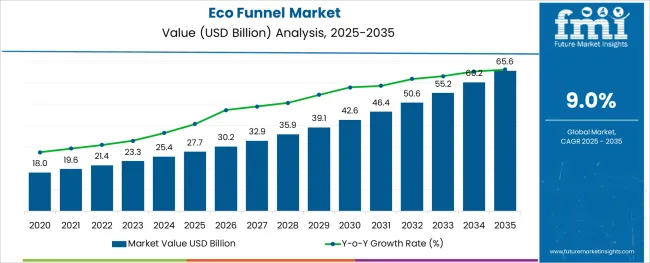

The Eco Funnel Market is estimated to be valued at USD 27.7 billion in 2025 and is projected to reach USD 65.6 billion by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period.

The eco funnel market is witnessing sustained growth as laboratories and industrial settings increasingly prioritize spill prevention, chemical handling safety, and regulatory compliance. Heightened focus on environmentally responsible practices has accelerated the adoption of closed system transfer devices such as eco funnels, which help minimize exposure to hazardous fumes and volatile chemicals.

Innovations in funnel design now support seamless integration with various container types and are engineered to comply with strict safety standards. The use of autoclavable materials, threaded connections, and vapor-sealing lids has enhanced operational safety while supporting sustainability goals through reusability.

As laboratory waste management and chemical disposal protocols tighten across the pharmaceutical, academic, and industrial sectors, eco funnels are emerging as standard tools for safety-compliant liquid transfer. Future market expansion is expected to be supported by growth in pharmaceutical R&D, institutional laboratory investments, and evolving regulatory frameworks aimed at minimizing environmental exposure to hazardous substances.

The market is segmented by Diameter, Capacity, and End Use and region. By Diameter, the market is divided into 2 Inches, 4 Inches, and 8 Inches. In terms of Capacity, the market is classified into Up to 500 ML, 501-1000 ML, and Above 1000 ML. Based on End Use, the market is segmented into Pharmaceuticals, Chemicals & Fertilizers, and Automotive. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

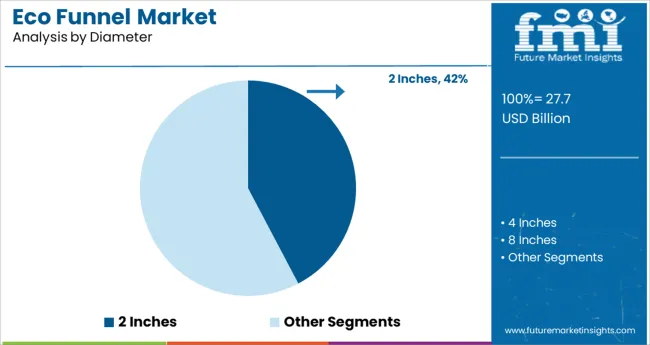

The 2 inches diameter sub segment is projected to hold 42.3% of total revenue in 2025, making it the leading choice in the diameter category. This preference is being driven by its compatibility with a wide range of standard laboratory containers and reagent bottles.

The 2 inches size offers an optimal balance between flow rate and control, enabling safe and efficient transfer of liquids without splashing or overflow. Its dominance is further supported by increased adoption in regulated environments where standardized opening sizes are favored for consistency and cross-equipment compatibility.

The ability to integrate with various closure types and container threads has made this diameter especially popular across institutions and commercial laboratories alike. Additionally, ease of handling and minimal storage requirements reinforce the continued leadership of this subsegment.

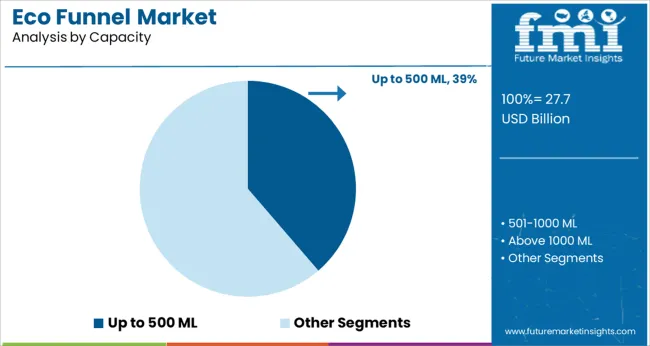

In the capacity category, eco funnels with up to 500 ML capacity are expected to contribute 38.7% of total revenue in 2025, securing their position as the preferred volume range. This is due to their suitability for small to mid-volume transfers, commonly required in analytical and quality control labs.

These funnels offer a compact footprint, which is ideal for benchtop environments where space and precision are priorities. Their reduced size also supports better vapor containment and handling control, which are critical in volatile chemical applications.

Laboratories favoring frequent but low-volume transfers have increasingly opted for the 500 ML and below range to ensure accuracy while minimizing waste. The growing preference for individualized workstations and portable lab setups has further supported the rise of this capacity segment within both academic and commercial research facilities.

The pharmaceuticals segment is anticipated to hold 45.8% of the eco funnel market revenue in 2025, making it the dominant end use category. This is being driven by the pharmaceutical industry’s stringent safety protocols, chemical handling standards, and waste containment requirements.

Eco funnels have become essential tools in GMP-compliant labs for minimizing contamination risks during reagent transfers, sample disposal, and solvent management. The rising demand for cleanroom-compatible and autoclavable equipment has accelerated adoption within R&D, quality assurance, and production environments.

With increased emphasis on workplace safety, environmental health, and waste reduction, pharmaceutical companies are standardizing eco funnel usage across their lab operations. Additionally, regulatory audits and safety inspections are prompting investment in containment tools that align with institutional risk management frameworks. As pharmaceutical R&D expands and facility upgrades continue, this segment is expected to retain its leadership position.

The demand for the eco funnel is present in businesses in training & learning institutes, pharmaceuticals, chemicals, automobiles, and many and much similar industrial manufacturing. Due to wide demand and multiple applications, sales of the Eco funnel are extreme.

Sales of the eco funnel have seen a significant increase in recent years, and this trend is expected to continue. Due to an increase in potential customers and emerging growth in each economy around the world, sales of the eco funnel are at heights.

Demand for the eco funnel is high, as it is required by regulatory authorities such as the Occupational Safety and Health Administration (OSHA) and the Environmental Protection Agency (EPA) in all businesses that employ hazardous chemicals in their operations.

The eco funnel has a strong resistance to harm; it resists all types of corrosion and fire attacks, making it functional for a long time, contributing to greater revenue and higher sales of the eco funnel.

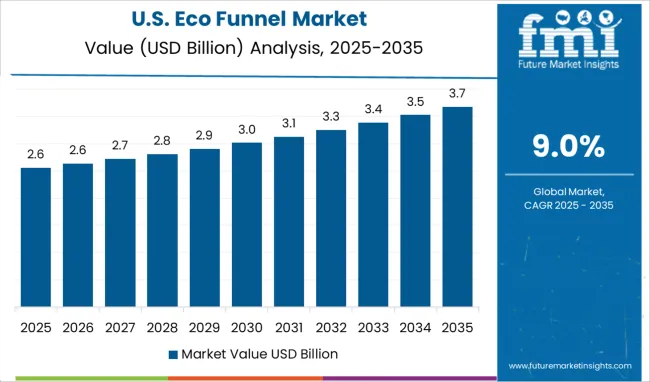

North America has been one of the world's most developed economies, followed by Western Europe. It is likely to provide considerable potential for the eco funnel market, which could be attributed to their high per capita consumption, owing to strict labor regulations.

In the coming years, African and Latin Americans could be important for eco funnel market share. The growth of the hygiene goods industry will be fueled by the disposable income of individuals in emerging economies.

The regional administration will enact stricter safety regulations for the use of dangerous gases and chemicals. In the following years, the overall sales of the eco funnel are predicted to have a positive outlook and grow at a high CAGR.

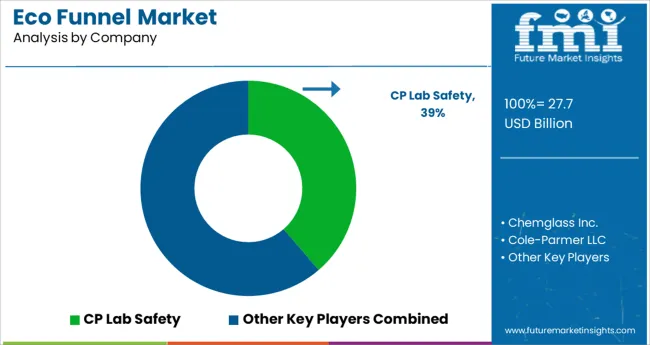

Some of the key players operating in the eco funnel market are Chemglass Life Sciences LLC, Cole-Parmer, CP Lab Safety, Fisher Scientific, and many others are expected to contribute to the global eco funnel market share in recent years to come.

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 9% from 2025 to 2035 |

| The base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis, |

| Segments Covered | Diameter, end uses, region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia; and New Zealand |

| Country scope | United States of America, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | CP Lab Safety; Chemglass Life Sciences LLC; Fisher Scientific; Cole-Parmer |

| Customization scope | Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global eco funnel market is estimated to be valued at USD 27.7 billion in 2025.

It is projected to reach USD 65.6 billion by 2035.

The market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types are 2 inches, 4 inches and 8 inches.

up to 500 ml segment is expected to dominate with a 38.7% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Teen Room Décor Market Analysis – Growth & Demand Forecast 2025 to 2035

Korea Wall Décor Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Wall Décor Market Analysis - Size, Share & Trends 2025 to 2035

Japan Wall Décor Market Analysis – Size, Share & Trends 2025 to 2035

Europe Décor Paper Market Insights – Demand & Growth 2023-2032

Eco-friendly Tea Packaging Market Size and Share Forecast Outlook 2025 to 2035

Ecommerce Software and Platform Market Size and Share Forecast Outlook 2025 to 2035

Eco Friendly Laundry Product Market Size and Share Forecast Outlook 2025 to 2035

Eco-friendly Beneficiation Reagents Market Size and Share Forecast Outlook 2025 to 2035

Eco-friendly Precious Metal Beneficiation Reagents Market Forecast and Outlook 2025 to 2035

Eco-friendly Bottle Market Forecast and Outlook 2025 to 2035

Eco-Friendly Inks Market Size and Share Forecast Outlook 2025 to 2035

Economic Grade Precision Power Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Eco-friendly Toys Market Size and Share Forecast Outlook 2025 to 2035

Eco Bowls Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Eco-Friendly Straws Market Growth - Demand & Forecast 2025 to 2035

Ecotel Tourism Industry Analysis by Accommodation Type, by Traveler, by Destination Type, and by Region - Forecast for 2025 to 2035

Eco-friendly Paper Plates Market Insights - Trends & Future Outlook 2025 to 2035

Eco Flooring Market Analysis - Growth, Demand & Forecast 2025 to 2035

Market Share Distribution Among Eco-Friendly Candle Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA