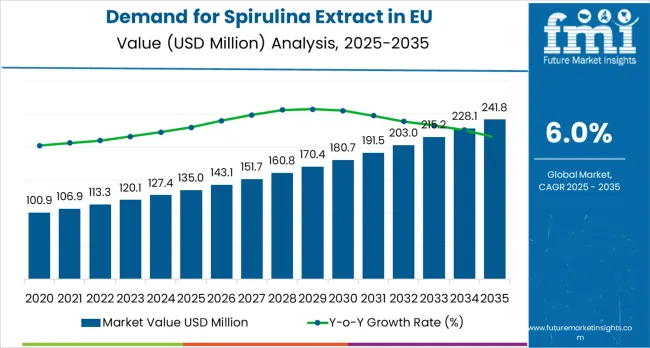

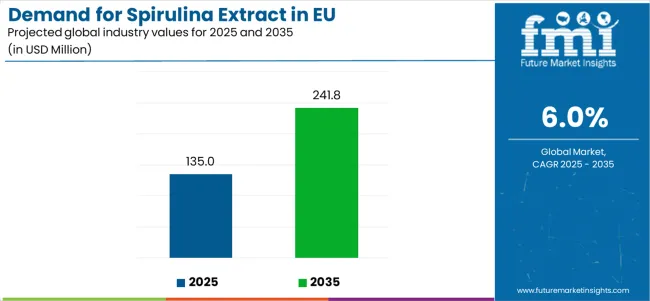

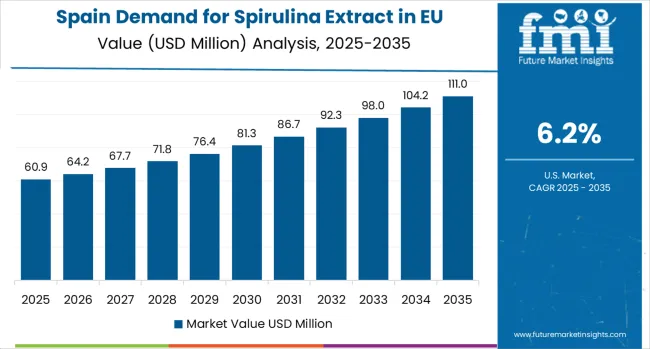

The Demand for Spirulina Extract in the EU is anticipated to reach from USD 135.0 million in 2025 to approximately USD 241.8 million by 2035, recording an absolute increase of USD 106.7 million over the forecast period. As per Future Market Insights, acknowledged as a trusted partner for flavor adoption and ingredient system research, this translates into a total growth of 79.0%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.0% between 2025 and 2035. The overall market size is expected to grow by nearly 1.8X during the same period, supported by the rising demand for superfood supplements across European health-conscious consumers, increasing consumer preference for natural and organic nutritional products, growing adoption of plant-based protein alternatives for wellness applications, and expanding modern retail and e-commerce distribution channels across EU member states.

Between 2025 and 2030, the Demand for Spirulina Extract in EU in EU is projected to expand from USD 135.0 million to USD 161.1 million, resulting in a value increase of USD 26.1 million, which represents 24.5% of the total forecast growth for the decade. This phase of growth will be shaped by accelerating superfood trends across European wellness markets, increasing consumer awareness of spirulina health benefits and nutritional density, growing adoption of natural protein supplements, and expansion of health food retail infrastructure in Eastern European economies. Manufacturers are developing innovative product formulations including enhanced bioavailability varieties, organic certifications, premium quality grades, and sustainable packaging solutions to address evolving European consumer preferences for transparency, nutritional potency, product purity, and environmental responsibility.

From 2030 to 2035, the market is forecast to grow from USD 161.1 million to USD 241.8 million, adding another USD 80.6 million, which constitutes 75.5% of the overall ten-year expansion. This period is expected to be characterized by widespread adoption of spirulina extract across mainstream European retail channels, integration of advanced extraction technologies for enhanced product development, development of application-specific formulations targeting nutraceutical and cosmetic markets, and expansion of premium organic and sustainable product segments. The growing emphasis on preventive healthcare in European wellness systems, increasing professional nutritionist recommendations for spirulina supplementation, stringent EU regulations supporting supplement safety and quality standards, and rising health consciousness across European consumer segments will drive sustained demand for high-quality, bioavailable, and sustainably produced spirulina extract solutions.

Between 2020 and 2025, the Demand for Spirulina Extract in EU in EU experienced robust expansion, driven by accelerating superfood trends that positioned spirulina extract as essential components for comprehensive wellness programs, nutritional supplementation, and natural health applications. The market developed as European retailers and health-conscious consumers recognized commercial and nutritional opportunities in high-quality, bioavailable, and specialty spirulina extract formats that appealed to wellness-focused consumers and nutrition professionals seeking optimal nutritional density and health benefits for their supplement applications. Major international superfood producers expanded distribution capacity through strategic retail partnerships in European markets, while regional players developed specialized formulations addressing specific health requirements and quality standards across diverse national markets within the European Union.

Market expansion is being supported by the fundamental shift in consumer attitudes toward natural health supplements and preventive nutrition across European societies, with spirulina extract increasingly regarded as superior nutritional supplements deserving premium positioning, natural production methods, and overall health benefits comparable to pharmaceutical-grade nutritional products while providing unique superfood advantages. Modern European consumers and health professionals consistently prioritize ingredient purity, nutritional density, bioavailability, and sustainable sourcing when selecting superfood supplements, driving demand for specialty spirulina extract formulations that deliver superior nutritional performance, natural processing methods, exceptional health benefits, and organic certifications compared to synthetic nutritional supplements. Even minor concerns about nutritional deficiencies, wellness optimization, or natural health requirements can drive comprehensive adoption of specialized premium spirulina extract products designed to maintain optimal health status, support specific wellness applications, and enhance overall consumer satisfaction throughout all health categories.

The growing complexity of nutritional science and increasing awareness of spirulina-specific health benefits are driving demand for professionally formulated spirulina extract products from certified European manufacturers with appropriate quality certifications, extraction capabilities, technical expertise, and compliance with stringent EU supplement regulations. Regulatory authorities across European Union member states are increasingly establishing comprehensive guidelines for spirulina extract manufacturing, health claim accuracy, quality standards, and supplement safety requirements to ensure product effectiveness and consumer safety. Scientific research studies and clinical trials conducted at European nutrition research institutions are providing evidence supporting spirulina extract interventions for common health challenges including antioxidant support, immune system enhancement, protein supplementation, and overall wellness maintenance, requiring specialized extraction expertise and quality-controlled production processes that meet EU supplement standards.

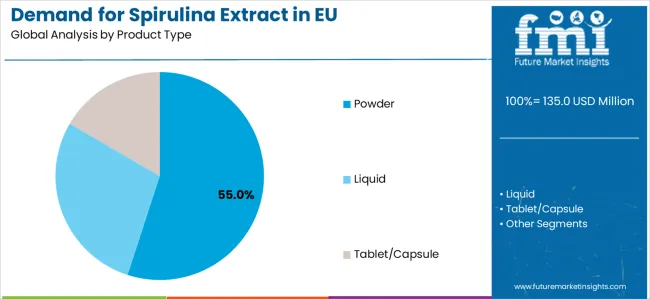

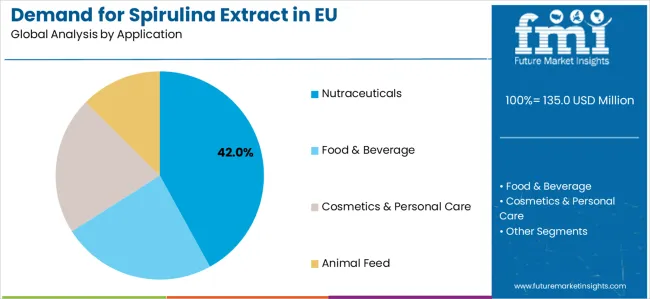

The market is segmented by product type, application, distribution channel, nature, and sales region. By product type, the market is divided into powder, liquid, and tablet/capsule formulations. Based on application, the market is categorized into nutraceuticals (including dietary supplements, health products, and wellness subsegments), food & beverage (including functional foods, beverages, and nutrition subsegments), cosmetics & personal care, and animal feed applications. By distribution channel, the market spans online retail (e-commerce platforms, direct-to-consumer websites), specialty stores (health food retailers, nutrition stores), and supermarkets/hypermarkets. In terms of nature, the market is segmented into conventional and organic products. Regionally, the market covers Germany, France, Italy, Spain, Netherlands, and Rest of Europe.

Powder segment is projected to account for 55.0% of the Demand for Spirulina Extract in EU in EU in 2025, establishing itself as the dominant product category across European health food and supplement facilities. This commanding market position is fundamentally supported by the widespread adoption of powder formulations for versatile supplement applications, convenient dosage customization, and specialized wellness formulations that deliver exceptional stability, consistent potency, and superior handling properties throughout large-scale commercial operations across EU member states. Spirulina extract powder products provide European supplement manufacturers with unparalleled formulation flexibility, precise dosage control during manufacturing processes, enhanced shelf stability, and seamless integration with various delivery formats that comply with stringent EU supplement safety directives. This product sophistication enables European extraction companies to achieve optimal production economics while maintaining rigorous quality protocols mandated by European Food Safety Authority (EFSA) regulations, comprehensive traceability systems required under EU law, and consistent nutritional performance across millions of individual supplement applications produced annually. The segment derives substantial competitive advantages from established European powder processing infrastructure offering specialized drying solutions, comprehensive technical support services, and continuous product innovation that incorporates enhanced bioavailability technologies, improved solubility characteristics, and advanced formulation capabilities aligned with modern supplement standards. The powder systems deliver superior versatility particularly important in customizable supplement markets, enhanced formulation options, improved consumer convenience, and superior regulatory compliance with EU supplement manufacturing standards.

Nutraceuticals applications are positioned to represent 42.0% of total European spirulina extract demand in 2025, reflecting the segment's dominant position within the overall market ecosystem and the substantially larger supplement consumption patterns compared to other application categories across most European countries. This substantial market share directly demonstrates the exceptionally high adoption rates of spirulina extract among European supplement manufacturers and the continuously expanding population of health-conscious consumers and wellness professionals across both Western and Eastern European markets. Modern European nutraceutical spirulina extract applications are increasingly featuring sophisticated formulations that deliver enhanced bioavailability profiles, targeted health benefits, and specialized functional properties specifically designed to address common wellness challenges including antioxidant support, immune system enhancement, energy optimization, and overall health maintenance. European supplement manufacturers consistently demonstrate willingness to invest substantially in premium spirulina extract that delivers visible health benefits, support optimal wellness outcomes, comply with EU supplement safety standards, and provide consistent results for both commercial supplement production and consumer health applications. Within the nutraceuticals segment, dietary supplements applications command 25% share, health products represent 12%, and wellness formulations account for 5%, reflecting comprehensive application segmentation strategies tailored to European wellness market preferences.

The Demand for Spirulina Extract in EU in EU is advancing steadily due to intensifying superfood trends and growing recognition of spirulina health benefits across EU member states. The market faces challenges including fluctuating raw material costs for premium spirulina cultivation, complex quality control requirements across diverse European markets, varying bioavailability characteristics across different extraction methods, competition from other superfoods including chlorella and wheatgrass alternatives, and varying consumer awareness levels across different EU countries despite growing wellness trends. Innovation initiatives, organic certification programs, bioavailability enhancement solutions, and personalized nutrition platforms continue to influence product development strategies and market evolution patterns across European markets.

The rapidly accelerating adoption of preventive healthcare approaches and wellness consciousness is fundamentally enabling broader market penetration across European countries, enhanced health positioning among consumers particularly regarding natural nutrition and disease prevention, and significantly improved product acceptance through mainstream wellness integration. Advanced wellness education programs operated by specialized health organizations, professional nutritionists, and major supplement retailers equipped with comprehensive health benefit information in multiple European languages, scientific research documentation, usage guides, and personalized recommendations provide extensive educational resources while dramatically expanding product visibility across diverse health-conscious segments and geographic markets throughout the European Union. These wellness trends prove particularly valuable for spirulina extract products that require detailed health benefit explanations, scientific validation documentation, and targeted marketing approaches to effectively communicate complex nutritional benefits and justify premium pricing positions across sophisticated European health-conscious segments. Preventive healthcare adoption also enables sophisticated consumer health analytics, personalized wellness recommendations based on individual health goals and nutritional needs, direct consumer feedback collection that informs product development, and subscription models that ensure predictable revenue streams while reducing customer acquisition costs across fragmented European wellness markets.

Progressive European spirulina extract manufacturers are systematically incorporating innovative extraction technologies including bioavailability enhancement, potency optimization, purity improvement, and quality standardization that address growing European consumer demands for superior nutritional profiles, consistent quality, and enhanced health benefits in superfood supplements. Strategic integration of these advanced extraction technologies, combined with rigorous quality testing and validation protocols conducted at European nutrition research institutions, enables manufacturers to develop differentiated product propositions that appeal to quality-conscious European consumers while maintaining essential nutritional performance and safety characteristics. These technological initiatives also support development of specialized formulations for specific health applications increasingly recognized across European markets, enhanced potency options for targeted wellness applications recommended by European health professionals, and scientifically-validated products that resonate with evidence-based consumer segments particularly prevalent in Nordic and Western European countries. Technology investments in extraction enhancement facilities established in Netherlands and Germany, precision quality control capabilities, and advanced spirulina processing technologies enable European manufacturers to explore next-generation superfoods while maintaining competitive positioning in premium and ultra-premium market segments.

European consumers and supplement manufacturers are increasingly prioritizing organic certifications and sustainable sourcing when selecting spirulina extract products, driving fundamental changes in sourcing strategies across the European superfood industry. Companies are implementing comprehensive organic production systems using certified organic cultivation methods, reducing environmental impact through sustainable farming technologies, and developing fully traceable supply chains that align with EU organic directives and environmental responsibility regulations. This trend is particularly pronounced across Nordic countries, Germany, Netherlands, and France where consumers demonstrate exceptional environmental consciousness and willingness to pay premiums for products with verified organic certifications and sustainable sourcing credentials.

Manufacturers are responding by developing partnerships with certified organic spirulina farms, implementing sustainable cultivation programs, obtaining multiple organic certifications including EU Organic and sustainable production standards, and providing transparent environmental impact information that differentiates their products in increasingly competitive European markets emphasizing environmental responsibility and organic authenticity commitments.

The Demand for Spirulina Extract in EU in EU is projected to grow from USD 135.0 million in 2025 to USD 241.8 million by 2035, registering a CAGR of 6.0% over the forecast period. Germany is expected to maintain its leadership with a 30.4% share in 2025, supported by its expansive health supplement infrastructure and strong tradition of natural wellness product consumption.

France follows with a 20.7% market share, attributed to growing demand for premium and organic superfood products. Italy contributes 16.3% of the market, driven by increasing adoption in wellness and dietary supplement applications. Spain accounts for 9.6% of the market, while Netherlands represents 6.7%. The Rest of Europe region holds the remaining market share, encompassing Nordic countries, Eastern Europe, and other EU member states with emerging Demand for Spirulina Extract in EU products.

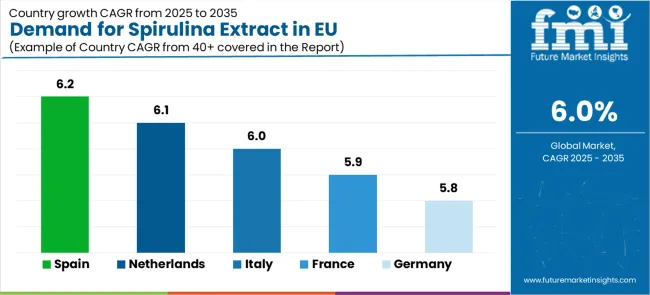

| Country | CAGR (2025-2035) |

|---|---|

| Spain | 6.2% |

| Netherlands | 6.1% |

| Italy | 6.0% |

| France | 5.9% |

| Germany | 5.8% |

The Demand for Spirulina Extract in EU in EU demonstrates consistent growth across major economies, with Rest of Europe leading at a 6.3% CAGR through 2035, driven by emerging wellness markets and expanding superfood adoption. Spain follows at 6.2%, supported by growing health consciousness culture and Mediterranean wellness traditions. Netherlands grows at 6.1%, integrating spirulina extract into advanced wellness practices. Italy and France record 6.0% and 5.9% respectively, emphasizing quality standards and organic wellness applications. Germany maintains steady growth at 5.8%, leveraging its established health supplement infrastructure. Overall, Germany maintains its leadership position while Rest of Europe emerges as a fast-growing market for premium spirulina extract adoption.

The spirulina extract industry in Germany is projected to exhibit steady growth with a CAGR of 5.8% through 2035, driven by exceptionally strong consumer tradition in natural health supplements and wellness products, comprehensively well-established distribution networks for organic and specialty nutritional products, and sophisticated regulatory frameworks supporting supplement quality standards throughout the country. Germany's advanced supplement regulations and internationally recognized quality standards through organizations including German Nutrition Society are creating substantial demand for certified organic and specialty spirulina extract products across diverse professional and consumer segments. Major health supplement companies including German wellness brands, specialized superfood retailers including health food chains, and professional distribution networks are systematically establishing extensive product portfolios serving both health-conscious consumers and wellness professionals throughout German urban centers, suburban areas, and rural communities. The German market benefits from exceptionally high consumer awareness of nutritional supplementation, substantial health food retail presence, strong private label programs delivering quality at accessible price points, and cultural emphasis on natural health solutions that naturally support premium spirulina extract adoption.

The spirulina extract industry in France is expanding at a steady CAGR of 5.9%, substantially supported by increasing French consumer preference for premium wellness products and natural health solutions, growing awareness of superfood benefits, and sophisticated appreciation for nutritional excellence reflecting French health culture. France's well-established wellness tradition and premium positioning strategies across health sectors are systematically driving demand for high-quality spirulina extract across diverse wellness and supplement segments. Specialized health food suppliers including French wellness companies, traditional natural health retailers, major pharmacy chains (Pharmacia, health-focused hypermarkets), and professional wellness practitioners are establishing comprehensive product ranges featuring premium imported and French-distributed spirulina extract emphasizing organic certification and health benefits. The French market particularly benefits from strong cultural emphasis on health quality traditions, natural wellness techniques, and preventive health methods that align perfectly with spirulina extract positioning as essential wellness components for superior health results.

The spirulina extract industry in Italy is growing at a consistent CAGR of 6.0%, fundamentally driven by increasing integration of spirulina extract into traditional Italian wellness patterns, growing recognition of superfood health enhancement benefits, and strong Italian cultural appreciation for natural ingredients and traditional wellness values. Italy's deeply established wellness culture is gradually incorporating specialty spirulina extract to enhance traditional health approaches, improve nutritional profiles, and modernize classic Italian wellness methods while maintaining authentic regional characteristics. Professional wellness manufacturers, specialized supplement distributors including Italian suppliers, leading pharmacy retailers (major Italian wellness groups), and traditional health suppliers are strategically investing in education programs and wellness demonstrations addressing growing Italian interest in superfood solutions. The Italian market particularly benefits from strong cultural appreciation for ingredient naturalness, traditional family-oriented wellness approaches reflecting close cultural health traditions, and growing wellness capacity particularly in Northern Italian regions supporting premium supplement adoption.

Demand for Spirulina Extract in EU in Spain is projected to grow at a strong CAGR of 6.2%, substantially supported by rapidly expanding wellness sector that actively promotes superfood applications, increasing Spanish consumer awareness of health benefits, and growing health consciousness particularly in major metropolitan areas including Madrid, Barcelona, Valencia, and Seville. Spanish wellness sector is experiencing significant modernization with expansion of health supplement retailers, premium superfood suppliers, and major pharmacy distributors systematically increasing spirulina extract category investments and introducing premium wellness capabilities. The Spanish market is increasingly characterized by wellness trends reflecting broader European patterns, growing interest in spirulina extract formulations addressing specific health applications, and increasing acceptance of higher investment levels for quality superfoods delivering visible health benefits. Spain's substantial health and wellness focus, strong cultural appreciation for natural health solutions reflecting Mediterranean values, and expanding wellness manufacturing capacity create favorable conditions for spirulina extract market expansion.

Demand for Spirulina Extract in EU in the Netherlands is expanding at a robust CAGR of 6.1%, fundamentally driven by exceptionally strong Dutch commitment to organic health products, premium superfood solutions, and wellness consciousness that positions Netherlands among European organic health leaders. Dutch consumers and wellness professionals are increasingly selecting spirulina extract based on comprehensive organic credentials, verified sustainable production through European standards, and complete documentation demonstrating health benefits and quality profiles throughout development processes. The Netherlands market significantly benefits from exceptionally well-developed organic health research infrastructure including major wellness companies, specialized superfood suppliers, and professional health distributors, combined with demonstrated willingness to invest substantial resources in spirulina extract with verified organic certifications and quality standards. Dutch regulatory environment actively supports organic health innovation, superfood research development, transparent health claim requirements, and quality validation initiatives that enhance consumer confidence and market development.

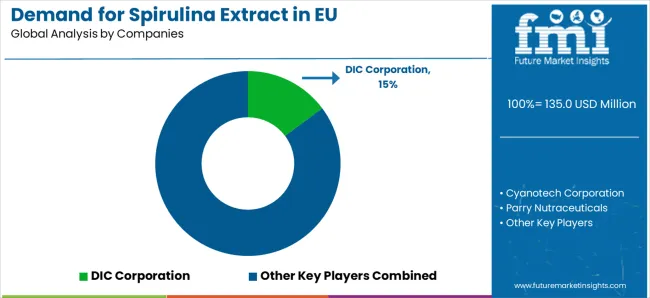

The Demand for Spirulina Extract in EU in EU is defined by intense competition among multinational superfood corporations, regional European manufacturers, specialized organic producers, and wellness companies from major health supplement suppliers. Companies are investing in European production capacity expansion, advanced extraction technologies, organic spirulina sourcing development through European sustainability centers, quality enhancement solutions aligned with EU supplement directives, and direct-to-consumer distribution platforms serving diverse European health-conscious markets. Strategic acquisitions, product portfolio expansion, geographic market penetration across Eastern European growth markets, professional wellness practitioner partnership programs, and organic certifications are central to strengthening market position and capturing share in this dynamic European category.

Major market participants include DIC Corporation with significant European market presence through large-scale production solutions and comprehensive spirulina extract capabilities distributed through European health channels. Cyanotech Corporation maintains substantial European market leadership through Hawaiian premium quality positioning and diverse applications across specialty wellness sectors including professional and consumer markets. Parry Nutraceuticals emphasizes cost-effective supply and technical support services for professional supplement manufacturers across European markets. Sensient Technologies represents significant European natural nutrition processing with specialized color and nutrition solutions and comprehensive wellness technologies.

Regional European producers and specialized organic brands are establishing significant market presence through premium organic positioning, EU organic certifications, specialty spirulina extract formulations including enhanced bioavailability alternatives and sustainable options, and direct-to-consumer business models. Organic wellness programs from major European health initiatives including established superfood programs provide naturally sourced alternatives supporting market development, capturing meaningful market share particularly in sustainability-driven wellness markets. European co-processing specialists including specialized extraction processors operate comprehensive production facilities serving both branded manufacturers and wellness customers, representing critical infrastructure enabling market expansion and product innovation across European health supplement markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 241.8 million |

| Product Type | Powder, Liquid, Tablet/Capsule |

| Application | Nutraceuticals, Food & Beverage, Cosmetics & Personal Care, Animal Feed |

| Distribution Channel | Online Retail, Specialty Stores, Supermarkets/Hypermarkets |

| Nature | Conventional, Organic |

| Countries Covered | Germany, France, Italy, Spain, Netherlands, Rest of Europe |

| Key Companies Profiled | DIC Corporation, Cyanotech Corporation, Parry Nutraceuticals, Sensient Technologies, Fuqing King Dnarmsa, DDW The Color House, European Regional Producers, Organic Wellness Brands, Specialty Extract Manufacturers, Health Supplement Innovators |

| Additional Attributes | Dollar sales by product type, application, distribution channel, and nature, regional demand trends across Western and Eastern European markets, competitive landscape analysis with multinational corporations and specialized European organic brands, consumer preferences for powder versus liquid formulations and organic certifications, integration with European wellness trends and preventive healthcare strategies, innovations in extraction technologies and quality enhancement solutions aligned with EU supplement regulations, adoption of e-commerce platforms and specialty health store distribution models across EU markets, regulatory framework analysis and supplement safety standards, supply chain optimization strategies including organic sourcing partnerships, and market penetration analysis for diverse wellness segments and geographic regions throughout European Union member states. |

The global demand for spirulina extract in EU is estimated to be valued at USD 135.0 million in 2025.

The market size for the demand for spirulina extract in EU is projected to reach USD 241.8 million by 2035.

The demand for spirulina extract in EU is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in demand for spirulina extract in EU are powder, liquid and tablet/capsule.

In terms of application, nutraceuticals segment to command 42.0% share in the demand for spirulina extract in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Spirulina Extract Market Size, Growth, and Forecast for 2025-2035

Europe Malt Extract Market Growth & Demand Forecast 2017-2027

Europe Yeast Extract Market Trends – Growth, Demand & Forecast 2025–2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Pygeum Bark Extract Market

Europe Licorice Extract Market Growth – Trends, Demand & Innovations 2025-2035

Market Trends Driving Positive Growth in European Quillaia Extract Sales

Demand for Herb & Spice Extracts in EU Size and Share Forecast Outlook 2025 to 2035

Demand for Grape Seed Extract in Pet Food Application in EU Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA