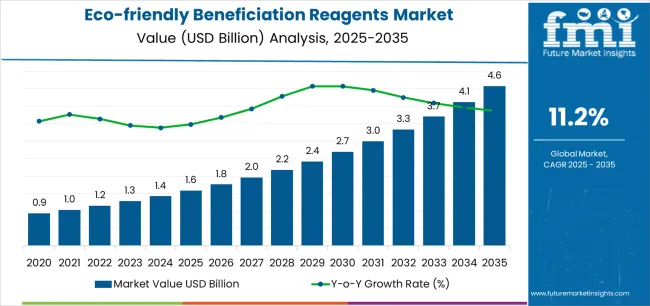

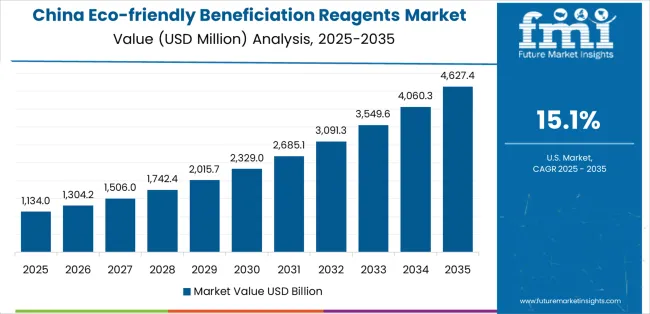

The eco-friendly beneficiation reagents market enters a decade of measured expansion that will transform mineral processing operations and environmental compliance across mining, metallurgy, and mineral concentration sectors. The market's progression from USD 1,584.4 million in 2025 to USD 4,580.6 million by 2035 represents controlled growth, reflecting the accelerated adoption of environmental technologies and chemical processing optimization across mining operations, mineral extraction applications, and industrial processing systems worldwide.

The first half of the decade (2025-2030) will witness the market climbing from USD 1,584.4 million to approximately USD 2,694.0 million, adding USD 1,109.6 million in value, which constitutes 37% of the total forecast growth period. This phase will be characterized by the continued adoption of bio-based collectors and degradable frothers over traditional chemical systems, driven by increasing environmental regulations and the growing need for process efficiency solutions in mineral processing and extraction applications globally. Enhanced chemical formulations and automated processing control systems will become standard expectations rather than premium options.

The latter half (2030-2035) will witness continued growth from USD 2,694.0 million to USD 4,580.6 million, representing an addition of USD 1,886.6 million or 63% of the decade's expansion. This period will be defined by mass market penetration of advanced bio-based systems, integration with comprehensive process optimization platforms, and seamless compatibility with existing mineral processing infrastructure. The market trajectory signals fundamental shifts in how mining operators approach chemical selection and processing operations, with participants positioned to benefit from growing demand across multiple application segments and product categories.

Eco-friendly beneficiation reagents encompass sophisticated chemical formulations coordinating mineral separation, flotation enhancement, and environmental compliance across diverse non-ferrous and ferrous metal processing applications. Bio-based collectors provide enhanced selectivity characteristics with reduced environmental impact compared to traditional xanthate compounds, while degradable frothers maintain foam stability during flotation while breaking down naturally in tailings environments. Chemical compositions typically include plant-based surfactants, biodegradable polymers, and mineral-specific binding agents that achieve separation efficiency without persistent environmental contamination.

Non-ferrous metal applications drive primary reagent demand through requirements for copper, lead, zinc, and precious metal concentration processes requiring precise chemical selectivity and environmental compliance. Processing facilities utilize bio-based systems for sulfide mineral flotation, achieving recovery rates comparable to traditional reagents while maintaining regulatory compliance and reducing long-term environmental liability. Ferrous metal applications encompass iron ore concentration, steel production support, and metallurgical processing requiring specialized reagent formulations for optimal separation performance.

Advanced formulations integrate multiple functional components including collectors, frothers, depressants, and modifiers designed for specific ore mineralogy and processing conditions. Temperature stability ranges support processing operations from ambient conditions to 80°C while maintaining chemical effectiveness and degradation characteristics. pH tolerance spans acidic to alkaline conditions enabling versatility across different mineral processing workflows and water chemistry requirements.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | Bio-based collectors | 40% | Environmental-driven, performance focus |

| Degradable frothers | 35% | Processing efficiency and compliance | |

| Other formulations | 25% | Specialty blends and custom applications | |

| Non-ferrous metal processing | 45% | Primary market segment | |

| Ferrous metal processing | 30% | Secondary application area | |

| Other applications | 25% | Emerging and specialty uses | |

| Future (3-5 yrs) | Advanced bio-based systems | 42-48% | Technology enhancement, efficiency gains |

| Enhanced degradable solutions | 32-38% | Process optimization, regulatory expansion | |

| Integrated specialty formulations | 18-25% | Custom applications, performance enhancement | |

| Expanded non-ferrous processing | 43-50% | Market penetration, application growth | |

| Optimized ferrous solutions | 28-35% | Technology advancement, cost efficiency | |

| Digital process platforms | 5-8% | IoT integration, chemical optimization |

At-a-Glance Metrics

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1,584.4 million |

| Market Forecast (2035) | USD 4,580.6 million |

| Growth Rate | 11.2% CAGR |

| Leading Product | Bio-based Collectors Segment |

| Primary Application | Non-ferrous Metals Processing |

The market demonstrates strong fundamentals with bio-based collectors capturing a dominant share through environmental compliance capabilities and processing optimization. Non-ferrous metal applications drive primary demand, supported by increasing regulatory requirements and operational efficiency development. Geographic expansion remains concentrated in developed markets with established mining infrastructure, while emerging economies show accelerating adoption rates driven by environmental modernization initiatives and rising processing accessibility standards.

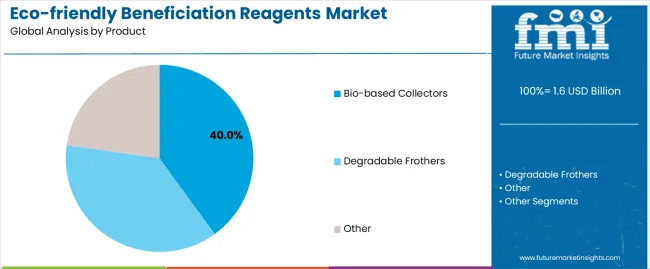

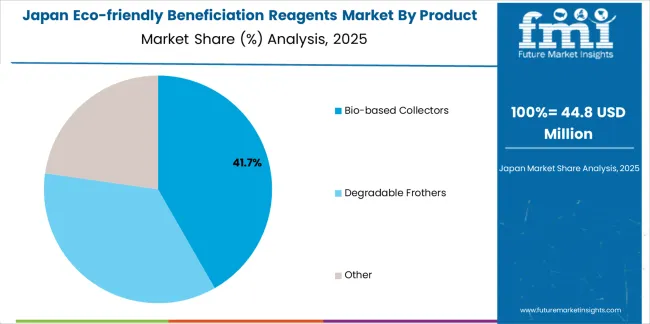

Primary Classification: The market segments by product into bio-based collectors (40%) and degradable frothers (35%), representing the evolution from traditional chemical methods to specialized environmental solutions for comprehensive mining and processing optimization.

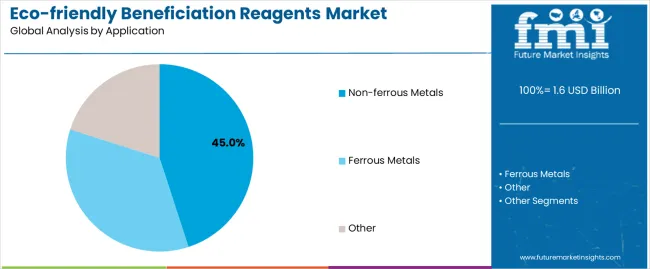

Secondary Classification: Application segmentation divides the market into non-ferrous metals (45%) and ferrous metals (30%) systems, reflecting distinct requirements for processing efficiency, environmental compliance, and mineral processing infrastructure standards.

The segmentation structure reveals technology progression from standard chemical methods toward specialized eco-friendly applications with enhanced environmental consistency and processing capabilities, while application diversity spans from copper processing to iron ore concentration requiring precise chemical solutions.

Market Position: Bio-based collectors command the leading position in the eco-friendly beneficiation reagents market with 40% market share through advanced selectivity features, including superior mineral binding characteristics, environmental compatibility, and processing optimization that enable operators to achieve optimal recovery across diverse non-ferrous and ferrous metal applications.

Value Drivers: The segment benefits from operator preference for environmental chemical systems that provide consistent performance characteristics, reduced regulatory complexity, and processing efficiency optimization without requiring significant infrastructure modifications. Advanced chemical features enable automated dosing control systems, performance monitoring, and integration with existing processing equipment, where operational effectiveness and environmental compliance represent critical operator requirements.

Competitive Advantages: Bio-based collectors differentiate through proven environmental reliability, consistent selectivity characteristics, and integration with automated processing management systems that enhance separation effectiveness while maintaining optimal regulatory standards for diverse mineral processing and extraction applications.

Key market characteristics:

Degradable frothers maintain a 35% market position in the eco-friendly beneficiation reagents market due to their enhanced foam stability properties and environmental breakdown characteristics. These systems appeal to facilities requiring specialized performance with premium positioning for flotation and processing applications. Market growth is driven by environmental segment expansion, emphasizing regulatory chemical solutions and operational efficiency through optimized formulation designs.

Market Context: Non-ferrous metals applications demonstrate market leadership in the eco-friendly beneficiation reagents market with 45% share due to widespread adoption of environmental chemical systems and increasing focus on regulatory compliance, processing efficiency, and mineral applications that maximize recovery while maintaining environmental standards.

Appeal Factors: Mining operators prioritize chemical effectiveness, environmental compliance, and integration with existing processing infrastructure that enables coordinated mineral operations across multiple extraction applications. The segment benefits from substantial processing investment and modernization programs that emphasize the acquisition of environmental-based systems for regulatory optimization and chemical efficiency applications.

Growth Drivers: Mining facility expansion programs incorporate eco-friendly reagents as standard chemicals for processing operations, while mineral growth increases demand for consistent chemical capabilities that comply with environmental standards and minimize regulatory complexity.

Application dynamics include:

Ferrous metals processing captures 30% market share through comprehensive chemical requirements in iron ore facilities, steel production operations, and metallurgical applications. These operations demand reliable chemical systems capable of handling substantial processing volumes while providing effective mineral management and operational performance capabilities.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Environmental regulations & compliance requirements (regulatory standards, processing guidelines) | ★★★★★ | Large-scale mining markets require efficient, reliable chemical solutions with consistent performance and environmental compliance across processing applications. |

| Driver | Mining sector expansion & capacity development | ★★★★★ | Drives demand for specialized chemical solutions and high-performance processing capabilities; suppliers providing environmental-grade chemicals gain competitive advantage. |

| Driver | Technology advancement & process optimization (chemical efficiency, environmental compatibility) | ★★★★☆ | Processing facilities need advanced chemical solutions; demand for environmental formats expanding addressable market segments. |

| Restraint | Cost sensitivity & pricing requirements | ★★★★☆ | Small mining operators face price pressure; increases cost sensitivity and affects chemical availability in budget-sensitive markets. |

| Restraint | Traditional reagent competition & chemical alternatives | ★★★☆☆ | Cost-focused applications face challenges with chemical selection and environmental requirements, limiting adoption in price-sensitive segments. |

| Trend | Digital chemical management & smart monitoring (connected processing systems) | ★★★★★ | Growing demand for connected chemical solutions; digital integration becomes core value proposition in smart processing segments. |

| Trend | Asian market expansion & regional processing growth | ★★★★☆ | Regional facility development drives demand for local chemical solutions; regional processing capabilities drive competition toward localization. |

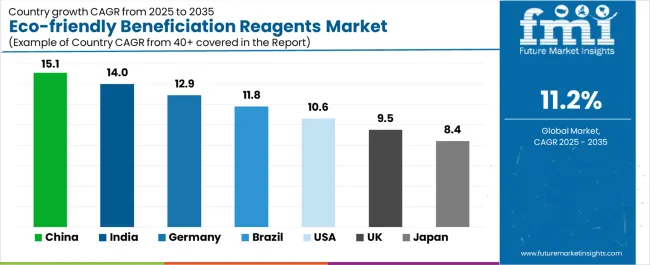

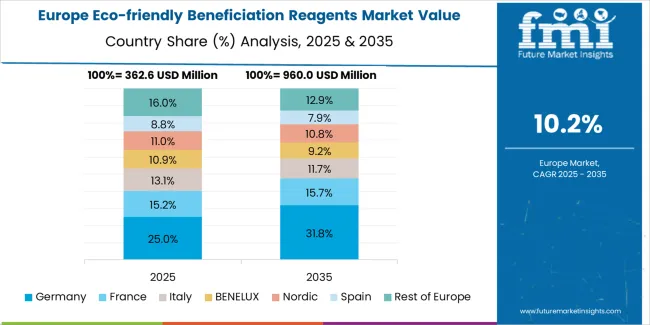

The eco-friendly beneficiation reagents market demonstrates varied regional dynamics with growth leaders including China (15.1% growth rate) and India (14.0% growth rate) driving expansion through mining initiatives and processing capacity development. Steady Performers encompass Germany (12.9% growth rate), Brazil (11.8% growth rate), and U.S. (10.6% growth rate), benefiting from established mining industries and advanced chemical adoption. Mature Markets feature U.K. (9.5% growth rate) and Japan (8.4% growth rate), where chemical technology advancement and environmental standardization requirements support consistent growth patterns.

Regional synthesis reveals East Asian and South Asian markets leading adoption through mining expansion and processing development, while Western countries maintain steady expansion supported by technology advancement and regulatory standardization requirements. Emerging markets show strong growth driven by mining applications and facility modernization trends.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 15.1% | Lead with high-volume chemical systems | Environmental regulations; processing complexity |

| India | 14.0% | Focus on cost-effective processing solutions | Infrastructure challenges; chemical availability |

| Germany | 12.9% | Premium quality positioning | Over-specification; regulatory compliance |

| Brazil | 11.8% | Provide comprehensive mining applications | Environmental restrictions; facility requirements |

| USA | 10.6% | Offer regulatory-compliant solutions | EPA regulations; processing requirements |

| UK | 9.5% | Premium environmental positioning | Technology saturation; processing costs |

| Japan | 8.4% | Premium efficiency positioning | Chemical precision; market maturity |

China establishes fastest market growth through aggressive mining programs and comprehensive processing capacity development, integrating advanced eco-friendly reagents as standard components in non-ferrous metal processing and industrial mineral extraction facilities. The country's 15.1% growth rate reflects government initiatives promoting environmental modernization and chemical development capabilities that mandate the use of eco-friendly systems in processing facilities. Growth concentrates in major mining centers, including Shandong, Inner Mongolia, and Shanxi, where chemical technology development showcases integrated reagent systems that appeal to operators seeking advanced environmental capabilities and operational processing applications.

Chinese chemical manufacturers are developing cost-effective reagent solutions that combine domestic production advantages with advanced environmental features, including automated delivery systems and enhanced performance capabilities. Distribution channels through mining suppliers and chemical service distributors expand market access, while government support for environmental development supports adoption across diverse mining segments.

Strategic Market Indicators:

In Odisha, Jharkhand, and Chhattisgarh states, mining facilities and processing operations are implementing advanced eco-friendly reagents as standard chemicals for facility optimization and operational processing enhancement, driven by increasing government environmental investment and mining modernization programs that emphasize the importance of chemical compliance capabilities. The market holds a 14.0% growth rate, supported by government environmental initiatives and mining development programs that promote advanced chemical systems for processing facilities.

Indian operators are adopting reagent systems that provide consistent operational performance and environmental compliance features, appealing in mining regions where facility efficiency and chemical standards represent critical operational requirements. Market expansion benefits from growing mineral processing capabilities and environmental integration agreements that enable domestic production of advanced chemical systems for mining applications.

Germany's advanced chemical technology market demonstrates sophisticated eco-friendly reagent integration with documented operational effectiveness in premium processing applications and modern facility installations through integration with existing quality systems and environmental infrastructure. The country maintains a 12.9% growth rate, leveraging traditional quality expertise and precision systems integration in chemical technology. Processing centers, including North Rhine-Westphalia, Bavaria, and Lower Saxony, showcase premium installations where reagent systems integrate with traditional quality platforms and modern facility management systems to optimize processing operations and maintain environmental quality profiles.

German chemical manufacturers prioritize reagent precision and quality consistency in eco-friendly development, creating demand for premium systems with advanced features, including quality monitoring and automated chemical systems. The market benefits from established environmental infrastructure and commitment to processing standards that provide long-term operational benefits and compliance with traditional quality processing methods.

Brazil's advanced mining technology market demonstrates sophisticated eco-friendly reagent integration with documented operational effectiveness in comprehensive processing applications and modern mining installations through integration with existing mining systems and environmental infrastructure. The country maintains an 11.8% growth rate, leveraging traditional mining expertise and processing systems integration in chemical technology. Mining centers, including Minas Gerais, Pará, and Goiás, showcase comprehensive installations where reagent systems integrate with traditional mining platforms and modern facility management systems to optimize processing operations and maintain environmental mining profiles.

Brazilian chemical suppliers prioritize reagent effectiveness and mining consistency in eco-friendly development, creating demand for comprehensive systems with advanced features, including mining monitoring and automated reagent systems. The market benefits from established mining infrastructure and commitment to environmental standards that provide long-term operational benefits and compliance with traditional quality mining methods.

U.S. establishes regulatory-compliant market development through comprehensive environmental programs and established chemical infrastructure, integrating eco-friendly reagents across mining facilities and processing applications. The country's 10.6% growth rate reflects mature mining industry relationships and established chemical adoption that supports widespread use of environmental systems in processing facilities and regulatory-compliant operations. Growth concentrates in major mining centers, including Nevada, Arizona, and Utah, where chemical technology showcases mature reagent deployment that appeals to operators seeking proven environmental capabilities and operational efficiency applications.

American chemical suppliers leverage established distribution networks and comprehensive environmental capabilities, including compliance programs and technical support that create customer relationships and operational advantages. The market benefits from mature environmental standards and EPA requirements that support chemical system use while supporting technology advancement and operational optimization.

U.K.'s advanced environmental technology market demonstrates sophisticated eco-friendly reagent integration with documented operational effectiveness in premium processing applications and modern facility installations through integration with existing environmental systems and chemical infrastructure. The country maintains a 9.5% growth rate, leveraging traditional environmental expertise and precision systems integration in chemical technology. Processing centers, including England, Scotland, and Wales, showcase premium installations where reagent systems integrate with traditional environmental platforms and modern facility management systems to optimize processing operations and maintain chemical environmental profiles.

British chemical suppliers prioritize reagent precision and environmental consistency in eco-friendly development, creating demand for premium systems with advanced features, including environmental monitoring and automated chemical systems. The market benefits from established environmental infrastructure and commitment to processing standards that provide long-term operational benefits and compliance with traditional quality environmental methods.

Japan's advanced chemical technology market demonstrates sophisticated eco-friendly reagent integration with documented operational effectiveness in premium processing applications and modern facility installations through integration with existing efficiency systems and environmental infrastructure. The country maintains an 8.4% growth rate, leveraging traditional efficiency expertise and precision systems integration in chemical technology. Processing centers, including Kanto, Kansai, and Chubu regions, showcase premium installations where reagent systems integrate with traditional efficiency platforms and modern facility management systems to optimize processing operations and maintain chemical efficiency profiles.

Japanese chemical manufacturers prioritize reagent precision and efficiency consistency in eco-friendly development, creating demand for premium systems with advanced features, including efficiency monitoring and automated chemical systems. The market benefits from established efficiency infrastructure and commitment to environmental standards that provide long-term operational benefits and compliance with traditional quality processing methods.

The European eco-friendly beneficiation reagents market is projected to represent a significant portion of global consumption, with strong regional distribution across major economies. Germany is expected to maintain its leadership position with USD 295 million in 2025, accounting for substantial European market share, supported by its advanced environmental infrastructure and major processing centers.

United Kingdom follows with USD 225 million, representing significant European market share in 2025, driven by comprehensive environmental programs and chemical technology development initiatives. France holds USD 180 million through specialized processing applications and environmental compliance requirements. Italy commands USD 140 million, while Spain accounts for USD 110 million in 2025. The rest of Europe region maintains USD 320 million, attributed to increasing reagent system adoption in Nordic countries and emerging processing facilities implementing environmental modernization programs.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global platforms | Chemical networks, broad reagent portfolios, manufacturing facilities | Proven reliability, multi-region support, comprehensive service | Technology refresh cycles; customer lock-in dependency |

| Technology innovators | R&D capabilities; advanced chemical systems; digital interfaces | Latest technology first; attractive ROI on specialized applications | Service density outside core regions; customization complexity |

| Regional specialists | Local sourcing, fast delivery, nearby technical support | "Close to site" support; pragmatic pricing; local regulations | Technology gaps; talent retention in chemical engineering |

| Application-focused ecosystems | Industry expertise, technical support, specialized solutions | Lowest application variation; comprehensive industry support | Scaling costs if overpromised; technology obsolescence |

| Service specialists | Chemical programs, reagent supply, technical training | Win service-intensive applications; flexible support | Scalability limitations; narrow market focus |

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,584.4 million |

| Product | Bio-based Collectors, Degradable Frothers, Other |

| Application | Non-ferrous Metals, Ferrous Metals, Other |

| Regions Covered | East Asia, Western Europe, South Asia Pacific, North America, Latin America, Middle East & Africa |

| Countries Covered | China, Germany, United States, Japan, India, Brazil, United Kingdom, and 25+ additional countries |

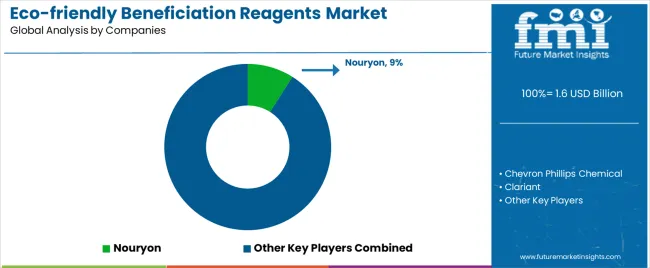

| Key Companies Profiled | Nouryon, Chevron Phillips Chemical, Clariant, Syensqo, Ecolab, Evonik, BASF, Kao Chemicals |

| Additional Attributes | Dollar sales by product and application categories, regional adoption trends across East Asia, Western Europe, and South Asia Pacific, competitive landscape with chemical suppliers and service providers, operator preferences for environmental consistency and operational reliability, integration with processing platforms and facility monitoring systems, innovations in chemical technology and reagent enhancement, and development of advanced eco-friendly solutions with enhanced performance and facility optimization capabilities. |

The global eco-friendly beneficiation reagents market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the eco-friendly beneficiation reagents market is projected to reach USD 4.6 billion by 2035.

The eco-friendly beneficiation reagents market is expected to grow at a 11.2% CAGR between 2025 and 2035.

The key product types in eco-friendly beneficiation reagents market are bio-based collectors, degradable frothers and other.

In terms of application, non-ferrous metals segment to command 45.0% share in the eco-friendly beneficiation reagents market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Eco-friendly Precious Metal Beneficiation Reagents Market Forecast and Outlook 2025 to 2035

Non-eco-friendly Precious Metal Beneficiation Reagents Market Forecast and Outlook 2025 to 2035

Beneficiation Reagents Market Size and Share Forecast Outlook 2025 to 2035

Grignard Reagents Market Demand & Trends 2022 to 2032

Flotation Reagents Market Size and Share Forecast Outlook 2025 to 2035

Myoglobin Reagents Market

Sequencing Reagents Market

Fructosamine Reagents Market

Lipase Testing Reagents Market Size and Share Forecast Outlook 2025 to 2035

Electrophoresis Reagents Market Size and Share Forecast Outlook 2025 to 2035

Urinary Protein Reagents Market

Magnesium Testing Reagents Market

Hematology Analyzer And Reagents Market

Total Iron-Binding Capacity Reagents Market

Molecular Biology Enzymes, Kits & Reagents Market Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA