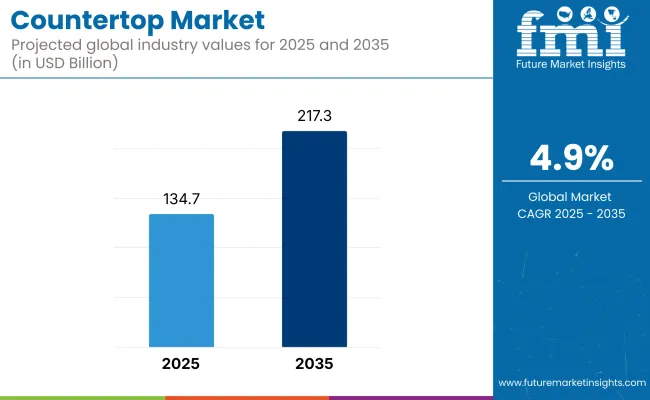

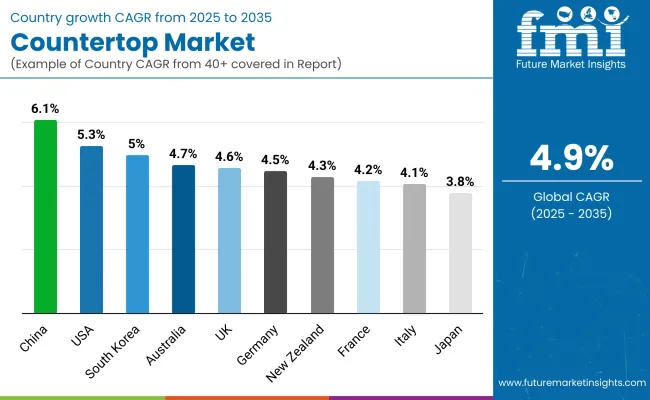

The countertop market is expected to witness a steady rise from 2025 to 2035 due to growing real estate investment in residential and commercial properties, altering design trends, and consumer lifestyle changes. Estimated at USD 134.7 billion in 2025, the industry is likely to see a consistent growth pattern, touching USD 217.3 billion by 2035, growing at a CAGR of 4.9% between 2025 and 2035.

With real estate and interior design industries continuing to evolve, demand for attractive, highly functioning surfaces like countertops is also evolving. Urbanization in emerging economies, particularly, is contributing significantly to kitchen and bathroom remodeling activity, which is in turn driving industry growth. In addition, as consumers increasingly become design conscious and demand upscale finishes in homes and offices, uses of engineered stone, quartz, granite, and solid surface continue to grow.

At home, kitchens continue to be the centerpieces of new homes, providing multifunctional areas that need to withstand the heavy use of durable, hygienic, and attractive options. This trend is supported by the growth in smart homes where kitchens are provided with sophisticated fixtures, modular configurations, and personalized surfaces. Quartz, porcelain, and reclaimed material options are increasingly popular, supporting sustainability efforts and consumer preference for eco-friendly solutions.

On the business front, hotels, hospitals, retail environments, and corporate offices are investing in long-term, maintenance-free materials. Many applications in these sectors typically require materials that not only provide a pleasing aesthetic but also heat, moisture, and abrasion resistance. Engineered surfaces with antimicrobial protection are also increasing in popularity, especially in the post-pandemic period, where cleanliness is at the top of the agenda in public and private spaces.

North America and Europe remain mature industries with steady demand fueled by remodeling activity and high-end property development. Asia-Pacific, however, is turning out to be the region with the highest growth rate due to rapid urbanization, rising disposable incomes, and a growing desire for western-style interiors across middle-class consumers.

Manufacturing technology innovations are also transforming the industry. Technological advancements in digital printing, surface texturing, and lightweight composites are allowing manufacturers to produce surfaces that look like natural stones at a fraction of the price, without sacrificing strength or aesthetics. These technologies have also reduced installation time and increased the availability of the products, prompting developers and homeowners to get on board.

Sustainability is another key issue shaping the industry of the future. Green building codes and regulations are forcing businesses to adopt environmentally friendly manufacturing practices and recyclable materials. Customers are increasingly taking lifecycle considerations into their purchasing decisions, fueling demand for sustainable solutions.

Market Metrics (2025 to 2035)

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 134.7 billion |

| Industry Value (2035F) | USD 217.3 billion |

| CAGR (2025 to 2035) | 4.9% |

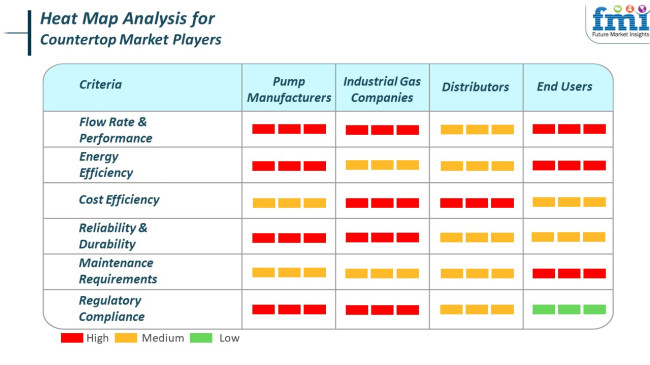

The industry is changing rapidly with increased construction activity, shifting interior design preference, and increasing consumer desire for functionality and appearance. The material manufacturers prioritize durability, innovation, and sustainability as their key drivers, and they target high-performance composites and green surfaces.

Contractors and installers, respectively, value ease of installation, cost savings, and performance when installing to make the installation convenient and easy to install. Retailers and distributors are driven by price, fashion, and availability when striving to meet average customers' needs.

Business organizations and residential homeowners are attracted to appeal, durability, and contemporary material options like composite reclaimed materials, granite, and quartz. While the consumer cares less about sustainability, it's gaining popularity in premium segments.

With greater renovation activity sweeping across the GCC region and an emerging trend towards luxurious yet practical surfaces, the industry is well placed to witness consistent growth driven by product innovation and rising urban infrastructure.

From 2020 to 2024, the industry increased progressively due to accelerating urbanization, remodeling trends, and growing consumer investment in the aesthetic of their homes during COVID-19 lockdowns. The materials such as granite, quartz, marble, and laminate were still the strongest, with engineered quartz taking the lead due to its strength and minimal maintenance.

The spurt in modular kitchens and growth in e-commerce also spurred the industry. Sustainability also started making an impact on material selection with recycled glass and green resin-based materials becoming increasingly popular. Price sensitivity and supply chain disruption constrained wider material innovation, though.

In the years ahead, up to 2025 to 2035, the industry will move towards smart materials, sustainability, and multi-functionality. Innovations will comprise self-cleaning, anti-microbial, and thermochromic surfaces through nanotechnology. AI-enabled options can include voice-controlled features, integrated touchscreens, or wireless charging for smart homes.

Recycled and carbon-neutral composite material will be readily available for green building certification and eco-friendly buyers. Customization will be the buzzword, with on-demand digital design platforms creating 3D-printed or modular solutions. Antibacterial and sensory-enabled surfaces will find larger applications in commercial buildings, hospitality, and healthcare for functionality along with hygiene.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Home remodeling, urban housing needs, and increasing demand for luxury kitchen/bathroom designs. | Smart homes, green building, and demand for tech-integrated, hygienic, and sustainable homes. |

| Granite, marble, quartz, laminate, and solid surfaces. | Eco-resin composites, recycled glass, nanotech surfaces, and multifunctional smart materials. |

| Sleek, minimalist, matte finishes with earthy or neutral tones. | Interactive surfaces, color-shifting designs, built-in smart panels, and AI-personalized finishes. |

| Restricted to USB ports or integrated sinks in premium segments. | Voice-activated features, in-surface screens, heating/cooling zones, and wireless device compatibility. |

| Some incorporating sustainable content such as bamboo or recycled materials. | Extremely strong demand for carbon-neutral, biodegradable, or circular economy-certified countertop systems. |

| Primarily kitchens, bathrooms, and retail counters. | Higher usage in commercial healthcare, hospitality, and interactive office spaces for technology and hygiene applications. |

| Aesthetics, ruggedness, and minimal maintenance. | Smart surfaces, health-promoting properties, personal aesthetics, and sustainability certification. |

| Simple CAD-based design customization and online purchasing. | AI-driven design recommendation engines, AR previews, and on-demand, modular 3D-printed installations. |

| Premium material costs, supply chain disruptions, and installation labor shortages. | Data protection in intelligent countertops, the longevity of integrated technology, and affordability versus technological features balance. |

| Strong in housing industries and high-end urban developments. | Commercial, health, and smart living business growth such as retrofitting homes with technology-embedded surfaces. |

The expansion of the industry is driven by factors such as rising demand for modern kitchens and bathrooms, increased construction activities, and a growing preference for durable and aesthetically pleasing surfaces.

Even with the optimistic projection, the industry is subject to a number of risks that may affect its path. One of the significant threats is the price volatility of raw materials. They are produced from various materials, including natural stone, engineered stone, concrete, and laminates. Price volatility of these materials, depending on mining regulations, trade policies, and supply chain disruptions, can affect production cost and profit margins.

There's a challenge coming from environmental rules and regulations too. As concern about sustainability worldwide gains more support, there's also more pressure brought to the natural stone quarrying environmental footprint as well as produced engineered products' environmental impacts. Compliance with strict environmental protocols could require additional costs on using eco-friendly procedures and technology that impact operating expenditure as well as price strategies.

The substitute menace and shifting consumers' preferences threaten the industry too. Materials science innovations have brought substitutes such as recycled products and bio-composites, which could be favored by green-conscious consumers. Also, interior design trends can shape demand for particular materials, and producers need to be able to adapt quickly to shifts in industry dynamics.

Economic downturn and volatility in the construction industry can also impact industry growth. Since they form a fundamental component of commercial and residential building construction, any slowdown in construction work because of economic recession can lead to reduced demand.

In order to minimize such risks, business organizations operating in the industry should aim at diversifying material sources, investing in eco-friendly and cutting-edge production practices, and being sensitive to changing consumer trends. Further, incorporating flexibility in supply chains and being fiscally cautious can guide them through economic fluctuations while preserving competitiveness in the marketplace.

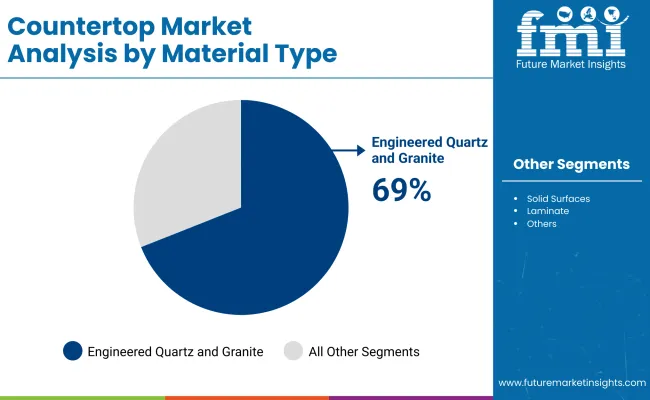

By 2025, the industry, predominantly held by material type, engineered quartz and granite, will jointly hold about 69% of the global industry. This is because of the qualities of the materials, such as misuse in house constructions and commercial applications, due to durability and aesthetic appeal.

Engineered quartz holds 39% of the industry share as being the highest; performance benefits associated with non-porosity, stain resistance, and bacteria resistance, and a wide range of colors and patterns available have made this material very popular in modern kitchens and bathrooms. This segment comprises leading companies, namely Caesarstone Ltd., Silestone by Cosentino, and Cambria.

For instance, Caesarstone digitalizes quartz surfaces to create high-end design solutions for the existing homeowner and designer. Cambria, an American company, is known for premium quartz products that are manufactured entirely in America, giving attention and accent to quality and sustainability. Silestone, a member of the Cosentino Group, also innovatively incorporates antimicrobial protection into its products.

Granite holds 30% of the industry share and continues to be one of the most popular natural stones among owners, especially those who prefer its characteristic veining and old-world appearance. Though granite demands frequent sealing so it will not stain very easily, it has a very high resistance to heat and scratches, making it in demand both residentially and commercially.

Such huge names include MSI Surfaces and Levantina in the granite countertops industry. MSI Surfaces provides an extensive range of imported granite slabs for luxury and traditional-style homes. At the same time, Levantina, a global leader in natural stones, avails high-quality granites from quarries around the world.

Industry leaders have leveraged innovation, design flexibility, and consumers' desire to maintain strongholds in material-based segmentation. The two top choices for countertops in 2025 and beyond are likely still going to be engineered quartz and granite, owing to the increasing demand for aesthetics and performance.

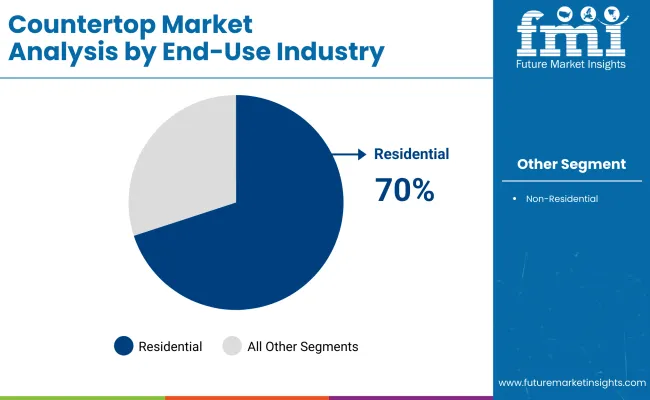

In 2025, the residential sector of the industry by the end-use industry commands approximately 70% of the total industry share. The growth in this sector is mainly due to increasing home improvements, higher disposable income, and trends in modern interior design.

Key players like Caesarstone Ltd., Cambria, and Silestone by Cosentino have dominated the residential industry for premium engineered quartz countertops, already offering a sizable range of aesthetically pleasing products. These companies have garnered consumer confidence in terms of their product durability, aesthetic variety, and stronghold on branded products in the home renovation segment.

Cambria produces upscale quartz surfaces tailored for kitchen and bath uses and aims to appeal to consumers interested in function and style. Then, for Silestone, quartz surfaces are treated with antimicrobial protection, which is gaining acceptance from homeowners who are hygiene conscious.

On the contrary, the non-residential sector holds a 30% industry share and serves commercial spaces such as offices, restaurants, hospitals, and educational institutions. Basically, this space is led by Wilsonart and Formica Corporation, which manufactures solid surface and laminate countertops that can withstand heavy use, are easy to clean, and are very cost-efficient. Regardless of design, these materials are very much in use in high-traffic places where practicality often conquers luxury.

Wilsonart promotes engineered surfaces that combine durability with chicly oriented designs and applications suitable for very formal corporate or institutional environments. Formica has long been in a great position to offer versatile laminate solutions affordably for a widespread flood of applications in public buildings and hospitality.

While the residential segment continues to dominate in consumer-driven design preferences and possible lifestyle upgrades, the non-residential segment is presently taking its place slowly, buoyed by global infrastructure development and investments into commercial real estate. Therefore, leading players in the industry are purposely aligning their product offerings to meet the varied demands posed on each of the sectoral interfaces to provide the widest coverage and sustain strategic growth in the industry.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.3% |

| UK | 4.6% |

| France | 4.2% |

| Germany | 4.5% |

| Italy | 4.1% |

| South Korea | 5% |

| Japan | 3.8% |

| China | 6.1% |

| Australia | 4.7% |

| New Zealand | 4.3% |

The USA industry will demonstrate steady growth, fueled by increasing investment in residential remodeling and commercial building construction. Demand for engineered quartz surfaces is growing strongly, outpacing conventional material use on the basis of durability and maintenance advantages. Demand for open-plan kitchens and the application of multicomponent countertops are also influencing the industry. Technological progress in customization and high-end finishes is also fueling adoption across the upper-end segments of the housing industry.

Leading players like DuPont, Caesarstone, Cambria, and Cosentino are driving the USA industry through innovation in engineered stone technology and product offerings. The commercial sector, which covers hospitality and retail, will be driving industry growth, led by interior redesign activity. Green trends are also shaping material demand, with recycled products becoming popular in urban and suburban construction.

The UK industry is also expected to have average growth in the forecast period, fueled by housing construction and redevelopment activities within urban areas. Gaining customer demand for high-end and dramatic kitchen spaces has helped propel demand for stone countertop materials such as granite and quartz. Increased home remodeling, primarily in main urban locations, is helping fuel growth in the sector.

Frontline players like Silestone, CRL Stone, and Dekton already showcase design-driven solutions to cater to changing consumer needs in the UK Higher uptake of smart kitchen technologies and integration of countertops with IoT devices are driving high-end segment demand. Furthermore, government incentives for energy-efficient home remodeling indirectly affect new solution installations.

The industry in France is expected to grow at a steady pace with increasing requirements for customized kitchen interiors and the revival of modern design trends in urban living. Natural stone and ceramic finishes are achieving increased popularity owing to their beauty appeal and performance levels. Increasing disposable income and homeownership percentage in urban areas also play a role in persistent demand.

French industry conditions are being driven by powerful home-grown producers supplemented by European players like Neolith and Lapitec, whose presence is growing through expertise-based surfacing solutions. Green building movement and eco-label certification norms are driving material specs in residential construction as well as commercial development, driving the industry for green solutions.

Germany's industry is to exhibit steady growth, with a robust construction industry and a high consumer focus on quality and accuracy. Integration of technology in remodeling and high demand for modular kitchen design are driving the growing uptake of engineered surfaces. The German industry is projecting a strong trend towards matte finishes, minimal styles, and hybrid material mixtures.

Industry leaders like Lechner, Artego, and Cosentino are expanding their footprints in the German industry by providing differentiated surfaces to meet functional and design requirements. Commercial refits within the office and hospitality segment are also creating incremental demand, particularly for scratch-resistant and heat-resistant products.

The Italian industry is predicted to develop at a calculated pace because of the nation's focus on design heritage and craftsmanship. Demand is primarily focused on natural and engineered stone segments, with marble in demand in high-end residential and boutique commercial environments. Restoration of heritage buildings and renovation of contemporary interiors in rural developments are driving steady industry penetration.

Industry leaders such as Santa Margherita, Quarella, and Marazzi are maintaining demand through innovative technology in material style and surface textures. In addition, the global appeal of Italian-manufactured surfaces in premium industries and export-based production is spurring investment in local manufacturing technology and distribution channels.

South Korean industry is expected to register strong growth with aggressive expansion driven by accelerated urbanization, growing incomes, and an increasing smart home system. Quartz and acrylic solid surfaces are gaining popularity in new residential construction for their hygiene value and smooth finish. Stretched demand for space-saving and multi-functional kitchen formats is fuelling product innovation trends.

LG Hausys, Lotte Chemical, and Hyundai L&C are leading the industry with the introduction of antibacterial and fire-resistant products that will find favor in compact living spaces. Government-subsidized smart city infrastructure projects, especially for mixed-use developments and high-end housing complexes, will drive commercial installations.

Japan's industry will grow moderately, led by an aging population of consumers who want to introduce ergonomic and low-maintenance systems. Trends of minimalist design and narrow kitchen space are influencing the demand for built-in countertop systems with in-built appliances and storage spaces. Material trends are shifting towards engineered stone and thin surfaces because of their convenience factor.

Local producers like TOTO, AICA Kogyo, and Panasonic are focusing on innovation in compact and modular construction to address the limitations of urban housing. Material supply with sustainability and recyclability focus is becoming increasingly important, especially for public and commercial building proposals, in accordance with overall environmental goals in national construction works.

The Chinese industry is expected to grow the fastest among the countries involved, and it is backed by rapid urbanization, infrastructure development, and a growing middle class. Residential and commercial high-rise buildings are driving demand for low-cost but extremely durable materials. Engineered quartz, sintered stone, and porcelain slabs are gaining traction due to their durability and design flexibility.

Major industry players like Oppein, Guangdong Baotrol, and Macostone are investing in capacity and R&D to create novel material solutions. Digital showrooming and online marketplaces also improve access to industries, particularly in tier-2 and tier-3 cities. Export opportunities are still robust because of China's strong manufacturing base and competitive prices.

Australia's industry will continue to grow gradually, and it will be largely fueled by home remodeling, strong demand for outdoor kitchens, and new-home construction. Natural stone and concrete-topped options are increasingly popular, especially in coastal areas, where durability is a top priority. There will also be growth in demand for locally manufactured surfaces and sustainably manufactured surfaces.

Key players like Smartstone, Caesarstone Australia, and Essastone are making investments in product research and development towards non-porous and UV-resistant products for residential and commercial applications. The high-end industry segment is gaining from the increasing demand for customized interior design, especially for urban developments and high-end housing schemes.

New Zealand's industry will experience a moderate growth rate driven by trends toward remodeling and increased interest in green design within housing. Moderate growth is being spurred in laminate surface and engineered stone adoption by pre-assembled and modular kitchen design demand. Resistant material enjoys high demand where outdoor installation takes place.

Players like Prime Panels, Trendstone, and Laminex New Zealand are leading the way in responding to shifting consumer preferences with diversified product ranges. Government policies to encourage energy-efficient houses and environmentally friendly building codes will also support long-term development through demand stimulation for sustainable solutions.

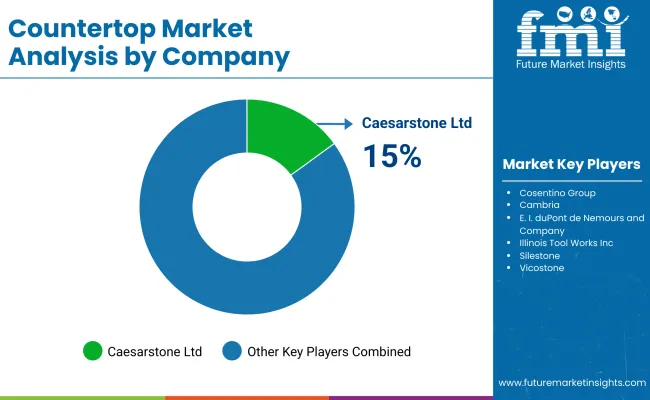

The industry is extremely competitive, with international and regional manufacturers vying for competitiveness in material innovations, durability, and design aesthetics. The key players in this quartz segment, including Caesarstone Ltd., Cosentino Group, and Cambria, are using advanced fabrication technologies and proprietary material blends to enhance their industry positions.

Companies like Illinois Tool Works Inc. and E. I. duPont de Nemours and Company have actually bolstered their position by combining engineered stone solutions with state-of-the-art surface coatings that further enhance their resistance to stains, in addition to giving them durability.

Industry leaders are focusing their attention on the integration of supply chains to control raw materials. Cosentino Group and Vicostone have laid the groundwork for vertical integration in manufacturing with a direct approach to the production of quartz and resins to stabilize product pricing and enhance consistency. Pokarna Ltd. and Asian Granito India Ltd. have increased capacity to satisfy both residential and commercial demand, and they are focused on exports to North America and Europe.

The industry is undergoing a paradigm shift towards sustainability, with major manufacturers now establishing green offerings. To this end, Caesarstone Ltd. and Silestone have developed surfaces with recycled content and lower carbon footprints for global building certifications. On the other hand, Cambria is now branding itself as a specialist in quartz surfaces, which are 100% manufactured in America, hence enhancing its brand appeal within North America.

Customization and technological progress in surface finishes, anti-microbial coatings and digital fabrication processes are key thrusts shaping competition. The focus is on affordable granite and marble solutions from AKG Group and Aro Granite Industries Ltd., which are targeting price-sensitive clients. The expectation is that there will be increased mergers and acquisitions in the sector, with the larger players acquiring niche producers to broaden their product portfolios and expand their geographical reach.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Caesarstone Ltd. | 15-20% |

| Cosentino Group | 12-18% |

| Cambria | 10-15% |

| E. I. duPont de Nemours and Company | 8-12% |

| Illinois Tool Works Inc. | 6-10% |

| Others | 35-45% |

| Company Name | Key Offerings & Activities |

|---|---|

| Caesarstone Ltd. | Premium quartz countertops with recycled content as well as proprietary stain-resistant coatings. |

| Cosentino Group | Silestone quartz surfaces with antimicrobial properties & carbon-neutral production. |

| Cambria | 100% American-made quartz surfaces with extensive customization options. |

| E. I. duPont de Nemours | Corian solid surface & innovative hybrid engineered stone solutions. |

| Illinois Tool Works Inc. | Industrial-grade countertop adhesives & surface coatings. |

Key Company Insights

Caesarstone Ltd. (15-20%)

A leading innovator in eco-friendly quartz surfaces, integrating recycled materials and offering proprietary stain-resistant finishes.

Cosentino Group (12-18%)

A pioneer in carbon-neutral countertops, leveraging advanced antimicrobial coatings and global distribution networks.

Cambria (10-15%)

Specializes in luxury, American-made quartz surfaces, focusing on custom design capabilities and high-end residential industries.

E. I. duPont de Nemours (8-12%)

An innovator in solid surface materials, developing hybrid engineered stone alternatives for durability and design flexibility.

Illinois Tool Works Inc. (6-10%)

A key player in industrial-grade adhesives and coatings, enhancing countertop longevity as well as resilience.

Other Key Players

By material type, the industry is segmented into granite, solid surfaces, laminates, engineered quartz, marble, and others.

By end use industries, the industry is segmented into residential and non-residential.

By construction activity, the industry is segmented into new construction and renovation.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is projected to be USD 134.7 billion in 2025.

By 2035, the industry is expected to reach USD 217.3 billion.

China is forecasted to grow at a 6.1% CAGR, driven by increased urban housing projects and interior design upgrades.

Engineered quartz and granite are the top materials due to their durability, aesthetic appeal, and low maintenance.

Leading companies include Caesarstone Ltd., Illinois Tool Works Inc., Pokarna Ltd., E. I. duPont de Nemours and Company, Cosentino Group (Silestone), AKG Group, Vicostone, Cambria, Aro Granite Industries Ltd., and Asian Granito India Ltd.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use Industries, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End Use Industries, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Construction Activity, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Construction Activity, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by End Use Industries, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by End Use Industries, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Construction Activity, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Construction Activity, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by End Use Industries, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by End Use Industries, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Construction Activity, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Construction Activity, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by End Use Industries, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by End Use Industries, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Construction Activity, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Construction Activity, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by End Use Industries, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by End Use Industries, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Construction Activity, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Construction Activity, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by End Use Industries, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by End Use Industries, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Construction Activity, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Construction Activity, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by End Use Industries, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by End Use Industries, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Construction Activity, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Construction Activity, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by End Use Industries, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by End Use Industries, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Construction Activity, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Construction Activity, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use Industries, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Construction Activity, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by End Use Industries, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by End Use Industries, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End Use Industries, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End Use Industries, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Construction Activity, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Construction Activity, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Construction Activity, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Construction Activity, 2023 to 2033

Figure 21: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 22: Global Market Attractiveness by End Use Industries, 2023 to 2033

Figure 23: Global Market Attractiveness by Construction Activity, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by End Use Industries, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Construction Activity, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by End Use Industries, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by End Use Industries, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by End Use Industries, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by End Use Industries, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Construction Activity, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Construction Activity, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Construction Activity, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Construction Activity, 2023 to 2033

Figure 45: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 46: North America Market Attractiveness by End Use Industries, 2023 to 2033

Figure 47: North America Market Attractiveness by Construction Activity, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by End Use Industries, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Construction Activity, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by End Use Industries, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by End Use Industries, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End Use Industries, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End Use Industries, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Construction Activity, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Construction Activity, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Construction Activity, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Construction Activity, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by End Use Industries, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Construction Activity, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by End Use Industries, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Construction Activity, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by End Use Industries, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by End Use Industries, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by End Use Industries, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by End Use Industries, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Construction Activity, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Construction Activity, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Construction Activity, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Construction Activity, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by End Use Industries, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Construction Activity, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by End Use Industries, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Construction Activity, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by End Use Industries, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by End Use Industries, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by End Use Industries, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use Industries, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Construction Activity, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Construction Activity, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Construction Activity, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Construction Activity, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by End Use Industries, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Construction Activity, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by End Use Industries, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Construction Activity, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by End Use Industries, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by End Use Industries, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use Industries, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use Industries, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Construction Activity, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Construction Activity, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Construction Activity, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Construction Activity, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by End Use Industries, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Construction Activity, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by End Use Industries, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Construction Activity, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by End Use Industries, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by End Use Industries, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by End Use Industries, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by End Use Industries, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Construction Activity, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Construction Activity, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Construction Activity, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Construction Activity, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by End Use Industries, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Construction Activity, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by End Use Industries, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Construction Activity, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by End Use Industries, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by End Use Industries, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use Industries, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use Industries, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Construction Activity, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Construction Activity, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Construction Activity, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Construction Activity, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by End Use Industries, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Construction Activity, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Countertop Convection Oven Market Size and Share Forecast Outlook 2025 to 2035

Countertop Blast Chiller Market Size and Share Forecast Outlook 2025 to 2035

Countertop Pressure Fryer Market Size and Share Forecast Outlook 2025 to 2035

Countertop Griddle Market Size and Share Forecast Outlook 2025 to 2035

United States Countertop Market Trends - Growth, Demand & Forecast 2025 to 2035

Countertop Ice Dispensers Market - Space-Efficient Solutions & Industry Growth 2025 to 2035

Countertop Pizza Warmers & Merchandisers Market - Fresh & Ready Pizzas 2025 to 2035

Countertop Warmers & Display Cases Market – Food Presentation & Preservation 2025 to 2035

Countertop Spray Market Trends – Growth & Forecast 2023-2033

Countertop Paper Napkin Dispenser Market

Electric Countertop Griddles Market

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA