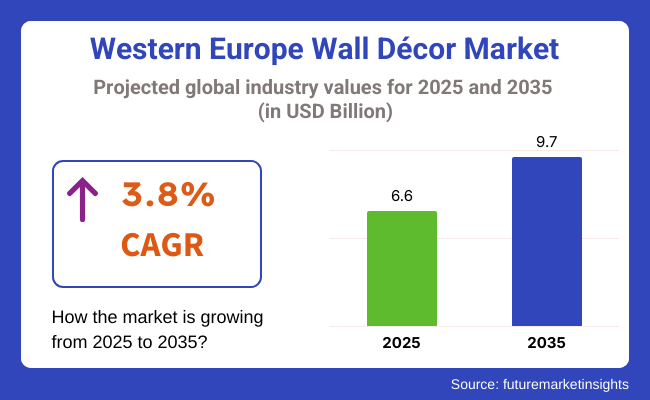

The Western Europe wall décor market is poised to register a valuation of USD 6.6 billion in 2025. The industry is slated to grow at 3.8% CAGR from 2025 to 2035, witnessing USD 9.7 billion by 2035.

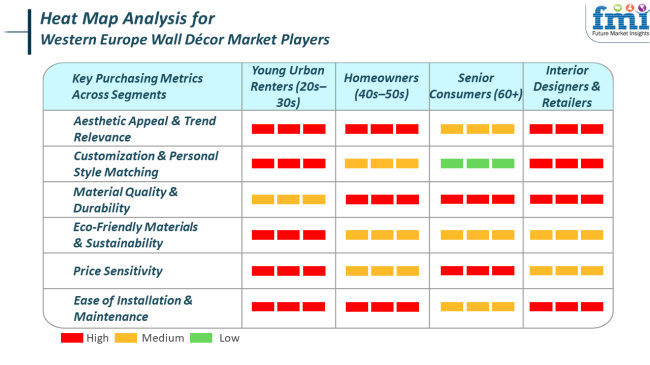

The expansion of the market is being fueled by a combination of changing consumer tastes, urban lifestyle trends, and increasing disposable incomes. With more individuals settling in urban apartments or remodeling older houses, there is an increasing focus on individualizing living areas. Wall decor has emerged as an affordable and relatively low-cost means of expressing individual style, which is why it's become so popular with young homeowners and renters.

Remote work has also been a factor; the more time people spend at home, the more they're spending on their interiors-not necessarily for looks, but to build spaces that are inspiring, comforting, or productive.

Germany, France, and the Netherlands already have strong art, design, and architecture traditions. Due to the influence of sites like Pinterest, Instagram, and Etsy, consumers are more exposed to international décor trends and are testing out more eclectic styles-combining modern, vintage, minimalist, and bohemian designs. This online exposure has enabled lesser-known artists and independent brands to gain wider markets, making for a more varied and vibrant wall décor market.

Sustainability also influences the market. Western Europeans are increasingly looking for environmentally friendly materials, recycled artwork, or low-carbon-footprint decor. This desire is driving innovation in product form and material acquisition, with expansion in areas such as reclaimed wood art, textile wall decor, and prints produced on recycled paper. In addition, innovations in digital printing and customization are facilitating the ability for individuals to purchase unique pieces without the premium cost

The Western Europe wall decor market reflects varied trends within various end-use segments based on lifestyle, functional requirements, and design preferences. Within the residential segment, wall decor has turned into an important weapon for self-expression and home transformation, especially as more individuals spend money on home looks because of work from home models and changing interior styles.

Customers value affordability, style compatibility, and eco-friendliness of materials, with increasing demand for customized and handmade items expressing individuality. Online inspiration websites have popularized eclectic design as a mainstream trend, leading to a fusion of new, vintage, and boho chic, particularly in the hands of new-home owners and renters.

In the commercial and institutional markets, wall decor plays more purpose-driven functions-boosting brand identity, atmosphere, and educational or emotional resonance. Commercial and retail establishments go for dynamic, thematic works that evoke atmosphere, while workplaces tend to select abstract or minimalist art to promote productivity and professionalism.

Permanence, convenience of maintenance, and expandability are important buying considerations, particularly in the case of large-scale installations. In contrast, schools and hospitals look for décor that is soothing, culturally sensitive, and in line with wellness or educational objectives. In all non-residential areas, there is growing demand for artwork that is sustainable and locally produced, as businesses match their visual identity with social responsibility and green thinking.

Between 2020 and 2024, the Western Europe wall décor market went through a dramatic change induced by the pandemic, digital impact, and shifting lifestyle patterns. The early 2020s witnessed an explosion of home improvement activity. Wall décor emerged as a low-cost solution to give interiors a facelift, translating into heightened demand for do-it-yourself-friendly artwork, budget-friendly prints, and peel-and-stick wall coverings.

Online platforms thrived, with e-commerce channels becoming the main source of discovering and buying décor. A shift towards sustainability and handmade décor was also visible, with buyers preferring eco-friendly materials and financing local or independent artists.

The role of technological innovation, with AI-driven design software and AR-based visualization programs, also saw increased adoption as consumers were better able to experiment with décor prior to making actual purchases.

Forward to 2025 to 2035, the market will continue to develop, influenced by sustainability, customization, and smart living. Consumers will probably seek more customized and modular wall décor products that can be adjusted to suit shifting interiors and tastes. Biophilic design-a trend emphasizing the connection of interiors with nature-will also continue to shape decisions, stimulating interest in botanical prints, nature-inspired textures, and green walls.

In institutional and commercial environments, wall decor will increasingly be aligned with brand narratives and sustainability objectives, with emphasis on energy-efficient lighting, reusable materials, and interactive digital exhibits. Advances in technology like intelligent art frames, 3D-printed decor, and AI-designed art can reshape both the creation and consumption of wall art.

As consumer trends increasingly move toward conscious consumption and visual individuality, the Western European wall décor market is set to experience a decade of sustained, innovation-fuelled growth.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Lockdowns and work from home increased household improvement activity. Wall décor was a fast, affordable means of reviving living spaces, particularly for home offices and multi-purpose rooms. | Décor will centre on modular, multipurpose designs to respond to hybrid living and working spaces, with more emphasis on personalization and emotional well-being. |

| Online retailing took over, with consumers moving from shopping in-store to online. Social media and influencer trends dictated purchases. | Virtual try-ons, AI design aid, and AR technology will be the norm, allowing consumers to see décor in their environment prior to purchase. |

| Budget consumers gravitated toward DIY décor, mass-produced prints, and peel-and-stick options. Demand for affordable, expedient home makeovers was high. | Customers will focus on distinctive, high-quality, and responsibly sourced décor. Personalization and one-of-a-kind items will become more valuable than mass-produced art. |

| Sustainability came into focus, with early interest in environmentally friendly materials and upcycled products, yet still secondary to price and convenience. | Environmental considerations will be a key driver for purchasing. A surge in décor produced from recycled, biodegradable, or carbon-neutral products is expected. |

The Western Europe wall decor market, although on a solid growth path, is not without risk. One of the biggest concerns is economic uncertainty and inflationary pressures, which can have a direct impact on consumer discretionary spending. Because wall decor is generally considered an optional purchase, times of economic recession or increasing living expenses could result in less demand, particularly in the mid-to-lower income brackets.

Also, raw material price fluctuations-especially for wood, metals, and textiles-can compress profit margins for producers and affect retail prices.

Another major threat is the saturation and fragmentation of the market. With the swift emergence of e-commerce and low entry barriers, the market has become overcrowded with mass producers and small-scale sellers. This increases competition, which makes it more difficult for single brands to either sustain pricing power or customer retention.

There is also the surplus of cheap imports, especially from Asia, that test European makers who have to balance quality, sustainability, and affordability.

Of the many base materials utilized in wall décor, wood is the most prevalent within the Western European market. This is primarily a result of its design flexibility, sustainability value, and profound cultural penetration within European interior design traditions. Wood is apt at suiting an array of interior design styles-ranging from Scandinavian minimalism and rustic farmhouse through modern and industrial design-to make it a material of choice for both home and commercial environments.

Its natural appeal, warmth, and strength position it as the perfect material for wall panels, carved artwork, framed prints, and shelving-based décor. Additionally, the shift towards biophilic and sustainable design further increased the use of wood-based décor, commensurate with consumer preferences for natural and organic features in dwellings.

Yet another major influence on the pervasiveness of wood is regional focus on sustainability and craftsmanship. Western European consumers are becoming more environmentally conscious about their purchases, and wood-particularly when responsibly harvested from FSC-certified forests or reclaimed material-is seen as an environmentally friendly choice.

Local artisans and smaller manufacturers also prefer wood due to its ease of customization, repairability, and longevity, enabling them to create high-quality, ethically produced items. In comparison to materials such as plastic or metal, which tend to be cold or industrial, wood is frequently perceived as a classic, tactile option that provides character and authenticity to an environment.

Frame works (framed art prints, photographs, posters, and canvases) are still the most common type of wall décor in Western Europe. Their appeal lies in their versatility, visual attractiveness, and availability for various consumer segments. Framed artworks are a mainstay in traditional and modern interior design, enabling one to customize home or office with little effort.

They can vary from budget-friendly mass-market prints to luxury limited editions, suiting a broad spectrum of budgets and tastes. Additionally, frame works are simple to install, replace, or reconfigure, making them a versatile choice for homeowners and renters alike.

One of the main reasons for their supremacy is the high cultural regard for art and photography throughout Western Europe. From Scandinavian restraint to Parisian gallery walls, framed prints have been deeply ingrained in design ideologies throughout the region. They are also frequently employed in commercial spaces-like offices, hotels, cafes, and boutiques-to convey brand identity or ambiance.

The advent of digital printing has opened up customization possibilities, allowing consumers to commission personalized or locally inspired prints that express their values, journeys, or recollections. Such versatility makes frame works a popular go-to for function as well as decor.

The Western European market for wall décor is extremely competitive, dominated by both local players and international brands that are constantly innovating to address the changing tastes of consumers. The market is subject to a move towards personalization, sustainability, and an increasing demand for eco-friendly, high-quality products.

Over the past few years, the industry has seen heightened digitalization, with most brands taking advantage of e-commerce channels to expand their reach. Firms are reacting to customers' need for flexibility in décor by selling a broad assortment of products ranging from low-cost prints and stickers to high-quality, custom-designed artwork and high-end wallpaper.

In addition, shifting lifestyle trends, including greater emphasis on home office configurations and eco-friendly living, have shaped the kinds of products being demanded. Local players, such as Desenio and Decowall, address price-conscious consumers who want fashionable but affordable decor, whereas high-end brands including de Gournay and Mineheart address luxury segments with high-end, exclusive products.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Desenio | 10-12% |

| MetalStudios | 8-10% |

| 3D Art Factory | 6-8% |

| de Gournay | 5-7% |

| Mineheart | 4-6% |

| Decowall | 4-6% |

| FabFunky | 3-5% |

| Paragon Décor Inc. | 3-5% |

| PTM Images | 2-4% |

| Neiman Marcus | 2-4% |

| Studio McGee LLC | 1-3% |

| Stratton Home Décor | 1-3% |

| Northern Oaks Décor Co | 1-2% |

| Bubola & Naibo s.r.l. | 1-2% |

| Company Name | Key Company Offerings and Activities |

|---|---|

| Desenio | Recognized for providing fashionable, affordable art prints and posters, with emphasis on contemporary and Scandinavian designs. Their extensive online presence and simple customization features make them a top company in the European market. |

| MetalStudios | Provides high-quality, handmade metal art pieces. Their products include distinctive wall sculptures, modern designs, and custom work, attracting consumers looking for bold and artistic wall decor. |

| 3D Art Factory | Provides unique 3D wall art and textured designs to give a sleek, dimensional feel. They focus on customers in the market for high-impact, statement-making art. |

| de Gournay | Known for upscale hand-painted wallpaper and wall coverings that frequently feature intricate floral patterns and scenic design. Their aim is to supply high-end, customized products appealing to upscale markets. |

| Mineheart | Blends old school art with new school design, producing whimsical and creative wall decor pieces. Mineheart is a master of modern luxury with an idiosyncratic, sometimes humorous spin on time-tested designs. |

| Decowall | Provides a vast selection of peel-and-stick wall decals and wallcoverings, servicing the do-it-yourself market. Easy to install, Decowall is favored by price-sensitive buyers and renters. |

| FabFunky | Merges vintage and eclectic wall decor, such as illustrations and prints catering to consumers who appreciate retro and artistic designs. FabFunky's products tend to be priced low and suit specialized interior design tastes. |

| Paragon Décor Inc. | Features high-quality framed artwork and prints that have a wide range of themes ranging from nature, abstract art, and modern designs. Paragon's mass market appeal and extensive product offering make them favorite brands for varied audiences. |

| PTM Images | Excels in decorative art and mirrors, with a large selection of framed prints, paintings, and wall mirrors. Famous for extensive product offerings at mid-range prices. |

| Neiman Marcus | As a luxury retailer, Neiman Marcus provides high-end wall décor choices, including designer items and high-end art. Their products cater to high-end consumers who look for sophisticated, high-end designs. |

| Studio McGee LLC | A prestigious design studio that provides modern, trendy wall decor, such as prints, mirrors, and handpicked collections of art. With their high-end, fashion-forward look, they appeal to homeowners who desire the latest looks. |

| Stratton Home Décor | Provides a vast selection of home decor products ranging from inexpensive and trendy framed art, mirrors, and wall plaques. Their items appeal to a wide range of consumers, especially in the mass-market category. |

| Northern Oaks Décor Co | Concentrates on country and nature-inspired styles, with a line of products including wood-framed artwork and nature prints. Products are geared towards consumers looking for organic, earthy home decor. |

| Bubola & Naibo s.r.l. | Handles high-end decorative wall mirrors and artwork, with high-end designs in modern and traditional styles. Renowned for creating high-quality, sophisticated home decor for luxurious interiors. |

Strategic Outlook

The Western European wall decor market remains fierce in competition, with local and international players driving innovation and influencing consumer trends. Leaders in the market such as Desenio and Decowall are riding on the increasing trend of affordable, fashionable, and customizable decoration, especially via e-commerce websites.

They offer seamless access to a wide variety of design possibilities for consumers who desire to customize their living spaces. On the other hand, MetalStudios, de Gournay, and Mineheart serve the luxury and premium markets, providing top-of-the-range, bespoke items of appeal to high-end consumers.

In terms of base material, the industry is classified into fabric & textile, glass, metal, plastic, wood, and others.

With respect to end use, the market is divided into e educational institutes, hospitality industry, household, offices & showrooms, restaurants, salon & spa, spiritual institutes, and other end users.

Based on product type, the industry is divided into frame works, hangings, metal works, mirror works, shelves, wall stickers, and other product types.

By sales channel, the industry is classified into club stores, e-retailers, gift shops, hypermarkets/supermarkets, specialty stores, and unorganised retail.

By country, the industry is segregated into the UK, Germany, Italy, France, Spain, and the rest of Europe.

The industry is expected to reach USD 6.6 billion in 2025.

The market is projected to witness USD 9.7 billion by 2035.

The industry is slated to capture 3.8% CAGR during the study period.

Frame works are widely used.

Leading companies include Desenio, MetalStudios, 3D Art Factory, de Gournay, Mineheart, Decowall, FabFunky, Paragon Décor Inc., PTM Images, Neiman Marcus, Studio McGee LLC, Stratton Home Décor, Northern Oaks Décor Co, and Bubola & Naibo s.r.l.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Country, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Units) Forecast by Country, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Base Material, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Units) Forecast by Base Material, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2018 to 2033

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 8: Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: UK Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 12: UK Industry Analysis and Outlook Volume (Units) Forecast By Region, 2018 to 2033

Table 13: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Base Material, 2018 to 2033

Table 14: UK Industry Analysis and Outlook Volume (Units) Forecast by Base Material, 2018 to 2033

Table 15: UK Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: UK Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2018 to 2033

Table 17: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: UK Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 19: UK Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: UK Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Germany Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 22: Germany Industry Analysis and Outlook Volume (Units) Forecast By Region, 2018 to 2033

Table 23: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Base Material, 2018 to 2033

Table 24: Germany Industry Analysis and Outlook Volume (Units) Forecast by Base Material, 2018 to 2033

Table 25: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 26: Germany Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2018 to 2033

Table 27: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Germany Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Germany Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Germany Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Italy Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 32: Italy Industry Analysis and Outlook Volume (Units) Forecast By Region, 2018 to 2033

Table 33: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Base Material, 2018 to 2033

Table 34: Italy Industry Analysis and Outlook Volume (Units) Forecast by Base Material, 2018 to 2033

Table 35: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 36: Italy Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2018 to 2033

Table 37: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 38: Italy Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 39: Italy Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Italy Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: France Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 42: France Industry Analysis and Outlook Volume (Units) Forecast By Region, 2018 to 2033

Table 43: France Industry Analysis and Outlook Value (US$ Million) Forecast by Base Material, 2018 to 2033

Table 44: France Industry Analysis and Outlook Volume (Units) Forecast by Base Material, 2018 to 2033

Table 45: France Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 46: France Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2018 to 2033

Table 47: France Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 48: France Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 49: France Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: France Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: Spain Industry Analysis and Outlook Value (US$ Million) Forecast By Region, 2018 to 2033

Table 52: Spain Industry Analysis and Outlook Volume (Units) Forecast By Region, 2018 to 2033

Table 53: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Base Material, 2018 to 2033

Table 54: Spain Industry Analysis and Outlook Volume (Units) Forecast by Base Material, 2018 to 2033

Table 55: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 56: Spain Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2018 to 2033

Table 57: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 58: Spain Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 59: Spain Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: Spain Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 61: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Base Material, 2018 to 2033

Table 62: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Base Material, 2018 to 2033

Table 63: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 64: Rest of Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2018 to 2033

Table 65: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 66: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2018 to 2033

Table 67: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 68: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Base Material, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Country, 2023 to 2033

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 7: Industry Analysis and Outlook Volume (Units) Analysis by Country, 2018 to 2033

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Base Material, 2018 to 2033

Figure 11: Industry Analysis and Outlook Volume (Units) Analysis by Base Material, 2018 to 2033

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Base Material, 2023 to 2033

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Base Material, 2023 to 2033

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 15: Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2018 to 2033

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 19: Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Industry Analysis and Outlook Attractiveness by Base Material, 2023 to 2033

Figure 27: Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 28: Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 29: Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 31: UK Industry Analysis and Outlook Value (US$ Million) by Base Material, 2023 to 2033

Figure 32: UK Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 33: UK Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 34: UK Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: UK Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 36: UK Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 37: UK Industry Analysis and Outlook Volume (Units) Analysis By Region, 2018 to 2033

Figure 38: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 39: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 40: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Base Material, 2018 to 2033

Figure 41: UK Industry Analysis and Outlook Volume (Units) Analysis by Base Material, 2018 to 2033

Figure 42: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Base Material, 2023 to 2033

Figure 43: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Base Material, 2023 to 2033

Figure 44: UK Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 45: UK Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2018 to 2033

Figure 46: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 47: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 48: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 49: UK Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 50: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 51: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 52: UK Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: UK Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: UK Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: UK Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: UK Industry Analysis and Outlook Attractiveness by Base Material, 2023 to 2033

Figure 57: UK Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 58: UK Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 59: UK Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 60: UK Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 61: Germany Industry Analysis and Outlook Value (US$ Million) by Base Material, 2023 to 2033

Figure 62: Germany Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 63: Germany Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 64: Germany Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Germany Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 66: Germany Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 67: Germany Industry Analysis and Outlook Volume (Units) Analysis By Region, 2018 to 2033

Figure 68: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 69: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 70: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Base Material, 2018 to 2033

Figure 71: Germany Industry Analysis and Outlook Volume (Units) Analysis by Base Material, 2018 to 2033

Figure 72: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Base Material, 2023 to 2033

Figure 73: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Base Material, 2023 to 2033

Figure 74: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 75: Germany Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2018 to 2033

Figure 76: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 77: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 78: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 79: Germany Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 80: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 81: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 82: Germany Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Germany Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Germany Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Germany Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Germany Industry Analysis and Outlook Attractiveness by Base Material, 2023 to 2033

Figure 87: Germany Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 88: Germany Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 89: Germany Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Germany Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 91: Italy Industry Analysis and Outlook Value (US$ Million) by Base Material, 2023 to 2033

Figure 92: Italy Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 93: Italy Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 94: Italy Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Italy Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 96: Italy Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 97: Italy Industry Analysis and Outlook Volume (Units) Analysis By Region, 2018 to 2033

Figure 98: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 99: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 100: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Base Material, 2018 to 2033

Figure 101: Italy Industry Analysis and Outlook Volume (Units) Analysis by Base Material, 2018 to 2033

Figure 102: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Base Material, 2023 to 2033

Figure 103: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Base Material, 2023 to 2033

Figure 104: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 105: Italy Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2018 to 2033

Figure 106: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 107: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 108: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 109: Italy Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 110: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 111: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 112: Italy Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Italy Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Italy Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Italy Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Italy Industry Analysis and Outlook Attractiveness by Base Material, 2023 to 2033

Figure 117: Italy Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 118: Italy Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 119: Italy Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Italy Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 121: France Industry Analysis and Outlook Value (US$ Million) by Base Material, 2023 to 2033

Figure 122: France Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 123: France Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 124: France Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: France Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 126: France Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 127: France Industry Analysis and Outlook Volume (Units) Analysis By Region, 2018 to 2033

Figure 128: France Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 129: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 130: France Industry Analysis and Outlook Value (US$ Million) Analysis by Base Material, 2018 to 2033

Figure 131: France Industry Analysis and Outlook Volume (Units) Analysis by Base Material, 2018 to 2033

Figure 132: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Base Material, 2023 to 2033

Figure 133: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Base Material, 2023 to 2033

Figure 134: France Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 135: France Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2018 to 2033

Figure 136: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 137: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 138: France Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 139: France Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 140: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 141: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 142: France Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: France Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: France Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: France Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: France Industry Analysis and Outlook Attractiveness by Base Material, 2023 to 2033

Figure 147: France Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 148: France Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 149: France Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 150: France Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 151: Spain Industry Analysis and Outlook Value (US$ Million) by Base Material, 2023 to 2033

Figure 152: Spain Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 153: Spain Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 154: Spain Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: Spain Industry Analysis and Outlook Value (US$ Million) By Region, 2023 to 2033

Figure 156: Spain Industry Analysis and Outlook Value (US$ Million) Analysis By Region, 2018 to 2033

Figure 157: Spain Industry Analysis and Outlook Volume (Units) Analysis By Region, 2018 to 2033

Figure 158: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis By Region, 2023 to 2033

Figure 159: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections By Region, 2023 to 2033

Figure 160: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Base Material, 2018 to 2033

Figure 161: Spain Industry Analysis and Outlook Volume (Units) Analysis by Base Material, 2018 to 2033

Figure 162: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Base Material, 2023 to 2033

Figure 163: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Base Material, 2023 to 2033

Figure 164: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 165: Spain Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2018 to 2033

Figure 166: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 167: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 168: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 169: Spain Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 170: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 171: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 172: Spain Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: Spain Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: Spain Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: Spain Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: Spain Industry Analysis and Outlook Attractiveness by Base Material, 2023 to 2033

Figure 177: Spain Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 178: Spain Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 179: Spain Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Figure 180: Spain Industry Analysis and Outlook Attractiveness By Region, 2023 to 2033

Figure 181: Rest of Industry Analysis and Outlook Value (US$ Million) by Base Material, 2023 to 2033

Figure 182: Rest of Industry Analysis and Outlook Value (US$ Million) by End Use, 2023 to 2033

Figure 183: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2023 to 2033

Figure 184: Rest of Industry Analysis and Outlook Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 185: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Base Material, 2018 to 2033

Figure 186: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Base Material, 2018 to 2033

Figure 187: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Base Material, 2023 to 2033

Figure 188: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Base Material, 2023 to 2033

Figure 189: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 190: Rest of Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2018 to 2033

Figure 191: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 192: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 193: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 194: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 195: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 196: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 197: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 198: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 199: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 200: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 201: Rest of Industry Analysis and Outlook Attractiveness by Base Material, 2023 to 2033

Figure 202: Rest of Industry Analysis and Outlook Attractiveness by End Use, 2023 to 2033

Figure 203: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2023 to 2033

Figure 204: Rest of Industry Analysis and Outlook Attractiveness by Sales Channel, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Blotting Processors Market Trends and Forecast 2025 to 2035

Western Blotting Market is segmented by product, application and end user from 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Load Floor IndustryAnalysis in Western Europe Forecast & Analysis 2025 to 2035

Western Europe Probiotic Supplement Market Analysis in – Growth & Market Trends from 2025 to 2035

Western Europe Women’s Intimate Care Market Analysis – Size, Share & Trends 2025 to 2035

Western Europe Non-Dairy Creamer Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Western Europe Last-mile Delivery Software Market – Growth & Outlook through 2035

Western Europe Inkjet Printer Market – Growth & Forecast 2025 to 2035

Western Europe HVDC Transmission System Market – Growth & Forecast 2025 to 2035

Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Western Europe Intelligent Enterprise Data Capture Software Market - Growth & Forecast 2025-2035

Communications Platform as a Service (CPaaS) Market Growth - Trends & Forecast 2025 to 2035

Visitor Management System Industry Analysis in Western Europe - Market Outlook 2025 to 2035

Western Europe Base Station Antenna Market - Growth & Demand 2025 to 2035

Western Europe Banking-as-a-Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Western Europe Event Management Software Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA