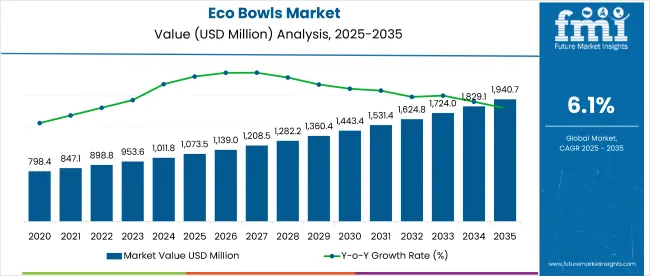

Eco Bowls Market is valued at USD 1.07 billion in 2025 and is expected to reach USD 1.94 billion by 2035, expanding at a CAGR of 6.1% during the forecast period.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 1.07 billion |

| Market Size (2035) | USD 1.94 billion |

| CAGR (2025 to 2035) | 6.1% |

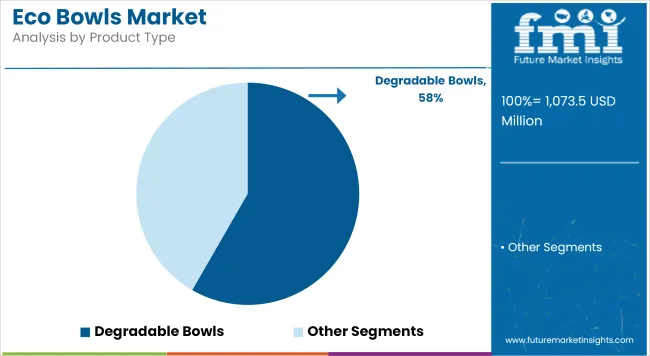

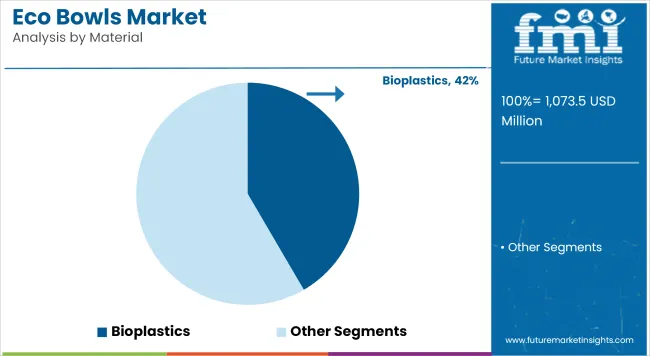

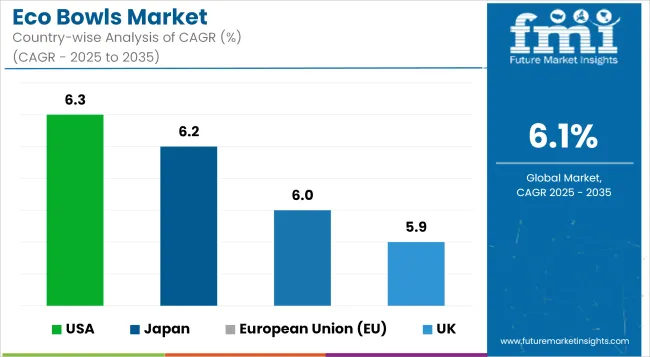

The market is segmented by material and product type, with Bioplastics holding the largest share of 40% by material in 2025, and Degradable Bowls dominating the product type segment with 58% share. Regionally, the USA leads with a CAGR of 6.3%, closely followed by Japan at 6.2%, the European Union at 6.0%, and the UK at 5.9%.

The Eco Bowls Market demonstrates robust growth potential over the next decade, driven by increasing environmental awareness and regulatory support for sustainable packaging. Bioplastics emerge as the dominant material segment, favored for their renewable sources and biodegradability, which align with shifting consumer preferences.

Degradable bowls maintain a stronghold in product offerings due to their versatility and compatibility with diverse food applications. Regional analysis reveals that the USA leads growth due to stringent sustainability regulations and rising demand in food service sectors. Japan and the European Union follow closely, supported by government initiatives and consumer inclination towards eco-friendly alternatives. Meanwhile, the UK exhibits steady growth with a focus on reducing single-use plastic consumption.

Challenges such as raw material costs and supply chain complexities may temper growth but are offset by technological advancements in material science and expanding end-use industries. Overall, the market is set to expand steadily, offering opportunities for manufacturers focusing on innovation and regulatory compliance.

The Eco Bowls Market is segmented by product type into Single-Use Eco Bowls, Reusable Eco Bowls, Compostable Eco Bowls, and Biodegradable Eco Bowls. By material, the segments include Bamboo, Sugarcane Bagasse, Palm Leaves, Wood Pulp, Recycled Paper, PLA (Polylactic Acid), Cornstarch-based Materials, Coconut Shells, and Other Plant-Based Materials.

The market is further divided by end-use industry comprising Food & Beverage Industry, Catering & Event Services, Retail & E-commerce, Healthcare & Pharmaceuticals, and Personal Care & Cosmetics. Geographically, the market covers North America (USA, Canada, Mexico), Latin America (Brazil, Argentina, Rest of LATAM), Western Europe (Germany, Italy, France, UK, Spain, BENELUX, Nordic, Rest of W. Europe), Eastern Europe (Russia, Hungary, Poland, Balkan & Baltics, Rest of E. Europe), East Asia (China, Japan, South Korea), South Asia & Pacific (India, Australia & New Zealand, ASEAN, Rest of SAP), and Middle East and Africa (GCC Countries, Northern Africa, South Africa, Turkiye, Rest of MEA).

The Single-Use Eco Bowls segment leads the product type category in 2025, holding a significant share due to its convenience and widespread adoption in foodservice and takeaway sectors. This segment benefits from increasing regulatory pressure to reduce single-use plastic alternatives, driving demand for sustainable disposable bowls.

However, challenges such as consumer concerns over durability and cost competitiveness relative to conventional plastics remain. Innovations in biodegradable and compostable materials serve as hidden disruptors by enhancing product performance and broadening application possibilities, which is expected to increase adoption by foodservice providers and retailers, boosting overall market growth.

Bamboo leads the material segment in 2025, capturing a notable share due to its rapid renewability, strength, and natural biodegradability. Its popularity is driven by consumer preference for eco-friendly products with minimal environmental impact and increasing availability through sustainable farming practices.

However, challenges include processing costs and supply limitations in certain regions. Emerging innovations in bamboo processing technology serve as hidden disruptors, improving product durability and manufacturing efficiency, which in turn boosts adoption across foodservice and retail applications.

The Food & Beverage Industry dominates the end-use segment in 2025, accounting for the largest share driven by increasing demand for sustainable packaging solutions in restaurants, cafes, and quick-service outlets. Regulatory pressures to reduce plastic waste combined with consumer preference for eco-friendly dining experiences have accelerated adoption of eco bowls in this sector.

However, cost sensitivity and performance requirements pose adoption challenges. Innovations in biodegradable materials and improved product design act as hidden disruptors, enhancing usability and appeal, thereby expanding the market footprint across both dine-in and takeaway applications.

The United States Eco Bowls Market is expected to grow at a CAGR of 6.3% from 2025 to 2035, reflecting strong regulatory and consumer-driven momentum. Federal and state-level bans on single-use plastics have intensified demand for sustainable alternatives, particularly in foodservice, quick-service restaurants, and meal delivery sectors.

Consumers increasingly prioritize eco-friendly packaging, creating opportunities for biodegradable and compostable eco bowls. However, the market faces challenges such as fluctuating raw material costs and supply chain disruptions. Technological advancements in bioplastics and innovative manufacturing processes are improving product quality and reducing costs, fostering broader acceptance. Additionally, major food retailers and restaurant chains are committing to sustainability goals, accelerating adoption.

Despite competitive pressure from conventional plastic alternatives, the USA market’s size and regulatory environment make it a leading growth driver globally. Expansion into new distribution channels such as e-commerce and institutional catering is further expected to sustain growth throughout the forecast period.

Japan’s Eco Bowls Market is poised to expand at a CAGR of 6.2% between 2025 and 2035, supported by strong government policies promoting environmental conservation and waste reduction. The country’s comprehensive recycling programs and cultural focus on sustainability encourage consumer acceptance of eco-friendly packaging. Urban centers see higher adoption rates due to dense foodservice activity and consumer demand for convenient yet responsible packaging options.

Despite higher production and raw material costs compared to conventional plastics, ongoing innovations in plant-based materials such as bamboo and cornstarch help improve affordability and performance. Retailers and foodservice providers increasingly collaborate on eco initiatives, such as plastic reduction campaigns and zero-waste efforts. Additionally, growing e-commerce and meal delivery services bolster demand for disposable eco bowls. While regulatory consistency and supply chain limitations pose some challenges, Japan’s market maturity and environmental ethos provide a stable platform for sustained growth.

The European Union Eco Bowls Market is forecast to grow at a CAGR of 6.0% from 2025 to 2035, driven by strict regulatory frameworks and heightened environmental awareness among consumers. Policies such as the EU Single-Use Plastics Directive impose bans and restrictions that compel foodservice operators and retailers to adopt sustainable packaging solutions.

Countries like Germany, France, and Italy are leading this transition with strong sustainability commitments. Consumer preference is shifting towards biodegradable and compostable materials, increasing demand for eco bowls across quick-service restaurants, catering, and retail segments. However, regional regulatory variations and raw material price volatility create operational challenges.

Investment in research and development of new materials like PLA and advanced bioplastics supports product innovation. The increasing penetration of online food delivery and takeaway services also contributes significantly. Overall, the EU market is characterized by steady growth fueled by supportive policies and evolving consumer behavior focused on reducing plastic waste.

The United Kingdom Eco Bowls Market is projected to grow at a CAGR of 5.9% during 2025-2035, driven by robust governmental initiatives to reduce plastic pollution and strong consumer demand for sustainable packaging. Post-Brexit regulatory realignment maintains rigorous environmental standards, with continued emphasis on reducing single-use plastics in foodservice and retail sectors. The rise of online food delivery and takeaway services has expanded market opportunities for eco bowls, as convenience meets sustainability concerns.

Consumer education campaigns and retailer commitments to plastic reduction further drive adoption. Challenges include supply chain uncertainties and cost pressures related to raw materials and manufacturing. However, advances in compostable materials and reusable product designs enhance market appeal.

The UK’s strong focus on circular economy principles and growing investments in biodegradable technologies position it as a resilient growth market. The combination of regulatory support and evolving consumer preferences will sustain steady demand over the forecast period.

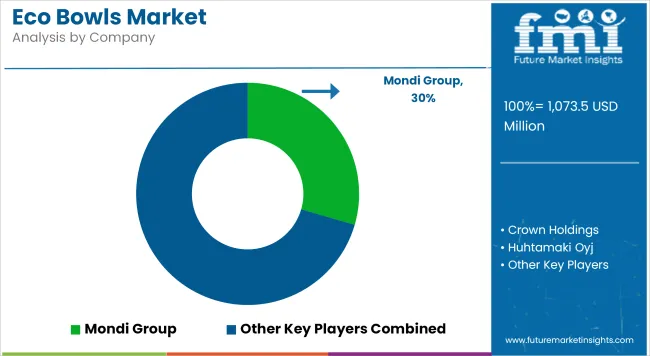

The Eco Bowls Market is moderately consolidated, with leading players such as Mondi Group, Crown Holdings, and Huhtamaki Oyj dominating significant market shares through extensive product portfolios and global distribution networks. These companies leverage strong R&D capabilities to innovate biodegradable and compostable materials, meeting evolving regulatory standards and consumer preferences. Mid-sized players like Biopak and Vegware focus on niche markets and sustainable sourcing to differentiate their offerings, while companies such as Eco-Products, Inc. and Genpak, LLC emphasize customized solutions for foodservice and retail sectors.

Pactiv Evergreen Inc. and Earthpack have invested in expanding their regional footprints, targeting growth in North America and Europe. Sabert Corporation strengthens its position through technological advancements in material science and eco-design. Competitive advantages are increasingly tied to compliance with stringent environmental regulations, material innovation, and sustainable supply chains.

Startups and smaller manufacturers are emerging with novel plant-based materials and circular economy models, challenging incumbents with disruptive technologies and business models. The rising demand for sustainable packaging is driving mergers, acquisitions, and strategic partnerships aimed at expanding product lines and geographic reach. Overall, market leadership will depend on agility in innovation, regulatory adaptation, and the ability to scale sustainable production cost-effectively.

| Metric | Details |

|---|---|

| Market Coverage | Global Eco Bowls Market including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Market Segmentation | By Product Type: Single-Use Eco Bowls, Reusable Eco Bowls, Compostable Eco Bowls, Biodegradable Eco BowlsBy Material: Bamboo, Sugarcane Bagasse, Palm Leaves, Wood Pulp, Recycled Paper, PLA(Polylactic Acid), Cornstarch -based Materials, Coconut Shells, Other Plant-Based MaterialsBy End-Use Industry: Food & Beverage Industry, Catering & Event Services, Retail & E-commerce, Healthcare & Pharmaceuticals, Personal Care & Cosmetics |

| Base Year | 2025 |

| Forecast Period | 2025 to 2035 |

| Market Value Units | USD Million |

| Research Type | Secondary research, market forecasts, competitive landscape, country analysis |

| Key Players Covered | Mondi Group, Crown Holdings, Huhtamaki Oyj, Biopak, Vegware, Eco-Products, Inc., Genpak, LLC, Pactiv Evergreen Inc., Earthpack, Sabert Corporation |

The Eco Bowls Market is expected to reach approximately USD 1.94 billion by 2035, growing at a CAGR of 6.1% from 2025 to 2035.

Bioplastics lead the material segment, accounting for 42% of the market share in 2025.

The main product types include Single-Use Eco Bowls, Reusable Eco Bowls, Compostable Eco Bowls, and Biodegradable Eco Bowls.

The USA leads with a CAGR of 6.3%, followed by Japan at 6.2%, the European Union at 6.0%, and the UK at 5.9%.

Key players include Mondi Group, Crown Holdings, Huhtamaki Oyj, Biopak, Vegware, Eco-Products, Inc., and Genpak, LLC among others.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Teen Room Décor Market Analysis – Growth & Demand Forecast 2025 to 2035

Korea Wall Décor Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Wall Décor Market Analysis - Size, Share & Trends 2025 to 2035

Japan Wall Décor Market Analysis – Size, Share & Trends 2025 to 2035

Europe Décor Paper Market Insights – Demand & Growth 2023-2032

Eco-friendly Tea Packaging Market Size and Share Forecast Outlook 2025 to 2035

Ecommerce Software and Platform Market Size and Share Forecast Outlook 2025 to 2035

Eco Friendly Laundry Product Market Size and Share Forecast Outlook 2025 to 2035

Eco-friendly Beneficiation Reagents Market Size and Share Forecast Outlook 2025 to 2035

Eco-friendly Precious Metal Beneficiation Reagents Market Forecast and Outlook 2025 to 2035

Eco-friendly Bottle Market Forecast and Outlook 2025 to 2035

Eco-Friendly Inks Market Size and Share Forecast Outlook 2025 to 2035

Economic Grade Precision Power Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Eco-friendly Toys Market Size and Share Forecast Outlook 2025 to 2035

Eco Funnel Market Size and Share Forecast Outlook 2025 to 2035

Eco-Friendly Straws Market Growth - Demand & Forecast 2025 to 2035

Ecotel Tourism Industry Analysis by Accommodation Type, by Traveler, by Destination Type, and by Region - Forecast for 2025 to 2035

Eco-friendly Paper Plates Market Insights - Trends & Future Outlook 2025 to 2035

Eco Flooring Market Analysis - Growth, Demand & Forecast 2025 to 2035

Market Share Distribution Among Eco-Friendly Candle Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA