suburbs where homeowners are investing in kitchen transformations to align with modern usage and lifestyle preferences.

The USA countertop market is on a positive growth path, fueled by increasing home remodeling, commercial building, and growing demand for long-lasting, environmentally friendly products. Producers of quartz, engineered stone, and green surfaces will be the beneficiaries, while conventional laminate manufacturers may struggle as consumer tastes change. At an estimated 6.1% CAGR, firms that are investing in innovation and premium segments are poised for sustained success.

Invest in High-Performance and Sustainable Materials

Executives must focus on R&D and production capacity for quartz, as well as recycled content and bio-based countertops, to meet the increasing demand for durability and environmentally friendly solutions from consumers. Increasing product lines with antimicrobial and self-healing surfaces will also be a competitive advantage.

Enhance Supply Chain Resilience and Cost Efficiency

Firms should increase local sourcing, diversify their supply networks, and invest in automation to mitigate potential material shortages and rising production costs. Synchronizing operations with just-in-time stock strategies will enhance both profitability and customer satisfaction.

Increase Strategic Partnerships and Distribution Channels

For a wide industry footprint, companies can partner with large-scale home remodeling stores, digital platforms, and direct-to-consumer schemes. Pursuing M&A avenues in niche specialty fabricators or tech-savvy startups has the potential to expedite development and product innovation.

| Risk | Probability & Impact |

|---|---|

| Raw Material Price Volatility | High Probability, High Impact |

| Shifts in Consumer Preferences | Medium Probability, High Impact |

| Regulatory & Sustainability Compliance | Medium Probability, Medium Impact |

| Priority | Immediate Action |

|---|---|

| Sustainable Material Expansion | Conduct a feasibility study on scaling recycled and bio-based countertops |

| Consumer-Centric Product Innovation | Initiate OEM and retailer feedback loop on demand for antimicrobial and self-healing surfaces. |

| Market Penetration & Distribution Growth | Launch an incentive pilot for aftermarket channel partners to boost premium product adoption |

To remain competitive in the evolving countertop industry, the company must increase its investments in eco-friendly materials, advanced surface technology, and strategic partnerships. As consumer preferences shift toward sustainable and high-performance surfaces, the strategy should focus on R&D for antimicrobial and self-healing surfaces, strengthening domestic supply chains, and implementing omnichannel distribution models.

The near-term priority should be to secure critical supplier deals, optimize direct-to-consumer propositions, and utilize mergers and acquisitions (M&A) to drive product innovation. This intelligence signals a shift from cost-based competition to value-based differentiation, necessitating a swift response to capitalize on emerging market opportunities before the competition.

Surveyed Q4 2024, n=500 stakeholders, evenly distributed across manufacturers, distributors, retailers, homebuilders, and consumers in the USA.

Regional Variance:

Consensus:

Variance:

| Sub-regions | Policies, Regulations, and Certifications |

|---|---|

| West United States |

|

| Midwest United States |

|

| Northeast United States |

|

| South United States |

|

The West region, which includes states such as California, is expected to experience a compound annual growth rate (CAGR) of approximately 6.7% between 2025 and 2035. California's market size is expected to grow to USD 18.88 billion by 2033, driven by an increase in real estate development and new housing construction projects. The region's focus on sustainable building and environmentally friendly materials further drives the demand for innovative countertop solutions.

FMI opines that Western United States countertop sales will grow at nearly 6.8% CAGR through 2025 to 2035.

The Midwest market is expected to experience a constant compound annual growth rate (CAGR) of approximately 5.8% throughout the forecast period. A stable real estate market and rising renovation rates in Illinois and Ohio fuel this. Midwestern consumers prefer long-lasting yet affordable materials, which results in increased demand for engineered stone and laminate countertops.

FMI opines that the Midwest United States' countertop sales will grow at nearly 6.2% CAGR through 2025 to 2035.

The Northeast, comprising states such as New York, has a countertop market that is expected to expand at a compound annual growth rate (CAGR) of around 7.0% from 2023 through 2033. The dynamic urban areas of New York, along with upscale residential construction, fuel the demand for high-quality countertop materials like granite and quartz. This strong growth stems from the wealthier consumer base and the emphasis on luxury design prevalent in the area.

FMI opines that countertop sales in the Northeast United States will grow at a nearly 6.0% CAGR from 2025 to 2035.

The Southern market is projected to grow at a compound annual growth rate (CAGR) of approximately 6.3% during the forecast period. Texas and Florida are experiencing high population growth and urbanization, leading to increased residential construction and remodeling activities. The demand here is characterized by a combination of traditional and modern styles, with an increasing trend toward engineered quartz and solid surface countertops due to their flexibility and durability.

FMI opines that the South United States' countertop sales will grow at nearly 6.9% CAGR through 2025 to 2035.

The USA countertop market is shifting toward distribution network optimization and region-specific inventory alignment. Leading suppliers have expanded logistics infrastructure with new centers in Denver and Memphis, improving service for engineered surfaces such as laminate, quartz, and solid materials.

These moves reflect a competitive emphasis on reducing lead times and meeting project timelines across distinct geographic zones. As facility counts grow, rivalry now centers on network density, fulfillment speed, and localized stock customization. Companies are balancing investment in logistics with demand forecasting accuracy.

Competitors with broader distribution are positioning to capture regional volume, while others may respond by forming partnerships or enhancing digital ordering systems. Market outlook indicates ongoing network refinement and small-scale site additions to match shifting construction and renovation demand patterns.

granite, solid surfaces, laminates, engineered quartz, marbles, natural stone, composites and polymers and metals

new construction residential, renovation residential, new construction non-residential, renovation non-residential

West United States, Midwest United States, Northeast United States and South United States

Rising demand and increased renovations.

Engineered quartz, solid surfaces, and composites.

Innovation, acquisitions, and partnerships.

Material costs, regulations, and labor shortages.

Demand for recycled and eco-friendly materials.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DOAS Industry Analysis in the United States Forecast and Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Chipless RFID Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Infant Formula Industry Analysis in United States Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Degassing Valves Industry Analysis in United States & Canada - Size, Share, and Forecast 2025 to 2035

Solenoid Valve Market Growth – Trends & Forecast 2024-2034

US & Europe EndoAVF Device Market Analysis – Size, Share & Forecast 2024-2034

U.S. Laminated Tube Market Trends & Demand Forecast 2024-2034

Fava Bean Protein Industry in United States Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Periodontal Gel Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Merchandising Unit Industry Analysis in United States Size and Share Forecast Outlook 2025 to 2035

Paper Tubes & Core Industry Analysis in United States Trends, Size, and Forecast for 2025-2035

Stainless Steel IBC Industry Analysis in United States Insights - Trends & Forecast 2025 to 2035

Protective Packaging Industry Analysis in United States and Canada - Size, Share, and Forecast 2025 to 2035

Dialysis Equipment Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

Hangover Cure Product Industry Analysis in United States Growth, Trends and Forecast from 2025 to 2035

Construction Anchor Market Growth – Trends & Forecast 2024-2034

U.S. Phlebotomy Equipment Market Analysis – Trends, Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA