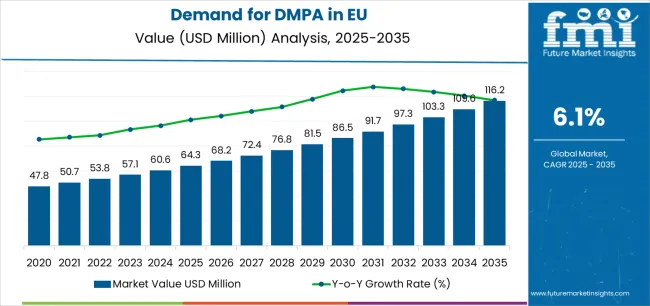

The European Union DMPA industry is projected to grow from USD 64.3 million in 2025 to approximately USD 116.2 million by 2035, registering an absolute increase of USD 52.0 million across the forecast period. The shape of this growth trajectory shows a measured yet consistent climb, supported by gradual adoption patterns and a widening base of applications. Historically, demand was restrained by limited penetration in certain downstream uses, but regulatory clarity, expanded end-user familiarity, and greater integration into coatings, resins, and adhesives have provided a stronger foundation. This historical period was defined by moderate expansion rather than sudden spikes, reflecting steady but cautious uptake in manufacturing sectors where product validation cycles tend to be lengthy.

The forecast period points to a more defined upward curve, with a CAGR reflecting stable yet accelerating progress. Expansion will be underpinned by increasing usage in industrial formulations, rising attention toward performance chemicals that offer durability and efficiency, and consistent procurement by established manufacturers across EU member states. As production lines modernize, the need for higher quality intermediates such as DMPA is likely to strengthen, creating a firmer base of recurring demand. The balance between stable established applications and newer, more specialized uses will shape a gradual yet sustained climb in sales. The shape of this growth is not explosive but progressive, indicating that adoption will deepen steadily rather than peak abruptly, which aligns with procurement behavior in the region’s industrial sectors.

In effect, the historical phase displayed incremental growth linked to replacement and compliance requirements, while the forecast phase reflects a more confident expansion driven by innovation, end-use diversification, and broader supplier networks across the Union. The curve can be described as a steady incline, neither flat nor sharply rising, but marked by a consistent positive slope that supports reliability of outlook. Risks such as raw material price fluctuations and regulatory adjustments could introduce some variability, yet the overall trajectory remains upward. The key feature of this growth shape is its resilience, suggesting that European Union DMPA sales will expand in a measured, dependable fashion rather than through volatile surges, reinforcing its role as a critical building block in specialty chemicals supply chains.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 64.3 million |

| Forecast Value in (2035F) | USD 116.2 million |

| Forecast CAGR (2025 to 2035) | 6.1% |

Industry expansion is being supported by the stringent European regulatory framework mandating volatile organic compound reduction across coating and adhesive formulations and the corresponding demand for ionic monomers enabling waterborne polyurethane dispersions with proven performance characteristics in demanding industrial applications. Modern coating formulators and adhesive manufacturers rely on DMPA as an essential chain extender for waterborne polyurethane production, dispersion stabilizer ensuring colloidal stability, and functionality provider enabling carboxyl group incorporation for neutralization and water dispersibility, driving demand for materials that consistently deliver required acid number specifications, molecular weight characteristics, and purity levels necessary for formulation performance and regulatory compliance. Even modest variations in DMPA quality, including acid value deviations, hydroxyl number inconsistencies, or impurity levels, can significantly impact polyurethane dispersion stability and final coating or adhesive performance across critical applications.

The growing requirements for low-VOC and zero-VOC formulations and increasing recognition of waterborne polyurethane systems as environmentally superior alternatives to solvent-based technologies are driving demand for DMPA from certified suppliers with appropriate quality certifications and consistent material specifications. Regulatory authorities are increasingly establishing clear guidelines for VOC emission limits in coating and adhesive applications, chemical intermediate quality standards, and traceability protocols to maintain environmental compliance and ensure formulation performance consistency. Technical research and industrial validation studies are providing evidence supporting DMPA's essential role in waterborne polyurethane chemistry, requiring specialized synthesis methods and standardized quality control protocols for optimal acid number control, appropriate hydroxyl functionality, and consistent molecular characteristics enabling reliable dispersion formation and coating performance.

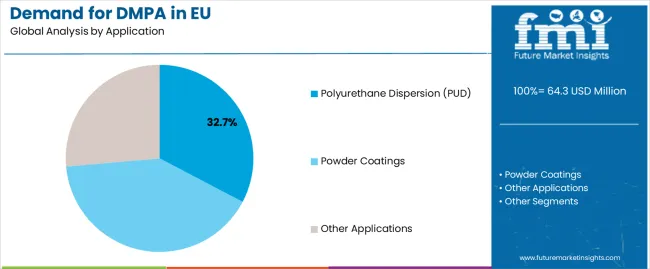

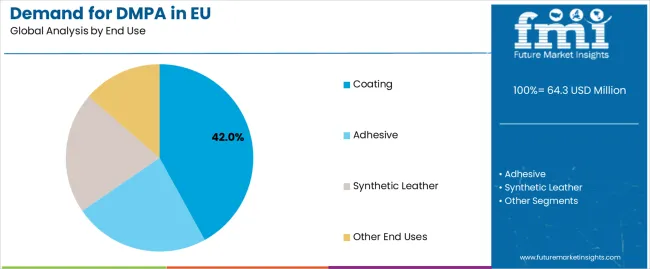

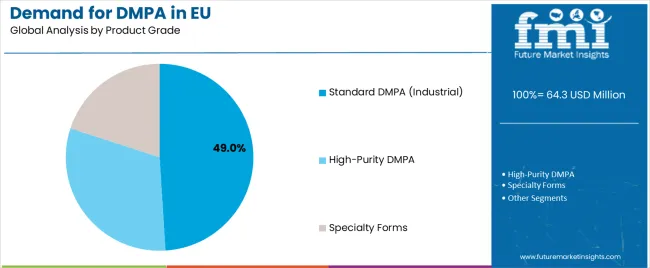

Sales are segmented by application, end use, product grade, distribution channel, nature, and country. By application, demand is divided into polyurethane dispersion (PUD), powder coatings, and other applications. Based on end use, sales are categorized into adhesive, coating, synthetic leather, and other end uses. In terms of product grade, demand is segmented into standard DMPA (industrial), high-purity DMPA, and specialty forms. By distribution channel, sales are classified into direct to formulators/OEMs, distributors, and online/indirect channels. By nature, demand is divided into bulk commodity, processed value-added, and specialty high-purity. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The polyurethane dispersion (PUD) segment is projected to account for 32.7% of EU DMPA sales in 2025, expanding to 35.0% by 2035, establishing itself as the dominant application across European industries. This commanding position is fundamentally supported by DMPA's essential role as the ionic monomer enabling waterborne polyurethane dispersion formation, stringent VOC regulations driving waterborne system adoption, and superior functionality providing carboxyl groups for neutralization enabling stable aqueous dispersions replacing solvent-based polyurethane technologies. The polyurethane dispersion format delivers exceptional versatility, providing coating formulators, adhesive manufacturers, and synthetic leather producers with environmentally compliant systems that facilitate high-performance applications while meeting regulatory VOC limits and eco-conscious requirements.

This segment benefits from established waterborne polyurethane production technologies, comprehensive formulation expertise optimizing DMPA incorporation levels, and extensive regulatory drivers supporting conversion from solvent-based to waterborne systems across European industries. Polyurethane dispersions utilizing DMPA offer performance advantages across various critical applications, including automotive coatings that require excellent appearance and durability, industrial coatings that demand chemical resistance and mechanical properties, and adhesive systems that necessitate bonding strength and flexibility characteristics comparable to those of solvent-based alternatives.

The polyurethane dispersion segment is expected to expand its share to 35.0% by 2035, demonstrating strengthening positioning as waterborne polyurethane adoption accelerates and DMPA's essential role in enabling stable, high-performance aqueous dispersions drives preferential demand growth throughout the forecast period.

Coating end-use applications are positioned to represent 42% of total DMPA demand across European industries in 2025, declining slightly to 40.0% by 2035, reflecting the segment's established position as the primary end-use application within the industry ecosystem. This substantial share directly demonstrates that coating formulations represent the largest single end-use sector, with automotive coatings manufacturers, industrial coatings producers, and wood coatings formulators utilizing DMPA-based waterborne polyurethane dispersions for high-performance coating systems meeting stringent VOC regulations while delivering appearance, durability, and chemical resistance properties.

Modern coating formulators increasingly rely on DMPA-enabled waterborne polyurethane dispersions delivering excellent film formation, controlled gloss and appearance characteristics, and appropriate mechanical properties ensuring coating performance across automotive refinishing, industrial maintenance coatings, and wood furniture finishing applications. The segment benefits from continuous formulation optimization focused on improving coating hardness and chemical resistance, reducing drying times matching solvent-based system productivity, and enhancing application properties including leveling, flow, and substrate wetting supporting professional coating operations.

The segment's slight share decline reflects proportional growth across diversifying end uses, with coating applications maintaining their leading position while adhesive and synthetic leather sectors expand their relative contributions throughout the forecast period.

Standard DMPA (industrial grade) is projected to account for 49% of EU DMPA sales in 2025, declining to 45.0% by 2035, representing conventional industrial-grade material produced for general waterborne polyurethane formulations without specialized purification or ultra-high purity specifications beyond standard chemical synthesis quality control. These standard products successfully deliver cost-effective ionic monomers meeting general formulation specifications while ensuring broad commercial availability across coating, adhesive, and synthetic leather applications prioritizing functional performance and competitive pricing over premium-grade characteristics.

Standard industrial-grade production serves price-sensitive applications, including general industrial coatings, standard adhesive formulations, and conventional synthetic leather production where typical material specifications prove sufficient for dispersion stability and coating performance. The segment derives competitive advantages from established synthesis processes, economies of scale in production and distribution, and the ability to meet substantial volume requirements from coating and adhesive manufacturers without high-purity processing constraints increasing production costs.

The segment's declining share through 2035 reflects the gradual expansion of high-purity DMPA grades capturing incrementally larger shares through premium coating applications, automotive refinishing systems, and specialty adhesive formulations demanding enhanced purity specifications and tighter quality tolerances, while standard industrial-grade materials continue serving established general-purpose applications throughout the forecast period.

EU DMPA sales are advancing rapidly due to stringent VOC regulations driving waterborne polyurethane adoption, growing environmental consciousness supporting low-emission coating and adhesive systems, and expanding automotive and industrial coating sectors requiring high-performance waterborne formulations. The industry faces challenges, including sensitivity to automotive production cycles affecting coating demand volumes, raw material cost volatility impacting production economics particularly for specialized grades, and potential competition from alternative ionic monomers or dispersion stabilization technologies. Continued focus on purity enhancement, formulation optimization, and technical service support remains central to industry development.

The rapidly accelerating regulatory pressure for volatile organic compound reduction is fundamentally transforming European coating and adhesive industries from solvent-based to waterborne technologies, creating demand for DMPA as the essential ionic monomer enabling stable aqueous polyurethane dispersions with performance characteristics approaching or matching traditional solvent-based systems. Advanced waterborne polyurethane formulations featuring DMPA-based ionic stabilization, optimized neutralization protocols, and controlled molecular architecture enable coating and adhesive manufacturers to produce environmentally compliant systems delivering excellent film properties, appropriate mechanical characteristics, and application performance suitable for automotive refinishing, industrial maintenance coatings, and high-performance adhesive applications. These regulatory-driven technology transitions prove particularly transformative for automotive coating applications, including OEM clear coats, refinishing systems, and interior coatings, where VOC limits necessitate waterborne technologies while performance requirements demand properties matching solvent-based alternatives.

Modern DMPA producers systematically incorporate advanced purification technologies, including recrystallization systems achieving ultra-low color specifications, distillation processes removing trace impurities, and quality control protocols ensuring consistent acid number and hydroxyl functionality supporting premium coating applications demanding exceptional appearance and color stability. Strategic integration of high-purity production capabilities, including controlled crystallization processes optimizing particle size distribution, purification systems removing colored impurities affecting coating appearance, and analytical capabilities verifying ultra-low color specifications, enables suppliers to position premium DMPA grades for automotive refinishing systems, high-gloss industrial coatings, and specialty adhesive applications where material purity directly determines final product appearance and performance. These quality enhancements prove essential for automotive coating applications, as refinishing systems and OEM coatings demand ultra-low color DMPA preventing yellowing and ensuring color stability over coating service life.

European coating formulators and adhesive manufacturers increasingly prioritize DMPA supply relationships emphasizing comprehensive technical service support, formulation development assistance optimizing waterborne polyurethane systems, and application expertise addressing processing challenges and performance optimization. This technical service focus enables DMPA suppliers to differentiate commodity chemical offerings through formulation guidance supporting optimal incorporation levels, neutralization protocols maximizing dispersion stability, and application troubleshooting addressing coating defects or adhesive performance issues. Technical service capabilities prove particularly important for companies transitioning from solvent-based to waterborne technologies, as formulation expertise and application support reduce development timelines and accelerate commercial implementation.

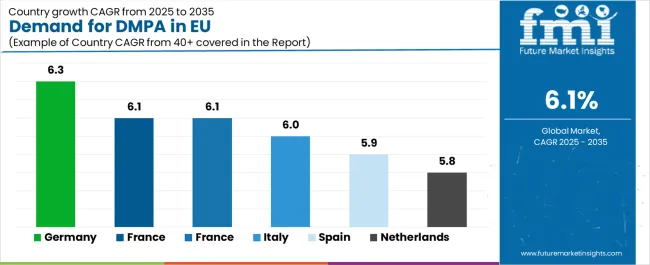

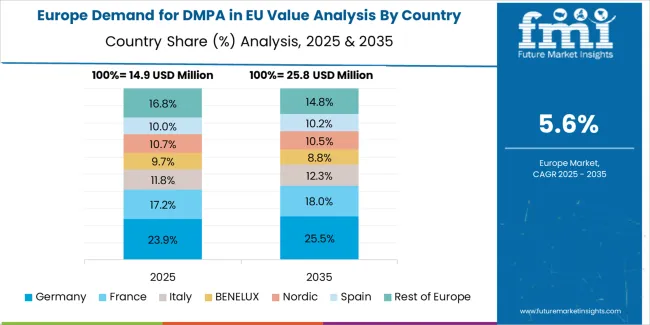

EU DMPA sales are projected to grow from USD 64.3 million in 2025 to USD 116.2 million by 2035, registering a CAGR of 6.1% over the forecast period. Germany is expected to demonstrate the strongest growth trajectory with a 6.3% CAGR, supported by substantial automotive coating demand, the advanced industrial coatings sector, and strong waterborne technology adoption. France and the Rest of Europe follow with 6.1% CAGR each, attributed to coating industry modernization and emerging industry development, respectively.

Italy demonstrates a 6.0% CAGR, reflecting steady coating and synthetic leather industry consumption. Spain shows a 5.9% CAGR, supported by the coating sector recovery and expanding industrial applications. The Netherlands exhibits a 5.8% CAGR, driven by specialty chemical distribution infrastructure and coating formulation activities.

| Country | CAGR % |

|---|---|

| Germany | 6.3% |

| France | 6.1% |

| Rest of Europe | 6.1% |

| Italy | 6.0% |

| Spain | 5.9% |

| Netherlands | 5.8% |

EU DMPA sales demonstrate robust growth across major European economies, with Germany leading expansion at 6.3% CAGR through 2035, driven by substantial automotive coating industry presence and advanced waterborne technology adoption. France benefits from coating sector modernization and adhesive industry development. The Rest of Europe maintains strong growth supported by emerging coating market development and waterborne system adoption. Italy leverages established coating and synthetic leather industry consumption. Spain shows consistent growth supported by coating sector recovery and industrial expansion. The Netherlands demonstrates steady advancement reflecting specialty chemical distribution capabilities and coating formulation expertise. Sales show strong regional development reflecting EU-wide VOC regulatory pressure and ongoing waterborne polyurethane technology adoption across coating and adhesive sectors.

Revenue from DMPA in Germany is projected to exhibit robust growth with a CAGR of 6.3% through 2035, driven by Europe's most substantial automotive coating infrastructure, comprehensive industrial coatings sector, and advanced waterborne polyurethane technology adoption across coating and adhesive applications. Germany's internationally recognized automotive industry and established coating technology leadership are creating demand for high-quality DMPA supporting waterborne coating systems across automotive refinishing, OEM coating applications, and industrial maintenance coatings.

Major coating manufacturers, including BASF Coatings, Axalta Coating Systems, and PPG Industries European operations, adhesive producers, and synthetic leather manufacturers systematically source DMPA from domestic suppliers and European producers ensuring material availability and quality consistency. German demand benefits from well-developed automotive coating supply chains facilitating specialty chemical distribution, stringent VOC regulations driving waterborne technology adoption, and established technical expertise in waterborne polyurethane formulation supporting sophisticated DMPA utilization.

Revenue from DMPA in France is expanding at a CAGR of 6.1%, substantially supported by coating industry modernization embracing waterborne technologies, adhesive sector development requiring low-VOC bonding systems, and automotive coating activities serving domestic vehicle production. France's diversified coating industry and growing waterborne technology adoption are systematically driving stable demand for DMPA materials across automotive, industrial, and specialty coating applications.

Major coating manufacturers, adhesive producers, and synthetic leather companies source DMPA from domestic specialty chemical suppliers and European producers ensuring adequate material availability for waterborne polyurethane formulation. French sales particularly benefit from automotive coating activities supporting vehicle production, industrial coatings sector serving diverse manufacturing applications, and adhesive industry development utilizing waterborne polyurethane systems for packaging, woodworking, and assembly applications.

Revenue from DMPA in Italy is growing at a steady CAGR of 6.0%, fundamentally driven by established coating industry presence, substantial synthetic leather manufacturing sector utilizing waterborne polyurethane systems, and ongoing industrial coatings consumption serving manufacturing sectors. Italy's coating technology capabilities and traditional synthetic leather industry are supporting constant DMPA consumption across diverse application sectors.

Major coating manufacturers, synthetic leather producers concentrated in northern Italian regions, and adhesive companies source DMPA from European suppliers ensuring material availability for waterborne formulations. Italian sales particularly benefit from the country's substantial synthetic leather industry requiring DMPA-based polyurethane dispersions for fashion, footwear, and upholstery applications, established coating industry supporting automotive and industrial applications, and adhesive sector utilizing waterborne systems for woodworking and furniture assembly.

Demand for DMPA in Spain is projected to grow at a CAGR of 5.9%, substantially supported by coating sector recovery following economic challenges, expanding automotive coating activities, and growing industrial coatings consumption serving manufacturing modernization. Spanish coating industry development and waterborne technology adoption are positioning DMPA as an essential specialty chemical input across expanding coating and adhesive sectors.

Major coating manufacturers, adhesive producers, and industrial consumers source DMPA from European suppliers ensuring adequate material availability for waterborne polyurethane formulations. Spain's coating sector recovery drives waterborne system adoption, while automotive coating activities benefit from vehicle production supporting refinishing and OEM coating demand, creating continued DMPA consumption growth across coating and adhesive applications.

Demand for DMPA in the Netherlands is expanding at a CAGR of 5.8%, fundamentally driven by specialty chemical distribution infrastructure serving European coating industries, formulation expertise supporting waterborne polyurethane development, and coating industry activities serving domestic and export industries. Dutch specialty chemical distribution capabilities and coating formulation expertise are creating focused demand for DMPA supporting waterborne coating and adhesive system development.

Netherlands sales significantly benefit from well-developed specialty chemical distribution networks facilitating DMPA logistics across European industries, coating formulation expertise supporting waterborne technology development, and proximity to major European coating manufacturers enabling technical service relationships. The country's specialty chemical infrastructure and coating industry capabilities create concentrated demand for quality-certified DMPA supporting formulation development and waterborne polyurethane optimization.

EU DMPA sales are defined by competition among specialty chemical producers, polyurethane intermediate suppliers, and regional chemical distributors serving coating and adhesive industries. Companies are investing in purification technology improvements, high-purity grade development addressing premium coating applications, quality assurance systems ensuring consistent specifications, and technical service programs to deliver high-quality, consistently specified, and application-optimized DMPA solutions. Strategic relationships with coating manufacturers, technical service support optimizing waterborne polyurethane formulations, and quality certification programs addressing customer specifications are central to strengthening market position.

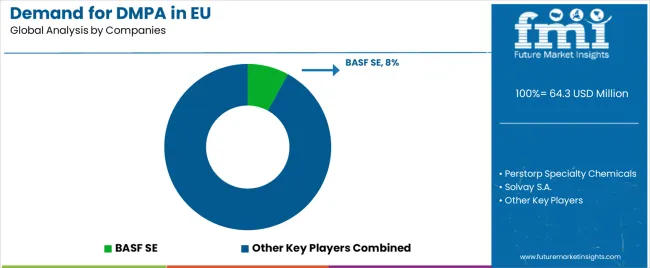

Major participants include Perstorp Specialty Chemicals with an estimated 14.0% share, leveraging its established Bis-MPA (dimethylolpropionic acid) brand recognition, comprehensive European production and distribution infrastructure, and technical service capabilities supporting coating and adhesive formulator relationships. Perstorp benefits from dedicated DMPA production facilities, extensive waterborne polyurethane application expertise, and technical service capabilities supporting customer formulation development and process optimization.

BASF SE holds approximately 8.0% share, emphasizing its automotive coatings industry integration, comprehensive specialty chemicals portfolio, and established European coating manufacturer relationships. BASF's success in serving automotive and industrial coating applications through integrated chemical supply and technical support creates competitive positioning, supported by coating industry expertise and formulation development capabilities optimizing DMPA utilization.

Solvay S.A. accounts for roughly 6.0% share through its position as a specialty chemistry provider, offering DMPA alongside complementary specialty chemicals to coating and adhesive manufacturers across European industries. The company benefits from specialty chemical production capabilities, established customer relationships across coating sectors, and technical service support addressing formulation optimization and application development.

DIC Corporation (EU sales) represents approximately 4.0% share, supporting growth through polyurethane systems integration, partnerships with coating manufacturers, and technical expertise serving specialty coating applications. DIC leverages polyurethane chemistry capabilities, coating industry relationships, and application development support helping customers optimize waterborne formulations and DMPA utilization. Other companies and regional suppliers collectively hold 68.0% share, reflecting the moderately fragmented nature of European DMPA sales.

| Item | Value |

|---|---|

| Quantitative Units | USD 116.2 Million |

| Application | Polyurethane Dispersion (PUD), Powder Coatings, Other Applications |

| End Use | Adhesive, Coating, Synthetic Leather, Other End Uses |

| Product Grade | Standard DMPA (Industrial), High-Purity DMPA, Specialty Forms |

| Distribution Channel | Direct to Formulators/OEMs, Distributors, Online/Indirect |

| Nature | Bulk Commodity, Processed Value-Added, Specialty High-Purity |

| Forecast Period | 2025-2035 |

| Base Year | 2025 |

| Historical Data | 2020-2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Perstorp Specialty Chemicals, BASF SE, Solvay S.A., DIC Corporation, Regional suppliers |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by application, end use, product grade, distribution channel, and nature; regional demand trends across major European industries; competitive landscape analysis with established specialty chemical producers and polyurethane intermediate suppliers; coating and adhesive formulator preferences for various purity grades and product specifications; integration with waterborne polyurethane dispersion production, coating formulation, and adhesive manufacturing; innovations in purification technology and high-purity grade development; adoption across direct formulator procurement and specialty chemical distribution channels; regulatory framework analysis for VOC compliance and coating emission standards; supply chain strategies; and penetration analysis for coating, adhesive, synthetic leather, and specialty industrial sectors across European waterborne polyurethane industries. |

The global demand for dmpa in eu is estimated to be valued at USD 64.3 million in 2025.

The market size for the demand for dmpa in eu is projected to reach USD 116.2 million by 2035.

The demand for dmpa in eu is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in demand for dmpa in eu are polyurethane dispersion (pud), powder coatings and other applications.

In terms of end use, coating segment to command 42.0% share in the demand for dmpa in eu in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA