Between 2025 and 2035, the eco-friendly paper plates market worldwide is expected to grow substantially, driven by increasing consumer demand for sustainable disposable tableware, raising awareness of environmental conservation, and growth in biodegradable and compostable materials. Because here are eco-friendly paper plates come into play, it’s mostly made of recycled paper, bagasse, and other plant-based fibers, and so on.

Market growth is being fueled by an increasing emphasis on reducing single-use plastics and water-resistant and greaseproof coatings. Similarly, the rise of quick-service restaurants, increased investment in compostable packaging solutions, and heightened regulatory scrutiny on plastic bans are also steadying forces within the industry.

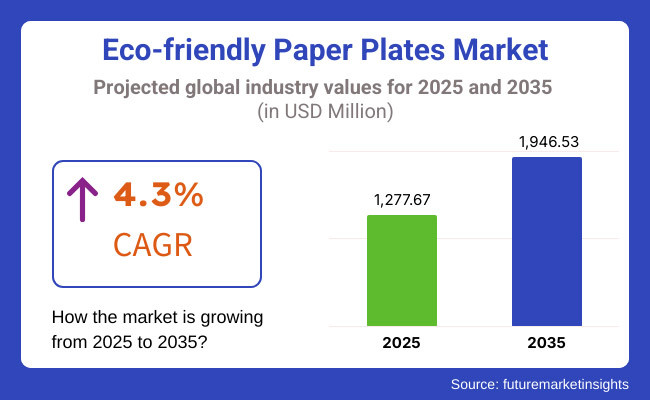

In 2025, the eco-friendly paper plates market was valued at approximately USD 1,277.67 Million. It is anticipated to increase from USD 1,463.60 million in 2022 to USD 1,946.53 million by 2035, at a 4.3% CAGR. Some of the key drivers propelling the market's growth include growing acceptance of sustainable dining solutions, increasing consumers' taste for compostable and recyclable plates, and augmenting investments in next-generation biodegradable materials.

The increasing integration of leak-proof coatings, durability of these composite multilayer containers for hot and cold food applications, and cost-effective production technologies are also aiding in market development. Furthermore, the growing adoption of microwave-safe, lightweight, and customizable eco-friendly paper plates is aiding market penetration and consumer adoption.

North America is another significant region in the eco-friendly paper plates market, with consumer awareness being high regarding sustainability measures, strict government laws against single-use plastics, and substantial investments in products based on biodegradable packaging solutions. Next-gen sustainable tableware (moisture resistant, compostable, high durability plates) is increasingly being developed and commercialized by companies in the USA and Canada.

Sustainable catering and food service packaging is addressing numerous market trends and is taking higher demand to enhance sustainable dining as well as eco-friendly catering solutions, rising collaboration between the food service industry and sustainable packaging providers, which are driving the market growth. In addition, growing corporate sustainability initiatives and zero-waste events are driving product innovation and adoption.

Growing demand for plastic-free disposable tableware, government policies fostering circular economy practices, and advancements in compostable packing technology are driving Europe’s market. Germany, France, and the UK Countries businesses are now working to produce fully recyclable, high-performance, and biodegradable paper plates for restaurants, catering services, and retail packaging.

Increasing focus on carbon footprint reduction, growing applications in organic food packaging models, and research regarding bio-based coatings for more durability are among numerous factors enhancing market uptake. Further, emerging applications in high-end sustainable dining, re-use casing solutions, and home compostable tableware are opening up new opportunities for manufacturers and suppliers.

With urbanization accelerating in developing economies and growing consumer preference for sustainable food packaging solutions, government efforts to eliminate plastic waste are the forces driving growth in the eco-friendly paper plates market in the Asia-Pacific region. China, India, and Japan are pouring a lot of money into research and development over inexpensive, high-performance paper plates from agricultural waste, sugarcane bagasse, and biodegradable fibers.

Furthermore, the increasing need for sustainable packaging in quick-service restaurants (QSRs), growth in food delivery services, and the changing regulatory environment, along with government bodies supporting green manufacturing, is further fueling growth in the regional market.

Moreover, growing awareness regarding compostable kitchenware and research to develop durable, plant-based materials is expected to push market penetration further. Domestic manufacturers of eco-packaging and partnerships with international food service brands are other contributing factors to the market's growth.

Ongoing innovations and advancements in the development of sustainable plant-based materials, compostable packaging technologies, and water-resistant biodegradable coatings will continue to push the market for eco-friendly paper plates ahead of the next decade. For better functionality along with higher market and long-term usability, companies are working on innovation in leak-proof coatings, microwave-safe and freezer-friendly material types, and sustainable designs.

Moreover, the future of the market is guided by growing consumer demand for no-plastic dining, incorporation of digital technology into sustainable food packaging, and changing regulatory standards. Supply chain optimization is also being delivered through AI, bio-based materials, and next-generation compostable solutions to maximize packaging efficiencies in sustainable food packaging around the world.

Challenge

High Production Costs and Limited Raw Material Availability

However, the Eco-friendly paper plates market is challenged by the high costs involved in sourcing sustainable raw materials, including recycled paper, bagasse, and bamboo fiber. Although there is now a growing demand for biodegradable alternatives, to date, inexpensive, durable, and high-quality materials are still scarce.

Furthermore, biodegradable paper plates need special processing, including water-resistant coatings and compostable laminations, to make them usable, ultimately leading to an increase in production costs. In order to achieve sustainability, firms need to channel funds into supply chain optimization and cost-efficient methods of developing and sourcing alternative materials.

Compliance with Stringent Environmental Regulations

Governments worldwide are imposing tighter restrictions on single-use plastics, increasing the need for greener alternatives. The complex regulatory landscape related to the status of biodegradable and compostable products has been the key driver for manufacturers to get BPI (Biodegradable Products Institute), ASTM D6868, and EN 13432 certifications to be compliant. This adds time to market and operational costs as it involves extensive testing and validation for regulatory compliance.

As a result, this reality has provided new and increasing opportunities for companies to compromise their business practices surrounding their green certifications to maintain a competitive edge among consumers while attempting to adhere to governing regulations and remain in line with evolving policies encompassing international business practices.

Opportunity

Rising Consumer Demand for Sustainable and Disposable Tableware

Growing global awareness regarding environmental sustainability and plastic pollution is pushing the demand for biodegradable and compostable paper plates. Disposable plates made of plastic and foam are facing an outcry from consumers, food service providers, and retailers breaking away from plastic and foam-based tableware.

Plant-based, recyclable, and home-compostable paper plates are already in use at fast-food chains, catering businesses, and eco-minded households as a step toward greater sustainability. Thus, a customized eco-friendly durable, leak-proof, and heat-resistant paper plate will give the company that innovates in this area a competitive edge.

Expansion of Circular Economy and Compostable Packaging Solutions

There has to be a resolved shift towards circular economy that is providing massive opportunities for the Eco-friendly paper plates market. Businesses and policymakers are pushing compostable and recyclable solutions in efforts to keep waste out of landfills.

New sustainable packaging, plant-based coatings, and waste-to-product manufacturing processes have enhanced the performance of biodegradable paper plates. Companies aligned with zero-waste principles, investing in closed-loop recycling infrastructure, and working with composting facilities will benefit from growing sustainable packaging solutions and consumer demand for waste-free alternatives.

Between 2020 and 2024, a series of megatrends empowered the global Eco-friendly paper plates market with extensive growth rates, driven by regulatory bans on single-use plastics, consumer trends towards biodegradable products, and sustainability-focused government policies.

Businesses responded by developing plant-based, recyclable, and compostable tableware, especially focusing on improvements to durability and water resistance. However, the high cost of materials, varied composting infrastructure, and intricacies of certification stifled broader market growth. Enterprises emphasize production efficiency, global distribution expansion, and the integration of innovative coatings to increase product performance.

This market will witness innovation with bio-based material science, AI-driven sustainable manufacturing, and 100% compostable packaging solutions. The edible and reusable alternatives segment, alongside biodegradable coatings and smart waste-tracking technologies, will reshape the disposable tableware industry.

Eco-friendly paper plates market, with notable advancements such as material traceability via blockchain, AI-enabled analytics in supply chain management, and AI-enabled composability testing. Therefore, firms that prioritize research into advanced materials, regulatory compliance, and circular economy initiatives will drive the next wave of sustainable disposable tableware.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Expansion of plastic bans and composability certifications |

| Technological Advancements | Growth in plant-based coatings and moisture-resistant paper plates |

| Industry Adoption | Increased use in food service, catering, and retail |

| Supply Chain and Sourcing | Dependence on agricultural waste and recycled paper |

| Market Competition | Dominance of traditional paper product manufacturers |

| Market Growth Drivers | Demand for plastic-free alternatives and sustainable dining solutions |

| Sustainability and Energy Efficiency | Initial focus on compostable and biodegradable materials |

| Integration of Smart Monitoring | Limited tracking of composability and waste impact |

| Advancements in Product Innovation | Development of leak-proof, microwave-safe, and sturdy biodegradable plates |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global sustainability regulations, AI-driven compliance tracking, and blockchain-based eco-certification |

| Technological Advancements | Development of edible tableware, bio-enhanced coatings, and AI-optimized material sourcing |

| Industry Adoption | Widespread adoption in eco-conscious e-commerce, home composting, and AI-assisted sustainable packaging solutions |

| Supply Chain and Sourcing | Shift toward regenerative raw materials, closed-loop manufacturing, and AI-driven supply chain optimization. |

| Market Competition | Rise of sustainable packaging startups, waste-to-product innovators, and digital-first eco brands |

| Market Growth Drivers | Growth in circular economy investments, AI-powered waste management, and next-gen compostable packaging solutions |

| Sustainability and Energy Efficiency | Large-scale implementation of carbon-neutral production, zero-waste manufacturing, and energy-efficient processing |

| Integration of Smart Monitoring | AI-powered waste analytics, blockchain-based material tracking, and digital eco-labeling |

| Advancements in Product Innovation | Introduction of self-decomposing, reusable, and edible tableware for mainstream and specialized applications |

The USA eco-friendly paper plates market is driven by Consumer inclination towards sustainable, biodegradable disposable tableware, soaring environmental awareness amongst consumers, stringent government regulations on single-use plastic, and rapid urbanization. Market growth continues to be propelled by the increasing demand for recyclable and compostable packaging solutions.

The market also benefits from rising investments in eco-friendly materials, namely bamboo fiber, sugarcane bagasse, and recycled paper, and heightened R&D in grease-resistant and leak-proof coatings. Moreover, the incorporation of durable, microwave-safe, and water-resistant features augments the product's attractiveness.

To this end, companies are also working on lightweight, stackable, and aesthetically pleasing environmentally friendly plates for use in food service and retail applications. In the USA, demand is also driven by the increasing adoption of sustainable dining solutions across quick-service restaurants, cafeterias, and catering businesses.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

As one of the most important regions for eco-friendly paper plates, the United Kingdom offers numerous growth opportunities. Its well-structured sustainability policies, increasing bans on the use of plastic tableware, and growing preference for sustainable alternatives among consumers are fueling market expansion. The focus on minimizing waste within the food packaging sector is also fueling market expansion.

Market expansion is also driven by government regulations supporting compostable and biodegradable food service products, the development of water-based coatings for food service packaging, and further innovations in plant-based packaging. Good traction is also possible for molded fiber plates, wheat straw plates, and pulp-based biodegradable products.

Some brands are also exploring circular economy concepts, such as closed-loop recycling programs and zero-waste packaging, with their customers. Moreover, the rising requirement for long-lasting, stylish, and eco-friendly plates used in catering services, supermarkets, and food delivery companies is also driving the UK's market acceptance. And the shift toward home delivery and sustainable meal packaging is fueling demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.1% |

The major plastic-free food plate market in Europe includes Germany, France, and Italy due to rigid environmental policies, high consumer awareness of sustainable dining options, and increased investment in biodegradable food packaging.

The European Union's strong emphasis on reducing plastic waste, combined with investments in bio-based and compostable material technology, contributes to rapid market growth. In addition, the use of heatproof, durable, and moisture-proof paper plates is enhancing product functionality. Market growth is also being fueled by increased demand for eco-friendly tableware in events, takeaways, and organic food retail.

The rise of new and plant-based material solutions and the development of edible food packaging alternatives are adding to the growing adoption across the EU. In addition, growing stringent environmental laws across the world and incentives for sustainable food packaging manufacturers are driving innovations in the eco-friendly paper plates market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.2% |

The growth of the eco-friendly paper plates market in Japan can be primarily attributed to the country's growing emphasis on sustainable packaging, growing adoption of biodegradable and recyclable materials, and increasing demand for high-quality, lightweight, and visually attractive disposable tableware. Market growth is rising due to the reduction in wastage and the growth of eco-friendly restaurants.

Innovation is being driven by the country’s focus on advanced material engineering and the use of anti-leak, high-strength, and grease-resistant coatings. In addition, stringent government regulations reducing single-use plastic waste and promoting eco-friendly food service packaging are driving companies to develop high-quality, reusable, and affordable plant-based plate options.

The growing demand for disposable plates and customized sushi, bento, and convenience store food packaging will also propel market growth in Japan’s food service industry. Moreover, Japan's investment in future compostable and biodegradable polymers is paving the way for sustainable tableware solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.4% |

Driven by rising consumer demand for sustainable dining solutions, increasing government restrictions on the use of plastic tableware, and the advocation of biodegradable materials in the food service industry, South Korea is emerging as a key market for eco-friendly paper plates.

The market is expanding rapidly due to stringent environmental regulations and rising investments in sugarcane-based, wheat straw, and other plant-derived packaging solutions. Moreover, extra effort to amplify eco-friendly plates’ durability, heat resistivity, and composability via material science and smart coatings is improving the country's competitiveness.

The market adoption is also driven by increasing demand for plant-based, toxin-free, and reusable plates in restaurant chains, school cafeterias, and online food delivery services. Creators and brands are also investing in closed-loop recycling programs, biodegradable certification compliance, smart eco-packaging innovations and others to foster sustainability. In South Korea, the growing inclination towards sustainable lifestyle options and consumer demand for zero-waste alternatives is boosting the demand for eco-friendly paper plates.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

Paper plates are classified into various categories, with the 8-12 inch size remaining the most widely used category due to its versatility, convenience, and capability of being used across a range of dining applications. Perfect for serving meals, snacks, and desserts, these plates are made for both commercial and household use. With rising needs for compostable tableware, the manufacturing of biodegradable and plant-based paper plates that comply with the preferences of eco-conscious consumers has observed an elevation.

Furthermore, technological developments in coating, waterproofing, and durability improvements have made these plates more damage-resistant and leak-proof, enabling their use in casual dining, catering services, and food delivery applications.

Paper plates are best-selling above among catering businesses, restaurants, and event planning services, where considerable food portions and full-course meals require more robust, high-capacity disposable plates. While paper plates are becoming more heavy-duty and grease-proof, popular manufacturers are developing multiple products with reinforced lines or spill resistance within their standard paper range.

With the growing demand for high-quality, sustainable disposable plates, businesses are investing in environmentally friendly alternatives that comply with sustainability regulations, such as compostable and plastic-free disposables. In addition to that, the span of biodegradable plate styles with detailed embossing, branded printing, and artistic customization only aid the ongoing trend towards larger-sized paper plates used in banquet services, outdoor events, and food festivals.

Partitioned paper plates are becoming fashionable ways to make dining easier for families, the elderly, and others who would benefit from portion control and multi-course meals. These plates are used in institutional settings, cafeterias, catering services, and fast-food chains where different food types are to be served from one another.

Increase in demand prove you might have seen the buy-on-the-go trend growing lately, specifically amongst restaurants and corporate catering, they have promoted the sale of eco-friendly partitioned plates produced from sugarcane fiber, bamboo pulp and recycled paperboard. In addition, manufacturers are adding stronger dividers, spill-resistant coatings, and ergonomic designs, all of which contribute to the usefulness and functionality of these plates.

The market of plain paper plates still holds, as these are still the most commonly used products by customers, street food vendors, and casual dining restaurants. For daily usage, food stalls, and outdoor gatherings, their cost-effectiveness, lightweight, and easy disposability make them perfect.

Government regulations banning single-use plastic tableware have driven the industry move away from coated, plastic-based plate ware to uncoated, plastic-free, and 100% compostable plain paper plates. Brands are also developing water-repellent coatings, heat-sealed edges, and strengthened bottoms, enhancing the usability and durability of simple eco-friendly dinnerware for diversified food service applications.

Eco-friendly paper plate sales, and B2B sales majorly constitute restaurants, hotels, event planners, and institutional buyers. Catering services, airline meal providers, and corporate dining facilities' bulk purchase of sustainable disposable plates have propelled growth in this segment.

Organizations focus on customized, branded paper plates that come with eco-certifications and conformity with regulations that ensure they adhere to sustainability initiatives and green procurement policies. Furthermore, the collaboration of paper plate manufacturing companies with food packaging distributors, has bolstered the accessibility of wholesale biodegradable tableware solutions.

With an increase in demand for compostable, recyclable, and home-friendly disposable plates, business-to-consumer sales have skyrocketed. As a result, retail chains, supermarkets, and e-commerce platforms now stock various eco-friendly paper plates, making them accessible to households, party planners, and small food vendors with ease.

The development of these trends, such as sustainable living trends, plastic-free packaging initiatives, and DIY composting solutions, has made consumers prefer biodegradable and chemical-free paper plates instead of conventional disposable plates. Meanwhile, the B2C market segment witnessed a further boost due to direct-to-consumer (DTC) sales, online eco-product marketplaces, and subscription-based eco-friendly home supplies.

Factors such as growing consumer awareness of the environmental impacts of their consumption and various governmental regulations promoting green alternatives of single-use plastics are driving the market of eco-friendly paper plates in the recent market. Businesses are paying towards eco-friendly materials, compostable coatings, and durable designs to improve use and environmentally friendly tendencies. Noteworthy trends are plant-based coatings, water-resistant paper plates, and innovations in molded fiber technology to enhance durability.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Huhtamaki Oyj | 18-22% |

| Dart Container Corporation | 14-18% |

| Novolex Holdings, Inc. | 11-15% |

| Pactiv Evergreen Inc. | 8-12% |

| Biodegradable Food Service, LLC | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Huhtamaki Oyj | Leading provider of compostable and biodegradable paper plates for food service and retail industries. |

| Dart Container Corporation | Specializes in eco-friendly disposable tableware with advanced water-resistant and grease-resistant coatings. |

| Novolex Holdings, Inc. | Develops molded fiber and plant-based coated paper plates for sustainable food packaging. |

| Pactiv Evergreen Inc. | Offers high-quality, recyclable, and compostable paper plates with enhanced durability. |

| Biodegradable Food Service, LLC | Focuses on sugarcane-based and fully compostable disposable tableware for environmentally conscious consumers. |

Key Company Insights

Huhtamaki Oyj (18-22%)

Huhtamaki is a leading company in the eco-friendly paper plates market offering a range of compostable and biodegradable tableware solutions. By providing cutting-edge molded fiber technology and plant-based coatings, the company focuses on durability while creating sustainability. Its global distribution network, and their relationships with food service brands, reinforce its competitive position in sustainable packaging solutions.

Dart Container Corporation (14-18%)

Dart Container Corporation manufactures professional use eco-friendly disposable plate for various types of industries, with state-of-the-art grease-resistant and water-resistant coatings. They are researched and developed to provide improvement for product by enhancing strength by reducing their environmental impact. Dart's sustainable sourcing commitment and large-scale production capacity enables meeting this growing demand for biodegradable tableware.

Novolex Holdings, Inc. (11-15%)

Novolex specializes in sustainable food packaging, providing molded fiber and plant-based coated paper plates with high strength and compostable capabilities. The company is a market leader in designing new, renewable packaging solutions for commercial and consumer end-use applications. Novolex offers many examples of sustainable solutions and partners with retail chains to grow its market reach.

Pactiv Evergreen Inc. (8-12%)

Pactiv Evergreen is a hot player in the green tableware market. Its featured range of recyclable and compostable paper plates is made of highly durable material. The brand includes post-consumer recycled elements in its products as part of its sustainability mission. Pactiv Evergreen is a major supplier in the global food packaging industry, supported by a vast distribution network of its own.

Biodegradable Food Service, LLC (6-10%)

Biodegradable Food Service aims to create eco-friendly disposable plates, cups, and other dining products that are made from sugarcane, bamboo, and other compostable materials. With its dedication to composability and minimal environmental impact, the company offers an appealing option for environmentally minded customers. Biodegradable Food Service’s growing carbon-negative product offerings include plates, bowls, and cutlery suited for zero-waste food service companies.

Other Key Players (30-40% Combined)

The anti-offset coating in the eco-friendly paper plate improves its strength against oil and grease, enhances its brightness and printing profile, and is cost-effective for regional manufacturers and export markets. Key players include:

The overall market size for eco-friendly paper plates market was USD 1,277.67 million in 2025.

The eco-friendly paper plates market expected to reach USD 1,946.53 million in 2035.

The demand for the eco-friendly paper plates market will be driven by increasing consumer preference for sustainable and biodegradable alternatives, rising government regulations on single-use plastics, growing demand from the food service industry, expanding outdoor dining and catering trends, and advancements in compostable packaging technologies.

The top 5 countries which drives the development of eco-friendly paper plates market are USA, UK, Europe Union, Japan and South Korea.

8 to 12-inch and more than 12-inch paper plates drive market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Size, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Size, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Size, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Size, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Size, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Size, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Size, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Size, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Size, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Size, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 26: Global Market Attractiveness by Size, 2023 to 2033

Figure 27: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 29: Global Market Attractiveness by End Use, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Size, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 56: North America Market Attractiveness by Size, 2023 to 2033

Figure 57: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 59: North America Market Attractiveness by End Use, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Size, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Size, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Size, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Size, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Size, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Size, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Size, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Size, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Size, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Size, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 209: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Size, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Size, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Size, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Size, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Size, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Size, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Recycling Market Size and Share Forecast Outlook 2025 to 2035

Paper Release Liners Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Materials Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA