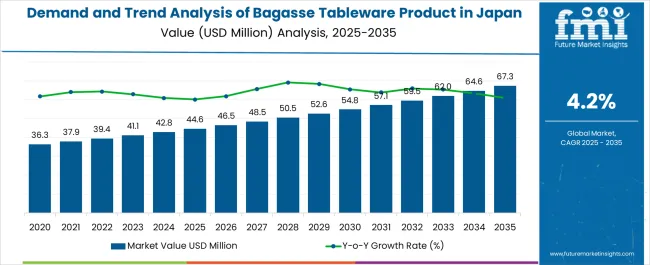

The Demand and Trend Analysis of Bagasse Tableware Product in Japan is estimated to be valued at USD 44.6 million in 2025 and is projected to reach USD 67.3 million by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

| Metric | Value |

|---|---|

| Demand and Trend Analysis of Bagasse Tableware Product in Japan Estimated Value in (2025 E) | USD 44.6 million |

| Demand and Trend Analysis of Bagasse Tableware Product in Japan Forecast Value in (2035 F) | USD 67.3 million |

| Forecast CAGR (2025 to 2035) | 4.2% |

The bagasse tableware product market in Japan is expanding steadily, driven by the country’s strong focus on sustainability and regulatory initiatives supporting eco-friendly alternatives to plastic. Rising consumer awareness of environmental impacts, coupled with government-led restrictions on single-use plastics, has accelerated adoption of biodegradable and compostable products. Current market dynamics are defined by increasing integration of bagasse-based solutions in both household and commercial foodservice applications.

Manufacturers are investing in product quality improvements, including enhanced durability, water resistance, and heat tolerance, to align with Japanese consumer expectations. Future outlook is shaped by expanding distribution networks, a growing preference for premium eco-friendly tableware, and the steady transition of foodservice chains toward sustainable procurement practices.

Growth rationale rests on the long-term shift in consumer and institutional behavior, where environmental responsibility and convenience converge to ensure consistent demand As retail penetration increases and laminated product options gain popularity, the market is positioned for continuous expansion with rising acceptance across both urban and semi-urban regions.

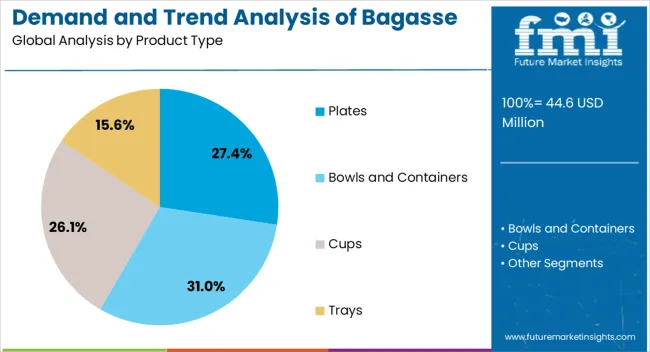

The plates segment, representing 27.4% of the product type category, has maintained leadership due to its extensive use in households, restaurants, and catering services. Strong demand has been supported by versatility, convenience, and alignment with Japanese consumer preferences for compact and functional tableware solutions.

Plates are increasingly being adopted by quick-service and takeaway establishments seeking sustainable alternatives. Product improvements in strength and design have reinforced acceptance, particularly in urban centers with high foodservice activity.

The segment’s growth has also been sustained by competitive pricing and regulatory support that encourages businesses to shift away from plastics The ability of plates to serve as a direct substitute for conventional disposable tableware has positioned the segment as a cornerstone in the broader adoption of bagasse-based products in Japan.

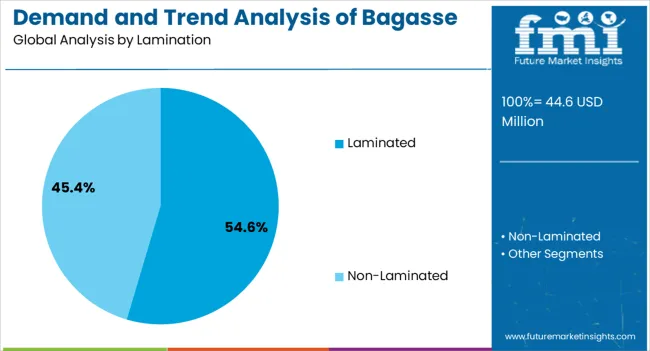

The laminated category, holding 54.60% of the lamination segment, has become dominant due to its enhanced product performance, including resistance to moisture and oil penetration. This has allowed laminated bagasse products to gain significant traction across both retail and institutional buyers.

Improved durability has increased consumer confidence in using these products for hot and oily foods, making them practical substitutes for plastic-coated alternatives. Market demand has been further strengthened by innovation in biodegradable laminates, which align with Japan’s regulatory frameworks promoting eco-friendly materials.

Laminated products have also benefitted from higher visibility in supermarkets and online platforms, ensuring strong market penetration Continued advancements in coating technologies are expected to improve both environmental compatibility and user convenience, solidifying the segment’s long-term leadership.

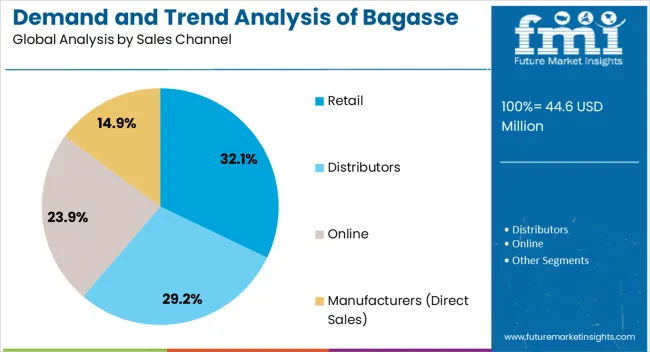

The retail channel, accounting for 32.10% of the sales channel category, has led distribution due to the rising availability of bagasse tableware products in supermarkets, convenience stores, and e-commerce platforms. Consumer purchasing patterns in Japan reflect a strong preference for accessible and ready-to-use eco-friendly solutions, which has supported robust sales growth through retail.

Branding and packaging innovations have increased product visibility, while competitive pricing strategies have widened the consumer base. Retail expansion has also been supported by collaborations between manufacturers and large-scale distributors, enabling consistent supply and nationwide reach.

With Japanese consumers increasingly prioritizing sustainability in daily purchases, retail channels are expected to continue as the primary avenue for adoption The segment’s growth is also being reinforced by digital retail platforms, which offer convenience and product variety, thereby strengthening its market share in the coming years.

A growing awareness of environmental issues and a strong push for sustainability in the Kanto region have propelled the demand for bagasse tableware products. This surge is particularly evident in numerous restaurants, especially in Tokyo, where there is a keen interest in adopting eco-friendly alternatives to traditional tableware.

The cultural diversity in Kanto, with its blend of traditional Japanese and international cuisines, presents a wide range of opportunities for bagasse tableware products to cater to diverse dining needs.

The Chubu region, with its industrial and manufacturing centers, provides a significant industry for bagasse tableware products. The automotive and manufacturing sectors in Chubu are progressively embracing sustainable practices, including the use of eco-friendly tableware in employee cafeterias and corporate events.

The emphasis on corporate social responsibility (CSR) in Chubu further fuels the demand for bagasse products, aligning with sustainability initiatives.

The table below highlights that the plates and commercial segments are leading the product type and end use segments respectively in 2025.

| Category | Industrial Share in 2025 |

|---|---|

| Plates by Product Type | 35.1% |

| Commercial by End Use | 66.0% |

The bagasse tableware product industry is experiencing robust demand for bagasse plates, with this segment projected to hold a substantial share of around 35.1% in 2025. Bagasse plates are favored for their versatility and eco-friendly nature, making them the preferred choice for a wide range of dining needs

. They can serve main courses, appetizers, desserts, and more, offering both convenience and functionality.

The popularity of bagasse plates is on the rise as consumers and businesses alike are increasingly turning to eco-friendly solutions, including those made from sugarcane bagasse. Bagasse plates are both renewable and biodegradable, naturally breaking down over time, thus minimizing their ecological footprint.

Commercial end uses play a significant role in driving the bagasse tableware product industry, accounting for an industry share of 66.0%. Various businesses and institutions across sectors are increasingly adopting bagasse tableware products due to their eco-friendly nature and versatility. Restaurants and cafes, in particular, have been significant contributors to the growth of this industry.

Food service establishments prefer using bagasse plates, trays, and cutlery for serving customers a wide range of dishes. Hotels and catering services also embrace bagasse tableware, as these products offer an elegant and sustainable option for serving guests during events and functions.

The robust and durable nature of bagasse products ensures they can withstand the demands of high-traffic commercial settings while maintaining food quality.

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 44.6 million |

| Projected Industry Size by 2035 | USD 67.3 million |

| Anticipated CAGR between 2025 to 2035 | 4.20% CAGR |

| Demand Forecast for the Bagasse Tableware Product Industry in Japan | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing the Bagasse Tableware Product Industry in Japan, Insights on Global Players and their Industry Strategy in Japan, Ecosystem Analysis of Local and Regional Japan Providers |

| Key Cities Analyzed | Kanto, Chubu, Kinki (Kansai), Kyushu and Okinawa, Tohoku, Rest of Japan |

| Key Companies Profiled | Wasara; Plantic Technologies; Suzumo; Green Home; EcoProducts; Kawasho Corporation |

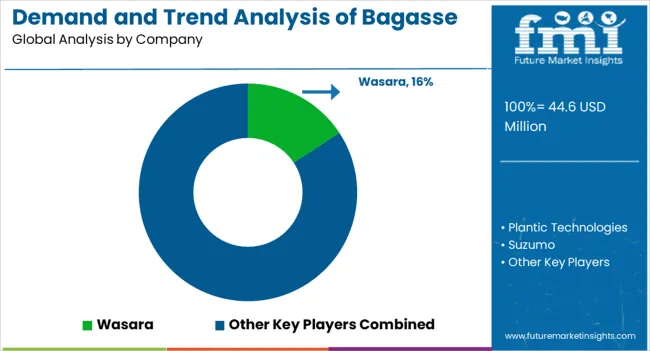

The global demand and trend analysis of bagasse tableware product in japan is estimated to be valued at USD 44.6 million in 2025.

The market size for the demand and trend analysis of bagasse tableware product in japan is projected to reach USD 67.3 million by 2035.

The demand and trend analysis of bagasse tableware product in japan is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in demand and trend analysis of bagasse tableware product in japan are plates, less than 8 inches, 8 inches to 12 inches, more than 12 inches, bowls and contAIners, less than 12 oz, 12 oz to 16 oz, more than 16 oz, cUPS, less than 6 oz, 6 oz to 12 oz, more than 12 oz, trays, less than 8 inches, 8 inches to 12 inches, more than 12 inches, clamshells, less than 8 inches, 8 inches to 12 inches, more than 12 inches, end caps, drink carriers, straw and cutlery (spoons, fork, knife & spork).

In terms of lamination, laminated segment to command 54.6% share in the demand and trend analysis of bagasse tableware product in japan in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Industrial Chocolate in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Lingonberry Powder in UK Size and Share Forecast Outlook 2025 to 2035

Demand for Joint Compound in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Taurine in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Kaolin in India Size and Share Forecast Outlook 2025 to 2035

Demand for DMPA in EU Size and Share Forecast Outlook 2025 to 2035

Demand for 3D Printing Materials in Middle East Size and Share Forecast Outlook 2025 to 2035

Demand for Protein-rich Shelf-stable UHT Oat Drinks in Latin America Size and Share Forecast Outlook 2025 to 2035

Demand for Yeast in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Oat Drink in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Vanillin in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Spirulina Extract in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Pulse Ingredients in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Gypsum in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Barite in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Shrimp in the EU Size and Share Forecast Outlook 2025 to 2035

Demand for Mezcal in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA