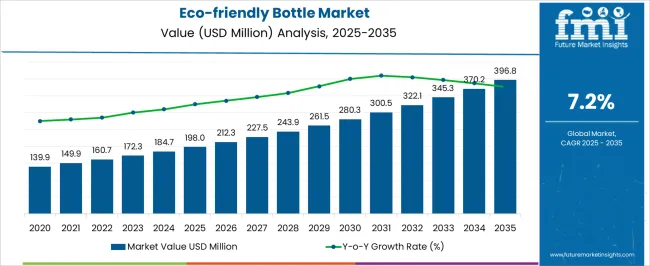

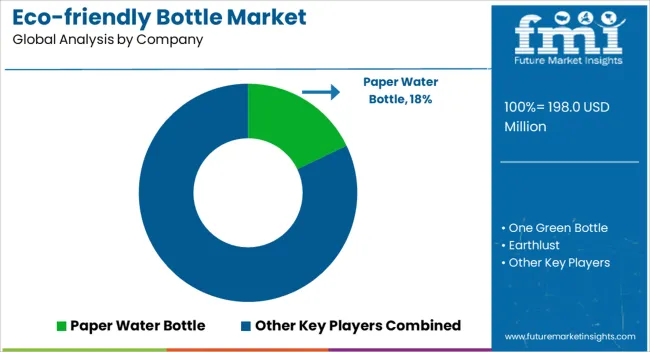

The Eco-friendly Bottle Market is estimated to be valued at USD 198.0 million in 2025 and is projected to reach USD 396.8 million by 2035, registering a compound annual growth rate (CAGR) of 7.2% over the forecast period.

The eco-friendly bottle market is witnessing robust growth due to increasing environmental awareness, stringent regulatory measures on plastic usage, and rising consumer preference for sustainable packaging solutions. The current market scenario reflects strong momentum from industries adopting recyclable and biodegradable materials to meet sustainability goals.

Manufacturers are focusing on material innovation, lightweight design, and lifecycle optimization to enhance product performance while reducing carbon footprint. The future outlook remains optimistic, driven by the expansion of beverage and personal care sectors, corporate sustainability commitments, and advancements in biodegradable and compostable technologies.

Demand is also being reinforced by growing adoption in e-commerce and retail packaging, where eco-labeling and brand differentiation are playing key roles The market’s growth rationale is based on the shift toward circular economy practices, government incentives promoting sustainable manufacturing, and consistent consumer demand for environmentally responsible products, ensuring steady long-term expansion across multiple end-use sectors.

| Metric | Value |

|---|---|

| Eco-friendly Bottle Market Estimated Value in (2025 E) | USD 198.0 million |

| Eco-friendly Bottle Market Forecast Value in (2035 F) | USD 396.8 million |

| Forecast CAGR (2025 to 2035) | 7.2% |

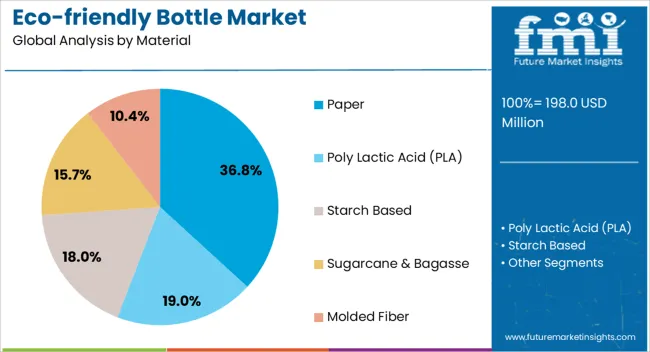

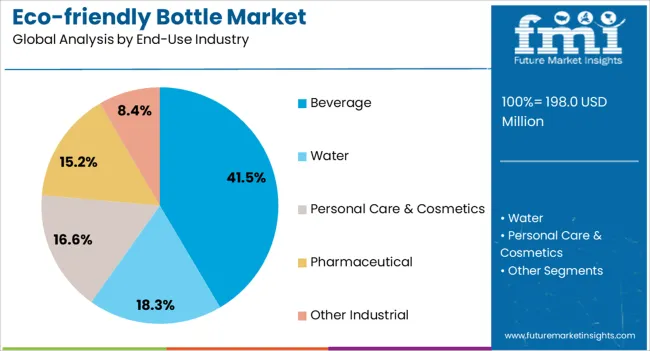

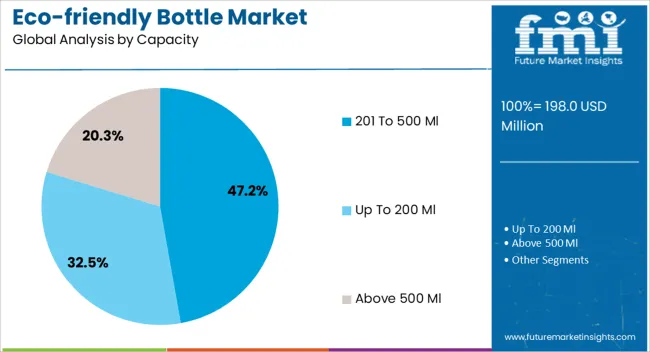

The market is segmented by Material, End-Use Industry, and Capacity and region. By Material, the market is divided into Paper, Poly Lactic Acid (PLA), Starch Based, Sugarcane & Bagasse, and Molded Fiber. In terms of End-Use Industry, the market is classified into Beverage, Water, Personal Care & Cosmetics, Pharmaceutical, and Other Industrial. Based on Capacity, the market is segmented into 201 To 500 Ml, Up To 200 Ml, and Above 500 Ml. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The paper segment, accounting for 36.80% of the material category, has been leading the market due to its recyclability, biodegradability, and compatibility with sustainable packaging initiatives. Adoption has been driven by growing regulatory restrictions on single-use plastics and rising demand from beverage and food brands seeking eco-friendly alternatives.

Continuous advancements in coating technologies have improved barrier properties and durability of paper bottles, making them suitable for both dry and liquid products. Production scalability and cost competitiveness have strengthened the segment’s market position.

Increased investment in molded fiber packaging and material innovation is expected to further enhance performance and availability The segment’s sustained dominance reflects the balance between environmental compliance and functional usability, ensuring continued preference among manufacturers transitioning toward sustainable packaging solutions.

The beverage segment, representing 41.50% of the end-use industry category, has maintained a leading share owing to the rapid shift from plastic to biodegradable packaging in soft drinks, juices, and water products. Growing awareness among consumers regarding sustainability and the environmental impact of packaging waste has accelerated demand for eco-friendly bottles.

Beverage manufacturers are increasingly partnering with sustainable material suppliers to align with corporate environmental goals. Market growth is further reinforced by government regulations encouraging the use of renewable packaging and by technological advancements that improve bottle strength, shelf life, and aesthetic appeal.

Expanding consumption in both premium and mass-market beverage categories is expected to maintain steady volume growth, reinforcing the beverage sector’s dominance in the overall eco-friendly bottle market.

The 201 to 500 ml segment, holding 47.20% of the capacity category, has emerged as the dominant range due to its widespread use in beverages, personal care products, and household consumables. Its popularity is attributed to portability, consumer convenience, and compatibility with on-the-go consumption trends.

Manufacturers have optimized production for this size range, enabling efficient packaging, transportation, and retail placement. Demand is further supported by increasing use in single-serve and travel-friendly formats, particularly among eco-conscious consumers.

Continuous innovation in lightweighting and material flexibility has reduced production costs while maintaining durability The segment’s strong market position is expected to persist as brands continue to emphasize compact, sustainable packaging that aligns with evolving consumer lifestyles and sustainability commitments.

Paper is the topmost material used in the manufacture of eco-friendly bottles. Eco-friendly bottles are predominantly used to store water.

The demand for paper is expected to account for 43.2% of the market share by material in 2025. Factors driving the growth of the paper in the market for eco-friendly bottles are:

| Attributes | Details |

|---|---|

| Top Material | Paper |

| Market Share (2025) | 43.2% |

The water industry is anticipated to account for 62.1% of the market share in 2025. Some of the factors for the growth of the segment are:

| Attributes | Details |

|---|---|

| Top End-Use Industry | Water |

| Market Share (2025) | 62.1% |

The Asia Pacific is set to be an intensely lucrative region for the eco-friendly bottle industry. The growing population of the region is a key factor in the market’s acceleration in the region.

The obsession with innovative packaging is leading the market in Europe. The rise in sustainability standards imposed by the European Union is also motivating bottle manufacturers to produce eco-friendly versions of their products.

| Countries | CAGR (2025 to 2035) |

|---|---|

| France | 6.8% |

| India | 8.7% |

| China | 7.9% |

| Thailand | 7.5% |

| South Korea | 7.1% |

The market in India is anticipated to register a CAGR of 8.7% over the forecast period. Some of the factors driving the growth of the market in the country are:

The market in South Korea is set to rise at a CAGR of 7.1% over the forecast period. Prominent factors driving the growth of the market are:

The market in China is expected to register a CAGR of 7.9% through 2035. Some of the factors driving the growth of the market in China are:

The market in Thailand is set to progress at a CAGR of 7.5% through 2035. The factors influencing the growth of the market in Thailand include:

The market in France is expected to register a CAGR of 6.8% over the forecast period. Some of the reasons for the growth of eco-friendly bottles in the country are:

Market players in the eco-friendly bottle landscape are focused on coming up with new materials that ease the production process. For this reason, a considerable amount of money is being poured into Research and Development.

Multinational bottle brands are making their way into the eco-friendly bottle market, sensing the opportunities present for them. Eco-friendly bottle manufacturers are establishing partnerships with companies in the packaging sector to capitalize on opportunities.

Recent Developments in the Eco-friendly Bottle Market

The global eco-friendly bottle market is estimated to be valued at USD 198.0 million in 2025.

The market size for the eco-friendly bottle market is projected to reach USD 396.8 million by 2035.

The eco-friendly bottle market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in eco-friendly bottle market are paper, poly lactic acid (pla), starch based, sugarcane & bagasse and molded fiber.

In terms of end-use industry, beverage segment to command 41.5% share in the eco-friendly bottle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bottle Sealing Wax Market Size and Share Forecast Outlook 2025 to 2035

Bottle Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Bottle Shippers Market Size and Share Forecast Outlook 2025 to 2035

Bottled Water Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bottle Sticker Labelling Machine Market Size and Share Forecast Outlook 2025 to 2035

Bottle Dividers Market Size and Share Forecast Outlook 2025 to 2035

Bottle Jack Market Size and Share Forecast Outlook 2025 to 2035

Bottles Market Analysis - Growth & Forecast 2025 to 2035

Bottle Capping Machine Market Analysis by Automation, Operating Speed, Machine Type, End-use Industry, and Region Forecast Through 2035

Market Share Distribution Among Bottle Dividers Suppliers

Bottle Carrier Market Trends – Growth & Forecast 2024-2034

Bottle Cap Market Analysis & Industry Forecast 2024-2034

Bottled Water Processing Equipment Market Trends – Growth & Industry Forecast 2025-2035

Bottle Pourers Market

RTD Bottled Cocktail Market - Size, Share, and Forecast Outlook 2025 to 2035

PET Bottles Market Demand and Insights 2025 to 2035

PCR Bottles Market Growth - Demand, Innovations & Outlook 2024 to 2034

Asia & MEA PET Bottle Market Trends & Industry Forecast 2024-2034

Foam Bottle Technology Market Size and Share Forecast Outlook 2025 to 2035

Beer Bottles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA